Global Biodegradable Paper Plastic Packaging Market

Market Size in USD Billion

CAGR :

%

USD

13.51 Billion

USD

28.27 Billion

2024

2032

USD

13.51 Billion

USD

28.27 Billion

2024

2032

| 2025 –2032 | |

| USD 13.51 Billion | |

| USD 28.27 Billion | |

|

|

|

|

Biodegradable Paper and Plastic Packaging Market Size

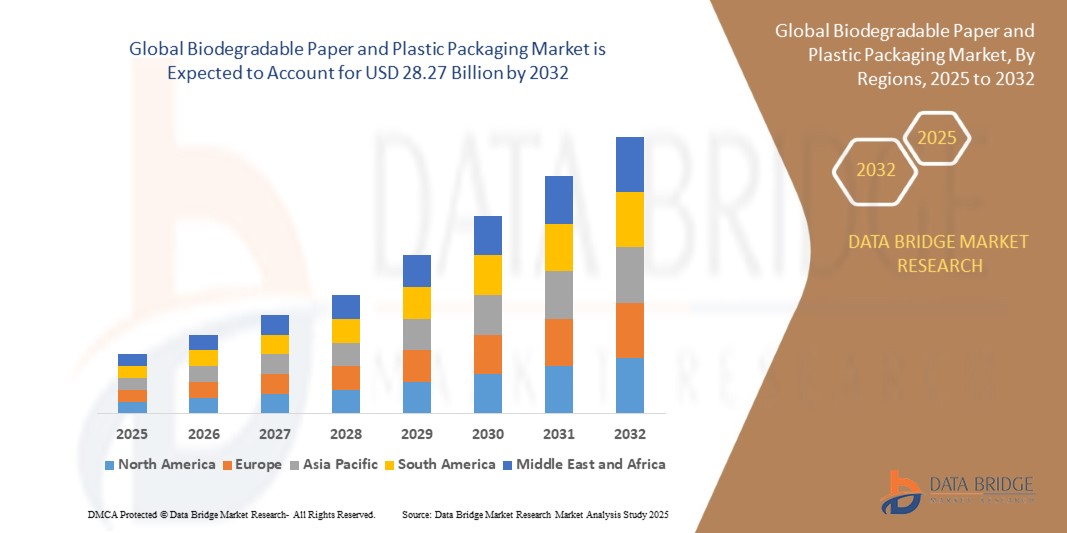

- The global biodegradable paper and plastic packaging market was valued at USD 13.51 billion in 2024 and is expected to reach USD 28.27 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 9.67%, primarily driven by increasing environmental concerns and government incentives

- This growth is fueled by factors such as the rising demand for sustainable packaging solutions, advancements in material technology, and the Asia-Pacific region's dominance, which accounts for over one-third of the market share

Biodegradable Paper and Plastic Packaging Market Analysis

- Biodegradable paper and plastic packaging plays a crucial role in sustainable packaging solutions, reducing environmental impact while meeting consumer and regulatory demands. These materials decompose naturally, minimizing pollution and waste accumulation

- The demand for biodegradable packaging is significantly driven by increasing environmental concerns, government regulations on single-use plastics, and a shift toward sustainable business practices. The food & beverage industry is a major contributor, with packaging solutions tailored for disposable cutlery, food containers, and wrapping materials

- The Europe region stands out as one of the dominant regions for biodegradable paper and plastic packaging, driven by stringent environmental policies and consumer awareness

- For instance, the European Union has implemented strict bans on single-use plastics and promotes eco-friendly alternatives, boosting demand for biodegradable packaging solutions. Leading manufacturers in the region continue to innovate with compostable materials and improved degradation technologies

- Globally, biodegradable paper and plastic packaging ranks among the fastest-growing segments in the packaging industry, following recyclable packaging materials. It plays a pivotal role in driving sustainability efforts across industries, ensuring compliance with evolving regulations while catering to environmentally conscious consumers

Report Scope and Biodegradable Paper and Plastic Packaging Market Segmentation

|

Attributes |

Biodegradable Paper and Plastic Packaging Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework |

Biodegradable Paper and Plastic Packaging Market Trends

“Rising Demand for Sustainable Packaging Solutions”

- One prominent trend in the global biodegradable paper and plastic packaging market is the increasing demand for eco-friendly and sustainable packaging alternatives

- These solutions address environmental concerns by reducing plastic waste and promoting the use of biodegradable materials like polylactic acid (PLA), polyhydroxyalkanoates (PHA), and starch-based plastics

