Global Bioanalytical Testing Services Market

Market Size in USD Billion

CAGR :

%

USD

3.64 Billion

USD

9.88 Billion

2021

2029

USD

3.64 Billion

USD

9.88 Billion

2021

2029

| 2022 –2029 | |

| USD 3.64 Billion | |

| USD 9.88 Billion | |

|

|

|

|

Bioanalytical Testing Services Market Analysis and Size

Bioanalytical testing devices are used to ordain metabolites and drugs present in biological metrices. For instance, fluids, primary blood, plasma, tissue extracts, serum or urine. It is also an analytical method to analysis biological products. A bioanalytical program's operations include sample preparation, bioanalytical technique development, validation, and ensuring quantitative results with accuracy, selectivity, precision, and stability. Sample preparation includes cleaning the test sample before beginning analysis and concentrating the sample for better detection.

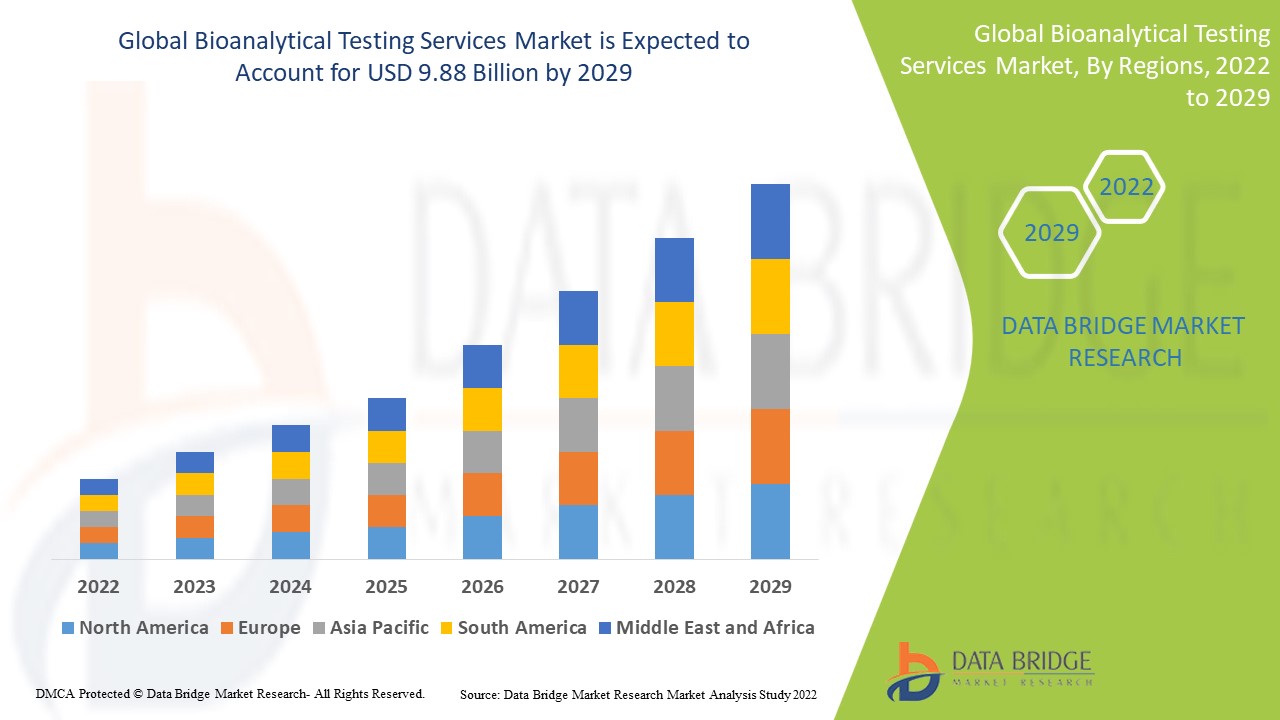

Data Bridge Market Research analyses that the bioanalytical testing services market which was USD 3.64 billion in 2021, is expected to reach USD 9.88 billion by 2029, at a CAGR of 13.30% during the forecast period 2022 to 2029. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

