Global Bone Marrow Market

Market Size in USD Billion

CAGR :

%

USD

11.11 Billion

USD

16.92 Billion

2024

2032

USD

11.11 Billion

USD

16.92 Billion

2024

2032

| 2025 –2032 | |

| USD 11.11 Billion | |

| USD 16.92 Billion | |

|

|

|

|

Bone Marrow Market Size

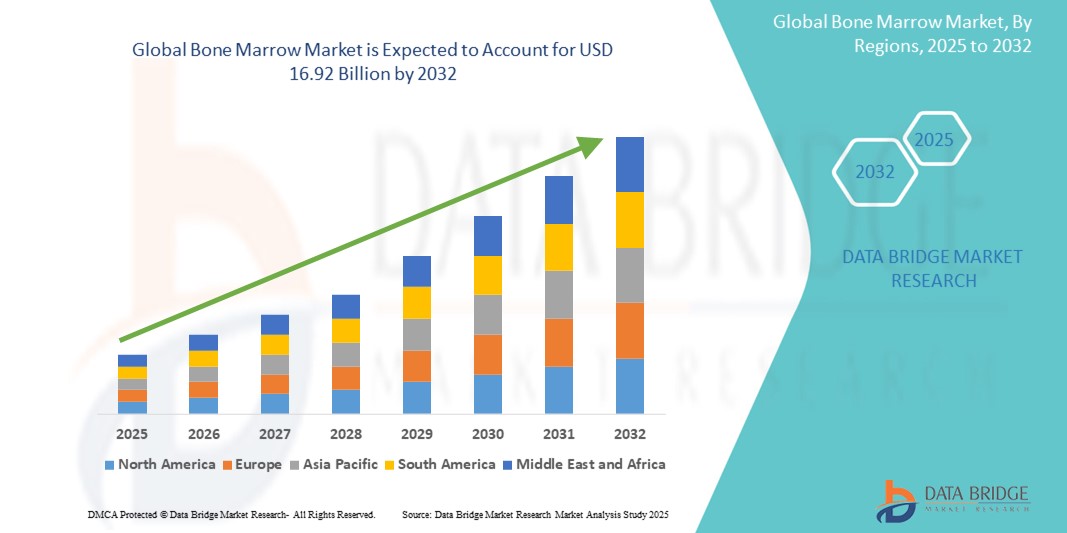

- The global bone marrow market size was valued at USD 11.11 billion in 2024 and is expected to reach USD 16.92 billion by 2032, at a CAGR of 5.40% during the forecast period

- Market growth is primarily driven by the increasing prevalence of hematological disorders, advancements in transplantation techniques, and growing awareness of bone marrow transplant benefits for treating life-threatening diseases

- Rising demand for personalized medicine and regenerative therapies is further propelling the adoption of bone marrow transplantation across hospitals and specialty clinics

Bone Marrow Market Analysis

- The bone marrow market is experiencing robust growth due to the rising incidence of blood-related disorders such as leukemia, lymphoma, and myeloma, coupled with advancements in allogeneic and autologous transplantation technologies

- Increasing investments in healthcare infrastructure and research into stem cell therapies are encouraging innovation in bone marrow transplantation, improving success rates and patient outcomes

- Europe dominates the bone marrow market with the largest revenue share of 35.7% in 2024, driven by a well-established healthcare system, high adoption of advanced medical technologies, and strong presence of key market players

- North America is projected to be the fastest-growing region during the forecast period, fuelled by increasing R&D investments, rising awareness of bone marrow transplantation benefits, and a growing number of specialized treatment centers in the U.S. and Canada

- The allogeneic bone marrow transplantation segment holds the largest market revenue share of 62.5% in 2024, supported by its widespread use in treating complex hematological disorders and the availability of advanced donor-matching technologies. The growing demand for minimally invasive procedures and improved post-transplant care is also driving this segment’s growth

Report Scope and Bone Marrow Market Segmentation

|

Attributes |

Bone Marrow Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Bone Marrow Market Trends

“Rising Preference for Autologous Bone Marrow Transplantation”

- Autologous bone marrow transplantation is gaining traction due to its lower risk of complications, such as graft-versus-host disease (GVHD), compared to allogeneic transplantation