- For instance, biodegradable plastics derived from cornstarch, sugarcane, and polylactic acid (PLA) are gaining traction as they offer similar durability to conventional plastics while being compostable and less harmful to the environment

- Governments worldwide are introducing incentives and regulations to encourage the adoption of biodegradable packaging, further driving market growth

- This trend is transforming the packaging industry, fostering innovation in material technology, and meeting consumer preferences for environmentally responsible products

Biodegradable Paper and Plastic Packaging Market Dynamics

Driver

“Growing Need for Sustainable Packaging Solutions”

- The increasing environmental concerns and the harmful effects of traditional plastic packaging are driving the demand for biodegradable paper and plastic packaging

- Governments and organizations worldwide are implementing stringent regulations to reduce plastic waste, further boosting the adoption of biodegradable alternatives

- Consumers are becoming more eco-conscious, preferring products with sustainable packaging, which is encouraging manufacturers to shift towards biodegradable materials

- Biodegradable packaging materials, such as polylactic acid (PLA), polyhydroxyalkanoates (PHA), and cellulose-based plastics, are gaining popularity due to their ability to decompose naturally without harming the environment

- The food and beverage industry, in particular, is a significant contributor to the growth of this market, as it seeks sustainable solutions to maintain product freshness and safety while reducing environmental impact

For instance,

- In 2022, the Asia-Pacific region dominated the biodegradable paper and plastic packaging market, capturing over one-third of the market share. This growth is attributed to government incentives, advancements in material technology, and increasing environmental awareness

- As a result of these factors, the global biodegradable paper and plastic packaging market is experiencing significant growth, driven by the need for sustainable and eco-friendly packaging solutions

Opportunity

“Revolutionizing Sustainable Packaging with Biodegradable Material Innovations”

- AI-driven material innovation can enhance the development of biodegradable paper and plastic packaging by optimizing material compositions, improving durability, and ensuring faster decomposition while maintaining product integrity

- AI algorithms can analyze environmental impact and optimize supply chains, helping manufacturers reduce waste, improve recyclability, and create more efficient, cost-effective biodegradable packaging solutions

- AI-powered quality control systems can assist in detecting defects, monitoring production efficiency, and ensuring consistency in biodegradable packaging materials, leading to higher consumer confidence and industry adoption

For instance,

- In February 2025, according to an article published in the Journal of Sustainable Materials, AI-driven biodegradable material testing has enabled researchers to develop new plant-based polymers that decompose 30% faster than traditional biodegradable plastics. These advancements are accelerating the adoption of eco-friendly packaging in the food and beverage industry

- In September 2023, according to an article published in the Environmental Packaging Journal, AI was instrumental in improving the performance of biodegradable coatings for paper packaging. By analyzing degradation rates and environmental interactions, AI-assisted research has led to coatings that enhance moisture resistance without compromising biodegradability

- The integration of AI in biodegradable packaging production can also lead to reduced manufacturing waste, enhanced efficiency, and a lower carbon footprint. By leveraging AI-driven material analysis, companies can develop stronger, more sustainable packaging while ensuring compliance with evolving global regulations

Restraint/Challenge

“High Production Costs Hindering Market Expansion”

- The high cost of producing biodegradable paper and plastic packaging poses a significant challenge for the market, particularly affecting the pricing and adoption rates among businesses, especially in price-sensitive regions

- Biodegradable packaging materials, while environmentally friendly, often require advanced manufacturing processes and raw materials that are more expensive than conventional plastics, leading to higher production costs

- This substantial financial barrier can deter small and medium-sized enterprises (SMEs) from adopting biodegradable alternatives, as the higher costs may not be feasible for businesses operating on tight margins

For instance,

- In October 2024, according to an article published by the Sustainable Packaging Research Institute, one of the main concerns surrounding the high cost of biodegradable packaging is its impact on market competitiveness. The higher price point compared to traditional plastic packaging limits widespread adoption, particularly in industries with tight cost constraints, such as food and beverage and e-commerce

- Consequently, such limitations can result in slower adoption of biodegradable packaging solutions, widening the gap between sustainability goals and practical implementation. This challenge ultimately hinders the overall market growth, as many businesses struggle to justify the switch to biodegradable alternatives without sufficient cost reductions or government incentives

Biodegradable Paper and Plastic Packaging Market Scope

The market is segmented on the basis of type, material, and end user.

