Global Biosimulation Market

Market Size in USD Billion

CAGR :

%

USD

4.25 Billion

USD

14.77 Billion

2024

2032

USD

4.25 Billion

USD

14.77 Billion

2024

2032

| 2025 –2032 | |

| USD 4.25 Billion | |

| USD 14.77 Billion | |

|

|

|

|

Biosimulation Market Size

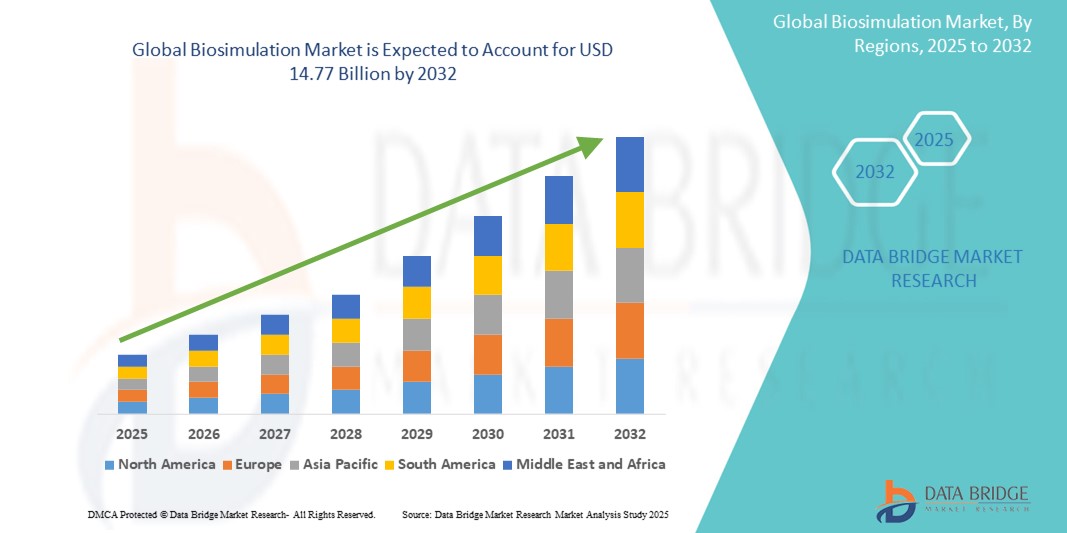

- The global biosimulation market size was valued at USD 4.25 billion in 2024 and is expected to reach USD 14.77 billion by 2032, at a CAGR of 16.85% during the forecast period

- This growth is driven by factors such as rising demand for cost-effective drug development, regulatory support, and growing use of in-silico models and AI technologies

Biosimulation Market Analysis

- Biosimulation tools are advanced computational solutions used to simulate biological processes, playing a crucial role in optimizing drug development and accelerating decision-making in life sciences

- The biosimulation market is witnessing strong growth, fueled by increasing demand for cost-effective drug discovery, growing adoption of in-silico models, regulatory encouragement for simulation-based trials, and advancements in AI and computational technologies across the pharmaceutical and biotech sectors

- North America is expected to dominate the biosimulation market with a share of 50.40%, due to the widespread integration of in-silico modeling tools in drug development processes, supported by strong regulatory support and the presence of a well-established pharmaceutical industry

- Asia-Pacific is expected to be the fastest growing region in the biosimulation market during the forecast period due to growing demand for efficient drug development solutions, increased adoption of healthcare I.T. systems, and rising preference for contract research organizations (CROs)

- Software segment is expected to dominate the market with a market share of 62.52% due to its critical role in accelerating drug discovery and development processes through predictive modeling, virtual trials, and pharmacokinetic/pharmacodynamic (PK/PD) simulations, which reduce time and cost compared to traditional methods

Report Scope and Biosimulation Market Segmentation

|

Attributes |

Biosimulation Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Biosimulation Market Trends

“Increasing Healthcare Spending”

- One prominent trend in the global biosimulation market is the increased healthcare spending

- This trend is driven by the growing investments in advanced healthcare technologies, rising demand for effective treatments, and an increased focus on reducing drug development costs and timelines through simulation-based approaches

- For instance, governments and private sectors in countries such as U.S., China, and Germany are allocating higher budgets for R&D, encouraging the adoption of biosimulation tools in clinical and preclinical research

