Global Blood Plasma Market

Market Size in USD Billion

CAGR :

%

USD

34.96 Billion

USD

78.27 Billion

2024

2032

USD

34.96 Billion

USD

78.27 Billion

2024

2032

| 2025 –2032 | |

| USD 34.96 Billion | |

| USD 78.27 Billion | |

|

|

|

|

Blood Plasma Market Size

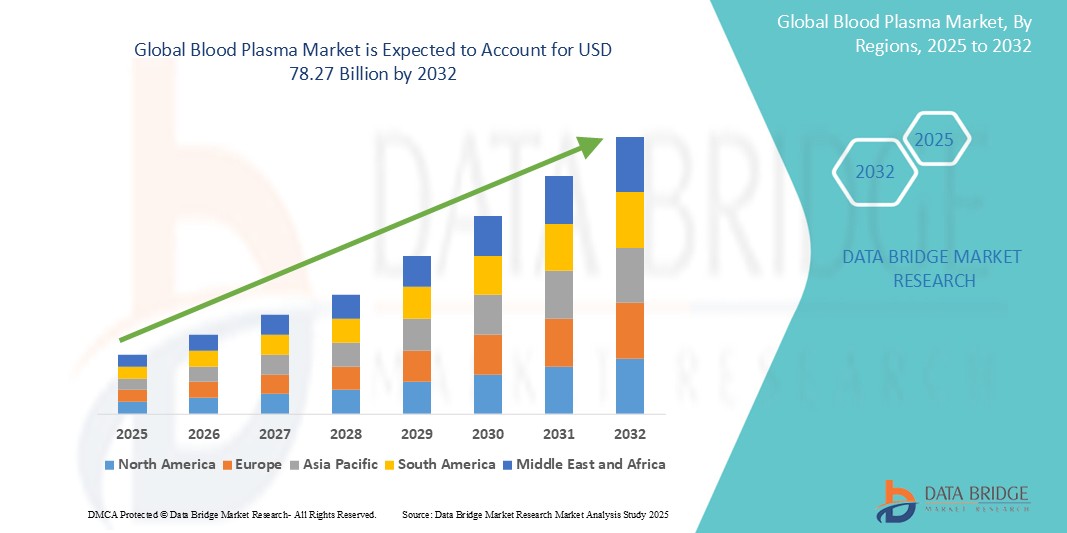

- The global blood plasma market size was valued at USD 34.96 billion in 2024 and is expected to reach USD 78.27 billion by 2032, at a CAGR of 10.60% during the forecast period

- The market growth is largely fueled by the rising demand for plasma-derived therapies for chronic and rare diseases, along with advancements in plasma collection and fractionation technologies

- Technological advancements in plasma collection, fractionation, and purification processes are significantly enhancing the efficiency and safety of plasma-derived therapies. Innovations such as improved donor screening, automated collection systems, and enhanced fractionation techniques are expanding plasma supply capacity while maintaining high product quality, further supporting market growth

- Expanding healthcare infrastructure in emerging economies, along with favorable government policies and reimbursement frameworks, is improving plasma collection networks and treatment accessibility. In addition growing investment by pharmaceutical companies and contract manufacturing organizations (CMOs) in plasma processing facilities is enabling scalable production to meet increasing global demand

Blood Plasma Market Analysis

- The global blood plasma market is largely shaped by the expanding use of plasma-derived therapies, which are crucial for treating a variety of chronic and rare medical conditions. For instance, therapies such as immunoglobulins and clotting factors have become essential in managing diseases such as immune deficiencies and bleeding disorders

- Increasing awareness among healthcare professionals and patients about the benefits and applications of plasma-derived treatments is influencing the market dynamics significantly. Educational campaigns and clinical research have enhanced understanding of how these therapies can improve quality of life for individuals with complex conditions

- North America dominates the blood plasma market with share of 47.05% in 2024, driven by a well-established healthcare infrastructure and high adoption of advanced plasma therapies

- Asia-pacific is expected to be the fastest growing region in the blood plasma market during the forecast period due to rising healthcare expenditures, growing awareness of plasma therapies, and expanding patient pools across emerging economies are key drivers

- The immunoglobulin segment dominates the largest market share with 45.09% in 2024, due to its widespread application in treating immune deficiencies and autoimmune diseases

Report Scope and Blood Plasma Market Segmentation

|

Attributes |

Blood Plasma Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Blood Plasma Market Trends

“Advancement in Plasma Therapies Boosting Market Growth”

- The blood plasma market is increasingly focused on the development of innovative plasma-derived therapies to address a wider range of chronic and rare diseases

- Advances in fractionation technology have improved the efficiency and purity of plasma products, enabling more effective treatments

- The growing number of plasma collection centers supports a more stable supply chain, ensuring consistent availability of plasma for therapeutic use

