Global Biologic Imaging Reagents Market

Market Size in USD Billion

CAGR :

%

USD

19.46 Billion

USD

35.16 Billion

2024

2032

USD

19.46 Billion

USD

35.16 Billion

2024

2032

| 2025 –2032 | |

| USD 19.46 Billion | |

| USD 35.16 Billion | |

|

|

|

|

Biologic Imaging Reagents Market Size

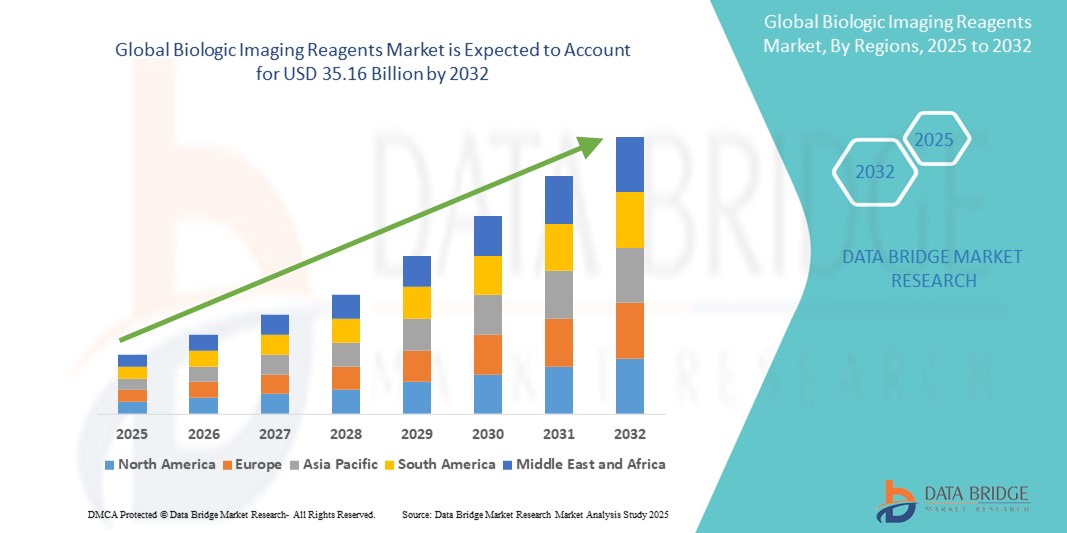

- The global biologic imaging reagents market size was valued at USD 19.46 billion in 2024 and is expected to reach USD 35.16 billion by 2032, at a CAGR of 7.67% during the forecast period

- The market growth is largely fueled by the rising prevalence of chronic diseases, advances in molecular imaging technologies, and increased demand for early disease diagnosis, especially in oncology and neurology

- Furthermore, growing investments in biotechnology research, coupled with the expansion of personalized medicine, are enhancing the adoption of targeted imaging reagents. These converging factors are accelerating the demand for biologic imaging reagents, thereby significantly boosting the industry's growth

Biologic Imaging Reagents Market Analysis

- Biologic imaging reagents, which enable the visualization of biological structures and processes in diagnostics and research, are critical tools in medical imaging modalities such as MRI, PET, CT, and fluorescence imaging, facilitating enhanced disease detection, staging, and monitoring

- The accelerating demand for biologic imaging reagents is primarily driven by the rising incidence of chronic and infectious diseases, an aging global population, and the increasing need for non-invasive diagnostic techniques

- North America dominated the biologic imaging reagents market with the largest revenue share of 40.2% in 2024, characterized by advanced healthcare infrastructure, high R&D investment, and early adoption of cutting-edge imaging technologies, particularly in oncology and neurology applications across the U.S. and Canada

- Asia-Pacific is expected to be the fastest growing region in the biologic imaging reagents market during the forecast period due to expanding healthcare access, rising healthcare expenditure, and increasing awareness of early disease detection

- Contrast reagents segment dominated the biologic imaging reagents market with a market share of 43.2% in 2024, driven by its critical role in enhancing image clarity and diagnostic accuracy across modalities such as MRI, CT, and ultrasound

Report Scope and Biologic Imaging Reagents Market Segmentation

|

Attributes |

Biologic Imaging Reagents Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework |

Biologic Imaging Reagents Market Trends

“Rising Adoption of Targeted and Molecular Imaging Technologies”

- A significant and accelerating trend in the global biologic imaging reagents market is the growing shift toward targeted and molecular imaging, which allows for highly specific visualization of cellular and molecular processes, thereby enabling earlier and more precise disease diagnosis

