Global Cancer Supportive Care Products Market

Market Size in USD Billion

CAGR :

%

USD

21.66 Billion

USD

26.40 Billion

2024

2032

USD

21.66 Billion

USD

26.40 Billion

2024

2032

| 2025 –2032 | |

| USD 21.66 Billion | |

| USD 26.40 Billion | |

|

|

|

|

Cancer Supportive Care Products Market Size

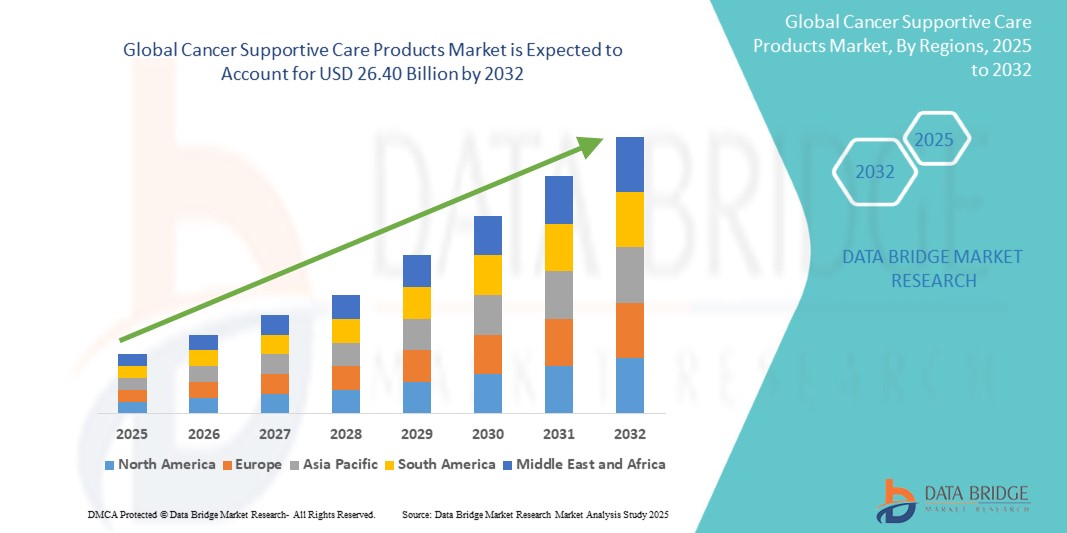

- The global cancer supportive care products market size was valued at USD 21.66 billion in 2024 and is expected to reach USD 26.40 billion by 2032, at a CAGR of 2.50% during the forecast period

- This growth is driven by increasing cancer incidences

Cancer Supportive Care Products Market Analysis

- Cancer supportive care products play a crucial role in oncology by managing side effects of cancer treatments such as chemotherapy-induced nausea, neutropenia, anemia, and bone complications, thereby improving patients’ quality of life and adherence to primary therapies

- The demand for supportive care therapies is growing steadily due to the rising global cancer burden, increasing survival rates, and growing awareness of integrated cancer management approaches

- North America is expected to dominate the cancer supportive care products market with the largest market share of 48.87%, driven by a high prevalence of cancer, widespread adoption of advanced supportive therapies, robust healthcare spending, and strong regulatory frameworks

- Asia-Pacific is projected to witness the highest growth rate in the cancer supportive care products market during the forecast period, supported by rising cancer incidence, expanding healthcare access, increasing government healthcare spending, and growing adoption of biosimilars in emerging economies

- The granulocyte colony stimulating factor segment is expected to dominate the usability segment with the largest market share of 25.34% in 2025, as it serves as a frontline treatment for cancer-related neutropenia and is one of the most widely used supportive care therapies in the management of breast and lymphoma cancers

Report Scope and Cancer Supportive Care Products Market Segmentation

|

Attributes |

Cancer Supportive Care Products Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Cancer Supportive Care Products Market Trends

“Growing Focus on Oral Supportive Care Therapies”

- A prominent trend in the cancer supportive care products market is the shift toward oral formulations for managing side effects such as nausea, anemia, and neutropenia, driven by patient convenience and adherence benefits

- Oral supportive care drugs are being increasingly favored over intravenous formulations due to lower hospitalization needs, reduced healthcare costs, and enhanced patient quality of life

- This trend aligns with the industry’s broader move toward outpatient care and home-based cancer treatment protocols

- For instance, in 2023, Amgen expanded access to its oral antiemetic portfolio to support outpatient chemotherapy centers across the U.S.

