Global Automotive Wheels Aftermarket Market

Market Size in USD Billion

CAGR :

%

USD

6.44 Billion

USD

8.22 Billion

2024

2032

USD

6.44 Billion

USD

8.22 Billion

2024

2032

| 2025 –2032 | |

| USD 6.44 Billion | |

| USD 8.22 Billion | |

|

|

|

|

Automotive Wheels Aftermarket Market Size

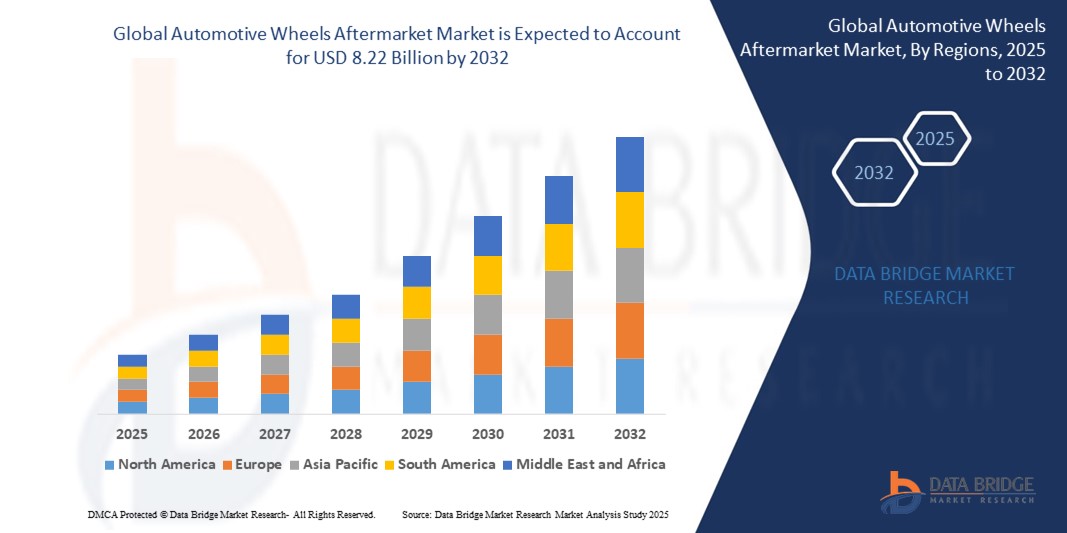

- The global Automotive Wheels Aftermarket market size was valued at USD 6.44 billion in 2024 and is expected to reach USD 8.22 billion by 2032, at a CAGR of 3.10% during the forecast period

- The market growth is primarily driven by the rising demand for vehicle customization, particularly among car enthusiasts seeking enhanced aesthetics and performance through aftermarket alloy and forged wheels.

- In addition, the expanding global vehicle parc and aging fleet are creating a sustained need for replacement wheels, especially in regions with high vehicle ownership, thereby supporting steady market expansion.

Automotive Wheels Aftermarket Market Analysis

- Automotive Wheels Aftermarkets play a key role in enhancing vehicle aesthetics, performance, and handling, offering a wide range of customization options through alloy, forged, and steel wheels for both passenger and commercial vehicles.

- The increasing consumer inclination towards vehicle personalization, combined with the growing popularity of motorsports and car modification culture, is a major factor fueling the demand for aftermarket wheels globally.

- North America leads the global Automotive Wheels Aftermarket market with the largest revenue share of 37.6% in 2024, supported by a robust automotive aftermarket industry, high disposable income, and a strong enthusiast community focused on customization.

- Asia-Pacific is projected to be the fastest-growing region during the forecast period, driven by rising vehicle ownership, a growing middle class, and expanding automotive repair and customization services in countries like China and India.

- The alloy wheels segment dominates the market with a market share of 43.2% in 2024, favored for its lightweight, strength, aesthetic appeal, and better fuel efficiency compared to steel wheels

Report Scope and Automotive Wheels Aftermarket Market Segmentation

|

Attributes |

Automotive Wheels Aftermarket Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Automotive Wheels Aftermarket Market Trends

“Rising Demand for Aesthetic Customization and Performance Enhancement”

- A major trend in the global Automotive Wheels Aftermarket market is the rising consumer demand for vehicle personalization and performance optimization through aftermarket wheels, especially alloy and forged options that offer both visual appeal and functional benefits such as improved handling and fuel efficiency.

