Global Boiler Water Treatment Chemicals Market

Market Size in USD Billion

CAGR :

%

USD

5.10 Billion

USD

9.70 Billion

2024

2032

USD

5.10 Billion

USD

9.70 Billion

2024

2032

| 2025 –2032 | |

| USD 5.10 Billion | |

| USD 9.70 Billion | |

|

|

|

|

Boiler Water Treatment Chemicals Market Size

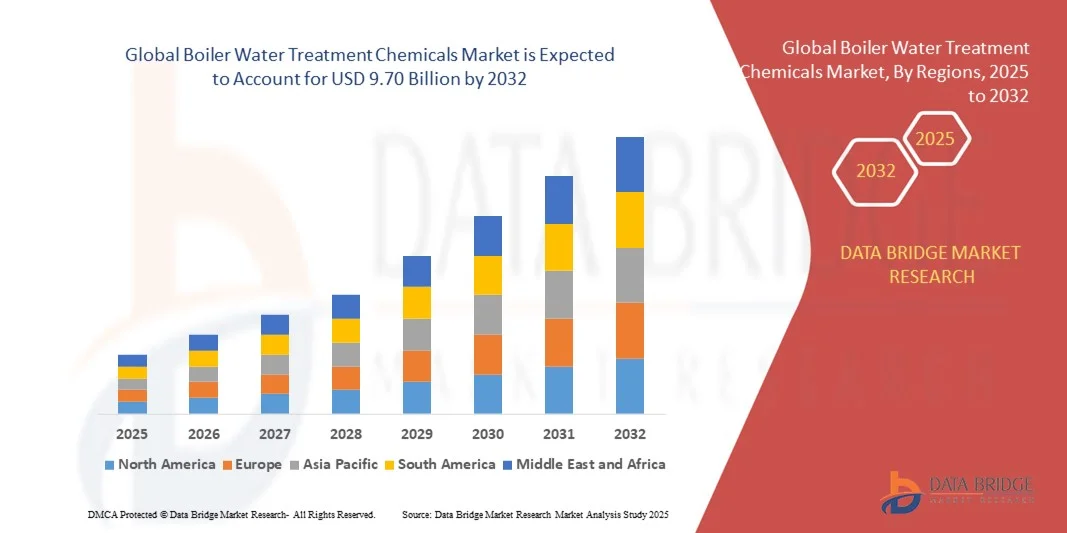

- The global boiler water treatment chemicals market size was valued at USD 5.10 billion in 2024 and is expected to reach USD 9.70 billion by 2032, at a CAGR of 8.36% during the forecast period

- The market growth is largely fuelled by the rising demand for high-efficiency boilers and stringent regulations regarding industrial water discharge

- Increasing industrialization, particularly in the power generation and manufacturing sectors, is boosting the need for effective water treatment solutions to prevent corrosion, scaling, and fouling in boilers

Boiler Water Treatment Chemicals Market Analysis

- The boiler water treatment chemicals market is witnessing strong growth driven by the increasing emphasis on operational efficiency and equipment longevity across industries such as power generation, oil & gas, and manufacturing

- These chemicals play a crucial role in maintaining boiler performance by mitigating corrosion, scale formation, and microbiological contamination, which helps in reducing downtime and maintenance costs

- Asia-Pacific dominated the boiler water treatment chemicals market with the largest revenue share of 42.15% in 2024, driven by rapid industrialization, urbanization, and expanding manufacturing and power generation capacities in countries such as China, India, and Japan

- North America region is expected to witness the highest growth rate in the global boiler water treatment chemicals market, driven by rising industrial modernization, demand for high-efficiency boilers, adoption of smart dosing and monitoring technologies, and compliance with strict wastewater discharge standards

- The Corrosion Inhibitors segment held the largest market revenue share in 2024, driven by its critical role in preventing metal degradation and extending boiler lifespan. These chemicals help maintain system integrity under high-temperature and high-pressure conditions, making them essential for continuous industrial operations

Report Scope and Boiler Water Treatment Chemicals Market Segmentation

|

Attributes |

Boiler Water Treatment Chemicals Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Boiler Water Treatment Chemicals Market Trends

Shift Toward Eco-Friendly and Sustainable Treatment Solutions

- The global boiler water treatment chemicals market is witnessing a significant shift toward green and sustainable chemical formulations aimed at minimizing environmental impact and complying with stringent regulatory standards. Industries are increasingly adopting biodegradable and non-toxic alternatives to reduce hazardous waste discharge while maintaining boiler efficiency

- The transition is being driven by growing environmental awareness and government initiatives promoting the use of eco-friendly water treatment technologies. Companies are investing in R&D to develop advanced formulations that offer similar or superior performance compared to conventional chemicals, ensuring corrosion and scale prevention without ecological harm

