Global Bioactive Coating Devices Market

Market Size in USD Million

CAGR :

%

USD

365.94 Million

USD

723.83 Million

2024

2032

USD

365.94 Million

USD

723.83 Million

2024

2032

| 2025 –2032 | |

| USD 365.94 Million | |

| USD 723.83 Million | |

|

|

|

|

Bioactive Coating Devices Market Size

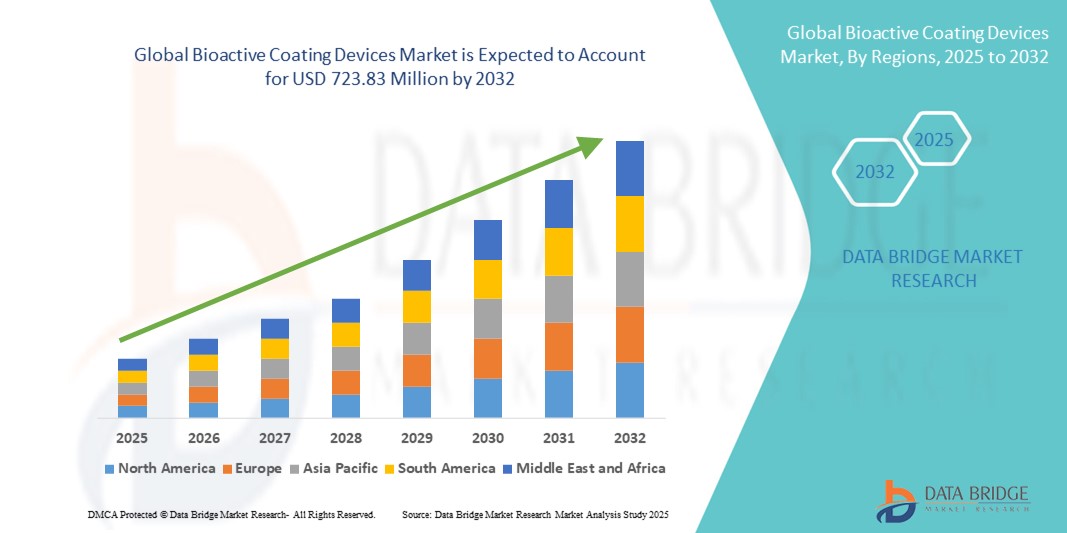

- The global bioactive coating devices market size was valued at USD 365.94 million in 2024 and is expected to reach USD 723.83 million by 2032, at a CAGR of 8.90% during the forecast period

- The market growth is largely fueled by the increasing need for improved biocompatibility and osseointegration in implantable medical devices, particularly in orthopedic and dental applications.

- Furthermore, rising demand for advanced surface modification technologies to reduce infection risks and enhance device performance is positioning bioactive coatings as a critical component in next-generation medical implants. These converging factors are accelerating the adoption of bioactive coating solutions, thereby significantly boosting the industry's growth.

Bioactive Coating Devices Market Analysis

- Bioactive coating devices, enhancing implant surface functionality, are increasingly vital in modern medical procedures particularly in orthopedic, cardiovascular, and dental sectors due to their superior ability to improve biocompatibility, reduce infection, and support tissue integration

- The escalating demand for bioactive coatings is primarily fueled by the growing volume of implant surgeries, rising geriatric population, and increasing preference for advanced surface-modified implants that enhance patient outcomes and reduce complications

- North America dominated the bioactive coating devices market with the largest revenue share of 42.2% in 2024, driven by strong healthcare infrastructure, high adoption of advanced implant technologies, and significant investment in R&D, particularly in the U.S., which is witnessing rising demand for infection-resistant and drug-eluting implants

- Asia-Pacific is expected to be the fastest growing region in the bioactive coating devices market during the forecast period due to expanding healthcare access, rapid urbanization, and increased investments in surgical infrastructure and local medical device manufacturing

- Anti-Microbial Coatings segment dominated the bioactive coating devices market with a market share of 39% in 2024, due to growing concerns over implant-associated infections and increasing usage across stents, catheters, and orthopedic implants

Report Scope and Bioactive Coating Devices Market Segmentation

|

Attributes |

Bioactive Coating Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Bioactive Coating Devices Market Trends

“Technological Advancements in Functional Surface Coatings”

- A significant and accelerating trend in the global bioactive coating devices market is the integration of multifunctional properties into coating technologies such as antimicrobial resistance, drug-eluting capabilities, and tissue regeneration support aimed at enhancing implant safety and performance

