Global Automotive Pressure Sensor Market, By Application Type (ABS, Airbags, Direct TPMS, Engine Control System, HVAC, Power Steering and Transmission), Electric Vehicle Type (BEV, HEV, PHEV, and FCEV), Vehicle Type (Passenger Cars and Commercial Vehicles), Transduction Type (Piezoresistive, Capacitive, Optical, Resonant, and Others), Technology (MEMS, Strain Gauge, and Ceramic) - Industry Trends and Forecast to 2031.

Automotive Pressure Sensor Market Analysis and Size

The market is witnessing significant growth, driven by the increasing demand for passenger vehicles, stringent emission regulations, and the integration of advanced safety features in vehicles. In addition, the growing trend of electric vehicles (EVs) and autonomous vehicles (AVs) is expected to create new opportunities for market growth, as these vehicles require advanced sensor technologies for efficient operation. Overall, the market is poised for significant growth, driven by the increasing demand for advanced safety and performance features in vehicles worldwide.

The global automotive pressure sensor market size was valued at USD 12.01 billion in 2023 and is projected to reach USD 23.98 billion by 2031, with a CAGR of 9.03% during the forecast period of 2024 to 2031. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2024 to 2031

|

|

Base Year

|

2023

|

|

Historic Years

|

2022 (Customizable to 2016-2021)

|

|

Quantitative Units

|

Revenue in USD Million, Volumes in Units, Pricing in USD

|

|

Segments Covered

|

Application Type (ABS, Airbags, Direct TPMS, Engine Control System, HVAC, Power Steering, and Transmission), Electric Vehicle Type (BEV, HEV, PHEV, and FCEV), Vehicle Type (Passenger Cars and Commercial Vehicles), Transduction Type (Piezoresistive, Capacitive, Optical, Resonant, and Others), Technology (MEMS, Strain Gauge, and Ceramic)

|

|

Countries Covered

|

U.S., Canada, Mexico, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa, Brazil, Argentina, and Rest of South America

|

|

Market Players Covered

|

TE Connectivity (Switzerland), STMicroelectronics (Switzerland), Littelfuse Inc. (U.S.), Robert Bosch GmbH (Germany), Continental AG (Germany), Delphi Technologies (U.K.), Analog Devices Inc. (U.S.), NXP Semiconductors (Netherlands), Sensata Technologies Inc. (U.S.), Infineon Technologies AG (Germany), DENSO CORPORATION (Japan), Autoliv Inc. (Sweden), Texas Instruments Incorporated (U.S.), and Hitachi Automotive Systems Americas Inc. (U.S.)

|

|

Market Opportunities

|

|

Market Definition

An automotive pressure sensor is a device used in vehicles to measure and monitor various types of pressure within the automotive system. These sensors convert physical pressure into an electrical signal, which can be read by the vehicle's electronic control unit (ECU). Automotive pressure sensors are crucial for the safe and efficient operation of vehicles, providing critical data for a range of applications such as engine management, tire pressure monitoring, and HVAC systems.

Automotive Pressure Sensor Market Dynamics

Drivers

- Increasing Vehicle Production

The automotive industry is experiencing a surge in global demand for vehicles, particularly in emerging markets such as China, India, and Southeast Asia. This increasing demand is driving the need for pressure sensor in automotive, which play a crucial role in various vehicle systems. Pressure sensors are integral components in engine management, transmission systems, and brake systems, among others, ensuring optimal performance and safety. As vehicle production continues to rise to meet consumer demand, the demand for automotive pressure sensors is expected to grow proportionally, driving the automotive industry.

- Stringent Emission Regulations

Governments worldwide are implementing stringent emission regulations to reduce pollution and combat climate change. These regulations require automakers to monitor and control vehicle emissions effectively, driving the adoption of automotive pressure sensors. Pressure sensors are used in exhaust gas recirculation (EGR) systems, fuel systems, and other emission control systems to ensure compliance with emission standards. As regulations become stricter, the demand for accurate and reliable pressure sensors is increasing. This is expected to drive the market, particularly with the rise of electric vehicles and the need for precise pressure monitoring in battery systems and other components.