- These transplants use the patient’s own stem cells, harvested before high-dose chemotherapy or radiation, making them ideal for treating conditions such as lymphoma and multiple myeloma

- In regions with advanced healthcare infrastructure, such as North America and Europe, autologous transplants account for a significant share of procedures, with approximately 60% of bone marrow transplants in the U.S. being autologous between 2015 and 2019

- Improved stem cell harvesting and cryopreservation techniques have enhanced the success rates of autologous transplants, driving their adoption in hospitals and multi-specialty clinics

- For instance, the FDA approval of APHEXDA™ (motixafortide) in September 2023 for mobilizing hematopoietic stem cells in multiple myeloma patients has further boosted autologous transplant efficiency

- Leading transplant centers, such as those in Germany and the U.S., are increasingly offering autologous transplant packages as a cost-effective and safer option for eligible patients

Bone Marrow Market Dynamics

Driver

“Increasing Prevalence of Hematologic Disorders and Demand for Curative Treatments”

- The growing incidence of blood-related disorders, such as leukemia, lymphoma, and multiple myeloma, is a major driver of the global bone marrow transplant market. For instance, the Leukemia & Lymphoma Society estimates that 1,698,339 people in the U.S. are living with or in remission from these conditions

- Bone marrow transplantation is often the only curative option for advanced-stage blood cancers and genetic disorders such as sickle cell anemia and thalassemia, increasing its demand globally

- Technological advancements, such as improved donor matching, next-generation conditioning regimens, and AI-driven stem cell viability assessments, have enhanced transplant success rates and patient outcomes

- The rise of cord blood banking and haploidentical transplants is addressing donor shortages, particularly in regions such as Asia Pacific, where countries such as India and China are seeing a surge in transplant procedures

- Automakers of the medical industry, such as biotech firms such as StemCyte and Osiris Therapeutics, are partnering with hospitals to provide advanced stem cell therapies, further fueling market growth

- The increasing adoption of bone marrow transplants for non-hematologic conditions, such as autoimmune and metabolic disorders, is expanding the market’s scope, especially in research-driven regions such as North America

Restraint/Challenge

“High Costs and Regulatory Challenges”

- The high cost of bone marrow transplantation, for autologous and allogeneic procedures, respectively, limits accessibility, particularly in developing regions with inadequate healthcare infrastructure

- Strict regulatory frameworks governing stem cell therapies and transplant procedures vary across countries, complicating standardization for global providers and increasing compliance costs

- Risks associated with allogeneic transplants, such as GVHD and infections, pose clinical challenges, deterring some patients and healthcare providers from pursuing these treatments

- For instance, in regions such as Africa and parts of Asia Pacific, limited donor registries and lack of trained professionals hinder market growth, despite rising disease prevalence

- Stringent regulations, such as those in the U.S. and Europe requiring rigorous donor matching and post-transplant monitoring, can delay procedures and increase operational costs for transplant centers

- These challenges discourage widespread adoption, particularly in cost-sensitive markets, and may result in limited market expansion in certain regions

Bone Marrow Market Scope

The market is segmented on the basis of transplantation type, disease indication, and end user.

- By Transplantation Type

On the basis of transplantation type, the market is segmented into allogeneic bone marrow transplantation and autologous bone marrow transplantation. The allogeneic bone marrow transplantation segment holds the largest market revenue share of 62.5% in 2024, supported by its widespread use in treating complex hematological disorders and the availability of advanced donor-matching technologies. The growing demand for minimally invasive procedures and improved post-transplant care is also driving this segment’s growth.

The autologous bone marrow transplantation segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by increasing demand for treatments requiring patients’ own stem cells, particularly for conditions such as multiple myeloma and lymphoma, due to lower risks of graft-versus-host disease and improved patient recovery rates.

- By Disease Indication

On the basis of disease indication, the market is segmented into lymphoma, leukemia, myeloma, myelodysplasia, aplastic anemia, sickle cell anemia, solid tumors, thalassemia, myeloproliferative neoplasms, and others. The leukemia segment dominated with a revenue share of 35.7% in 2024, attributed to the high prevalence of leukemia globally and the critical role of bone marrow transplantation in its treatment.

