Global Automotive Pressure Sensor Market

Market Size in USD Billion

CAGR :

%

USD

13.09 Billion

USD

26.15 Billion

2024

2032

USD

13.09 Billion

USD

26.15 Billion

2024

2032

| 2025 –2032 | |

| USD 13.09 Billion | |

| USD 26.15 Billion | |

|

|

|

|

Automotive Pressure Sensor Market Size

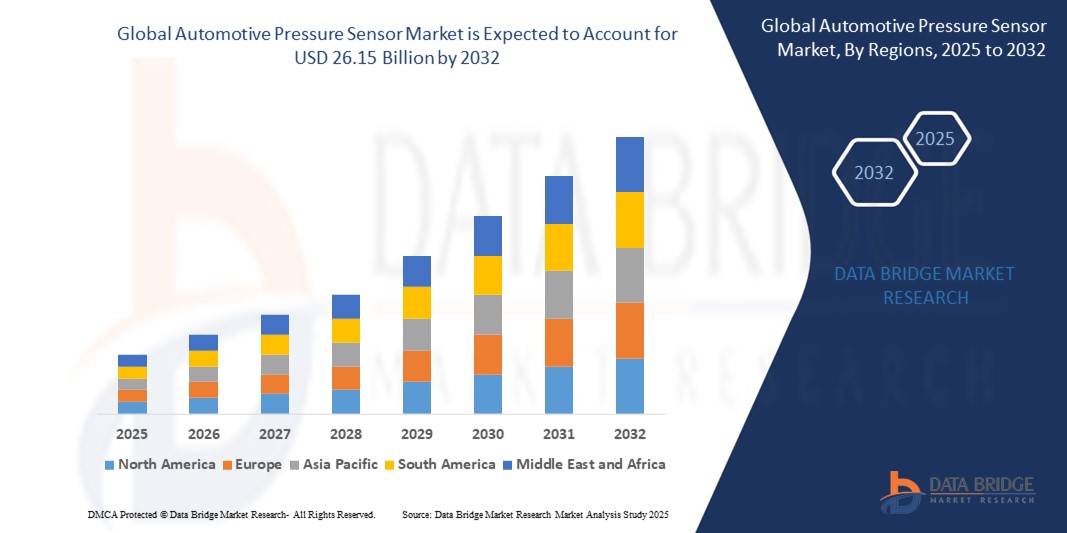

- The global automotive pressure sensor market size was valued at USD 13.09 billion in 2024 and is expected to reach USD 26.15 billion by 2032, at a CAGR of 9.03% during the forecast period

- The market growth is primarily driven by the increasing adoption of advanced driver-assistance systems (ADAS), stringent automotive safety regulations, and the rising demand for electric vehicles (EVs) globally

- In addition, the growing focus on fuel efficiency, emission control, and vehicle performance optimization is propelling the demand for pressure sensors in various automotive applications, establishing them as critical components in modern vehicles

Automotive Pressure Sensor Market Analysis

- Automotive pressure sensors, which measure pressure in gases or liquids within vehicle systems, are essential for enhancing safety, performance, and efficiency in modern automotive applications, including ABS, airbags, tire pressure monitoring systems (TPMS), and engine control systems

- The surge in demand for automotive pressure sensors is driven by the increasing integration of advanced technologies in vehicles, rising consumer awareness of vehicle safety, and the global shift toward electric and hybrid vehicles

- Asia-Pacific dominated the automotive pressure sensor market with the largest revenue share of 42.5% in 2024, attributed to the region’s robust automotive manufacturing hub, high vehicle production rates, and increasing adoption of electric vehicles, particularly in China, Japan, and South Korea

- North America is expected to be the fastest-growing region during the forecast period, fueled by advancements in autonomous vehicle technologies, stringent emission regulations, and growing demand for electric vehicles

- The engine control system segment dominated the largest market revenue share of 32.5% in 2024, driven by its critical role in optimizing engine performance, fuel efficiency, and emissions through real-time pressure monitoring in fuel injection, exhaust, and air intake systems

Report Scope and Automotive Pressure Sensor Market Segmentation

|

Attributes |

Automotive Pressure Sensor Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Automotive Pressure Sensor Market Trends

“Increasing Integration of Advanced Sensor Technologies and IoT”

- The Global Automotive Pressure Sensor Market is experiencing a notable trend toward the integration of advanced sensor technologies and Internet of Things (IoT) connectivity

- These technologies enable real-time data collection and analysis, providing enhanced insights into vehicle system performance, safety, and efficiency

- IoT-enabled pressure sensors facilitate proactive maintenance by detecting anomalies in systems such as ABS, airbags, and engine control, reducing downtime and repair costs

- For instances, companies are developing smart pressure sensors that monitor tire pressure in real-time, optimizing fuel efficiency and enhancing safety through integration with vehicle telematics systems

- This trend is increasing the adoption of pressure sensors across passenger cars and commercial vehicles, appealing to both manufacturers and consumers

- Advanced algorithms analyze data from pressure sensors to optimize system performance, such as improving engine combustion efficiency or ensuring precise airbag deployment

Automotive Pressure Sensor Market Dynamics

Driver

“Rising Demand for Vehicle Safety and Emission Regulations”

- