Global Automotive Test Equipment Market

Market Size in USD Billion

CAGR :

%

USD

10.10 Billion

USD

15.90 Billion

2024

2032

USD

10.10 Billion

USD

15.90 Billion

2024

2032

| 2025 –2032 | |

| USD 10.10 Billion | |

| USD 15.90 Billion | |

|

|

|

|

Automotive Test Equipment Market Size

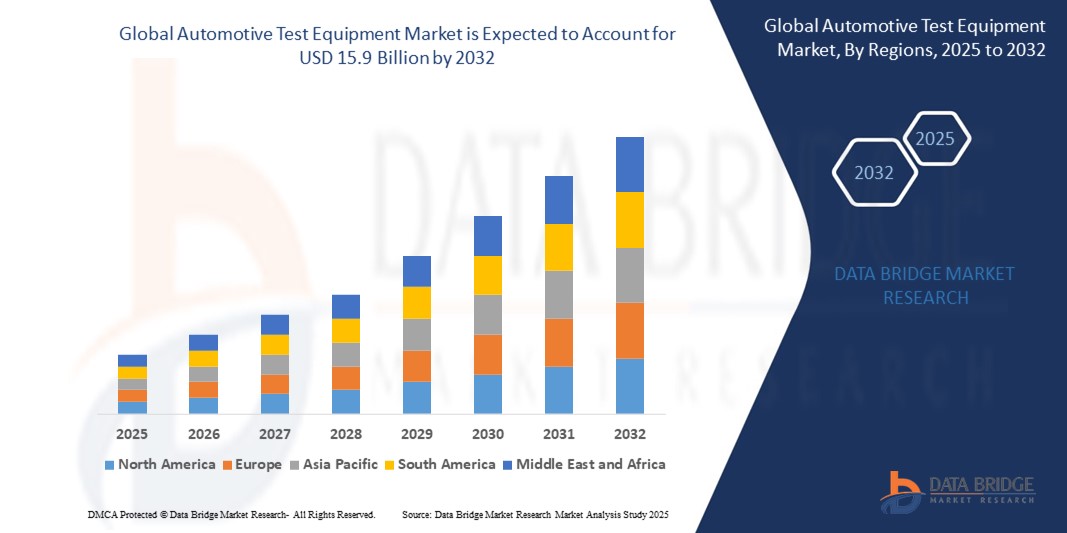

- The global automotive test equipment market size was valued at USD 10.1 Billion in 2025 and is expected to reach USD 15.9 Billion by 2032, growing at a CAGR of 6.7% during the forecast period.

- Market growth is driven by stringent vehicle emission regulations, rising focus on vehicle performance and safety, the electrification of vehicles, and the growing adoption of advanced diagnostic systems by both OEMs and aftermarket service providers.

- Additionally, increasing R&D investments in autonomous and electric vehicle technologies are creating a need for sophisticated testing solutions that ensure compliance, safety, and real-time diagnostics across varied environments.

Automotive Test Equipment Market Analysis

- Automotive test equipment enables manufacturers and service providers to test and diagnose various vehicle parameters such as emissions, engine performance, and electronic systems. These tools are crucial for regulatory compliance, quality assurance, and enhanced vehicle lifecycle performance.

- The shift towards connected and electric mobility, coupled with the emergence of autonomous vehicles, is reshaping testing protocols, making advanced testing platforms more relevant.

- North America dominated the market in 2025 due to stringent regulatory frameworks, robust automotive R&D infrastructure, and high EV adoption. The U.S. leads with extensive investment in emission testing technologies and EV diagnostics.

- Asia-Pacific is anticipated to grow at the fastest pace during the forecast period, driven by rapid automotive production in China and India, increasing vehicle exports, and rising government mandates for emission testing and roadworthiness.

- The engine dynamometer segment captured the largest share in 2025 due to its critical role in powertrain and fuel efficiency testing across vehicle types..

Report Scope and Automotive Test Equipment Market Segmentation

|

Attributes |

Automotive Test Equipment Market Key Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

Growing penetration of electric vehicles is spurring demand for high-voltage battery testers, regenerative braking test systems, and powertrain performance analyzers, thereby opening new avenues for manufacturers of EV test equipment.

