Global Carbon Nanotubes Market

Market Size in USD Billion

CAGR :

%

USD

1.17 Billion

USD

3.94 Billion

2024

2032

USD

1.17 Billion

USD

3.94 Billion

2024

2032

| 2025 –2032 | |

| USD 1.17 Billion | |

| USD 3.94 Billion | |

|

|

|

|

Carbon Nanotubes (CNT) Market Size

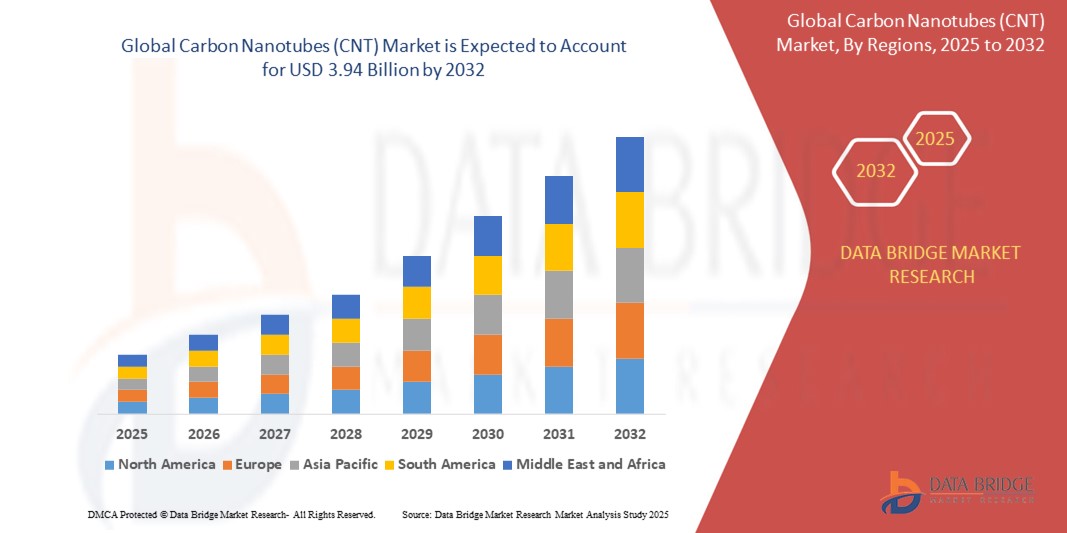

- The global carbon nanotubes (CNT) market size was valued at USD 1.17 billion in 2024 and is expected to reach USD 3.94 billion by 2032, at a CAGR of 16.40% during the forecast period

- The market growth is largely fuelled by the increasing adoption of CNTs in electronics, energy storage, and composite materials due to their exceptional strength, electrical conductivity, and thermal properties

- Rising demand from the automotive and aerospace industries for lightweight and high-performance materials is accelerating the use of carbon nanotubes in structural components and conductive composites

Carbon Nanotubes (CNT) Market Analysis

- The carbon nanotubes market is experiencing steady growth due to rising applications in electronics, composites, and energy storage technologies

- Manufacturers are investing in scalable production techniques to meet demand while ensuring consistent quality and performance

- North America dominated the carbon nanotubes market with the largest revenue share of 36.7% in 2024, driven by robust investments in advanced materials and the presence of major aerospace and defense companies

- The Asia-Pacific region is expected to witness the highest growth rate in the global carbon nanotubes (CNT) market, driven by rapid industrialization, growing demand for advanced materials in electronics, automotive, and energy storage, and rising investments in nanotechnology

- The Chemical Vapor Deposition (CVD) segment held the largest revenue share in 2024, attributed to its ability to produce high-quality CNTs with controllable length, diameter, and alignment. This method is widely used across research and industrial settings due to its cost-effectiveness and scalability

Report Scope and Carbon Nanotubes (CNT) Market Segmentation

|

Attributes |

Carbon Nanotubes (CNT) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Carbon Nanotubes (CNT) Market Trends

“Increasing Adoption of Carbon Nanotubes in Energy Storage Applications”