- The demand for sustainable solutions is especially strong among industries with high water consumption such as power generation and manufacturing, where environmental compliance and resource optimization are key operational priorities. This trend aligns with the global push toward cleaner production practices and circular economy principles

- For instance, in 2023, several leading chemical manufacturers introduced phosphate-free and biodegradable boiler treatment products designed to comply with international wastewater discharge standards. These innovations are gaining traction across Europe and North America, where environmental regulations are among the strictest globally

- While sustainability-driven products are redefining the competitive landscape, their market success depends on balancing cost-effectiveness, performance consistency, and regulatory compliance. Manufacturers must continue investing in technological innovation and scalable production to meet the rising demand for eco-conscious water treatment solutions

Boiler Water Treatment Chemicals Market Dynamics

Driver

Increasing Industrialization and Growing Demand for High-Efficiency Boilers

- Rapid industrialization across emerging economies has led to a surge in the installation of high-capacity boilers in power generation, oil & gas, and chemical processing sectors. This expansion has intensified the demand for boiler water treatment chemicals to enhance equipment efficiency and operational reliability. Industries are prioritizing continuous operation and long-term performance, which is directly supported by advanced chemical treatments that prevent corrosion and scaling over extended cycles of usage

- The need to maintain optimal heat transfer efficiency and prevent costly equipment failures has encouraged industries to implement comprehensive water treatment programs. Corrosion inhibitors, oxygen scavengers, and scale-control agents are being increasingly adopted to minimize downtime and extend boiler life. Proper chemical management ensures consistent system performance and contributes to reduced energy consumption, thereby improving overall plant profitability and sustainability metrics

- Governments and environmental authorities are enforcing strict guidelines on industrial water quality and discharge, further accelerating the adoption of specialized treatment solutions. Compliance with such standards has become a key priority for companies seeking to optimize performance while avoiding regulatory penalties. These regulations are driving the use of advanced, eco-friendly formulations that align with sustainability goals and help industries maintain their environmental certifications

- For instance, in 2023, several large industrial facilities in China and India upgraded their water treatment systems to incorporate advanced chemical dosing technologies aimed at improving energy efficiency and meeting local discharge norms. These facilities reported improved operational consistency and reduced maintenance downtime following the implementation of digital monitoring and automated control systems. Such upgrades have set new benchmarks for efficiency and compliance in industrial boiler operations

- While industrial growth continues to fuel chemical demand, ongoing technological upgrades and sustainability concerns are expected to further shape the market’s evolution during the forecast period. Continuous innovation in chemical compositions and smart dosing systems is likely to improve precision and reduce wastage. The growing focus on energy conservation and eco-compliance will remain a defining factor in the market’s long-term trajectory

Restraint/Challenge

High Operational Costs and Dependence on Skilled Workforce

- The boiler water treatment process requires precise chemical dosing, continuous monitoring, and periodic maintenance, leading to high operational expenses for industrial users. The rising cost of advanced treatment chemicals and automation equipment adds further pressure on budget-sensitive sectors. Small-scale industries often face difficulties in justifying these expenses, especially when short-term financial constraints outweigh long-term efficiency benefits

- Many small and medium-sized enterprises lack access to skilled professionals capable of managing complex boiler systems and implementing optimized chemical treatment programs. This skill gap often results in inefficient chemical usage and suboptimal water quality management. Without proper training and supervision, incorrect dosing can lead to scaling, corrosion, or even boiler failure, causing significant production losses and safety concerns

- The absence of standardized monitoring infrastructure and high equipment maintenance costs discourage adoption among smaller industrial units, particularly in developing regions. Limited awareness about the long-term benefits of proper water treatment also contributes to slower market penetration. Moreover, inconsistent chemical quality and poor maintenance protocols in such facilities further reduce the effectiveness of treatment programs and raise operational risks

- For instance, in 2023, a study conducted across Southeast Asian manufacturing plants revealed that nearly 60% of operators lacked trained water treatment specialists, leading to increased scaling and energy losses in boiler systems. The absence of automated monitoring systems compounded the issue, with many operators relying on manual testing that provided delayed or inaccurate results. These inefficiencies continue to challenge sustainable industrial operations in cost-sensitive markets

- While advancements in automation and smart dosing technologies are helping mitigate these challenges, reducing operational costs and expanding technical training programs will be crucial to unlocking the market’s full growth potential. Industry players are increasingly collaborating with educational institutions and technology providers to create skill development initiatives. Such efforts are expected to improve workforce competency and encourage wider adoption of efficient water treatment systems across all industry tiers

Boiler Water Treatment Chemicals Market Scope

The market is segmented on the basis of type, chemistry, and end-use industry.

