Global Background Check Market

Market Size in USD Billion

CAGR :

%

USD

15.54 Billion

USD

39.60 Billion

2024

2032

USD

15.54 Billion

USD

39.60 Billion

2024

2032

| 2025 –2032 | |

| USD 15.54 Billion | |

| USD 39.60 Billion | |

|

|

|

|

Background Check Market Size

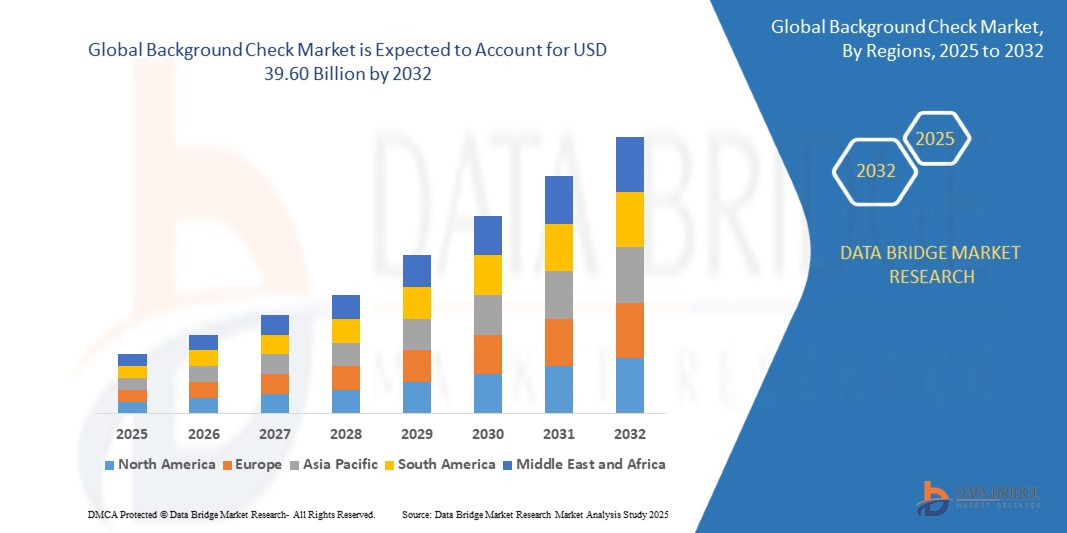

- The global background check market was valued at USD 15.54 billion in 2024 and is expected to reach USD 39.60 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 12.40%, primarily driven by the increasing demand for background verification across industries, rising concerns over security and fraud prevention, and advancements in technology such as AI-driven background check tools

- This growth is driven by factors such as the growing need for compliance with legal regulations, expansion of global businesses requiring thorough employee screening, increasing adoption of digital platforms, and rising awareness of the importance of trust and security in hiring processes

Background Check Market Analysis

- The background check market is expanding rapidly as businesses increasingly focus on verifying the credentials of potential employees, contractors, and partners

- For instance, according to a report by Society for Human Resource Management (SHRM), 96% of employers conduct background checks to confirm qualifications and ensure a safe work environment, particularly in industries such as finance and healthcare

- Advancements in technology, especially artificial intelligence and machine learning, have significantly improved the accuracy and speed of background checks. Checkr, a background check company, uses AI-powered technology to speed up the process, reducing turnaround times from several days to just a few hours, as reported in their 2023 annual report.

- There is a growing demand for background checks due to the rise of remote work and global hiring practices. According to a PwC report, 48% of global employers are hiring remotely, requiring background check services that comply with local regulations, such as compliance with the General Data Protection Regulation (GDPR) in Europe and Fair Credit Reporting Act (FCRA) in the U.S.

