Global Blood Banking Devices Market

Market Size in USD Billion

CAGR :

%

USD

46.36 Billion

USD

88.91 Billion

2024

2032

USD

46.36 Billion

USD

88.91 Billion

2024

2032

| 2025 –2032 | |

| USD 46.36 Billion | |

| USD 88.91 Billion | |

|

|

|

|

Blood Banking Devices Market Size

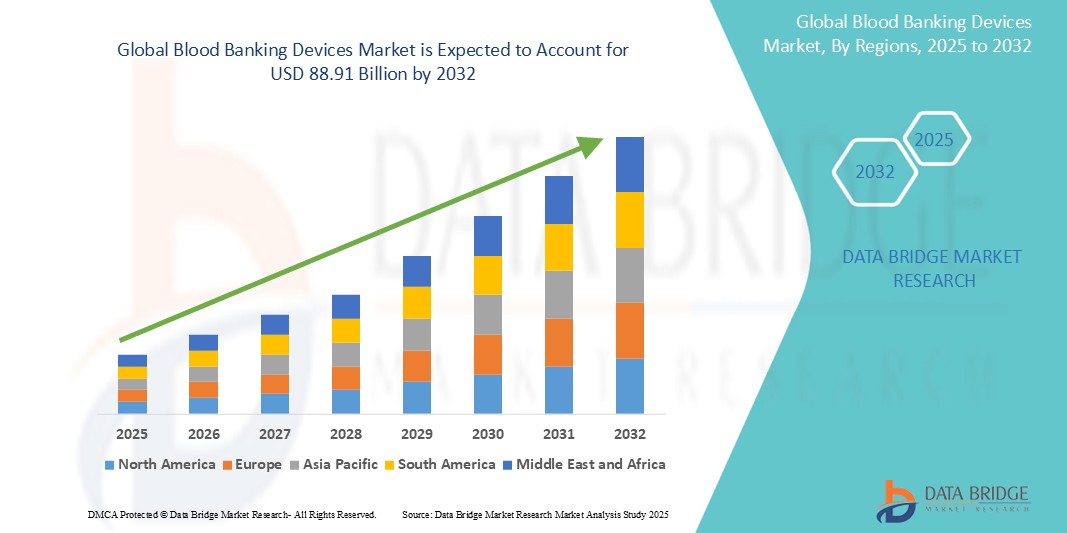

- The global blood banking devices market size was valued at USD 46.36 billion in 2024 and is expected to reach USD 88.91 billion by 2032, at a CAGR of 8.48% during the forecast period

- The market growth is largely fueled by the rising prevalence of blood disorders and the increasing number of surgical procedures globally, leading to a higher demand for blood transfusions and related devices

- Furthermore, an aging population, technological advancements in blood banking, and growing initiatives for blood donation are establishing blood banking devices as critical components of modern healthcare systems. These converging factors are accelerating the adoption of blood banking solutions, thereby significantly boosting the industry's growth

Blood Banking Devices Market Analysis

- Blood banking devices, encompassing instruments and consumables used for the collection, processing, storage, and transfusion of blood and its components, are indispensable for supporting various medical treatments and procedures across healthcare settings. Their role is critical in ensuring the availability and safety of blood products for patients in need

- The increasing demand for blood banking devices is primarily driven by a rising global prevalence of blood disorders, a growing volume of surgical procedures, and an expanding aging population that often requires blood transfusions. In addition, advancements in medical technologies and a heightened focus on transfusion safety contribute significantly to market growth

- North America dominates the blood banking devices market with the largest revenue share of 42.5% in 2024, characterized by its well-established healthcare infrastructure, high adoption rates of advanced medical technologies, and the presence of leading market players. The U.S., in particular, demonstrates substantial market growth due to a high number of surgical interventions and a stringent focus on blood safety regulations

- Asia-Pacific is expected to be the fastest growing region in the blood banking devices market during the forecast period due to improving healthcare infrastructure, increasing healthcare expenditure, a large patient population, and rising awareness regarding blood donation and transfusion medicine

- Blood collection devices dominates the blood banking devices market with a market share of 35.5% in 2024, driven by its fundamental and continuous need for these devices in all blood banking operations to procure the initial blood supply for processing, storage, and transfusion

Report Scope and Blood Banking Devices Market Segmentation

|

Attributes |

Blood Banking Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Blood Banking Devices Market Trends

"Growing Emphasis on Automation, Integration, and Safety Features”

- A significant and accelerating trend in the global blood banking devices market is the increasing emphasis on automation of various blood processing stages and the seamless integration of devices with laboratory information systems (LIS) and hospital information systems (HIS). This trend aims to enhance efficiency, reduce manual errors, and improve the overall turnaround time in blood banking operations.

