Global Bag In Box Containers Market

Market Size in USD Billion

CAGR :

%

USD

4.53 Billion

USD

6.77 Billion

2024

2032

USD

4.53 Billion

USD

6.77 Billion

2024

2032

| 2025 –2032 | |

| USD 4.53 Billion | |

| USD 6.77 Billion | |

|

|

|

|

Bag-in-Box Containers Market Size

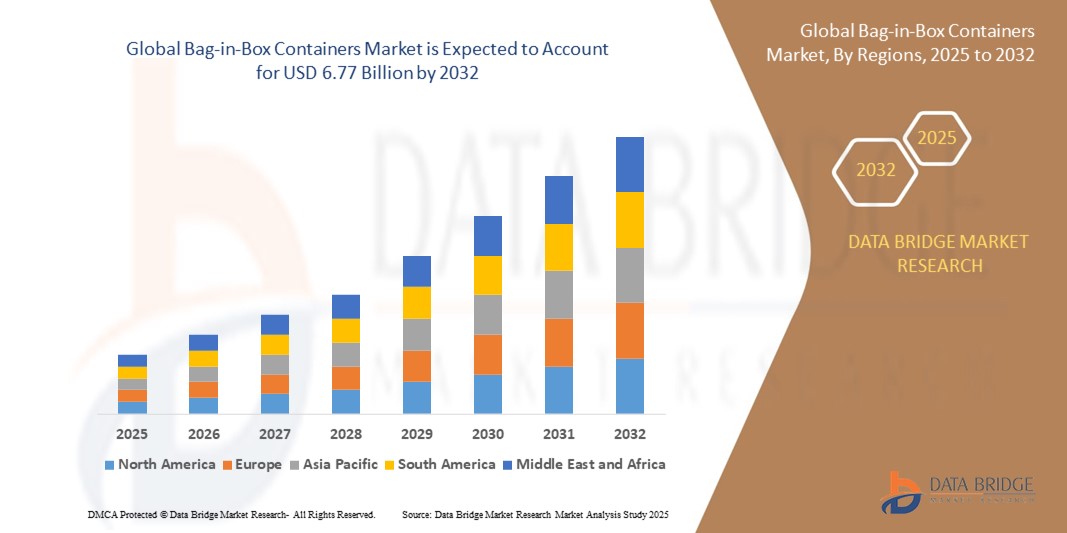

- The global bag-in-box containers market size was valued at USD 4.53 billion in 2024 and is expected to reach USD 6.77 billion by 2032, at a CAGR of 5.15% during the forecast period

- The market growth is primarily driven by increasing demand for sustainable, cost-effective, and lightweight packaging solutions across various industries, particularly food and beverages

- Rising consumer awareness of eco-friendly packaging and the need for extended shelf life and efficient dispensing are further propelling demand for bag-in-box containers in both consumer and industrial applications

Bag-in-Box Containers Market Analysis

- The bag-in-box containers market is experiencing robust growth due to the rising preference for sustainable packaging alternatives that reduce plastic waste and carbon footprint compared to traditional rigid packaging

- The food and beverage sector, particularly for products such as wine, juices, and dairy, dominates the market, accounting for approximately 66% of the global revenue share in 2024, driven by the need for efficient storage and dispensing solutions

- Asia Pacific dominates the bag-in-box containers market with a market share of 38.43% in 2024, fueled by rapid industrialization, increasing adoption of packaged food and beverage products, and growing consumer demand in countries such as China and India

- Europe is the fastest-growing region during the forecast period, driven by the expanding food and beverage industry, stringent environmental regulations, and increasing adoption of recyclable packaging solutions

- The paper and paperboard segment dominates the largest market revenue share of approximately 72.6% in 2024, driven by its cost-effectiveness, lightweight nature, and eco-friendliness, aligning with global sustainability trends

Report Scope and Bag-in-Box Containers Market Segmentation

|

Attributes |

Bag-in-Box Containers Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Bag-in-Box Containers Market Trends

“Rising Preference for Sustainable Bag-in-Box Packaging”

- Bag-in-box containers are increasingly favored for their sustainability, with a focus on recyclable paper and paperboard materials, reducing plastic usage compared to traditional rigid containers

- These containers use up to 85% less plastic than rigid packaging, appealing to environmentally conscious consumers and businesses aiming to lower their environmental impact

- Companies are introducing fully recyclable bag-in-box solutions, such as Smurfit Kappa’s 2023 recyclable bag-in-box made from 53% recycled and renewable resources, enhancing sustainability