The myeloma segment is projected to grow at the fastest rate during the forecast period, driven by rising incidences of multiple myeloma and advancements in transplant techniques that improve survival rates and patient outcomes.

- By End User

On the basis of end user, the market is segmented into hospitals, multi-specialty clinics, and ambulatory surgical centers. The hospital segment accounted for the largest revenue share of 68.3% in 2024, owing to the availability of advanced medical infrastructure, specialized transplant units, and skilled healthcare professionals in hospitals.

The ambulatory surgical centers segment is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing adoption of outpatient transplant procedures, advancements in minimally invasive techniques, and growing patient preference for cost-effective and convenient treatment options.

Bone Marrow Market Regional Analysis

- Europe dominates the bone marrow market with the largest revenue share of 35.7% in 2024, driven by a well-established healthcare system, high adoption of advanced medical technologies, and strong presence of key market players

- The region benefits from extensive research and development in hematology and oncology, as well as favorable reimbursement policies for bone marrow transplantation

- Growth is further supported by increasing awareness of bone marrow therapies and collaborations between research institutions and healthcare providers

U.S. Bone Marrow Market Insight

The U.S. is projected to be the fastest-growing market in North America, fueled by advanced healthcare facilities, significant investments in stem cell research, and increasing prevalence of hematological disorders. The growing adoption of autologous transplants and advancements in precision medicine further boost market expansion. Partnerships between hospitals and research organizations, along with robust FDA regulations, support the development of innovative therapies.

Europe Bone Marrow Market Insight

Europe dominates the revenue growth of the bone marrow market, driven by its advanced medical research ecosystem and high adoption of bone marrow transplantation in countries such as Germany, France, and the U.K. The region’s focus on improving patient outcomes through innovative therapies and strong regulatory frameworks encourages market growth. Increasing collaborations between academic institutions and healthcare providers further enhance the adoption of advanced transplant techniques.

U.K. Bone Marrow Market Insight

The U.K. market is expected to witness significant growth, driven by increasing investments in healthcare infrastructure and growing awareness of bone marrow transplantation for treating blood-related disorders. The National Health Service (NHS) support for transplant procedures and advancements in donor registries contribute to market expansion. Rising research initiatives in stem cell therapies also bolster growth.

Germany Bone Marrow Market Insight

Germany is expected to witness a high growth rate in the bone marrow market, attributed to its leadership in medical research and a strong healthcare system focused on oncology and hematology. The country’s adoption of cutting-edge transplant technologies and government funding for stem cell research drive market growth. The integration of advanced therapies in leading hospitals supports sustained market expansion.

Asia-Pacific Bone Marrow Market Insight

The Asia-Pacific region is expected to witness the fastest growth rate, driven by rising healthcare expenditure, increasing prevalence of blood-related disorders, and growing awareness of bone marrow transplantation in countries such as China, India, and Japan. Government initiatives to improve healthcare access and advancements in medical tourism further encourage the adoption of bone marrow therapies.

Japan Bone Marrow Market Insight

Japan’s bone marrow market is expected to witness rapid growth due to its advanced healthcare infrastructure and strong focus on research in hematology and oncology. The presence of leading medical institutions and increasing adoption of allogeneic transplants for leukemia and lymphoma drive market penetration. Growing investments in regenerative medicine and stem cell research also contribute to growth.

China Bone Marrow Market Insight

China holds the largest share of the Asia-Pacific bone marrow market, propelled by rapid urbanization, increasing healthcare investments, and a rising burden of hematological diseases. The country’s expanding network of specialized hospitals and growing awareness of bone marrow transplantation support market growth. Strong government initiatives and competitive pricing of medical procedures enhance market accessibility.

Bone Marrow Market Share

The bone marrow market industry is primarily led by well-established companies, including:

- Agilent Technologies, Inc. (U.S.)

- Astellas Pharma Inc. (U.S.)

- Illumina, Inc. (U.S.)

- QIAGEN (U.S.)

- F Hoffmann-La Roche Ltd (U.S.)

- Sanofi (France)

- Stryker Corporation (U.S.)

- PromoCell GmbH (Germany)

- STEMCELL Technologies Inc. (Canada)

- Lonza (U.S.)