Stricter emission standards (e.g., Euro 7, BS VI) are necessitating advanced emission testing systems, boosting demand across OEMs and certified testing centers.

The development of ADAS and vehicle telematics has accelerated the integration of software-based diagnostic tools and real-time simulation platforms for advanced vehicle testing.

Autonomous driving systems require comprehensive validation frameworks involving simulation, on-road testing, and sensor calibration – increasing the need for integrated and automated test equipment platforms. |

|

Value Added Data Infosets |

In addition to insights on market value, CAGR, segmentation, and regional coverage, the Global Automotive Test Equipment Market report includes detailed assessments of technology integration across traditional and electric vehicle platforms, ROI benchmarking for advanced diagnostic tools, and system compatibility with OEM and aftermarket service workflows. It also features lifecycle cost analysis of testing equipment, case studies on autonomous vehicle test beds, the impact of environmental regulations on emission testing infrastructure, and predictive maintenance modeling for service optimization. Strategic frameworks such as PESTLE Analysis, Porter’s Five Forces, and comprehensive reviews of global safety standards, emissions compliance mandates, and automotive testing certification protocols are included to guide stakeholders in strategic planning and capital allocation. |

Automotive Test Equipment Market Trends

“Advanced Vehicle Diagnostics and Autonomous Testing Powered by AI and Connectivity”

- A dominant trend in the automotive test equipment market is the integration of AI-powered diagnostics, machine learning, and vehicle connectivity technologies to enhance the precision, automation, and real-time feedback of vehicle testing.

- Leading companies like Bosch, AVL, and Siemens are leveraging AI for intelligent fault detection, automated calibration, and dynamic system validation, significantly reducing test time and human error.

- The shift toward connected vehicles and OTA (Over-the-Air) diagnostics is driving demand for cloud-integrated test systems capable of remote monitoring, predictive maintenance, and software validation across the vehicle lifecycle.

- Advanced testing platforms now use sensor fusion technologies, including CAN bus analysis, thermal imaging, and vibration diagnostics, to evaluate complex components in EVs and ADAS systems with greater accuracy.

- Virtual simulation and digital twins are being used to replicate real-world driving scenarios, aiding in the validation of autonomous and semi-autonomous driving features before physical deployment.

- These innovations are transforming traditional testing into a predictive, data-centric process that enhances safety compliance, product quality, and development speed in an increasingly software-defined automotive environment.

Precision harvesting market Dynamics

Driver

“Rising Demand for Automated, Real-Time Testing in EVs, ADAS, and Regulatory Compliance”

- Growing automotive complexity—driven by electrification, autonomous technologies, and tighter emissions and safety regulations—is propelling the need for advanced, automated test equipment across the global market.

- Automakers and Tier 1 suppliers are investing in next-gen testing platforms capable of validating battery systems, electric drivetrains, and driver assistance features (ADAS) through real-time data capture, load simulation, and fault detection.

- For example, companies like Horiba Ltd. and MAHA are deploying vehicle inspection systems that simulate dynamic driving conditions, support RDE (Real Driving Emissions) testing, and measure particulate emissions with high accuracy.

- In the EV segment, demand for high-voltage test benches, battery simulators, and regenerative braking testers is surging, especially in markets such as Europe, China, and North America where electric vehicle adoption is rapidly increasing.

- These solutions help manufacturers ensure compliance with global standards while minimizing recall risks and improving product reliability.

Restraint/Challenge

“High Equipment Costs and Skill Gaps Among Technicians and Service Centers”

- One of the main restraints in the automotive test equipment market is the significant capital investment required to procure advanced testing platforms—especially those designed for electric and autonomous vehicles.

- High-performance dynamometers, multi-sensor diagnostic units, and AI-integrated analyzers can be financially out of reach for small and mid-size automotive service centers or independent garages.

- Moreover, the technical complexity of operating modern test equipment demands trained personnel proficient in interpreting data logs, configuring test cycles, and navigating digital interfaces—a skill set that is still underdeveloped in many regions.