- The growing preference for oral supportive care options is improving patient compliance, expanding market reach, and reshaping cancer treatment delivery models

Cancer Supportive Care Products Market Dynamics

Driver

“Rising Prevalence of Chemotherapy-Induced Side Effects”

- The global increase in chemotherapy usage for various cancer types has led to a higher incidence of treatment-related complications such as neutropenia, anemia, and bone loss

- This surge in side effects is driving the demand for supportive care drugs such as G-CSF agents, erythropoiesis-stimulating agents, bisphosphonates, and antiemetics

- Hospitals and oncology centers are increasingly prioritizing prophylactic supportive therapies to reduce treatment delays and improve patient outcomes

- For instance, in 2024, the National Comprehensive Cancer Network (NCCN) updated its guidelines to recommend earlier use of growth factors during chemotherapy cycles for breast and lung cancer patients

- This driver is expected to continue supporting market growth by increasing the usage of preventive supportive care products in standard oncology protocols

Opportunity

“Expansion of Biosimilar Supportive Care Products”

- The patent expiration of several blockbuster supportive care drugs is opening doors for biosimilar development, making these therapies more affordable and accessible globally

- Biosimilars offer a cost-effective alternative for managing cancer treatment side effects without compromising clinical outcomes, especially in emerging economies

- Regulatory support and rising confidence among physicians are further boosting biosimilar adoption across healthcare systems

- For instance, in 2023, Biocon Biologics received regulatory approval in Latin America for its biosimilar pegfilgrastim, expanding access to neutropenia management for underserved cancer patients

- The biosimilars boom represents a major opportunity for market penetration and growth in cost-sensitive and high-burden regions

Restraint/Challenge

“Stringent Regulatory Hurdles for Supportive Care Drug Approvals”

- Regulatory agencies impose rigorous clinical and quality standards for the approval of supportive care drugs, particularly biosimilars and novel formulations

- The complexity of demonstrating equivalence in efficacy and safety compared to reference drugs delays market entry and increases R&D costs

- Moreover, differing regulatory pathways across countries create inconsistencies in approval timelines and hinder global commercialization

- For instance, in 2023, a biosimilar application by a European manufacturer for anti-anemia therapy was stalled in the U.S. due to additional data requests from the FDA

- Addressing regulatory challenges will be critical for accelerating the availability of advanced supportive care options and fostering innovation in the market

Cancer Supportive Care Products Market Scope

The market is segmented on the basis of drug class, indication, and distribution channel.

|

Segmentation |

Sub-Segmentation |

|

By Drug Class |

|

|

By Indication |

|

|

By Distribution Channel |

|

In 2025, the granulocyte colony stimulating factor is projected to dominate the market with a largest share in drug class segment

The granulocyte colony stimulating factor segment is expected to dominate the cancer supportive care products market with the largest market share of 25.34% in 2025, as it serves as a frontline treatment for cancer-related neutropenia and is one of the most widely used supportive care therapies in the management of breast and lymphoma cancers.

The breast cancer is expected to account for the largest share during the forecast period in indication segment

In 2025, the breast cancer segment is expected to dominate the market with the largest market share of 15.11% due to its treatment includes combination of surgery, radiation therapy, chemotherapy, and targeted therapy, each of which may lead to various side effects such as fatigue, pain, nausea, and emotional strain.

