Global Blockchain Market Segmentation, By Component (Platform and Services), Provider (Application and Solution Providers, Middleware Providers and Infrastructure Providers), Type (Private, Public, Hybrid, and Consortium), Organization Size (Small and Medium-Sized Enterprises and Large Enterprises), Development (Proof of Concept, Pilot, and Production), Application (Real Estate and Construction, Agriculture and Food, Manufacturing, Energy and Utilities, Documentation, IT and Telecom, Insurance, E-Commerce, Consumer Goods, and others), End User (Transportation and Logistics, Retail and E-commerce, Media, Advertising and Entertainment, Travel, Health care and Life Science, Banking, Financial Service and Insurance (BFSI), and Government) - Industry Trends and Forecast to 2032

Blockchain Market Size

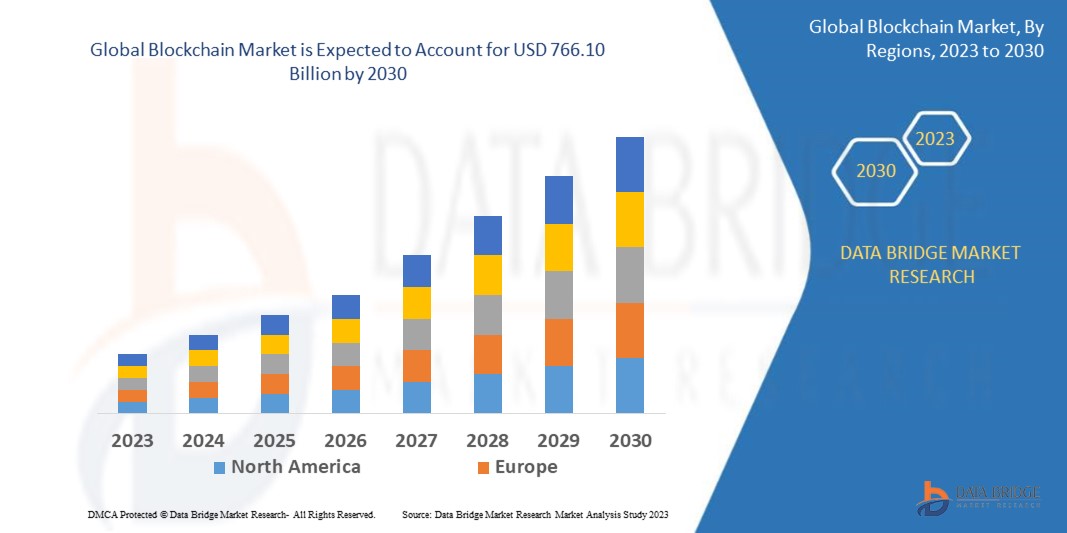

- The global blockchain market was valued at USD 29.62 billion in 2024 and is expected to reach USD 2264.66 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 71.96%, primarily driven by growth in cryptocurrency and digital assets

- This growth is driven by factors such as institutional adoption, mainstream acceptance and use cases and technological advancements

Blockchain Market Analysis

- The blockchain market refers to the ecosystem of distributed ledger technologies that facilitate secure, transparent, and decentralized digital transactions. It enables peer-to-peer data exchange, reduces reliance on intermediaries, and enhances security through cryptographic validation and consensus mechanisms

- The industry is experiencing rapid expansion due to increasing demand for secure and tamper-proof digital transactions, growing adoption of decentralized finance (DeFi), and the rising integration of blockchain in enterprise applications. As businesses seek innovative solutions for data integrity and automation, companies are deploying scalable, interoperable, and energy-efficient blockchain networks to drive market growth

- The adoption of smart contracts, tokenization, and blockchain-as-a-service (BaaS) is transforming the blockchain landscape by enabling automated processes, asset digitization, and seamless cross-border transactions

- For instance, companies such as IBM, Ethereum, and Hyperledger have introduced blockchain frameworks with enhanced security, scalability, and interoperability to streamline enterprise adoption and improve operational efficiency

- The increasing demand for decentralized applications (DApps), enterprise blockchain solutions, and sustainable blockchain models will continue to shape the industry, with developers and enterprises focusing on scalability, security, and mainstream adoption to maintain a competitive edge

