Global Biological Dural Repair Market

Market Size in USD Billion

CAGR :

%

USD

3.74 Billion

USD

6.51 Billion

2025

2033

USD

3.74 Billion

USD

6.51 Billion

2025

2033

| 2026 –2033 | |

| USD 3.74 Billion | |

| USD 6.51 Billion | |

|

|

|

|

Biological Dural Repair Market Size

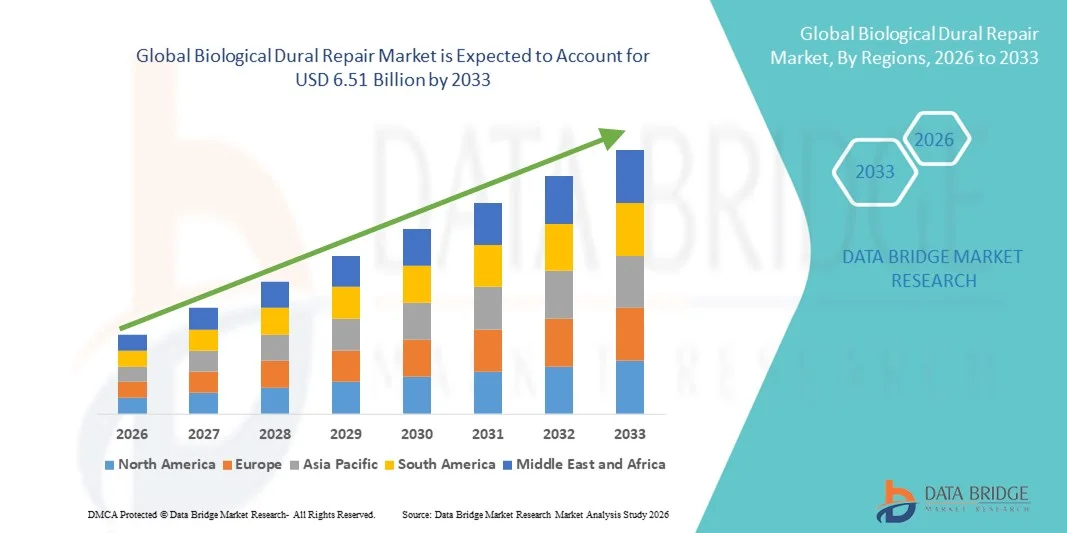

- The global biological dural repair market size was valued at USD 3.74 billion in 2025 and is expected to reach USD 6.51 billion by 2033, at a CAGR of 7.18% during the forecast period

- The market growth is largely fueled by the increasing prevalence of neurological surgeries and growing awareness of advanced surgical repair solutions, leading to higher adoption of biological dural repair materials in hospitals and specialty clinics

- Furthermore, rising demand for safer, biocompatible, and faster-healing dural repair products is driving the uptake of Biological Dural Repair solutions, thereby significantly boosting the industry's growth

Biological Dural Repair Market Analysis

- Biological dural repair, offering advanced solutions for repairing dural defects in neurosurgical procedures, is increasingly vital in both hospitals and specialty clinics due to its enhanced biocompatibility, reduced risk of complications, and faster patient recovery

- The escalating demand for biological dural repair is primarily fueled by the growing number of neurological surgeries, rising awareness of safer repair options, and a preference for products that improve surgical outcomes

- North America dominated the biological dural repair market with the largest revenue share of 36.8% in 2025, supported by the high number of neurosurgical procedures, established healthcare infrastructure, and strong presence of leading dural repair product manufacturers

- Asia-Pacific is expected to be the fastest-growing region in the biological dural repair market during the forecast period due to increasing healthcare investments, rising geriatric population, and expanding neurosurgery centers

- The Neurosurgery segment dominated the largest market revenue share of 52% in 2025, driven by the high prevalence of cranial and brain surgeries requiring safe and durable dural substitutes

Report Scope and Biological Dural Repair Market Segmentation

|

Attributes |

Biological Dural Repair Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Biological Dural Repair Market Trends