- Growing integration of CNTs in lithium-ion batteries and supercapacitors due to their superior electrical conductivity and structural properties, enhancing overall energy storage performance

- Enhances battery efficiency by improving energy density, thermal stability, and lifecycle, making CNTs essential for next-gen battery systems. For instance, LG Chem has been developing CNT-based anodes to improve battery output and lifespan

- Crucial for electric vehicles (EVs) and portable electronics, where fast charging, longer battery life, and compact designs are key performance metrics

- Supercapacitor manufacturers increasingly adopt CNTs to enable rapid charging and discharging, vital for applications such as hybrid energy systems and regenerative braking

- Global push for clean energy and electric mobility is accelerating demand for advanced CNT-based solutions in energy storage, aligning with carbon neutrality goals and smart grid advancements

Carbon Nanotubes (CNT) Market Dynamics

Driver

“Expanding Use of CNTs in Electronics and Energy Storage”

- Carbon nanotubes (CNTs) possess high tensile strength, excellent electrical conductivity, and superior thermal stability, making them essential in high-performance electronics and energy storage systems

- CNTs are increasingly integrated into transistors, field emission displays, and conductive films, supporting the miniaturization of electronic devices while boosting efficiency and reducing energy loss

- Their unique structure facilitates faster signal transmission and lower power consumption in semiconductor applications, meeting the performance needs of next-gen electronics

- CNTs improve lithium-ion batteries, supercapacitors, and fuel cells by enhancing energy density, charging speed, and lifecycle

- For instance, LG Chem has invested in CNT technology to develop advanced battery materials for electric vehicles (EVs)

- With the global shift toward sustainability and rapid EV adoption, CNTs are becoming key to developing lightweight, durable, and efficient energy solutions for the future

Restraint/Challenge

“High Production Costs and Technical Barriers”

- Manufacturing carbon nanotubes (CNTs) requires advanced and expensive methods such as chemical vapor deposition (CVD), laser ablation, and arc discharge, making mass production economically challenging

- Producing CNTs with uniform quality, especially when differentiating between single-walled and multi-walled structures, involves intricate control over the synthesis process, increasing operational costs

- Properly dispersing CNTs into matrices such as polymers or composites without clumping remains a major hurdle, affecting their functionality and limiting their performance in end-use applications

- Toxicological concerns during CNT production and disposal, such as inhalation hazards and unknown long-term effects, raise regulatory and safety challenges. For instance, some studies have linked CNT inhalation to lung inflammation in lab settings

- Due to these limitations, CNT applications are largely confined to niche and research-based uses where performance demands outweigh the cost, stalling their broader industrial adoption

Carbon Nanotubes (CNT) Market Scope

The carbon nanotubes (CNT) market is segmented into five notable categories based on method, type, technology, application, and end user.

• By Method

On the basis of method, the carbon nanotubes (CNT) market is segmented into Chemical Vapor Deposition (CVD), Catalytic Chemical Vapor Deposition (CCVD), High-Pressure Carbon Monoxide Reaction, and Others. The Chemical Vapor Deposition (CVD) segment held the largest revenue share in 2024, attributed to its ability to produce high-quality CNTs with controllable length, diameter, and alignment. This method is widely used across research and industrial settings due to its cost-effectiveness and scalability.

The High-Pressure Carbon Monoxide Reaction method is expected to witness the fastest growth rate from 2025 to 2032, driven by its capability to produce high-purity single-walled CNTs (SWCNTs). This method is particularly preferred in advanced electronics and nanotechnology applications that demand consistent and uniform nanotube quality.

• By Type

Based on type, the carbon nanotubes (CNT) market is segmented into Single-Walled, Multi-Walled, and Others. The Multi-Walled Carbon Nanotubes (MWCNTs) segment dominated the market in 2024 with the highest revenue share, owing to their mechanical strength, cost-efficiency, and widespread use in polymer composites and structural applications. MWCNTs are favored for industrial-scale applications due to their ease of synthesis and thermal conductivity.