Report Scope and Blockchain Market Segmentation

|

Attributes

|

Blockchain Key Market Insights

|

|

Segments Covered

|

|

|

Countries Covered

|

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players

|

|

|

Market Opportunities

|

|

|

Value Added Data Infosets

|

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis.

|

Blockchain Market Trends

“Growing Adoption of Blockchain-As-A-Service (BaaS) by Enterprises”

- One prominent trend in the global blockchain market is the growing adoption of blockchain-as-a-service (BaaS) by enterprises

- This trend is driven by rising demand for streamlined blockchain deployment, encouraging technology providers to develop managed services that enhance security, interoperability, and ease of integration across industries such as finance, supply chain, and healthcare

- For instance, Microsoft Azure Blockchain Service, IBM Blockchain Platform, and Oracle Blockchain Cloud Service offer enterprise-grade BaaS solutions that simplify implementation and provide enhanced security and scalability

- As businesses seek more efficient and cost-effective blockchain solutions, companies are incorporating interoperability, AI-powered security enhancements, and energy-efficient consensus mechanisms to meet enterprise requirements

- This shift is expected to accelerate blockchain adoption, ensuring long-term market growth as providers continue to enhance BaaS platforms with advanced security, seamless integration, and industry-specific applications to remain competitive in an evolving digital economy

Blockchain Market Dynamics

Driver

“Increased Demand for Transparency”

- The rising need for transparency and trust in digital transactions is a key driver of growth in the blockchain market

- As businesses and consumers prioritize secure, verifiable, and tamper-proof data, the demand for blockchain solutions that enhance transparency across industries continues to increase

- With organizations seeking greater accountability and fraud prevention, blockchain technology is being integrated into sectors such as finance, supply chain, healthcare, and government

- Features such as decentralized ledgers, immutable records, and real-time verification enable businesses to establish trust and streamline operations

- The growing demand for transparent and auditable systems has led to significant investments in blockchain development, encouraging enterprises to adopt solutions that provide end-to-end traceability, automated compliance, and enhanced security against data manipulation

For instance,

- IBM’s Food Trust blockchain platform enables food suppliers and retailers to track products from farm to shelf, ensuring quality and safety

- VeChain provides blockchain-based supply chain solutions that allow companies to authenticate products and prevent counterfeiting

- As industries continue to prioritize transparency and regulatory compliance, blockchain providers are leveraging this trend by developing secure, scalable, and interoperable solutions tailored to industry-specific needs. With increasing regulatory scrutiny and the need for verifiable digital transactions, the blockchain market will continue to expand, driving technological advancements, enterprise adoption, and innovative applications across multiple industries

Opportunity

“Growing Need for Data Privacy”

- The rising emphasis on data privacy and security presents a significant opportunity for the blockchain market. As individuals and organizations become increasingly concerned about data breaches, unauthorized access, and digital surveillance, the demand for blockchain-based privacy solutions is growing

- With stricter data protection regulations such as GDPR, CCPA, and HIPAA, there is a growing need for blockchain solutions that provide secure identity management, encrypted transactions, and tamper-proof data storage

- The demand for privacy-focused blockchain solutions is also driving advancements in cryptographic technologies such as zero-knowledge proofs (ZKPs), secure multi-party computation, and confidential smart contracts. These innovations allow for data validation and processing without exposing sensitive information

For instance,

- Zcash has integrated ZKPs to enable private financial transactions while ensuring blockchain integrity

- Oasis Network offers privacy-preserving smart contracts that allow organizations to process sensitive data securely

- As data privacy concerns continue to shape digital interactions, blockchain developers have the opportunity to create innovative, privacy-first solutions for industries such as finance, healthcare, and identity verification. With increasing global attention on data security, blockchain adoption will continue to grow, driving further innovation in privacy-preserving technologies

Restraint/Challenge

“Public Perception and Awareness”

- The lack of widespread understanding and awareness of blockchain technology poses a significant challenge for market growth. Despite its potential to enhance security, transparency, and efficiency across industries, blockchain remains complex and often misunderstood by businesses, regulators, and the general public

- Misconceptions surrounding blockchain, including its association with cryptocurrency volatility, regulatory uncertainty, and energy consumption concerns, create hesitation among enterprises and consumers.