- By Type

On the basis of type, the boiler water treatment chemicals market is segmented into Corrosion Inhibitors, Coagulants and Flocculants, pH Boosters, Scale Inhibitors, Oxygen Scavengers, Biocides, Foam Control Agents, Neutralizing Amine, All Volatile Treatment (AVT), and Others. The Corrosion Inhibitors segment held the largest market revenue share in 2024, driven by its critical role in preventing metal degradation and extending boiler lifespan. These chemicals help maintain system integrity under high-temperature and high-pressure conditions, making them essential for continuous industrial operations.

The Scale Inhibitors segment is expected to witness the fastest growth rate from 2025 to 2032, fuelled by rising industrial demand to reduce energy losses and maintenance costs caused by scale formation. Their ability to enhance heat transfer efficiency and ensure consistent performance in both low- and high-pressure boiler systems is accelerating adoption across industries such as power generation, manufacturing, and chemicals.

- By Chemistry

On the basis of chemistry, the boiler water treatment chemicals market is categorized into Basic Chemicals and Blended/Specialty Chemicals. The Blended/Specialty Chemicals segment dominated the market in 2024, owing to the increasing preference for customized formulations designed to meet specific industrial water quality requirements. These advanced blends often combine corrosion control, pH adjustment, and scaling prevention functions, delivering greater efficiency and reduced environmental impact.

The Basic Chemicals segment is expected to witness the fastest growth rate from 2025 to 2032, supported by their cost-effectiveness and widespread use in conventional water treatment applications. Basic chemicals such as sodium sulfite and hydrazine continue to be preferred in small- and medium-scale industries where standardized boiler systems are still prevalent.

- By End Use Industry

On the basis of end use industry, the boiler water treatment chemicals market is segmented into Oil and Gas, Power, Steel and Metals, Public Facilities, Textiles and Dyes, Automobile and Aerospace, Food and Beverage, Pulp and Paper, Commercials, Manufacturing, Construction, Chemical and Petrochemical, and Others. The Power segment accounted for the largest share of market revenue in 2024, driven by the high demand for high-pressure boilers and the need for efficient water treatment to optimize thermal power generation. Continuous operation and stringent water quality regulations in this sector have reinforced the importance of advanced chemical treatment programs.

The Food and Beverage segment is expected to witness the fastest growth rate from 2025 to 2032, as industries increasingly adopt safe and non-toxic boiler treatment solutions to comply with hygiene and food safety standards. The growing focus on steam purity and process water quality in food processing plants is expected to further boost the demand for specialized chemical formulations tailored for this sector.

Boiler Water Treatment Chemicals Market Regional Analysis

- Asia-Pacific dominated the boiler water treatment chemicals market with the largest revenue share of 42.15% in 2024, driven by rapid industrialization, urbanization, and expanding manufacturing and power generation capacities in countries such as China, India, and Japan

- Industries in the region are increasingly adopting advanced chemical treatments to prevent corrosion, scaling, and fouling in high-capacity boilers, ensuring operational efficiency and minimizing maintenance costs

- The market growth is further supported by government initiatives promoting energy efficiency, industrial sustainability, and compliance with environmental regulations, as well as the growing presence of domestic chemical manufacturers

China Boiler Water Treatment Chemicals Market Insight

The China boiler water treatment chemicals market accounted for the largest revenue share in Asia-Pacific in 2024, fueled by rapid industrial expansion, increasing energy demand, and extensive infrastructure development. High adoption of high-capacity boilers across power, steel, and chemical industries is driving the need for effective water treatment solutions. Domestic manufacturers and government policies promoting energy efficiency and eco-friendly operations are further bolstering market growth.

Japan Boiler Water Treatment Chemicals Market Insight

The Japan boiler water treatment chemicals market is expected to witness significant growth from 2025 to 2032 due to the country’s focus on technological innovation, energy efficiency, and sustainable industrial practices. Japanese industries are increasingly implementing advanced chemical monitoring and dosing systems to maintain boiler reliability, reduce operational costs, and integrate eco-friendly treatment solutions across power generation and manufacturing sectors.

Europe Boiler Water Treatment Chemicals Market Insight

The Europe boiler water treatment chemicals market is expected to witness the fastest growth rate from 2025 to 2032, primarily driven by stringent environmental regulations and the need to optimize boiler efficiency across industries. Rising industrial automation, coupled with the adoption of sustainable and non-toxic chemical formulations, is accelerating market penetration. The region is witnessing growth across power generation, steel, and chemical industries, with advanced treatment chemicals being incorporated in both new installations and retrofit projects.

U.K. Boiler Water Treatment Chemicals Market Insight

The U.K. boiler water treatment chemicals market is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing industrial modernization and the need for reliable, high-efficiency boiler operations. The focus on energy efficiency, emission reduction, and sustainability is prompting industries to adopt advanced chemical treatment programs. Supportive regulatory frameworks and technological awareness among industrial operators are further boosting market expansion.