- Healthcare providers are placing greater emphasis on personalized treatment plans using plasma therapies to improve patient outcomes

- Immunoglobulin therapies are being tailored to specific patient needs, enhancing their effectiveness in managing immune-related disorders

- In conclusion, overall, the market is shifting towards more specialized and advanced plasma products that cater to evolving healthcare demands and improve quality of care

Blood Plasma Market Dynamics

Driver

“Rising Demand for Immunoglobulin and Plasma-Derived Therapies”

- The global rise in chronic and rare diseases such as primary immunodeficiency, hemophilia, and autoimmune disorders has significantly increased the demand for immunoglobulin and plasma-derived therapies

- The growing elderly population and improved access to healthcare services are contributing to higher treatment rates, thereby fueling plasma consumption in both developed and emerging markets

- Advancements in plasma fractionation now allow multiple therapeutic proteins to be extracted from a single donation, enhancing overall product yield and efficiency across production pipelines

- For instance, the U.S. and Germany have scaled outpatient use of plasma therapies, which supports better adherence and long-term patient management while easing pressure on inpatient facilities

- In conclusion, as global healthcare systems recognize the critical value of these therapies, investments in collection infrastructure and technological innovation by biopharmaceutical companies continue to rise, supporting market expansion and sustainability

Restraint/Challenge

“High Cost and Complex Manufacturing Process”

- The production of plasma-derived therapies is costly and highly complex, requiring extensive quality control, sophisticated infrastructure, and skilled personnel, which raises the overall cost of manufacturing

- Plasma must be collected under strict regulatory conditions with consistent donor screening, followed by multi-step processing including fractionation, purification, and pathogen inactivation that further complicate operations

- These procedures demand large investments in cold chain logistics and specialized equipment, which create significant barriers for new entrants and limit cost-effective expansion in low-income regions

- Setting up a single plasma donation center involves millions in capital expenditure, strict compliance protocols, and trained staff, making it less viable in developing healthcare systems

- In conclusion, these operational constraints result in limited global accessibility and higher prices for patients, reducing the pace of market growth and slowing adoption in resource-constrained areas where such therapies are urgently needed

Blood Plasma Market Scope

The market is segmented on the basis of type, communication protocol, unlocking mechanism, and application.

- By Type

On the basis of type, the blood plasma market is segmented into hyperimmune globulin, albumin, factor VIII, factor IX, immunoglobulin, and others. The immunoglobulin segment dominates the wth largest market share with 45.09% in 2024, due to its widespread application in treating immune deficiencies and autoimmune diseases. Its established clinical relevance, supported by increasing demand in chronic disease management, ensures its stronghold in the market.

The hyperimmune globulin segment is anticipated to witness the fastest growth from 2025 to 2032, driven by its use in targeted treatment of specific infectious diseases and its rising adoption in epidemic response strategies.

- By Mode of Delivery

On the basis of mode of delivery, the blood plasma market is segmented into infusion solutions, gels, sprays, and biomedical sealants. The infusion solutions segment holds the largest revenue share in 2024, attributed to their routine use in hospital settings for delivering plasma-derived therapies. Their clinical efficiency, safety profile, and physician preference contribute to their continued dominance.

The biomedical sealants segment anticipated to register the fastest growth, as these are increasingly utilized in surgeries for wound management and hemostasis, supported by innovation in bio-compatible materials.

- By Therapeutic Indication

On the basis of therapeutic indication, the blood plasma market is segmented into immunology, oncology, pulmonology, rheumatology, transplantation, neurology, hematology and other. The immunology segment leads the market in terms of revenue share in 2024, fueled by the high prevalence of immune-related disorders and the critical role plasma therapies play in their treatment.

The neurology segment is expected to register the fastest growth, as plasma-derived products are gaining recognition for their effectiveness in treating neurological conditions such as guillain-barré syndrome and chronic inflammatory demyelinating polyneuropathy.

- By Application

On the basis of application, the blood plasma market is segmented into hypogammaglobulinemia, immunodeficiency diseases, hemophilia, von willebrand's disease (vwd) and others. The immunodeficiency diseases segment dominates the market in 2024, due to the increasing global awareness and diagnosis of primary and secondary immunodeficiencies. Its reliance on long-term immunoglobulin therapy supports sustained growth.

The hemophilia segment is poised to witness the fastest growth, driven by advancements in factor replacement therapies and increased availability of recombinant plasma products.

- By End User

On the basis of end user, the blood plasma market is segmented into hospitals, clinics and other. The hospitals segment accounts for the largest revenue share in 2024, due to their extensive infrastructure for transfusion services, diagnostics, and emergency care. Hospitals also remain central to patient access and long-term therapy management.

The clinics segment is projected to register the fastest growth, supported by the decentralization of healthcare and rising demand for outpatient plasma therapy services, particularly for chronic disease management.

