Global Biodegradable Plastics Market Segmentation, By Product Type (Polylactic Acid (PLA), Starch Blends, Biodegradable Polyesters, Polyhydroxyalkanoates (PHA), and Others), Application (Packaging and Bags, Consumer Goods, Agriculture and Horticulture, Textile, and Others) - Industry Trends and Forecast to 2031

Biodegradable Plastics Market Analysis

The biodegradable plastics market is experiencing significant growth, driven by increasing environmental awareness and stringent regulations on plastic waste. Innovations in material science have led to the development of advanced biodegradable options, such as polylactic acid (PLA) and polyhydroxyalkanoates (PHA), which are gaining traction in various applications, including packaging, agriculture, and consumer goods. In recent developments, major players are expanding their production capacities and forming strategic partnerships. In addition, in October 2023, Versalis acquired Novamont's biodegradable plastic business, enhancing its offerings in this eco-friendly segment. Furthermore, government initiatives promoting sustainable practices and the circular economy are encouraging manufacturers to innovate and adopt biodegradable materials. As a result, the market is expected to flourish, with a forecasted CAGR that reflects the increasing emphasis on sustainability and the reduction of plastic pollution globally.

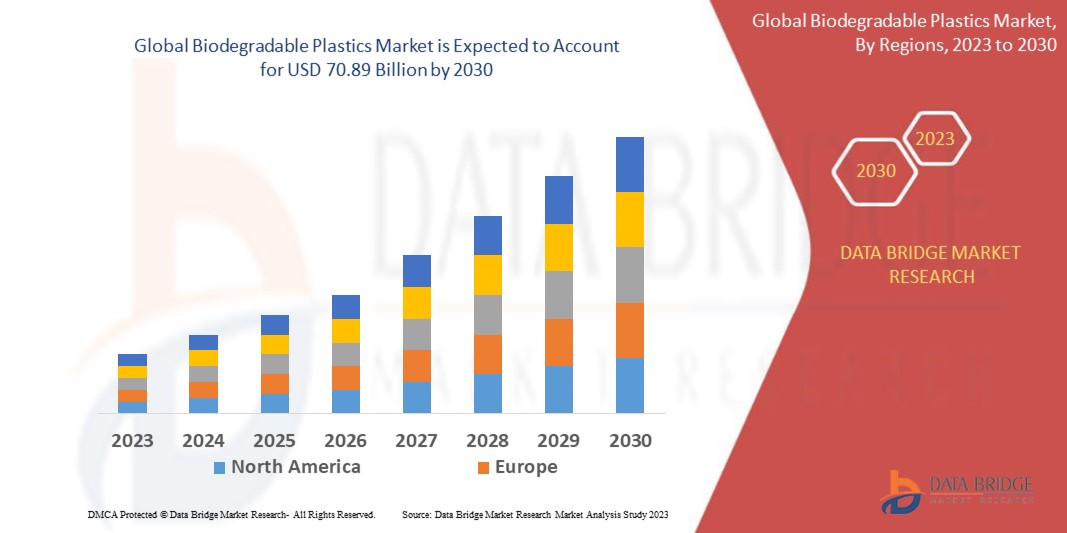

Biodegradable Plastics Market Size

The global biodegradable plastics market size was valued at USD 20.84 billion in 2023 and is projected to reach USD 84.44 billion by 2031, with a CAGR of 19.11% during the forecast period of 2024 to 2031. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework.

Biodegradable Plastics Market Trends

“Increasing Adoption of Plant-Based Materials”

The biodegradable plastics market is experiencing significant growth, driven by increasing environmental awareness and stringent regulations on plastic waste. A notable trend in the biodegradable plastics market is the increasing adoption of plant-based materials, particularly polylactic acid (PLA), which is derived from renewable resources such as corn starch and sugarcane. As consumers become more environmentally conscious, the demand for sustainable packaging solutions has surged. Companies such as NatureWorks, a leading producer of PLA, have reported significant growth in their production capacity to meet this rising demand. In addition, various industries, including food and beverage, are increasingly using biodegradable plastics for packaging to align with sustainability goals. For instance, many brands now offer biodegradable plastic containers for food and cutlery, reflecting a broader commitment to environmentally friendly practices. Such trend is reshaping the packaging landscape, fostering innovation, and driving the expansion of the biodegradable plastics market.

