Global Building Information Modelling Market

Market Size in USD Billion

CAGR :

%

USD

20.61 Billion

USD

58.39 Billion

2025

2033

USD

20.61 Billion

USD

58.39 Billion

2025

2033

| 2026 –2033 | |

| USD 20.61 Billion | |

| USD 58.39 Billion | |

|

|

|

|

Building Information Modelling Market Size

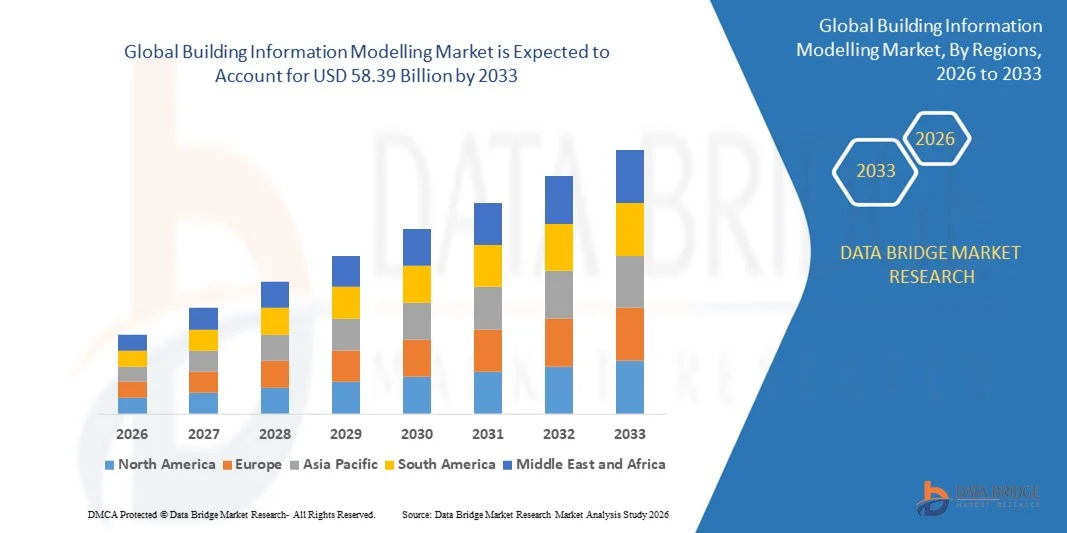

- The global building information modelling market size was valued at USD 20.61 billion in 2025 and is expected to reach USD 58.39 billion by 2033, at a CAGR of 13.90% during the forecast period

- The market growth is largely fueled by the increasing adoption of digital construction technologies and advanced project management solutions, leading to greater efficiency, collaboration, and cost savings across residential, commercial, and infrastructure projects

- Furthermore, rising demand from architects, engineers, contractors, and facility managers for integrated design, visualization, and lifecycle management solutions is establishing BIM as the preferred platform for planning, executing, and maintaining building projects. These converging factors are accelerating the uptake of BIM software, thereby significantly driving the market's expansion

Building Information Modelling Market Analysis

- Building information modelling, offering 3D modeling, digital collaboration, and lifecycle management for construction projects, is becoming a critical tool for enhancing accuracy, reducing rework, and improving decision-making across residential, commercial, and infrastructure developments

- The escalating demand for BIM solutions is primarily fueled by digitalization in the construction industry, government mandates promoting BIM adoption, increasing urbanization, and the need for sustainable, cost-efficient, and time-saving construction practices

- North America dominated the building information modelling market with a share of 37.90% in 2025, due to the increasing adoption of digital construction technologies and advanced project management practices

- Asia-Pacific is expected to be the fastest growing region in the building information modelling market during the forecast period due to rapid urbanization, large-scale infrastructure projects, and government initiatives promoting smart city development in countries such as China, Japan, and India

- On-premise segment dominated the market with a market share of 71.60% in 2025, due to organizations’ preference for local control of project data, enhanced security, and integration with existing IT infrastructure. Large construction firms and government projects often rely on on-premise solutions to ensure compliance with data governance policies and safeguard proprietary designs. The ability to customize software modules and workflows according to specific project requirements also supports the continued dominance of on-premise BIM solutions

Report Scope and Building Information Modelling Market Segmentation

|

Attributes |

Building Information Modelling Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Building Information Modelling Market Trends

