Global Bio Based Smart Materials For Food Packaging Market

Market Size in USD Million

CAGR :

%

USD

846.71 Million

USD

3,890.61 Million

2025

2033

USD

846.71 Million

USD

3,890.61 Million

2025

2033

| 2026 –2033 | |

| USD 846.71 Million | |

| USD 3,890.61 Million | |

|

|

|

|

What is the Global Bio-Based Smart Materials for Food Packaging Market Size and Growth Rate?

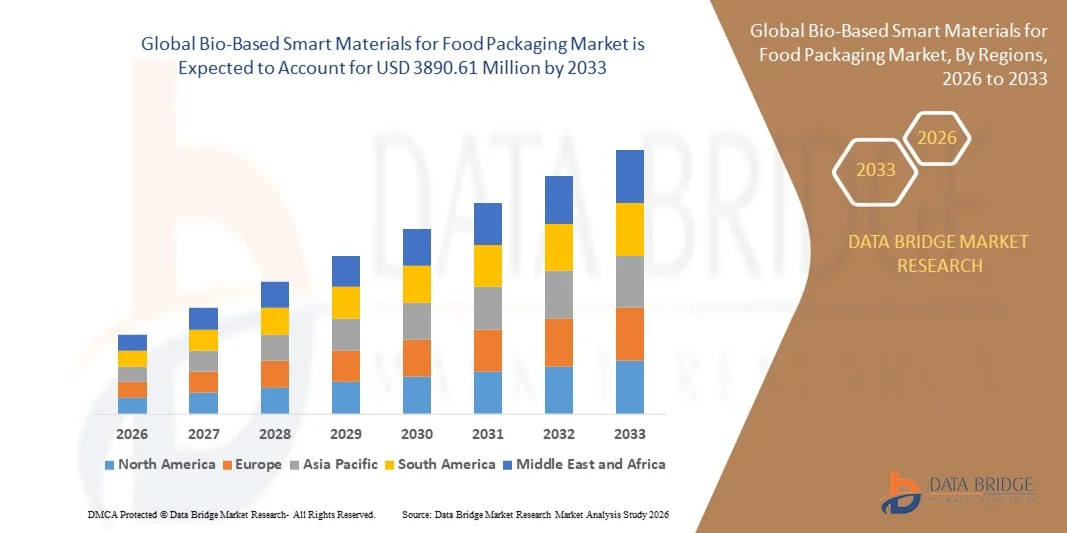

- The global bio-based smart materials for food packaging market size were valued at USD 846.71 million in 2025 and is expected to reach USD 3890.61 million by 2033, at a CAGR of 21.00% during the forecast period

- Major factors that are expected to boost the bio-based smart materials for food packaging market in the forecast period are busy lifestyles

- Furthermore, the rise in the need for food that is fresh, healthy, convenient, and increase in the urban populations and initiatives by the government towards eco-friendly packaging is further anticipated to propel the bio-based smart materials for food packaging market

What are the Major Takeaways of Bio-Based Smart Materials For Food Packaging Market?

- The downsizing of packaging and advancing in new technologies is further estimated to cushion the bio-based smart materials for food packaging market. On the other hand, decrease infrastructural facilities for recycling are further projected to impede the growth of the bio-based smart materials for food packaging market in the timeline period

- In addition, the developments in the technologies for new packaging methods will further provide potential opportunities for bio-based smart materials for food packaging market in the coming years. However, the variations in the costs of the raw material might further challenge the growth of the bio-based smart materials for food packaging market in the near future

- Asia-Pacific dominated the bio-based smart materials for food packaging market with a 41.8% revenue share in 2025, driven by rapid growth in food processing industries, high packaged food consumption, and large-scale adoption of sustainable packaging solutions across China, Japan, India, South Korea, and Southeast Asia

- North America is expected to register the fastest CAGR of 8.25% from 2026 to 2033, driven by stringent food safety regulations, high sustainability awareness, and rapid adoption of smart and eco-friendly packaging solutions across the U.S. and Canada

- The Flexible plastics segment dominated the market with an estimated 58.6% share in 2025, driven by its extensive use in pouches, wraps, sachets, and multilayer films for food packaging

Report Scope and Bio-Based Smart Materials For Food Packaging Market Segmentation

|

Attributes |

Bio-Based Smart Materials For Food Packaging Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Bio-Based Smart Materials For Food Packaging Market?