- The use of digital platforms for background checks has surged, as organizations seek faster, more accessible services. Sterling, a global provider of background checks, has integrated its platform with major human resource management systems, enabling employers to seamlessly run checks within their recruitment workflow, as outlined in their 2023 business update

- As security concerns rise, industries such as healthcare and education have placed greater emphasis on thorough background checks

- For instance, The American Hospital Association (AHA) reports that 90% of healthcare employers conduct background checks, particularly to ensure patient safety and to verify certifications of healthcare professionals working in high-risk environments

Report Scope and Background Check Market Segmentation

|

Attributes |

Background Check Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis |

Background Check Market Trends

“Growing Reliance on Automated and AI-Powered Background Check Solutions”

- The growing reliance on automated and AI-powered background check solutions is driven by the need for quicker and more efficient hiring processes

- For instance, Checkr, a company specializing in AI-driven background checks, reports that their platform reduces background screening time from several days to just a few hours, streamlining recruitment for companies such as Uber and Instacart

- AI-powered tools enhance accuracy by cross-checking large datasets, including criminal records, employment history, and social media profiles

- For instance, HireRight, uses AI to analyze candidate data, improving the accuracy of their reports and minimizing human error, which is particularly valuable for industries such as healthcare and finance where accuracy is critical

- Automation of background checks reduces operational costs by eliminating the need for manual data entry and follow-up

- For instance, Sterling, a leading background check provider, offers a fully automated system that integrates with applicant tracking systems, allowing employers to handle the entire recruitment process efficiently and cost-effectively

- The trend towards automation also allows for better scalability as companies expand globally

- For instance, First Advantage, a global background check provider, offers automated services that cater to international hiring needs, ensuring compliance with different legal standards across various countries, such as the General Data Protection Regulation (GDPR) in Europe

- AI-powered background checks offer the benefit of learning from data over time, improving their predictive capabilities

- For instance, GoodHire, a provider of automated background checks, claims their AI-based system gets smarter with each data point, ensuring higher accuracy and reliability for businesses across diverse sectors, including technology, retail, and healthcare

Background Check Market Dynamics

Driver

“Increasing Focus on Security and Fraud Prevention Across Various Industries”

- The growing need for security and fraud prevention is a significant driver in the background check market, especially in sectors that handle sensitive data. According to a PwC report, 88% of global companies conduct background checks to reduce hiring risks, especially in high-stakes industries such as healthcare, finance, and education

- In the healthcare sector, background checks are essential for safeguarding vulnerable populations

- For instance, Children’s Healthcare of Atlanta conducts thorough background checks on all potential employees, including criminal history and professional certifications, to ensure patient safety and maintain trust, as highlighted in their 2023 annual report

- The Health Insurance Portability and Accountability Act (HIPAA) in the U.S. requires healthcare organizations to perform stringent employee screenings, particularly for those with access to sensitive patient data. In compliance with HIPAA, organizations such as Ascension Health conduct thorough background checks to ensure that employees do not have a history of criminal behavior or malpractice

- In the finance sector, compliance with Anti-Money Laundering (AML) laws necessitates rigorous employee background checks

- For instance, JPMorgan Chase has strict background check protocols to ensure that employees do not have any criminal history related to fraud or financial crimes, reducing the risk of financial misconduct, as outlined in their 2022 corporate responsibility report

- As businesses continue to adopt digital tools, AI-driven background checks are becoming increasingly popular. Checkr, a leading provider of background screening services, uses AI to speed up the background check process, providing real-time insights and minimizing human errors. This shift to automation is especially beneficial for tech companies such as Uber and Instacart, which need quick and reliable hiring solutions

Opportunity

“Expansion of Global Remote Work”

- The rise of remote work has created a significant opportunity for background check providers to offer international screening services. With companies hiring talent globally, there is an increasing demand for providers who can manage international background checks. Upwork, a global freelancing platform, regularly uses background checks to ensure the credibility of its international freelancers, highlighting the need for global screening services

- Companies now seek background check providers that comply with international laws such as the General Data Protection Regulation (GDPR) in Europe, which governs data privacy