- This lack of awareness slows adoption, as organizations struggle to fully grasp its benefits and practical applications

For instance,

- Many businesses hesitate to adopt blockchain due to misconceptions about its complexity and high energy consumption, often associating it solely with cryptocurrency rather than its broader applications in supply chain management, healthcare, and secure digital identity

- As blockchain technology continues to evolve, misconceptions and lack of awareness remain significant barriers to its adoption. Unclear regulations, skepticism about its real-world applications, and associations with cryptocurrency volatility contribute to slow market growth. Without a broader understanding of blockchain’s benefits, businesses and consumers may be hesitant to embrace its full potential, impacting its expansion across various industries

Blockchain Market Scope

The market is segmented on the basis of component, provider, type, organization type, development, application, and end user.

|

Segmentation

|

Sub-Segmentation

|

|

By Component

|

|

|

By Provider

|

|

|

By Type

|

|

|

By Organization Size

|

|

|

By Development

|

|

|

By Application

|

|

|

By End User

|

|

Blockchain Market Regional Analysis

“North America is the Dominant Region in the Blockchain Market”

- North America dominates the blockchain market, driven by its transparent nature, lower transaction costs, and time-efficient processes. The region’s strong technological infrastructure, increasing blockchain adoption across industries, and presence of key market players reinforce its dominance

- The U.S. holds a significant share due to active integration of blockchain for data protection, cybersecurity, and financial transactions by businesses. The financial services sector, in particular, is leveraging blockchain for fraud prevention, secure transactions, and enhanced operational efficiency

- In addition, organizations across industries, including healthcare, supply chain, and government, are implementing blockchain solutions to improve transparency, security, and regulatory compliance

- Major companies such as IBM, Microsoft, and Oracle continue to drive innovation and expand blockchain applications, further strengthening North America’s leadership in the market

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- The Asia-Pacific region is expected to witness the highest growth rate in the blockchain market, driven by early adoption of blockchain technologies and rapid advancements in financial services

- Countries such as China, India, Japan, and South Korea are seeing a surge in blockchain implementation, particularly in banking, payments, and trade finance. The increasing digitization of financial systems and government initiatives supporting blockchain development are key factors propelling market growth

- The region’s booming fintech sector and growing number of blockchain startups are further accelerating adoption, as businesses seek secure, transparent, and efficient solutions for digital payments

- With emerging economies investing in blockchain-driven innovations across industries, Asia-Pacific is set to become a major growth hub for blockchain applications in the coming years

Blockchain Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- IBM (U.S.)

- Microsoft (U.S.)

- SAP SE (Germany)

- Oracle (U.S.)

- Digital Asset (U.S.)

- Stratis Group (U.S.)

- Intel Corporation (U.S.)

- Guardtime (Estonia)

- AlphaPoint. (U.S.)

- NTT DATA, Inc. (U.S.)

- Ripple (U.S.)

- SoluLab (India)

- Chainalysis (U.S.)

- Cision US Inc. (U.S.)

- Riot Platforms, Inc. (U.S.)

- Bitfarms Ltd (Canada)

Latest Developments in Global Blockchain Market

- In April 2023, The German government has introduced the Future Finance Act, which aims to create a regulatory framework for startups focused on financial innovation. This legislation is designed to enhance the digitalization of capital markets, specifically by facilitating the issuance of e-securities using blockchain technology. By doing so, the government seeks to promote transparency and efficiency within financial transactions, ultimately fostering a more dynamic financial ecosystem

- In April 2023, The BBK Network has implemented a state-based architecture on the Ethereum Virtual Machine (EVM), significantly improving operational efficiency by removing the necessity for open payment channels between parties. This innovation addresses key challenges that have historically hindered the adoption of decentralized applications (DApps) within blockchain ecosystems. By streamlining interactions, the BBK Network aims to foster a more user-friendly environment for developers and users

- In January 2023, Amazon Web Services (AWS) announced a strategic partnership with Ava Labs, aimed at scaling blockchain adoption through the development of the Avalanche layer-1 blockchain. This collaboration will simplify the process of launching blockchain applications for individuals and organizations, enabling efficient management of nodes on the Avalanche network. The partnership signifies AWS's commitment to fostering innovation in blockchain technology across various sectors, including enterprises and government entities

SKU-