Global Bioplastics Packaging Market

Market Size in USD Billion

CAGR :

%

USD

10.13 Billion

USD

30.74 Billion

2024

2032

USD

10.13 Billion

USD

30.74 Billion

2024

2032

| 2025 –2032 | |

| USD 10.13 Billion | |

| USD 30.74 Billion | |

|

|

|

|

Bioplastics Packaging Market Size

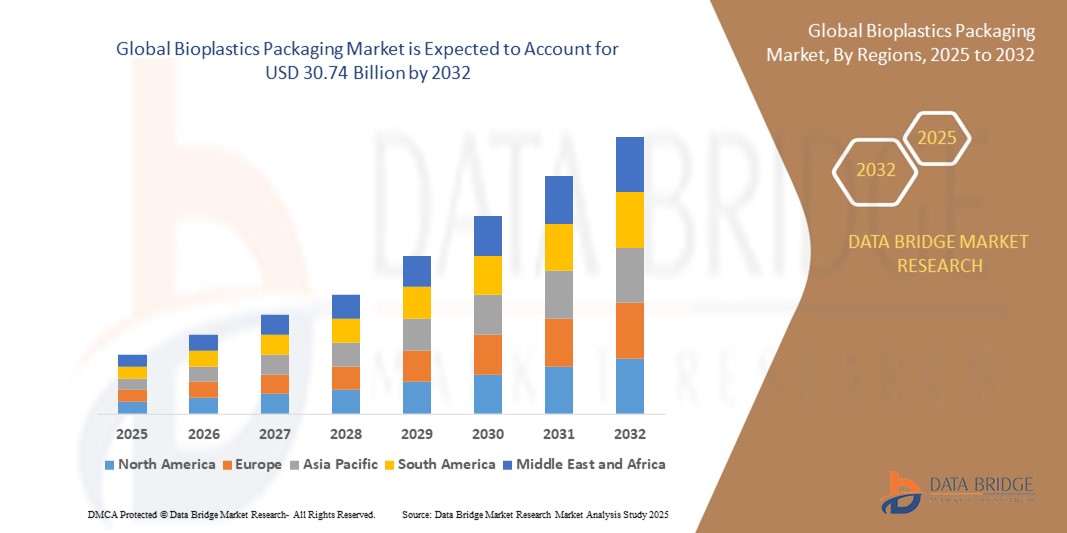

- The global bioplastics packaging market size was valued at USD 10.13 billion in 2024 and is expected to reach USD 30.74 billion by 2032, at a CAGR of 14.88 % during the forecast period

- Market growth is driven by increasing consumer demand for sustainable and eco-friendly packaging solutions, stringent government regulations on single-use plastics, and growing awareness of environmental concern

- Rising adoption of bioplastics in food and beverage packaging, coupled with advancements in biodegradable and compostable materials, is further propelling market expansion

Bioplastics Packaging Market Analysis

- The bioplastics packaging market is experiencing robust growth due to rising environmental consciousness and the shift toward sustainable packaging alternatives across industries

- The food and beverage sector dominates the market, driven by the need for biodegradable packaging for perishable goods and increasing consumer preference for eco-friendly products

- Europe holds the largest revenue share of 39% in 2024, attributed to stringent regulations on plastic waste, a strong focus on sustainability, and the dominance of the automotive original equipment manufacturer (OEM) market, which influences packaging innovations

- Asia-Pacific is projected to be the fastest-growing region during the forecast period, fueled by rapid industrialization, increasing consumer awareness, and government initiatives promoting sustainable packaging in countries such as China, India, and Japan

- The PLA and PLA Blends segment held the largest market revenue share of approximately 21.5% in 2024, driven by its versatility in food packaging, compostability, and recognition as safe for food contact by the U.S. food and drug administration

Report Scope and Bioplastics Packaging Market Segmentation

|

Attributes |

Bioplastics Packaging Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Bioplastics Packaging Market Trends

“Rising Preference for Bio-Based and Compostable Packaging Solutions”