- ATCC (American Type Culture Collection) (U.S.)

- HemaCare (U.S.)

- Mesoblast Ltd. (U.S.)

- Merck KGaA (Germany)

- Discovery Life Sciences (U.S.)

Latest Developments in Global Bone Marrow Market

- In January 2024, Fortis Healthcare introduced CAR-T cell therapy across its Bone Marrow Transplant centers in Mohali, Delhi, Gurgaon, Noida, Mumbai, and Bangalore. This groundbreaking therapy enhances treatment options for blood cancers such as leukemia and lymphoma, utilizing advanced cellular technology to improve patient outcomes. The launch reinforces Fortis Healthcare’s leadership in the global bone marrow market, expanding access to cutting-edge therapies in India

- In September 2022, Scopio Labs introduced the Full-Field Bone Marrow Aspirate (FF-BMA) application, a digital workflow solution designed to streamline bone marrow aspirate scanning and analysis. This innovation enhances diagnostic efficiency and accuracy, addressing the rising demand for automated tools in bone marrow diagnostics. By integrating AI-powered imaging, the FF-BMA application strengthens the capabilities of transplant centers and laboratories worldwide

- In June 2022, the US FDA granted 510(k) approval for the MAXX-BMC bone marrow aspirate concentration system, developed by Royal Biologics. This system enables optimal sample collection of concentrated bone marrow aspirate at point-of-care settings, enhancing efficiency in orthopedic and sports medicine procedures. Featuring patented Lead Screw technology, MAXX-BMC improves stem cell concentration and accelerates bone growth and tissue regeneration

- In February 2022, Celgene and Bluebird Bio announced a collaboration to develop and commercialize CAR T-cell therapies for blood cancers. By combining Celgene’s expertise in hematology and oncology with Bluebird Bio’s CAR T-cell technology, the partnership aims to advance treatment options for bone marrow-related disorders. This collaboration strengthens their competitive position in the global bone marrow market, accelerating innovation and market reach

- In February 2022, Gilead Sciences and Kite Pharma partnered to develop and commercialize CAR T-cell therapies for blood cancers. This collaboration leverages Gilead’s global commercial expertise and Kite Pharma’s specialized CAR T-cell technology to enhance bone marrow transplant therapies. The partnership aims to advance treatment efficacy and expand access to innovative therapies worldwide

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL BONE MARROW MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL BONE MARROW MARKET SIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 MARKET GUIDE

2.2.4 COMPANY POSITIONING GRID

2.2.5 COMPANY MARKET SHARE ANALYSIS

2.2.6 MULTIVARIATE MODELLING

2.2.7 TOP TO BOTTOM ANALYSIS

2.2.8 STANDARDS OF MEASUREMENT

2.2.9 VENDOR SHARE ANALYSIS

2.2.10 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.11 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL BONE MARROW MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 PESTEL ANALYSIS

