Global Biotechnology Reagents Market

Market Size in USD Million

CAGR :

%

USD

477.41 Million

USD

1,199.04 Million

2024

2032

USD

477.41 Million

USD

1,199.04 Million

2024

2032

| 2025 –2032 | |

| USD 477.41 Million | |

| USD 1,199.04 Million | |

|

|

|

|

Biotechnology Reagents Market Size

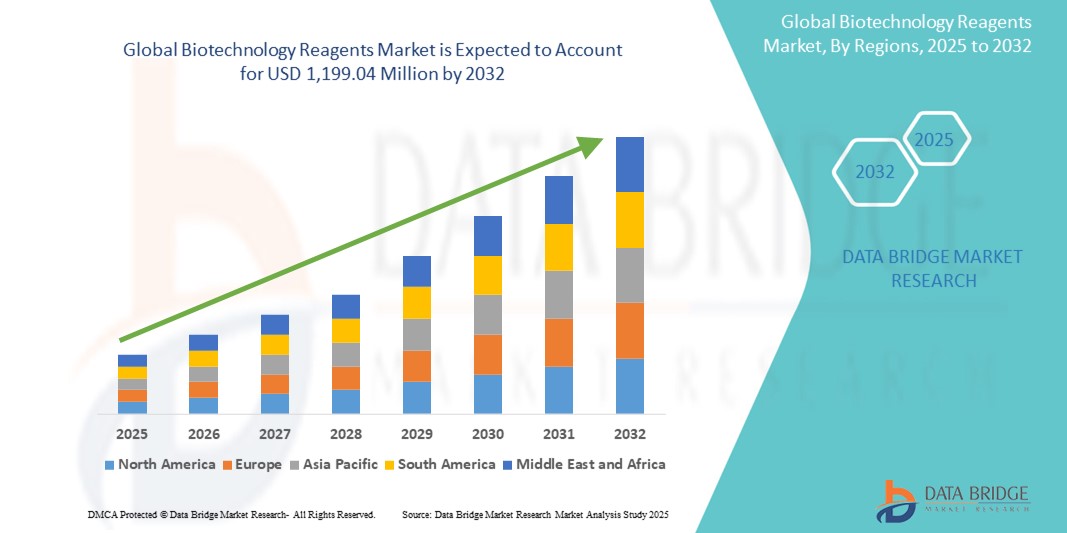

- The global biotechnology reagents market size was valued at USD 477.41 million in 2024 and is expected to reach USD 1,199.04 million by 2032, at a CAGR of 12.20% during the forecast period

- This growth is driven by factors such as the increasing research and development expenditure, and rising prevalence of chronic disease and genetic disorder

Biotechnology Reagents Market Analysis

- Biotechnology reagents are essential components used in various biological and chemical experiments, enabling precise analysis, detection, and measurement in research and diagnostics. They play a crucial role in applications such as polymerase chain reactions (PCR), cell culture, and molecular diagnostics

- The demand for biotechnology reagents is significantly driven by the rising prevalence of chronic diseases, increasing focus on personalized medicine, and ongoing advancements in life sciences research

- North America is expected to dominate the biotechnology reagents market with a market share of 43.4% due to its well-established research infrastructure, high R&D spending, and the presence of major biotechnology and pharmaceutical companies

- Asia-Pacific is expected to be the fastest growing region in the biotechnology reagents market with a market share of 23.6%, driven by rapid expansion in healthcare infrastructure, increasing research and development activities, and growing investments in biotechnology

- Protein synthesis and purification segment is expected to dominate the market, with a market share of 39.40%, driven by its crucial role in drug discovery, biotechnology research, and therapeutic protein production. The growing demand for biopharmaceuticals and therapeutic proteins, such as those used in treating cancer, diabetes, and autoimmune disorders, is expected to further fuel market growth

Report Scope and Biotechnology Reagents Market Segmentation

|

Attributes |

Biotechnology Reagents Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Biotechnology Reagents Market Trends

“Increasing Demand for Specialized Reagents Tailored for Precision Medicine and Genomic Research”

- One prominent trend in the biotechnology reagents market is the increasing demand for specialized reagents tailored for precision medicine and genomic research, driven by advancements in molecular biology and personalized healthcare

