Global Bio Sensors Technology Market

Market Size in USD Billion

CAGR :

%

USD

26.40 Billion

USD

45.70 Billion

2024

2032

USD

26.40 Billion

USD

45.70 Billion

2024

2032

| 2025 –2032 | |

| USD 26.40 Billion | |

| USD 45.70 Billion | |

|

|

|

|

Bio Sensors Technology Market Analysis

The biosensors technology market has been significantly impacted by advancements in various fields, including nanotechnology, microelectronics, and wireless communication. One of the latest methods is the integration of wearable biosensors, such as smartwatches and patches, that continuously monitor vital signs, blood glucose levels, or hydration status in real-time. These devices use nanomaterials such as carbon nanotubes or graphene to enhance sensitivity and accuracy while maintaining portability and comfort. In addition, the introduction of point-of-care biosensors, which allow for quick and accurate diagnostics in remote settings, has expanded the market's potential.

The growth of the biosensors technology market is driven by the increasing demand for health monitoring devices, personalized medicine, and early disease detection. The integration of artificial intelligence (AI) with biosensors has opened new possibilities for predictive health analytics and automated diagnostics. In sectors such as food safety and environmental monitoring, biosensors are gaining traction for their ability to detect contaminants in real time. As healthcare becomes more proactive and personalized, the biosensor technology market is expected to experience substantial growth, particularly in healthcare, fitness, and environmental applications.

Bio Sensors Technology Market Size

The global bio sensors technology market size was valued at USD 26.40 billion in 2024 and is projected to reach USD 45.70 billion by 2032, with a CAGR of 7.1% during the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand.

Bio Sensors Technology Market Trends

“Integration of Wearable Biosensors in Healthcare”

A significant trend driving growth in the biosensors technology market is the integration of wearable biosensors in healthcare applications. These devices monitor vital health metrics in real-time, such as heart rate, blood oxygen levels, and glucose concentration, providing continuous health monitoring. For instance, the use of wearable glucose biosensors for diabetes management is becoming increasingly popular. Companies such as Dexcom and Abbott have developed advanced continuous glucose monitoring (CGM) systems, which are transforming diabetes care by providing real-time, actionable data. As healthcare moves towards more personalized, data-driven solutions, the demand for wearable biosensors is expected to rise, offering both convenience and improved patient outcomes.

Report Scope and Bio Sensors Technology Market Segmentation

|

Attributes |

Bio Sensors Technology Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Key Market Players |

Abbott (U.S.), Johnson & Johnson Services, Inc. (U.S.), Medtronic (Ireland), DuPont (U.S.), Bio-Rad Laboratories, Inc. (U.S.), Universal Biosensors (Australia), Sysmex Corporation (Japan), Nova Biomedical (U.S.), ACON Laboratories, Inc. (U.S.), General Electric (U.S.), Danaher (U.S.), Drägerwerk AG & Co. KGaA (Germany), Ercon Inc. (U.S.), Xsensio (Switzerland), Analog Devices, Inc. (U.S.), Animas LLC (U.S.),LifeSensors (U.S.), Siemens (Germany), F. Hoffmann-La Roche Ltd (Switzerland), i-SENS, Inc. (South Korea), and TaiDoc Technology Corporation (Taiwan) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Bio Sensors Technology Market Definition

Biosensors technology involves devices that detect biological or chemical reactions by converting a biological response into an electrical signal. These sensors typically consist of a biological element (such as enzymes, antibodies, or microorganisms) and a transducer that amplifies the signal. Used widely in healthcare, environmental monitoring, and food safety, biosensors can track glucose levels, detect pathogens, or measure contaminants in water. Recent advancements focus on enhancing sensitivity, miniaturization, and real-time data monitoring. The technology also integrates with wearable devices, enabling continuous health monitoring and improving personalized medicine by providing faster and more accurate results for diagnostics and treatment.

