Global Automotive Shielding Market

Market Size in USD Billion

CAGR :

%

USD

13.50 Billion

USD

24.71 Billion

2024

2032

USD

13.50 Billion

USD

24.71 Billion

2024

2032

| 2025 –2032 | |

| USD 13.50 Billion | |

| USD 24.71 Billion | |

|

|

|

|

Automotive Shielding Market Size

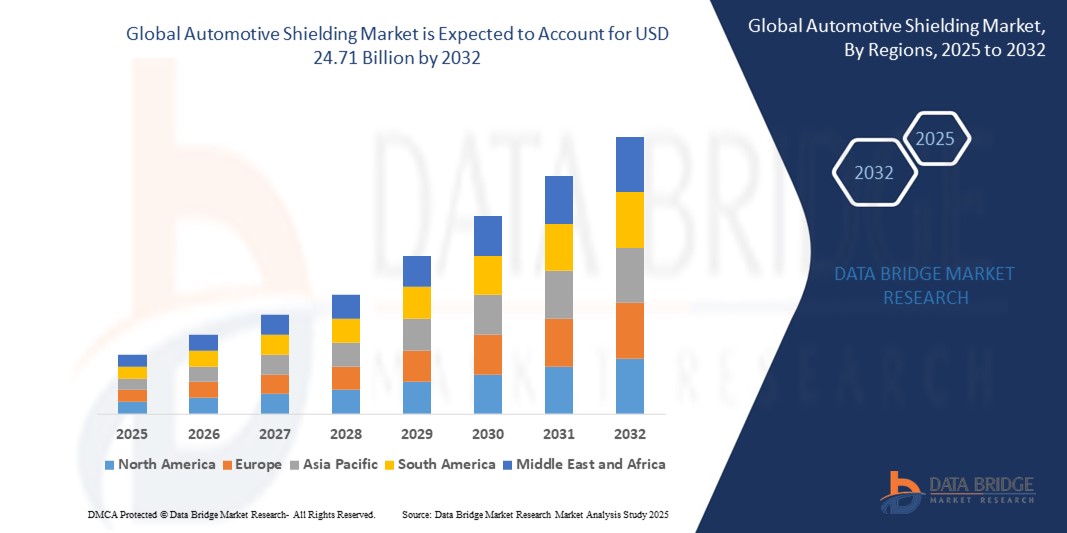

- The Global Automotive Shielding Market size was valued at USD 13.5 billion in 2024 and is expected to reach USD 24.71 billion by 2032, at a CAGR of 9.0% during the forecast period

- This growth is driven by factors such as the rising vehicle electrification, increasing demand for advanced safety features, and stricter electromagnetic interference (EMI) regulations.

Automotive Shielding Market Analysis

- Automotive shielding is defined as a protective layer installed over the components of the vehicles protecting them from the heat radiated in the operations of the vehicles, or the electromagnetic dispersions from the electrical components and devices present in the vehicles.

- This shielding protects other parts and devices present in the vehicle from being affected by isolating the harmful components over to one part.

- Asia-Pacific dominates the automotive shielding market due to rising rapid development of intelligent transport systems and connected mobility in countries such as China and Japan, rising demand for electronic-based safety systems and conformity toward standards of fuel efficiency and rising usage of electronic components in automotive vehicles as well as increasing vehicle production in this region.

- North America is expected to be the fastest growing region in the Automotive Shielding market during the forecast period due to the rapid adoption of electric vehicles and stringent EMI regulations.

- The Metallic Shield segment is expected to dominate the Automotive Shielding market with market share of 35.23% due to its superior conductivity, durability, and effectiveness in blocking electromagnetic interference.

Report Scope and Automotive Shielding Market Segmentation

|

Attributes |

Automotive Shielding Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Automotive Shielding Market Trends

“Shift Toward Lightweight Shielding Materials”

- As automakers aim to produce more fuel-efficient and electric vehicles, there’s a strong push toward using lighter materials throughout the vehicle — and shielding components are no exception. Traditional metal-based shielding, while effective, adds significant weight to the vehicle. This is prompting manufacturers to explore alternatives like conductive polymers, coated fabrics, and advanced composites that can offer similar protection against electromagnetic interference (EMI) without the added weight. Lighter vehicles consume less energy, which is especially important for electric vehicles where range is a critical factor.

- In this context, lightweight shielding not only improves vehicle efficiency but also supports overall design flexibility. Automotive suppliers are investing in R&D to develop materials that balance performance, weight, and cost. This trend is particularly gaining traction in markets like Europe and Asia, where fuel economy standards are strict. As a result, demand for innovative, lightweight shielding materials is expected to rise significantly. This change marks a shift from functionality alone to performance with sustainability in mind.

- For instance, In March 2025, Continental AG introduced the UltraContact NXT tire, which incorporates up to 65% renewable, recycled, and ISCC PLUS mass balance certified materials. This tire exemplifies the company's commitment to sustainability and lightweighting in automotive components. The integration of lightweight materials in tire manufacturing contributes to overall vehicle weight reduction, enhancing fuel efficiency and performance. Continental's approach demonstrates how lightweighting strategies can be applied across various automotive components, not just in structural parts but also in accessories like tires.