The Single-Walled Carbon Nanotubes (SWCNTs) segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by their superior electrical properties and rising demand in high-performance electronics, sensors, and medical applications. Their unique structure enables enhanced conductivity and flexibility in nanodevices.

• By Technology

On the basis of technology, the carbon nanotubes (CNT) market is segmented into Arc Discharge, Laser Ablation, CVD, Catalytic CVD, High-Pressure Carbon Monoxide, CoMoCAT, Floating Catalyst, and Others. The CVD segment led the market in 2024 due to its versatility in producing both SWCNTs and MWCNTs with controlled dimensions and alignment, supporting large-scale production.

The Floating Catalyst method is expected to witness the fastest growth rate from 2025 to 2032, as it offers continuous production of high-quality CNTs. This technique is gaining traction in industrial settings for its scalability and lower operational costs, making it suitable for automotive and electronics applications.

• By Application

Based on application, the carbon nanotubes (CNT) market is segmented into Structural Polymer Composites, Conductive Polymer Composites, Conductive Adhesives, Fire Retardant Plastics, Metal Matrix Composites, Li-ion Battery Electrodes, and Others. The Li-ion Battery Electrodes segment held the largest revenue share in 2024, driven by the rising adoption of CNTs to improve battery performance, including enhanced conductivity, energy density, and charge-discharge cycles.

The Conductive Polymer Composites segment is expected to witness the fastest growth rate from 2025 to 2032, spurred by the growing demand in EMI shielding, flexible electronics, and anti-static packaging. CNTs are used extensively in this segment for their lightweight nature and superior electrical performance.

• By End User

On the basis of end user, the carbon nanotubes (CNT) market is segmented into Aerospace and Defense, Chemicals and Polymers, Electronics and Semiconductors, Advanced Materials, Batteries and Capacitors, Medical, Energy, and Others. The Electronics and Semiconductors segment led the market in 2024, owing to CNTs' exceptional electrical and thermal conductivity, making them ideal for transistors, sensors, and flexible displays.

The Medical segment is expected to witness the fastest growth rate from 2025 to 2032, supported by innovations in CNT-based drug delivery systems, biosensors, and tissue engineering. Their biocompatibility and ability to interact at the molecular level offer transformative potential in diagnostics and therapeutic applications.

Carbon Nanotubes (CNT) Market Regional Analysis

- North America dominated the carbon nanotubes market with the largest revenue share of 36.7% in 2024, driven by robust investments in advanced materials and the presence of major aerospace and defense companies

- The region benefits from a mature R&D infrastructure, which supports innovation in CNT-based composites and electronics. The growing demand for lightweight, high-strength materials in automotive and defense sectors is also boosting CNT adoption

- Furthermore, collaboration between research institutions and nanomaterial manufacturers is accelerating commercial CNT applications

U.S. Carbon Nanotubes (CNT) Market Insight

The U.S. carbon nanotubes market accounted for more than 79% of the North American share in 2024, led by increased usage across electronics, batteries, and polymer composites. Strong government funding for nanotechnology research and a well-established industrial base support innovation and scale-up efforts. Notable use cases include Li-ion battery electrodes and conductive polymers, particularly in electric vehicles and next-generation electronics. In addition, partnerships between U.S. startups and global firms are accelerating CNT commercialization across emerging sectors.

Europe Carbon Nanotubes (CNT) Market Insight

The Europe carbon nanotubes market is expected to witness the fastest growth rate from 2025 to 2032, driven by growing applications in renewable energy, electronics, and sustainable packaging. EU regulations promoting lightweight and recyclable materials are encouraging CNT incorporation into composites and conductive polymers. Countries such as Germany and France are witnessing increasing R&D activity, particularly in green energy storage and nanomedicine. Cross-industry collaborations and public funding are also strengthening CNT deployment across diverse verticals.

