Global Blood Preparation Market

Market Size in USD Billion

CAGR :

%

USD

52.96 Billion

USD

75.60 Billion

2025

2033

USD

52.96 Billion

USD

75.60 Billion

2025

2033

| 2026 –2033 | |

| USD 52.96 Billion | |

| USD 75.60 Billion | |

|

|

|

|

Blood Preparation Market Size

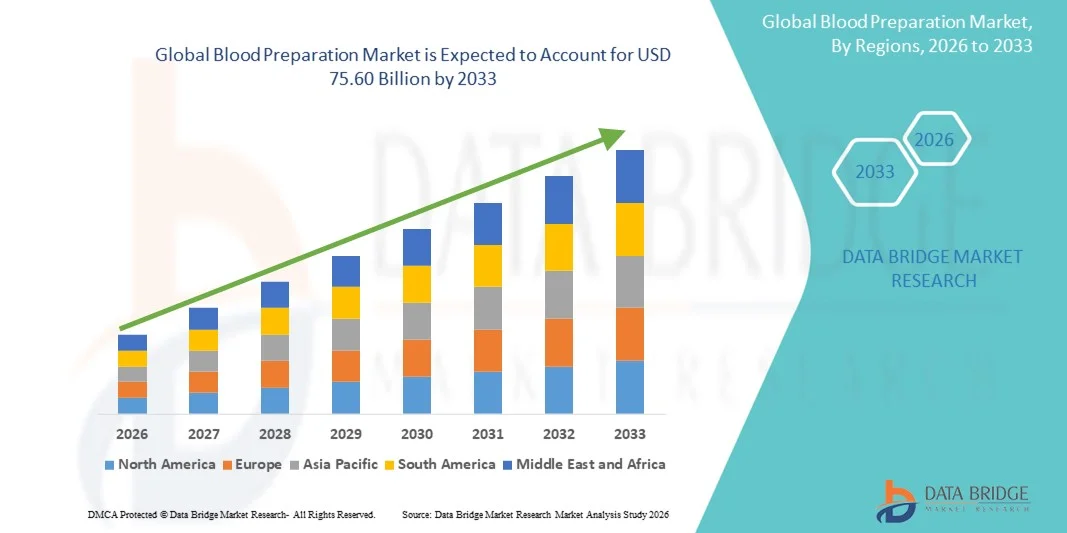

- The global Blood Preparation market size was valued at USD 52.96 billion in 2025 and is expected to reach USD 75.60 billion by 2033, at a CAGR of 4.55% during the forecast period

- The market growth is largely fueled by the increasing demand for advanced blood components and derivatives across hospitals, diagnostic centers, and research institutions, supported by rising prevalence of chronic diseases, trauma cases, and surgical procedures worldwide. The continuous technological progress in blood processing systems, separation technologies, and storage solutions is enhancing the efficiency, accuracy, and safety of blood collection and preparation, contributing significantly to market expansion

- Furthermore, growing emphasis on high-quality blood components, improved transfusion safety, and standardized processing protocols is driving the adoption of modern blood preparation solutions. The rising need for platelets, plasma, cryoprecipitate, and red blood cells in therapeutic applications—as well as the increasing focus on pathogen reduction, leukoreduction, and automated separation techniques—is accelerating the uptake of Blood Preparation systems, thereby substantially boosting the industry’s overall growth

Blood Preparation Market Analysis

- Blood preparation technologies, which include systems for separating, processing, and preserving blood components, are becoming increasingly essential across hospitals, blood banks, diagnostic laboratories, and research institutions due to their critical role in ensuring safe, efficient, and high-quality transfusion practices. These solutions support the preparation of red blood cells, plasma, platelets, and other derivatives with greater precision, reduced contamination risk, and enhanced storage stability