Opportunities

- Increased Focus on Vehicle Efficiency

Automotive pressure sensors play a critical role in enhancing vehicle efficiency and performance, driven by factors such as regulatory requirements and consumer demand for more fuel-efficient and environmentally friendly vehicles by enabling more precise monitoring and control of various vehicle systems. Pressure sensors are used in engine management systems to optimize fuel injection and combustion, leading to improved fuel efficiency and reduced emissions. Similarly, pressure sensors are employed in tire pressure monitoring systems (TPMS) to maintain optimal tire pressure, enhancing vehicle safety and fuel economy. As the industry continues to prioritize vehicle efficiency, there is a growing demand for advanced automotive pressure sensors that can further enhance performance and contribute to sustainability.

- Rapid Technological Advancements

Manufacturers are developing smart sensors that can provide more accurate and real-time data, enabling better performance monitoring and diagnostics. In addition, the integration of pressure sensors with Internet of Things (IoT) platforms is opening up new opportunities for sensor manufacturers to enhance functionality and offer value-added services. IoT-enabled pressure sensors can be used to monitor vehicle performance remotely, detect potential issues early, and even enable predictive maintenance. These advancements are driving innovation in the automotive pressure sensors market, creating new opportunities for the market.

Restraints/Challenges

- Complexity of Integration

Integrating automotive pressure sensors into existing vehicle systems can be a complex process that requires specialized knowledge and expertise. Manufacturers must ensure that the sensors are compatible with the vehicle's electronic control unit (ECU) and other components and that they are installed correctly to ensure accurate readings and reliable performance. In addition, the integration process can vary based on the vehicle model and the specific system into which the sensor is being installed. This complexity presents a challenge for manufacturers.

- Supply Chain Disruptions

Disruptions in the supply chain, such as raw material shortages or transportation issues, can result in delays in production and delivery, leading to increased lead times and potential shortages of sensors in the market. Manufacturers may also face challenges in sourcing high-quality materials and components for the sensors, which can further exacerbate supply chain issues and can be challenging for market growth.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Recent Developments

- In January 2023, NXP Semiconductors N.V. (NXP) revealed its involvement in the initial development stages of new VinFast automotive ventures at CES 2023. VinFast aims to utilize NXP's processors, semiconductors, and sensors, while NXP will deliver high-quality solutions to accelerate time-to-market. The collaborative effort will concentrate on creating solutions for designing and manufacturing state-of-the-art EVs based on NXP's established reference assessment platforms and software layers

- In December 2022, Continental AG (Continental) announced it’s unveiling of modules and sensors specifically designed for electromobility. Continental will introduce its Advanced Driver Assistance Systems (ADAS), which have been integrated into the "CV3" SoC (System on Chip) family with artificial intelligence (AI) from semiconductor startup Ambarella

Automotive Pressure Sensor Market Scope

The market is segmented based on application type, electric vehicle type, vehicle type, transduction type, and technology. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Application Type