Blood Plasma Market Regional Analysis

- North America dominates the blood plasma market with the largest revenue share of 47.05% in 2024, driven by a well-established healthcare infrastructure and high adoption of advanced plasma therapies

- The region benefits from robust plasma collection networks and regulatory support, ensuring consistent supply and innovation in therapeutic development

- The presence of leading industry players and specialized research institutions contributes to ongoing clinical advancements and widespread availability of plasma-derived products

U.S. Blood Plasma Market Insight

The U.S. blood plasma market encompasses a wide range of applications, including immunology, neurology, hematology, and critical care. It is driven by rising demand for plasma-derived therapies to treat rare and chronic diseases such as primary immunodeficiencies, hemophilia, and autoimmune disorders. The market scope is further broadened by a well-established healthcare infrastructure, a growing donor base, and advanced collection and fractionation technologies. Leading pharmaceutical companies and contract manufacturing organizations (CMOs) are investing in expanding their plasma processing capacities, contributing to market growth.

Europe Blood Plasma Market Insight

The European blood plasma market covers applications such as immune deficiency treatments, coagulation disorders, and critical care. The scope is supported by favorable reimbursement policies, stringent regulatory standards, and increasing prevalence of chronic conditions. Efforts to boost plasma collection within the EU and cross-border collaborations among countries enhance supply stability. The presence of key market players and growing investments in research and development also strengthen the market’s scope across western and eastern Europe.

U.K. Blood Plasma Market Insight

In the U.K., the blood plasma market scope includes therapeutic areas such as immunology, neurology, and hematology, with a particular focus on treating rare and orphan diseases. The national health service (NHS) plays a crucial role in managing plasma-derived product distribution and ensuring access to essential treatments. An increase in awareness campaigns and regulatory support for donor recruitment is expanding the domestic plasma supply, thereby contributing to the availability and affordability of therapies.

Germany Blood Plasma Market Insight

Germany's blood plasma market spans across various medical specialties, with a strong emphasis on immunoglobulins, albumin, and clotting factors. The country’s rigorous regulatory environment and high healthcare standards ensure consistent quality and safety of plasma-derived therapies. With one of the largest healthcare systems in Europe, Germany’s scope includes both public and private healthcare providers, and it continues to invest in local plasma collection centers and biopharmaceutical innovations.

Asia-Pacific Blood Plasma Market Insight

The Asia-pacific blood plasma market features a broad scope across therapeutic applications such as immunology, infectious diseases, and emergency care. Rising healthcare expenditures, growing awareness of plasma therapies, and expanding patient pools across emerging economies are key drivers. Countries such as China, India, and Japan are investing in domestic plasma collection infrastructure and local manufacturing, while regional collaborations aim to address the rising demand for plasma-derived products.

Japan Blood Plasma Market Insight

Japan’s blood plasma market is defined by its focus on high-precision plasma fractionation and treatment of chronic and rare diseases, including immune deficiencies and neurological disorders. The market scope is enhanced by strong governmental backing for R&D, stringent quality controls, and a sophisticated healthcare delivery system. Additionally, Japan’s aging population and rising chronic disease burden necessitate a growing need for plasma-derived therapies.

China Blood Plasma Market Insight

China’s blood plasma market encompasses applications in immunoglobulin therapy, albumin supplementation, and treatment for hemophilia and other coagulation disorders. The country’s scope is reinforced by a rapidly developing healthcare infrastructure, large patient population, and government support for expanding domestic plasma collection networks. As local manufacturers increase production capabilities and regulatory frameworks evolve, the availability and scope of plasma therapies continue to grow rapidly.

Blood Plasma Market Share

The blood plasma industry is primarily led by well-established companies, including:

- Allergan (Ireland)

- AbbVie Inc. (U.S.)

- GALDERMA (Switzerland)

- Evolus, Inc. (U.S.)

- Revance (U.S.)

- HUGEL, Inc. (South Korea)

- Ipsen Pharma (France)

- USWM, LLC. (U.S.)

- Sun Pharmaceutical Industries Ltd. (India)

- Pfizer Inc. (U.S.)

- GlaxoSmithKline plc (UK)

- Merz Pharma (Germany)

- Medytox (South Korea)

- Smith+Nephew (U.S.)

- Sanofi (France)

- Novartis AG (Switzerland)

- Teva Pharmaceutical Industries Ltd. (Israel)

- LGM Pharma. (U.S.)

- Lannett (U.S.)

- NorthStar Rx LLC (U.S.)