5.2 PORTER’S FIVE FORCES MODEL

5.3 IN-DEPTH ANALYSIS OF OPERATIONAL TECNIQUES, BY COUNTRY

6 INDUSTRY INSIGHTS

6.1 MICRO AND MACRO ECONOMIC FACTORS

6.2 PENETRATION AND GROWTH PROSPECT MAPPING

6.3 KEY PRICING STRATEGIES

6.4 INTERVIEWS WITH SPECIALIST

6.5 ANALYIS AND RECOMMENDATION

7 COST ANALYSIS BREAKDOWN

8 TECHNONLOGY ROADMAP

9 INNOVATION TRACKER AND STRATEGIC ANALYSIS

9.1 MAJOR DEALS AND STRATEGIC ALLIANCES ANALYSIS

9.1.1 JOINT VENTURES

9.1.2 MERGERS AND ACQUISITIONS

9.1.3 LICENSING AND PARTNERSHIP

9.1.4 TECHNOLOGY COLLABORATIONS

9.1.5 STRATEGIC DIVESTMENTS

9.2 NUMBER OF PRODUCTS IN DEVELOPMENT

9.3 STAGE OF DEVELOPMENT

9.4 TIMELINES AND MILESTONES

9.5 INNOVATION STRATEGIES AND METHODOLOGIES

9.6 RISK ASSESSMENT AND MITIGATION

9.7 FUTURE OUTLOOK

10 REGULATORY COMPLIANCE

10.1 REGULATORY AUTHORITIES

10.2 REGULATORY CLASSIFICATIONS

10.2.1 CLASS I

10.2.2 CLASS II

10.2.3 CLASS III

10.3 REGULATORY SUBMISSIONS

10.4 INTERNATIONAL HARMONIZATION

10.5 COMPLIANCE AND QUALITY MANAGEMENT SYSTEMS

10.6 REGULATORY CHALLENGES AND STRATEGIES

11 REIMBURSEMENT FRAMEWORK

12 VALUE CHAIN ANALYSIS

13 HEALTHCARE ECONOMY

13.1 HEALTHCARE EXPENDITURE

13.2 CAPITAL EXPENDITURE

13.3 CAPEX TRENDS

13.4 CAPEX ALLOCATION

13.5 FUNDING SOURCES

13.6 INDUSTRY BENCHMARKS

13.7 GDP RATION IN OVERALL GDP

13.8 HEALTHCARE SYSTEM STRUCTURE

13.9 GOVERNMENT POLICIES

13.1 ECONOMIC DEVELOPMENT

14 GLOBAL BONE MARROW MARKET, BY TYPE

14.1 OVERVIEW

14.2 AUTOLOGOUS TRANSPLANTATION

14.3 ALLOGENEIC TRANSPLANTATION

14.4 OTHERS

15 GLOBAL BONE MARROW MARKET, BY DIAGNOSIS TEST

15.1 OVERVIEW

15.2 BONE MARROW BIOPSY

15.3 BONE MARROW ASPIRATION

15.4 OTHERS

16 GLOBAL BONE MARROW MARKET, BY PRODUCT

16.1 OVERVIEW

16.2 DEVICES

16.2.1 DIAGNOSTIC

16.2.2 FULL-FIELD BONE MARROW ASPIRATE

16.2.3 BONE MARROW BIOPSY AND ASPIRATION NEEDLES

16.2.4 OTHERS

16.2.5 COLLECTION

16.2.6 BONE MARROW CONCENTRATOR

16.2.7 BONE MARROW PROCESSING SYSTEM

16.2.8 OTHERS

16.3 BONE MARROW-DERIVED PRODUCTS

16.3.1 CD34+ HEMATOPOIETIC STEM AND PROGENITOR CELLS (HSPCS)

16.3.2 BONE MARROW ASPIRATE CONCENTRATE (BMAC)

16.3.3 MESENCHYMAL STEM CELLS (MSCS)

16.4 OTHERS

17 GLOBAL BONE MARROW MARKET, BY POPULATION TYPE

17.1 OVERVIEW

17.2 PEDIATRIC

17.3 ADULT

17.4 GERIATRIC

18 GLOBAL BONE MARROW MARKET, BY GENDER

18.1 OVERVIEW

18.2 MALE

18.2.1 PEDIATRIC

18.2.2 ADULT

18.2.3 GERIATRIC

18.3 FEMALE

18.3.1 PEDIATRIC

18.3.2 ADULT

18.3.3 GERIATRIC

19 GLOBAL BONE MARROW MARKET, BY APPLICATION

19.1 OVERVIEW

19.2 LYMPHOMA

19.3 LEUKEMIA

19.4 MYELOMA

19.5 MYELODYSPLASIA