- For instance, the development of receptor-specific imaging reagents for cancer, such as HER2-targeted PET tracers, is enhancing the ability of clinicians to identify tumors at the molecular level and tailor treatment strategies accordingly

- Advancements in biologics and genetic engineering have enabled the creation of novel imaging reagents such as labeled monoclonal antibodies, peptides, and nucleic acids that bind to disease-specific biomarkers, offering superior sensitivity and specificity compared to conventional agents

- These targeted reagents are being increasingly integrated into hybrid imaging systems allowing multi-parametric assessments that improve diagnostic confidence and therapy monitoring. For example, fluorescent-labeled antibodies used in intraoperative imaging enable surgeons to more precisely locate and remove tumor tissue

- The trend toward personalized and precision medicine is also driving demand for biologic imaging reagents that align with individual patient profiles. Companies such as PerkinElmer and Bracco are developing biomarker-specific reagents and companion diagnostics to support this transformation in clinical practice

- This evolution toward more personalized, precise, and biologically relevant imaging tools is reshaping diagnostic pathways, encouraging early detection and improving patient outcomes across various disease areas, including oncology, cardiology, and neurology

Biologic Imaging Reagents Market Dynamics

Driver

“Rising Demand for Early and Accurate Disease Diagnosis”

- The increasing global burden of chronic diseases such as cancer, cardiovascular conditions, and neurological disorders is a significant driver fueling the demand for biologic imaging reagents, as healthcare systems prioritize early and accurate diagnosis for effective treatment

- For instance, in February 2024, Bracco Imaging announced the development of a next-generation MRI contrast agent with improved safety and diagnostic performance, underscoring the industry's focus on innovation to meet growing diagnostic demands

- As clinical practice shifts toward precision medicine, biologic imaging reagents enable more targeted, sensitive, and non-invasive visualization of cellular and molecular processes, allowing clinicians to detect diseases at earlier stages and monitor therapeutic responses more effectively

- Furthermore, increasing investments in research and the advancement of hybrid imaging technologies, such as PET/MRI and SPECT/CT, are enhancing the capabilities of biologic imaging reagents and expanding their applications across oncology, cardiology, and neurology

- The growing adoption of imaging-based biomarker discovery and companion diagnostics also highlights the vital role of biologic reagents in personalized treatment planning, thereby further accelerating their utilization in both clinical and research settings. The rising demand for high-precision diagnostics across emerging markets In addition supports continued market expansion

Restraint/Challenge

“Skin Irritation Issues and Regulatory Compliance Hurdle”

- Safety concerns related to potential adverse reactions such as allergic responses or skin irritation from contrast agents and biologic reagents pose a significant challenge to the broader adoption of biologic imaging reagents in clinical practice

- For instance, gadolinium-based contrast agents used in MRI imaging have faced scrutiny due to risks of nephrogenic systemic fibrosis (NSF) in patients with impaired kidney function, leading to stricter usage guidelines and heightened regulatory oversight

- Addressing these concerns requires the continuous development of safer formulations and rigorous clinical testing to ensure minimal side effects. Companies such as Bayer and GE HealthCare are actively investing in next-generation contrast agents with improved safety profiles to meet regulatory expectations and reduce patient risks

- In addition, navigating the complex and evolving regulatory landscape—especially in highly regulated markets such as the U.S., EU, and Japan—can delay product approvals and market entry, particularly for novel biologic reagents

- The cost and time associated with meeting stringent compliance standards, combined with the need for post-market surveillance and pharmacovigilance, can be burdensome for manufacturers. Moreover, the high development cost of biologic imaging reagents can limit accessibility in cost-sensitive markets

- Overcoming these challenges through investment in safer product development, strategic partnerships for regulatory navigation, and pricing models suited to emerging markets will be crucial for driving sustained market growth

Biologic Imaging Reagents Market Scope

The market is segmented on the basis of class, modality, application, and end user.

- By Class

On the basis of class, the biologic imaging reagents market is segmented into contrast reagents, optical reagents, and nuclear reagents. The contrast reagents segment dominated the market with the largest revenue share of 43.2% in 2024, driven by their critical role in enhancing visualization for modalities such as MRI, CT, and ultrasound. Their wide usage in diagnostic procedures across various medical specialties, along with continuous advancements in safer and more effective formulations, supports their dominance in the market.