- The rising demand for blood preparation solutions is primarily fueled by the growing prevalence of chronic diseases, rising surgical volumes, trauma cases, cancer therapies, and increasing reliance on blood components in emergency and critical care settings. Advancements in automated blood processing systems, pathogen-reduction technologies, and high-throughput separation devices are further accelerating adoption across both developed and emerging healthcare markets

- North America dominated the blood preparation market with the largest revenue share of 38.9% in 2025, driven by advanced healthcare infrastructure, high transfusion rates, strong presence of leading blood processing system manufacturers, and widespread adoption of automated and standardized blood preparation technologies. The U.S. continues to lead regional growth due to expanding hospital capacities, increasing demand for plasma and platelets, and ongoing investment in safety-enhanced processing systems across blood banks and clinical laboratories

- Asia-Pacific is expected to be the fastest-growing region in the blood preparation market, projected to record a CAGR of 13.4% during the forecast period, supported by rising healthcare expenditure, rapid expansion of blood banks, growing government initiatives for safe transfusion practices, and increasing adoption of modern blood processing equipment in countries such as China, India, and Japan. The region’s growing burden of chronic illnesses and surgical procedures further strengthens market momentum

- The Blood Components segment dominated the largest market revenue share of 47.3% in 2025, driven by the increasing demand for components such as plasma, platelets, and red blood cells across hospitals and blood banks

Report Scope and Blood Preparation Market Segmentation

|

Attributes |

Blood Preparation Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• Grifols S.A. (Spain) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Blood Preparation Market Trends

Rising Adoption of Advanced Component Separation and Automation Technologies

- A significant and accelerating trend in the global blood preparation market is the growing adoption of automated blood processing systems, advanced component separation technologies, and quality-control–enhancing platforms. These innovations are transforming how blood banks and transfusion centers manage donation, processing, storage, and distribution, enabling higher efficiency, reduced human error, and improved safety profiles

- For instance, several global manufacturers have introduced next-generation automated centrifugation and apheresis systems that streamline plasma, platelet, and RBC separation while improving yield consistency. Likewise, fully automated bag sealing, leukoreduction, and pathogen-inactivation technologies are rapidly becoming standard in modern blood centers, driving operational precision and standardization across the supply chain

- The integration of AI-driven quality control software and smart tracking systems in blood processing devices enables real-time monitoring of temperature, sterility, volume measurement, and contamination indicators. Some advanced systems are capable of predicting component degradation patterns or identifying anomalies in blood bag handling, thereby greatly improving safety outcomes

- Furthermore, the expansion of pathogen-reduction technologies (PRT) for plasma and platelets—supported by global regulatory approvals—has strengthened the trend toward safer and more reliable blood component preparation. These technologies help minimize the risk of transfusion-transmitted infections (TTIs), a major global concern

- The shift toward standardized, automated, and traceable blood preparation workflows is reshaping global blood bank operations, driving increased adoption of closed-system processing equipment, automated separation devices, and high-precision cell-handling solutions

- As demand rises for safe blood components in surgical, trauma, oncology, and chronic disease management settings, the adoption of advanced blood preparation technologies is accelerating across both developed and emerging markets

Blood Preparation Market Dynamics

Driver

Growing Need for Safe Blood Products Due to Rising Disease Burden and Surgical Procedures

- The continuously growing number of surgeries, trauma cases, cancer treatments, and chronic disease-related hospitalizations has increased global demand for blood and blood components, fueling the expansion of the Blood Preparation market

- For instance, in April 2025, multiple regional blood centers announced expansions of pathogen-inactivation and leukoreduction technologies, emphasizing global efforts to reduce transfusion-transmitted infection risks. Such strategies by key organizations are expected to significantly drive Blood Preparation industry growth during the forecast period

- As awareness of diseases such as anemia, hemophilia, thalassemia, and blood-borne infections increases, demand for high-quality red blood cells, plasma, and platelets is rising. This is accompanied by rapid adoption of technologies that improve sterility, efficiency, and purity

