Global Busbar Market

Market Size in USD Billion

CAGR :

%

USD

17.04 Billion

USD

26.97 Billion

2024

2032

USD

17.04 Billion

USD

26.97 Billion

2024

2032

| 2025 –2032 | |

| USD 17.04 Billion | |

| USD 26.97 Billion | |

|

|

|

|

Busbar Market Size

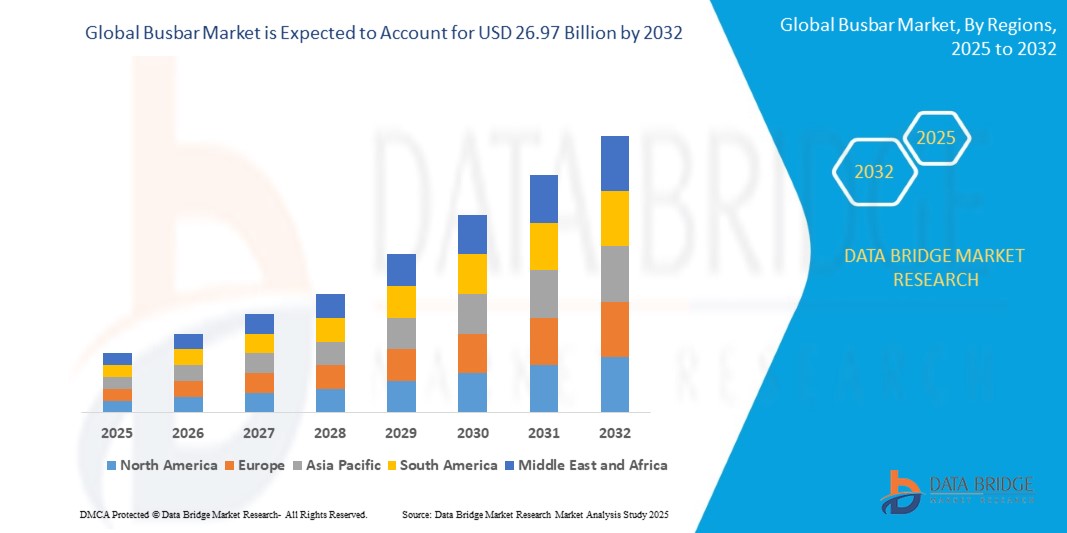

- The global busbar market size was valued at USD 17.04 billion in 2024 and is expected to reach USD 26.97 billion by 2032, at a CAGR of 5.90% during the forecast period

- The market growth is largely fuelled by the increasing demand for reliable and efficient power distribution systems, expansion of smart grid infrastructure, and the rising need for compact and cost-effective power systems in industrial and commercial sectors

- In addition, the growing focus on renewable energy integration and the modernization of aging electrical infrastructure are further contributing to the steady rise in global busbar demand

Busbar Market Analysis

- The busbar market is witnessing steady growth due to the growing integration of renewable energy sources into existing power grids, which requires flexible and efficient power distribution solutions

- Rapid urbanization and infrastructure development across developing regions, particularly in Asia-Pacific, are generating a significant demand for advanced electrical components, including busbars

- North America dominated the global busbar market with the largest revenue share in 2024, driven by increasing demand for modernized power infrastructure, growth in smart grid investments, and rising adoption of energy-efficient electrical distribution systems

- Asia-Pacific region is expected to witness the highest growth rate in the global busbar market, driven by rapid industrialization, increasing energy demand, and widespread deployment of smart grid and power transmission systems in countries such as China, India, and Japan

- The copper segment dominated the market with the largest revenue share in 2024, owing to its superior electrical conductivity, corrosion resistance, and mechanical strength. Copper busbars are widely used in high-performance electrical applications such as switchgear, panel boards, and substations due to their durability and reliability under varying load conditions

Report Scope and Busbar Market Segmentation

|

Attributes |

Busbar Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Busbar Market Trends

“Growing Adoption of Compact and Modular Busbar Systems”

- The global shift toward space optimization is accelerating the adoption of compact and modular busbar systems, especially in urban infrastructure and commercial buildings where space is limited and system efficiency is prioritized. These systems reduce the footprint of electrical installations while enhancing layout flexibility. As a result, industries are turning to modular busbars to meet both structural and performance requirements