Increasing Adoption of Biocompatible and Minimally Invasive Solutions

- A significant trend in the global biological dural repair market is the growing preference for biocompatible, absorbable, and minimally invasive repair materials. This trend is driven by the need to reduce post-surgical complications and improve patient recovery times

- For instance, synthetic dural substitutes, such as collagen-based or polymer-based grafts, are increasingly being used in neurosurgical procedures due to their high tissue compatibility and reduced risk of infection

- There is an increasing focus on products that allow for precise surgical application, including pre-shaped or ready-to-use patches that reduce operating time and enhance procedural efficiency

- Research and development in advanced biomaterials, including antibacterial and regenerative variants, is enabling the creation of next-generation dural repair solutions that actively support tissue healing

- The integration of minimally invasive surgical techniques, such as endoscopic or robotic-assisted dural repairs, is further driving adoption of specialized biological repair materials across hospitals and surgical centers

Biological Dural Repair Market Dynamics

Driver

Rising Incidence of Neurosurgical Procedures and Patient Safety Concerns

- The growing prevalence of neurological disorders, traumatic brain injuries, and spinal surgeries is a key driver for the Biological Dural Repair market. As the number of surgical interventions increases, demand for safe and effective dural repair solutions is rising

- For instance, the expansion of neurosurgical procedures in countries like the U.S., Germany, and Japan has significantly increased the use of collagen and polymer-based dural substitutes in routine clinical practice

- Patient safety considerations are encouraging hospitals and surgical centers to adopt biological dural repair products that minimize risks of infection, cerebrospinal fluid leakage, and immune reactions

- Healthcare providers are seeking durable yet flexible repair materials that integrate well with host tissue, providing both structural support and promoting tissue regeneration

- Investment in R&D by leading medical device companies to develop innovative biological dural repair products with enhanced biocompatibility, ease of use, and faster healing profiles is further propelling market growth

- Surgeons are increasingly demanding materials that can simplify complex procedures, reduce operative times, and improve long-term patient outcomes, which in turn drives adoption

- The rising awareness among patients about minimally invasive procedures and faster recovery options is prompting hospitals to adopt advanced dural repair solutions

- Growth in elective and emergency neurosurgical procedures globally, including tumor resections and spinal surgeries, is creating consistent demand for high-quality dural repair materials

Restraint/Challenge

High Costs and Regulatory Hurdles

- The relatively high cost of advanced biological dural repair products compared to traditional synthetic materials poses a challenge, particularly for smaller hospitals or cost-sensitive regions

- For instance, premium collagen or polymer-based grafts can be significantly more expensive than conventional autografts, which may limit adoption in emerging markets

- Stringent regulatory approval processes for medical devices and biomaterials, including FDA (U.S.), CE (Europe), and PMDA (Japan) certifications, create barriers for rapid market entry of new products

- Inconsistent reimbursement policies and limited insurance coverage in certain regions can further hinder adoption of advanced dural repair materials

- Addressing these challenges requires manufacturers to focus on cost optimization, clinical evidence generation, and strategic partnerships with hospitals and surgical centers to increase accessibility

- The need for extensive clinical trials to demonstrate safety, efficacy, and long-term outcomes increases the time-to-market for new biological dural repair products

- Regional disparities in healthcare infrastructure and limited availability of skilled neurosurgeons in some countries may slow the adoption of advanced dural repair technologies

- Limited awareness among healthcare providers in developing regions about the benefits of biological dural repair solutions can hinder market penetration

- Competition from traditional repair methods, such as autologous grafts, which are lower-cost and widely accepted, can also act as a restraint to the adoption of newer biological alternatives

Biological Dural Repair Market Scope

The market is segmented on the basis of application and end user.