Germany Boiler Water Treatment Chemicals Market Insight

The Germany boiler water treatment chemicals market is expected to witness the fastest growth rate from 2025 to 2032, fueled by rising awareness of energy conservation and the adoption of eco-friendly treatment solutions. Germany’s emphasis on industrial efficiency, technological innovation, and environmental sustainability is promoting the integration of advanced chemical formulations in power plants and manufacturing facilities. Continuous monitoring and smart dosing systems are becoming increasingly prevalent, enhancing boiler performance and compliance.

North America Boiler Water Treatment Chemicals Market Insight

North America is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing industrialization, stringent environmental regulations, and the presence of a mature industrial infrastructure. Industries in the region highly prioritize the prevention of boiler corrosion, scaling, and fouling, leveraging advanced chemical solutions to optimize equipment efficiency and reduce maintenance costs. The market growth is further supported by high adoption of automation and monitoring technologies, as well as the growing emphasis on energy efficiency and compliance with wastewater discharge standards.

U.S. Boiler Water Treatment Chemicals Market Insight

The U.S. boiler water treatment chemicals market is expected to witness the fastest growth rate from 2025 to 2032, fueled by the widespread use of high-capacity boilers in power generation, oil & gas, and manufacturing sectors. Industrial operators are increasingly investing in advanced chemical dosing systems and automated monitoring solutions to enhance operational reliability. The adoption of eco-friendly formulations and compliance with federal environmental regulations further propels the market growth in the country.

Boiler Water Treatment Chemicals Market Share

The Boiler Water Treatment Chemicals industry is primarily led by well-established companies, including:

- BASF SE (Germany)

- Kemira (Finland)

- Kurita Water Industries Ltd. (Japan)

- Solenis (U.S.)

- Ecolab (U.S.)

- SUEZ (France)

- Eastman Chemical Company (U.S.)

- Lonza (Switzerland)

- SNF (France)

- Solvay (Belgium)

- Akzo Nobel N.V. (Netherlands)

- Dow (U.S.)

- Chembond Chemicals Limited (India)

- Henkel AG & Co. KGaA (Germany)

- Chemtex Speciality Limited (India)

- Accepta Ltd – Accepta The Water Treatment Products Company (U.K.)

- ControlChem Canada Ltd. (Canada)

- ChemTreat, Inc. (U.S.)

- Bond Water Technologies, Inc. (U.S.)

- VEOLIA ENVIRONNEMENT SA (France)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL BOILER WATER TREATMENT CHEMICALS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL BOILER WATER TREATMENT CHEMICALS MARKET SIZE

2.3 VENDOR POSITIONING GRID

2.4 MARKETS COVERED

2.5 GEOGRAPHIC SCOPE

2.6 YEARS CONSIDERED FOR THE STUDY

2.7 RESEARCH METHODOLOGY

2.8 TECHNOLOGY LIFE LINE CURVE

2.9 MULTIVARIATE MODELLING

2.1 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.11 DBMR MARKET POSITION GRID