- For instance, companies such as SurModics and BioInteractions are developing next-generation coatings that combine antibacterial properties with drug delivery systems, reducing post-surgical complications and improving healing outcomes. Similarly, DSM Biomedical is advancing hydrogel-based bioactive coatings that facilitate tissue integration and minimize immune response

- Innovations in material science, such as nanostructured and hybrid bioactive coatings, enable improved adhesion, controlled drug release, and long-term implant stability. These materials are designed to interact positively with biological systems, promoting osteointegration in orthopedic devices and endothelialization in vascular implants

- The trend toward personalized and precision medicine is driving demand for coatings tailored to specific clinical needs, such as coating surfaces that release anti-inflammatory drugs or promote faster bone growth. AI-based modeling and simulation tools are also being adopted in R&D processes to predict coating behavior and optimize functionality

- The increasing integration of bioactive coatings into both permanent and temporary medical implants, including stents, catheters, and surgical instruments, is reshaping expectations in implantable device design. This has led to collaborative innovations between device manufacturers and material science firms to develop coatings that enhance clinical outcomes

- The demand for multifunctional, safe, and biocompatible coatings is growing rapidly across both developed and emerging healthcare markets, as hospitals and surgeons increasingly prioritize patient outcomes, infection control, and long-term implant performance

Bioactive Coating Devices Market Dynamics

Driver

“Rising Implantation Rates and Infection Prevention Demand”

- The increasing number of implant surgeries across orthopedic, cardiovascular, and dental fields driven by aging populations and chronic disease prevalence—is significantly propelling the demand for bioactive coating devices

- For instance, as per a 2024 report from the American Joint Replacement Registry, total knee and hip replacements have seen a consistent rise, increasing the need for advanced coatings that promote bone integration and reduce revision surgeries. Such trends reflect the growing reliance on coated implants for long-term success

- Bioactive coatings enhance implant efficacy by preventing bacterial colonization, promoting tissue bonding, and enabling localized drug delivery, which improves recovery and reduces complications. These benefits are driving their adoption in high-risk surgical environments

- Furthermore, regulatory encouragement for infection prevention in medical devices, along with a global push for improving patient outcomes, has led manufacturers to invest in coating technologies. Collaborations between medical device OEMs and biotech companies are also accelerating the commercialization of novel coating solutions

- Increased demand for minimally invasive procedures and technologically advanced implants across hospitals and ambulatory surgical centers further fuels the market growth for bioactive coating devices

Restraint/Challenge

“Biocompatibility Issues and Regulatory Barriers”

- Despite their advantages, bioactive coatings face challenges related to biocompatibility, long-term safety, and consistency in clinical performance. Variability in patient responses to certain materials or drug combinations can lead to complications or regulatory delays

- For instance, metal ion leaching or delayed tissue response associated with some coatings has raised concerns, necessitating extensive biocompatibility testing and post-market surveillance. In addition, long development cycles and stringent regulatory requirements can delay market entry, especially for drug-eluting or multifunctional coatings

- Regulatory agencies such as the FDA and EMA require robust clinical evidence and risk-benefit analyses, which increases the cost and time involved in bringing new coated products to market. Smaller companies often face difficulty navigating these hurdles without strategic partnerships

- Furthermore, the high cost of bioactive coating technologies, particularly for multi-layer or nanostructured systems, can limit adoption in cost-sensitive markets or among healthcare facilities with limited budgets

- Overcoming these challenges through innovative biocompatible materials, standardization in testing, and collaborative development frameworks will be essential to achieving broader market penetration and sustained growth

Bioactive Coating Devices Market Scope

The market is segmented on the basis of product type, medical application, material, and end user.

- By Product Type

On the basis of product type, the bioactive coating devices market is segmented into hydrophilic coatings, anti-microbial coatings, drug eluting coatings, and others. The anti-microbial coatings segment dominated the market with the largest market revenue share of 39% in 2024, owing to the increasing need to prevent post-surgical infections in implantable medical devices. These coatings offer superior bacterial resistance, making them crucial in high-risk environments such as orthopedic and cardiovascular procedures. Widespread adoption in catheters, stents, and prosthetic devices continues to drive the dominance of this segment.

The drug eluting coatings segment is anticipated to witness the fastest growth rate from 2025 to 2032, due to advancements in localized drug delivery technologies. These coatings enable implants to release therapeutic agents over time, improving healing, reducing inflammation, and enhancing overall patient outcomes. Their growing use in cardiovascular and orthopedic implants is accelerating segmental growth.