- Furthermore, the rising popularity of automated and closed-system blood processing devices is ensuring higher accuracy in component separation, enhanced safety, and reduced contamination risk, making them essential in hospitals, blood banks, and transfusion centers

- Convenience, accuracy, reduced processing time, and scalability offered by modern automated systems—along with growing investments in improving national blood transfusion services—are major factors propelling market growth. The increasing availability of user-friendly Blood Preparation devices further contributes to industry expansion

Restraint/Challenge

High Costs of Advanced Technologies and Strict Regulatory Requirements

- High initial costs associated with automated blood processing systems, pathogen-inactivation platforms, and advanced separation devices pose a significant challenge to broader adoption, especially in low-resource or budget-constrained regions

- For instance, several advanced pathogen-reduction and leukoreduction technologies require substantial capital investment and ongoing maintenance, making smaller hospitals or local blood banks hesitant to transition from manual methods

- Strict regulatory standards governing the collection, processing, testing, and distribution of blood products add further pressure on manufacturers and healthcare institutions. Meeting these standards requires continuous upgrades, documentation, audits, and staff training, which increases operational complexity and costs

- In addition, concerns surrounding operational challenges such as device calibration, storage infrastructure, and the need for trained technicians have also slowed adoption in some regions. While prices of certain consumables are gradually decreasing, the overall cost burden still creates barriers for many blood centers

- Overcoming these challenges through improved cost-efficiency, streamlined regulatory pathways, staff training programs, and the development of more affordable Blood Preparation devices will be crucial for sustaining long-term global market growth

Blood Preparation Market Scope

The market is segmented on the basis of product, antithrombotic/anticoagulant type, and application.

- By Product

On the basis of product, the Blood Preparation market is segmented into Whole Blood, Blood Components, and Blood Derivatives. The Blood Components segment dominated the largest market revenue share of 47.3% in 2025, driven by the increasing demand for components such as plasma, platelets, and red blood cells across hospitals and blood banks. Growing cases of trauma injuries, anemia, and surgical procedures significantly increase the need for specialized components instead of whole blood. Component-based therapy offers greater precision in patient treatment and reduces the risks associated with transfusion. Rising adoption of leukoreduced and pathogen-reduced blood products also boosts demand. Technological advancements in component separation and storage enhance shelf life and safety. Blood components are widely required in oncology, critical care, and chronic disease management. Government and NGO-led blood donation programs ensure consistent availability. The growing focus on plasma-derived therapies further enhances segment growth. Increasing awareness of transfusion guidelines encourages component-based use. Expansion of blood processing facilities in emerging economies contributes to rising adoption. Rising prevalence of blood disorders such as hemophilia strengthens the demand outlook.

The Blood Derivatives segment is expected to witness the fastest CAGR of 18.4% from 2026 to 2033, driven by rapid growth in plasma-derived therapeutics and biologics used for immunodeficiency, autoimmune diseases, and coagulation disorders. Increasing R&D investments in immunoglobulins, albumin, and clotting factors significantly enhance market growth. The segment benefits from rising demand for advanced therapies in hematology and infectious disease management. Improvements in fractionation technologies lead to higher yields and improved product safety. Expanding applications in neurology, critical care, and chronic inflammatory diseases increase utilization. Government support for plasma collection centers accelerates production scale. Growing adoption of recombinant derivatives supports long-term expansion. Pharmaceutical companies increasingly collaborate with blood banks to ensure supply stability. Rising incidence of rare genetic disorders requiring specialized treatment contributes to demand. Higher awareness of immune therapies improves acceptance. Strong market penetration in high-income countries fuels early adoption of innovative products.