U.K. Carbon Nanotubes (CNT) Market Insight

The U.K. carbon nanotubes market is expected to witness the fastest growth rate from 2025 to 2032, supported by increasing investment in nanotechnology and materials science. The demand for CNTs in energy storage, electronics, and advanced coatings is rising, especially in aerospace and research-driven industries. Government-backed innovation hubs and growing start-up activity in graphene and carbon nanomaterials are further supporting market expansion. Focus on green technology and low-carbon applications is enhancing CNT adoption across industrial processes.

Germany Carbon Nanotubes (CNT) Market Insight

The Germany carbon nanotubes market is expected to witness the fastest growth rate from 2025 to 2032, backed by the country’s advanced manufacturing ecosystem and emphasis on sustainable innovations. German industries are integrating CNTs in automotive components, coatings, and electronic devices for their superior mechanical and electrical properties. Continuous R&D investments and government support for high-performance materials are helping position Germany as a leading CNT adopter in Europe, especially in automotive electrification and advanced robotics.

Asia-Pacific Carbon Nanotubes (CNT) Market Insight

The Asia-Pacific region is expected to witness the fastest growth rate from 2025 to 2032, driven by expanding industrialization and rising demand for lightweight, durable materials in electronics, automotive, and energy. Countries such as China, Japan, and South Korea are key manufacturing hubs for CNT-based products. Government initiatives supporting nanotechnology research, along with high-volume production capabilities and cost-effective CNT synthesis, are strengthening the region's global footprint in the market.

Japan Carbon Nanotubes (CNT) Market Insight

The Japan’s carbon nanotubes market is expected to witness the fastest growth rate from 2025 to 2032, due to strong demand in electronics, semiconductors, and battery technologies. The country’s leading role in technological innovation, particularly in electric vehicles and high-performance computing, drives CNT usage in conductive films and thermal management applications. Japanese firms are also pioneering compact, high-purity CNT synthesis techniques, which enhance quality and performance consistency. The nation's aging population and clean energy initiatives are expected to fuel CNT adoption in medical and energy storage applications.

China Carbon Nanotubes (CNT) Market Insight

The China accounted for the largest market share in the Asia-Pacific CNT market in 2024, driven by high production capacity, strong domestic demand, and government support for nanomaterials. CNTs are widely used in flexible electronics, EV batteries, and smart manufacturing across the country. Major investments in 5G infrastructure and smart grid development are creating new growth opportunities for CNT-based components. Moreover, local manufacturers are improving quality standards to compete globally, enhancing China’s role as both a consumer and supplier of CNTs.

Carbon Nanotubes (CNT) Market Share

The Carbon Nanotubes (CNT) industry is primarily led by well-established companies, including:

- LG Chem (South Korea)

- Cabot Corporation (U.S.)

- SHOWA DENKO K.K. (Japan)

- Dupont (U.S.)

- Solvay (Belgium)

- DAIKIN INDUSTRIES, Ltd., (Japan)

- Carbon Solutions, Inc. (U.S.)

- OCSiAl (Luxembourg)

- SABIC (Saudi Arabia)

- Nanoshel LLC (U.S.)

- Thomas Swan & Co. Ltd. (U.K.)

- Nanothinx S.A. (Greece)

- XinNano Materials, Inc. (China)

- Continental Carbon Company. (U.S.)

- KUMHO PETROCHEMICAL (South Korea)

- Raymor Industries Inc. (Canada)

- CHASM (U.S.)

Latest Developments in Global Carbon Nanotubes (CNT) Market

- In May 2023, LG Chem announced the commencement of construction for its fourth carbon nanotube (CNT) plant at its Daesan Complex, located 80 kilometers southwest of Seoul. Scheduled for operation in 2025, LG Chem's CNT 4 Plant will double the company's annual CNT production capability to 6,100 tons. Before this development, LG Chem's CNT 3 Plant in Yeosu, with a capacity of 1,200 tons, was recently put into full operation. This addition has enabled LG Chem to secure a total production capacity of 2,900 tons per year, in addition to the existing 1,700 tons

- In March 2021, Cabot Corporation unveiled its latest innovation in high-performance carbon nanotubes (CNTs) with the launch of the ENERMAX™ 6 series. This new series boasts a high aspect ratio, making it the most conductive multi-walled CNT product in Cabot's lineup. The ENERMAX™ 6 CNT series is designed to significantly improve battery performance, allowing for higher energy density at lower loadings

