Global Cannabidiol Cbd Infused Beverages Market

Market Size in USD Billion

CAGR :

%

USD

4.36 Billion

USD

13.80 Billion

2024

2032

USD

4.36 Billion

USD

13.80 Billion

2024

2032

| 2025 –2032 | |

| USD 4.36 Billion | |

| USD 13.80 Billion | |

|

|

|

|

Cannabidiol (CBD) Infused Beverages Market Size

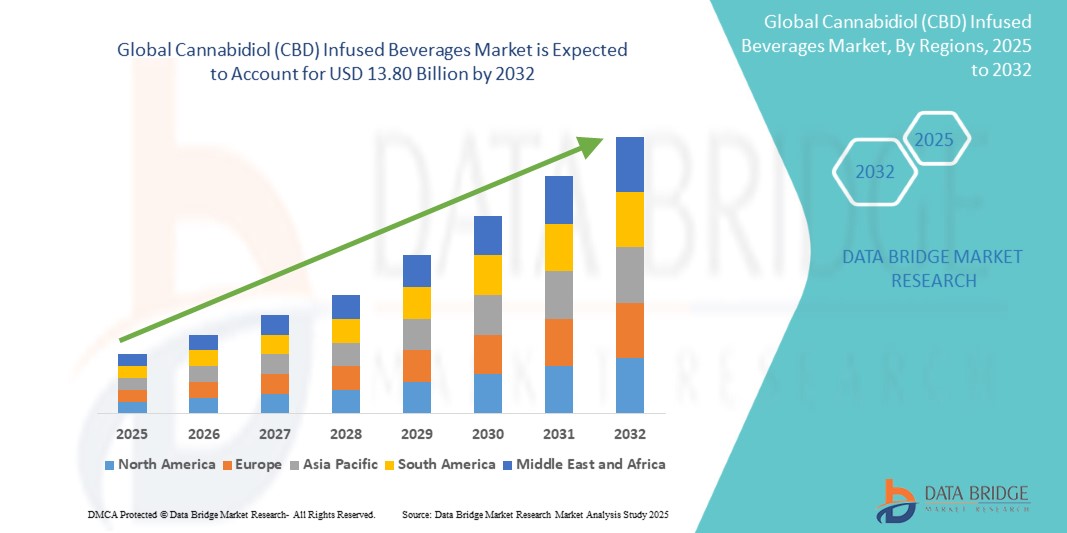

- The global cannabidiol (CBD) infused beverages market was valued at USD 4.36 billion in 2024 and is expected to reach USD 13.80 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 15.50%, primarily driven by is driven by increasing consumer demand for functional and wellness beverages

- This growth is driven by growing acceptance of CBD legalization across various regions, particularly in North America and Europe

Cannabidiol (CBD) Infused Beverages Market Analysis

- The cannabidiol (CBD) infused beverages market is experiencing significant growth due to increasing consumer demand for functional beverages and wellness drinks, particularly those infused with CBD for relaxation, stress relief, and overall well-being. The shift toward natural, plant-based alternatives in the beverage industry is fueling interest in CBD-infused teas, coffees, sparkling waters, and energy drinks. In addition, growing awareness of CBD’s potential health benefits, such as anti-inflammatory and anxiety-reducing properties, is expanding its consumer base

- The market’s growth is primarily driven by regulatory advancements, increasing legalization of CBD-based products, and the rising trend of non-alcoholic beverages. Expanding e-commerce platforms, along with retail distribution partnerships, are making CBD-infused beverages more accessible, while continuous innovations in CBD extraction and water-soluble formulations enhance product appeal

- North America dominates the CBD-infused beverage market, with the U.S. leading the industry due to its well-established cannabis sector, strong demand for wellness drinks, and increasing investments from major beverage brands. The presence of leading CBD beverage manufacturers and ongoing product innovations further solidify the region’s dominance

- For instance, in the U.S., major beverage brands are expanding their CBD-infused product portfolios, offering a variety of functional drinks aimed at relaxation and wellness, thereby driving market expansion

- Globally, the CBD-infused beverage industry is witnessing a surge in product diversification, with brands exploring different formulations, flavors, and infusion techniques. The rising consumer preference for low-sugar, organic, and non-alcoholic alternatives is pushing companies to introduce CBD drinks with additional health-enhancing ingredients, such as adaptogens and herbal extracts, fostering long-term industry growth

Report Scope and Cannabidiol (CBD) Infused Beverages Market Segmentation

|

Attributes |

Cannabidiol (CBD) Infused Beverages Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework |

Cannabidiol (CBD) Infused Beverages Market Trends

“Increasing Popularity of Functional and Wellness-Boosting Beverages”