Report Scope and Biodegradable Plastics Market Segmentation

|

Attributes

|

Biodegradable Plastics Key Market Insights

|

|

Segments Covered

|

|

|

Countries Covered

|

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America

|

|

Key Market Players

|

BASF (Germany), NatureWorks LLC (U.S.), TotalEnergies (Netherlands), Novamont S.p.A. (Italy), FkuR (Germany), DuPont (U.S.), Biome Bioplastics (U.K.), Mitsubishi Chemical Group Corporation (Japan), TORAY INDUSTRIES, INC. (Japan), Dow (U.S.), Plantic (Australia), Hubei Tianan Hongtai Biotechnology Co., Ltd. (China), Danimer Scientific (U.S.), Evonik Industries AG (Germany), Eastman Chemical Company (U.S.), DAIKIN INDUSTRIES, Ltd. (Japan), and Solvay (Belgium)

|

|

Market Opportunities

|

|

|

Value Added Data Infosets

|

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework.

|

Biodegradable Plastics Market Definition

Biodegradable plastics are a type of plastic that can break down into natural substances, such as water, carbon dioxide, and biomass, through the action of microorganisms, enzymes, or other biological processes. Biodegradable plastics are designed to decompose more quickly, typically within a few months to a few years, depending on environmental conditions. Their ability to reduce environmental impact makes them a more sustainable alternative to traditional petroleum-based plastics.

Biodegradable Plastics Market Dynamics

Drivers

- Growing Consumer Awareness of Sustainability

The growing consumer awareness of sustainability and eco-friendly products is significantly propelling the market for biodegradable plastics, particularly among environmentally conscious buyers. Companies across various industries are increasingly prioritizing sustainable practices and incorporating biodegradable materials into their product offerings. Prominent brands such as Coca-Cola and McDonald’s have committed to reducing plastic waste and have begun exploring biodegradable packaging options, further illustrating the impact of consumer demand on the growth of the biodegradable plastics market. This heightened awareness encourages manufacturers to innovate and drives regulatory changes, as governments respond to the call for more sustainable product solutions, thereby driving the market for future growth.

- Rising Demand for Biodegradable Plastics

The rising demand for biodegradable plastics in the packaging sector is significantly driven by growing consumer awareness regarding environmental sustainability and the detrimental effects of conventional plastic waste. Retailers and food brands are actively seeking sustainable packaging solutions to meet regulatory pressures and consumer expectations for eco-friendly products. For instance, major companies such as Unilever and Nestlé have committed to using biodegradable or recyclable materials in their packaging by 2025, further emphasizing the shift toward biodegradable plastics. Such trend aligns with corporate sustainability goals and addresses the increasing scrutiny from consumers who prefer brands that prioritize environmental responsibility, thereby driving higher demand in both the food packaging and retail sectors.

Opportunities

- Increasing Regulatory Support

Regulatory support for biodegradable plastics is emerging as a significant market opportunity, as governments globally are enacting regulations aimed at reducing plastic waste and promoting sustainable materials. For instance, the European Union has introduced the Single-Use Plastics Directive, which targets specific plastic products and encourages the use of alternatives, including biodegradable plastics. Such directive compels manufacturers to transition to eco-friendly materials, thus creating a favorable environment for the growth of biodegradable plastics. Similarly, countries such as Canada and various states in the U.S. are adopting legislation to limit single-use plastics and promote biodegradable options, driving demand for innovative solutions. As regulatory frameworks continue to evolve, manufacturers of biodegradable plastics stand to benefit from increased sales opportunities, as companies and consumers seek compliant, sustainable alternatives that align with environmental goals.

- Growing Innovative Products Development

Innovative product development in biodegradable plastics represents a significant market opportunity as advancements in technology enable the creation of new materials with enhanced properties tailored for various applications. For instance, researchers at universities and companies are exploring the use of new biopolymers and composite materials that offer improved strength, flexibility, and durability compared to traditional biodegradable options. This includes the development of polylactic acid (PLA) reinforced with natural fibers, which enhances mechanical properties while remaining environmentally friendly. Such innovations cater to diverse applications ranging from packaging and agriculture to consumer goods and automotive parts. As manufacturers respond to the demand for high-performance biodegradable plastics, they can tap into niche markets and meet the needs of environmentally conscious consumers, ultimately creating opportunities in the biodegradable plastics market.

Restraints/Challenges

- High Production Costs

High production costs are a significant challenge for the biodegradable plastics market, as the manufacturing process often involves utilizing more expensive raw materials, such as starch, polylactic acid (PLA), or polyhydroxyalkanoates (PHA), which can significantly increase overall expenses. For instance, while conventional petroleum-based plastics can be produced at a lower cost due to established supply chains and economies of scale, biodegradable alternatives such as PLA require advanced fermentation and polymerization processes, driving up production costs. This economic disadvantage can deter small and medium-sized enterprises from entering the biodegradable plastics market, particularly when they are competing against large corporations that produce traditional plastics at scale. Consequently, the higher price point of biodegradable plastics can limit the overall growth of the market.

- Issues Related to Intellectual Property (IP)

Intellectual property (IP) issues pose significant challenges for companies in the biodegradable plastics sector, as the competitive landscape often revolves around proprietary technologies and patented processes. These legal barriers can hinder innovation, as companies may be reluctant to share knowledge or collaborate on research and development projects due to concerns over potential patent infringements. For instance, if a small start-up develops a novel biodegradable plastic formulation but finds itself facing litigation from a larger company claiming patent rights, the start-up may struggle to secure funding or partnerships necessary for scaling its operations. This reluctance can stifle the overall advancement of biodegradable plastics technology, limiting the introduction of new, more effective materials into the market.

