Global Blockchain Insuretech Market, By Sector (Health Insurance, Life Insurance and Title Insurance), Application (GRC Management, Death and Claims Management, Identity Management and Fraud Detection, Payments, Smart Contracts and Others), Type (Consortium Or Federated Blockchain, Public Blockchain and Private Blockchain), Organization Size (SMEs and Large Enterprises), Service Providers (Application & Solution Providers, Middleware Service Providers and Infrastructure & Protocols Providers), Country (U.S., Canada, Mexico, Brazil, Argentina, Rest of South America, Germany, Italy, U.K., France, Spain, Netherlands, Belgium, Switzerland, Turkey, Russia, Rest of Europe, Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa) Industry Trends and Forecast to 2028.

Blockchain Insuretech Market Analysis and Insights

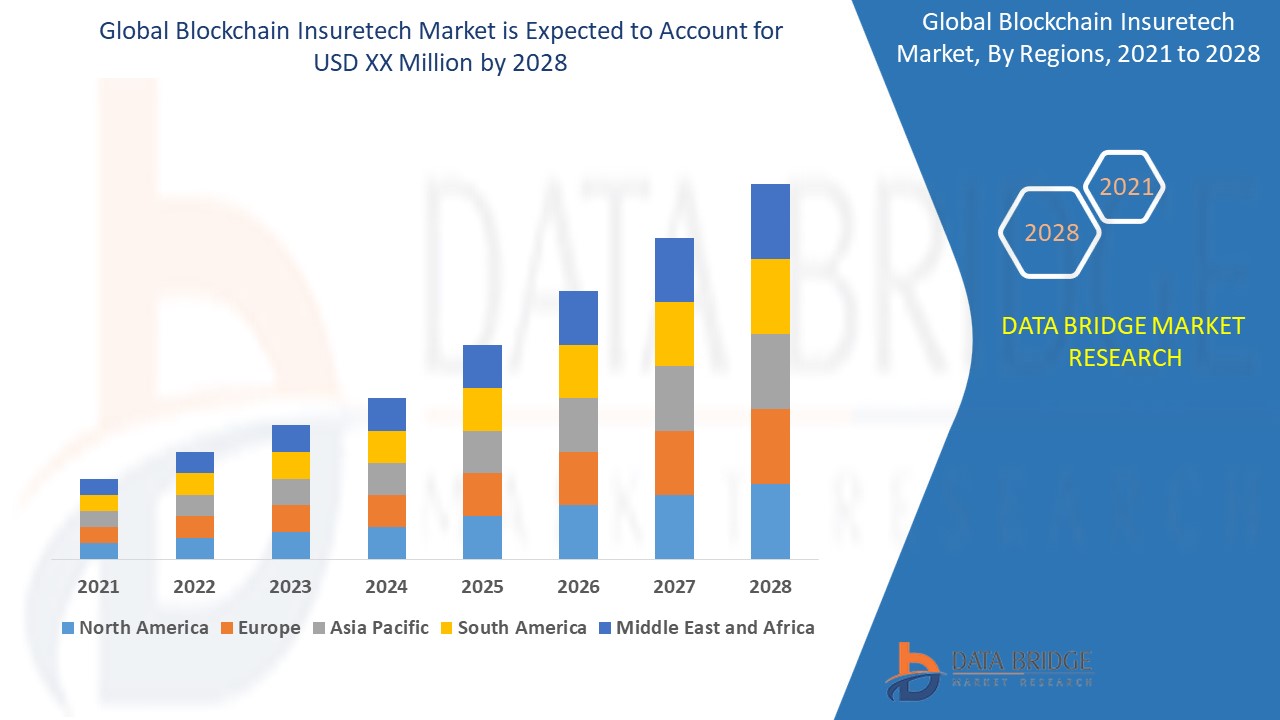

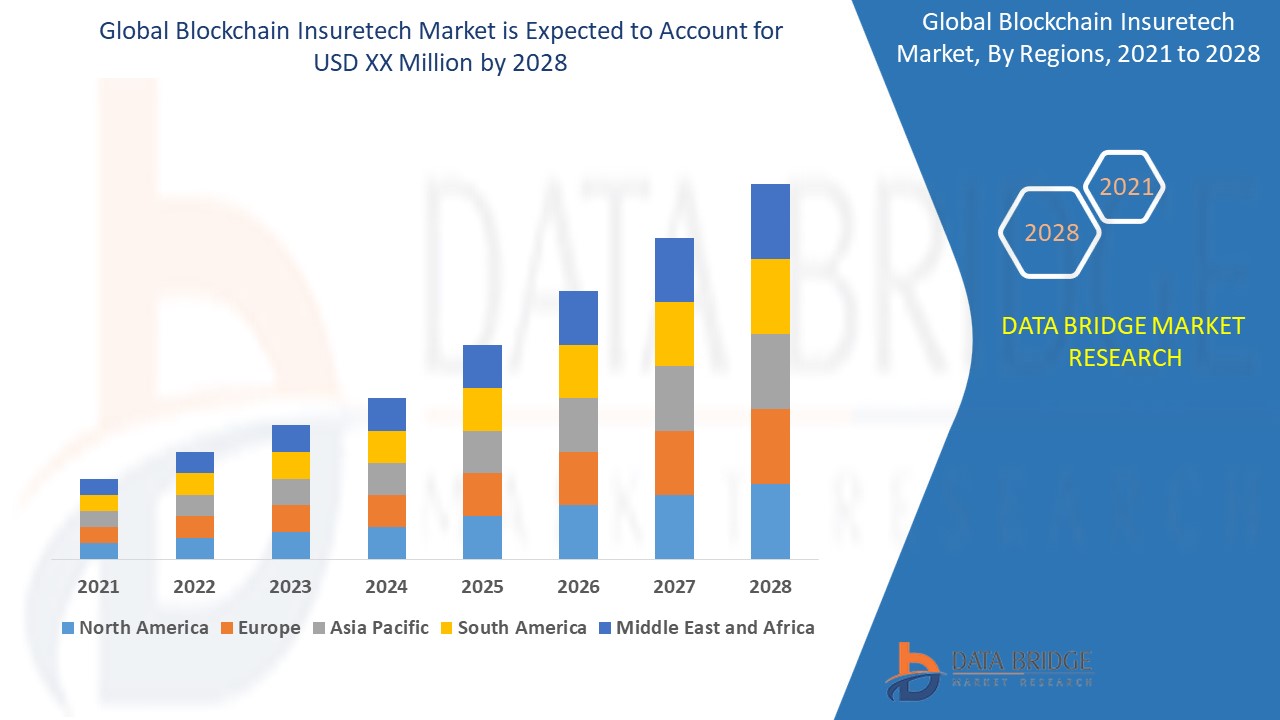

Blockchain insuretech market will reach at an estimated value of 2970.28 million and grow at a CAGR of 10.40% in the forecast period of 2021 to 2028. Growing number of fraudulent insurance claims is an essential factor driving the blockchain insuretech market.

Blockchain is defined as the encrypted protocol which is used to secure the digitalized data. It is basically used to record each financial transaction that is digitally secured and which cannot be tamper. The basic purpose of blockchain in the insurance is to provide safety against the frauds to claim automated transactions and also helps in enabling them to track and manage the physical accessed data digitally.

Rising need to have transparent and trustworthy systems is a crucial factor accelerating the market growth, also increasing focus on reducing the total cost of ownership, rising adoption of the blockchain as service, and the internet of things (IOTs), rising reduction in the cost of ownership and rising number of industrial sector all over the globe are the major factors among others boosting the blockchain insuretech market. Moreover, increasing rapid penetration of IoT Devices, increasing growth of Baas and rising technological advancements and modernization in the devices used will further create new opportunities for blockchain insuretech market in the forecast period mentioned above.

However, uncertain regulatory status and lack of common standards are the major factors among others restraining the market growth, while lack of awareness about the blockchain technology and lack of understanding of blockchain concept, skill sets, and technical knowledge will further challenge the blockchain insuretech market in the forecast period mentioned above.

This blockchain insuretech market report provides details of new recent developments, trade regulations, import export analysis, production analysis, value chain optimization, market share, impact of domestic and localised market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on blockchain insuretech market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Blockchain Insuretech Market Scope and Market Size