- In emerging markets, a lack of consistent training infrastructure and internet connectivity further impedes adoption of cloud-based and remote diagnostic tools.

- Bridging this gap requires stronger collaboration between OEMs, government agencies, and technology vendors to offer affordable leasing models, technician upskilling programs, and simplified user interfaces that promote broader accessibility.

Automotive Test Equipment Market Scope (By Segment)

- By Product Type

Engine dynamometers led in 2025 due to their indispensable role in performance and durability testing of combustion engines. Chassis dynamometers are widely adopted for emission and drive-cycle simulation. Emission test systems are expected to grow fastest amid regulatory pressure.

- By Vehicle Type

Passenger vehicles dominate due to higher production volumes and increasing integration of onboard diagnostics and safety features.

- By Propulsion

ICE vehicles account for the larger share, but electric vehicle testing is the fastest-growing segment, driven by increasing EV launches and supportive infrastructure.

- By End Use

Vehicle OEMs lead the market due to large-scale deployment of advanced testing during design and pre-production phases. Automotive service centers are also adopting automated testing tools for enhanced customer service and compliance.

Automotive Test Equipment Market Regional Analysis

- North America leads the global automotive test equipment market in 2025, accounting for the largest revenue share, driven by strict emission norms, widespread EV adoption, and a robust automotive R&D ecosystem. The presence of industry leaders such as Snap-on Incorporated, Honeywell, and Delphi Technologies, along with advanced vehicle diagnostics infrastructure, reinforces the region’s dominance. U.S.-based OEMs and testing centers are deploying high-performance emission analyzers, EV battery test benches, and ADAS validation systems to ensure regulatory compliance and enhance vehicle quality.

- Europe is a major regional market, supported by rigorous EU emissions and safety standards, sustainability goals, and a mature automotive industry. Countries like Germany, France, and the U.K. are early adopters of chassis dynamometers, engine diagnostics platforms, and ADAS testing equipment. EU-backed investments in green mobility and zero-emission vehicles are accelerating the deployment of high-precision test systems for electric and hybrid drivetrains across manufacturing and inspection facilities.

- Asia-Pacific is projected to register the fastest CAGR from 2025 to 2032, fueled by rapid vehicle production, growing EV adoption, and increasing government mandates for vehicle safety and emissions. Nations such as China, India, and Japan are investing heavily in smart test labs, real-world emissions testing, and connected vehicle diagnostics. Regional OEMs are integrating cloud-based and AI-driven test equipment to enhance quality assurance and support export readiness.

- Middle East and Africa (MEA) is experiencing steady growth, with rising focus on emissions control, vehicle safety, and aftermarket diagnostics. Countries like the UAE, Saudi Arabia, and South Africa are adopting modern test lanes, roadworthiness inspection tools, and sensor-integrated vehicle test platforms.

- Government-led infrastructure modernization and increasing vehicle imports are driving the need for reliable, compliant automotive testing solutions in this region.

- South America, particularly Brazil and Argentina, is seeing growing uptake of automotive test equipment due to stricter vehicle regulations and the expansion of automotive manufacturing. The region’s strong position in ethanol and flex-fuel vehicles is encouraging investment in emissions testing, engine validation, and hybrid powertrain diagnostics. Automotive service centers and OEMs are adopting advanced tools to reduce recalls and meet international quality benchmarks

United States Automotive Test Equipment Market Insight

The United States holds the largest revenue share in 2025, supported by stringent EPA regulations, high adoption of connected diagnostics, and a mature EV ecosystem. U.S. OEMs, repair centers, and regulatory agencies utilize engine dynamometers, vehicle emission analyzers, and ADAS calibration tools to support safety certification, emissions compliance, and real-time vehicle diagnostics. Leading players such as Snap-on and Bosch are deeply integrated into the country’s automotive testing landscape.