- For instance, the increasing adoption of fully automated blood typing and antibody screening analyzers such as the Ortho Vision Analyzer showcases this trend. These systems streamline complex testing, reduce manual errors, and integrate with LIS for faster, more accurate blood compatibility testing, ultimately enhancing patient safety and efficiency in blood transfusion services

- Furthermore, there's a growing focus on incorporating advanced safety features into blood banking devices. This includes the development of devices with enhanced pathogen detection capabilities, improved temperature monitoring during blood storage, and features that minimize the risk of contamination during blood collection and transfusion processes. For example, newer generation blood bag systems often include integrated filters and safety needles to enhance the safety of blood transfusions for both patients and healthcare workers

- The seamless integration of blood banking devices with digital platforms facilitates better inventory management, optimized blood product utilization, and improved communication between blood banks and hospitals. Through centralized dashboards and data analytics, healthcare providers can gain better insights into blood supply levels and patient needs, leading to more efficient resource allocation

- The demand for blood banking devices with seamless integration into digital ecosystems and enhanced safety features is growing rapidly across hospitals, blood centers, and research institutions, as healthcare providers increasingly prioritize efficiency, accuracy, and patient safety in blood transfusion practices

Blood Banking Devices Market Dynamics

Driver

“Increasing Demand Driven by Rising Healthcare Needs and Technological Advancements”

- The escalating global healthcare needs, characterized by a higher prevalence of chronic diseases, a growing number of surgical procedures, and an expanding geriatric population, are significant drivers for the increased demand for blood and blood components, consequently fueling the need for advanced blood banking devices

- For instance, the ongoing advancements in surgical techniques, such as minimally invasive surgeries and organ transplantation, often require substantial blood transfusions, thereby increasing the reliance on efficient blood banking systems. Similarly, the rising incidence of hematological disorders such as leukemia and sickle cell anemia necessitate frequent blood transfusions and sophisticated blood processing technologies

- As healthcare systems worldwide strive to provide better patient care and manage complex medical conditions, the demand for reliable and efficient blood banking devices that ensure the safety and availability of blood products continues to grow. These devices are crucial for accurate blood typing, screening for infectious diseases, component separation, and safe storage, all of which are essential for effective transfusion therapies

- Furthermore, continuous technological advancements in blood banking, such as the development of more sensitive diagnostic tests, automated processing equipment, and improved storage solutions, are driving the adoption of newer and more sophisticated devices. These innovations not only enhance the efficiency and safety of blood banking operations but also expand the range of available blood products and therapies

- The increasing focus on transfusion medicine and the establishment of robust blood banking infrastructure in developing economies further contribute to the growing demand for blood banking devices. As healthcare access improves globally, the need for safe and readily available blood supplies will continue to rise, driving the expansion of the blood banking devices market

Restraint/Challenge

“High Cost of Advanced Equipment and Stringent Regulatory Requirements”

- A significant factor restraining the widespread adoption of certain advanced blood banking devices is the high initial investment required for sophisticated equipment and the substantial costs associated with their maintenance and operation

- For instance, advanced automated blood component separators and nucleic acid testing (NAT) systems for infectious disease screening involve significant capital expenditure, which can be a considerable barrier, particularly for smaller blood banks and healthcare facilities in developing regions. Furthermore, the specialized reagents and consumables required for these advanced devices add to the overall operational costs

- In addition, the blood banking industry is subject to stringent regulatory requirements and quality control standards imposed by various national and international health authorities. Compliance with these regulations necessitates significant investments in validation processes, quality assurance systems, and skilled personnel, which can further increase the overall cost of blood banking operations and the adoption of new technologies

- The complexity of these regulatory frameworks and the need for rigorous adherence to safety protocols can also slow down the adoption of innovative blood banking devices, as manufacturers and end-users navigate the lengthy approval processes and ensure compliance with evolving standards. This can be particularly challenging for smaller companies with limited resources to manage the regulatory burden

- The high cost of advanced equipment and the complexities associated with stringent regulatory compliance can therefore act as significant restraints on the growth of the global blood banking devices market, particularly in resource-limited settings and for smaller healthcare providers

Blood Banking Devices Market Scope

The market is segmented on the basis of product, end user, and mode of collection