Bio Sensors Technology Market Dynamics

Drivers

- Rising Demand for Non-invasive Testing

The growing preference for non-invasive or minimally invasive testing in medical and research fields is a significant driver for the biosensors market. Biosensors provide painless, real-time monitoring of biomarkers, reducing patient discomfort and improving compliance. For instance, glucose monitoring in diabetic patients has seen a shift from traditional blood sampling to non-invasive biosensor devices, such as wearable patches that measure glucose levels through sweat or interstitial fluid. This trend is expanding beyond glucose monitoring, with biosensors being developed for tracking vital signs such as heart rate, oxygen levels, and even stress indicators. The increasing demand for convenient, pain-free testing across healthcare systems supports the biosensors technology market’s growth.

- Rising Miniaturization of Biosensors

The miniaturization of biosensors is a key driver in the market, making these devices more portable, cost-effective, and user-friendly. As sensors become smaller, they can be seamlessly integrated into wearable devices, smartphones, and other personal healthcare tools, enhancing accessibility for both healthcare professionals and consumers. This trend has expanded the potential applications of biosensors, ranging from continuous glucose monitoring to heart rate and blood pressure tracking. The reduction in size without compromising functionality allows for more efficient, real-time health monitoring, ultimately improving patient care. As biosensors become more affordable and versatile, they open up opportunities for broader adoption in healthcare, environmental monitoring, and even consumer health applications.

Opportunities

- Increasing Incidence of Chronic Diseases

The rising prevalence of chronic diseases, particularly diabetes and heart disease, presents a significant opportunity for the biosensors technology market. As these conditions require continuous monitoring to manage symptoms and prevent complications, there is a growing demand for reliable and non-invasive biosensors. These devices enable real-time tracking of vital signs, such as glucose levels and heart rate, empowering patients and healthcare providers with timely data. As the global incidence of chronic diseases continues to rise, the need for advanced, user-friendly biosensors in both clinical and home settings will expand, driving market growth and fostering innovation in biosensor technology.

- Advancements in Wearable Technology

The growing popularity of wearable devices, such as fitness trackers and smartwatches, has created significant opportunities for the biosensors market. These devices are increasingly capable of tracking vital signs such as glucose, heart rate, and blood pressure, and there is a rising demand for biosensors that can provide accurate, real-time data. As wearable technology evolves, biosensors must integrate seamlessly with these devices to ensure precise monitoring. This presents opportunities for innovation in sensor sensitivity, miniaturization, and energy efficiency, fostering market growth. In addition, the demand for continuous health monitoring in both medical and consumer markets will drive the development of advanced biosensor technologies.

Restraints/Challenges

- High Cost of Development

The high cost of development in the biosensors technology market is a significant restraint. Creating advanced biosensors requires specialized materials, complex designs, and extensive testing to ensure accuracy and reliability. This process demands substantial investment, making it difficult for small and medium enterprises (SMEs) to compete. As a result, the affordability and accessibility of biosensors are limited, restricting widespread adoption. The expense also discourages innovation and collaboration in the field, as smaller players struggle to enter or scale their operations. Furthermore, the long development cycles and high production costs make it challenging to meet the growing demand for cost-effective biosensor solutions, slowing market expansion.

- Issue in Integration and Scalability

Integrating biosensors into existing systems, particularly in medical and industrial applications, poses significant challenges. These sensors often require complex interfaces and protocols to seamlessly interact with current technologies, which can be time-consuming and costly. Furthermore, scaling up biosensor production while maintaining high accuracy and reliability proves difficult. As production volumes increase, ensuring consistent performance and cost-efficiency becomes more challenging. The need for specialized infrastructure and expertise to handle large-scale manufacturing adds to the complexity. These integration and scalability issues not only delay product deployment but also limit the widespread adoption of biosensors across various sectors, ultimately hindering the overall market growth.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Bio Sensors Technology Market Scope

The market is segmented on the basis of product type, product, type, application, and medical application. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product Type