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL CARBON NANOTUBES (CNT) MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL CARBON NANOTUBES (CNT) MARKET SIZE

2.3 VENDOR POSITIONING GRID

2.4 MARKETS COVERED

2.5 GEOGRAPHIC SCOPE

2.6 YEARS CONSIDERED FOR THE STUDY

2.7 RESEARCH METHODOLOGY

2.8 TECHNOLOGY LIFE LINE CURVE

2.9 MULTIVARIATE MODELLING

2.1 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.11 DBMR MARKET POSITION GRID

2.12 MARKET APPLICATION COVERAGE GRID

2.13 DBMR MARKET CHALLENGE MATRIX

2.14 IMPORT AND EXPORT DATA

2.15 SECONDARY SOURCES

2.16 GLOBAL CARBON NANOTUBES (CNT) MARKET: RESEARCH SNAPSHOT

2.17 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 RAW MATERIAL COVERAGE

5.2 PRODUCTION CONSUMPTION ANALYSIS

5.3 IMPORT EXPORT SCENARIO

5.4 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

5.5 PORTER’S FIVE FORCES

5.6 VENDOR SELECTION CRITERIA

5.7 PESTEL ANALYSIS

5.8 REGULATION COVERAGE

5.8.1 PRODUCT CODES

5.8.2 CERTIFIED STANDARDS

5.8.3 SAFETY STANDARDS

5.8.3.1. MATERIAL HANDLING & STORAGE

5.8.3.2. TRANSPORT & PRECAUTIONS

5.8.3.3. HARAD IDENTIFICATION

6 PRICING ANALYSIS

7 SUPPLY CHAIN ANALYSIS

7.1 OVERVIEW

7.2 LOGISTIC COST SCENARIO

7.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

8 CLIMATE CHANGE SCENARIO

8.1 ENVIRONMENTAL CONCERNS

8.2 INDUSTRY RESPONSE

8.3 GOVERNMENT’S ROLE

8.4 ANALYST RECOMMENDATIONS

9 GLOBAL CARBON NANOTUBES (CNT) MARKET, BY TYPE, 2022-2031, (USD MILLION) (KILO TONS)

9.1 OVERVIEW

9.2 SINGLE-WALLED CARBON NANOTUBES (SWCNT)

9.3 MULTI-WALLED CARBON NANOTUBES (MWCNT)

10 GLOBAL CARBON NANOTUBES (CNT) MARKET, BY FORM, 2022-2031, (USD MILLION)

10.1 OVERVIEW

10.2 POWDER

10.3 MASTER-BATCH

10.4 OTHERS

11 GLOBAL CARBON NANOTUBES (CNT) MARKET, BY TECHNOLOGY, 2022-2031, (USD MILLION)

11.1 OVERVIEW

11.2 ARC DISCHARGE

11.3 LASER ABLATION

11.4 CVD (CHEMICAL VAPOUR DEPOSITION)

11.5 CATALYTIC CVD

11.6 HIGH PRESSURE CARBON MONOXIDE

11.7 COMOCAT

11.8 FLOATING CATALYST

11.9 OTHERS

12 GLOBAL CARBON NANOTUBES (CNT) MARKET, BY APPLICATION, 2022-2031, (USD MILLION)