- For instance, First Advantage has designed solutions that meet GDPR requirements, allowing employers to screen international candidates while ensuring compliance with privacy laws, as mentioned in their 2022 service update

- Global hiring also demands that background check providers cater to different labor laws and regulatory requirements across various regions

- For instance, Checkr, a background check provider, has expanded its services to offer global screening, ensuring it adheres to diverse legal standards across North America, Europe, and Asia, helping companies navigate these complexities

- International background checks must also address challenges such as language barriers and different criminal record systems in various countries

- For instance, Sterling, a leading background check provider, has created a multilingual platform to accommodate different languages and provide accurate criminal record checks in diverse legal systems worldwide

- As businesses continue to expand globally, there is a growing need for specialized background check services that ensure compliance with various legal frameworks

- For instance, Randstad, a global staffing company, relies on international background check providers to screen candidates across multiple countries, ensuring compliance with varying regulations, thus showing the demand for such services in multinational companies

Restraint/Challenge

“Complexity of Managing and Protecting Sensitive Data”

- A major challenge in the background check market is the complexity of managing sensitive data, including criminal records, employment history, and financial details. Data privacy laws such as the General Data Protection Regulation (GDPR) impose strict requirements on how companies handle, store, and share this personal information

- For instance, Google was fined USD 57 million in 2019 for violating GDPR due to inadequate data privacy practices, underscoring the serious consequences of mishandling sensitive information

- Data breaches are a significant concern for companies conducting background checks. The exposure of personal data can result in severe penalties, loss of customer trust, and reputational damage

- For instance, In 2015, Experian, a global credit reporting agency, suffered a massive data breach that exposed the personal information of millions of people. This incident highlighted the risks of managing sensitive data in a digital age, causing financial and reputational damage to the company

- Third-party background check providers add another layer of complexity. Organizations must ensure that these third-party services comply with privacy laws and safeguard personal data. Target

- For instance, Faced a data breach in 2013, where hackers accessed payment card information through a third-party vendor, resulting in significant financial losses and reputational harm. Companies that outsource background checks need to maintain strict oversight to avoid similar risks

- The increasing pressure to implement robust cybersecurity measures adds costs to background check companies. According to Cybersecurity Ventures, global spending on cybersecurity is expected to exceed $1 trillion from 2017 to 2021, reflecting the growing importance of safeguarding sensitive information. Background check providers must invest in advanced technologies to protect their clients' data and mitigate the risk of data breaches

- Balancing the need for thorough background checks with data privacy concerns can slow the growth of the market. Businesses need to carefully navigate regulations such as HIPAA in healthcare and FCRA in the U.S. to ensure compliance while ensuring data protection

- For instance, Amazon uses third-party providers for background checks but has faced scrutiny over how it handles employee data, prompting it to implement stricter internal controls to avoid regulatory and reputational risks

Background Check Market Scope

The market is segmented on the basis of type and application.

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Application |

|

Background Check Market Regional Analysis

“North America is the Dominant Region in the Background Check Market”

- North America is dominating the Background Check market due to its strong demand across industries such as healthcare, finance, and education, where security and compliance are paramount

- The need for comprehensive screening solutions in this region is backed by stringent regulatory standards and growing concerns around fraud and security

- As businesses in North America continue to prioritize safety, the demand for thorough background checks, including criminal record verification and employment history checks, remains high

- The expansion of remote work and global hiring in North America has further increased the demand for background checks, as companies require international screening services that comply with diverse legal and regulatory frameworks.

- The growing awareness of security risks, such as identity theft and fraud, drives businesses in North America to invest in comprehensive background checks, ensuring that they safeguard their workforce and organizational reputation.