Rising Adoption of Cloud-Based and Collaborative BIM Solutions

- A notable trend in the building information modelling market is the increasing adoption of cloud-based and collaborative BIM platforms that enable seamless project coordination across architects, engineers, contractors, and owners. This trend is enhancing real-time data accessibility, reducing project errors, and accelerating decision-making across construction projects

- For instance, Autodesk’s BIM 360 and Bentley Systems’ ProjectWise provide cloud-enabled collaborative environments that allow multiple stakeholders to work simultaneously on design, planning, and operational workflows. These solutions improve project transparency, coordination efficiency, and overall construction quality

- The integration of artificial intelligence (AI) and machine learning (ML) into BIM software is gaining traction to automate clash detection, predictive maintenance planning, and construction scheduling. This technological infusion is positioning BIM as a more intelligent and proactive tool for project lifecycle management

- Adoption of BIM in infrastructure and large-scale urban development projects is increasing, where detailed digital modeling supports efficient cost estimation, risk mitigation, and sustainability assessments. This is reinforcing BIM’s role as a strategic enabler for complex projects with tight timelines and regulatory compliance requirements

- Sustainability and energy-efficiency planning are driving the use of BIM for simulation and analysis, where applications such as energy modeling and carbon footprint assessment are becoming standard practices. This trend is expanding BIM’s scope beyond design and construction into operational efficiency and environmental compliance

- Construction firms are increasingly leveraging BIM for facilities management and long-term asset performance tracking, integrating IoT data with digital models to monitor structural health and operational efficiency. This evolution is strengthening BIM’s adoption as a holistic solution across the entire building lifecycle

Building Information Modelling Market Dynamics

Driver

Increasing Government Mandates and Construction Industry Digitalization

- Government regulations and initiatives mandating the use of BIM for public infrastructure projects are significantly driving market growth. These mandates encourage standardization in digital project delivery and promote efficient construction practices across both public and private sectors

- For instance, the U.K. Government’s requirement for Level 2 BIM in all centrally procured public projects has accelerated adoption across construction companies such as Arup and Balfour Beatty. This has resulted in improved collaboration, reduced project delays, and cost savings on large-scale government contracts

- The ongoing digital transformation in the construction industry is fueling demand for BIM solutions that support integrated workflows and centralized project data management. This shift is enabling construction firms to optimize resource allocation, enhance design accuracy, and reduce errors during execution

- Large-scale infrastructure development in regions such as the Asia-Pacific is boosting BIM adoption, where government-backed smart city initiatives and industrial construction projects require comprehensive digital planning tools. This is positioning BIM as a critical component for achieving project efficiency and regulatory compliance

- The rising complexity of construction projects globally continues to strengthen this driver, as integrated BIM platforms provide centralized control, data-driven insights, and real-time collaboration that are critical for meeting project timelines and budget targets

Restraint/Challenge

High Implementation Costs and Technical Skill Gaps

- The building information modelling market faces challenges due to the high costs associated with BIM software licensing, implementation, and hardware requirements. These costs can be a barrier for small and medium-sized construction firms with limited budgets

- For instance, firms such as Turner Construction and Skanska experience significant upfront investment in Autodesk Revit and Navisworks deployment, including staff training and infrastructure upgrades. These expenses often limit rapid adoption, especially in projects with smaller margins

- A shortage of skilled professionals proficient in BIM, including modelers, coordinators, and data managers, hampers effective utilization of BIM platforms. This skills gap necessitates extensive training programs and talent acquisition efforts to ensure successful implementation

- Integration of BIM with legacy systems and existing project workflows can be complex and time-consuming, requiring specialized IT support and customization. These technical challenges can delay project schedules and reduce the anticipated efficiency benefits

- The market continues to face constraints related to balancing investment costs with anticipated returns, particularly for smaller construction firms and contractors in emerging economies. Addressing these cost and skill-related barriers remains critical for wider adoption and sustained market growth

Building Information Modelling Market Scope

The market is segmented on the basis of component, deployment mode, project life cycle, building type, application, and end-user.