12.1 OVERVIEW

12.2 ELECTRONICS & SEMICONDUCTORS

12.2.1 ELECTRONICS & SEMICONDUCTORS, BY APPLICATION

12.2.1.1. INTEGRATED CIRCUITS

12.2.1.2. FLEXIBLE DISPLAY

12.2.1.3. SUPERCONDUCTORS

12.2.1.4. TRANSISTORS

12.2.1.5. INDUSTRIAL SENSORS

12.2.1.6. OTHERS

12.2.2 ELECTRONICS & SEMICONDUCTORS, BY NANOTUBES TYPE

12.2.2.1. SINGLE-WALLED CARBON NANOTUBES (SWCNT)

12.2.2.2. MULTI-WALLED CARBON NANOTUBES (MWCNT)

12.3 ENERGY & STORAGE

12.3.1 ENERGY & STORAGE, BY APPLICATION

12.3.1.1. LITHIUM-ION BATTERIES

12.3.1.2. FUEL CELLS

12.3.1.3. SOLAR PV CELLS

12.3.1.4. HYDROGEN STORAGE

12.3.1.5. ELECTROCHEMICAL SUPERCAPACITORS

12.3.1.6. PROPELANTS

12.3.1.7. OTHERS

12.3.2 ENERGY & STORAGE, BY NANOTUBES TYPE

12.3.2.1. SINGLE-WALLED CARBON NANOTUBES (SWCNT)

12.3.2.2. MULTI-WALLED CARBON NANOTUBES (MWCNT)

12.4 STRUCTURAL COMPOSITES

12.4.1 STRUCTURAL COMPOSITES, BY APPLICATION

12.4.1.1. DEFENSE

12.4.1.2. SPORTING GOODS

12.4.1.3. WIND TURBINE BLADES

12.4.1.4. LIGHT VEHICLES / AUTOMOTIVE

12.4.1.5. CONSTRUCTION AND INFRASTRUCTURE

12.4.1.6. AEROSPACE

12.4.1.7. OTHERS

12.4.2 STRUCTURAL COMPOSITES, BY NANOTUBES TYPE

12.4.3 SINGLE-WALLED CARBON NANOTUBES (SWCNT)

12.4.4 MULTI-WALLED CARBON NANOTUBES (MWCNT)

12.5 CHEMICAL MATERIALS & POLYMERS

12.5.1 CHEMICAL MATERIALS & POLYMERS, BY APPLICATION

12.5.1.1. COATINGS, ADHESIVES AND SEALANTS

12.5.1.2. WATER FILTRATION

12.5.1.3. CATALYSTS

12.5.1.4. OTHERS

12.5.2 CHEMICAL MATERIALS & POLYMERS, BY NANOTUBES TYPE

12.5.2.1. SINGLE-WALLED CARBON NANOTUBES (SWCNT)

12.5.2.2. MULTI-WALLED CARBON NANOTUBES (MWCNT)

12.6 MEDICAL

12.6.1 MEDICAL, BY APPLICATION

12.6.1.1. DRUG DELIVERY

12.6.1.2. CANCER TREATMENT

12.6.1.3. PROTEOMICS

12.6.1.4. OTHERS

12.6.2 MEDICAL, BY NANOTUBES TYPE

12.6.2.1. SINGLE-WALLED CARBON NANOTUBES (SWCNT)

12.6.2.2. MULTI-WALLED CARBON NANOTUBES (MWCNT)

12.7 OTHERS

13 GLOBAL CARBON NANOTUBES (CNT) MARKET, BY GEOGRAPHY, 2022-2031, (USD MILLION) (KILO TONS)

GLOBAL CARBON NANOTUBES (CNT) MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