Rising Integration of Intelligent, Sustainable, and Active Bio-Based Materials in Food Packaging

- The bio-based smart materials for food packaging market is witnessing a strong shift toward active and intelligent packaging solutions that enhance food freshness, safety, and shelf life while reducing environmental impact

- Manufacturers are increasingly developing bio-based materials embedded with sensors, indicators, and antimicrobial agents to monitor temperature, humidity, gas levels, and microbial activity in real time

- Growing demand for eco-friendly, lightweight, and regulatory-compliant packaging is accelerating adoption across meat, dairy, ready-to-eat, and fresh produce applications

- For instance, companies such as Amcor, Tetra Pak, Mondi, and Smurfit Kappa are investing in bio-based smart films, coatings, and paper-based solutions with enhanced barrier and monitoring capabilities

- Increased focus on food traceability, waste reduction, and transparency is pushing food brands to adopt intelligent bio-based packaging technologies

- As sustainability and food safety regulations tighten globally, bio-based smart materials will remain central to next-generation food packaging innovation

What are the Key Drivers of Bio-Based Smart Materials For Food Packaging Market?

- Rising demand for sustainable and biodegradable packaging solutions to reduce plastic waste and carbon emissions in the food industry

- For instance, between 2024 and 2025, leading packaging companies such as Huhtamaki, BASF, and Berry Global expanded bio-based material portfolios to support recyclable and compostable food packaging

- Growing consumption of packaged, processed, and ready-to-eat foods is increasing the need for advanced packaging that ensures freshness and safety

- Advancements in bio-polymers, nanotechnology, and active packaging additives are improving barrier performance, durability, and intelligence of smart materials

- Rising adoption of smart labeling, freshness indicators, and antimicrobial coatings is enhancing shelf-life management and reducing food spoilage

- Supported by strong investments in sustainable materials, food safety innovation, and circular economy initiatives, the Bio-Based Smart Materials For Food Packaging market is expected to witness robust long-term growth

Which Factor is Challenging the Growth of the Bio-Based Smart Materials For Food Packaging Market?

- High production costs associated with advanced bio-based polymers, smart sensors, and functional additives limit adoption among cost-sensitive food manufacturers

- For instance, during 2024–2025, volatility in raw material prices and limited availability of bio-based feedstocks increased manufacturing costs for several global packaging suppliers

- Technical complexity in integrating smart features without compromising recyclability or food contact safety poses development challenges

- Limited awareness and infrastructure in emerging markets regarding smart packaging benefits and disposal methods restrict wider adoption

- Competition from conventional plastic packaging and low-cost alternatives creates pricing pressure and slows transition to bio-based solutions

- To overcome these challenges, companies are focusing on scalable production, cost optimization, regulatory alignment, and consumer education to accelerate global adoption of Bio-Based Smart Materials For Food Packaging

How is the Bio-Based Smart Materials For Food Packaging Market Segmented?

The market is segmented on the basis of plastics and food type.

- By Plastics

On the basis of plastics, the bio-based smart materials for food packaging market is segmented into Rigid and Flexible plastics. The Flexible plastics segment dominated the market with an estimated 58.6% share in 2025, driven by its extensive use in pouches, wraps, sachets, and multilayer films for food packaging. Flexible bio-based smart materials offer superior barrier properties, lightweight structure, cost efficiency, and adaptability to intelligent features such as freshness indicators, moisture control, and antimicrobial layers. Their compatibility with high-speed packaging lines and growing preference for sustainable, lightweight packaging across processed and ready-to-eat foods further strengthens adoption.

The Rigid plastics segment is expected to grow at the fastest CAGR from 2026 to 2033, supported by rising demand for smart containers, trays, bottles, and reusable packaging solutions. Increasing use in premium food products, improved shelf-life protection, and integration of temperature and quality monitoring technologies are accelerating growth. Advancements in bio-based polymers and circular packaging designs continue to enhance rigid packaging adoption across global food supply chains.

- By Food Type

On the basis of food type, the bio-based smart materials for food packaging market is segmented into Wet Food and Dry Food. The Dry Food segment dominated the market with a 61.2% share in 2025, owing to high consumption of packaged cereals, snacks, bakery products, confectionery, and powdered foods. Smart bio-based packaging for dry food enables moisture control, oxygen management, and real-time quality monitoring, which helps extend shelf life and reduce food waste. Strong growth in convenience foods, e-commerce grocery sales, and sustainable packaging adoption further supports segment dominance.

The Wet Food segment is projected to register the fastest CAGR from 2026 to 2033, driven by increasing demand for fresh, chilled, and ready-to-cook food products. Bio-based smart materials with antimicrobial properties, temperature indicators, and leakage prevention features are gaining traction in meat, seafood, dairy, and prepared meals. Rising food safety regulations and consumer focus on freshness and traceability are expected to significantly boost wet food packaging adoption globally.