- The wine and juice sectors are increasingly adopting bag-in-box packaging for its ability to extend shelf life and reduce transportation costs, particularly in regions such as Asia Pacific

- The rise of e-commerce and home delivery services has boosted demand for lightweight, durable bag-in-box containers, ideal for efficient shipping and storage

- Innovations such as tamper-proof and spill-resistant taps, such as Smurfit Kappa’s Vitop Original Tap, enhance usability and appeal for liquid food and beverage packaging

Bag-in-Box Containers Market Dynamics

Driver

“Growing Demand for Sustainable and Cost-Effective Packaging”

- Rising awareness of environmental concerns is driving demand for eco-friendly packaging solutions such as bag-in-box containers, which minimize waste and use recyclable materials

- These containers reduce transportation and storage costs due to their lightweight design and efficient use of materials, making them attractive for businesses across food, beverage, and industrial sectors

- Bag-in-box packaging, with its multi-layer barrier films, protects contents from air and contaminants, extending shelf life for products such as wine, juices, and industrial liquids

- The food and beverage sector, particularly for wines and dairy, benefits from bag-in-box containers’ ability to package both liquid and semi-liquid products, while industrial sectors use them for chemicals and lubricants

- Similar to how electric vehicles require optimized thermal management, bag-in-box containers support efficient liquid storage and dispensing, reducing waste and enhancing sustainability in industries such as food and beverage

- Companies such as Liquibox and DS Smith are developing innovative, sustainable bag-in-box solutions, such as recyclable films and advanced filling machines, to meet growing demand

Restraint/Challenge

“Regulatory and Competitive Challenges”

- Different countries impose diverse regulations on packaging materials and recyclability, complicating standardization for manufacturers operating internationally

- Bag-in-box containers face competition from rigid packaging such as glass bottles and plastic containers, which are often cheaper and more familiar to consumers in certain markets, such as soft drinks

- The use of mixed materials (plastic films and paperboard) in bag-in-box containers can pose recycling challenges, deterring adoption in regions with strict waste management policies

- The production of bag-in-box systems, including separate manufacturing lines for bags, boxes, and fitments, can result in higher initial costs, limiting adoption in cost-sensitive markets

- Some consumers remain skeptical about plastic components in bag-in-box packaging, preferring traditional packaging for premium products such as wine, which can hinder market growth

Bag-in-Box Containers Market Scope

The market is segmented on the basis of material type, component, capacity, material state, tap, and end-use.

- By Material Type

On the basis of material type, the global bag-in-box containers market is segmented into paper and paperboard and plastic. The paper and paperboard segment dominates the largest market revenue share of approximately 72.6% in 2024, driven by its cost-effectiveness, lightweight nature, and eco-friendliness, aligning with global sustainability trends. Paper and paperboard, including corrugated cardboard and solid board, are highly recyclable, making them a preferred choice for environmentally conscious consumers and manufacturers.

The plastic segment is anticipated to witness the fastest growth rate of approximately 7.8% from 2025 to 2032, fueled by the durability and barrier properties of materials such as low-density polyethylene (LDPE), ethylene vinyl acetate (EVA), and ethylene vinyl alcohol (EVOH). These materials offer excellent protection against oxygen and light, enhancing product shelf life, particularly for beverages and industrial liquids.

- By Component

On the basis of component, the global bag-in-box containers market is segmented into bags, boxes, and fitments. The bags segment held the largest market revenue share in 2024, driven by their critical role in liquid containment and the use of advanced barrier films that extend product freshness. Bags are typically made from multi-layered plastics such as LDPE and EVOH, ensuring product integrity.

The fitments segment is expected to witness the fastest CAGR from 2025 to 2032, driven by innovations such as aseptic valves, anti-glug features, and easy-pour spouts. These advancements enhance usability, minimize waste, and support the growing demand for convenient and sustainable dispensing systems in foodservice and household applications.

- By Capacity

On the basis of capacity, the global bag-in-box containers market is segmented into less than 5 litres, 5-10 litres, 10-15 litres, 15-20 litres, and more than 20 litres. The 5-10 litres segment accounted for the largest market revenue share in 2024, driven by its widespread use in the foodservice industry for bulk packaging of sauces, condiments, and beverages such as wine and juices. This capacity offers a balance of convenience and cost-efficiency for both commercial and household use.

The less than 5 litres segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by rising demand for single-serve and on-the-go beverage solutions, such as premium olive oils, craft juices, and health drinks, which prioritize portability and convenience.

