Global Bio Based Polyethylene Terephthalate Pet Packaging Market

Market Size in USD Billion

CAGR :

%

USD

20.40 Billion

USD

35.05 Billion

2025

2033

USD

20.40 Billion

USD

35.05 Billion

2025

2033

| 2026 –2033 | |

| USD 20.40 Billion | |

| USD 35.05 Billion | |

|

|

|

|

Bio-Based Polyethylene Terephthalate (PET) Packaging Market Size

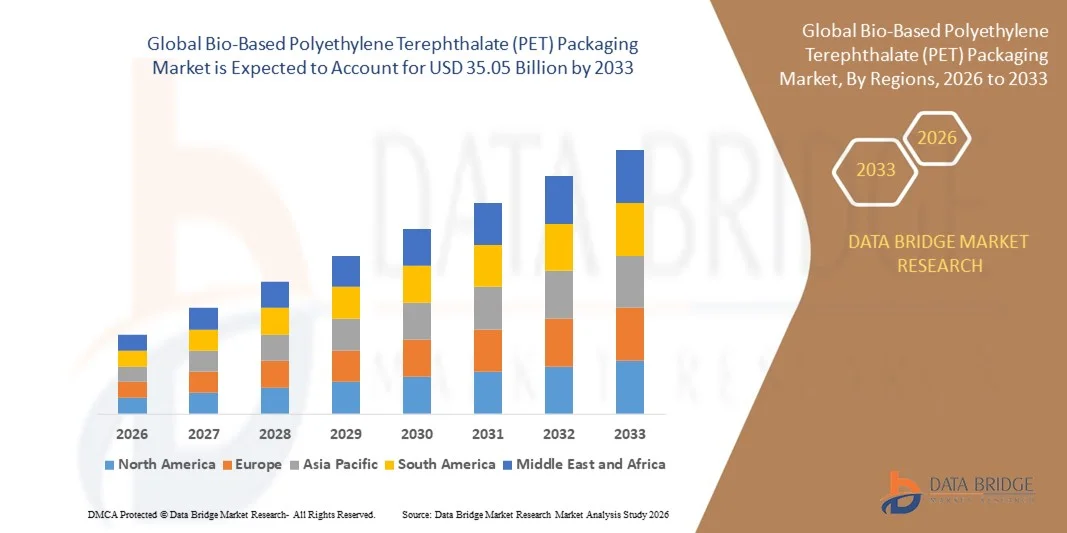

- The global bio-based Polyethylene Terephthalate (PET) packaging market size was valued at USD 20.40 billion in 2025 and is expected to reach USD 35.05 billion by 2033, at a CAGR of 7.0% during the forecast period

- The market growth is largely driven by increasing adoption of sustainable and renewable packaging materials across food, beverage, and consumer goods industries, supported by rising environmental regulations and corporate sustainability commitments aimed at reducing carbon emissions

- Furthermore, growing consumer preference for eco-friendly packaging, combined with brand initiatives to replace fossil-based plastics with bio-based alternatives, is accelerating the demand for bio-based PET packaging and strengthening overall market expansion

Bio-Based Polyethylene Terephthalate (PET) Packaging Market Analysis

- Bio-based Polyethylene Terephthalate (PET) packaging is produced using renewable feedstocks such as sugar, molasses, or corn while offering comparable strength, clarity, and recyclability to conventional PET packaging materials

- The increasing use of bio-based PET is primarily driven by its compatibility with existing PET recycling streams, rising adoption by beverage and FMCG companies, and its ability to support circular economy goals without compromising packaging performance

- Asia-Pacific dominated the bio-based Polyethylene Terephthalate (PET) packaging market with a share of 40.1% in 2025, due to strong beverage consumption, rapid urbanization, and increasing adoption of sustainable packaging across food and consumer goods industries

- North America is expected to be the fastest growing region in the bio-based Polyethylene Terephthalate (PET) packaging market during the forecast period due to increasing sustainability commitments from beverage and consumer goods companies and growing investments in bio-based polymer production

- Sugar segment dominated the market with a market share of 45.5% in 2025, due to its high bio-based yield efficiency and well-established fermentation processes used to produce bio-ethanol for PET synthesis. Sugar feedstocks benefit from mature agricultural supply chains and consistent quality, enabling large-scale production with predictable costs

Report Scope and Bio-Based Polyethylene Terephthalate (PET) Packaging Market Segmentation

|

Attributes |

Bio-Based Polyethylene Terephthalate (PET) Packaging Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Bio-Based Polyethylene Terephthalate (PET) Packaging Market Trends

