Global Cannula Market

Market Size in USD Billion

CAGR :

%

USD

26.20 Billion

USD

43.52 Billion

2024

2032

USD

26.20 Billion

USD

43.52 Billion

2024

2032

| 2025 –2032 | |

| USD 26.20 Billion | |

| USD 43.52 Billion | |

|

|

|

|

Cannula Market Size

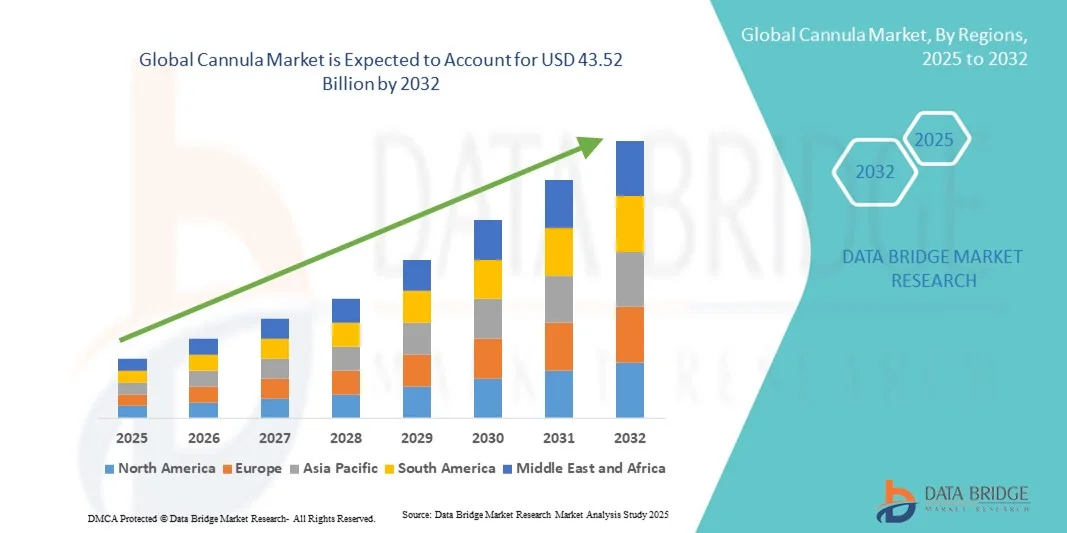

- The global cannula market size was valued at USD 26.20 billion in 2024 and is expected to reach USD 43.52 billion by 2032, at a CAGR of 6.55% during the forecast period

- The market growth is largely fueled by the increasing adoption of advanced medical procedures, minimally invasive surgeries, and the growing focus on patient safety and comfort

- Furthermore, rising demand for precision medical devices and the integration of innovative materials and designs in healthcare practices are accelerating the uptake of Cannula solutions, thereby significantly boosting the industry's growth

Cannula Market Analysis

- Cannulas, essential medical devices used for administering fluids, drugs, or for cosmetic procedures, are increasingly vital in modern healthcare and aesthetic treatments due to their precision, safety, and minimally invasive nature

- The escalating demand for cannulas is primarily fueled by the rising prevalence of chronic diseases, growth in surgical and cosmetic procedures, and the increasing adoption of advanced healthcare technologies across hospitals, clinics, and aesthetic centers

- North America dominated the cannula market with the largest revenue share of 41.5% in 2024, driven by the strong presence of leading medical device manufacturers, high R&D expenditure, and advanced healthcare infrastructure. The U.S. particularly witnessed substantial growth due to rising investments in hospitals, clinics, and aesthetic centers, along with government initiatives supporting healthcare modernization and adoption of advanced medical devices

- Asia-Pacific is expected to be the fastest-growing region in the cannula market during the forecast period, with a CAGR of 9.8% from 2025 to 2032. Growth is driven by increasing healthcare infrastructure, rising medical tourism, urbanization, and growing adoption of minimally invasive procedures in countries such as China, India, and Japan

- The Plastic Cannulas segment dominated the cannula market with a market share of 44.2% in 2024, owing to its affordability, ease of large-scale production, and wide adoption across hospitals and clinics. Plastic cannulas are largely disposable, which significantly reduces the risk of infection and ensures compliance with strict healthcare hygiene regulations

Report Scope and Cannula Market Segmentation

|

Attributes |

Cannula Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Cannula Market Trends