- ABS

- Airbags

- Direct TPMS

- Engine Control System

- HVAC

- Power Steering

- Transmission

Electric Vehicle Type

- BEV

- HEV

- PHEV

- FCEV

Vehicle Type

- Passenger Cars

- Commercial Vehicles

Transduction Type

- Piezoresistive

- Capacitive

- Optical

- Resonant

- Others

Technology

- MEMS

- Strain Gauge

- Ceramic

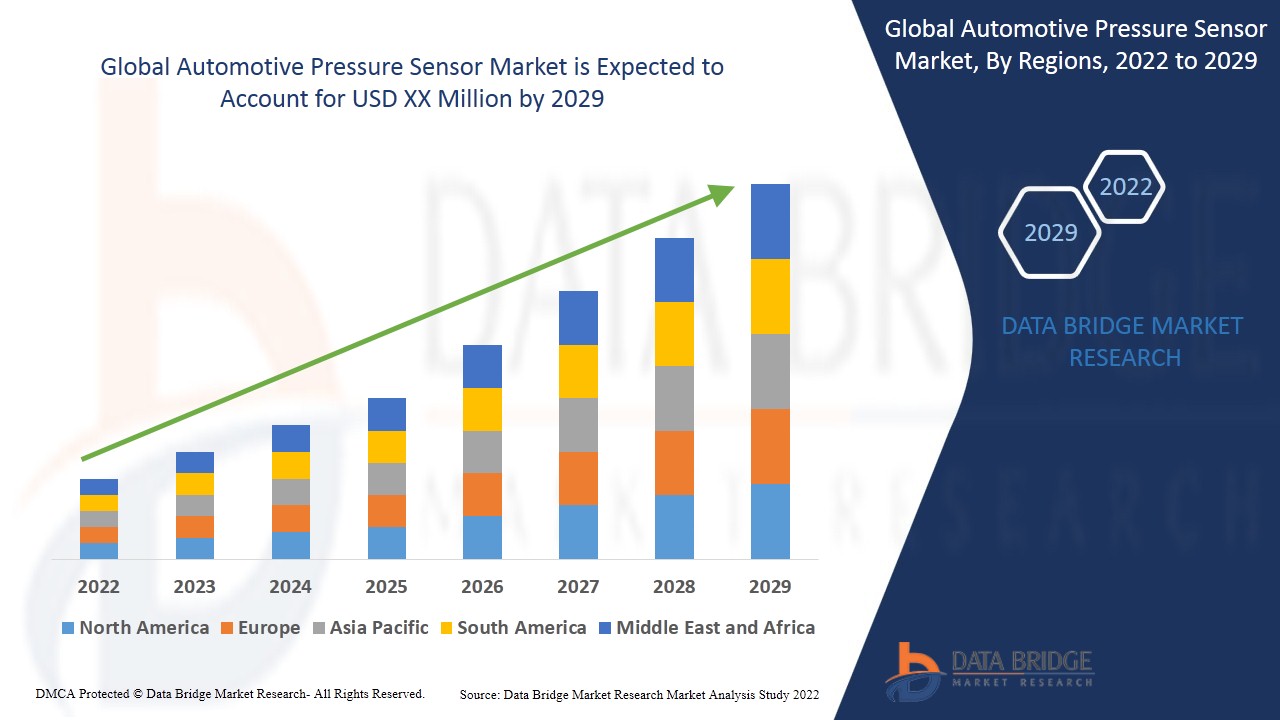

Automotive Pressure Sensor Market Regional Analysis/Insights

The market is analyzed and market size insights and trends are provided by country, application type, electric vehicle type, vehicle type, transduction type, and technology as referenced above.

The countries covered in the market report are U.S., Canada, Mexico, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, rest of Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, rest of Asia-Pacific, Saudi Arabia, U.A.E., South Africa, Egypt, Israel, rest of Middle East and Africa, Brazil, Argentina, and rest of South America.

Asia-Pacific is expected to be the dominating region due to the increasing demand for automobiles. Countries such as China, Japan, and India are key contributors to this growth, supported by their large automotive manufacturing bases and expanding consumer markets.

North America is expected to show the fastest growth in the market due to the significant entry of major industry players into the region, enhancing the market's competitive landscape. The U.S. and Canada, in particular, are expected to benefit from these new entrants, fostering innovation and expanding the market for advanced automotive pressure sensors.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Automotive Pressure Sensor Market Share Analysis

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to the market.

Some of the major players operating in the market are:

- TE Connectivity (Switzerland)

- STMicroelectronics (Switzerland)

- Littelfuse Inc. (U.S.)

- Robert Bosch GmbH (Germany)

- Continental AG (Germany)

- Delphi Technologies (U.K.)

- Analog Devices Inc. (U.S.)

- NXP Semiconductors (Netherlands)

- Sensata Technologies Inc. (U.S.)

- Infineon Technologies AG (Germany)

- DENSO CORPORATION (Japan)

- Autoliv Inc. (Sweden)

- Texas Instruments Incorporated (U.S.)

- Hitachi Automotive Systems Americas Inc. (U.S.)

SKU-