Global Aws Managed Services Market, By Services Type (Operations Services, Cloud Migration Services, Advisory Services), Deployment Mode (On-premises, Cloud), Organization Size (SME, Large Enterprises), Industry Vertical (BFSI, Healthcare, Manufacturing, Government and Defense, Media and Entertainment, IT and Telecommunication, Other) – Industry Trends and Forecast to 2031.

Aws Managed Services Market Analysis and Size

Cloud migration and transformation involve the strategic movement of an organization's digital assets, applications, and workflows from on-premise infrastructure to cloud environments, often leveraging AWS managed services. This process aims to enhance scalability, flexibility, and efficiency while reducing operational overhead. AWS managed services play a crucial role by automating infrastructure management, ensuring seamless migration, optimizing performance, and facilitating ongoing transformation efforts, thereby enabling businesses to discover the full potential of cloud computing while focusing on their core objectives.

According to Datto, managed service providers (MSPs) typically manage an average of 122 clients, with around 60% of these clients being small to medium-sized businesses (SMBs) with 1-150 employees, and only 5% comprising larger enterprises with over 500 employees. This data underscores the focus of MSPs on catering to SMBs by offering cost-effective and scalable solutions such as AWS managed services, tailored to their needs for cloud migration and management support.

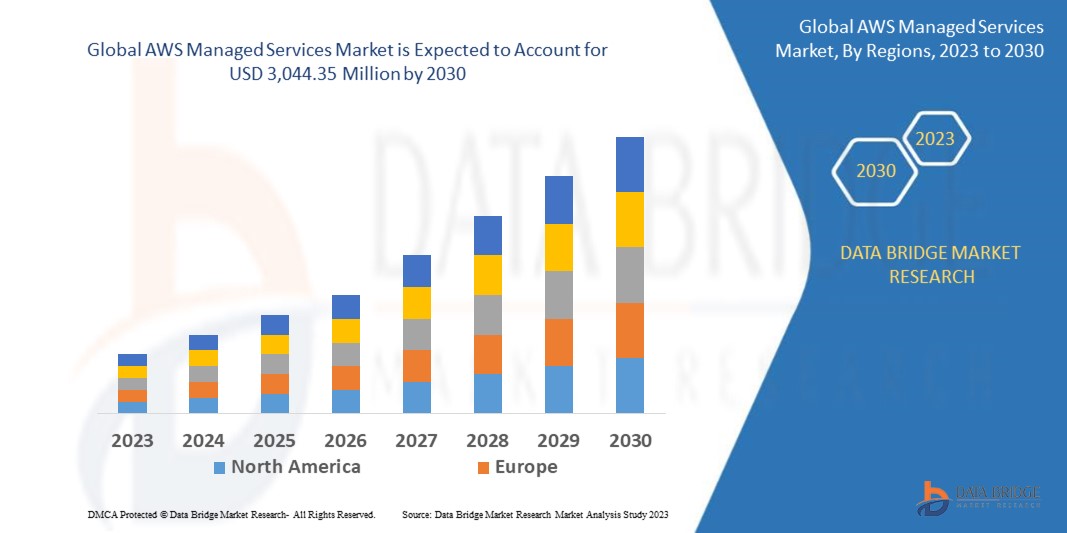

Global AWS managed services market size was valued at USD 974.91 million in 2023 and is projected to reach USD 3,045.07 million by 2031, with a CAGR of 15.3% during the forecast period of 2024 to 2031. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2024-2031

|

|

Base Year

|

2023

|

|

Historic Years

|

2022 (Customizable to 2016-2021)

|

|

Quantitative Units

|

Revenue in USD Million, Volumes in Units, Pricing in USD

|

|

Segments Covered

|

Services Type (Operations Services, Cloud Migration Services, Advisory Services), Deployment Mode (On-premises, Cloud), Organization Size (SME, Large Enterprises), Industry Vertical (BFSI, Healthcare, Manufacturing, Government and Defense, Media and Entertainment, IT and Telecommunication, Other)

|

|

Countries Covered

|

U.S., Canada, Mexico, Brazil, Argentina, Rest of South America, Germany, France, Italy, U.K., Belgium, Spain, Russia, Turkey, Netherlands, Switzerland, Rest of Europe, Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, U.A.E., Saudi Arabia, Egypt, South Africa, Israel, Rest of Middle East and Africa

|

|

Market Players Covered

|

RACKSPACE US INC. (U.S.), Smartronix Inc. (U.S.), Mission Cloud Services, Inc. (U.S.), Claranet Limited (U.K.), DXC Technology Company (U.S.), Onica (U.S.), Slalom, LLC (U.S.), e-Zest Solutions (India), Great Software Laboratory (India), Cloudnexa (U.S.), Logicworks (U.S.), CLOUDREACH (U.K.), AllCloud (Israel), Hitachi Vantara LLC (U.S.)