Latest Developments in Global Blood Plasma Market

- In January 2024, CSL Behring, a division of the renowned biotechnology company CSL, made a 10g prefilled syringe for Hizentra® (Immune Globulin Subcutaneous [Human] 20% Liquid) accessible to the public. The Hizentra prefilled syringes enhance the treatment experience for individuals with Chronic Inflammatory Demyelinating Polyneuropathy (CIDP) and Primary Immunodeficiency (PI) by eliminating the requirement to extract medication from vials

- In October 2023, KTC Edibles, the leading provider of edible oils in the U.K., introduced Planet Palm, a fresh line of palm oil products that are certified sustainable, traceable, and sustainably produced. These products are specifically designed for food producers in the U.K.

- In September 2023, Grifols announced the expansion of its plasma collection network in North America, aiming to increase access to high-quality plasma for immunotherapy and other treatments

- In August 2023, CSL Behring launched a new high-purity immunoglobulin product, enhancing treatment options for patients with immune deficiencies and autoimmune diseases

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL BLOOD PLASMA MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL BLOOD PLASMA MARKET SIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 TRIPOD DATA VALIDATION MODEL

2.2.4 MARKET GUIDE

2.2.5 MULTIVARIATE MODELLING

2.2.6 TOP TO BOTTOM ANALYSIS

2.2.7 CHALLENGE MATRIX

2.2.8 APPLICATION COVERAGE GRID

2.2.9 STANDARDS OF MEASUREMENT

2.2.10 VENDOR SHARE ANALYSIS

2.2.11 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.12 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL BLOOD PLASMA MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 PESTEL ANALYSIS

5.2 PORTER’S FIVE FORCES MODEL

6 INDUSTRY INSIGHTS

6.1 MICRO AND MACRO ECONOMIC FACTORS

6.2 PENETRATION AND GROWTH PROSPECT MAPPING

6.3 KEY PRICING STRATEGIES

6.4 INTERVIEWS WITH SPECIALIST

6.5 ANALYIS AND RECOMMENDATION

7 INTELLECTUAL PROPERTY (IP) PORTFOLIO

7.1 PATENT QUALITY AND STRENGTH

7.2 PATENT FAMILIES

7.3 LICENSING AND COLLABORATIONS

7.4 COMPETITIVE LANDSCAPE

7.5 IP STRATEGY AND MANAGEMENT

7.6 OTHER

8 COST ANALYSIS BREAKDOWN

9 TECHNONLOGY ROADMAP

10 INNOVATION TRACKER AND STRATEGIC ANALYSIS

10.1 MAJOR DEALS AND STRATEGIC ALLIANCES ANALYSIS

10.1.1 JOINT VENTURES

10.1.2 MERGERS AND ACQUISITIONS

10.1.3 LICENSING AND PARTNERSHIP

10.1.4 TECHNOLOGY COLLABORATIONS

10.1.5 STRATEGIC DIVESTMENTS

10.2 NUMBER OF PRODUCTS IN DEVELOPMENT

10.3 STAGE OF DEVELOPMENT

10.4 TIMELINES AND MILESTONES

10.5 INNOVATION STRATEGIES AND METHODOLOGIES

10.6 RISK ASSESSMENT AND MITIGATION

10.7 MERGERS AND ACQUISITIONS

10.8 FUTURE OUTLOOK

11 EPIDEMIOLOGY

11.1 INCIDENCE OF ALL BY GENDER

11.2 TREATMENT RATE

11.3 MORTALITY RATE

11.4 DRUG ADHERENCE AND THERAPY SWITCH MODEL

11.5 PATIENT TREATMENT SUCCESS RATES

12 REGULATORY COMPLIANCE

12.1 REGULATORY AUTHORITIES

12.2 REGULATORY CLASSIFICATIONS

12.2.1 CLASS I

12.2.2 CLASS II

12.2.3 CLASS III

12.3 REGULATORY SUBMISSIONS

12.4 INTERNATIONAL HARMONIZATION

12.5 COMPLIANCE AND QUALITY MANAGEMENT SYSTEMS

12.6 REGULATORY CHALLENGES AND STRATEGIES

13 PIPELINE ANALYSIS

13.1 CLINICAL TRIALS AND PHASE ANALYSIS

13.2 DRUG THERAPY PIPELINE

13.3 PHASE III CANDIDATES

13.4 PHASE II CANDIDATES

13.5 PHASE I CANDIDATES

13.6 OTHERS (PRE-CLINICAL AND RESEARCH)

TABLE 1 GLOBAL CLINICAL TRIAL MARKET FOR BLOOD PLASMA MARKET

Company Name Product Name

XX XX

XX XX

XX XX

XX XX

XX XX

XX XX

XX XX

Sources: Press Releases, Annual Reports, SEC Filings, Investor Presentations, Other Government Sources, Analysis Based on Inputs from Secondary, Expert Interviews