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Material |

|

|

By End User |

|

Biodegradable Paper and Plastic Packaging Market Regional Analysis

“Europe is the Dominant Region in the Biodegradable Paper and Plastic Packaging Market”

- Europe is expected to dominate the biodegradable paper and plastic packaging market, driven by stringent environmental regulations, strong consumer demand for sustainable packaging, and government initiatives promoting eco-friendly alternatives

- The European Union holds a significant share due to strict bans on single-use plastics, rising awareness of plastic pollution, and increasing adoption of compostable and biodegradable materials in the food, beverage, and retail industries

- The presence of well-established sustainability policies and substantial investments in research & development by leading packaging manufacturers further strengthen the market

- In addition, the growing demand for eco-friendly packaging solutions, combined with corporate sustainability commitments and advancements in biodegradable material technology, is fueling market expansion across the region

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- The Asia-Pacific region is expected to witness the highest growth rate in the biodegradable paper and plastic packaging market, driven by rising environmental awareness, government regulations on plastic waste reduction, and increasing demand for sustainable packaging solutions

- Countries such as China, India, and Japan are emerging as key markets due to rapid industrialization, expanding e-commerce sectors, and growing consumer preference for eco-friendly packaging alternatives

- Japan, with its advanced packaging technology and strong commitment to sustainability, remains a crucial market for biodegradable packaging. The country continues to lead in the development and adoption of high-performance biodegradable materials to align with its environmental goals

- China and India, with their large populations and growing concerns about plastic pollution, are witnessing increased government and private sector investments in biodegradable packaging solutions. The expanding presence of global sustainable packaging manufacturers and improving accessibility to eco-friendly alternatives further contribute to market growth

Biodegradable Paper and Plastic Packaging Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Riverside Paper Co. Inc. (U.S.)

- SmartSolve Industries (U.S.)

- Özsoy Plastik (Turkey)

- Ultra Green Sustainable Packaging (U.S.)

- Hosgör Plastik (Turkey)

- Eurocell S.r.l (U.K.)

- Tetra Pak International SA (Switzerland)

- Kruger Inc. (Canada)

- Amcor PLC (Switzerland)

- Mondi (U.K.)

- International Paper Company (U.S.)

- Smurfit Kappa (U.S.)

- DS Smith (U.K.)

- Klabin SA (Brazil)

- Rengo Co. Ltd (Japan)

- WestRock Company (U.S.)

- Stora Enso (Sweden)

- Bemis Manufacturing Company (U.S.)

- Rocktenn (U.S.)

- BASF SE (Germany)

- Clearwater Paper Corporation (U.S.)

Latest Developments in Global Biodegradable Paper and Plastic Packaging Market

- In November 2024, BASF SE introduced its CircleCELL midsole technology, developed with Mount to Coast for ultrarunning footwear. This innovative midsole uses BASF's biomass-balanced ecoflex BMB biopolymer, ensuring both performance enhancement and sustainability by incorporating renewable feedstocks. It is reported to be 90% more durable than traditional materials like PEBA, while maintaining the same energy return vital for high-performance running. This represents a notable leap in eco-conscious durability

- In November 2024, Toray Industries, Inc. signed a memorandum of understanding with PTT Global Chemical Public Company Limited (GC) to explore mass production technology for adipic acid derived from non-edible biomass. The collaboration aimed to evaluate the feasibility of this technology and its commercialization in Thailand and Japan, with the ambitious goal of producing several thousand metric tons of bio-based muconic and adipic acid annually by 2030. This initiative represents a significant step toward sustainable chemical production

- In September 2024, Danimer Scientific and Ningbo Homelink Eco-iTech announced the commercial launch of Nodax, a home compostable extrusion coating biopolymer based on polyhydroxyalkanoate (PHA). This innovative material serves as a liquid barrier for paper cups, offering a sustainable alternative to traditional polyethylene coatings

- In April 2024, NatureWorks LLC partnered with IMA Coffee to launch a turn-key compostable coffee pod solution compatible with Keurig brewers in the North American market. This collaboration, initiated in April 2021, combines NatureWorks' expertise in Ingeo PLA biopolymer with IMA Coffee's proficiency in coffee processing and packaging technologies. The partnership aims to simplify the supply chain for coffee brands, offering sustainable packaging solutions that preserve the taste and aroma of coffee

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Biodegradable Paper Plastic Packaging Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Biodegradable Paper Plastic Packaging Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Biodegradable Paper Plastic Packaging Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.