Enhanced Precision and Minimally Invasive Procedures

- A significant trend in the global cannula market is the increasing adoption of precision-engineered and minimally invasive cannulas across surgical and therapeutic applications. These innovations are improving procedural accuracy, reducing patient trauma, and enhancing post-operative recovery

- For instance, in March 2023, Terumo Corporation introduced a next-generation vascular cannula for minimally invasive cardiovascular procedures, featuring improved flow control and reduced vascular trauma

- Modern cannulas now include specialized designs such as winged, ported, and silicone-coated variants, which allow surgeons to perform complex procedures with high precision while minimizing tissue damage

- Integration with imaging systems and robotic-assisted surgery is enhancing surgical outcomes, enabling real-time monitoring and guided interventions

- The trend of developing single-use and disposable cannulas is also gaining traction, helping reduce cross-contamination risks and improving clinical safety

- Advanced materials, such as biocompatible plastics and flexible silicone, are being incorporated to enhance patient comfort and procedural efficiency

- Research and development in high-flow cannulas for critical care and cardiovascular surgery is driving adoption among hospitals and specialized clinics

Cannula Market Dynamics

Driver

Rising Demand from Expanding Surgical Procedures and Healthcare Infrastructure

- The growing number of surgical procedures worldwide, coupled with expanding healthcare infrastructure and investment in advanced medical technologies, is driving the adoption of cannulas

- For instance, in May 2024, Becton Dickinson (BD) expanded its neonatal and vascular cannula portfolio to meet increasing demand in cardiovascular and critical care procedures, highlighting the industry’s focus on improving patient outcomes

- High demand in cardiovascular, orthopedic, cosmetic, and other surgical procedures is prompting hospitals and surgical centers to adopt advanced cannula systems to enhance operational efficiency and patient safety

- Technological innovations, including improved material quality, specialized cannula sizes, and versatile designs, further support broad adoption across multiple applications

- The rising prevalence of chronic diseases such as diabetes and cardiovascular disorders has increased the requirement for long-term therapies involving cannulas, such as insulin infusion or hemodialysis

- Expansion of outpatient surgical centers and ambulatory care facilities in emerging markets is creating additional demand for portable and easy-to-use cannula systems

- Training programs and workshops by manufacturers are raising clinician awareness about optimized cannula usage, indirectly driving higher adoption rates

- Regulatory approvals and certifications for safety and efficacy in major regions (FDA, CE marking) are providing confidence to healthcare providers, boosting market growth

Restraint/Challenge

Safety Concerns, Compatibility Issues, and High Costs

- Despite advances, safety and compatibility concerns remain key challenges in the cannula market. Incorrect selection or usage can lead to tissue injury, infection, or vascular complications

- For instance, a 2023 study published in the Journal of Vascular Surgery emphasized proper cannula sizing for neonatal and pediatric patients to minimize procedural complications

- High-end cannula systems with advanced coatings or integrated monitoring features often come at a premium price, limiting adoption in cost-sensitive hospitals or regions

- Improper storage and sterilization practices in some facilities can compromise cannula safety and lifespan, creating hurdles for widespread adoption

- Compatibility issues between cannulas and other surgical instruments can result in inefficiencies during complex procedures

- Training gaps among healthcare professionals may lead to procedural errors, slowing adoption despite technological advancement

- To overcome these barriers, manufacturers are focusing on producing safe, cost-effective, and universally compatible cannulas, while offering clinician training programs

- Companies such as Medtronic, Terumo, and Becton Dickinson are emphasizing product standardization, safety, and affordability to sustain growth and address clinical concerns

Cannula Market Scope

The market is segmented on the basis of product, type, material, size, application, and end-users.

- By Product

On the basis of product, the Cannula market is segmented into Vascular Cannula, Cardiac Cannula, Arthroscopy Cannula, Dermatology Cannula, Nasal Cannula, and Others. The Vascular Cannula segment dominated the largest market revenue share of 42.6% in 2024, driven by its extensive use in hospitals, emergency care, and outpatient procedures. Vascular cannulas are highly preferred due to their critical role in intravenous therapy, fluid administration, and blood sampling. Repeated usage in clinical treatments, high patient demand, and standardized protocols make them indispensable in modern healthcare facilities. The availability of advanced, low-risk vascular cannulas with safety features and sterile packaging further boosts adoption. Leading manufacturers focus on innovation and product reliability, supporting strong market growth in North America and Europe.