- By Material State

On the basis of material state, the global bag-in-box containers market is segmented into semi-liquid and liquid. The semi-liquid segment held the largest market revenue share in 2024, driven by its extensive use in industrial applications for products such as petroleum-based fluids, household cleaners, and dairy products, which benefit from the longer shelf life of semi-liquid packaging.

The liquid segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the growing popularity of bag-in-box packaging for beverages such as wine, juices, and water, where airtight seals and low oxygen transfer rates maintain product quality and freshness.

- By Tap

On the basis of tap, the global bag-in-box containers market is segmented into with tap and without tap. The with tap segment dominated the market with a revenue share of approximately 65.4% in 2024, driven by its convenience for dispensing beverages and liquid foods in both household and commercial settings. Features such as tamper-evident and controlled-flow taps enhance usability and reduce waste.

The without tap segment is expected to witness the fastest CAGR from 2025 to 2032, driven by its cost-effectiveness and growing use in industrial and institutional settings for bulk storage and transportation of liquids, where precise dispensing is less critical.

- By End-Use

On the basis of end-use, the global bag-in-box containers market is segmented into food and beverages, industrial, household products, and cosmetics and personal care. The food and beverages segment accounted for the largest market revenue share of over 68% in 2024, driven by the increasing adoption of bag-in-box packaging for wine, juices, dairy, and sauces, due to its cost-effectiveness, extended shelf life, and eco-friendly attributes.

The household products segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by the rising demand for eco-friendly cleaning solutions, such as surface deodorizers and liquid detergents, which benefit from the convenience and reduced plastic usage of bag-in-box packaging.

Bag-in-Box Containers Market Regional Analysis

- Asia Pacific dominates the bag-in-box containers market with a market share of 38.43% in 2024, fueled by rapid industrialization, increasing adoption of packaged food and beverage products, and growing consumer demand in countries such as China and India

- Europe is the fastest-growing region during the forecast period, driven by the expanding food and beverage industry, stringent environmental regulations, and increasing adoption of recyclable packaging solutions

U.S. Bag-in-Box Containers Market Insight

The U.S. bag-in-box containers market held a substantial revenue share in 2024, fueled by the strong presence of the food and beverage industry, particularly in the United States. The region's focus on sustainable packaging and the growing adoption of bag-in-box solutions for wine, juice, and dairy products contribute to market growth. In addition, the demand for convenient, user-friendly packaging in both retail and commercial sectors, coupled with advancements in material durability, supports the market's expansion.

Europe Bag-in-Box Containers Market Insight

The European bag-in-box containers market is projected to grow at the fastest CAGR during the forecast period, driven by stringent environmental regulations and a strong push towards sustainable packaging solutions. The increasing adoption of bag-in-box containers in the wine and beverage industries, particularly in countries such as France, Italy, and Spain, is a key growth factor. Europe’s well-established retail infrastructure and consumer preference for eco-conscious and recyclable packaging further accelerate market growth, with applications expanding in both residential and industrial sectors.

U.K. Bag-in-Box Containers Market Insight

The U.K. bag-in-box containers market is anticipated to grow at a notable CAGR during the forecast period, driven by the increasing demand for sustainable and convenient packaging solutions in the wine and beverage sectors. The U.K.’s robust e-commerce and retail infrastructure, combined with consumer awareness of environmental concerns, promotes the adoption of bag-in-box containers. In addition, the trend towards home consumption of packaged beverages and the focus on reducing packaging waste are key factors driving market growth.

Germany Bag-in-Box Containers Market Insight

The German bag-in-box containers market is expected to expand at a considerable CAGR, fueled by the country’s strong emphasis on sustainability and innovation in packaging solutions. Germany’s advanced infrastructure and leadership in eco-conscious practices drive the adoption of bag-in-box containers in both food and non-food applications. The integration of these containers with automated dispensing systems and their alignment with Germany’s focus on reducing environmental impact make them increasingly popular in residential and commercial settings.

Asia-Pacific Bag-in-Box Containers Market Insight

The Asia-Pacific region dominated the global bag-in-box containers market in 2025, driven by rapid urbanization, rising disposable incomes, and increasing demand for packaged food and beverages in countries such as China, India, and Japan. The region’s emergence as a manufacturing hub for packaging solutions, coupled with government initiatives promoting sustainable practices, fuels the adoption of bag-in-box containers. The affordability and versatility of these containers, along with their growing use in industrial applications, contribute to the region's market leadership.