- Bio-based plastics, such as PLA (Polylactic Acid) and PHA (Polyhydroxyalkanoates), are gaining traction due to their biodegradable and compostable properties, offering an eco-friendly alternative to traditional petroleum-based plastics

- These materials decompose naturally, reducing landfill waste and environmental impact, making them highly sought after in regions with stringent sustainability regulations, such as Europe

- PLA and PLA blends are particularly favored in food and beverage packaging for their clarity, strength, and ability to preserve product freshness without compromising safety

- Luxury and eco-conscious brands are adopting bioplastics for premium packaging, such as bio-PET bottles and molded fiber trays, to align with consumer demand for sustainable products

- For instance, companies such as Coca-Cola have introduced bio-PET-based PlantBottle packaging to reduce their carbon footprint and appeal to environmentally aware consumers

- Retailers and manufacturers are increasingly offering bioplastic packaging as a value-added feature, with some incorporating compostable pouches and sachets in their product lines

Bioplastics Packaging Market Dynamics

Driver

“Growing Demand for Sustainable and Eco-Friendly Packaging”

- Rising consumer and regulatory awareness about the environmental impact of single-use plastics is driving demand for bioplastics packaging with lower carbon footprints and biodegradability

- Bioplastics, such as starch blends and cellulose, help reduce reliance on fossil fuels, aligning with global sustainability goals and circular economy initiatives

- These materials provide comparable performance to conventional plastics, enabling applications in bottles, films, and trays, while supporting eco-conscious branding for food and beverage, consumer goods, and pharmaceutical industries

- The rise of e-commerce and packaged goods has spurred demand for lightweight, durable bioplastic packaging, such as bio-PE bags and bio-PP clamshells, which reduce transportation emissions

- Major manufacturers, such as Nestlé, are investing in bio-based packaging solutions, such as PHA and PBS films, to meet net-zero emissions targets and enhance product appeal.

- The growth of the food and beverage sector, particularly in Europe and Asia-Pacific, is fueling adoption of bioplastics for applications such as cups and pouches, driven by consumer preference for sustainable packaging

Restraint/Challenge

“High Production Costs and Limited Scalability”

- The production of bioplastics, such as PHA and bio-PA, is often more expensive than conventional plastics due to complex extraction technologies such as biomass processing and bio-derived monomer synthesization

- Limited availability of raw materials, such as sugarcane or corn for PLA production, creates supply chain challenges, particularly in regions with competing agricultural demands

- Regulatory variations across countries, such as differing compostability standards, complicate the adoption of bioplastics for global manufacturers and distributors

- For instance, while Europe enforces strict composting certifications, some Asia-Pacific countries lack infrastructure for industrial composting, limiting the practical benefits of biodegradable bioplastics

- High costs and scalability issues discourage smaller manufacturers from adopting bioplastics, potentially slowing market growth in cost-sensitive markets such as industrial goods packaging

Bioplastics Packaging Market Scope

The market is segmented on the basis of product, application type, extraction technology, and end-users.

- By Product

On the basis of product, the market is segmented into Bio-PET, PLA and PLA Blends, Starch Blends, Bio-PP, Bio-PA, TPS, PHA, Bio-PE, PBS, aliphatic and aromatic polyesters, cellulose, molded fiber, AAC, WSP, and others. The PLA and PLA blends segment held the largest market revenue share of approximately 21% in 2024, driven by its versatility in food packaging, compostability, and recognition as safe for food contact by the U.S. Food and Drug Administration. Its bio-based origins from renewable sources such as corn starch and sugarcane further enhance its appeal for sustainable packaging solutions.

The PHA (polyhydroxyalkanoates) segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by its high biodegradability and expanding applications in food packaging, pharmaceutical packaging, and 3D printing filaments. Innovations in PHA production processes and composite materials are driving its adoption across various industries.

- By Application Type

On the basis of application type, the market is segmented into bottles, pouch and sachet, trays, clamshells, cups, films, bags, and others. The bottles segment dominated with the largest market revenue share in 2024, driven by increasing demand for sustainable beverage packaging. Bioplastic bottles, particularly those made from Bio-PET and PLA, offer enhanced recyclability and compostability, aligning with consumer preferences for eco-friendly products.