Bioanalytical Testing Services Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2014 - 2019) |

|

Quantitative Units |

Revenue in USD Billion, Volumes in Units, Pricing in USD |

|

Segments Covered |

Test Type (ADME, Pharmacokinetic Test, Pharmacodynamic Test, Bioequivalence Test, Bioavailability Test, other Test), Molecule Type (Small Molecule, Large Molecule), Type (Cell-Based Assays, Virology Testing, Method Development Optimization and Validation, Serology, Immunogenicity, and Neutralizing Antibodies, Biomarker Testing; Pharmacokinetic Testing, Others), Application (Oncology, Neurology, Infectious Diseases, Gastroenterology, Cardiology, Other Applications), Workflow (Sample Analysis, Sample Preparation), End User (Pharmaceutical and Biopharmaceutical Companies, Contract Development and Manufacturing Organizations; Contract Research Organizations) |

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America. |

|

Market Players Covered |

Charles River Laboratories (U.S.), Medpace (U.S.), WuXi AppTec (China), Eurofins Scientific (Luxembourg), IQVIA (U.S.), SGS Société Générale de Surveillance SA (Switzerland), Intertek Group plc (U.K.), Syneos Health. (U.K.), ICON plc (Ireland), PPD Inc. (U.S.), Parexel International Corporation. (U.S.), Almac Group (U.K.), Altasciences. (Canada), BioAgilytix Labs. (U.S.), LGC Limited (U.K.) |

|

Market Opportunities |

|

Market Definition

Bioanalytical testing services are used to quantify drug concentrations, metabolites, and pharmacodynamic biomarkers in biological fluids. These services include method validation to ensure results that demonstrate accuracy, precision, selectivity, and stability as well as sample analysis results that are accurate.

Global Bioanalytical Testing Services Market Dynamics

Drivers

- Increased number of laboratory outsourcing service

Outsourcing bioanalytical services is becoming increasingly popular in order to maximise resource utilisation. While dedicated in-house laboratories have cutting-edge equipment, they may be incapable of handling complex bioanalytical testing. Furthermore, on a strategic level, running in-house laboratories can be costly. Outsourcing the lab role reduces overhead and operational costs, allowing businesses to continue to benefit from such lab services. Lab outsourcing helps businesses and other institutions make money by allowing them to trade higher fixed costs for lower variable costs, reducing the need for capital investment in the company and providing instant access to world-class analytical expertise and capabilities on short notice. The above mentioned factors are driving market growth significantly.

- Rise in the R&D expenditure in the pharmaceutical and biopharmaceutical industry

The pharmaceutical industry spent a total of 136 billion dollars in 2012. In 2019, it spent 186 billion dollars on research and development. According to PhRMA, research and development (R&D) investment by PhRMA member companies totaled 83 billion US dollars in 2019, making the biopharmaceutical industry the most R&D-intensive industry in the US economy. In fact, the biopharmaceutical industry invests six times as much in research and development as all other manufacturing sectors combined. Over the last few decades, PhRMA member companies have invested nearly USD 1 trillion in the discovery and development of new and improved drugs and cures. Usually during the pre-clinical phase, the regulatory authority is involved in the process to oversee, control, and eventually authorise the drugs. Major advances in pharmaceutical research and development have begun to alter the R&D landscape in recent years.

Opportunities

- Rising demand of biosimilar

The increased expiration of patents has resulted in the emergence of biosimilar. Even though biosimilar are similar to their original drug in chemical composition and other aspects, these drugs must go through several stages of drug development to prove their safety and efficacy. The number of biosimilar in the pipeline has increased by more than 200% since 2013; there are now more than 1,050 biosimilar in various stages of development.

Restraints/Challenges

- Lack of dearth of skilled professionals

There is an increase in demand worldwide for qualified healthcare professionals. Approximately 80 million healthcare workers would be required worldwide by 2030, according to an estimate that was published in the journal Human Resources for Health in 2016. However, it is anticipated that only 65 million healthcare professionals will be available by 2020, leaving a 15 million global shortage. Despite the fact that there should be 23 qualified professionals for every 10,000 people, 83 nations still fall short of the goal. In 2012, 6.6 million children under the age of five lost their lives. Diseases that could have been prevented or cured were to blame for the majority of fatalities.

This bioanalytical testing services market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the bioanalytical testing services market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

COVID-19 Impact on the Bioanalytical Testing Services Market

The COVID-19 pandemic had a significant impact on the global economy, as well as business operations. The high infection rates and negative impact on public health systems, several countries were forced to implement nationwide lockdowns, which had a significant impact on industrial supply chains, trade, and related services. COVID-19 also caused a drop in the market for global bioanalytical testing services. Furthermore, limited clinic access, combined with social distancing norms and complete lockdown declared by several countries, resulted in a slowdown in patient flow and referral, affecting market growth. Cancer screenings dropped dramatically during the COVID-19 epidemic. Cervical cancer screenings decreased by 68% in the first 15 weeks of 2020 in the United States, while breast cancer screenings increased.