- By Application

On the basis of application, the Biological Dural Repair market is segmented into Neurosurgery, Spine Surgery, and Others. The Neurosurgery segment dominated the largest market revenue share of 52% in 2025, driven by the high prevalence of cranial and brain surgeries requiring safe and durable dural substitutes. Biological dural materials are preferred due to biocompatibility, lower infection risk, and ability to integrate with native tissue. Increasing incidences of neurological disorders, trauma, and tumor excisions are further fueling demand. Technological advancements in minimally invasive neurosurgery also support segment growth. Hospitals and specialized centers increasingly adopt these materials to improve patient outcomes. Regulatory approvals and rising healthcare expenditure across North America and Europe strengthen the segment. The segment also benefits from surgeon preference and training in advanced surgical techniques, alongside growing awareness about patient safety.

The Spine Surgery segment is expected to witness the fastest CAGR of 8.2% from 2026 to 2033, driven by rising spinal injuries, degenerative disorders, and the growing number of complex spine surgeries requiring dural reconstruction. Biological dural repair materials are chosen for flexibility, biocompatibility, and regenerative properties. The segment growth is supported by the increasing adoption of minimally invasive spine surgery, expansion of ambulatory surgery centers, and growing awareness among surgeons regarding reduced complications. Rising geriatric population and increasing spine procedure volumes in Asia-Pacific and North America further fuel demand. The segment also benefits from innovations in material design and enhanced handling characteristics.

- By End User

On the basis of end user, the Biological Dural Repair market is segmented into Hospitals, Ambulatory Surgery Centers (ASCs), and Others. The Hospitals segment accounted for the largest market revenue share of 68% in 2025, due to advanced surgical infrastructure, availability of trained neurosurgeons, and preference for high-quality, regulatory-compliant dural repair materials. Hospitals perform most neurosurgical and spinal procedures, and the adoption of biological dural repair materials ensures improved clinical outcomes and reduced postoperative complications. High healthcare expenditure, growing surgical volumes, and government funding in North America and Europe further support segment dominance. The segment also benefits from hospital partnerships with key medical device manufacturers and established procurement channels.

The Ambulatory Surgery Centers segment is expected to witness the fastest CAGR of 9.1% from 2026 to 2033, fueled by the rising number of outpatient procedures and minimally invasive surgeries. ASCs increasingly prefer biological dural repair materials for faster patient recovery, reduced infection risk, and improved efficiency. Expansion of ASCs in emerging markets, particularly in Asia-Pacific, and rising investment in outpatient healthcare facilities drive adoption. Surgeons at ASCs also favor materials that are easy to handle and compatible with smaller surgical teams. The segment is further supported by increasing awareness among patients and providers about the benefits of biological dural repair in ambulatory settings.

Biological Dural Repair Market Regional Analysis

- North America dominated the biological dural repair market with the largest revenue share of 36.8% in 2025, supported by the high number of neurosurgical procedures, established healthcare infrastructure, and the strong presence of leading dural repair product manufacturers

- The market remains the largest contributor in the region, driven by advanced hospitals, high healthcare expenditure, and widespread adoption of innovative dural repair solutions

- Investments in R&D, increasing awareness among neurosurgeons, and the use of biological grafts and sealants to improve surgical outcomes further strengthen market growth

U.S. Biological Dural Repair Market Insight

The U.S. biological dural repair market captured the largest revenue share within North America in 2025, fueled by a significant number of neurosurgical procedures and adoption of advanced dural repair technologies. Hospitals and specialty neurosurgery centers are increasingly integrating biological dural grafts and sealants to enhance patient outcomes. Strong regulatory support, continuous product innovation, and the presence of key manufacturers in the country are contributing to sustained market expansion.

Europe Biological Dural Repair Market Insight

The Europe biological dural repair market is projected to expand at a substantial CAGR during the forecast period, primarily driven by increasing neurosurgical procedures, rising awareness about advanced dural repair solutions, and well-established healthcare infrastructure. Countries such as Germany, France, and Italy are witnessing growing adoption of biological grafts and sealants in both public and private hospitals. Reimbursement frameworks and established distribution networks further encourage adoption of premium dural repair products.