- By Product

On the basis of product, the blood banking devices market is segmented into blood collection devices, blood processing devices, and blood storage devices. The blood collection devices segment is anticipated to command the largest market revenue share of 35.5% in 2024, driven by the fundamental and continuous need for these devices in initiating the blood banking process. The consistent demand for blood donation and the essential nature of safe and efficient blood collection tools underpin the dominance of this segment. This includes blood bags, needles, and collection monitors, which are the primary tools for sourcing blood for all subsequent procedures

The blood processing devices segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by increasing automation in blood banks and the growing demand for separated blood components. As transfusion medicine becomes more sophisticated, the need for advanced equipment such as centrifuges, blood cell washers, and plasma separation devices to efficiently process whole blood into its various therapeutic components will continue to rise, driving the rapid expansion of this segment

- By End User

On the basis of end-users, the blood banking devices market is segmented into hospitals, academic institutes, independent diagnostics centers/clinics, and blood banks. Hospitals held the largest market revenue share in 2024, driven by the high volume of surgical procedures, trauma cases, and chronic disease management requiring blood transfusions. Hospitals are the primary sites for blood utilization, thus necessitating a significant demand for a wide array of blood banking devices to support their transfusion services and patient care activities

Independent diagnostics centers/clinics are expected to witness the fastest CAGR from 2025 to 2032, driven by the increasing focus on early disease detection and the expansion of outpatient transfusion services. As healthcare shifts towards more decentralized and accessible models, independent centers are playing a growing role in providing diagnostic testing and basic transfusion support, leading to a higher demand for blood banking devices in these settings

- By Mode of Collection

On the basis of mode of collection, the blood banking devices market is segmented into manual blood collection and automated blood collection. The manual blood collection segment held the largest market revenue share in 2024, driven by its established presence and suitability for routine blood donations and collections in various settings, particularly in regions with limited resources for advanced automation. Traditional blood bags and manual collection systems remain fundamental to blood banking operations globally

The automated blood collection segment is expected to witness the fastest CAGR from 2025 to 2032, favored for its efficiency in collecting specific blood components (apheresis) and its increasing adoption in larger blood centers and hospitals seeking to streamline their operations and enhance the quality of collected products. Automated systems allow for targeted collection of platelets, plasma, and red blood cells, catering to specific clinical needs and improving donor convenience, thus driving its rapid growth

Blood Banking Devices Market Regional Analysis

- North America dominates the blood banking devices market with the largest revenue share of 42.5% in 2024, driven by its well-established healthcare infrastructure, high adoption rates of advanced medical technologies, and stringent regulatory standards emphasizing blood safety and quality

- Consumers in this region have access to advanced healthcare facilities and are increasingly aware of the importance of safe blood transfusions and the technologies that support them. This awareness, coupled with a robust healthcare expenditure, fuels the demand for high-quality blood banking devices

- The region benefits from a significant number of hospitals and blood banks equipped with sophisticated blood processing and testing devices. Furthermore, a strong emphasis on patient safety and the presence of major market players contribute to the dominance of North America in the global market

U.S. Blood Banking Devices Market Insight

The U.S. blood banking devices market captured a significant revenue share of 66.7% within North America in 2024, fueled by a robust healthcare infrastructure, high adoption of advanced medical technologies, and stringent regulations ensuring blood safety. The presence of major market players and a high volume of medical procedures requiring blood transfusions further contribute to the market size. Consumers benefit from well-established blood banks and advanced transfusion services, driving the demand for sophisticated blood banking equipment and consumables. The increasing focus on automation and molecular diagnostics in blood screening also propels market growth

Europe Blood Banking Devices Market Insight

European blood banking devices market is projected to expand at a considerable CAGR throughout the forecast period, primarily driven by well-defined healthcare systems, increasing adoption of automation in laboratories, and stringent quality standards for blood products. The rise in chronic diseases and surgical interventions across the region necessitates a strong blood banking infrastructure. European consumers benefit from advanced healthcare facilities and a focus on transfusion safety, leading to consistent demand for reliable blood banking technologies in both hospital and blood center settings

U.K. Blood Banking Devices Market Insight

The U.K. blood banking devices market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by a well-established healthcare system and a focus on technological advancements in blood transfusion services. Concerns regarding blood safety and efficiency are encouraging hospitals and blood banks to adopt advanced devices for collection, processing, and testing. The UK's commitment to high healthcare standards and the presence of reputable medical institutions contribute to a steady demand for innovative blood banking solutions

Germany Blood Banking Devices Market Insight

The German blood banking devices market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing awareness of transfusion medicine and a strong emphasis on high-quality healthcare. Germany's well-developed healthcare infrastructure and its focus on technological innovation promote the adoption of advanced blood banking equipment, particularly in hospitals and research institutions. The integration of sophisticated diagnostic tools and automated systems in blood banks aligns with the country's focus on precision and efficiency in healthcare