The Dermatology Cannula segment is expected to witness the fastest CAGR of 10.8% from 2025 to 2032, driven by the rising popularity of minimally invasive cosmetic and dermatological procedures. Increasing awareness of non-surgical treatments, coupled with expanding aesthetic clinic networks across Asia-Pacific, is fueling demand. Technological advancements in cannula design, including reduced patient discomfort and precision in dermal filler administration, further accelerate adoption. Social media awareness, affordability, and repeat procedures contribute to robust market growth, particularly in urban regions with growing disposable incomes.

- By Type

On the basis of type, the Cannula market is segmented into Neonatal, Straight, Winged, Wing with Port, and Winged with Stop Cork. The Straight Cannula segment dominated the market with a revenue share of 38.9% in 2024, widely preferred for general surgical and clinical applications due to its simplicity, ease of use, and compatibility with standard protocols. Hospitals favor straight cannulas for their reliability in intravenous access, blood sampling, and routine fluid administration. The segment’s large adoption is supported by its presence across emergency, inpatient, and outpatient care, coupled with repeatability and minimal training requirements for healthcare staff.

The Winged Cannula segment is expected to witness the fastest CAGR of 9.9% from 2025 to 2032, driven by increasing applications in precise interventions, pediatric procedures, and specialized surgeries. Its flexible wings allow better control and patient comfort, encouraging adoption in cosmetic and dermatology clinics. Manufacturers are innovating winged cannulas for safer administration and reduced trauma, further contributing to growth. Rising demand for minimally invasive procedures in emerging markets also fuels this segment’s expansion. In addition, enhanced training and awareness among healthcare professionals about the benefits of winged cannulas are supporting wider adoption. The segment is further boosted by technological improvements that improve visibility and handling during complex procedures.

- By Material

On the basis of material, the Cannula market is segmented into Plastic Cannulas, Silicone Cannulas, and Metal Cannulas. The Plastic Cannulas segment dominated with a market share of 44.2% in 2024, owing to its affordability, ease of large-scale production, and wide adoption across hospitals and clinics. Plastic cannulas are largely disposable, which significantly reduces the risk of infection and ensures compliance with strict healthcare hygiene regulations. Hospitals and surgical centers prefer plastic variants due to their availability in various gauges and lengths, reliability during high-volume procedures, and compatibility with standard connectors and devices. The segment also benefits from the ability to maintain consistent sterility standards, high repeat usage, and low procurement costs. In addition, plastic cannulas are suitable for both general surgery and specialized procedures, making them a versatile choice for healthcare providers globally. The combination of regulatory compliance, operational efficiency, and cost-effectiveness drives steady revenue growth in this segment.

The Silicone Cannulas segment is expected to witness the fastest CAGR of 10.2% from 2025 to 2032, driven by their superior flexibility, biocompatibility, and enhanced patient comfort in surgical, cosmetic, and minimally invasive procedures. Surgeons and dermatologists increasingly prefer silicone cannulas for delicate tissue applications, where precision and minimal trauma are critical. The rising adoption of cosmetic treatments and outpatient procedures globally further accelerates the segment’s growth. Features c soft tips and ergonomic designs enhance patient satisfaction, reduce complications, and facilitate safer administration of medications and fillers. Expansion of dermatology and cosmetic clinics, coupled with increased awareness of patient-centered care, fuels rapid adoption. Continuous product innovations, such as temperature-resistant silicone and specialized coatings for smoother insertion, further drive market momentum.

- By Size

On the basis of size, the Cannula market is segmented into 14G, 16G, 18G, 20G, 22G, 24G, and 26G. The 18G segment dominated the market with a 29.5% revenue share in 2024, attributed to its balanced flow rate and suitability for the majority of clinical and surgical procedures. This size offers optimal fluid delivery speed while maintaining ease of insertion, making it the standard choice in hospitals, cardiac centers, and general surgery settings. The segment benefits from repeat usage across multiple departments, widespread clinical familiarity, and high reliability in both emergency and elective procedures. Its availability in disposable and reusable formats ensures compatibility with varied healthcare requirements. Hospitals also favor 18G cannulas due to standardized staff training, consistent procedural outcomes, and regulatory compliance. In addition, the segment is supported by strong manufacturing capabilities and global supply chains, enabling broad adoption across developed and emerging markets.