U.K. Biological Dural Repair Market Insight

The U.K. biological dural repair market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the growing number of neurosurgeries, rising awareness of patient outcomes, and the adoption of minimally invasive procedures. Leading hospitals’ preference for high-quality biological dural repair solutions supports the market’s expansion, alongside the U.K.’s strong e-commerce and medical distribution infrastructure.

Germany Biological Dural Repair Market Insight

The Germany biological dural repair market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing awareness of surgical innovations and adoption of biological dural grafts. Germany’s well-developed healthcare infrastructure, advanced hospitals, and focus on technologically advanced and eco-conscious solutions are promoting growth in both neurosurgical and spinal applications.

Asia-Pacific Biological Dural Repair Market Insight

The Asia-Pacific biological dural repair market is poised to grow at the fastest CAGR during the forecast period, driven by rising healthcare investments, increasing number of neurosurgery centers, rapid urbanization, and growing geriatric population. Countries such as China, Japan, and India are expanding neurosurgical facilities and upgrading hospital infrastructure, boosting demand for high-quality biological dural repair products.

Japan Biological Dural Repair Market Insight

The Japan biological dural repair market is gaining momentum due to the country’s advanced healthcare system, high prevalence of neurological disorders among the aging population, and increasing adoption of innovative surgical solutions. Hospitals are increasingly implementing biological dural grafts and sealants to improve outcomes and reduce complications.

China Biological Dural Repair Market Insight

The China biological dural repair market accounted for the largest revenue share in Asia-Pacific in 2025, attributed to rapid expansion of hospital infrastructure, increasing neurosurgical procedures, and rising awareness about advanced dural repair products. Government initiatives promoting healthcare modernization and increasing hospital capacities are further fueling market growth.

Biological Dural Repair Market Share

The Biological Dural Repair industry is primarily led by well-established companies, including:

- Meril Life Sciences (India)

- Integra LifeSciences (U.S.)

- B. Braun S.E. (Germany)

- Stryker Corporation (U.S.)

- Gamma Healthcare (U.K.)

- Medtronic (Ireland)

- Spinal Elements (U.S.)

- Terumo Corporation (Japan)

- Pfizer Inc. (U.S.)

- Orthofix Medical Inc. (U.S.)

- Sequent Medical (U.S.)

- Genzyme Corporation (U.S.)

- Exactech Inc. (U.S.)

- TE Connectivity (Switzerland)

- Coviden/Medtronic (U.S.)

- ReGen Biologics (U.S.)

- Biomet (U.S.)

- NuVasive Inc. (U.S.)

- Cerenovus (U.S.)

Latest Developments in Global Biological Dural Repair Market

- In March 2023, Integra LifeSciences expanded its U.S. manufacturing capacity for biologic dural grafts, enhancing production to meet rising demand for next‑generation dural repair materials that support improved surgical outcomes in neurosurgery

- In April 2023, Polyganics announced that its bioresorbable dural sealant patch Liqoseal received CE mark approval, enabling its commercial availability across Europe and offering surgeons a new option to reduce cerebrospinal fluid (CSF) leakage after cranial surgery

- In 2023, Medtronic introduced a flexible multilayer dural repair patch system in pilot clinical evaluations across Europe, which demonstrated reduced surgical time and improved handling characteristics compared with earlier products

- In June 2024, Zimmer Biomet announced a collaboration with Terumo to co‑develop bioactive dura substitutes for neurosurgical applications, aiming to improve tissue integration and healing in dural repair procedures

- In September 2024, Polyganics’ Liqoseal dural sealant patch became widely commercialized in European healthcare facilities, supporting improved dural closure performance in routine neurosurgical practice

- In January 2025, Medtronic launched its flagship dural patch product, DuraGuard Pro, featuring a semi‑rigid collagen–synthetic composite that promotes rapid dural sealing and enhanced handling for surgeons in cranial and spinal procedures

- In March 2025, Integra LifeSciences introduced DuraGen Matrix Plus, a next‑generation collagen‑based dural graft designed to improve surgical handling and reduce postoperative CSF leakage, enhancing biologic repair options

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.