- The rise in healthcare expenditure is evident across regions such as North America, Europe, and Asia-Pacific, where pharmaceutical and biotech companies are expanding their simulation capabilities

- As global healthcare budgets continue to grow, the demand for biosimulation solutions that enhance drug discovery efficiency and patient safety is expected to remain a key trend driving market expansion

Biosimulation Market Dynamics

Driver

“Rising Adoption of Biosimulation Software”

- Increasing adoption of biosimulation software is emerging as a key driver for the biosimulation market, as pharmaceutical and biotech companies seek to accelerate drug development while reducing costs and risks

- This shift is gaining traction worldwide, with organizations leveraging biosimulation tools to improve predictive accuracy, optimize clinical trial design, and minimize late-stage failures

- As companies focus on enhancing R&D efficiency, there is growing emphasis on adopting sophisticated, user-friendly biosimulation platforms that support complex biological modeling with greater precision

- Industry leaders are investing in advanced software solutions that integrate AI and machine learning to deliver more reliable simulations, helping streamline workflows and reduce dependency on costly experimental methods

- Furthermore, increasing demand for faster drug approvals and personalized medicine is driving the need for scalable, flexible biosimulation software across diverse therapeutic areas

For instance,

- Dassault Systèmes and Certara are enhancing their biosimulation platforms by incorporating AI-driven analytics and cloud-based capabilities to provide pharmaceutical companies with more robust modeling tools

- Companies such as Simcyp and BIOVIA offer integrated software solutions that enable seamless collaboration across research teams, helping reduce time-to-market and improve decision-making accuracy

- As computational technologies advance, the rising adoption of biosimulation software with enhanced functionality and cost efficiency will continue to drive growth in the biosimulation market

Opportunity

“Growing Demand for Personalized Medicine”

- The growing demand for personalized medicine presents a significant opportunity for the biosimulation market, enabling more precise prediction of individual drug responses and treatment outcomes

- Industry players are capitalizing on this by developing advanced biosimulation platforms that integrate patient-specific data to tailor therapies, improving efficacy and reducing adverse effects

- This opportunity aligns with the broader shift toward precision healthcare, as pharmaceutical companies and researchers increasingly adopt biosimulation tools to support customized drug development and regulatory approval processes

For instance,

- Companies such as Certara and Dassault Systèmes are enhancing their biosimulation software with capabilities to model genetic, metabolic, and environmental variations among patients for personalized treatment strategies

- Simcyp has integrated patient variability modeling into its platforms, helping researchers optimize dosing and safety profiles tailored to individual populations

- As demand for personalized therapies rises across oncology, rare diseases, and chronic conditions, the biosimulation market is well-positioned to benefit from expanding adoption of simulation-driven precision medicine solutions

Restraint/Challenge

“Integration with Existing Systems”

- Integration with existing systems presents a significant challenge for the biosimulation market, as organizations often face difficulties incorporating new simulation tools into established drug development workflows and IT infrastructures

- Educating stakeholders on how to seamlessly implement and utilize biosimulation software alongside legacy systems remains complex, requiring clear guidance on compatibility, data standardization, and long-term benefits for R&D efficiency and regulatory compliance

- This challenge is further intensified by concerns over data security, interoperability issues, and the technical expertise needed to manage sophisticated biosimulation platforms, which can slow adoption rates

For instance,

- Companies such as Simcyp and Dassault Systèmes offer integration support and customizable solutions, yet smaller biotech firms often struggle with limited IT infrastructure and lack of specialized personnel to fully leverage these technologies

- Without improved integration strategies and user education, organizations may underutilize biosimulation technologies, potentially restricting the market’s growth and delaying broader implementation in drug development processes

Biosimulation Market Scope

The market is segmented on the basis of product and service, application, delivery model, and end user.

|

Segmentation |

Sub-Segmentation |

|

By Product and Service |

|

|

By Application |

|

|

By Delivery Model |

|

|

By End User

|

|

In 2025, the software is projected to dominate the market with a largest share in product and service segment

The software segment is expected to dominate the biosimulation market with the largest share of 62.52% in 2025 due to its critical role in accelerating drug discovery and development processes through predictive modeling, virtual trials, and pharmacokinetic/pharmacodynamic (PK/PD) simulations, which reduce time and cost compared to traditional methods.