- By Antithrombotic and Anticoagulants Type

On the basis of antithrombotic and anticoagulant type, the market is segmented into Platelet Aggregation Inhibitors, Fibrinolytics, and Anticoagulants. The Anticoagulants segment dominated the largest market revenue share of 42.8% in 2025, driven by the rising prevalence of cardiovascular diseases, deep vein thrombosis (DVT), and atrial fibrillation globally. Anticoagulants are widely used in hospitals for preventing blood clots before and after surgeries. The segment benefits from the strong adoption of direct oral anticoagulants (DOACs), which offer better safety and convenience than traditional therapies. Growing incidence of lifestyle-related disorders such as obesity and hypertension increases the need for long-term anticoagulation. Advancements in drug formulations enhance patient compliance and safety profiles. Clinical guidelines increasingly recommend anticoagulants for stroke prevention, boosting demand. Awareness of clot-related complications fuels ongoing medical use. Aging population and higher surgical rates contribute significantly to growth. Pharmaceutical companies continuously expand product pipelines to address clotting disorders. Reimbursement support in many countries strengthens market stability.

The Fibrinolytics segment is expected to witness the fastest CAGR of 17.2% from 2026 to 2033, driven by increasing use in emergency care for acute myocardial infarction, pulmonary embolism, and ischemic stroke. Fibrinolytics play a critical role in dissolving blood clots rapidly, making them essential in life-saving interventions. As emergency services improve globally, demand for quick-acting thrombolytic agents increases. Expansion of stroke centers and cardiac emergency units enhances the need for fibrinolytic therapy. New drug formulations with enhanced safety profiles are driving adoption. Growing awareness of early treatment for stroke and heart attacks supports market penetration. Governments promote rapid-response strategies, indirectly boosting fibrinolytic usage. Telemedicine integration aids faster diagnosis and treatment decision-making. Rising research in targeted clot-dissolving therapies further contributes to growth. Training programs for emergency care professionals increase usage of these drugs. Hospitals increasingly adopt fibrinolytics due to reduced treatment window limitations.

- By Application

On the basis of application, the Blood Preparation market is segmented into Thrombocytosis, Pulmonary Embolism, Renal Impairment, Angina Blood Vessel Complications, and Others. The Pulmonary Embolism segment dominated the largest market revenue share of 36.4% in 2025, owing to the rising global incidence of venous thromboembolism (VTE) and the increasing adoption of anticoagulant therapies. Pulmonary embolism requires immediate medical attention, driving high demand for blood preparation products used in clot prevention and treatment. Advancements in diagnostic imaging improve the identification of PE, leading to earlier treatment intervention. Hospitals heavily rely on anticoagulants, blood components, and fibrinolytics for PE management. Rising sedentary lifestyles, obesity, and aging populations contribute to increasing case numbers. Growing awareness among patients and physicians supports early diagnosis and therapy. Clinical guidelines worldwide recommend aggressive treatment, strengthening market demand. Expansion of emergency care infrastructure enhances treatment rates. Greater investment in critical care units drives ongoing product utilization. Pharmaceutical innovations and new anticoagulant approvals further expand the segment’s growth.

The Thrombocytosis segment is expected to witness the fastest CAGR of 16.9% from 2026 to 2033, driven by increasing prevalence of platelet disorders and rising use of blood derivatives for managing abnormal platelet counts. Advanced diagnostic tools enable earlier detection of thrombocytosis in patients with chronic inflammatory diseases and hematological disorders. Rising use of platelet-lowering therapies increases reliance on blood preparation products. Hospitals and hematology clinics increasingly adopt blood derivatives to manage complex platelet conditions. Growth in cancer treatments contributes to secondary thrombocytosis cases, boosting demand. Ongoing clinical studies in platelet-related diseases support therapeutic advancements. Rising awareness of blood disorders improves diagnosis rates. Increased expenditure on hematology testing enhances segment utilization. Expanding patient pool due to population aging accelerates long-term growth. Pharmaceutical companies continue to develop targeted treatments associated with platelet regulation.