- By Component

On the basis of component, the BIM market is segmented into solution and services. The solution segment dominated the market with the largest revenue share in 2025, driven by the increasing adoption of software platforms that enable digital modeling, design visualization, and collaboration across project stakeholders. Organizations prefer BIM solutions due to their ability to reduce errors, optimize resource allocation, and enhance project efficiency from preconstruction to facility management. The growing integration of AI, machine learning, and cloud-based analytics in BIM solutions further strengthens their appeal among architects, engineers, and construction firms. Solutions offering compatibility with multiple file formats and project management tools also contribute to their widespread adoption and market dominance.

The services segment is expected to witness the fastest growth rate from 2026 to 2033, fueled by rising demand for consultancy, implementation, training, and maintenance services associated with BIM platforms. For instance, companies such as Autodesk provide specialized BIM implementation services to guide enterprises in adopting digital workflows effectively. Increasing outsourcing of BIM services to reduce operational complexity and ensure compliance with global standards also drives market expansion. In addition, services supporting project lifecycle management, clash detection, and data analytics are gaining traction, particularly among large construction projects.

- By Deployment Mode

On the basis of deployment mode, the BIM market is segmented into on-premise and cloud. The on-premise segment held the largest revenue share of 71.60% in 2025, driven by organizations’ preference for local control of project data, enhanced security, and integration with existing IT infrastructure. Large construction firms and government projects often rely on on-premise solutions to ensure compliance with data governance policies and safeguard proprietary designs. The ability to customize software modules and workflows according to specific project requirements also supports the continued dominance of on-premise BIM solutions.

The cloud segment is anticipated to witness the fastest growth from 2026 to 2033, propelled by the increasing adoption of remote collaboration tools and the rising need for real-time data access across geographically dispersed teams. For instance, Bentley Systems offers cloud-based BIM platforms that enable seamless project collaboration and data synchronization. Cloud deployment reduces upfront costs, facilitates scalability, and supports integration with emerging technologies such as IoT and AI, driving rapid adoption in both small and large enterprises.

- By Project Life Cycle

On the basis of project life cycle, the BIM market is segmented into preconstruction, construction, and operations. The construction segment dominated the market with the largest revenue share in 2025, driven by the critical need for clash detection, project visualization, and real-time coordination during the execution phase. BIM adoption in construction enhances project efficiency, reduces delays, and minimizes cost overruns by enabling proactive problem-solving and accurate scheduling. Contractors increasingly rely on BIM for resource allocation, site monitoring, and on-site decision-making, supporting its market dominance.

The preconstruction segment is expected to witness the fastest growth from 2026 to 2033, fueled by rising investment in planning, simulation, and digital design workflows. For instance, Trimble provides preconstruction BIM solutions that help architects and engineers optimize designs before actual construction. The focus on predictive modeling, energy analysis, and sustainability planning during preconstruction drives rapid adoption of BIM tools. In addition, early-phase digital collaboration reduces errors downstream and improves stakeholder alignment, further accelerating market growth.

- By Building Type

On the basis of building type, the BIM market is segmented into commercial, residential, and industrial. The commercial segment dominated the market with the largest revenue share in 2025, driven by the growing demand for large-scale infrastructure, office complexes, and institutional projects requiring precise design, coordination, and lifecycle management. BIM adoption in commercial buildings improves operational efficiency, ensures regulatory compliance, and supports long-term maintenance planning. Integration with smart building systems and sustainability standards further enhances the value proposition for commercial projects.

The residential segment is expected to witness the fastest growth from 2026 to 2033, fueled by the rising adoption of smart homes, prefabricated housing, and modular construction practices. For instance, Graphisoft provides residential BIM solutions that enable homeowners and developers to optimize layouts, energy efficiency, and cost planning. The focus on digital collaboration between architects, developers, and contractors, as well as government initiatives promoting digital construction in housing projects, accelerates market expansion.

- By Application

On the basis of application, the BIM market is segmented into planning & modelling, construction & design, asset management, building system analysis & maintenance scheduling, and others. The construction & design segment dominated the market with the largest revenue share in 2025, driven by the critical role of BIM in 3D/4D/5D modeling, clash detection, and project visualization. Construction firms increasingly rely on BIM to enhance accuracy, optimize material usage, and streamline collaboration among multidisciplinary teams. Integration with project management software and advanced analytics also strengthens the adoption of BIM in construction & design workflows.