- Sensor Patch

- Embedded Device

Product

- Wearable Biosensors

- Non-wearable Biosensors

Type

- Electrochemical Biosensors

- Optical Biosensors

- Piezoelectric Biosensors

- Thermal Biosensors

- Nanomechanical Biosensors

Application

- POC

- Home Diagnostics

- Research Labs

- Environmental Monitoring

- Food and Beverages

- Biodefense

Medical Application

- Blood Glucose Testing

- Cholesterol Testing

- Blood Gas Analysis

- Pregnancy Testing

- Drug Discovery

- Infectious Disease Testing

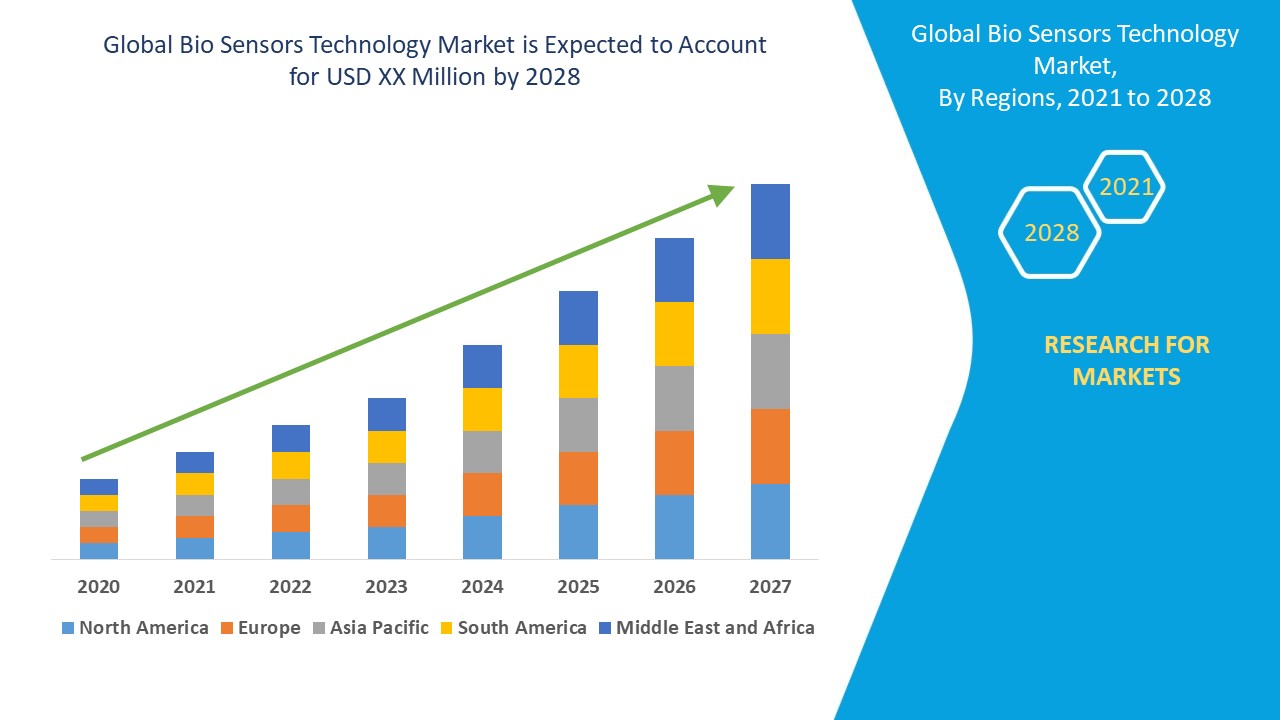

Bio Sensors Technology Market Regional Analysis

The market is analyzed and market size insights and trends are provided by product type, product, type, application, and medical application as referenced above.

The countries covered in the market report are U.S., Canada, Mexico in North America, Germany, Sweden, Poland, Denmark, Italy, U.K., France, Spain, Netherland, Belgium, Switzerland, Turkey, Russia, Rest of Europe in Europe, Japan, China, India, South Korea, New Zealand, Vietnam, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in Asia-Pacific (APAC), Brazil, Argentina, Rest of South America as a part of South America, U.A.E, Saudi Arabia, Oman, Qatar, Kuwait, South Africa, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA).

North America is expected to dominate the bio sensors technology market due to rising prevalence rate of targeted diseases and presence of key innovative players, increasing technological advancements such as the introduction of miniaturized diagnostic equipment rendering rapid and accurate results and rising market penetration of Electronic Medical Records (EMR) in this region.