Blood Preparation Market Regional Analysis

- North America dominated the blood preparation market with the largest revenue share of 38.9% in 2025, driven by its advanced healthcare infrastructure, high blood transfusion rates, and the strong presence of leading manufacturers specializing in automated blood processing systems. The region benefits from widespread adoption of standardized technologies that support efficient separation, storage, and handling of whole blood, plasma, and platelets

- Consumers—including hospitals, clinical laboratories, and blood banks—highly prioritize product safety, automation, and compliance with stringent regulatory guidelines. The growing burden of chronic diseases, rising surgical procedures, and increased utilization of plasma-derived therapeutics further contribute to market expansion

- In addition, the ongoing modernization of transfusion services and investments in safety-enhanced processing systems are reinforcing North America’s dominant position

U.S. Blood Preparation Market Insight

The U.S. blood preparation market captured the largest revenue share within North America in 2025, supported by expanding hospital capacities, high rates of voluntary blood donation, and the rising need for platelets, plasma, and cryoprecipitate in critical care settings. Increasing adoption of automated centrifugation systems, pathogen-reduction technologies, and advanced collection kits is accelerating market growth. The U.S. continues to lead regional innovation due to strong regulatory support from agencies such as the FDA, rising demand for personalized and targeted transfusion therapies, and growing investments in modernizing blood banks and emergency care units. Continuous emphasis on donor safety and the efficiency of blood processing workflows further fuels industry advancement.

Europe Blood Preparation Market Insight

The Europe blood preparation market is projected to grow at a substantial CAGR throughout the forecast period, driven by stringent transfusion safety regulations, expansion of national blood donation programs, and increased need for reliable blood components in both public and private healthcare institutions. Rising surgical procedures, aging population, and growing incidence of blood-related disorders are supporting adoption of advanced blood separation and storage technologies. Countries across Europe are integrating automated blood processing solutions into both existing and newly modernized hospital infrastructure. The region shows strong demand across trauma care, oncology, hematology, and cardiovascular treatments, making blood preparation systems essential for maintaining high-quality transfusion practices.

U.K. Blood Preparation Market Insight

The U.K. blood preparation market is expected to grow at a noteworthy CAGR, supported by the country’s highly regulated healthcare system and rising demand for high-quality blood components for clinical use. Increased focus on blood safety, emergency preparedness, and standardized transfusion protocols is strengthening market growth. Growing cases of chronic and lifestyle-associated diseases are increasing the demand for platelets, plasma, and other components. The U.K.'s expansion of digitalized blood bank systems, strong research activity in hematology, and well-established national donation networks continue to propel the adoption of advanced blood preparation equipment.

Germany Blood Preparation Market Insight

The Germany blood preparation market is projected to expand at a considerable CAGR, driven by the nation’s strong healthcare infrastructure, high emphasis on quality assurance, and rapid adoption of technologically advanced processing and storage solutions. Germany’s increasing awareness of transfusion safety, coupled with the growing demand for eco-conscious, efficient, and automated systems, supports the market’s development. The country’s strong innovation ecosystem, combined with its focus on precision medicine and strict healthcare standards, is encouraging greater use of advanced blood preparation solutions across hospitals, clinics, and blood banks.

Asia-Pacific Blood Preparation Market Insight

Asia-Pacific blood preparation market is expected to be the fastest-growing region, projected to record a CAGR of 13.4% from 2026 to 2033, driven by rising healthcare expenditure, rapid expansion of blood banks, and strong government initiatives promoting safe transfusion practices. Increasing urbanization, growing surgical volumes, and heightened awareness of voluntary blood donation are accelerating demand for modern blood processing technologies. Countries such as China, India, and Japan are increasingly investing in automated separation devices, cold-chain enhancements, and pathogen-reduced products. The region’s emergence as a manufacturing hub further boosts affordability, improving accessibility to advanced blood preparation solutions.