- Industries are favoring modular busbars due to their simplified installation, improved thermal management, and ability to handle high power loads within a confined layout, making them ideal for dense electrical setups. These features make them particularly suitable for manufacturing environments and server rooms. Their plug-and-play nature also reduces installation errors and labor costs

- Energy-efficient building designs are increasingly integrating modular systems that reduce energy losses and require minimal maintenance, aligning with green building standards and operational cost reduction goals. This trend supports sustainability objectives while improving long-term system reliability. Modular busbars also help reduce the use of non-recyclable wiring materials

- For instance, Schneider Electric’s I-Line Busway system and Siemens' BD2 compact busbars are being widely implemented in data centers and automated industrial environments due to their plug-and-play capability and system reliability. These products demonstrate industry adoption of modularity to reduce complexity and improve power density. Both systems are also designed with future scalability in mind

- The growing focus on modularity, compact design, and performance is pushing modular busbars to the forefront of power distribution innovation across various sectors. As urban infrastructure continues to densify and energy efficiency becomes a key metric, demand for these systems will continue to rise globally

Busbar Market Dynamics

Driver

“Rising Demand for Efficient Power Distribution in Industrial and Commercial Sectors”

- Industrial expansion and commercial real estate growth are leading to higher demand for reliable and streamlined power distribution systems that support uninterrupted operations, reduced energy losses, and system scalability. Busbars help improve power flow efficiency across complex electrical grids. They are increasingly viewed as critical infrastructure in power-intensive operations

- Busbars provide a compact and organized alternative to traditional wiring, enhancing current-carrying capacity, reducing electromagnetic interference, and supporting safe energy distribution in high-load environments. Their structured design helps reduce fault risks and facilitates better energy monitoring. This is crucial in sectors with continuous power demands such as automotive and food processing

- The adoption of Industry 4.0 and automation technologies is reinforcing the demand for advanced power systems, where busbars serve as an integral component to support robotics, sensors, and smart equipment networks. Their reliability and ease of integration make them ideal for smart factories. They also support rapid reconfiguration of equipment layouts

- For instance, ABB’s busbar systems are widely used in automotive manufacturing plants and high-rise commercial complexes for their flexibility, load-handling efficiency, and ease of integration into intelligent power management systems. These systems enhance operational safety and facilitate centralized energy monitoring. ABB’s products are also favored for their modular expandability

- As industries and commercial buildings evolve toward smarter and more efficient infrastructures, busbars are becoming indispensable for supporting next-generation electrical demands. Their role in minimizing energy losses, improving power distribution, and adapting to automation trends solidifies their place in modern industrial architecture

Restraint/Challenge

“High Initial Installation Costs and Compatibility Concerns”

- The significant upfront investment required for installing busbar systems, especially in retrofitting applications, poses a challenge for widespread adoption, particularly among small and mid-sized enterprises with budget constraints. These businesses may opt for traditional cabling despite the long-term savings offered by busbars. Cost sensitivity often overrides efficiency considerations in early phases

- Compatibility with existing electrical infrastructure often demands layout redesigns, custom fittings, or additional components, which can increase overall system costs and delay project implementation. This is especially challenging in older buildings where space and panel configurations may not support standardized busbar systems. Upgrades can require significant downtime

- The shortage of skilled professionals with expertise in busbar system design and installation further complicates deployment, particularly in rural or underdeveloped areas where technical resources are limited. Without qualified technicians, the risk of improper installation increases. This adds to the total cost through rework or system inefficiencies

- For instance, in several aging industrial plants across Eastern Europe, the adoption of busbar systems has been delayed due to high costs of integration and the need for building structural modifications. In these facilities, managers have cited a lack of local support and high custom installation costs as key deterrents. This trend affects retrofit adoption rates

- While busbars offer long-term efficiency benefits, the high initial expenditure and technical barriers continue to hinder market penetration, especially in cost-sensitive and legacy infrastructure environments. Addressing these challenges through cost-reduction strategies, skilled workforce development, and flexible system design will be critical for future market expansion

Busbar Market Scope

The market is segmented on the basis of conductor, weight, shape, insulation, length, busbar type, power rating, and end user.

• By Conductor

On the basis of conductor, the global busbar market is segmented into aluminium and copper. The copper segment dominated the market with the largest revenue share in 2024, owing to its superior electrical conductivity, corrosion resistance, and mechanical strength. Copper busbars are widely used in high-performance electrical applications such as switchgear, panel boards, and substations due to their durability and reliability under varying load conditions.