Asia-Pacific is the expected region in terms of growth in bio sensors technology market due to increasing presence of high unmet medical needs pertaining to target disease, such as cancer, diabetes, and other infectious diseases, growing patient awareness levels, and constantly improving healthcare expenditure, increasing demand for point-of-care, home healthcare, other healthcare establishments catering to the adult population, and rising initiatives undertaken by governments to shorten hospital stays by establishing outpatient care models in this region.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Bio Sensors Technology Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Bio Sensors Technology Market Leaders Operating in the Market Are:

- Abbott (U.S.)

- Johnson & Johnson Services, Inc. (U.S.)

- Medtronic (Ireland)

- DuPont (U.S.)

- Bio-Rad Laboratories, Inc. (U.S.)

- Universal Biosensors (Australia)

- Sysmex Corporation (Japan)

- Nova Biomedical (U.S.)

- ACON Laboratories, Inc. (U.S.)

- General Electric (U.S.)

- Danaher (U.S.)

- Drägerwerk AG & Co. KGaA (Germany)

- Ercon Inc. (U.S.)

- Xsensio (Switzerland)

- Analog Devices, Inc. (U.S.)

- Animas LLC (U.S.)

- LifeSensors (U.S.)

- Siemens (Germany)

- F. Hoffmann-La Roche Ltd (Switzerland)

- i-SENS, Inc. (South Korea)

- TaiDoc Technology Corporation (Taiwan)

Latest Developments in Bio Sensors Technology Market

- In January 2021, Roche signed a Global Business Partnership Agreement (GBP) with Sysmex to enhance hematology testing solutions. The partnership aims to leverage IT systems, improving clinical decision-making and customer experience. This collaboration has evolved over time, continuously introducing hematology testing innovations to laboratories worldwide, fostering advancements in the healthcare sector

- In December 2020, Abbott launched its next-generation glucose monitoring technology, the FreeStyle Libre 2. Approved by Health Canada, this sensor-based device is designed for both adults and children (4 years and older) with diabetes. The technology offers real-time glucose monitoring, allowing patients to manage their condition more effectively and safely, enhancing diabetes care

- In December 2020, Bio-Rad Laboratories expanded its joint marketing agreement with Siemens Healthineers. Under the new terms, Bio-Rad will provide quality control products and Unity Quality Control data management solutions for Siemens Healthineers' Atellica Solution platforms. This expansion strengthens both companies' position in the clinical diagnostics market, enhancing quality assurance and data management across laboratories

- In November 2020, Medtronic introduced InPen, integrated with real-time Guardian Connect CGM data. This device is the first FDA-cleared smart insulin pen for patients on multiple daily injections (MDI). InPen provides accurate insulin dosing, helps manage blood sugar levels, and offers real-time feedback, revolutionizing diabetes management for individuals requiring consistent insulin therapy

- In October 2020, Bio-Rad Laboratories launched the CFX Opus 96 and CFX Opus 384 Real-time PCR Systems. These advanced systems, combined with BR.io—a cloud-based connectivity and data management platform—enhance laboratory efficiency in molecular biology research and diagnostics. The launch signifies Bio-Rad’s continued commitment to improving scientific research and clinical diagnostics with cutting-edge technology

- In September 2020, Medtronic received FDA approval for its MiniMed 770G hybrid closed-loop insulin pump system. The system incorporates SmartGuard technology, which enhances diabetes management by automatically adjusting insulin delivery. It features smartphone connectivity and caters to a broader age range, starting at 2 years old, offering greater convenience and control for diabetes patients

- In June 2020, Abbott and Tandem Diabetes Care finalized an agreement to combine Abbott’s continuous glucose monitoring (CGM) technology with Tandem’s insulin delivery systems. This collaboration aims to offer integrated diabetes solutions, enhancing patient care by providing more accurate, seamless monitoring and insulin delivery options. It promises to improve overall diabetes management for patients

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Bio Sensors Technology Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Bio Sensors Technology Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Bio Sensors Technology Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.