COVID-19 pandemic has presented the bioanalytical community with new challenges. One year later, the pandemic's impact on business practises, supply chains, timelines, and project prioritisation is still being felt throughout the industry. Laboratories have modified their day-to-day lab operations and clinical trial procedures because of travel and personnel constraints. Supply chains have been disrupted, resulting in decreased availability of lab consumables, reagents, personal protective equipment (PPE), and biological matrices. COVID-19 clinical trials have more diverse analytical needs than traditional therapeutic candidates, as each therapeutic may require pharmacokinetic, immunogenicity, biomarker, SARS-CoV-2 antigen, and serological testing.

Recent Developments

- In January 2021, Eurofin's bioanalytical services division announced the launch of a surrogate virus neutralisation antibody assay against the COVID-19 virus. This is the first neutralising antibody serology test for SARS-CoV-2 virus that has been approved by the FDA as an Emergency Use Authorization (EUA). As a result of such innovative initiatives, the market is expected to grow significantly by 2020. The market is also expected to grow profitably over the forecast period, owing to a significant increase in demand for such services following the pandemic.

- On February 17, 2021, Charles River Laboratories announced the acquisition of Cognate BioServices, a leading cell and gene therapy contract development and manufacturing organisation (CDMO), and Cobra Biologics, its gene therapy division. Charles River will be established as a leading scientific partner for cell and gene therapy development, testing, and manufacturing, providing clients with an integrated solution from early research and discovery to CGMP production.

Global Bioanalytical Testing Services Market Scope

The bioanalytical testing services market is segmented on the basis of test type, molecule type, type, application, workflow and end user. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Test Type

- ADME

- In-Vivo

- In-Vitro

- Pharmacokinetic Test

- Pharmacodynamic Test

- Bioequivalence Test

- Bioavailability Test

- Other Test

Molecule Type

- Small Molecule

- Large Molecule

- LC-MS Studies

- Immunoassays

- PK

- ADA

- Others

- Others

Type

- Cell-Based Assays

- Virology Testing

- Method Development Optimization and Validation

- Serology

- Immunogenicity

- Neutralizing Antibodies

- Biomarker Testing

- Pharmacokinetic Testing

- Others

Application

- Oncology

- Neurology

- Infectious Diseases

- Gastroenterology

- Cardiology

- Other Applications

Workflow

- Sample Preparation

- Protein Precipitation

- Liquid-Liquid Extraction

- Solid Phase Extraction

- Sample Analysis

- Hyphenated technique

- Chromatographic technique

- Electrophoresis

- Ligand Binding Assay

- Mass Spectrometry

- Nuclear Magnetic Resonance

- Other Work Flow Processes

End User

- Pharmaceutical

- Biopharmaceutical Companies

- Contract Development

- Manufacturing Organizations

- Contract Research Organizations

Bioanalytical Testing Services Market Regional Analysis/Insights

The bioanalytical testing services market is analysed and market size insights and trends are provided by country, test type, molecule type, type, application, workflow and end user as referenced above.

The countries covered in the bioanalytical testing services market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

North America dominates the bioanalytical testing services market due to increasing demand for bioanalytical services, which is likely to drive market expansion in the region due to the volume of active research projects and clinical trials.

Asia-Pacific is expected to grow at the highest growth rate in the forecast period of 2022 to 2029 due to rise in the number of businesses using services, rise in investments by organizations providing bioanalytical testing services in the region, corporate and regulatory reforms.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Bioanalytical Testing Services Market Share Analysis

The bioanalytical testing services market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to bioanalytical testing services market.

Some of the major players operating in the bioanalytical testing services market are:

- Charles River Laboratories (U.S.)

- Medpace (U.S.)

- WuXi AppTec (China)

- Eurofins Scientific (Luxembourg)

- IQVIA (U.S.)

- SGS Société Générale de Surveillance SA (Switzerland)

- Intertek Group plc (U.K.)

- Syneos Health. (U.K.)

- ICON plc (Ireland)

- PPD Inc. (U.S.)

- Parexel International Corporation. (U.S.)

- Almac Group (U.K.)

- Altasciences. (Canada)

- BioAgilytix Labs. (U.S.)

- LGC Limited (U.K.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.