TABLE 2 DISTRIBUTION OF PRODUCTS AND PROJECTS BY PHASE FOR BLOOD PLASMA MARKET

Phase Number of Projects

Preclinical/Research Projects XX

Clinical Development XX

Phase I XX

Phase II XX

Phase III XX

U.S. Filed/Approved but Not Yet Marketed XX

Total XX

Sources: Press Releases, Annual Reports, SEC Filings, Investor Presentations, Other Government Sources, Analysis Based on Inputs from Secondary, Expert Interviews

TABLE 3 DISTRIBUTION OF PROJECTS BY THERAPEUTIC AREA AND PHASE FOR BLOOD PLASMA MARKET

Therapeutic Area Preclinical/ Research Project

XX XX

XX XX

XX XX

XX XX

XX XX

Total Projects XX

Sources: Press Releases, Annual Reports, SEC Filings, Investor Presentations, Other Government Sources, Analysis Based on Inputs from Secondary, Expert Interviews

TABLE 4 DISTRIBUTION OF PROJECTS BY SCIENTIFIC APPROACH AND PHASE FOR BLOOD PLASMA MARKET

Technology Preclinical/ Research Project

XX XX

XX XX

XX XX

XX XX

XX XX

Total Projects XX

Sources: Press Releases, Annual Reports, SEC Filings, Investor Presentations, Other Government Sources, Analysis Based on Inputs from Secondary, Expert Interviews

FIGURE 1 TOP ENTITIES BASED ON R&D GLANCE FOR BLOOD PLASMA MARKET

Sources: Press Releases, Annual Reports, SEC Filings, Investor Presentations, Other Government Sources, Analysis Based on Inputs from Secondary, Expert Interviews