The drug development is expected to account for the largest share during the forecast period in application segment

In 2025, the drug development segment is expected to dominate the market with the largest market share of 55.93% due to increasing adoption of biosimulation tools to enhance decision-making, reduce clinical trial failures, and improve the efficiency of developing safe and effective drugs.

Biosimulation Market Regional Analysis

“North America Holds the Largest Share in the Biosimulation Market”

- North America dominates the biosimulation market with a share of 50.40%, driven by the widespread integration of in-silico modeling tools in drug development processes, supported by strong regulatory support and the presence of a well-established pharmaceutical industry

- U.S. holds a significant share due to its robust R&D ecosystem, early adoption of biosimulation platforms in pharmaceutical and biotechnology companies, and favorable regulatory policies encouraging the use of simulation in clinical trials and drug approval processes

- Regional leadership is further supported by the presence of leading biosimulation software providers, extensive funding for life sciences research, and regulatory initiatives emphasizing patient safety through model-informed drug development

- With continued emphasis on personalized medicine, high healthcare expenditure, and increasing reliance on simulation-based approaches to reduce drug development costs and timelines, North America is projected to retain its dominance in the global biosimulation market through 2032

“Asia-Pacific is Projected to Register the Highest CAGR in the Biosimulation Market”

- Asia-Pacific is expected to witness the highest growth rate in the biosimulation market, driven by growing demand for efficient drug development solutions, increased adoption of healthcare I.T. systems, and rising preference for contract research organizations (CROs)

- India holds a significant share due to its rapidly growing pharmaceutical industry, expanding clinical trial activity, and the adoption of biosimulation technologies by CROs and academic institutions

- Market growth in the region is further driven by consistent improvements in healthcare infrastructure, government support for digital healthcare, and increased investment in biotechnology and life sciences R&D

- With rising awareness of the benefits of biosimulation in reducing clinical trial risks and costs, along with a growing talent pool in computational biology, Asia-Pacific is poised to emerge as the fastest-growing region in the global biosimulation market during the forecast period

Biosimulation Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Certara (U.S.)

- Simulations Plus (U.S.)

- Dassault Systèmes (France)

- Schrödinger, Inc (U.S.)

- ACD/Labs (Canada)

- Chemical Computing Group (Canada)

- Physiomics (U.K.)

- In silico biosciences (U.S.)

- INOSIM Software (Germany)

- Insilico Biotechnology (Germany)

- LeadInvent Technologies (India)

- Rosa (U.S.)

- Nuventra Pharma (U.S.)

Latest Developments in Global Biosimulation Market

- In August 2024, Certara, Inc., a global leader in model-informed drug development, launched Phoenix version 8.5, a leading pharmacokinetic/pharmacodynamic (PK/PD) and toxicokinetic modeling and simulation software widely regarded as the industry standard. Used by over 75 of the top 100 pharmaceutical companies worldwide, Phoenix’s updated platform strengthens Certara’s position in the biosimulation market by enhancing drug development accuracy and efficiency

- In June 2024, Simulations Plus expanded its market presence by acquiring Pro-ficiency, enabling the integration of Pro-ficiency’s innovative software solutions with its existing platforms. This strategic move is expected to create a comprehensive biosimulation platform that streamlines and optimizes drug development, strengthening Simulations Plus’s competitive position in the market

- In December 2023, Certara broadened its biosimulation portfolio through the acquisition of Applied Biomath, a leader in model-informed drug discovery. This acquisition enhances Certara’s capabilities in early-stage drug development, reinforcing its market leadership and ability to offer end-to-end simulation solutions

- In November 2023, Certara launched the Simcyp Biopharmaceutics software, aimed at improving the efficiency of both novel and generic drug formulation development. This product launch positions Certara to better address industry needs for faster, more cost-effective formulation strategies, thereby driving increased adoption of biosimulation technologies

- In June 2023, Simulations Plus further strengthened its foothold in specialized therapeutic areas by acquiring Immunetrics, a company focused on modeling and simulation for oncology, immunology, and autoimmune diseases. This acquisition expands Simulations Plus’s market reach and expertise, catering to growing demand for biosimulation in complex disease research

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.