13.1 NORTH AMERICA

13.1.1 U.S.

13.1.2 CANADA

13.1.3 MEXICO

13.2 EUROPE

13.2.1 GERMANY

13.2.2 U.K.

13.2.3 ITALY

13.2.4 FRANCE

13.2.5 SPAIN

13.2.6 RUSSIA

13.2.7 SWITZERLAND

13.2.8 TURKEY

13.2.9 BELGIUM

13.2.10 NETHERLANDS

13.2.11 REST OF EUROPE

13.3 ASIA-PACIFIC

13.3.1 JAPAN

13.3.2 CHINA

13.3.3 SOUTH KOREA

13.3.4 INDIA

13.3.5 SINGAPORE

13.3.6 THAILAND

13.3.7 INDONESIA

13.3.8 MALAYSIA

13.3.9 PHILIPPINES

13.3.10 AUSTRALIA & NEW ZEALAND

13.3.11 REST OF ASIA-PACIFIC

13.4 SOUTH AMERICA

13.4.1 BRAZIL

13.4.2 ARGENTINA

13.4.3 REST OF SOUTH AMERICA

13.5 MIDDLE EAST AND AFRICA

13.5.1 SOUTH AFRICA

13.5.2 EGYPT

13.5.3 SAUDI ARABIA

13.5.4 UNITED ARAB EMIRATES

13.5.5 ISRAEL

13.5.6 REST OF MIDDLE EAST AND AFRICA

14 GLOBAL CARBON NANOTUBES (CNT) MARKET, COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: GLOBAL

14.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

14.3 COMPANY SHARE ANALYSIS: EUROPE

14.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

14.5 MERGERS AND ACQUISITIONS

14.6 NEW PRODUCT DEVELOPMENT AND APPROVALS

14.7 EXPANSIONS

14.8 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

15 SWOT AND DATA BRIDGE MARKET RESEARCH ANALYSIS

16 GLOBAL CARBON NANOTUBES (CNT) MARKET - COMPANY PROFILES

16.1 LG CHEM

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 GEOGRAPHIC PRESENCE

16.1.4 PRODUCTION CAPACITY OVERVIEW

16.1.5 PRODUCT PORTFOLIO

16.1.6 RECENT UPDATES

16.2 CABOT CORPORATION

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 GEOGRAPHIC PRESENCE

16.2.4 PRODUCTION CAPACITY OVERVIEW

16.2.5 PRODUCT PORTFOLIO

16.2.6 RECENT UPDATES

16.3 ARKEMA

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 GEOGRAPHIC PRESENCE

16.3.4 PRODUCTION CAPACITY OVERVIEW

16.3.5 PRODUCT PORTFOLIO

16.3.6 RECENT UPDATES

16.4 JIANGSU CNANO TECHNOLOGY CO., LTD

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 GEOGRAPHIC PRESENCE

16.4.4 PRODUCTION CAPACITY OVERVIEW

16.4.5 PRODUCT PORTFOLIO

16.4.6 RECENT UPDATES

16.5 CHENGDU ORGANIC CHEMICALS CO. LTD. (TIMESNANO)

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 GEOGRAPHIC PRESENCE

16.5.4 PRODUCTION CAPACITY OVERVIEW

16.5.5 PRODUCT PORTFOLIO

16.5.6 RECENT UPDATES

16.6 NANOCYL SA

16.6.1 COMPANY SNAPSHOT

16.6.2 REVENUE ANALYSIS

16.6.3 GEOGRAPHIC PRESENCE

16.6.4 PRODUCTION CAPACITY OVERVIEW

16.6.5 PRODUCT PORTFOLIO

16.6.6 RECENT UPDATES

16.7 SUMITOMO CORPORATION

16.7.1 COMPANY SNAPSHOT

16.7.2 REVENUE ANALYSIS

16.7.3 GEOGRAPHIC PRESENCE

16.7.4 PRODUCTION CAPACITY OVERVIEW

16.7.5 PRODUCT PORTFOLIO

16.7.6 RECENT UPDATES

16.8 CHEAP TUBES, INC

16.8.1 COMPANY SNAPSHOT

16.8.2 REVENUE ANALYSIS

16.8.3 GEOGRAPHIC PRESENCE

16.8.4 PRODUCTION CAPACITY OVERVIEW

16.8.5 PRODUCT PORTFOLIO