Growing Use of Bio-Based PET Bottles by Major Beverage Brands

- A prominent trend in the bio-based polyethylene terephthalate (PET) packaging market is the increasing use of bio-based PET bottles by major beverage brands as part of their long-term sustainability and circular economy strategies. Global beverage producers are shifting toward plant-based and renewable material packaging to reduce dependence on fossil-based plastics and improve environmental performance across packaging portfolios

- For instance, The Coca-Cola Company has expanded the use of PlantBottle packaging, which incorporates bio-based PET derived from plant-based materials, across multiple global markets. This initiative supports the company’s carbon reduction goals and reinforces brand commitments toward sustainable packaging solutions

- The adoption of bio-based PET bottles is strengthening brand differentiation as consumers increasingly associate renewable packaging materials with environmental responsibility. Beverage companies are leveraging bio-based PET packaging to enhance brand perception and respond to growing consumer awareness around plastic waste and carbon emissions

- Technological advancements in bio-based feedstock processing are improving the quality and performance of bio-based PET, making it suitable for carbonated beverages and long shelf-life applications. These improvements are supporting broader adoption across water, soft drinks, and functional beverage segments

- Retailers and brand owners are increasingly collaborating with packaging suppliers to secure consistent supplies of bio-based PET materials. This collaboration is accelerating the commercialization of renewable PET packaging and supporting supply chain scalability

- Overall, the growing use of bio-based PET bottles by leading beverage brands is reinforcing market growth by aligning packaging innovation with sustainability goals, regulatory expectations, and evolving consumer preferences for environmentally responsible packaging

Bio-Based Polyethylene Terephthalate (PET) Packaging Market Dynamics

Driver

Increasing Sustainability Regulations and Carbon Reduction Targets

- Rising sustainability regulations and carbon reduction targets imposed by governments and regulatory bodies are a key driver for the bio-based PET packaging market. Policies aimed at reducing plastic waste and greenhouse gas emissions are encouraging manufacturers to adopt renewable and low-carbon packaging materials

- For instance, PepsiCo has committed to reducing virgin plastic use and lowering its carbon footprint by increasing the share of bio-based and recycled PET across its packaging portfolio. These regulatory-aligned commitments are accelerating demand for bio-based PET solutions within the beverage and food packaging sectors

- Extended producer responsibility frameworks and plastic taxation policies are motivating packaging producers to shift toward materials with lower environmental impact. Bio-based PET packaging supports compliance with these regulations while maintaining performance standards required for food and beverage applications

- Corporate sustainability targets set by multinational brands are reinforcing investments in bio-based PET technologies and supply chains. Companies are prioritizing renewable packaging materials to meet science-based targets and public sustainability commitments

- The alignment of regulatory pressure with corporate environmental strategies is strengthening long-term demand for bio-based PET packaging. This driver continues to position bio-based PET as a viable solution for reducing carbon emissions and meeting evolving sustainability mandates

Restraint/Challenge

Higher Costs of Bio-Based PET Compared to Conventional PET

- The bio-based PET packaging market faces a significant challenge due to the higher costs associated with producing bio-based PET compared to conventional fossil-based PET. The use of renewable feedstocks and specialized processing technologies increases raw material and production expenses

- For instance, packaging suppliers working with bio-based PET resins sourced from companies such as Braskem encounter higher procurement costs due to limited feedstock availability and complex production processes. These cost factors impact pricing competitiveness in high-volume packaging applications

- The relatively smaller scale of bio-based PET production compared to conventional PET limits economies of scale and contributes to cost disparities. Manufacturers face challenges in achieving cost parity while maintaining consistent quality and supply reliability

- Price-sensitive markets and industries may hesitate to adopt bio-based PET packaging due to higher unit costs, particularly in regions with limited regulatory enforcement. This cost barrier can slow adoption despite growing sustainability awareness

- The challenge of higher costs continues to influence market penetration and adoption rates, placing pressure on producers to improve production efficiency, expand feedstock availability, and reduce costs to support wider commercialization of bio-based PET packaging

Bio-Based Polyethylene Terephthalate (PET) Packaging Market Scope

The market is segmented on the basis of raw material and application.