The asset management segment is expected to witness the fastest growth from 2026 to 2033, fueled by the growing need for real-time monitoring, predictive maintenance, and operational efficiency of built assets. For instance, Autodesk’s BIM 360 platform supports asset lifecycle management and facility maintenance. Organizations adopting BIM for asset management can reduce operational costs, track performance metrics, and ensure compliance with sustainability and safety standards, driving rapid adoption.

- By End-User

On the basis of end-user, the BIM market is segmented into architects/engineers, contractors, and others. The architects/engineers segment dominated the market with the largest revenue share in 2025, driven by the extensive use of BIM for design, modeling, visualization, and coordination across project stakeholders. BIM solutions enable architects and engineers to create accurate digital twins, optimize space utilization, and improve collaboration with contractors and clients. The integration of advanced technologies such as AI and generative design also enhances productivity and design quality, contributing to market dominance.

The contractors segment is expected to witness the fastest growth from 2026 to 2033, fueled by increasing adoption of BIM for construction planning, site management, and cost control. For instance, Turner Construction uses BIM extensively to coordinate large-scale projects and improve on-site efficiency. Contractors benefit from real-time collaboration, clash detection, and improved resource allocation, which reduces project delays and costs, driving rapid adoption in the construction sector.

Building Information Modelling Market Regional Analysis

- North America dominated the building information modelling market with the largest revenue share of 37.90% in 2025, driven by the increasing adoption of digital construction technologies and advanced project management practices

- Firms in the region highly value the efficiency, collaboration, and accuracy offered by BIM across planning, design, and construction phases. This widespread adoption is supported by technologically advanced infrastructure, a skilled workforce, and government initiatives promoting smart and sustainable construction

- Companies are increasingly leveraging cloud-based BIM solutions and collaboration platforms to enhance project efficiency, reduce errors, and improve cost management. The focus on green building certifications and sustainable construction further reinforces BIM adoption in the region

U.S. Building Information Modelling Market Insight

The U.S. building information modelling market captured the largest revenue share in 2025 within North America, fueled by rapid digitalization in construction and increasing government mandates for building information modelling implementation in public projects. Architects and contractors are increasingly prioritizing the reduction of project delays and cost overruns through advanced BIM platforms. The rising adoption of cloud-based BIM solutions, along with integration with project management and IoT tools, further drives market growth. In addition, BIM software compatibility with smart city and sustainable building initiatives is contributing to the expansion of the U.S. market.

Europe Building Information Modelling Market Insight

The Europe building information modelling market is projected to grow at a significant CAGR during the forecast period, primarily driven by strict regulations on construction efficiency and sustainability standards. For instance, companies such as Bentley Systems and Graphisoft are enabling large-scale infrastructure and residential projects to adopt building information modelling workflows. Increasing urbanization, smart building initiatives, and demand for digital collaboration across stakeholders are fostering adoption. European markets are also embracing building information modelling for renovation projects, energy-efficient buildings, and large commercial developments, highlighting its multifaceted applicability.

U.K. Building Information Modelling Market Insight

The U.K. BIM market is anticipated to grow steadily during the forecast period, fueled by government mandates for Level 2 building information modelling in public projects and rising private sector adoption. Concerns regarding construction efficiency, cost management, and project transparency are encouraging firms to implement digital modeling solutions. The U.K.’s advanced construction technology ecosystem and strong digital infrastructure further support building information modelling adoption in complex commercial and infrastructure projects.

Germany Building Information Modelling Market Insight

The Germany building information modelling market is expected to expand at a notable CAGR, driven by the country’s focus on Industry 4.0 in construction and the demand for sustainable, technologically advanced solutions. Germany’s well-developed construction and engineering sectors, along with government incentives for digital construction, promote BIM implementation. Integration of building information modelling with IoT, AI, and cloud-based project management tools is becoming increasingly prevalent, reflecting Germany’s emphasis on efficiency, precision, and sustainability.

Asia-Pacific Building Information Modelling Market Insight

The Asia-Pacific building information modelling market is poised to grow at the fastest CAGR during 2026–2033, driven by rapid urbanization, large-scale infrastructure projects, and government initiatives promoting smart city development in countries such as China, Japan, and India. The region’s construction sector is increasingly investing in digital tools to enhance project efficiency and reduce costs. BIM adoption is also supported by rising awareness among stakeholders and the presence of local and global BIM software providers offering affordable, scalable solutions.