- The trend is notably prominent among automotive enthusiasts and younger demographics seeking unique, sporty, or luxury looks. For example, in September 2023, Wheel Pros introduced new forged and flow-formed wheel models under the Rotiform and American Racing brands, targeting premium customization segments.

- Additionally, the expansion of car culture on social media platforms and auto expos like SEMA 2023, where aftermarket wheel innovations were showcased, continues to inspire consumer interest in upgraded wheels.

- OEMs and aftermarket brands are also collaborating; Enkei Wheels continues partnerships with motorsport teams to promote high-performance wheel options adapted for daily use, reinforcing aftermarket credibility.

- Moreover, the rise of electric vehicles (EVs) is influencing design trends, with lightweight and aerodynamic aftermarket wheels being developed to complement EV efficiency needs, as seen in BBS’s 2024 launch of lightweight forged wheels optimized for EVs like Tesla and Lucid Air

Automotive Wheels Aftermarket Market Dynamics

Driver

“Increasing Vehicle Customization Culture and Aging Vehicle Fleet”

- The global demand for aftermarket automotive wheels is significantly driven by the increasing consumer appetite for customization and the growing age of vehicles on the road. As cars age, owners are more inclined to upgrade or replace wheels for performance or aesthetic reasons.

- According to Auto Care Association’s 2024 Factbook, the average vehicle age in the U.S. reached 12.5 years, contributing to sustained aftermarket demand.

- In July 2023, Fuel Off-Road, a prominent aftermarket brand, launched a new line of rugged, off-road alloy wheels designed for SUVs and pickup trucks, addressing the rising popularity of off-roading and adventure lifestyle vehicles.

- Additionally, the growth of motorsports and car modification events in regions like North America, Europe, and parts of Asia is reinforcing this trend, driving sales in the alloy and forged segments.

- The ease of installation and wide availability of aftermarket wheels through both online channels and specialty retailers further supports the upward trajectory of the market.

Restraint/Challenge

“High Production Costs and Limited Access to Advanced Manufacturing Technologies”

- One of the main restraints in the global Automotive Wheels Aftermarket market is the high cost associated with manufacturing premium aftermarket wheels, especially forged and carbon fiber options, which limits affordability for a broad customer base.

- Production of high-end wheels involves precision engineering, costly raw materials, and advanced forging or casting technologies—raising the final product price.

- For instance, HRE Performance Wheels offers premium forged wheels that can cost upwards of $2,000 per wheel, making them accessible mostly to premium vehicle owners.

- Small and mid-tier aftermarket suppliers often struggle with the capital investment required to adopt cutting-edge manufacturing like flow forming or CNC machining, leading to reduced innovation and limited product offerings.

- Additionally, global supply chain disruptions and rising aluminum prices (as reported by World Bank Commodities Data 2024) have further impacted cost structures, squeezing margins and deterring new entrants.

- Addressing this restraint will require advancements in cost-effective production technologies, broader material sourcing strategies, and improved distribution models to reduce prices and increase accessibility for mainstream consumers.

Automotive Wheels Aftermarket Market Scope

The market is segmented on the basis of vehicle type, material type, rim size, and coating type.

• By Vehicle Type

The Automotive Wheels Aftermarket market is segmented into passenger cars and commercial vehicles. The passenger cars segment accounted for the largest market revenue share in 2024, driven by growing consumer inclination toward vehicle customization, aesthetics, and performance enhancement. Increased vehicle ownership, especially in emerging markets, and rising demand for alloy and lightweight wheels are contributing to the segment’s dominance.

The commercial vehicles segment is projected to witness significant growth during the forecast period, as fleet operators increasingly invest in durable, high-performance wheels to improve fuel efficiency and reduce maintenance costs. This trend is especially strong in logistics and last-mile delivery sectors, driven by the global surge in e-commerce activity.