- By Raw Material

On the basis of raw material, the Bio-Based Polyethylene Terephthalate (PET) Packaging market is segmented into sugar, molasses, and corn. The sugar-based segment dominated the largest market revenue share of 45.5% in 2025, driven by its high bio-based yield efficiency and well-established fermentation processes used to produce bio-ethanol for PET synthesis. Sugar feedstocks benefit from mature agricultural supply chains and consistent quality, enabling large-scale production with predictable costs. Major packaging producers prefer sugar-based bio-PET due to its compatibility with existing PET manufacturing infrastructure and its ability to deliver performance characteristics equivalent to conventional PET. The growing focus on renewable packaging solutions among beverage and food companies further supports the dominance of sugar-derived bio-PET materials.

The corn-based segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by expanding corn availability and advancements in bio-refining technologies. Corn-based raw materials offer improved scalability and regional sourcing advantages, particularly in North America, where corn supply is abundant. Continuous investments in sustainable agriculture and bio-chemical processing are improving conversion efficiency and reducing production costs. These factors are accelerating the adoption of corn-based bio-PET among packaging manufacturers seeking long-term feedstock security and sustainability compliance.

- By Application

On the basis of application, the Bio-Based PET Packaging market is segmented into bottles, consumer goods, automotive, electronics, and others. The bottles segment accounted for the largest market revenue share in 2025, driven by strong demand from the beverage industry for sustainable packaging alternatives. Bio-based PET bottles offer similar strength, clarity, and barrier properties as conventional PET while supporting carbon footprint reduction targets. Global beverage brands are increasingly incorporating bio-based PET bottles to meet regulatory pressure and corporate sustainability commitments. High-volume consumption and established recycling compatibility continue to reinforce the dominance of this segment.

The consumer goods segment is expected to register the fastest growth during the forecast period, supported by rising use of bio-based PET in personal care, household products, and packaged consumer items. Brand owners are actively shifting toward renewable packaging materials to enhance environmental positioning and meet evolving consumer preferences. Bio-based PET provides design flexibility, durability, and aesthetic appeal required for premium consumer goods packaging. Increasing awareness of sustainable packaging across retail channels is further accelerating growth in this application segment.

Bio-Based Polyethylene Terephthalate (PET) Packaging Market Regional Analysis

- Asia-Pacific dominated the bio-based Polyethylene Terephthalate (PET) packaging market with the largest revenue share of 40.1% in 2025, driven by strong beverage consumption, rapid urbanization, and increasing adoption of sustainable packaging across food and consumer goods industries

- The region’s large manufacturing base, cost-effective production capabilities, and growing investments in bio-based polymers are accelerating market penetration of bio-based PET packaging

- Supportive government initiatives promoting bio-economy development, availability of agricultural feedstocks, and rising environmental awareness among consumers are boosting regional demand

China Bio-Based Polyethylene Terephthalate (PET) Packaging Market Insight

China held the largest share in the Asia-Pacific bio-based Polyethylene Terephthalate (PET) packaging market in 2025, supported by its massive beverage and packaged food industries and strong domestic packaging manufacturing capacity. The country’s emphasis on reducing plastic emissions, expanding bio-based material production, and integrating sustainable packaging across FMCG sectors is driving demand. Presence of large-scale PET converters and improving recycling infrastructure further strengthens market growth.

India Bio-Based Polyethylene Terephthalate (PET) Packaging Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, fueled by rising packaged beverage consumption, expanding food processing sector, and increasing focus on sustainable packaging solutions. Government initiatives encouraging bio-based materials, growing sugar and molasses availability, and rising investments by domestic packaging manufacturers are accelerating adoption. Rapid growth of organized retail and e-commerce is further supporting market expansion.

Europe Bio-Based Polyethylene Terephthalate (PET) Packaging Market Insight

The Europe bio-based Polyethylene Terephthalate (PET) packaging market is growing steadily, driven by stringent environmental regulations, strong circular economy policies, and high demand for sustainable packaging from beverage and personal care brands. The region places strong emphasis on carbon footprint reduction and recyclability, encouraging the use of bio-based PET. Continuous innovation in bio-polymers and strong consumer preference for eco-friendly packaging support market growth.

Germany Bio-Based Polyethylene Terephthalate (PET) Packaging Market Insight

Germany’s market is supported by its advanced packaging industry, strong sustainability commitments, and leadership in recycling and bio-based material innovation. The country’s robust beverage sector and emphasis on high-quality, compliant packaging solutions are driving demand for bio-based PET. Collaboration between packaging manufacturers, brand owners, and research institutions is fostering continuous product development.