Japan Blood Preparation Market Insight

The Japan blood preparation market is gaining momentum due to its technologically advanced healthcare environment, strong focus on patient safety, and rising need for high-quality blood components in aging populations. Japan’s hospitals and blood centers emphasize automation, precision, and integration of sophisticated equipment, supporting strong adoption of modern centrifugation, filtration, and storage systems. Increasing prevalence of chronic diseases and the proliferation of connected healthcare solutions further strengthen the country’s growth trajectory.

China Blood Preparation Market Insight

China blood preparation market accounted for the largest revenue share within Asia-Pacific in 2025, supported by rapid urbanization, growing middle-class population, and strong adoption of advanced healthcare technologies. China’s expanding network of hospitals, emergency care units, and blood donation centers is driving strong demand for whole blood, plasma, and platelet preparation systems. Government-led initiatives for improving blood safety, coupled with rising investments from domestic manufacturers, are accelerating the commercialization and adoption of advanced blood processing devices. The nation’s role as one of the largest markets for medical devices and its rapid progress toward digitalized, smart healthcare infrastructure continue to propel market growth.

Blood Preparation Market Share

The Blood Preparation industry is primarily led by well-established companies, including:

• Grifols S.A. (Spain)

• CSL Behring (Australia)

• Takeda Pharmaceutical Company Limited (Japan)

• Octapharma AG (Switzerland)

• Baxter International Inc. (U.S.)

• Kedrion Biopharma (Italy)

• Bio Products Laboratory Ltd. – BPL (U.K.)

• Terumo Corporation (Japan)

• Haemonetics Corporation (U.S.)

• Fresenius Kabi AG (Germany)

• Shanghai RAAS Blood Products Co., Ltd. (China)

• China Biologic Products Holdings, Inc. (China)

• Sanquin (Netherlands)

• LFB Group (France)

• Arkray Inc. (Japan)

• Immucor, Inc. (U.S.)

• MacoPharma (France)

Latest Developments in Global Blood Preparation Market

- In December 2021, Health Canada approved the use of Cerus Corporation’s INTERCEPT® Pathogen Inactivation Technology for manufacturing pooled, psoralen-treated platelets, enabling Canadian Blood Services to begin rollout of pathogen-reduced platelets at selected hospitals. This marked a notable regulatory step toward wider adoption of pathogen-reduction technologies (PRT) in national blood systems to reduce transfusion-transmitted infection risk

- In May 2021, Cerus Corporation signed a contract with Canadian Blood Services to implement pathogen-reduced platelets (INTERCEPT) starting with pilot implementation in Ottawa — a practical, large-scale deployment that demonstrated how health services can adopt PRT in routine component manufacture and influenced other national programs evaluating PRT

- In December 2023, the U.S. Food and Drug Administration (FDA) granted approval for the INTERCEPT Blood System for Platelets, officially recognizing an FDA-cleared pathogen-reduction platform for platelet products in the U.S. market — a milestone expected to accelerate adoption of PRT and change standard blood-safety practices in transfusion service

- In August 2023, Fresenius Kabi introduced a new DEHP-free blood bag system (and related whole-blood processing disposables), addressing safety and regulatory concerns about plasticizer exposure and supporting modernized transfusion practices; the announcement also highlighted clinical research validating the system’s performance. This product launch reflects broader industry momentum toward safer, more biocompatible disposables for blood collection and processing

- In March 2024, Cerus announced an FDA decision extending the shelf life of INTERCEPT Platelet Processing Sets to 12 months (from date of manufacture). The longer shelf life improves logistics and inventory management for blood centers using pathogen-reduction workflows and reduces pressure on supply chains for processing consumables

- In October 2024, Terumo Blood and Cell Technologies kicked off the U.S. commercial launch of Reveos, an automated whole-blood processing system that processes whole blood into components (RBCs, plasma, platelets) in an integrated cycle — a major automation advance designed to boost throughput, improve yields (especially platelets) and address chronic platelet shortages in blood centers

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.