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- The Asia-Pacific region is expected to witness the highest growth rate in the Background Check market, driven by rapid digital transformation and the increasing adoption of cloud-based solutions, which enhance the efficiency and scalability of background check processes

- The rise of remote work in the region has led to an increased demand for international background checks, as businesses hire talent from various countries, necessitating services that comply with local regulations and international standards

- The diverse legal and regulatory environments across Asia Pacific countries create a growing need for customized background check services that cater to each region’s unique requirements, boosting the demand for specialized screening providers

- As companies expand their operations and workforce across borders, particularly in countries such as India, China, and Japan, the need for accurate and timely background checks to verify candidates’ credentials, criminal history, and employment history has surged

- The increasing focus on security, fraud prevention, and compliance within industries such as finance, technology, and healthcare in Asia Pacific is further accelerating the demand for comprehensive background checks, ensuring businesses protect their interests and mitigate risks

Background Check Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Sterling (U.S.)

- First Advantage (U.S.)

- HireRight, LLC. (U.S.)

- Kroll, LLC. (U.S.)

- Spokeo, Inc. (U.S.)

- INSTANT CHECKMATE LLC (U.S.)

- MeridianLink (U.S.)

- Checkr (U.S.)

- Greenhouse Software, Inc. (U.S.)

- PeopleConnect (U.S.)

- Spokeo, Inc. (U.S.)

- TruthFinder, LLC. (U.S.)

- BeenVerified, LLC (U.S.)

Latest Developments in Global Background Check Market

- In October 2024, First Advantage completed the acquisition of Sterling Check for $2.2 billion, strengthening its position in the global background check market. The acquisition combines Sterling’s specialized services and advanced technologies with First Advantage’s infrastructure, enabling more efficient, scalable, and accurate screening solutions. This strategic move enhances First Advantage’s ability to meet growing demands in sectors such as healthcare, finance, and education, where compliance and security are critical. The merger creates a more competitive entity, positioning First Advantage for greater market share and innovation in the evolving background check industry, setting the stage for continued growth and technological advancements.

- In May 2024, G&P and ADP expanded their collaboration to simplify global employment processes. By integrating ADP’s payroll and HR solutions with G&P’s background screening services, the partnership streamlines workforce management, offering automated, compliant, and comprehensive employment solutions across multiple countries. This move aims to improve operational efficiencies, reduce manual tasks, and minimize compliance risks for global businesses. The expansion strengthens ADP’s leadership in workforce management and enhances G&P’s role in the background check market, fostering growth and innovation

- In February 2024, Stone Point Capital and General Atlantic announced the acquisition of HireRight for USD 1.65 billion, aiming to strengthen HireRight’s position in the global background check market. The deal combines HireRight’s services with the expertise and resources of the two investment firms, enabling enhanced technological capabilities, expanded service offerings, and improved compliance and security. The acquisition positions HireRight to meet growing demand across various industries while improving operational efficiencies and expanding its global reach. It also leverages Stone Point Capital and General Atlantic’s experience to drive innovation and capitalize on emerging trends such as remote work and international hiring, positioning HireRight for future growth

- In November 2023, Convera and ADP announced a strategic collaboration to offer an enhanced global payment and payroll solution. The partnership integrates Convera’s cross-border payment solutions with ADP’s payroll and HR services, simplifying global workforce management. This collaboration enables businesses to manage employee payments across multiple countries, ensuring compliance and optimizing operational efficiencies. The combined solution streamlines payroll processes, reduces administrative burdens, and enhances the accuracy of international payments, making it easier for companies to manage their global workforce. This alliance positions Convera and ADP as leaders in the global payments and payroll industry, setting the stage for further growth with technology-driven solutions for international workforce management

- In January 2023, The Citation Group announced the acquisition of Disclosure Services, enhancing its portfolio in the background screening and compliance sector. This acquisition allows The Citation Group to expand its service offerings by integrating Disclosure Services' comprehensive screening solutions and advanced technology. The move improves the efficiency and accuracy of services, particularly in criminal background checks, employment verification, and compliance with industry regulations. The deal strengthens The Citation Group's ability to serve clients in sectors such as healthcare, finance, and education, positioning the company for growth and innovation in the background check industry while meeting the evolving needs of businesses

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.