19.6 APLASTIC ANEMIA

19.7 SICKLE CELL ANEMIA

19.8 SOLID TUMORS

19.9 THALASSEMIA

19.1 MYELOPROLIFERATIVE NEOPLASMS

19.11 OTHERS

20 GLOBAL BONE MARROW MARKET, BY END USER

20.1 OVERVIEW

20.2 HOSPITALS

20.2.1 PUBLIC

20.2.2 PRIVATE

20.3 ONCOLOGICAL CENTRES

20.4 MULTI-SPECIALTY CLINICS

20.5 ACADEMIC AND RESEARCH INSTITUTE

20.6 OTHERS

21 GLOBAL BONE MARROW MARKET, BY DISTRIBUTION CHANNEL

21.1 OVERVIEW

21.2 DIRECT TENDER

21.3 THIRD PARTY DISTRIBUTION

21.4 OTHERS

22 GLOBAL BONE MARROW MARKET, BY REGION

Global Bone Marrow Market, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

22.1 NORTH AMERICA

22.1.1 U.S.

22.1.2 CANADA

22.1.3 MEXICO

22.2 EUROPE

22.2.1 GERMANY

22.2.2 FRANCE

22.2.3 U.K.

22.2.4 FINLAND

22.2.5 DENMARK

22.2.6 NORWAY

22.2.7 POLAND

22.2.8 ITALY

22.2.9 SPAIN

22.2.10 RUSSIA

22.2.11 TURKEY

22.2.12 BELGIUM

22.2.13 NETHERLANDS

22.2.14 SWITZERLAND

22.2.15 SWEDEN

22.2.16 REST OF EUROPE

22.3 ASIA-PACIFIC

22.3.1 JAPAN

22.3.2 CHINA

22.3.3 SOUTH KOREA

22.3.4 INDIA

22.3.5 SINGAPORE

22.3.6 THAILAND

22.3.7 INDONESIA

22.3.8 MALAYSIA

22.3.9 PHILIPPINES

22.3.10 AUSTRALIA

22.3.11 NEW ZEALAND

22.3.12 VIETNAM

22.3.13 TAIWAN

22.3.14 REST OF ASIA-PACIFIC

22.4 SOUTH AMERICA

22.4.1 BRZIL

22.4.2 ARGENTINA

22.4.3 REST OF SOUTH AMERICA

22.5 MIDDLE EAST AND AFRICA

22.5.1 SOUTH AFRICA

22.5.2 SAUDI ARABIA

22.5.3 UAE

22.5.4 EGYPT

22.5.5 KUWAIT

22.5.6 OMAN

22.5.7 ISRAEL

22.5.8 BAHRAIN

22.5.9 REST OF MIDDLE EAST AND AFRICA

22.6 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

23 GLOBAL BONE MARROW MARKET, COMPANY LANDSCAPE

23.1 COMPANY SHARE ANALYSIS: GLOBAL

23.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

23.3 COMPANY SHARE ANALYSIS: EUROPE

23.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

23.5 MERGERS & ACQUISITIONS

23.6 EXPANSIONS

23.7 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

24 GLOBAL BONE MARROW MARKET, SWOT AND DBMR ANALYSIS

25 GLOBAL BONE MARROW MARKET, COMPANY PROFILE

25.1 CHARLES RIVER LABORATORIES

25.1.1 COMPANY OVERVIEW

25.1.2 GEOGRAPHIC PRESENCE

25.1.3 PRODUCT PORTFOLIO

25.1.4 RECENT DEVELOPMENTS

25.2 ATCC

25.2.1 COMPANY OVERVIEW

25.2.2 GEOGRAPHIC PRESENCE

25.2.3 PRODUCT PORTFOLIO

25.2.4 RECENT DEVELOPMENTS

25.3 KOSHEEKA

25.3.1 COMPANY OVERVIEW

25.3.2 GEOGRAPHIC PRESENCE

25.3.3 PRODUCT PORTFOLIO

25.3.4 RECENT DEVELOPMENTS

25.4 STEMCELL TECHNOLOGIES

25.4.1 COMPANY OVERVIEW

25.4.2 GEOGRAPHIC PRESENCE

25.4.3 PRODUCT PORTFOLIO

25.4.4 RECENT DEVELOPMENTS

25.5 LONZA

25.5.1 COMPANY OVERVIEW

25.5.2 GEOGRAPHIC PRESENCE