Blockchain insuretech market is segmented on the basis of sector, application, type, organization site and service providers. The growth among segments helps you analyse niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

- On the basis of sector, blockchain insuretech market is segmented into health insurance, life insurance and title insurance.

- Based on application, the blockchain insuretech market is segmented into GRC management, death and claims management, identity management and fraud detection, payments, smart contracts and others. Others have been further segmented into content storage management and customer communication.

- Based on type, the blockchain insuretech market is segmented into consortium or federated blockchain, public blockchain and private blockchain.

- Based on organization site, the blockchain insuretech market is segmented into SMEs and large enterprises.

- The blockchain insuretech market is also segmented on the basis of service providers into application & solution providers and middleware service providers and infrastructure & protocols providers.

Blockchain Insuretech Market Scope Country Level Analysis

Blockchain insuretech market is analysed and market size, volume information is provided by country, sector, application, type, organization site and service providers as referenced above.

The countries covered in the blockchain insuretech market report are U.S., Canada and Mexico in North America, Brazil, Argentina and Rest of South America as part of South America, Germany, Italy, U.K., France, Spain, Netherlands, Belgium, Switzerland, Turkey, Russia, Rest of Europe in Europe, Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA).

North America dominates the blockchain insuretech market due to increasing focus on reducing the total cost of ownership, rising adoption of the blockchain as service, and the internet of things (IOTs) and rising reduction in the cost of ownership and rising number of industrial sector in this region.

The country section of the blockchain insuretech market report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Blockchain Insuretech Market Share Analysis

Blockchain insuretech market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, regional presence, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies’ focus related to blockchain insuretech market.

The major players covered in blockchain insuretech market report are Algorythmix Tech, Auxesis Services & Technologies (P) Ltd., Bitfury Group Limited, IBM Corporation, Microsoft, SAP SE, Oracle, Amazon Web Services, Inc., Digital Asset Holdings LLC, Consensus Systems (ConsenSys), Huawei Technologies Co., Ltd., Factom, Stratis Group Ltd, Intel, Symbiont, Earthport, Guardtime, AlphaPoint, NTT Data, Ripple, Applied Blockchain Ltd. among other domestic and global players. Market share data is available for global, North America, Europe, Asia-Pacific (APAC), Middle East and Africa (MEA) and South America separately. DBMR analysts understand competitive strengths and provide competitive analysis for each competitor separately.

SKU-