The 22G segment is expected to witness the fastest CAGR of 9.7% from 2025 to 2032, driven by increasing applications in pediatric care, IV therapies, and precision cosmetic procedures. Its smaller diameter reduces patient discomfort and allows for highly controlled fluid or medication administration in delicate treatments. Rising demand for minimally invasive procedures and outpatient care boosts its adoption in dermatology and cosmetic clinics. Hospitals and ambulatory centers prefer 22G cannulas for specific indications, such as pediatric or geriatric patients, where vein fragility and comfort are critical. The segment is further supported by innovative designs, including color-coded gauges for easy identification and soft-tipped variants for safer insertion. Expanding healthcare infrastructure, rising patient awareness, and increased adoption of outpatient procedures contribute to accelerated growth.

- By Application

On the basis of application, the Cannula market is segmented into Oxygen Therapy, Cardiovascular Surgery, General Surgery, Orthopedic Surgery, Cosmetic/Plastic Surgery, Diabetes Treatment, Neurology, and Others. The General Surgery segment dominated the market with a 33.8% share in 2024, fueled by the high volume of surgical procedures worldwide and the essential role of cannulas in fluid administration, medication delivery, and blood sampling. Hospitals rely on general surgery cannulas for consistent performance, ease of use across diverse procedures, and adherence to hygiene standards. The segment benefits from repeat usage across multiple surgical departments, broad applicability in emergency and elective surgeries, and standardization in procurement processes. Cannulas for general surgery are widely available in various sizes and materials, enhancing procedural flexibility. In addition, manufacturers focus on sterility, quality assurance, and ease of handling to meet regulatory requirements, driving sustained adoption globally.

The Cosmetic/Plastic Surgery segment is expected to witness the fastest CAGR of 11.1% from 2025 to 2032, driven by rising demand for aesthetic procedures, minimally invasive techniques, and outpatient treatments. Dermatology and cosmetic clinics are increasingly adopting specialized cannulas for dermal fillers, liposuction, and skin rejuvenation, where precision, patient comfort, and safety are critical. Patient awareness of non-invasive treatments, coupled with expanding clinic networks and disposable income growth in emerging markets, accelerates segment growth. Product innovations such as soft-tipped and flexible cannulas, which reduce tissue trauma and discomfort, further boost adoption. Marketing campaigns and social media influence highlighting safe, effective cosmetic procedures also contribute to the segment’s rapid expansion.

- By End-Users

On the basis of end-users, the Cannula market is segmented into Hospitals, Cardiac Centers, Ambulatory Surgical Centers, and Others. The Hospitals segment dominated with a revenue share of 41.7% in 2024, owing to their high procedural volumes, repeat cannula usage, and established procurement channels. Hospitals require reliable, standardized, and sterile devices to maintain operational efficiency and patient safety across multiple departments, including general surgery, cardiovascular interventions, and outpatient care. High adoption rates are supported by training, familiarity among healthcare professionals, and consistent global supply.

The Ambulatory Surgical Centers segment is expected to witness the fastest CAGR of 10.5% from 2025 to 2032, driven by the rapid increase in outpatient surgeries, minimally invasive procedures, and cosmetic treatments. These centers adopt specialized cannulas to improve patient comfort, ensure precision, and maintain procedural efficiency. Rising outpatient infrastructure, increased consumer awareness, and cost-effective treatment options compared to hospitals support rapid growth. Manufacturers are targeting ambulatory centers with tailored products designed for ease of use, patient-centric outcomes, and compliance with clinical standards, boosting adoption globally.

Cannula Market Regional Analysis

- North America dominated the cannula market with the largest revenue share of 41.5% in 2024

- Driven by the strong presence of leading medical device manufacturers, high R&D expenditure, and advanced healthcare infrastructure

- The region witnessed growing adoption of minimally invasive procedures, cardiovascular interventions, and surgical applications, which significantly boosted demand for high-quality cannula products

U.S. Cannula Market Insight

The U.S. cannula market captured the largest revenue share within North America in 2024, fueled by rising investments in hospitals, clinics, and aesthetic centers. The adoption of advanced medical devices and government initiatives supporting healthcare modernization further accelerated market growth. Increasing use of cannulas in cardiovascular surgery, cosmetic procedures, and critical care applications contributed to the robust expansion of the market.