• By Material Type

On the basis of material type, the market is segmented into alloy, steel, aluminum, carbon fiber, and others. The alloy wheels segment leads the market with the largest share in 2024, owing to its widespread usage in both OEM replacements and aftermarket upgrades due to its strength-to-weight ratio and visual appeal.

The carbon fiber wheels segment is expected to register the fastest CAGR from 2025 to 2032. Though expensive, carbon fiber wheels offer ultra-lightweight performance and enhanced durability, making them increasingly attractive for luxury and performance vehicles.

Meanwhile, aluminum wheels continue to gain traction for balancing strength, affordability, and fuel efficiency across passenger and commercial vehicles.

• By Rim Size

The market is segmented by rim size into 13–15 inch, 16–18 inch, 19–21 inch, and above 21 inch. The 16–18 inch segment held the dominant share in 2024, largely due to its compatibility with a wide range of mid-size passenger cars and SUVs. These sizes strike a balance between aesthetics, ride comfort, and performance.

The 19–21 inch segment is expected to witness the fastest growth rate, fueled by rising consumer interest in sportier aesthetics and premium vehicles, which often come with larger factory-fitted rims. Additionally, the above 21 inch segment is gaining traction in luxury SUVs and performance cars for enhancing aggressive styling and road presence.

• By Coating Type

Based on coating type, the market is divided into powdered coating and liquid coating. The powdered coating segment dominated the market in 2024, driven by its superior durability, corrosion resistance, and environmentally friendly application process. Powder coatings are widely preferred in aftermarket customization for their finish quality and longevity.

The liquid coating segment is projected to grow steadily due to its ease of application on complex wheel designs and suitability for small-batch or customized color solutions. Liquid coatings also offer a broader color palette, which appeals to design-conscious consumers and tuners in the aftermarket space.

Automotive Wheels Aftermarket Market Regional Analysis

North America dominates the global Automotive Wheels Aftermarket market with the largest revenue share of 37.6% in 2024, driven by high consumer demand for vehicle customization, performance enhancement, and aesthetic upgrades. The region has a mature aftermarket ecosystem supported by a strong network of distributors, specialty retailers, and automotive enthusiasts. Growth is further bolstered by the popularity of light trucks and SUVs, especially in the U.S., which encourages demand for larger, high-performance aftermarket wheels.

U.S. Automotive Wheels Aftermarket Market Insight

The U.S. accounted for over 82% of North America’s revenue share in 2024, underpinned by a strong culture of vehicle personalization and the presence of leading aftermarket suppliers such as American Racing, HRE Wheels, and Fuel Off-Road. Additionally, the growing number of aging vehicles and rising off-road vehicle modifications are further stimulating aftermarket wheel replacements. Recent launches like the 2024 Fuel Off-Road D822 in the 20x12 size with a black milled finish highlight the segment’s evolving design and material innovations aimed at truck and SUV owners.

Europe Automotive Wheels Aftermarket Market Insight

The European Automotive Wheels Aftermarket market is expected to grow steadily at a CAGR of 4.3% from 2025 to 2032, supported by rising consumer interest in sustainability and fuel efficiency, which encourages the adoption of lightweight alloy and carbon fiber wheels. Moreover, government mandates promoting reduced emissions and energy-efficient vehicles in countries like Germany and France are indirectly driving the demand for weight-reducing aftermarket components such as aluminum and carbon fiber wheels.

U.K. Automotive Wheels Aftermarket Market Insight

The U.K. market is witnessing a rise in demand for customized and performance wheels, especially in the luxury and sports car segment. Local players and tuning specialists are capitalizing on this trend by offering bespoke alloy wheel solutions. For instance, in 2024, Vossen Wheels expanded its European operations with new offerings tailored to the U.K. market, enhancing availability and customer service in the region.

Germany Automotive Wheels Aftermarket Market Insight

Germany holds a significant share in Europe’s automotive aftermarket, driven by its position as a major automotive manufacturing hub. The country's focus on premium vehicles like BMW, Audi, and Mercedes-Benz supports high demand for aftermarket wheels, particularly forged and carbon fiber variants. The German market is also seeing increasing interest in eco-conscious wheel coatings and corrosion-resistant finishes, aligned with the region’s green mobility goals.