The optical reagents segment is expected to witness the fastest growth rate during the forecast period, fueled by their expanding application in preclinical research and real-time intraoperative imaging. These reagents enable non-ionizing, highly specific imaging with minimal invasiveness, contributing to their increased adoption in oncology, neurology, and cardiovascular research settings.

- By Modality

On the basis of modality, the market is segmented into MRI, ultrasound, X-ray and CT, nuclear, optical imaging, and others. The MRI segment held a significant market share in 2024 due to its superior soft tissue contrast and widespread clinical use in diagnosing neurological, musculoskeletal, and cardiovascular conditions. The demand for MRI-compatible contrast agents with improved safety profiles continues to rise.

The optical imaging modality is projected to grow at the fastest CAGR from 2025 to 2032, owing to its increasing role in molecular imaging and real-time surgical guidance. Its non-invasive nature and potential for high-resolution imaging at the cellular level are driving its rapid adoption, particularly in research and intraoperative settings.

- By Application

On the basis of application, the market is bifurcated into in vitro and in vivo. The in vivo segment dominated the market in 2024, supported by its extensive use in real-time imaging of biological processes for diagnostics and disease monitoring. The growth of personalized medicine and biomarker-targeted diagnostics is further enhancing the need for in vivo biologic imaging reagents.

The in vitro segment is expected to experience steady growth during forecast period, fueled by its importance in pharmaceutical research, drug discovery, and laboratory-based studies. Increasing investment in life science R&D and advancements in reagent technologies are contributing to its expansion.

- By End User

On the basis of end user, the market is segmented into diagnostic laboratories, imaging centers, life science companies, research and academic institutes, and others. The diagnostic laboratories segment accounted for the largest market share in 2024, driven by the high volume of imaging tests conducted in clinical diagnostics, especially for cancer, cardiovascular, and metabolic disorders. The growing availability of advanced imaging platforms in labs supports this dominance.

The research and academic institutes segment is anticipated to register the fastest growth over the forecast period, owing to the increasing emphasis on translational research, preclinical studies, and the development of novel imaging biomarkers. Supportive government funding and industry-academic collaborations are further propelling this segment’s growth.

Biologic Imaging Reagents Market Regional Analysis

- North America dominated the biologic imaging reagents market with the largest revenue share of 40.2% in 2024, driven by advanced healthcare infrastructure, high R&D investment, and early adoption of cutting-edge imaging technologies

- The region benefits from a well-established healthcare infrastructure, high R&D investment, and a strong presence of leading life science and imaging companies actively developing and commercializing innovative biologic reagents

- In addition, the increasing prevalence of chronic diseases such as cancer and cardiovascular disorders, coupled with favorable reimbursement policies and a growing emphasis on early and accurate diagnosis, continues to support the widespread use of biologic imaging reagents across clinical and research applications

U.S. Biologic Imaging Reagents Market Insight

The U.S. biologic imaging reagents market captured the largest revenue share of 78% in 2024 within North America, driven by a strong presence of advanced imaging infrastructure and major biotech and pharmaceutical companies. The country’s focus on early disease detection, coupled with robust investment in R&D and personalized medicine, fuels demand for targeted biologic reagents. The expanding use of molecular imaging in oncology, cardiology, and neurology further supports the market's growth, alongside favorable reimbursement policies and regulatory support for diagnostic innovation.

Europe Biologic Imaging Reagents Market Insight

The Europe biologic imaging reagents market is projected to grow at a significant CAGR during the forecast period, fueled by the increasing burden of chronic diseases and growing demand for non-invasive diagnostic tools. Stringent healthcare standards, advancements in imaging modalities, and support for translational research are contributing to reagent adoption. Key growth is seen in both clinical and academic research settings, with countries such as Germany, the U.K., and France at the forefront of diagnostic innovation and biologic imaging integration.

U.K. Biologic Imaging Reagents Market Insight

The U.K. biologic imaging reagents market is expected to expand steadily during the forecast period, driven by strong government support for life sciences, increasing cancer screening programs, and active adoption of molecular diagnostics. The growing application of PET and SPECT imaging in oncology and neurological research, combined with academic-industry collaborations, is accelerating the market. Demand is further bolstered by the country’s strategic investments in precision medicine and diagnostic infrastructure

Germany Biologic Imaging Reagents Market Insight

The Germany biologic imaging reagents market is projected to grow considerably during the forecast period, supported by the country’s leadership in healthcare innovation, robust medical device sector, and growing usage of advanced imaging systems. Emphasis on early diagnosis and personalized care drives demand for targeted imaging reagents. With significant funding for clinical research and cancer diagnostics, Germany remains a key hub for the development and clinical adoption of biologic reagents.