Which Region Holds the Largest Share of the Bio-Based Smart Materials For Food Packaging Market?

- Asia-Pacific dominated the bio-based smart materials for food packaging market with a 41.8% revenue share in 2025, driven by rapid growth in food processing industries, high packaged food consumption, and large-scale adoption of sustainable packaging solutions across China, Japan, India, South Korea, and Southeast Asia. Rising urbanization, expanding middle-class population, and increasing demand for longer shelf-life food products are accelerating adoption of bio-based smart packaging materials across fresh food, ready-to-eat meals, dairy, and beverages

- Leading packaging manufacturers in Asia-Pacific are actively developing bio-based films, active packaging materials, freshness indicators, and antimicrobial coatings to meet food safety regulations and sustainability goals. Strong manufacturing capacity, cost-effective production, and increasing investments in circular economy initiatives strengthen the region’s market leadership

- Government support for biodegradable materials, bans on single-use plastics, and growing consumer awareness around eco-friendly packaging further reinforce Asia-Pacific’s dominance

China Bio-Based Smart Materials For Food Packaging Market Insight

China is the largest contributor in Asia-Pacific, supported by massive food production volumes, rapid expansion of packaged and processed food sectors, and strong government policies promoting biodegradable and bio-based packaging materials. Increasing adoption of smart labels, oxygen scavengers, and antimicrobial packaging in meat, seafood, and ready-to-eat food segments drives demand. Local manufacturing capabilities, competitive pricing, and strong export-oriented food industries further accelerate market growth.

Japan Bio-Based Smart Materials For Food Packaging Market Insight

Japan demonstrates steady growth due to its strong focus on food quality, safety, and waste reduction. High adoption of intelligent packaging solutions such as freshness indicators and temperature-sensitive labels supports premium food packaging applications. Advanced material science capabilities and strict food safety standards continue to encourage innovation in bio-based smart packaging.

India Bio-Based Smart Materials For Food Packaging Market Insight

India is emerging as a high-growth market, driven by rapid urbanization, expanding packaged food consumption, and increasing investments in food processing infrastructure. Government initiatives supporting biodegradable materials and rising demand for sustainable packaging in dairy, snacks, and frozen foods are boosting adoption. Growing startup activity and local manufacturing further enhance market penetration.

North America Bio-Based Smart Materials For Food Packaging Market

North America is expected to register the fastest CAGR of 8.25% from 2026 to 2033, driven by stringent food safety regulations, high sustainability awareness, and rapid adoption of smart and eco-friendly packaging solutions across the U.S. and Canada. Increasing demand for traceability, shelf-life monitoring, and food waste reduction is accelerating adoption of intelligent bio-based materials. Strong R&D capabilities, early adoption of active packaging technologies, and growing investments by major packaging companies support rapid market expansion

U.S. Bio-Based Smart Materials For Food Packaging Market Insight

The U.S. leads North America, supported by strong presence of global packaging companies, high consumption of packaged foods, and strict FDA food safety regulations. Increasing adoption of smart packaging for meat, dairy, and ready-to-eat foods, combined with rising investments in sustainable materials and recycling infrastructure, drives strong market growth.

Canada Bio-Based Smart Materials For Food Packaging Market Insight

Canada contributes significantly through growing demand for sustainable food packaging, strong regulatory support for biodegradable materials, and rising adoption of smart packaging solutions in fresh produce and dairy segments. Government-backed sustainability initiatives and increasing focus on reducing food waste continue to support market expansion.

Which are the Top Companies in Bio-Based Smart Materials For Food Packaging Market?

The bio-based smart materials for food packaging industry is primarily led by well-established companies, including:

- Amcor plc (Switzerland)

- Mondi (U.K.)

- Sealed Air (U.S.)

- Tetra Pak International S.A. (Switzerland)

- Berry Global Inc. (U.S.)

- BALL CORPORATION (U.S.)

- Crown Holdings Inc. (U.S.)

- BASF SE (Germany)

- Huhtamaki (Finland)

- WestRock Company (U.S.)

- Smurfit Kappa (Ireland)

- Sonoco Products Company (U.S.)

- Pactiv Evergreen Inc. (U.S.)

- ELOPAK (Norway)

- WINPAK LTD. (Canada)

- Printpak. (U.S.)

- Paperfoam (Sweden)

- Sustainable Packaging Industries (U.S.)

- Global Water Partnership (GWP) (Sweden)

- Swedbrandgroup (Sweden)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Bio Based Smart Materials For Food Packaging Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Bio Based Smart Materials For Food Packaging Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Bio Based Smart Materials For Food Packaging Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.