The aluminium segment is expected to witness the fastest growth rate from 2025 to 2032, driven by its lightweight nature, cost-effectiveness, and increasing preference in low-to-medium voltage applications. Aluminium busbars are gaining traction in commercial buildings and renewable energy systems where weight reduction and affordability are critical considerations.

• By Weight Wise

On the basis of weight, the busbar market is segmented into less than 1 kg and more than 1 kg. The more than 1 kg segment accounted for the largest revenue share in 2024, supported by high-volume industrial applications such as energy-intensive manufacturing, electric vehicle infrastructure, and data centers. These installations demand thicker, heavier busbars to handle high currents and ensure system stability.

The less than 1 kg segment is expected to witness the fastest growth rate from 2025 to 2032, owing to rising use in compact electrical units, residential panels, and portable electronic systems. Miniaturization of components and focus on lightweight electrical assemblies are encouraging the demand for lighter busbars.

• By Shape Wise

On the basis of shape, the market is segmented into chamfer and rectangle. The rectangle segment led the market in 2024 due to its standardization, ease of installation, and suitability for high-load electrical systems. Rectangular busbars are preferred in industrial and utility-scale projects where uniformity and design consistency are critical.

The chamfer segment is expected to witness the fastest growth rate from 2025 to 2032, due to its growing adoption in custom and high-frequency applications. Chamfered designs improve current flow, reduce skin effect losses, and are gaining popularity in aerospace and advanced electronics segments.

• By Insulation

On the basis of insulation, the market is segmented into epoxy power coating, teonix, tedler, mylar, nomex, kapton, and others. The epoxy power coating segment held the largest market share in 2024 due to its superior dielectric strength, mechanical protection, and resistance to harsh environmental conditions. It is widely used in outdoor switchgear and transportation systems.

Kapton is expected to witness the fastest growth rate from 2025 to 2032, owing to its exceptional thermal stability and application in high-temperature environments such as aerospace, defense electronics, and specialized industrial systems.

• By Length

On the basis of length, the market is segmented into less than 1m, 1m to 2m, 2m to 3m, and more than 3m. The 1m to 2m segment dominated the market in 2024, supported by standardized product configurations for electrical cabinets, control panels, and switchboards across industrial and commercial installations.

The more than 3m segment is expected to witness the fastest growth rate from 2025 to 2032, as large-scale infrastructure projects, substations, and renewable energy systems increasingly require longer busbars to span greater distances without performance loss.

• By Busbar Type

On the basis of type, the market is segmented into single conductor busbars, multiple conductor busbars, flexible busbars, and laminate busbars. The single conductor busbar segment captured the largest market share in 2024 due to its simplicity, robustness, and extensive use in power distribution panels and industrial control systems.

The flexible busbar segment is expected to witness the fastest growth rate from 2025 to 2032, driven by its ability to bend and adapt to compact spaces, making it ideal for electric vehicles, modular switchgear, and compact control assemblies.

• By Power Rating

On the basis of power rating, the market is segmented into low power, medium power (125A–800A), and high power (above 800A). The medium power segment dominated the market in 2024 due to its wide application range in commercial buildings, manufacturing units, and data centers, where moderate current distribution is required.

The high power segment is expected to witness the fastest growth rate from 2025 to 2032, supported by the surge in demand from power utilities, heavy industries, and electric vehicle charging stations requiring high-capacity current handling.

• By End User

On the basis of end user, the market is segmented into industrial, residential, and commercial. The industrial segment held the largest revenue share in 2024, owing to large-scale deployment of busbars in machinery, power systems, and automation lines for uninterrupted energy supply.

The commercial segment is expected to witness the fastest growth rate from 2025 to 2032, driven by increased investment in commercial infrastructure such as malls, hospitals, hotels, and office buildings that demand efficient and safe power distribution solutions.

Busbar Market Regional Analysis

- North America dominated the global busbar market with the largest revenue share in 2024, driven by increasing demand for modernized power infrastructure, growth in smart grid investments, and rising adoption of energy-efficient electrical distribution systems

- The region benefits from strong industrial automation, rapid expansion of electric vehicle charging infrastructure, and robust construction activity in both residential and commercial segments

- Supportive regulatory frameworks, high technology adoption, and the presence of key market players are further strengthening North America’s leadership in the global busbar market

U.S. Busbar Market Insight

The U.S. busbar market accounted for the largest revenue share in North America in 2024, supported by extensive upgrades to aging electrical grids, rising penetration of smart building technologies, and expanding electric vehicle infrastructure. The country’s push toward sustainable energy practices and advanced manufacturing is fueling demand for efficient, high-performance busbar systems. Moreover, U.S.-based innovations in insulation technology and modular power components are further enhancing market growth.