14 REIMBURSEMENT FRAMEWORK

15 OPPUTUNITY MAP ANALYSIS

16 VALUE CHAIN ANALYSIS

17 HEALTHCARE ECONOMY

17.1 HEALTHCARE EXPENDITURE

17.2 CAPITAL EXPENDITURE

17.3 CAPEX TRENDS

17.4 CAPEX ALLOCATION

17.5 FUNDING SOURCES

17.6 INDUSTRY BENCHMARKS

17.7 GDP RATION IN OVERALL GDP

17.8 HEALTHCARE SYSTEM STRUCTURE

17.9 GOVERNMENT POLICIES

18 GLOBAL BLOOD PLASMA MARKET, BY PRODUCT

18.1 OVERVIEW

18.2 IMMUNOGLOBULINS

18.2.1 BY TYPE

18.2.1.1. INTRAVENOUS IMMUNOGLOBULINS

18.2.1.2. SUBCUTANEOUS IMMUNOGLOBULINS

18.2.1.3. OTHER IMMUNOGLOBULINS

18.2.2 BY APPLICATION

18.2.2.1. NEUROLOGY

18.2.2.1.1. MYASTHENIA GRAVIS

18.2.2.1.2. GUILLAIN-BARRÉ SYNDROME

18.2.2.1.3. CHRONIC INFLAMMATORY DEMYELINATING POLYNEUROPATHY

18.2.2.1.4. OTHERS

18.2.2.2. IMMUNOLOGY

18.2.2.3. LUPUS

18.2.2.4. RHEUMATOID ARTHRITIS

18.2.2.5. SCLERODERMA

18.2.2.6. SJÖGREN'S SYNDROME

18.2.2.7. HEMATOLOGY

18.2.2.8. CRITICAL CARE

18.2.2.9. PULMONOLOGY

18.2.2.10. HEMATO-ONCOLOGY

18.2.2.11. RHEUMATOLOGY

18.2.2.12. OTHER APPLICATIONS

18.3 COAGULATION FACTOR CONCENTRATES

18.3.1 BT TYPE

18.3.1.1. FACTOR VIII

18.3.1.2. FACTOR IX

18.3.1.3. VON WILLEBRAND FACTOR

18.3.1.4. PROTHROMBIN COMPLEX CONCENTRATE

18.3.1.5. FIBRINOGEN CONCENTRATES

18.3.1.6. FACTOR XIII

18.3.2 BY APPLICATION

18.3.2.1. NEUROLOGY

18.3.2.1.1. MYASTHENIA GRAVIS

18.3.2.1.2. GUILLAIN-BARRÉ SYNDROME

18.3.2.1.3. CHRONIC INFLAMMATORY DEMYELINATING POLYNEUROPATHY

18.3.2.1.4. OTHERS

18.3.2.2. IMMUNOLOGY

18.3.2.3. LUPUS

18.3.2.4. RHEUMATOID ARTHRITIS

18.3.2.5. SCLERODERMA

18.3.2.6. SJÖGREN'S SYNDROME

18.3.2.7. HEMATOLOGY

18.3.2.8. CRITICAL CARE

18.3.2.9. PULMONOLOGY

18.3.2.10. HEMATO-ONCOLOGY

18.3.2.11. RHEUMATOLOGY

18.3.2.12. OTHER APPLICATIONS

18.4 ALBUMIN

18.4.1 BY TYPE

18.4.1.1. HUMAN SERUM ALBUMIN

18.4.1.2. RECOMBINANT ALBUMIN

18.4.1.3. IV ALBUMIN

18.4.2 BY APPLICATION

18.4.2.1. NEUROLOGY

18.4.2.1.1. MYASTHENIA GRAVIS

18.4.2.1.2. GUILLAIN-BARRÉ SYNDROME

18.4.2.1.3. CHRONIC INFLAMMATORY DEMYELINATING POLYNEUROPATHY

18.4.2.1.4. OTHERS

18.4.2.2. IMMUNOLOGY

18.4.2.3. LUPUS

18.4.2.4. RHEUMATOID ARTHRITIS

18.4.2.5. SCLERODERMA

18.4.2.6. SJÖGREN'S SYNDROME

18.4.2.7. HEMATOLOGY

18.4.2.8. CRITICAL CARE

18.4.2.9. PULMONOLOGY

18.4.2.10. HEMATO-ONCOLOGY

18.4.2.11. RHEUMATOLOGY

18.4.2.12. OTHER APPLICATIONS

18.5 HYPERIMMUNE GLOBINS

18.5.1 BY TYPE

18.5.1.1. HEPATITIS B IMMUNE GLOBULIN (HBIG)

18.5.1.2. CYTOMEGALOVIRUS IMMUNE GLOBULIN

18.5.1.3. VARICELLA-ZOSTER IMMUNE GLOBULIN

18.5.1.4. RHO(D) IMMUNE GLOBULIN

18.5.2 BY APPLICATION

18.5.2.1. NEUROLOGY

18.5.2.1.1. MYASTHENIA GRAVIS

18.5.2.1.2. GUILLAIN-BARRÉ SYNDROME

18.5.2.1.3. CHRONIC INFLAMMATORY DEMYELINATING POLYNEUROPATHY

18.5.2.1.4. OTHERS

18.5.2.2. IMMUNOLOGY

18.5.2.3. LUPUS

18.5.2.4. RHEUMATOID ARTHRITIS

18.5.2.5. SCLERODERMA

18.5.2.6. SJÖGREN'S SYNDROME

18.5.2.7. HEMATOLOGY

18.5.2.8. CRITICAL CARE

18.5.2.9. PULMONOLOGY

18.5.2.10. HEMATO-ONCOLOGY

18.5.2.11. RHEUMATOLOGY

18.5.2.12. OTHER APPLICATIONS

18.6 PROTEASE INHIBITORS

18.6.1 BY TYPE

18.6.1.1. ALPHA-1 ANTITRYPSIN (AAT)

18.6.1.2. C1 ESTERASE INHIBITOR (C1-INH)

18.6.1.3. ANTITHROMBIN III