2.12 MARKET APPLICATION COVERAGE GRID

2.13 DBMR MARKET CHALLENGE MATRIX

2.14 IMPORT AND EXPORT DATA

2.15 SECONDARY SOURCES

2.16 GLOBAL BOILER WATER TREATMENT CHEMICALS MARKET: RESEARCH SNAPSHOT

2.17 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 REGUALTORY OVERVIEW

5.2 VALUE CHAIN ANALYSIS

6 INDUSTRY INSIGHTS

7 IMPACT OF COVID-19 PANDEMIC ON GLOBAL BOILER WATER TREATMENT CHEMICALS MARKET

7.1 ANALYSIS ON IMPACT OF COVID-19 ON THE MARKET

7.2 AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVE TO BOOST THE MARKET

7.3 STRATEGIC DECISIONS FOR MANUFACTUERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

7.4 PRICE IMPACT

7.5 IMPACT ON DEMAND

7.6 IMPACT ON SUPPLY CHAIN

7.7 CONCLUSION

8 GLOBAL BOILER WATER TREATMENT CHEMICALS MARKET, BY BIOLER TYPE

8.1 OVERVIEW

8.2 STEAM WATER BOILERS

8.3 HOT WATER BOILERS

9 GLOBAL BOILER WATER TREATMENT CHEMICALS MARKET, BY TREATMENT TYPE

9.1 OVERVIEW

9.2 EXTERNAL TREATMENT

9.2.1 SOFTENING

9.2.2 EVAPORATION

9.2.2.1. NATURAL

9.2.2.2. SYNTHETIC

9.2.3 DEAERATION

9.2.4 MEMBRANE CONTRACTORS

9.2.5 OTHERS

9.3 INTERNAL TREATMENT

9.3.1 SOFTENING

9.3.2 COMBINATION WITH EXTERNAL TREATMENT

10 GLOBAL BOILER WATER TREATMENT CHEMICALS MARKET, BY TYPE

10.1 OVERVIEW

10.2 COAGULANTS AND FLOCCULANTS

10.2.1 FERRIC SULAFTE

10.2.2 FERRIC CHLORIDE

10.2.3 SODIUM ALUMINATE

10.2.4 OTHERS

10.3 BIOCIDES

10.3.1 ALCOHOLS

10.3.2 ALDEHYDES

10.3.3 CHLORINE

10.3.4 CHLORINE- RELEASING AGENTS

10.3.4.1. SODIUM HYPOCHLORITE

10.3.4.2. CHLORHEXIDINE

10.3.4.3. OTHERS

10.3.5 IODINE

10.3.6 PEROXYGEN COMPOUNDS

10.3.6.1. HYDROGEN PEROXIDE

10.3.6.2. PERACETIC ACID

10.3.6.3. OTHERS

10.3.7 PHENOLIC TYPE COMPOUNDS

10.3.8 QUATERNARY AMMONIUM COMPOUNDS

10.3.9 BASES

10.3.9.1. SODIUM HYDROXIDE

10.3.9.2. POTASSIUM HYDROXIDE

10.3.9.3. SODIUM CARBONATE

10.3.9.4. OTHERS

10.3.10 ACIDS

10.3.10.1. MINERAL

10.3.10.2. ORGANIC ACIDS

10.3.10.3. OTHERS

10.3.11 OTHERS

10.4 ALKALINITY BUILDERS

10.4.1 SODIUM HYDROXIDE

10.4.2 POTASSIUM HYDROXIDE

10.5 CORROSION INHIBITORS

10.5.1 ANODIC INHIBITORS

10.5.1.1. CHROMATES

10.5.1.2. NITRATES

10.5.1.3. MOLYBDATES

10.5.1.4. TUNGSTATE

10.5.1.5. OTHERS

10.5.2 CATHODIC INHIBITORS

10.5.2.1. CATHODIC POISON

10.5.2.2. OXYGEN SCAVENGERS

10.5.2.3. OTHERS

10.5.3 MIXED INHIBITORS

10.5.3.1. SILICATES

10.5.3.2. PHOSPATES

10.5.3.3. OTHERS

10.5.4 VOLATILE CORROSION INHIBITORS (VCI)

10.5.4.1. MORPHOLINE

10.5.4.2. HYDRAZINE

10.5.4.3. OTHERS

10.5.5 OTHERS

10.6 OXYGEN SCAVENGERS

10.6.1 HYDRAZINE

10.6.2 CARBOHYDRAZIDE

10.6.3 SODIUM SULFITE

10.6.4 DIETHYLHYDROXYLAMINE (DEHA)

10.6.5 TANNINS

10.6.6 OTHERS

10.7 PH BOOSTERS

10.7.1 MORPHOLINE BASED ALKALINE FORMULATIONS

10.7.2 LIQUID ALKALINE FORMULATIONS

10.7.3 GRANULES PH BALLS

10.7.4 OTHERS

10.8 SCALE INHIBITORS

10.8.1 CHELATING AGENTS

10.8.2 PHOSPHONATES

10.8.2.1. INORGANIC POLYPHOSPHATES

10.8.2.2. ORGANIC PHOSPHATES ESTERS

10.8.2.3. ORGANIC PHOSPHONATES

10.8.3 CARBOXYLATES

10.8.4 OTHERS

10.9 FOAM CONTROL AGENTS