Asia-Pacific Busbar Market Insight

The Asia-Pacific busbar market is expected to witness the fastest growth rate from 2025 to 2032, driven by rapid urbanization, ongoing electrification projects, and significant growth in the manufacturing and construction sectors. Countries such as China, India, and Japan are investing heavily in energy infrastructure, automation, and renewable energy systems, boosting demand for reliable power distribution solutions such as busbars. Local production and competitive pricing also support widespread adoption.

China Busbar Market Insight

The China busbar market captured the largest revenue share in Asia-Pacific in 2024, driven by the country’s extensive industrial base, large-scale infrastructure projects, and high adoption of smart grid technologies. China’s domestic production capabilities in both copper and aluminium busbars contribute to lower costs and enhanced availability. The market is further supported by government investments in electric mobility, power generation, and urban development.

Japan Busbar Market Insight

The Japan busbar market is expected to witness the fastest growth rate from 2025 to 2032, fueled by the country’s emphasis on energy efficiency, automation, and compact electrical solutions. Busbars are being widely adopted in data centers, electric mobility applications, and precision manufacturing facilities. The trend toward integration of busbars in smart and modular electrical systems supports long-term market expansion in Japan’s technology-driven environment.

Europe Busbar Market Insight

The Europe busbar market is expected to witness the fastest growth rate from 2025 to 2032, supported by strong regulatory focus on sustainability, energy efficiency, and the electrification of transport and industrial systems. Demand is being driven by smart grid deployments, renewable energy integration, and construction of energy-efficient buildings. Countries such as Germany, France, and the United Kingdom are at the forefront of advanced electrical system adoption.

Germany Busbar Market Insight

The Germany busbar market is expected to witness the fastest growth rate from 2025 to 2032, driven by the country's focus on industrial efficiency, automation, and renewable energy integration. Busbars are widely deployed in wind and solar installations, manufacturing facilities, and smart building applications. The push for carbon neutrality and modern power infrastructure is fostering innovation and accelerating adoption of advanced busbar systems across German industries.

U.K. Busbar Market Insight

The U.K. busbar market is expected to witness the fastest growth rate from 2025 to 2032, supported by the growing demand for sustainable building systems and smart grid modernization. The adoption of busbars in commercial, residential, and institutional sectors is being fueled by government policies aimed at energy efficiency. Upgrades in aging infrastructure and rising electric vehicle adoption are also contributing to market growth in the UK.

Busbar Market Share

The Busbar industry is primarily led by well-established companies, including:

- ABB (Switzerland)

- Siemens (Germany)

- Schneider Electric (France)

- Eaton (Ireland)

- GENERAL ELECTRIC (U.S.)

- Legrand SA (France)

- Rittal GmbH & Co. KG (Germany)

- CHINT Group (China)

- Emerson Electric Co. (U.S.)

- Rogers Corporation (U.S.)

- Eaton (Ireland)

Latest Developments in Global Busbar Market

- In April 2024, Referro Systems, an authorized distributor of Rockwell Automation in South Africa, announced the launch of the Cubic Cu-Flex range, a new line of flexible copper busbars. This development aims to offer enhanced flexibility and ease of installation in power distribution systems. The introduction of Cu-Flex is expected to support compact design requirements in modern electrical setups, improving both space efficiency and system reliability in commercial and industrial applications

- In March 2024, ABB unveiled its FlexLine series of modular protection devices designed to simplify installation and improve flexibility in residential and small commercial buildings. The series includes RCDs, MCBs, and AFDDs, all featuring push-in technology for quick integration on a single busbar type. This innovation enhances user convenience, reduces wiring time, and supports the growing demand for safer, smarter electrical distribution systems

- In April 2021, Tai Sin Electric launched its Busbar Trunking System, also known as Busway or Busduct, and established Singapore’s first and only Busbar Test Lab. This innovation marks a significant milestone in power distribution, offering a compact, efficient alternative to traditional cable systems. The move reinforces Tai Sin Electric’s position in the market and is expected to accelerate the adoption of advanced busbar systems across Southeast Asia

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Busbar Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Busbar Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Busbar Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.