18.6.2 BY APPLICATION

18.6.2.1. NEUROLOGY

18.6.2.1.1. MYASTHENIA GRAVIS

18.6.2.1.2. GUILLAIN-BARRÉ SYNDROME

18.6.2.1.3. CHRONIC INFLAMMATORY DEMYELINATING POLYNEUROPATHY

18.6.2.1.4. OTHERS

18.6.2.2. IMMUNOLOGY

18.6.2.3. LUPUS

18.6.2.4. RHEUMATOID ARTHRITIS

18.6.2.5. SCLERODERMA

18.6.2.6. SJÖGREN'S SYNDROME

18.6.2.7. HEMATOLOGY

18.6.2.8. CRITICAL CARE

18.6.2.9. PULMONOLOGY

18.6.2.10. HEMATO-ONCOLOGY

18.6.2.11. RHEUMATOLOGY

18.6.2.12. OTHER APPLICATIONS

18.7 OTHER PRODUCTS

19 GLOBAL BLOOD PLASMA MARKET, BY APPLICATION

19.1 OVERVIEW

19.2 NEUROLOGY

19.2.1 MYASTHENIA GRAVIS

19.2.2 GUILLAIN-BARRÉ SYNDROME

19.2.3 CHRONIC INFLAMMATORY DEMYELINATING POLYNEUROPATHY

19.2.4 OTHERS

19.3 IMMUNOLOGY

19.4 LUPUS

19.5 RHEUMATOID ARTHRITIS

19.6 SCLERODERMA

19.7 SJÖGREN'S SYNDROME

19.8 HEMATOLOGY

19.9 CRITICAL CARE

19.1 PULMONOLOGY

19.11 HEMATO-ONCOLOGY

19.12 RHEUMATOLOGY

19.13 OTHER APPLICATIONS

20 GLOBAL BLOOD PLASMA MARKET, BY PROCESSING TECHNOLOGY

20.1 OVERVIEW

20.2 ION-EXCHANGE CHROMATOGRAPHY

20.3 AFIINITY CHROMATOGRAPHY

20.4 CRYOPRECIPITATION

20.5 ULTRAFILTRATION

20.6 MICROFILTRATION

21 GLOBAL BLOOD PLASMA MARKET, BY MODE

21.1 MODERN PLASMA FRACTIONATION

21.2 TRADITIONAL PLASMA FRACTIONATION

22 GLOBAL BLOOD PLASMA MARKET, BY AGE GROUP

22.1 OVERVIEW

22.2 PEDIATRIC

22.3 ADULT

22.4 GERIATRIC

23 GLOBAL BLOOD PLASMA MARKET, BY END USER

23.1 OVERVIEW

23.2 HOSPITALS & CLINICS

23.3 CLINICAL RESEARCH LABORATORIES

23.4 ACADEMIC INSTITUTES

23.5 OTHERS

24 GLOBAL BLOOD PLASMA MARKET, BY DISTRIBUTION CHANNEL

24.1 OVERVIEW

24.2 DIRECT TENDERS

24.3 THIRD PARTY DISTRIBUTION

24.4 OTHERS

25 GLOBAL BLOOD PLASMA MARKET, COMPANY LANDSCAPE

25.1 COMPANY SHARE ANALYSIS: GLOBAL

25.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

25.3 COMPANY SHARE ANALYSIS: EUROPE

25.4 COMPANY SHARE ANALYSIS: ASIA PACIFIC

25.5 MERGERS & ACQUISITIONS

25.6 NEW PRODUCT DEVELOPMENT & APPROVALS

25.7 EXPANSIONS

25.8 REGULATORY CHANGES

25.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

26 GLOBAL BLOOD PLASMA MARKET, SWOT AND DBMR ANALYSIS

27 GLOBAL BLOOD PLASMA MARKET, COMPANY PROFILE

27.1 BIOTEST AG

27.1.1 COMPANY OVERVIEW

27.1.2 REVENUE ANALYSIS

27.1.3 GEOGRAPHIC PRESENCE

27.1.4 PRODUCT PORTFOLIO

27.1.5 RECENT DEVELOPEMENTS

27.2 CSL

27.2.1 COMPANY OVERVIEW

27.2.2 REVENUE ANALYSIS

27.2.3 GEOGRAPHIC PRESENCE

27.2.4 PRODUCT PORTFOLIO

27.2.5 RECENT DEVELOPEMENTS

27.3 GC BIOPHARMA CORP

27.3.1 COMPANY OVERVIEW

27.3.2 REVENUE ANALYSIS

27.3.3 GEOGRAPHIC PRESENCE

27.3.4 PRODUCT PORTFOLIO

27.3.5 RECENT DEVELOPEMENTS

27.4 GRIFOILS

27.4.1 COMPANY OVERVIEW

27.4.2 REVENUE ANALYSIS

27.4.3 GEOGRAPHIC PRESENCE

27.4.4 PRODUCT PORTFOLIO

27.4.5 RECENT DEVELOPEMENTS

27.5 INTAS PHARMACEUTICALS LTD.

27.5.1 COMPANY OVERVIEW

27.5.2 REVENUE ANALYSIS

27.5.3 GEOGRAPHIC PRESENCE

27.5.4 PRODUCT PORTFOLIO

27.5.5 RECENT DEVELOPEMENTS

27.6 KEDRION S.P.A.

27.6.1 COMPANY OVERVIEW

27.6.2 REVENUE ANALYSIS

27.6.3 GEOGRAPHIC PRESENCE

27.6.4 PRODUCT PORTFOLIO

27.6.5 RECENT DEVELOPEMENTS

27.7 LFB

27.7.1 COMPANY OVERVIEW

27.7.2 REVENUE ANALYSIS