16.8.6 RECENT UPDATES

16.9 CARBON SOLUTIONS, INC

16.9.1 COMPANY SNAPSHOT

16.9.2 REVENUE ANALYSIS

16.9.3 GEOGRAPHIC PRESENCE

16.9.4 PRODUCTION CAPACITY OVERVIEW

16.9.5 PRODUCT PORTFOLIO

16.9.6 RECENT UPDATES

16.1 OCSIAL

16.10.1 COMPANY SNAPSHOT

16.10.2 REVENUE ANALYSIS

16.10.3 GEOGRAPHIC PRESENCE

16.10.4 PRODUCTION CAPACITY OVERVIEW

16.10.5 PRODUCT PORTFOLIO

16.10.6 RECENT UPDATES

16.11 KLEAN INDUSTRIES INC

16.11.1 COMPANY SNAPSHOT

16.11.2 REVENUE ANALYSIS

16.11.3 GEOGRAPHIC PRESENCE

16.11.4 PRODUCTION CAPACITY OVERVIEW

16.11.5 PRODUCT PORTFOLIO

16.11.6 RECENT UPDATES

16.12 RAYMOR INDUSTRIES

16.12.1 COMPANY SNAPSHOT

16.12.2 REVENUE ANALYSIS

16.12.3 GEOGRAPHIC PRESENCE

16.12.4 PRODUCTION CAPACITY OVERVIEW

16.12.5 PRODUCT PORTFOLIO

16.12.6 RECENT UPDATES

16.13 NANOLAB INC

16.13.1 COMPANY SNAPSHOT

16.13.2 REVENUE ANALYSIS

16.13.3 GEOGRAPHIC PRESENCE

16.13.4 PRODUCTION CAPACITY OVERVIEW

16.13.5 PRODUCT PORTFOLIO

16.13.6 RECENT UPDATES

16.14 NANOSHEL LLC

16.14.1 COMPANY SNAPSHOT

16.14.2 REVENUE ANALYSIS

16.14.3 GEOGRAPHIC PRESENCE

16.14.4 PRODUCTION CAPACITY OVERVIEW

16.14.5 PRODUCT PORTFOLIO

16.14.6 RECENT UPDATES

16.15 NANO-C

16.15.1 COMPANY SNAPSHOT

16.15.2 REVENUE ANALYSIS

16.15.3 GEOGRAPHIC PRESENCE

16.15.4 PRODUCTION CAPACITY OVERVIEW

16.15.5 PRODUCT PORTFOLIO

16.15.6 RECENT UPDATES

16.16 CHASM

16.16.1 COMPANY SNAPSHOT

16.16.2 REVENUE ANALYSIS

16.16.3 GEOGRAPHIC PRESENCE

16.16.4 PRODUCTION CAPACITY OVERVIEW

16.16.5 PRODUCT PORTFOLIO

16.16.6 RECENT UPDATES

16.17 XINNANO MATERIAL, INC. (SHANGHAI DANFAN NETWORK SCIENCE&TECHNOLOGY CO., LTD)

16.17.1 COMPANY SNAPSHOT

16.17.2 REVENUE ANALYSIS

16.17.3 GEOGRAPHIC PRESENCE

16.17.4 PRODUCTION CAPACITY OVERVIEW

16.17.5 PRODUCT PORTFOLIO

16.17.6 RECENT UPDATES

16.18 MERCK KGAA

16.18.1 COMPANY SNAPSHOT

16.18.2 REVENUE ANALYSIS

16.18.3 GEOGRAPHIC PRESENCE

16.18.4 PRODUCTION CAPACITY OVERVIEW

16.18.5 PRODUCT PORTFOLIO

16.18.6 RECENT UPDATES

16.19 NANOINTEGRIS INC

16.19.1 COMPANY SNAPSHOT

16.19.2 REVENUE ANALYSIS

16.19.3 GEOGRAPHIC PRESENCE

16.19.4 PRODUCTION CAPACITY OVERVIEW

16.19.5 PRODUCT PORTFOLIO

16.19.6 RECENT UPDATES

16.2 NOPO NANOTECHNOLOGIES

16.20.1 COMPANY SNAPSHOT

16.20.2 REVENUE ANALYSIS

16.20.3 GEOGRAPHIC PRESENCE

16.20.4 PRODUCTION CAPACITY OVERVIEW

16.20.5 PRODUCT PORTFOLIO

16.20.6 RECENT UPDATES

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

17 RELATED REPORTS

18 QUESTIONNAIRE

19 CONCLUSION

20 ABOUT DATA BRIDGE MARKET RESEARCH

Global Carbon Nanotubes Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Carbon Nanotubes Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Carbon Nanotubes Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.