Automotive Shielding Market Dynamics

Driver

“Rising Adoption of Electric Vehicles (EVs)”

- One of the biggest forces driving the automotive shielding market today is the explosive growth in electric vehicle (EV) production. Unlike traditional vehicles, EVs rely entirely on complex electric powertrains and advanced battery systems, which are highly sensitive to electromagnetic interference (EMI). Even small levels of EMI can disrupt the operation of these systems, which is why shielding has become a necessary component. As countries tighten emissions regulations and offer incentives for cleaner transportation, automakers are investing more in EV production. This shift naturally increases the demand for efficient and reliable EMI shielding solutions.

- Beyond batteries, EVs include systems like onboard chargers, inverters, and high-voltage cabling—all of which require specialized shielding. This demand is particularly strong in markets such as China, the U.S., and Europe, where EV adoption is rising rapidly. With manufacturers racing to increase range and reduce charging time, shielding technologies are becoming a core part of the EV ecosystem. In short, the more EVs on the road, the greater the demand for shielding.

For instance,

- In March 2025, Robert Bosch GmbH unveiled a new ADAS product family, featuring radar sensors with in-house designed system-on-chip (SoC), next-generation multi-purpose cameras, and inertial sensor units. These components are designed to be lightweight, enhancing the overall efficiency of connected and autonomous vehicles. The use of lightweight materials in these ADAS components contributes to the reduction of vehicle weight, which is crucial for improving fuel efficiency and performance.

Opportunity

“Integration of Advanced Driver Assistance Systems (ADAS)”

- Automakers are increasingly integrating Advanced Driver Assistance Systems (ADAS) into their vehicles to improve road safety and user experience. These systems rely on sensors, cameras, and radar units—each of which can be disrupted by electromagnetic interference if not properly shielded. The growing sophistication of ADAS, including features like lane-keeping assist, adaptive cruise control, and automatic emergency braking, requires robust shielding solutions to function reliably.

- As governments around the world mandate safety technologies in new vehicles, the demand for ADAS-enabled vehicles is surging. This rise creates an indirect but significant opportunity for the automotive shielding market. Suppliers who can provide lightweight, cost-effective, and high-performance shielding will find strong demand. The complexity of modern vehicles makes shielding a necessity, not a luxury, and as such, it's becoming embedded into the core of automotive design strategies.

For instance,

- In May 2025, Continental AG achieved a significant milestone by producing 200 million radar sensors, underscoring its leadership in automotive safety technology. These radar sensors are integral components of ADAS, enabling features like adaptive cruise control, emergency braking, and lane-keeping assistance. The company secured major series orders worth approximately €1.5 billion in the first quarter of 2025, with production slated to commence in 2026 and 2027. This surge in radar sensor deployment emphasizes the critical need for advanced electromagnetic interference (EMI) shielding solutions to ensure the reliability and safety of these systems.

Restraint/Challenge

“High Manufacturing Costs of Advanced Shielding Materials”

- The rising demand for advanced shielding solutions in vehicles, particularly in electric vehicles (EVs) and connected cars, has led to a surge in the use of high-performance materials such as conductive polymers, metal composites, and specialized coatings. While these materials provide excellent EMI protection, they come at a significantly higher cost compared to traditional shielding methods. As automakers look to integrate more of these materials, the overall production costs rise.

- For manufacturers, the challenge lies in balancing performance and cost, especially with the growing pressure to maintain affordable vehicle prices. This is particularly concerning for budget-friendly vehicle segments, where the cost of premium shielding materials could make the vehicles less competitive. As a result, some automakers may hesitate to adopt these advanced shielding technologies, limiting their widespread implementation. The continuous search for cost-effective yet high-performance shielding materials remains a key challenge for the market.

For instance,

- In February 2025, ArcelorMittal announced plans to construct an advanced steel manufacturing facility in Calvert, Alabama, aimed at boosting production capacity to meet U.S. automotive sector demand. The facility is projected to produce 150 kilotons annually of premium non-grain-oriented electrical steel (NOES), which is essential for electric vehicle (EV) motors. The anticipated cost of the facility is $0.9 billion, with production expected to begin in the latter half of 2027. This significant investment underscores the high manufacturing costs associated with advanced materials required for EVs.

Automotive Shielding Market Scope

The market is segmented on the basis of material type, shielding type, vehicle type, EV type, heat application and EMI applications.

|

Segmentation |

Sub-Segmentation |

|

material type |

|

|

shielding type |

|

|

vehicle type |

|

|

EV type |

|

|

heat application |

|

|

EMI application |

|

In 2025, Metallic Shield segment is projected to dominate the market with a largest share in segment

The Metallic Shield segment is expected to dominate the Automotive Shielding market with market share of 35.23% due to its superior conductivity, durability, and effectiveness in blocking electromagnetic interference.