- These innovations are critical for applications such as next-generation sequencing (NGS), polymerase chain reaction (PCR), and gene editing, where precise, high-quality reagents are essential for accurate and reproducible results

- For instance, CRISPR-based gene editing technologies rely on highly specific nucleases and guide RNA reagents to target and modify genetic sequences with unmatched precision, enabling breakthroughs in genetic disease research and therapeutic development

- These advancements are transforming the biotechnology industry, enhancing the speed and accuracy of genomic studies, improving diagnostic outcomes, and driving the demand for next-generation reagents with superior performance and consistency

Biotechnology Reagents Market Dynamics

Driver

“Rising Demand for Personalized Medicine and Precision Therapeutics”

- The growing focus on personalized medicine, driven by advances in genomics, proteomics, and molecular diagnostics, is significantly boosting the demand for biotechnology reagents

- These reagents are essential for techniques such as next-generation sequencing (NGS), PCR, and immunoassays, which are critical for identifying genetic mutations, developing targeted therapies, and enhancing patient outcomes

- The increasing prevalence of chronic diseases such as cancer, cardiovascular disorders, and genetic disorders has further accelerated the demand for personalized diagnostic tools and reagents

For instance,

- In March 2025, according to a report by the Personalized Medicine Coalition, the global market for personalized medicine is projected to grow rapidly, driven by advances in molecular diagnostics and targeted therapies, which rely heavily on high-quality biotechnology reagents for accurate disease detection and treatment planning

- As personalized medicine continues to gain traction, the demand for innovative and specialized biotechnology reagents is expected to rise significantly, supporting the development of more precise, patient-centered treatment approaches

Opportunity

“Expanding Role of Biotechnology in Cell and Gene Therapy”

- The growing focus on cell and gene therapy, which promises to revolutionize the treatment of genetic disorders, rare diseases, and cancers, presents a significant market opportunity for biotechnology reagent manufacturers

- These therapies rely on advanced reagents for cell culture, gene editing, and viral vector production, creating a high demand for precise and reliable reagents

- As more biotech companies and research institutions focus on developing novel gene therapies, the need for specialized reagents for DNA/RNA synthesis, cell isolation, and gene delivery continues to expand

For instance,

- In January 2025, according to an article published by Nature Biotechnology, the global cell and gene therapy market is expected to witness substantial growth, driven by regulatory approvals for innovative therapies and the increasing number of clinical trials targeting rare genetic disorders. This trend is expected to boost the demand for high-quality biotechnology reagents used in these cutting-edge therapies

- The rising investment in cell and gene therapy research, coupled with favorable regulatory support, is expected to drive the demand for biotechnology reagents in this rapidly emerging field

Restraint/Challenge

“High Production Costs and Complex Manufacturing Processes”

- The high cost of producing biotechnology reagents, along with the complexity of maintaining consistent quality, poses a significant challenge for manufacturers

- These reagents often require precise formulations and stringent quality control, which can increase production costs and limit affordability, particularly for smaller biotech firms and research labs

- In addition, the need for specialized facilities and skilled personnel further adds to the cost, creating a barrier to market entry for new players

For instance,

- In May 2012, Santa Cruz Biotechnology, a major player in the antibody market, faced significant scrutiny from the U.S. Department of Agriculture (USDA) due to multiple violations related to animal welfare in their antibody production processes. These violations highlighted the challenges manufacturers face in maintaining consistent quality while controlling production costs

- This financial burden can hinder the adoption of advanced biotechnology tools, affecting the overall pace of innovation and market growth

Biotechnology Reagents Market Scope

The market is segmented on the basis of technology and applications.

|

Segmentation |

Sub-Segmentation |

|

By Technology |

|

|

By Application |

|

In 2025, the protein synthesis and purification is projected to dominate the market with a largest share in application segment

The protein synthesis and purification segment is expected to account for 39.40% of the biotechnology reagents market, driven by its crucial role in drug discovery, biotechnology research, and therapeutic protein production. This sub-segment is growing as biopharmaceuticals and therapeutic proteins, such as those used in treating cancer, diabetes, and autoimmune disorders, continue to be in high demand. The need for these treatments is expected to further fuel market growth.