U.K. Bio-Based Polyethylene Terephthalate (PET) Packaging Market Insight

The U.K. market benefits from rising adoption of sustainable packaging across food, beverage, and consumer goods sectors. Increasing regulatory pressure on plastic waste reduction, combined with strong brand-level sustainability targets, is driving demand for bio-based PET packaging. Growth is further supported by expanding use of renewable materials in premium and private-label packaging.

North America Bio-Based Polyethylene Terephthalate (PET) Packaging Market Insight

North America is projected to grow at the fastest CAGR from 2026 to 2033, driven by increasing sustainability commitments from beverage and consumer goods companies and growing investments in bio-based polymer production. Strong availability of corn-based feedstocks and advancements in bio-refining technologies are supporting market expansion. Rising consumer preference for environmentally responsible packaging is further accelerating adoption.

U.S. Bio-Based Polyethylene Terephthalate (PET) Packaging Market Insight

The U.S. accounted for the largest share in the North America market in 2025, supported by high consumption of bottled beverages, strong presence of major packaging and FMCG companies, and advanced recycling infrastructure. Corporate sustainability goals, regulatory initiatives promoting renewable materials, and increasing use of bio-based PET bottles by leading beverage brands are reinforcing the country’s dominant position.

Bio-Based Polyethylene Terephthalate (PET) Packaging Market Share

The bio-based Polyethylene Terephthalate (PET) packaging industry is primarily led by well-established companies, including:

- Alpek S.A.B. de C.V. (Mexico)

- Indorama Ventures Public Company Limited (Thailand)

- JBF Industries Ltd. (India)

- LOTTE Chemical Corporation (South Korea)

- Far Eastern New Century Corporation (Taiwan)

- China Petrochemical Corporation (China)

- SABIC (Saudi Arabia)

- Reliance Industries Limited (India)

- RTP Company (U.S.)

- Vikas Ecotech Ltd. (India)

- TEIJIN LIMITED (Japan)

- Hitachi, Ltd. (Japan)

- NEO GROUP, UAB (Lithuania)

- DuPont de Nemours, Inc. (U.S.)

- Filatex India Limited (India)

- Polyplex (India)

- Retal Industries LTD. (U.A.E.)

- Persian Gulf Petrochemical Industries Co. (Iran)

- Mitsubishi Chemical Advanced Materials Group (Japan)

- Verdeco Recycling (U.S.)

Latest Developments in Global Bio-Based Polyethylene Terephthalate (PET) Packaging Market

- In June 2025, CHITOSE Group unveiled 100% bio-based PET resin derived from microalgae, representing a major advancement in next-generation feedstock development for bio-PET packaging. This development reduces reliance on sugar- and crop-based raw materials and addresses concerns around food-versus-material competition. The innovation has the potential to reshape long-term raw material sourcing strategies and accelerate adoption of fully renewable PET packaging across beverages, cosmetics, and consumer goods

- In November 2024, Indorama Ventures, in partnership with Suntory and other collaborators, commercialized the world’s first bio-PET bottles produced using bio-paraxylene, demonstrating the large-scale feasibility of bio-based PET packaging for mainstream beverage applications. This launch validated industrial scalability, strengthened confidence among global brand owners, and accelerated market acceptance of bio-PET as a direct substitute for fossil-based PET in high-volume packaging formats

- In July 2024, Anellotech and R Plus Japan advanced their Plas-TCat technology into the commercialization phase, enabling the conversion of plastic waste into chemical intermediates suitable for PET and bio-PET production. This development enhances circularity within the PET value chain and supports sustainable feedstock diversification, reinforcing long-term supply security for bio-based PET packaging manufacturers

- In August 2024, Indorama Ventures surpassed a milestone of recycling over 150 billion PET bottles globally, strengthening the integration of bio-based PET within circular economy frameworks. This achievement supports greater blending of bio-PET with recycled PET, improves lifecycle sustainability metrics, and increases brand confidence in adopting renewable PET packaging at scale

- In 2023, CHITOSE Group expanded its PET-MATSURI initiative focused on microalgae-based bio-PET development, accelerating research, pilot production, and industry collaboration. This initiative signaled a structural shift toward alternative biological feedstocks and reinforced long-term innovation pipelines, supporting future commercialization of fully bio-based PET packaging solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Bio Based Polyethylene Terephthalate Pet Packaging Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Bio Based Polyethylene Terephthalate Pet Packaging Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Bio Based Polyethylene Terephthalate Pet Packaging Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.