Asia-Pacific Automotive Wheels Aftermarket Market Insight

The Asia-Pacific market is expected to grow at the fastest CAGR of 6.7% from 2025 to 2032, fueled by rising vehicle ownership, urbanization, and economic development in countries like China, India, and Southeast Asia. Increasing consumer awareness of vehicle aesthetics and performance upgrades is driving the aftermarket wheels segment. The growing presence of regional players such as Lenso, Enkei, and Rays Engineering further enhances accessibility to a wide range of wheel types and price points.

Japan Automotive Wheels Aftermarket Market Insight

Japan’s Automotive Wheels Aftermarket benefits from a high penetration of performance cars and a strong motorsports culture. Leading domestic brands like Rays (maker of Volk Racing) and WedsSport drive product innovation and lightweight wheel design. In 2024, Rays introduced its new TE37 Ultra Track Edition 2, optimized for track performance, underscoring Japan’s leadership in forged wheel technology.

China Automotive Wheels Aftermarket Market Insight

China accounted for the largest market share in the Asia-Pacific Automotive Wheels Aftermarket in 2024, driven by its rapidly expanding vehicle fleet, booming auto modification culture, and favorable government support for automotive aftermarket growth. Domestic brands like Jiangsu Hongtai and Zhejiang Jinfei Kaida dominate the supply landscape, offering alloy and aluminum wheel solutions at competitive prices. The market is also supported by a surge in online aftermarket platforms, increasing accessibility for rural and urban consumers alike.

Automotive Wheels Aftermarket Market Share

The Automotive Wheels Aftermarket industry is primarily led by well-established companies, including:

- Enkei International, Inc. (Japan)

- Maxion Wheels (Brazil)

- Borbet GmbH (Germany)

- Superior Industries International, Inc. (U.S.)

- Accuride Corporation (U.S.)

- Steel Strips Wheels Ltd. (India)

- Zhejiang Wanfeng Auto Wheel Co., Ltd. (China)

- O.Z. S.p.A. (Italy)

- Ronal AG (Switzerland)

- BBS Kraftfahrzeugtechnik AG (Germany)

Latest Developments in Global Automotive Wheels Aftermarket Market

- In April 2024, Wheel Pros, a U.S.-based aftermarket wheel manufacturer, announced the acquisition of Hoonigan Industries, a brand known for its motorsports lifestyle content and aftermarket performance parts. This acquisition is expected to strengthen Wheel Pros' market position by integrating media influence with product offerings, expanding its reach among automotive enthusiasts and boosting demand for customized aftermarket wheels.

- In February 2024, Superior Industries International, a leading OEM supplier and aftermarket wheel provider, launched a new line of lightweight aluminum wheels under its proprietary brand. These wheels cater to the rising demand for fuel efficiency and performance in passenger vehicles, especially in EVs, as reduced wheel weight contributes to overall vehicle efficiency and battery range.

- In December 2023, Ronal Group, a global leader in alloy wheels, announced the expansion of its Forged Wheels product line tailored for high-performance vehicles, including premium electric vehicles. The company emphasized sustainability by using low-carbon aluminum and optimized manufacturing processes, aligning with the growing trend of eco-conscious customization in the aftermarket space.

- In November 2023, BBS Japan Co., Ltd., a premium performance wheels manufacturer, revealed a new range of motorsport-grade magnesium wheels targeted at the luxury performance aftermarket segment. The launch was in collaboration with several Formula and GT racing teams, reinforcing the brand’s reputation for quality and performance, and tapping into the racing-to-road market trend.

- In September 2023, Enkei Corporation introduced a new series of lightweight performance wheels called the Racing Revolution RS08, specifically designed for compact sports cars and track-day enthusiasts. The new wheels focus on improved rigidity and weight reduction, providing enhanced handling characteristics, thus meeting consumer demand for performance-enhancing aftermarket upgrades.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.