Impact and Current Market Scenario of Raw Material Shortage and Shipping Delays

Data Bridge Market Research offers a high-level analysis of the market and delivers information by keeping in account the impact and current market environment of raw material shortage and shipping delays. This translates into assessing strategic possibilities, creating effective action plans, and assisting businesses in making important decisions. Apart from the standard report, we also offer in-depth analysis of the procurement level from forecasted shipping delays, distributor mapping by region, commodity analysis, production analysis, price mapping trends, sourcing, category performance analysis, supply chain risk management solutions, advanced benchmarking, and other services for procurement and strategic support.

Expected Impact of Economic Slowdown on the Pricing and Availability of Products

When economic activity slows, industries begin to suffer. The forecasted effects of the economic downturn on the pricing and accessibility of the products are taken into account in the market insight reports and intelligence services provided by DBMR. With this, our clients can typically keep one step ahead of their competitors, project their sales and revenue, and estimate their profit and loss expenditures.

Biodegradable Plastics Market Scope

The market is segmented on the basis of product type and application. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product Type

- Polylactic Acid (PLA)

- Starch Blends

- Biodegradable Polyesters

- PCH

- PBAT

- PBS

- Polyhydroxyalkanoates (PHA)

- Others

- Regenerative Cellulose

- Cellulose Derivative

Application

- Packaging and Bags

- Consumer Goods

- Electrical Appliances

- Domestic Appliances

- Others

- Agriculture and Horticulture

- Textile

- Medical & Healthcare Textile

- Personal care, clothes, and other textiles

- Agriculture & Horticulture

- Tapes & Mulch Films

- Others

- Others

Biodegradable Plastics Market Regional Analysis

The market is analysed and market size insights and trends are provided by country, product type and application as referenced above.

The countries covered in the market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

North America leads the market, primarily driven by the growing utilization of biodegradable plastics in the agriculture and food & beverage sectors. In particular, the production of plant pots from biodegradable materials is gaining traction in the agricultural and horticultural industries, reflecting a broader trend toward sustainable practices. In addition, the rising demand for eco-friendly packaging solutions further fuels the growth of biodegradable plastics, as consumers and businesses alike prioritize environmentally responsible options.

Asia-Pacific region is anticipated to experience significant growth from 2024 to 2031, driven by increasing consumer preference for biodegradable plastics. Conventional plastics pose a major environmental challenge as they are derived from petroleum, taking decades to decompose and often ending up in landfills. In contrast, biodegradable plastics break down rapidly and integrate back into the environment, prompting a surge in global demand for these eco-friendly alternatives. This shift in consumer behavior is a key factor propelling market growth in the biodegradable plastics sector.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Biodegradable Plastics Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Biodegradable Plastics Market Leaders Operating in the Market Are:

- BASF (Germany)

- NatureWorks LLC (U.S.)

- TotalEnergies (Netherlands)

- Novamont S.p.A. (Italy)

- FkuR (Germany)

- DuPont (U.S.)

- Biome Bioplastics (U.K.)

- Mitsubishi Chemical Group Corporation (Japan)

- TORAY INDUSTRIES, INC. (Japan)

- Dow (U.S.)

- Plantic (Australia)

- Hubei Tianan Hongtai Biotechnology Co., Ltd. (China)

- Danimer Scientific (U.S.)

- Evonik (Germany)

- Eastman Chemical Company (U.S.)

- DAIKIN INDUSTRIES, Ltd. (Japan)

- Solvay (Belgium)

Latest Developments in Biodegradable Plastics Market

- In March 2024, Beyond Plastic announced a partnership with CJ Biomaterials to manufacture a biodegradable plastic bottle cap. This cap is crafted from polyhydroxyalkanoate (PHA), a biopolymer sourced from natural materials, which improves the functional properties of traditional plastics while providing environmental benefit

- In February 2024, Balrampur Chini Mills Ltd made a significant investment of USD 267 million in bioplastics and plans to establish a PLA plant with an annual production capacity of 75,000 tons. This strategic move aligns with the company’s commitment to sustainability and positions it to capitalize on the growing demand for eco-friendly packaging solutions

- In October 2023, Versalis, a prominent Italian chemical manufacturing firm, acquired Novamont's biodegradable plastic business. This strategic move is expected to strengthen Versalis's product portfolio in the biodegradable plastics sector

- In May 2023, DuPont revealed its acquisition of Spectrum Plastics Group, a company specializing in the production of medical devices. This acquisition aims to bolster DuPont's existing portfolio in biopharmaceutical and pharmaceutical processing, as well as medical device and packaging products, thereby strengthening its presence in the medical sector

- In September 2021, BASF partnered with WPO Polymers to distribute the biopolymer ecovio for certified compostable bags in Spain and Portugal. This collaboration aligns with BASF's strategy for growth in the biopolymers business

SKU-