10.9.1 ALCOHOLS (CETOSTEARYL ALCOHOL)

10.9.2 INSOLUBLE OILS (CASTOR OIL)

10.9.3 STEARATES

10.9.4 POLYDIMETHYLSILOXANES AND OTHER SILICONES DERIVATIVES

10.9.5 ETHER AND GLYCOLS

10.9.6 OTHERS

10.1 AMINES

10.10.1 CYCLOHEXYLAMINE

10.10.2 MORPHOLINE

10.10.3 DIETHYLAMINOETHANOL

10.10.4 OTHERS

10.11 OTHERS

11 GLOBAL BOILER WATER TREATMENT CHEMICALS MARKET, BY CHEMISTRY

11.1 OVERVIEW

11.2 BASIC CHEMICALS

11.3 SPECIALTY CHEMICALS

12 GLOBAL BOILER WATER TREATMENT CHEMICALS MARKET, BY DISTRIBUTION CHANNEL

12.1 OVERVIEW

12.2 OFFLINE

12.3 ONLINE

13 GLOBAL BOILER WATER TREATMENT CHEMICALS MARKET, BY END-USER

13.1 OVERVIEW

13.2 OIL & GAS

13.2.1 OIL & GAS, BY TYPE

13.2.1.1. COAGULANTS AND FLOCCULANTS

13.2.1.2. BIOCIDES

13.2.1.3. ALKALINITY BUILDERS

13.2.1.4. CORROSION INHIBITORS

13.2.1.5. OXYGEN SCAVENGERS

13.2.1.6. PH BOOSTERS

13.2.1.7. SCALE INHIBITORS

13.2.1.8. FOAM CONTROL AGENTS

13.2.1.9. AMINES

13.2.1.10. OTHERS

13.3 CHEMICALS & PETROCHEMICALS

13.3.1 CHEMICALS & PETROCHEMICALS, BY TYPE

13.3.1.1. COAGULANTS AND FLOCCULANTS

13.3.1.2. BIOCIDES

13.3.1.3. ALKALINITY BUILDERS

13.3.1.4. CORROSION INHIBITORS

13.3.1.5. OXYGEN SCAVENGERS

13.3.1.6. PH BOOSTERS

13.3.1.7. SCALE INHIBITORS

13.3.1.8. FOAM CONTROL AGENTS

13.3.1.9. AMINES

13.3.1.10. OTHERS

13.4 FOOD & BEVERAGE

13.4.1 FOOD & BEVERAGE, BY TYPE

13.4.1.1. COAGULANTS AND FLOCCULANTS

13.4.1.2. BIOCIDES

13.4.1.3. ALKALINITY BUILDERS

13.4.1.4. CORROSION INHIBITORS

13.4.1.5. OXYGEN SCAVENGERS

13.4.1.6. PH BOOSTERS

13.4.1.7. SCALE INHIBITORS

13.4.1.8. FOAM CONTROL AGENTS

13.4.1.9. AMINES

13.4.1.10. OTHERS

13.5 POWER

13.5.1 POWER, BY TYPE

13.5.1.1. COAGULANTS AND FLOCCULANTS

13.5.1.2. BIOCIDES

13.5.1.3. ALKALINITY BUILDERS

13.5.1.4. CORROSION INHIBITORS

13.5.1.5. OXYGEN SCAVENGERS

13.5.1.6. PH BOOSTERS

13.5.1.7. SCALE INHIBITORS

13.5.1.8. FOAM CONTROL AGENTS

13.5.1.9. AMINES

13.5.1.10. OTHERS

13.6 TEXTILES

13.6.1 TEXTILES, BY TYPE

13.6.1.1. COAGULANTS AND FLOCCULANTS

13.6.1.2. BIOCIDES

13.6.1.3. ALKALINITY BUILDERS

13.6.1.4. CORROSION INHIBITORS

13.6.1.5. OXYGEN SCAVENGERS

13.6.1.6. PH BOOSTERS

13.6.1.7. SCALE INHIBITORS

13.6.1.8. FOAM CONTROL AGENTS

13.6.1.9. AMINES

13.6.1.10. OTHERS

13.7 PULP & PAPER

13.7.1 PULP & PAPER, BY TYPE

13.7.1.1. COAGULANTS AND FLOCCULANTS

13.7.1.2. BIOCIDES

13.7.1.3. ALKALINITY BUILDERS

13.7.1.4. CORROSION INHIBITORS

13.7.1.5. OXYGEN SCAVENGERS

13.7.1.6. PH BOOSTERS

13.7.1.7. SCALE INHIBITORS

13.7.1.8. FOAM CONTROL AGENTS

13.7.1.9. AMINES

13.7.1.10. OTHERS

13.8 PHARMACEUTICALS

13.8.1 PHARMACEUTICALS, BY TYPE

13.8.1.1. COAGULANTS AND FLOCCULANTS

13.8.1.2. BIOCIDES

13.8.1.3. ALKALINITY BUILDERS

13.8.1.4. CORROSION INHIBITORS

13.8.1.5. OXYGEN SCAVENGERS

13.8.1.6. PH BOOSTERS

13.8.1.7. SCALE INHIBITORS

13.8.1.8. FOAM CONTROL AGENTS

13.8.1.9. AMINES

13.8.1.10. OTHERS

13.9 INDUSTRIAL

13.9.1 INDUSTRIAL, BY TYPE

13.9.1.1. COAGULANTS AND FLOCCULANTS

13.9.1.2. BIOCIDES

13.9.1.3. ALKALINITY BUILDERS

13.9.1.4. CORROSION INHIBITORS