Europe Cannula Market Insight

The Europe cannula market is projected to expand at a substantial CAGR during the forecast period, primarily driven by well-established healthcare infrastructure, stringent medical safety regulations, and growing demand for minimally invasive surgical procedures. Countries such as Germany, France, and Italy are witnessing increasing adoption of advanced cannula systems in hospitals, ambulatory surgical centers, and research institutes, supporting steady market growth.

U.K. Cannula Market Insight

The U.K. cannula market is anticipated to grow at a noteworthy CAGR during the forecast period, fueled by increased healthcare investments and rising awareness of minimally invasive procedures. The expansion of private and public healthcare facilities, coupled with increasing adoption of cannula-based interventions in surgical and therapeutic applications, is propelling market demand.

Germany Cannula Market Insight

The Germany cannula market is expected to expand at a considerable CAGR during the forecast period, driven by the country’s well-developed healthcare infrastructure, high healthcare expenditure, and preference for technologically advanced surgical devices. Growing demand for specialized cannulas in cardiovascular surgery, orthopedic surgery, and cosmetic procedures is further supporting market growth.

Asia-Pacific Cannula Market Insight

The Asia-Pacific cannula market is poised to grow at the fastest CAGR of 9.8% during the forecast period of 2025 to 2032, driven by increasing healthcare infrastructure, rising medical tourism, urbanization, and growing adoption of minimally invasive procedures in countries such as China, India, and Japan. The expansion of hospitals, clinics, and aesthetic centers, along with improving affordability of advanced cannula systems, is further enhancing regional market growth.

Japan Cannula Market Insight

The Japan cannula market is gaining momentum due to the country’s advanced healthcare infrastructure, high-tech medical culture, and increasing demand for minimally invasive and precision-based surgical procedures. Adoption of cannulas in cardiovascular interventions, cosmetic procedures, and specialized surgeries is fueling market expansion.

China Cannula Market Insight

The China cannula market accounted for the largest revenue share in Asia-Pacific in 2024, attributed to rapid urbanization, increasing healthcare infrastructure, growing medical tourism, and rising adoption of advanced minimally invasive procedures. Strong domestic manufacturers, expanding hospital networks, and government support for healthcare modernization are key factors driving the market’s growth in China.

Cannula Market Share

The Cannula industry is primarily led by well-established companies, including:

- B. Braun SE (Germany)

- Terumo Corporation (Japan)

- Smiths Group plc (U.S.)

- Medtronic (Ireland)

- Teleflex Incorporated (U.S.)

- Merit Medical Systems, Inc. (U.S.)

- BD (U.S.)

- Cook (U.S.)

- Nipro Corporation (Japan)

- Fresenius SE & Co. KGaA (Germany)

- Vygon SA (France)

- ICU Medical, Inc. (U.S.)

- Baxter International Inc. (U.S.)

- ConvaTec Group plc (U.K.)

Latest Developments in Global Cannula Market

- In April 2021, BD (Becton, Dickinson and Company) announced the 510(k) clearance from the U.S. Food and Drug Administration (FDA) for its Pristine Long-Term Hemodialysis Catheter. This catheter features a unique side-hole-free symmetric Y-Tip distal lumen design, aiming to enhance patient safety and comfort during long-term dialysis treatments. The clearance was supported by clinical data from a feasibility study with favorable primary patency rates observed up to 180 days. The Pristine Catheter became available in the U.S. in May 2021

- In July 2022, researchers developed an ultrathin, high-speed, all-optical photoacoustic endomicroscopy probe integrated within the cannula of a 20-gauge medical needle. This innovative probe combines multimode fiber for delivering photoacoustic excitation light and a single-mode optical fiber with a plano-concave microresonator for ultrasound detection. The device enables high-resolution imaging of tissue microstructures in real-time, potentially guiding minimally invasive surgeries more effectively

- In June 2025, a team of researchers successfully demonstrated the automatic cannulation of femoral vessels in a porcine hemorrhagic shock model. This advancement integrates robotic ultrasound technology for minimally invasive emergency procedures, potentially improving the speed and accuracy of vascular access in trauma and critical care situations

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.