Japan Bag-in-Box Containers Market Insight

The Japan bag-in-box containers market is gaining traction due to the country’s high-tech culture, rapid urbanization, and growing demand for sustainable packaging. The adoption of bag-in-box containers is driven by their use in the beverage sector, particularly for sake, wine, and other liquids, as well as in industrial applications. Japan’s focus on convenience and eco-friendly solutions, combined with its aging population’s preference for easy-to-use packaging, supports market growth.

China Bag-in-Box Containers Market Insight

The China bag-in-box containers market accounted for the largest revenue share in the Asia-Pacific region in 2025, driven by rapid urbanization, an expanding middle class, and increasing demand for packaged food and beverages. The country’s position as a manufacturing hub for packaging solutions, along with government initiatives promoting sustainable practices, fuels market growth. The affordability and scalability of bag-in-box containers, coupled with their widespread use in residential, commercial, and industrial applications, solidify China’s dominance in the region.

Bag-in-Box Containers Market Share

The bag-in-box containers industry is primarily led by well-established companies, including:

- Smurfit Kappa (Ireland)

- DS Smith (U.K.)

- SIG (Switzerland)

- CDF Corporation (U.S.)

- Optopack Ltd. (Bulgaria)

- Aran Group (U.S.)

- Zacros America (U.S.)

- Polsinelli Enologia Srl (Italy)

- Black Forest Container Systems, LLC (U.S.)

- Jigsaw Bag in Box (U.K.)

- Fujimori Kogyo Ltd. (Japan)

- Goglio S.p.A (Italy)

- Vine Valley Ventures LLC (U.S.)

- Parish Manufacturing Inc. (U.S.)

- Amcor Ltd. (Australia)

Latest Developments in Global Bag-in-Box Containers Market

- In November 2024, Smurfit Westrock unveiled the EasySplit Bag-in-Box, a patented packaging innovation designed to meet the EU’s Packaging and Packaging Waste Regulation (PPWR). This solution enhances recyclability, ensuring Bag-in-Box components can be easily separated, increasing the recycling rate to over 90%. The PPWR mandates at least 80% recyclability, making EasySplit a pioneering response to future regulations. The launch reinforces Smurfit Westrock’s leadership in sustainable packaging, particularly in the food and beverage sector

- In September 2024, Evopack introduced its advanced bag-in-box solution at FACHPACK 2024, showcasing a collaborative innovation with Ringmetall and Tricor. Designed for lightweight, leak-proof, and eco-friendly packaging, this system caters to sustainability-conscious consumers in the beverage and liquid food sectors. The Boxli 1000 lid module technology and Quick Bin 2.2.4 system ensure secure, oxygen-free storage, enhancing efficiency and environmental responsibility. Despite early challenges, Evopack’s partnership with Ringmetall provided the industrial expertise needed for successful implementation

- In August 2024, Alesayi Beverage Corporation partnered with SIG to introduce bag-in-box packaging for hotels, restaurants, and cafes (HoReCa). This collaboration leverages SIG’s SureFill 42 Aseptic filling system, 10-liter 2Pure Film bags, and OptiTap 2300 self-closing valve, ensuring efficient dispensing and extended product freshness. The initiative marks Alesayi’s entry into bag-in-box packaging, reinforcing its market presence in the Middle East’s hospitality sector. The new system is housed in Alesayi’s state-of-the-art production facility in Jeddah, covering 98,000 square meters

- In June 2024, Smurfit Kappa acquired Artemis Ltd., a Bag-in-Box packaging plant in Shumen, Bulgaria, strengthening its presence in Eastern Europe. This strategic move expands Smurfit Kappa’s production capacity, enhancing its ability to deliver customized, sustainable packaging solutions. Artemis specializes in food and beverage packaging, producing bags, films, and caps for wine. The acquisition integrates Artemis into Smurfit Kappa’s European Bag-in-Box operations, reinforcing its competitive edge in the global market

- In February 2023, Sealed Air (SEE) completed the $1.15 billion acquisition of Liquibox, a pioneer in Bag-in-Box sustainable packaging. This strategic move accelerates SEE’s CRYOVAC® brand fluids & liquids business, enhancing its global flexible packaging portfolio. Liquibox, previously owned by Olympus Partners, operates 18 locations worldwide, serving fresh food, beverage, consumer goods, and industrial markets. The acquisition aligns with SEE’s transformation into a digitally driven company, reinforcing its commitment to sustainable packaging solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Bag In Box Containers Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Bag In Box Containers Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Bag In Box Containers Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.