|

|

Market Opportunities

|

|

Market Definition

AWS managed services encompass a suite of tools and solutions aimed at automating infrastructure management for Amazon Web Services (AWS) deployments. Primarily targeting large enterprises, these services offer a streamlined pathway for migrating on-premise workloads to the cloud, with a focus on public cloud environments while also accommodating private or hybrid cloud setups.

AWS Managed Services Market Dynamics

Drivers

- Growing Cloud-First Strategies Leads to the Adoption Among Organizations

Cloud-first strategies refer to organizational approaches prioritizing cloud computing solutions for IT infrastructure and application needs over traditional on-premise systems. This strategic shift is a significant driver of the AWS managed services market as businesses increasingly recognize the agility, scalability, and cost-efficiency offered by cloud-based solutions. Leveraging AWS managed services, companies can efficiently manage their cloud environments, optimize resource utilization, and streamline operations. Moreover, as the demand for cloud-first strategies grows, AWS managed services provide essential support for businesses seeking to accelerate their digital transformation journeys, enabling them to stay competitive in today's dynamic market landscape.

- Increased Complex Compliance Raise the Demand for AWS Managed Services

Organizations across industries face increasingly stringent regulatory standards and cybersecurity threats, necessitating robust measures to ensure data protection and regulatory compliance. AWS managed services offer specialized expertise and comprehensive solutions to navigate these challenges, providing advanced security features, compliance frameworks, and automated monitoring capabilities. This heightened focus on compliance and security amplifies the demand for AWS managed services as a trusted partner in safeguarding sensitive data and ensuring regulatory adherence for businesses of all sizes.

Opportunities

- Growing AI integration Enhances Value Proposition

Leveraging AI technologies within AWS managed services enables automated optimization, predictive analytics, and intelligent resource allocation, leading to improved performance, cost-efficiency, and scalability for clients. Harnessing AI for tasks such as workload management, anomaly detection, and security enhancements, AWS managed services providers can deliver more robust and proactive solutions, meeting the evolving needs of businesses across diverse industries. This integration fosters innovation and competitiveness, empowering organizations to leverage the full potential of cloud computing while minimizing operational overhead and maximizing business outcomes.

- Rising Technological Development Increases the Adoption of AWS Managed Services

As advancements in cloud computing, artificial intelligence, and automation continue to evolve, organizations seek more efficient and cost-effective solutions for managing their IT infrastructure. AWS Managed Services leverages these innovations to provide automated infrastructure management, enhanced security, and scalability, catering to the evolving needs of businesses. Furthermore, the increasing complexity of IT environments necessitates specialized expertise, prompting organizations to rely on AWS Managed Services for comprehensive support in navigating the intricacies of cloud deployments. Overall, technological advancements empower AWS managed services to deliver robust, agile, and adaptable solutions, driving its widespread adoption in the market.

Restraints/Challenges

- High Data Sovereignty Concerns Limits the Adoption of AWS Managed Services

Data sovereignty concerns arise from regulations stipulating that data must be stored within specific geographic boundaries or jurisdictions. As AWS operates data centers worldwide, ensuring compliance with diverse data sovereignty regulations becomes complex. Consequently, organizations may hesitate to migrate to AWS managed services due to uncertainties regarding data residency and legal compliance.