13.9.1.5. OXYGEN SCAVENGERS

13.9.1.6. PH BOOSTERS

13.9.1.7. SCALE INHIBITORS

13.9.1.8. FOAM CONTROL AGENTS

13.9.1.9. AMINES

13.9.1.10. OTHERS

13.1 OTHERS

13.10.1 OTHERS, BY TYPE

13.10.1.1. COAGULANTS AND FLOCCULANTS

13.10.1.2. BIOCIDES

13.10.1.3. ALKALINITY BUILDERS

13.10.1.4. CORROSION INHIBITORS

13.10.1.5. OXYGEN SCAVENGERS

13.10.1.6. PH BOOSTERS

13.10.1.7. SCALE INHIBITORS

13.10.1.8. FOAM CONTROL AGENTS

13.10.1.9. AMINES

13.10.1.10. OTHERS

14 GLOBAL BOILER WATER TREATMENT CHEMICALS MARKET, BY GEOGRAPHY

14.1 GLOBAL BOILER WATER TREATMENT CHEMICALS MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

14.2 NORTH AMERICA

14.2.1 U.S.

14.2.2 CANADA

14.2.3 MEXICO

14.3 EUROPE

14.3.1 GERMANY

14.3.2 U.K.

14.3.3 ITALY

14.3.4 FRANCE

14.3.5 SPAIN

14.3.6 RUSSIA

14.3.7 SWITZERLAND

14.3.8 TURKEY

14.3.9 BELGIUM

14.3.10 NETHERLANDS

14.3.11 LUXEMBURG

14.3.12 REST OF EUROPE

14.4 ASIA-PACIFIC

14.4.1 JAPAN

14.4.2 CHINA

14.4.3 SOUTH KOREA

14.4.4 INDIA

14.4.5 SINGAPORE

14.4.6 THAILAND

14.4.7 INDONESIA

14.4.8 MALAYSIA

14.4.9 PHILIPPINES

14.4.10 AUSTRALIA & NEW ZEALAND

14.4.11 REST OF ASIA-PACIFIC

14.5 SOUTH AMERICA

14.5.1 BRAZIL

14.5.2 ARGENTINA

14.5.3 REST OF SOUTH AMERICA

14.6 MIDDLE EAST AND AFRICA

14.6.1 SOUTH AFRICA

14.6.2 EGYPT

14.6.3 SAUDI ARABIA

14.6.4 UNITED ARAB EMIRATES

14.6.5 ISRAEL

14.6.6 REST OF MIDDLE EAST AND AFRICA

15 GLOBAL BOILER WATER TREATMENT CHEMICALS MARKET, COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: GLOBAL

15.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

15.3 COMPANY SHARE ANALYSIS: EUROPE

15.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

15.5 MERGERS AND ACQUISITIONS

15.6 NEW PRODUCT DEVELOPMENT AND APPROVALS

15.7 EXPANSIONS

15.8 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

16 SWOT AND DATA BRIDGE MARKET RESEARCH ANALYSIS

17 GLOBAL BOILER WATER TREATMENT CHEMICALS MARKET- COMPANY PROFILE

17.1 BASF SE

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUE ANALYSIS

17.1.3 PRODUCT PORTFOLIO

17.1.4 RECENT UPDATES

17.2 VEOLIA

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 PRODUCT PORTFOLIO

17.2.4 RECENT UPDATES

17.3 SUEZ

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUE ANALYSIS

17.3.3 PRODUCT PORTFOLIO

17.3.4 RECENT UPDATES

17.4 ARKEMA

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUE ANALYSIS

17.4.3 PRODUCT PORTFOLIO

17.4.4 RECENT UPDATES

17.5 ECOLAB

17.5.1 COMPANY SNAPSHOT

17.5.2 REVENUE ANALYSIS

17.5.3 PRODUCT PORTFOLIO

17.5.4 RECENT UPDATES

17.6 WETICO

17.6.1 COMPANY SNAPSHOT

17.6.2 REVENUE ANALYSIS

17.6.3 PRODUCT PORTFOLIO

17.6.4 RECENT UPDATES

17.7 SOLENIS

17.7.1 COMPANY SNAPSHOT

17.7.2 REVENUE ANALYSIS

17.7.3 PRODUCT PORTFOLIO

17.7.4 RECENT UPDATES

17.8 CHEMTREAT, INC

17.8.1 COMPANY SNAPSHOT

17.8.2 REVENUE ANALYSIS

17.8.3 PRODUCT PORTFOLIO

17.8.4 RECENT UPDATES

17.9 METITO

17.9.1 COMPANY SNAPSHOT

17.9.2 REVENUE ANALYSIS

17.9.3 PRODUCT PORTFOLIO

17.9.4 RECENT UPDATES

17.1 THERMAX GLOBAL