Cancer Supportive Care Products Market Regional Analysis

“North America Holds the Largest Share in the Cancer Supportive Care Products Market”

- North America is expected to dominate the global cancer supportive care products market with the largest market share of 48.87%, due to the introduction and swift adoption of biosimilars, along with restrictions on opioid prescriptions, are influencing treatment patterns

- The U.S. continues to lead the region due to high cancer prevalence, widespread use of supportive care therapies, and strong insurance coverage supporting access to advanced treatments

- Technological innovations in drug delivery systems, focus on patient-centric supportive therapies, and collaborative efforts between government bodies and private players are expected to maintain North America's market dominance throughout the forecast period

“Asia-Pacific is Projected to Register the Highest CAGR in the Cancer Supportive Care Products Market”

- Asia-Pacific is projected to experience the highest compound annual growth rate (CAGR) in the cancer supportive care products market, driven by rising cancer incidence, improving access to care, and government initiatives promoting early diagnosis and treatment

- Countries such as India, China, and Japan are key contributors, with health programs such as India's "Ayushman Bharat" and China’s "Healthy China 2030" supporting infrastructure development and the inclusion of supportive care medications in treatment protocols

- Increasing awareness of quality-of-life interventions and expanding distribution channels such as online and retail pharmacies are accelerating market growth, solidifying Asia-Pacific as a major future growth region for cancer supportive care

Cancer Supportive Care Products Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Acacia Pharma Group Plc (U.K.)

- Teva Pharmaceutical Industries Ltd. (Israel)

- Fagron (Belgium)

- KYOWA HAKKO BIO CO.,LTD. (Japan)

- APR (Switzerland)

- F. Hoffmann-La Roche Ltd. (Switzerland)

- Amgen Inc. (U.K.)

- Baxter (U.S.)

- Bayer AG (Germany)

- DAIICHI SANKYO COMPANY, LIMITED. (Japan)

- GSK Plc (U.K.)

Latest Developments in Global Cancer Supportive Care Products Market

- In June 2023, the FDA approved the use of selumetinib (Koselugo) for treating patients with metastatic melanoma that has progressed after previous therapies. Selumetinib functions as a MEK inhibitor, targeting pathways that drive cancer cell proliferation. This approval expands the treatment options available for late-stage melanoma patients facing limited alternatives

- In May 2023, the FDA granted approval for denosumab (Prolia) to be used in the prevention of bone loss among breast cancer patients receiving aromatase inhibitors. Denosumab, a monoclonal antibody, works by blocking the RANKL protein, which is associated with bone degradation. This decision supports bone health preservation in patients undergoing hormonal cancer therapies

- In April 2023, the FDA authorized the use of pembrolizumab (Keytruda) for the treatment of advanced solid tumors that have progressed despite prior therapies. Pembrolizumab is a checkpoint inhibitor that disrupts the PD-1/PD-L1 interaction, thereby enhancing the immune system's ability to target cancer cells. This broadens the clinical application of immunotherapy in resistant solid tumor cases

- In March 2022, Novartis received FDA approval for Pluvicto, a therapy for metastatic castration-resistant prostate cancer (mCRPC) patients with PSMA-positive tumors who had already undergone hormone and chemotherapy treatments. Pluvicto offers a new avenue of treatment for patients with advanced stages of prostate cancer

- In March 2022, Australian biotech firm Imugene entered into a collaboration with MSD (Merck & Co., Inc.) to evaluate the combination of HER-Vaxx, a B-cell activating immunotherapy, with KEYTRUDA (pembrolizumab) in HER-2 positive gastric cancer patients. This clinical trial aims to explore the safety and efficacy of combining immunotherapies for enhanced treatment outcomes

- In June 2020, Pfizer Inc. announced that the FDA approved NYVEPRIA (pegfilgrastim-apgf), a biosimilar to Neulasta, designed to reduce the risk of infection due to febrile neutropenia in patients undergoing myelosuppressive chemotherapy for non-myeloid malignancies. This biosimilar expands access to supportive care therapies critical in cancer treatment cycles

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.