Asia-Pacific Biologic Imaging Reagents Market Insight

The Asia-Pacific biologic imaging reagents market is poised to register the fastest CAGR from 2025 to 2032, driven by rapid healthcare infrastructure development, rising disease prevalence, and growing demand for early diagnosis. Government-led healthcare reforms and increasing investment in diagnostic technology are enabling faster adoption of advanced biologic reagents across China, Japan, and India. The expansion of imaging facilities in urban and semi-urban centers further supports market penetration

Japan Biologic Imaging Reagents Market Insight

The Japan biologic imaging reagents market is gaining traction due to its advanced medical imaging ecosystem, aging population, and demand for precision diagnostics. Strong collaboration between academic institutions and technology companies is promoting the development of targeted reagents. Moreover, the integration of biologic imaging in cancer and neurodegenerative disease diagnostics is driving significant growth, along with a cultural emphasis on health monitoring and preventive care.

India Biologic Imaging Reagents Market Insight

The India biologic imaging reagents market accounted for the largest market revenue share in Asia Pacific in 2024, fueled by growing public and private investment in healthcare infrastructure and diagnostics. Rapid urbanization, increased awareness of early disease detection, and government initiatives such as Ayushman Bharat are expanding access to imaging services. The emergence of domestic players in life sciences and a rising demand for affordable, high-performance reagents are key factors driving growth across clinical and research segments.

Biologic Imaging Reagents Market Share

The biologic imaging reagents industry is primarily led by well-established companies, including:

- Bracco Imaging S.p.A. (Italy)

- GE HealthCare Technologies Inc. (U.S.)

- Bayer AG (Germany)

- Guerbet (France)

- PerkinElmer (U.S.)

- Siemens Healthineers AG (Germany)

- NanoPET Pharma GmbH (Germany)

- Thermo Fisher Scientific Inc. (U.S.)

- FUJIFILM Holdings Corporation (Japan)

- Lantheus Holdings, Inc. (U.S.)

- Navidea Biopharmaceuticals, Inc. (U.S.)

- Curium Pharma (France)

- Jubilant Radiopharma (Canada)

- Canon Medical Systems Corporation (Japan)

- CordenPharma International GmbH (Germany)

- Miltenyi Biotec B.V. & Co. KG (Germany)

- Zebra Medical Vision (Israel)

- Theragnostics Ltd. (U.K.)

- Eckert & Ziegler AG (Germany)

What are the Recent Developments in Global Biologic Imaging Reagents Market?

- In March 2024, Bracco Imaging announced the launch of a new generation MRI contrast agent with an enhanced safety profile and prolonged imaging window. Designed to minimize gadolinium retention while maintaining high image quality, this innovation reflects Bracco’s ongoing commitment to advancing safer diagnostic tools and addressing long-standing safety concerns surrounding traditional contrast agents in clinical imaging

- In February 2024, PerkinElmer Inc. introduced a novel optical imaging reagent tailored for use in preclinical oncology research. This reagent is designed for high-sensitivity, real-time imaging of tumor-specific biomarkers, offering researchers deeper insights into tumor behavior and drug response. The release strengthens PerkinElmer’s portfolio of molecular imaging solutions and supports the accelerating shift toward personalized cancer research and therapy development

- In January 2024, GE HealthCare entered into a strategic collaboration with the University of Cambridge to co-develop radiotracers for PET imaging in neurodegenerative diseases. This partnership aims to improve early detection of Alzheimer’s and Parkinson’s by leveraging biologic imaging reagents capable of binding to disease-specific proteins. The initiative emphasizes the growing intersection of academic research and commercial innovation in advancing next-generation diagnostic tools

- In December 2023, Guerbet, a specialist in contrast imaging, expanded its production facilities in France to meet increasing global demand for injectable MRI and CT reagents. The expansion supports the company's mission to ensure consistent global supply of high-quality contrast agents and highlights the rising utilization of biologic reagents in diagnostic imaging amid growing patient volumes and imaging needs worldwide

- In November 2023, NanoPET Pharma GmbH received regulatory clearance for its fluorine-18 labeled PET imaging reagent targeting fibroblast activation protein (FAP), a key marker in cancer and fibrosis. This approval marks a milestone in precision imaging by enabling clinicians to visualize and quantify FAP expression in vivo, thus advancing both cancer diagnostics and treatment planning. The development underscores the market’s focus on biomarker-driven imaging and targeted reagent innovation

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.