- The demand for functional beverages that offer health benefits beyond basic hydration is rapidly growing, and cannabidiol (CBD) infused beverages are gaining traction due to their potential stress-relief, relaxation, and anti-inflammatory properties

- More consumers are shifting towards beverages that offer additional wellness benefits, such as improved sleep, mental clarity, and immune support, with CBD-infused drinks becoming a key part of this growing wellness trend

- Beverage manufacturers are responding to the rising consumer preference by introducing CBD-infused functional drinks that combine CBD with other health-promoting ingredients such as adaptogens, vitamins, and electrolytes to create all-in-one wellness solutions

For instance,

- In May 2024, Canopy Growth Corporation launched a new line of CBD-infused sparkling waters, with additional ingredients such as vitamin B12 and electrolytes, targeting consumers looking for functional hydration

- In February 2024, Tilray Brands, Inc. introduced XMG Plus, a new CBD-infused energy drink, designed to provide consumers with a balanced boost of energy along with relaxation benefits

- In November 2023, NewAge Inc. expanded its CBD beverage line by adding drinks infused with turmeric and CBD, offering a blend of anti-inflammatory benefits for a health-conscious market

- As consumers continue to prioritize health and wellness, the demand for CBD-infused beverages as part of a holistic wellness routine is expected to expand, leading to the introduction of even more multi-functional beverage options across global markets.

Cannabidiol (CBD) Infused Beverages Market Dynamics

Driver

“Expansion of E-Commerce and Online Retail Channels”

- The rapid growth of e-commerce platforms and online retail channels has become a significant driver in the cannabidiol (CBD) infused beverages market, offering consumers greater accessibility and convenience in purchasing products

- With more consumers shopping online, brands are leveraging direct-to-consumer (DTC) models, providing consumers with an easy way to purchase CBD-infused beverages from the comfort of their homes

- Online marketplaces and subscription services are growing in popularity, allowing CBD beverage manufacturers to reach a broader customer base and establish strong brand loyalty through personalized offerings and promotions

For instance,

- In February 2024, Wild Hibiscus Flower Co. expanded its online presence by launching a subscription-based service for CBD-infused beverages, allowing consumers to receive regular deliveries of their products

- In January 2024, Tilray Brands, Inc. partnered with an e-commerce platform to offer a wider range of CBD-infused beverages, enhancing customer convenience and expanding market reach

- In December 2023, My Blue Tea launched an online store, targeting wellness-conscious consumers with its CBD-infused teas and offering discounts on bulk purchases for first-time buyers

- As e-commerce continues to thrive, it provides a strong foundation for CBD beverage brands to build customer loyalty and grow their presence in the competitive market, accelerating the overall expansion of the industry

Opportunity

“Rising Popularity of CBD Infused Beverages in the Luxury Beverage Market”

- As consumers increasingly seek premium, luxury beverages, CBD-infused drinks are emerging as a high-end option, attracting those who prioritize unique, sophisticated flavor profiles and health benefits in their drinks

- With the rise of craft beverages and artisanal products, CBD-infused beverages are gaining ground in the luxury sector, where exclusivity and innovative ingredients are highly valued

- The demand for premium CBD-infused beverages is also being driven by personalized experiences, with luxury brands offering customizable CBD-infused drinks that cater to consumers’ specific tastes and wellness needs

For instance,

- In 2024, Recess launched a premium line of CBD-infused sparkling waters, featuring exclusive flavors and high-quality CBD extracts, aimed at high-income, wellness-focused consumers

- In late 2023, Cannabiniers introduced a luxury CBD beverage collection, blending rare botanicals and premium CBD to offer a more refined, high-end option for beverage connoisseurs

- In 2022, The Alchemist's Kitchen partnered with a luxury hotel chain to offer CBD-infused beverages as part of a bespoke wellness experience, attracting affluent customers seeking relaxation and stress relief

- The growing demand for premium and luxury wellness products presents a significant opportunity for CBD-infused beverages, positioning these products as a functional health choice and a luxury indulgence for discerning consumers

Restraint/Challenge

“Regulatory Uncertainty Surrounding Cannabidiol (CBD) in Beverages”

- The regulatory landscape for CBD-infused beverages remains unclear in many countries, with varying rules and regulations regarding the inclusion of CBD in consumables. This uncertainty makes it difficult for manufacturers to ensure compliance across multiple markets

- In some regions, CBD is still classified as a controlled substance, while others require extensive testing and documentation, increasing the cost and complexity of market entry for producers

- Lack of clear guidelines also impacts marketing and distribution, as companies face challenges in advertising their products or even determining appropriate labeling requirements

For instance,

- In 2024, a CBD beverage company in the U.S. faced delays in launching a new product due to regulatory hold-ups in obtaining FDA approval for the use of CBD in beverages