The Non-Metallic Shield segment is expected to account for the largest share during the forecast period in Automotive Shielding Segment

In 2025, The Non-Metallic Shield segment is projected to hold the largest share of 31.56% in the automotive shielding market during the forecast period. This growth is driven by the increasing demand for lightweight materials, especially in electric vehicles (EVs), where reducing weight is crucial for improving energy efficiency and range. Non-metallic materials, such as conductive polymers and composites, provide effective electromagnetic interference (EMI) protection without the added weight of traditional metals. Moreover, these materials offer better design flexibility and cost-effectiveness, making them appealing to automakers.

Automotive Shielding Market Regional Analysis

“Asia-Pacific Holds the Largest Share in the Automotive Shielding Market”[AN1]

- Asia-Pacific holds the largest share in the automotive shielding market due to the rapid growth of the automotive industry in countries like China, Japan, and South Korea. The region is a hub for major automotive manufacturers, including both traditional and electric vehicle (EV) makers, driving the demand for advanced shielding solutions. As governments in the region continue to enforce stricter environmental regulations, automakers are focusing on reducing vehicle emissions and enhancing safety, which increases the need for effective EMI shielding.

- Additionally, the growing adoption of electric vehicles (EVs) in countries like China further boosts the demand for shielding materials to protect sensitive electronic components. The region's robust manufacturing capabilities, combined with the rising trend of smart and connected vehicles, contribute to Asia-Pacific’s dominant position in the market. Furthermore, increasing investments in the automotive sector and the ongoing development of infrastructure also support market growth. As EV production accelerates, Asia-Pacific's share is expected to continue rising throughout the forecast period.

“North America is Projected to Register the Highest CAGR in the Automotive Shielding Market”

- North America is projected to register the highest compound annual growth rate (CAGR) in the automotive shielding market during the forecast period. This growth is driven by the increasing demand for electric vehicles (EVs) and the integration of advanced technologies such as autonomous driving systems. As EV adoption continues to rise, there is a growing need for efficient electromagnetic interference (EMI) shielding to protect sensitive components like batteries, motors, and inverters.

- Additionally, stricter regulatory standards in the U.S. and Canada are pushing automakers to implement better shielding solutions to comply with environmental and safety regulations. The expansion of automotive manufacturing facilities in Mexico also contributes to this regional growth. With significant investments in automotive technology and innovation, North America is set to lead the market, driven by both consumer demand and regulatory incentives.

Automotive Shielding Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Dana Limited,

- 3M,

- ElringKlinger AG,

- Marian, Inc.,

- SCHAFFNER HOLDING AG,

- PARKER HANNIFIN CORP,

- Laird,

- Tenneco Inc.,

- Tech-Etch, Inc.,

- Henkel AG & Co. KGaA,

- Morgan Advanced Materials,

- Kitagawa Corporation,

- RTP Company,

- Seal Methods Inc.,

- S&A Industries

Latest Developments in Global Automotive Shielding Market

- In April 2025, Henkel introduced AI-powered virtual adhesives and mica-replacement safety coatings at The Battery Show Europe. These innovations aim to enhance EV battery safety and performance by reducing development cycles and improving recyclability. Henkel's showcase also included structural adhesive debonding solutions and electrode coatings, emphasizing their commitment to sustainable e-mobility.

- In March 2025, Dana Limited launched a new line of lightweight aluminum heat shields aimed at improving thermal management in electric vehicles. These shields use advanced materials to cut down on weight, helping EVs perform better and go farther on a charge. The move supports the rising demand for lighter, more efficient car parts. Dana is also staying true to its sustainability goals with this launch. Looking ahead, the company plans to roll out more shielding products while growing its reach in global automotive markets.

- In April 2025, At Auto Shanghai, ElringKlinger unveiled the ElroSeal™-G, a rotary shaft seal designed for high-speed applications in electric drivetrains. This seal addresses induced charges, enhancing efficiency and longevity in components like e-axles and actuators. The product showcases ElringKlinger's focus on lightweight and sealing technologies for e-mobility.

- In September 2023, Tenneco introduced several protective materials at the Battery Show Europe, including Protexx-Shield, ReflectShield 1435, and NyloGard 2451SA. These products offer thermal runaway protection, electrical insulation, and electromagnetic shielding for EV batteries, highlighting Tenneco's commitment to enhancing battery safety and performance.

- In February 2025, 3M launched new EMI shielding materials, including copper and aluminum foil tapes, designed to meet the tough electromagnetic interference standards for automotive electronics. These products are ideal for electric vehicles, autonomous driving systems, and advanced driver-assistance systems (ADAS), offering improved durability and performance in challenging conditions. 3M also focuses on eco-friendly manufacturing processes, aligning with sustainability goals. The company aims to grow its presence in the automotive sector with these innovative solutions. This move reflects 3M’s commitment to advancing technology while supporting the industry's push for cleaner, more efficient products.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.