Europe Automotive Test Equipment Market Insight

Europe’s market growth is underpinned by regulatory stringency and a strategic shift toward electrified and autonomous mobility. Automakers in Germany, France, and the U.K. are adopting state-of-the-art testing platforms for hybrid/electric vehicle components, in-vehicle software validation, and low-emission engine testing. The emphasis on Euro 7 standards and intelligent transport systems is boosting the adoption of automated and AI-integrated test systems across production lines and inspection stations.

India Automotive Test Equipment Market Insight

India is emerging as a high-growth market due to the implementation of BS VI norms, rapid automotive expansion, and increasing EV focus. Automotive OEMs and government-certified test agencies are deploying emission testers, battery simulators, and sensor calibration units to comply with rising regulatory demands. Incentive programs under FAME India and initiatives for smart vehicle testing infrastructure are further accelerating the adoption of automotive test solutions in both urban and rural service ecosystems.

Brazil Automotive Test Equipment Market Insight

Brazil is a pivotal market in South America, driven by the country’s established vehicle manufacturing base and regulatory framework on emissions and vehicle safety. Local OEMs and inspection agencies are investing in chassis and engine testing solutions to validate flex-fuel engines and reduce pollutants. The growing need for efficient and cost-effective aftermarket testing tools is pushing adoption of compact, software-driven diagnostics among regional service providers.

China Automotive Test Equipment Market Insight

China’s market is expanding rapidly, bolstered by national policies for new energy vehicles (NEVs) and advanced mobility solutions. The government’s focus on real-world driving emissions (RDE) testing, AI-enabled diagnostics, and vehicle data standardization is propelling the use of next-gen test systems. Chinese OEMs and global suppliers are collaborating on testing platforms tailored for EVs, autonomous vehicles, and smart city integration—making China a hub for automotive testing innovation.

Automotive Test Equipment Market Share

The competitive landscape of the global automotive test equipment market includes detailed insights into company product portfolios, regional and global market reach, strategic alliances, and investments in R&D and software-hardware integration.

Market share is influenced by each player’s ability to deliver comprehensive testing solutions, integrating mechanical diagnostics, software analytics, and regulatory compliance tools for both traditional and electric vehicles. Leading companies such as AVL List GmbH, Horiba Ltd., Bosch Automotive Service Solutions, and Siemens AG dominate the market owing to their extensive test equipment offerings, long-standing OEM partnerships, and early leadership in EV and ADAS test innovations.

Meanwhile, emerging players and specialized vendors are gaining ground by offering modular testing platforms, cloud-enabled diagnostics, and affordable test solutions tailored to regional inspection needs and small-to-medium vehicle service providers.:

- AVL List GmbH (Austria)

- Horiba Ltd. (Japan)

- Bosch Automotive Service Solutions (Germany)

- Siemens AG (Germany)

- Honeywell International Inc. (United States)

- SGS SA (Switzerland)

- Actia Group (France)

- Delphi Technologies (United Kingdom)

- Softing AG (Germany)

- KPIT Technologies Ltd. (India)

- MAHA Maschinenbau Haldenwang GmbH & Co. KG (Germany)

- ABB Ltd. (Switzerland)

- Denso Corporation (Japan)

- Continental AG (Germany)

- Snap-on Incorporated (United States)

Latest Developments in Global Automotive Test Equipment Market

- April 2025: Bosch Automotive Service Solutions introduced a next-gen ADAS calibration and diagnostic platform with AI-powered fault detection and cloud connectivity, enhancing workshop efficiency and reducing service downtime.

- March 2025: AVL List GmbH launched an advanced test bench system for electric vehicle powertrains, featuring real-time simulation, regenerative load handling, and multi-voltage compatibility to meet the needs of next-gen EVs.

- February 2025: Horiba Ltd. unveiled a modular emission testing platform compliant with upcoming Euro 7 regulations, offering enhanced particulate matter detection and real driving emissions (RDE) support.

- January 2025: Siemens AG rolled out its Digital Twin Integration Suite for automotive testing, enabling virtual vehicle validation and predictive failure diagnostics through cloud-synced testing environments.

- December 2024: Snap-on Incorporated introduced a mobile diagnostics toolkit for EV service centers, featuring wireless connectivity, battery health assessment, and OTA update readiness for electric and hybrid vehicles.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.