25.5.3 PRODUCT PORTFOLIO

25.5.4 RECENT DEVELOPMENTS

25.6 ACCEGEN

25.6.1 COMPANY OVERVIEW

25.6.2 GEOGRAPHIC PRESENCE

25.6.3 PRODUCT PORTFOLIO

25.6.4 RECENT DEVELOPMENTS

25.7 ALLCELLS, LLC

25.7.1 COMPANY OVERVIEW

25.7.2 GEOGRAPHIC PRESENCE

25.7.3 PRODUCT PORTFOLIO

25.7.4 RECENT DEVELOPMENTS

25.8 ZIMMER BIOMET

25.8.1 COMPANY OVERVIEW

25.8.2 GEOGRAPHIC PRESENCE

25.8.3 PRODUCT PORTFOLIO

25.8.4 RECENT DEVELOPMENTS

25.9 HUMANCELLS BIO

25.9.1 COMPANY OVERVIEW

25.9.2 GEOGRAPHIC PRESENCE

25.9.3 PRODUCT PORTFOLIO

25.9.4 RECENT DEVELOPMENTS

25.1 MERCK KGAA

25.10.1 COMPANY OVERVIEW

25.10.2 GEOGRAPHIC PRESENCE

25.10.3 PRODUCT PORTFOLIO

25.10.4 RECENT DEVELOPMENTS

25.11 BIOIVT LLC.

25.11.1 COMPANY OVERVIEW

25.11.2 GEOGRAPHIC PRESENCE

25.11.3 PRODUCT PORTFOLIO

25.11.4 RECENT DEVELOPMENTS

25.12 CGT GLOBAL.

25.12.1 COMPANY OVERVIEW

25.12.2 GEOGRAPHIC PRESENCE

25.12.3 PRODUCT PORTFOLIO

25.12.4 RECENT DEVELOPMENTS

25.13 LIFELINE CELL TECHNOLOGY

25.13.1 COMPANY OVERVIEW

25.13.2 GEOGRAPHIC PRESENCE

25.13.3 PRODUCT PORTFOLIO

25.13.4 RECENT DEVELOPMENTS

25.14 SCIENCELL RESEARCH LABORATORIES, INC

25.14.1 COMPANY OVERVIEW

25.14.2 GEOGRAPHIC PRESENCE

25.14.3 PRODUCT PORTFOLIO

25.14.4 RECENT DEVELOPMENTS

25.15 GLOBUS MEDICAL

25.15.1 COMPANY OVERVIEW

25.15.2 GEOGRAPHIC PRESENCE

25.15.3 PRODUCT PORTFOLIO

25.15.4 RECENT DEVELOPMENTS

25.16 EMCYTE CORPORATION

25.16.1 COMPANY OVERVIEW

25.16.2 GEOGRAPHIC PRESENCE

25.16.3 PRODUCT PORTFOLIO

25.16.4 RECENT DEVELOPMENTS

25.17 STRYKER

25.17.1 COMPANY OVERVIEW

25.17.2 GEOGRAPHIC PRESENCE

25.17.3 PRODUCT PORTFOLIO

25.17.4 RECENT DEVELOPMENTS

25.18 ISTO BIOLOGICS

25.18.1 COMPANY OVERVIEW

25.18.2 GEOGRAPHIC PRESENCE

25.18.3 PRODUCT PORTFOLIO

25.18.4 RECENT DEVELOPMENTS

25.19 RANFAC

25.19.1 COMPANY OVERVIEW

25.19.2 GEOGRAPHIC PRESENCE

25.19.3 PRODUCT PORTFOLIO

25.19.4 RECENT DEVELOPMENTS

25.2 ROYAL BIOLOGICS

25.20.1 COMPANY OVERVIEW

25.20.2 GEOGRAPHIC PRESENCE

25.20.3 PRODUCT PORTFOLIO

25.20.4 RECENT DEVELOPMENTS

25.21 ARTHREX, INC

25.21.1 COMPANY OVERVIEW

25.21.2 GEOGRAPHIC PRESENCE

25.21.3 PRODUCT PORTFOLIO

25.21.4 RECENT DEVELOPMENTS

25.22 TERUMO BCT, INC

25.22.1 COMPANY OVERVIEW

25.22.2 GEOGRAPHIC PRESENCE

25.22.3 PRODUCT PORTFOLIO

25.22.4 RECENT DEVELOPMENTS

25.23 FENWELL + BAXTER

25.23.1 COMPANY OVERVIEW

25.23.2 GEOGRAPHIC PRESENCE

25.23.3 PRODUCT PORTFOLIO

25.23.4 RECENT DEVELOPMENTS

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

26 RELATED REPORTS

27 QUESTIONNAIRE

28 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.