- High Cost of Management Impacts the Decision-Making Processes for Businesses

While AWS managed services offer numerous benefits, including scalability and flexibility, concerns regarding cost control are paramount. Organizations must carefully monitor and optimize their AWS usage to avoid unexpected expenses and ensure cost efficiency. Factors such as resource provisioning, data transfer fees, and storage costs necessitate ongoing vigilance and strategic planning to prevent budget overruns. Effective cost management strategies, such as rightsizing resources, leveraging reserved instances, and implementing automation, are essential for maximizing the value of AWS managed services while mitigating financial risks and maintaining competitiveness in the market.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Recent Developments

- In May 2022, EY and IBM collaborates to bolster digital innovation and resilience for global businesses. They established a Talent Center of Excellence (COE) focusing on data-driven AI and hybrid cloud solutions. This initiative aims to aid organizations in talent management, HR transformation, and workforce upskilling, addressing the pressing need for agile workforce strategies

- In May 2022, IBM and Amazon Web Services Inc. (AWS) announced a Strategic Collaboration Agreement (SCA) to offer IBM's software catalog as Software-as-a-Service (SaaS) on AWS. This collaboration enables customers to leverage IBM Software on AWS, facilitating the rapid deployment of modern, secure, and intelligent workflows, thereby enhancing business agility and value delivery

- In January 2022, Rackspace Technology and BT initiated a collaboration aimed at transforming BT's multinational customers' cloud services. Rackspace Technology's solutions will underpin BT's hybrid cloud services, deployed in BT data centers alongside Rackspace Fabric management layer. This partnership seeks to enhance cloud service delivery and support multinational enterprises' evolving digital needs, showcasing the competitive dynamics within the AWS Managed Services Market as industry leaders align to cater to evolving demands

- In March 2021, IBM Security launched a new and enhanced service designed to assist organizations in managing policies, cloud security strategies, and controls across hybrid cloud environments. Addressing the increasing complexity of cybersecurity threats and regulatory compliance requirements, this service offers comprehensive solutions for safeguarding digital assets. IBM's proactive response underscores the growing significance of robust security offerings within the AWS Managed Services Market, as organizations prioritize protecting their digital assets amidst evolving cyber threats and regulatory landscapes

AWS Managed Services Market Scope

The market is segmented on the basis of the basis of services type, deployment mode, organization size, and industry vertical. The growth amongst these segments will help you analyze meager growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Services Type

- Operations Services

- Cloud Migration Services

- Advisory Services

Deployment Mode

- On-premises

- Cloud

Organization Size

- SME

- Large Enterprises

Industry Vertical

- BFSI

- Healthcare

- Manufacturing

- Government and Defense

- Media and Entertainment

- IT and Telecommunication

- Other

AWS Managed Services Market Region Analysis/Insights

The market is segmented on the basis of services type, deployment mode, organization size, and industry vertical.

The countries covered in the market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E., Israel, Egypt, South Africa, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America

North America is expected to dominance in the AWS managed services market stems from its substantial investment in cutting-edge technologies and well-established network infrastructure. With a robust economy and a culture of innovation, businesses in the region prioritize leveraging AWS managed services to enhance their operational efficiency and scalability. This trend is further propelled by a burgeoning demand for cloud solutions across various industries, solidifying North America's position as a key market for AWS managed services in the forecast period.

The Asia-Pacific is expected for significant growth driven by rising adoption and awareness of AWS managed services across diverse industries. This expansion is fueled by businesses recognizing the benefits of outsourcing their cloud infrastructure management to AWS, allowing them to focus on core competencies. As digital transformation accelerates in the region, there's a growing demand for scalable and reliable cloud solutions, positioning AWS as a key player in meeting these needs. This trend forecasts a promising future for AWS managed services in the Asia-Pacific market, presenting ample opportunities for both service providers and businesses asuch as.

The country section of the global sales force automation software market report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as consumption volumes, production sites and volumes, import export analysis, price trend analysis, cost of raw materials, down-stream and upstream value chain analysis are some of the major pointers used to forecast the market scenario for individual countries. Also, presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and AWS Managed Services Market Share Analysis

The market competitive landscape provides details of competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance. The above data points provided are only related to the company's focus related to the market.

Some of the major players operating in the market are:

- RACKSPACE US INC. (U.S.)

- Smartronix Inc. (U.S.)

- Mission Cloud Services, Inc. (U.S.)

- Claranet Limited (U.K.)

- DXC Technology Company (U.S.)

- Onica (U.S.)

- Slalom, LLC (U.S.)

- e-Zest Solutions (India)

- Great Software Laboratory (India)

- Cloudnexa (U.S.)

- Logicworks (U.S.)

- CLOUDREACH (U.K.)

- AllCloud (Israel)

- Hitachi Vantara LLC (U.S.)

SKU-