- In 2023, a European CBD company was forced to withdraw its products from shelves in the UK after new local regulations were enacted, restricting the sale of CBD-infused beverages

- In 2022, a CBD beverage startup in Canada had to restructure its supply chain and packaging to comply with newly enforced regulations around CBD content and labeling requirements

- As regulatory clarity evolves, companies need to stay proactive in compliance, potentially adapting to new standards and laws, to maintain market access and avoid legal issues

Cannabidiol (CBD) Infused Beverages Market Scope

The market is segmented on the basis of product type, CBD type, grade, and distribution channel.

|

Segmentation |

Sub-Segmentation |

|

By Product Type |

|

|

By CBD Type |

|

|

By Grade |

|

|

By Distribution Channel |

|

Cannabidiol (CBD) Infused Beverages Market Regional Analysis

“North America is the Dominant Region in the Cannabidiol (CBD) Infused Beverages Market”

- The cannabidiol (CBD) infused beverages market in North America is dominating due to increasing consumer interest in functional and wellness beverages infused with CBD for relaxation and health benefits

- U.S. leads the region, driven by a favorable regulatory environment, growing acceptance of CBD products, and the rising number of brands launching CBD-infused teas, coffees, and sparkling waters

- Major players in the industry are investing in product innovation, strategic partnerships, and retail expansion to strengthen their market presence

For Instance,

- In 2023, Molson Coors expanded its line of CBD-infused beverages in Canada, targeting health-conscious consumers looking for non-alcoholic relaxation alternatives

- In 2022, Coca-Cola explored partnerships with cannabis companies to develop CBD-infused functional drinks for the U.S. market

- In 2021, Recess, a leading CBD beverage brand, secured significant funding to scale its distribution across North America, capitalizing on the growing wellness trend

- North America is expected to maintain its dominance in the cannabidiol (CBD) infused beverages market, fueled by increasing consumer demand, expanding distribution networks, and continuous innovation in product formulations

“Europe is projected to register the Highest Growth Rate”

- Europe is expected to witness the highest CAGR in the cannabidiol (CBD) infused beverages market, driven by increasing consumer acceptance of CBD products, supportive regulatory developments, and growing demand for functional wellness drinks

- Countries such as Germany, the U.K., and France are leading the market due to expanding CBD legalization, rising investments in the beverage sector, and the increasing popularity of plant-based and non-alcoholic relaxation beverages

- The rapid expansion of e-commerce platforms and specialty health stores, along with growing partnerships between beverage manufacturers and cannabis companies, is further fueling market growth

For Instance,

- In 2024, the U.K. Food Standards Agency (FSA) approved several CBD-infused beverage products, boosting their availability in mainstream retail stores

- With increasing consumer awareness, favorable policy shifts, and expanding distribution channels, Europe is poised to become one of the fastest-growing regions in the cannabidiol (CBD) infused beverages market

Cannabidiol (CBD) Infused Beverages Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Canopy Growth Corporation (Canada)

- The Cronos Group (Canada)

- Tilray Brands, Inc. (U.S.)

- CannTrust Holdings (Canada)

- Aurora Cannabis Inc. (Canada)

- Jazz Pharmaceuticals, Inc. (U.K.)

- Medipharm Labs (Canada)

- NewAge Inc. (U.S.)

- Cannara Biotech Inc. (Canada)

- Dixie Brands (U.S.)

- KANNAWAY USA, LLC (U.S.)

- The Supreme Cannabis Company, Inc. (Canada)

- Cannabis NL (Canada)

- CURA CS, LLC. (U.S.)

- Kazmira (U.S.)

- Curaleaf (U.S.)

- CannazALL (U.S.)

Latest Developments in Global Cannabidiol (CBD) Infused Beverages Market

- In May 2024, Tilray Brands, Inc. introduced new cannabis-infused beverages under its XMG brand, launching two sub-brands, XMG Plus ("XMG+") and XMG Zero, as part of its strategy to diversify offerings and redefine the cannabis beverage market with quality and variety

- In January 2024, Texas Original, a leading medical cannabis provider in Texas, launched Elevate, its first beverage product, featuring a balanced blend of CBG and THC along with key ingredients such as turmeric and ginger juice

- In June 2021, Canopy Growth, one of the largest cannabis companies worldwide, completed the acquisition of The Supreme Cannabis Company, securing 100 percent of Supreme’s issued and outstanding common shares

- In May 2021, TCV Sciences, Inc. introduced PLUSCBD Calm and Sleep Gummies, two flavorful gummies designed to support healthy stress responses and sleep cycles for individuals resuming their regular routines

- In March 2021, STADA Arzneimittel AG, one of Germany's largest pharmaceutical firms, entered the medical cannabis sector through an agreement with Canadian firm MediPharm Labs to launch two flower products, with six additional products planned for release

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.