The pouch and sachet segment is anticipated to experience the fastest growth from 2025 to 2032, driven by innovations in compostable and biodegradable bag designs. These flexible packaging solutions cater to diverse industries, including food, personal care, and household products, offering consumer convenience through features such as resealable zippers and spouts.

- By Extraction Technology

On the basis of extraction technology, the market is segmented into injection molding, biomass, pelletizing, non-biodegradable bio-derived thermoplastics, petrochemical synthesization, bio-derived monomers synthesization, natural or GMO, and others. The injection molding segment held the largest market revenue share of approximately 30% in 2024, driven by its widespread use in producing rigid packaging such as bottles, trays, and containers. This technology enables precise manufacturing and scalability, supporting the growing demand for durable bioplastic packaging.

The biomass segment is expected to witness significant growth from 2025 to 2032, as it leverages renewable resources such as corn starch, sugarcane, and cellulose to produce bioplastics. Advancements in bio-based feedstock processing and increasing investments in sustainable production methods are key drivers.

- By End-Users

On the basis of end-users, the market is segmented into food and beverages, consumer goods, pharmaceuticals, industrial goods, and others. The food and beverages segment dominated with a revenue share of approximately 47.8% in 2022, driven by the rising demand for sustainable packaging in quick-service restaurants and food retail. Bioplastics such as PLA and starch blends meet stringent food safety standards while offering biodegradability, making them ideal for packaging fresh foods, beverages, and takeout containers.

The pharmaceuticals segment is anticipated to witness robust growth from 2025 to 2032, fueled by the adoption of bio-based blister packs, vials, and pouches to meet regulatory requirements and consumer demand for eco-friendly healthcare packaging. Bioplastics ensure safety and sustainability, aligning with industry trends toward greener solutions.

Bioplastics Packaging Market Regional Analysis

- Europe holds the largest revenue share of 39% in 2024, attributed to stringent regulations on plastic waste, a strong focus on sustainability, and the dominance of the automotive original equipment manufacturer (OEM) market, which influences packaging innovations

- Consumers and businesses in the region highly prioritize reducing plastic waste and carbon footprints, leading to widespread adoption of bioplastic alternatives across various industries, including food and beverage, cosmetics, and consumer goods

- This leadership is further bolstered by supportive government policies, significant investments in research and development of bioplastic technologies, and a robust infrastructure for composting and recycling, establishing Europe as a frontrunner in sustainable packaging innovation

U.S. Bioplastics Packaging Market Insight

The U.S. is expected to witness the fastest growth rate in the North American bioplastics packaging market, driven by strong aftermarket demand and increasing consumer awareness of sustainability benefits. Initiatives such as the U.S. Plastics Pact and growing adoption by retailers and corporations to meet sustainability goals fuel market expansion. The integration of bioplastics in food, beverage, and personal care packaging, supported by advanced R&D, further accelerates growth.

Europe Bioplastics Packaging Market Insight

Europe’s bioplastics packaging market is expected to maintain significant growth, supported by regulatory emphasis on reducing plastic waste and promoting compostable materials. The adoption of bioplastics in food packaging, particularly PLA and starch blends, is prominent in countries such as Germany, France, and the U.K., driven by consumer demand for eco-friendly products and compliance with EU regulations such as EN 13432 for compostability.

U.K. Bioplastics Packaging Market Insight

The U.K. market for bioplastics packaging is expected to witness healthy growth, driven by demand for sustainable food and beverage packaging and increasing awareness of environmental benefits. Regulatory measures banning single-use plastics and promoting biodegradable alternatives encourage adoption. Bioplastics are widely used in flexible packaging such as bags and pouches, enhancing consumer convenience and sustainability.

Germany Bioplastics Packaging Market Insight

Germany is expected to witness significant growth in bioplastics packaging, attributed to its advanced manufacturing sector and strong consumer focus on sustainability and innovation. German industries prioritize bioplastics such as Bio-PET and PLA for food and beverage packaging, driven by their compostability and reduced carbon footprint. Robust aftermarket options and regulatory support for eco-friendly materials sustain market growth.