17.10.1 COMPANY SNAPSHOT

17.10.2 REVENUE ANALYSIS

17.10.3 PRODUCT PORTFOLIO

17.10.4 RECENT UPDATES

17.11 BWA WATER ADDITIVES

17.11.1 COMPANY SNAPSHOT

17.11.2 REVENUE ANALYSIS

17.11.3 PRODUCT PORTFOLIO

17.11.4 RECENT UPDATES

17.12 BUCKMAN

17.12.1 COMPANY SNAPSHOT

17.12.2 REVENUE ANALYSIS

17.12.3 PRODUCT PORTFOLIO

17.12.4 RECENT UPDATES

17.13 ION EXCHANGE LLC

17.13.1 COMPANY SNAPSHOT

17.13.2 REVENUE ANALYSIS

17.13.3 PRODUCT PORTFOLIO

17.13.4 RECENT UPDATES

17.14 AES ARABIA LTD

17.14.1 COMPANY SNAPSHOT

17.14.2 REVENUE ANALYSIS

17.14.3 PRODUCT PORTFOLIO

17.14.4 RECENT UPDATES

17.15 KURITA WATER INDUSTRIES LTD.

17.15.1 COMPANY SNAPSHOT

17.15.2 REVENUE ANALYSIS

17.15.3 PRODUCT PORTFOLIO

17.15.4 RECENT UPDATES

17.16 KEMIRA

17.16.1 COMPANY SNAPSHOT

17.16.2 REVENUE ANALYSIS

17.16.3 PRODUCT PORTFOLIO

17.16.4 RECENT UPDATES

17.17 ACCEPTA WATER TREATMENT

17.17.1 COMPANY SNAPSHOT

17.17.2 REVENUE ANALYSIS

17.17.3 PRODUCT PORTFOLIO

17.17.4 RECENT UPDATES

17.18 ARIES CHEMICAL

17.18.1 COMPANY SNAPSHOT

17.18.2 REVENUE ANALYSIS

17.18.3 PRODUCT PORTFOLIO

17.18.4 RECENT UPDATES

17.19 WILHELMSEN

17.19.1 COMPANY SNAPSHOT

17.19.2 REVENUE ANALYSIS

17.19.3 PRODUCT PORTFOLIO

17.19.4 RECENT UPDATES

17.2 EASTMAN CHEMICAL COMPANY

17.20.1 COMPANY SNAPSHOT

17.20.2 REVENUE ANALYSIS

17.20.3 PRODUCT PORTFOLIO

17.20.4 RECENT UPDATES

17.21 AKZO NOBEL

17.21.1 COMPANY SNAPSHOT

17.21.2 REVENUE ANALYSIS

17.21.3 PRODUCT PORTFOLIO

17.21.4 RECENT UPDATES

17.22 CHEMFAX PRODUCTS

17.22.1 COMPANY SNAPSHOT

17.22.2 REVENUE ANALYSIS

17.22.3 PRODUCT PORTFOLIO

17.22.4 RECENT UPDATES

17.23 DOWDUPONT

17.23.1 COMPANY SNAPSHOT

17.23.2 REVENUE ANALYSIS

17.23.3 PRODUCT PORTFOLIO

17.23.4 RECENT UPDATES

17.24 GUARDIAN CHEMICALS

17.24.1 COMPANY SNAPSHOT

17.24.2 REVENUE ANALYSIS

17.24.3 PRODUCT PORTFOLIO

17.24.4 RECENT UPDATES

17.25 AQUAFILSEP

17.25.1 COMPANY SNAPSHOT

17.25.2 REVENUE ANALYSIS

17.25.3 PRODUCT PORTFOLIO

17.25.4 RECENT UPDATES

17.26 CHEMTEX SPECIALITY

17.26.1 COMPANY SNAPSHOT

17.26.2 REVENUE ANALYSIS

17.26.3 PRODUCT PORTFOLIO

17.26.4 RECENT UPDATES

17.27 LENNTECH B.V.

17.27.1 COMPANY SNAPSHOT

17.27.2 REVENUE ANALYSIS

17.27.3 PRODUCT PORTFOLIO

17.27.4 RECENT UPDATES

17.28 CHEMBOND CHEMICALS LIMITED

17.28.1 COMPANY SNAPSHOT

17.28.2 REVENUE ANALYSIS

17.28.3 PRODUCT PORTFOLIO

17.28.4 RECENT UPDATES

17.29 FEEDWATER

17.29.1 COMPANY SNAPSHOT

17.29.2 REVENUE ANALYSIS

17.29.3 PRODUCT PORTFOLIO

17.29.4 RECENT UPDATES

17.3 QUALICHEM, INC

17.30.1 COMPANY SNAPSHOT

17.30.2 REVENUE ANALYSIS

17.30.3 PRODUCT PORTFOLIO

17.30.4 RECENT UPDATES

*NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

18 RELATED REPORTS

19 QUESTIONNAIRE

20 CONCLUSION

21 ABOUT DATA BRIDGE MARKET RESEARCH

Global Boiler Water Treatment Chemicals Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Boiler Water Treatment Chemicals Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Boiler Water Treatment Chemicals Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.