Asia-Pacific Blood Banking Devices Market Insight

The Asia-Pacific blood banking devices market is poised to grow at the fastest CAGR in 2024, driven by increasing investments in healthcare infrastructure, a rising prevalence of blood disorders, and growing awareness of transfusion medicine in countries such as China, Japan, and India. The region's expanding healthcare sector, coupled with government initiatives to improve blood safety and accessibility, is driving the adoption of blood banking devices. Furthermore, as healthcare access improves and medical tourism increases in the region, the demand for advanced blood banking technologies is expected to surge

Japan Blood Banking Devices Market Insight

The Japan blood banking devices market is gaining momentum due to the country’s advanced healthcare system, aging population, and focus on high-quality medical care. The Japanese market places a significant emphasis on transfusion safety and technological innovation in healthcare, driving the adoption of sophisticated blood banking equipment in hospitals and blood centers. The increasing demand for advanced diagnostics and therapeutic apheresis procedures further fuels market growth. Moreover, the emphasis on automation and efficiency in healthcare settings supports the adoption of automated blood processing and testing systems

India Blood Banking Devices Market Insight

The India blood banking devices market accounted for the highest compound annual growth rate Asia Pacific in 2024, attributed to the country's large population, increasing prevalence of blood-related disorders, and improving healthcare infrastructure. India stands as one of the largest markets for blood transfusions due to a high incidence of anemia, trauma cases, and surgical procedures. The increasing number of hospitals and blood banks, coupled with government initiatives to promote blood donation and improve blood safety standards, are key factors propelling the market in India.

Blood Banking Devices Market Share

The Blood Banking Devices industry is primarily led by well-established companies, including:

- Abbott (U.S.)

- BD (U.S.)

- Bio-Rad Laboratories, Inc. (U.S.)

- Cardinal Health (U.S.)

- Fresenius Kabi AG (Germany)

- Grifols, S.A. (Spain)

- Haemonetics Corporation (U.S.)

- Medtronic (Ireland)

- NIPRO (Japan)

- QuidelOrtho Corporation (U.S.)

- Siemens Healthineers AG (Germany)

- Terumo Corporation (Japan)

- Beckman Coulter, Inc. (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

- Sarstedt AG & Co. KG (Germany)

- MacoPharma (France)

- Polymedicure (India)

- MAK-System (France)

- Quotient Limited (U.K.)

- Mitra Industries (India)

Latest Developments in Global Blood Banking Devices Market

- In April 2023, MedTech Innovations Corp, announced the launch of a new automated blood component separation system in the European market. This advanced device is designed to significantly enhance the efficiency and throughput of blood processing centers, allowing for faster and more precise separation of blood into its various components such as plasma, platelets, and red blood cells. This development underscores the company's commitment to providing cutting-edge solutions that streamline blood banking operations and improve the availability of critical blood products for patients

- In March 2023, BioSafe Diagnostics, introduced an innovative rapid blood screening test for transfusion-transmissible infections (TTIs), specifically designed for use in resource-limited settings. This point-of-care testing solution aims to provide quick and accurate screening results, improving blood safety and reducing the risk of transmitting infections through blood transfusions, particularly in regions with less developed laboratory infrastructure. This advancement highlights the growing focus on developing accessible and effective blood safety measures globally

- In March 2023, Global Healthcare Solutions Ltd, based in Singapore, successfully implemented an advanced blood inventory management system across several major hospitals in Southeast Asia. This digital platform utilizes real-time data and analytics to optimize blood stock levels, reduce wastage, and ensure timely availability of the right blood types for patients in need. This initiative underscores the increasing importance of leveraging smart technology to enhance the efficiency and effectiveness of blood supply chains within healthcare systems

- In February 2023, Transfusion Technologies Inc., announced a strategic partnership with a major hospital network in Brazil to introduce its latest generation of safety-engineered blood collection sets. These devices incorporate advanced features to minimize the risk of needlestick injuries for healthcare workers and enhance the safety and comfort of blood donors. This collaboration reflects the ongoing efforts to improve safety standards and operational efficiency in blood collection practices within the healthcare industry.

- In January 2023, Lab Automation Systems, unveiled a new compact and automated blood grouping analyzer at a major medical technology trade show. This device is designed for smaller blood banks and laboratories, offering high accuracy and throughput in a space-saving format. The analyzer's user-friendly interface and connectivity features aim to simplify blood typing procedures and integrate seamlessly into existing laboratory workflows, highlighting the industry's focus on providing accessible and efficient solutions for blood testing

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.