Japan Building Information Modelling Market Insight

The Japan building information modelling market is gaining momentum due to technological advancements, a strong emphasis on smart infrastructure, and the need for disaster-resilient construction. Japanese firms prioritize safety, precision, and collaborative workflows, which BIM enables. Integration of building information modelling with IoT, robotics, and AI-assisted design is fueling growth. In addition, Japan’s aging workforce is encouraging adoption of digital construction tools to streamline operations and reduce labor dependency.

China Building Information Modelling Market Insight

The China building information modelling market accounted for the largest revenue share in Asia-Pacific in 2025, attributed to rapid urbanization, government smart city initiatives, and the rising adoption of advanced construction technologies. Large infrastructure projects and commercial developments increasingly rely on building information modelling for planning, monitoring, and cost management. The availability of cost-effective building information modelling solutions and support from domestic providers such as Glodon and Autodesk are key factors driving market expansion in China.

Building Information Modelling Market Share

The building information modelling industry is primarily led by well-established companies, including:

- Autodesk Inc. (U.S.)

- Asite Solutions Ltd. (U.K.)

- BENTLEY SYSTEMS, INCORPORATED (U.S.)

- Dassault Systèmes (France)

- HEXAGON AB (Sweden)

- NEMETSCHEK SE (Germany)

- PENTAGON SOLUTIONS LTD. (U.K.)

- Trimble Inc. (U.S.)

- AVEVA Group PLC (U.K.)

- Beck Technology (U.S.)

- Bimeye Inc. (Finland)

- ACCA Software (Italy)

Latest Developments in Global Building Information Modelling Market

- In March 2025, Motif launched a cloud-based collaboration platform to advance practical adoption of Building Information Modeling (BIM). The platform integrates 2D and 3D workflows into a unified environment with real-time model streaming from tools such as Revit and Rhino, enabling live sketching, markups, and synchronized feedback across design teams. This development is set to significantly enhance collaboration efficiency and streamline BIM workflows, reducing project delays and improving design accuracy. By lowering barriers to adoption, Motif is empowering design and construction firms to implement more connected, creative, and intelligent processes, which could accelerate digital transformation in the AEC sector

- In March 2025, IFMA and Autodesk launched the Building Lifecycle Management Initiative (BLMI) to transform building data management across its lifecycle. The initiative brings together facility managers, architects, engineers, and technology providers to align open standards and improve data interoperability. By promoting the use of BIM, digital twins, and AI-driven insights, BLMI is expected to optimize asset management, extend building lifecycles, reduce operational costs, and support decarbonization efforts. This collaboration is strengthening the market demand for integrated lifecycle solutions and highlighting the strategic role of digital tools in delivering sustainable and cost-efficient building operations

- In March 2025, Nemetschek Group surpassed EUR 1 billion (USD 1.13 billion) in annual revenue, reflecting strong demand for its multi-brand portfolio. This milestone underscores the rising adoption of BIM and allied software solutions across the global architecture, engineering, and construction (AEC) industry. Nemetschek’s growth signals a robust market trend toward integrated, scalable, and collaborative design platforms, further validating the expansion of BIM as a critical technology for digital construction and project management

- In February 2025, Autodesk published its “2025 State of Design & Make” report, revealing that 66% of industry leaders plan to increase investments in digital tools, with AI emerging as a key enabler for sustainability. This insight emphasizes the accelerating focus on intelligent design solutions, predictive modeling, and efficiency-driven workflows in construction and facility management. The report is likely to drive greater adoption of BIM and AI-powered technologies, reinforcing the market shift toward data-driven decision-making and sustainable building practices

- In April 2025, Conch Group partnered with the China Building Materials Federation and Huawei to launch an AI model tailored for the cement industry. Utilizing Huawei’s Cloud Pangu AI, the model optimizes operations such as clinker strength prediction, coal usage reduction, and real-time anomaly detection, with over 200 identified use cases across mining, production, safety, and logistics. This innovation enhances operational efficiency and resource utilization, demonstrating the growing convergence of AI and digital construction technologies. It signals an increased appetite in the materials sector for smart, predictive tools, which indirectly boosts demand for BIM-enabled process optimization and digital twin integration in construction projects

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.