- By Medical Application

On the basis of medical application, the market is segmented into stents, cardiac assist devices, electrosurgical tools, cochlear and ocular implants, mandrels and molds, catheters, elastomeric seals, needles and epidural probes, and medical electronics. The stents segment held the largest revenue share of 29.4% in 2024, attributed to the high global incidence of cardiovascular diseases and the critical role bioactive coatings play in preventing restenosis and thrombosis. Coated stents improve endothelialization and minimize complications, making them essential in modern interventional cardiology.

The catheters segment is expected to grow at the fastest CAGR during the forecast period due to rising adoption in hospital-acquired infection prevention. Coated catheters minimize microbial colonization and are widely used in urology and critical care.

- By Material

On the basis of material, the bioactive coating devices market is segmented into carbon-based materials, biological materials, polymers and synthetic, and metals and alloys. The metals and alloys segment dominated the market with a 36.2% revenue share in 2024, driven by their superior mechanical strength, durability, and compatibility with various coating technologies. Commonly used in orthopedic and dental implants, metal substrates coated with bioactive layers enhance osseointegration and long-term functionality.

The biological materials segment is projected to grow at the fastest rate due to increasing interest in naturally derived coatings, such as collagen or bioactive peptides, which provide excellent biocompatibility and are being explored for regenerative medicine applications.

- By End User

On the basis of end user, the global bioactive coating devices market is segmented into diagnostics centers, hospitals and clinics, and ambulatory surgical centers (ASCs). The hospitals and clinics segment dominated the market with a 53.6% share in 2024, owing to the high volume of surgical procedures and implant usage. These healthcare settings are early adopters of advanced coated devices that improve patient outcomes, reduce hospital stay durations, and align with infection control protocols.

The ambulatory surgical centers segment is expected to expand at the highest CAGR from 2025 to 2032, driven by the growing shift toward outpatient surgeries and minimally invasive procedures, where coated medical devices play a vital role in ensuring safety and efficiency.

Bioactive Coating Devices Market Regional Analysis

- North America dominated the bioactive coating devices market with the largest revenue share of 42.2% in 2024, driven by strong healthcare infrastructure, high adoption of advanced implant technologies, and significant investment in R&D, particularly in the U.S., which is witnessing rising demand for infection-resistant and drug-eluting implants

- The region’s strong healthcare infrastructure, coupled with substantial investments in R&D, has fostered the rapid adoption of bioactive coatings in orthopedic, cardiovascular, and dental applications.

- This widespread utilization is further supported by the presence of key market players, favorable regulatory frameworks, and increasing awareness among healthcare professionals about the benefits of bioactive-coated implants, positioning North America as a leading hub for innovation and market growth.

U.S. Bioactive Coating Devices Market Insight

The U.S. bioactive coating devices market captured the largest revenue share of 79% in 2024 within North America, driven by the growing volume of implant surgeries and increasing emphasis on infection control. The country's advanced healthcare infrastructure, along with a strong presence of leading medical device manufacturers, fosters innovation and adoption of next-generation coating technologies. The rising demand for orthopedic and cardiovascular implants with enhanced biocompatibility and antimicrobial properties continues to propel market growth. Regulatory support and increased R&D funding further reinforce the U.S. as a leading hub in this sector.

Europe Bioactive Coating Devices Market Insight

The Europe bioactive coating devices market is projected to expand at a substantial CAGR throughout the forecast period, primarily fueled by the region’s aging population and rising demand for implantable devices. Stringent EU regulations for medical device safety and the push for reduced hospital-acquired infections are key drivers. The adoption of advanced coatings in orthopedic, dental, and vascular implants is rising across countries such as Germany, France, and the Netherlands. Growing collaboration between academic research institutions and medical technology companies further accelerates product innovation and commercialization in the region.

U.K. Bioactive Coating Devices Market Insight

The U.K. bioactive coating devices market is anticipated to grow at a noteworthy CAGR during the forecast period, supported by a robust public healthcare system and strong demand for infection-resistant implantable devices. With a rising number of orthopedic and cardiovascular procedures, hospitals and surgical centers are increasingly adopting coated implants to improve patient outcomes. The U.K.'s active role in medical research and regulatory alignment with European standards contributes to faster adoption of advanced biocompatible materials in surgical applications.