27.7.3 GEOGRAPHIC PRESENCE

27.7.4 PRODUCT PORTFOLIO

27.7.5 RECENT DEVELOPEMENTS

27.8 OCTAPHARMA AG

27.8.1 COMPANY OVERVIEW

27.8.2 REVENUE ANALYSIS

27.8.3 GEOGRAPHIC PRESENCE

27.8.4 PRODUCT PORTFOLIO

27.8.5 RECENT DEVELOPEMENTS

27.9 SANQUIN

27.9.1 COMPANY OVERVIEW

27.9.2 REVENUE ANALYSIS

27.9.3 GEOGRAPHIC PRESENCE

27.9.4 PRODUCT PORTFOLIO

27.9.5 RECENT DEVELOPEMENTS

27.1 TAKEDA PHARMACEUTICALS

27.10.1 COMPANY OVERVIEW

27.10.2 REVENUE ANALYSIS

27.10.3 GEOGRAPHIC PRESENCE

27.10.4 PRODUCT PORTFOLIO

27.10.5 RECENT DEVELOPEMENTS

27.11 ABBVIE, INC.

27.11.1 COMPANY OVERVIEW

27.11.2 REVENUE ANALYSIS

27.11.3 GEOGRAPHIC PRESENCE

27.11.4 PRODUCT PORTFOLIO

27.11.5 RECENT DEVELOPEMENTS

27.12 IPSEN PHARMA

27.12.1 COMPANY OVERVIEW

27.12.2 REVENUE ANALYSIS

27.12.3 GEOGRAPHIC PRESENCE

27.12.4 PRODUCT PORTFOLIO

27.12.5 RECENT DEVELOPEMENTS

27.13 SUN PHARMACEUTICALS INDUSTRIES, LTD.

27.13.1 COMPANY OVERVIEW

27.13.2 REVENUE ANALYSIS

27.13.3 GEOGRAPHIC PRESENCE

27.13.4 PRODUCT PORTFOLIO

27.13.5 RECENT DEVELOPEMENTS

27.14 PFIZER, INC.

27.14.1 COMPANY OVERVIEW

27.14.2 REVENUE ANALYSIS

27.14.3 GEOGRAPHIC PRESENCE

27.14.4 PRODUCT PORTFOLIO

27.14.5 RECENT DEVELOPEMENTS

27.15 EUROPLASMA

27.15.1 COMPANY OVERVIEW

27.15.2 REVENUE ANALYSIS

27.15.3 GEOGRAPHIC PRESENCE

27.15.4 PRODUCT PORTFOLIO

27.15.5 RECENT DEVELOPEMENTS

27.16 IMMUNOTEK BIO CENTERS

27.16.1 COMPANY OVERVIEW

27.16.2 REVENUE ANALYSIS

27.16.3 GEOGRAPHIC PRESENCE

27.16.4 PRODUCT PORTFOLIO

27.16.5 RECENT DEVELOPEMENTS

27.17 KAMADA PHARMACEUTICALS

27.17.1 COMPANY OVERVIEW

27.17.2 REVENUE ANALYSIS

27.17.3 GEOGRAPHIC PRESENCE

27.17.4 PRODUCT PORTFOLIO

27.17.5 RECENT DEVELOPEMENTS

27.18 PROMETIC PLASMA RESOURCES

27.18.1 COMPANY OVERVIEW

27.18.2 REVENUE ANALYSIS

27.18.3 GEOGRAPHIC PRESENCE

27.18.4 PRODUCT PORTFOLIO

27.18.5 RECENT DEVELOPEMENTS

27.19 PLASMA INDUCTION (INDIA) PVT LTD.

27.19.1 COMPANY OVERVIEW

27.19.2 REVENUE ANALYSIS

27.19.3 GEOGRAPHIC PRESENCE

27.19.4 PRODUCT PORTFOLIO

27.19.5 RECENT DEVELOPEMENTS

27.2 HAEMONETICS CORPORATION

27.20.1 COMPANY OVERVIEW

27.20.2 REVENUE ANALYSIS

27.20.3 GEOGRAPHIC PRESENCE

27.20.4 PRODUCT PORTFOLIO

27.20.5 RECENT DEVELOPEMENTS

27.21 CHINA BIOLOGIC PRODUCTS

27.21.1 COMPANY OVERVIEW

27.21.2 REVENUE ANALYSIS

27.21.3 GEOGRAPHIC PRESENCE

27.21.4 PRODUCT PORTFOLIO

27.22 KM BIOLOGICS

27.22.1 COMPANY OVERVIEW

27.22.2 REVENUE ANALYSIS

27.22.3 GEOGRAPHIC PRESENCE

27.22.4 PRODUCT PORTFOLIO

27.23 SHANXI KANGBAO BIOLOGICAL PRODUCTS CO., LTD

27.23.1 COMPANY OVERVIEW

27.23.2 REVENUE ANALYSIS

27.23.3 GEOGRAPHIC PRESENCE

27.23.4 PRODUCT PORTFOLIO

27.24 SICHUAN YUANDA SHUYANG PHARMACEUTICAL CO., LTD

27.24.1 COMPANY OVERVIEW

27.24.2 REVENUE ANALYSIS

27.24.3 GEOGRAPHIC PRESENCE

27.24.4 PRODUCT PORTFOLIO

27.25 ADMA BIOLOGICS, INC.

27.25.1 COMPANY OVERVIEW

27.25.2 REVENUE ANALYSIS

27.25.3 GEOGRAPHIC PRESENCE

27.25.4 PRODUCT PORTFOLIO

27.25.5 RECENT DEVELOPEMENTS

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

28 RELATED REPORTS

29 CONCLUSION

30 QUESTIONNAIRE

31 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.