Asia-Pacific Bioplastics Packaging Market Insight

The Asia-Pacific region is expected to dominate the market revenue share in 2024, driven by rapid industrialization, rising vehicle ownership, and increasing adoption of bioplastics in packaging applications. Countries such as China, India, and Japan lead due to their expanding packaging industries and government policies promoting sustainable materials. The region’s tech-savvy population and growing middle class further support market penetration.

Japan Bioplastics Packaging Market Insight

Japan’s bioplastics packaging market is expected to witness robust growth due to strong consumer preference for high-quality, sustainable packaging solutions. Major manufacturers are integrating bioplastics such as PLA and Bio-PET into food and beverage packaging, supported by advancements in production technology. Rising interest in eco-friendly aftermarket products and government support for sustainable initiatives drive market expansion.

China Bioplastics Packaging Market Insight

China holds the largest share of the Asia-Pacific bioplastics packaging market, propelled by rapid urbanization, increasing consumer demand for sustainable packaging, and strong domestic manufacturing capabilities. The country’s focus on reducing plastic waste and promoting bio-based materials supports the adoption of bioplastics in food, beverage, and consumer goods sectors. Competitive pricing and government-backed sustainability initiatives enhance market accessibility.

Bioplastics Packaging Market Share

The bioplastics packaging industry is primarily led by well-established companies, including:

- Amcor plc (Australia)

- Tetra Laval International SA (Switzerland)

- Mondi (U.K.)

- WestRock Company (U.S.)

- BASF(Germany)

- Sonoco Products Company (U.S.)

- Smurfit Kappa (Ireland)

- Huhtamaki (Finland)

- Gerresheimer AG (Germany)

- BALL CORPORATION (U.S.)

- Crown Holdings (U.S.)

- DS Smith (U.K.)

- International Paper (U.S.)

- Berry Global Inc. (U.S.)

- DuPont (U.S.)

Latest Developments in Global Bioplastics Packaging Market

- In January 2025, Corn Next introduced CornNext-17, a bio-based plastic material made from corn starch for biodegradable packaging applications, such as tableware and single-use food containers. This product leverages natural fermentation to enhance sustainability and is designed for scalability in food and beverage packaging. The launch strengthens Corn Next’s position in the bioplastics market, catering to rising demand for eco-friendly alternatives

- In November 2024, Walki and Lactips formed a strategic partnership to develop biodegradable, plastic-free food packaging using casein-based polymers derived from milk processing. This collaboration focuses on creating recyclable packaging within the paper stream, aligning with European regulations targeting single-use plastics. The partnership enhances Walki’s portfolio and positions Lactips as a key innovator in sustainable packaging, boosting adoption in eco-conscious markets

- In October 2024, SK Leaveo announced plans to build the world’s largest biodegradable plastic plant in Hai Phong, Vietnam, with construction starting in early 2024. This facility will produce bioplastics for packaging, targeting the growing demand for sustainable solutions in the Asia-Pacific region. The plant aims to strengthen SK Leaveo’s market presence by offering high-capacity production of biodegradable films and rigid packaging for food and consumer goods.

- In September 2024, CSIRO and Murdoch University launched the Bioplastics Innovation Hub, an initiative to develop fully compostable bioplastics for packaging applications. This collaboration focuses on creating biologically sourced plastics that decompose in compost, land, or water, addressing the demand for sustainable food and beverage packaging. The hub works with industry partners to enhance scalability and market adoption, strengthening Australia’s position in the global bioplastics market

- In May 2023, BASF SE expanded its ecovio portfolio with the launch of ecovio 70 PS14H6, a biodegradable polymer for food and beverage packaging. This coating-grade material offers superior barrier properties, temperature stability, and food-contact approval, addressing the need for sustainable packaging with enhanced performance. BASF’s innovation reinforces its leadership in the bioplastics market, targeting high-growth sectors such as flexible packaging

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Bioplastics Packaging Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Bioplastics Packaging Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Bioplastics Packaging Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.