Germany Bioactive Coating Devices Market Insight

The Germany bioactive coating devices market is expected to expand at a considerable CAGR during the forecast period, driven by the country’s leadership in medical engineering, implant manufacturing, and clinical innovation. Germany’s emphasis on healthcare efficiency and infection control is fostering high adoption of bioactive coatings, particularly in orthopedic and dental procedures. Local manufacturers’ focus on precision technology and material science advancements further strengthens the country’s position in Europe’s coated implant segment.

Asia-Pacific Bioactive Coating Devices Market Insight

The Asia-Pacific bioactive coating devices market is poised to grow at the fastest CAGR of 23.5% during 2025 to 2032, driven by rising healthcare investments, an increasing elderly population, and expanding surgical volumes in countries such as China, India, and Japan. The region’s transition toward advanced medical infrastructure and heightened awareness of post-surgical infection prevention are fueling demand. Government-backed digital healthcare initiatives and growing domestic production of coated implants are further expanding market accessibility across urban and semi-urban areas.

Japan Bioactive Coating Devices Market Insight

The Japan bioactive coating devices market is gaining momentum due to its high technological standards and a strong focus on healthcare quality. Japan’s aging demographic and increasing rates of joint replacement and cardiovascular surgeries are key factors driving demand for bioactive coatings. Integration of coatings in minimally invasive devices, along with local innovations in biomaterials, supports widespread market adoption. The country’s stringent regulatory standards also ensure high-quality, safe implantable devices.

India Bioactive Coating Devices Market Insight

The India bioactive coating devices market accounted for the largest market revenue share in Asia-Pacific in 2024, fueled by its expanding healthcare infrastructure and rapid growth in implant-based procedures. The rise of domestic manufacturing, combined with initiatives such as “Make in India” and smart city development, is supporting demand for cost-effective, high-performance coated medical devices. Increased awareness about infection prevention and the growing private hospital sector are key contributors to market growth in India’s metropolitan and tier-2 cities.

Bioactive Coating Devices Market Share

The bioactive coating devices industry is primarily led by well-established companies, including:

- Surmodics, Inc. (U.S.)

- DSM Biomedical (Netherlands)

- Hydromer, Inc. (U.S.)

- Biocoat, Inc. (U.S.)

- Covalon Technologies Ltd. (Canada)

- Materion Corporation (U.S.)

- Harland Medical Systems, Inc. (U.S.)

- PAXXUS, Inc. (U.S.)

- AST Products, Inc. (U.S.)

- Nanova Biomaterials, Inc. (U.S.)

- Hemoteq AG (Germany)

- Sono-Tek Corporation (U.S.)

- Aculon, Inc. (U.S.)

- DAIKIN Industries, Ltd. (Japan)

- Precision Coating Co., Inc. (U.S.)

- Eurocoating S.p.A. (Italy)

- Buhler AG (Switzerland)

- Allvivo Vascular, Inc. (U.S.)

- Apar Industries Ltd. (India)

- Harro Höfliger Verpackungsmaschinen GmbH (Germany)

What are the Recent Developments in Global Bioactive Coating Devices Market?

- In May 2024, Surmodics, Inc., a leader in surface modification technologies, announced the commercial launch of its next-generation hydrophilic and antimicrobial coating platform for cardiovascular and neurovascular devices. This advanced coating is engineered to significantly reduce thrombus formation and microbial adhesion, improving patient outcomes and device safety. The launch highlights Surmodics' commitment to innovation in bioactive coatings and its continued support for OEMs developing high-performance medical devices

- In April 2024, Biocoat, Inc. expanded its ISO Class 7 cleanroom manufacturing capabilities at its Horsham, Pennsylvania facility to meet growing demand for customizable bioactive and lubricious coatings. The expansion is aimed at increasing production scalability and quality control for interventional devices, such as catheters and guidewires. This move reinforces Biocoat’s strategic growth and dedication to supporting its partners in delivering safer, more efficient medical solutions

- In March 2024, DSM Biomedical, a global biomaterials leader, announced a partnership with a European orthopedic implant manufacturer to co-develop drug-eluting bioactive coatings for bone implants. The goal of the collaboration is to reduce post-operative infections and enhance bone regeneration, leveraging DSM’s proprietary coating technology. This development underscores the increasing role of strategic partnerships in accelerating innovation and clinical impact in implantable device coatings

- In February 2024, Hydromer, Inc. introduced a new antimicrobial and thromboresistant bioactive coating specifically designed for use in long-term vascular access devices. The new formulation aims to extend device longevity while minimizing complications such as bloodstream infections. The innovation reflects Hydromer’s focus on addressing critical challenges in patient safety through surface engineering solutions tailored for high-risk medical applications

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.