The life science is expected to account for the largest share during the forecast period in technology market

In 2025, the life science segment is expected to dominate the market with the largest market share of 38.35% due to its extensive application in drug discovery, clinical diagnostics, genomics, and molecular biology research. This segment includes reagents such as immunoassay reagents, PCR reagents, and cell culture media, which are integral to a wide range of biomedical and pharmaceutical research processes.

Biotechnology Reagents Market Regional Analysis

“North America Holds the Largest Share in the Biotechnology Reagents Market”

- North America dominates the biotechnology reagents market, accounting for 43.4% of the total market share, driven by advanced healthcare infrastructure, high adoption of cutting-edge medical technologies, and a strong presence of key market players

- U.S. holds a significant share of 32.35%, supported by the increasing demand for high-precision diagnostic and therapeutic reagents, advancements in genomics and personalized medicine, and strong research funding from both public and private sectors

- The availability of well-established reimbursement policies, along with growing investments in biotechnology research and development, further strengthens the market in the region

- In addition, the increasing number of biotechnology and pharmaceutical research initiatives, along with a high rate of adoption of advanced diagnostic tools, is fueling market expansion across North America

“Asia-Pacific is Projected to Register the Highest CAGR in the Biotechnology Reagents Market”

- Asia-Pacific is expected to witness the highest growth rate in the biotechnology reagents market, with a market share of 23.6%, driven by rapid expansion in healthcare infrastructure, increasing research and development activities, and growing investments in biotechnology

- Countries such as China, India, and Japan are emerging as key markets due to a rise in healthcare spending, growing awareness about the importance of diagnostics, and the increasing prevalence of diseases requiring biotechnology-driven research

- Japan, with its advanced biotechnology research and technological infrastructure, continues to lead in reagent applications for drug discovery, diagnostics, and personalized medicine

- India is projected to register the highest CAGR of 16.1% in the biotechnology reagents market, driven by expanding healthcare infrastructure, growing research and development capabilities, and rising awareness about advanced diagnostic tools

Biotechnology Reagents Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Abbott (U.S.)

- Agilent Technologies Inc. (U.S.)

- Danaher Corporation (U.S.)

- BD (U.S.)

- Bio-Rad Laboratories Inc. (U.S.)

- General Electric Company (U.S.)

- BIOMÉRIEUX (France)

- Lonza (Switzerland)

- F. Hoffmann-La Roche Ltd. (Switzerland)

- Hoefer, Inc. (U.S.)

- PerkinElmer (U.S.)

- Merck KGaA (Germany)

- Promega Corporation (U.S.)

- Quality Biological (U.S.)

- Siemens Healthineers AG (Germany)

- Bio-Techne (U.S.)

- TAKARA HOLDINGS INC. (Japan)

- Sysmex Corporation (Japan)

- Tosoh Corporation (Japan)

- Ortho Clinical Diagnostics (U.S.)

- Olympus Corporation (Japan)

Latest Developments in Global Biotechnology Reagents Market

- In March 2025, Thermo Fisher Scientific, announced the launch of its next-generation PCR reagents for advanced DNA and RNA analysis. These reagents offer improved sensitivity, faster amplification, and higher throughput, enabling researchers to achieve more accurate and reproducible results in genomics, clinical diagnostics, and personalized medicine. The new PCR reagents are designed to meet the growing demand for precise and rapid genetic analysis in life sciences research

- In January 2025, Bio-Rad Laboratories, Inc., introduced its new line of single-cell RNA sequencing reagents. These reagents enable high-resolution analysis of gene expression in individual cells, providing deeper insights into cellular functions, disease mechanisms, and therapeutic responses. The innovative reagents are expected to enhance the company's position in the rapidly growing single-cell analysis market

- In November 2024, Merck KGaA launched its new CRISPR genome editing reagents, aimed at accelerating gene editing research and therapeutic development. These reagents are designed to offer precise and efficient genome modifications, supporting advancements in personalized medicine and biotechnology research. The launch reflects Merck's commitment to advancing life sciences research and expanding its biotechnology product portfolio

- In October 2024, Agilent Technologies announced the release of its next-generation HPLC reagents for biopharmaceutical analysis. These reagents are specifically designed to improve the accuracy and speed of protein purification and characterization, meeting the increasing demand for high-quality biologics. The new HPLC reagents are part of Agilent's broader strategy to support the rapidly expanding biopharmaceutical industry

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.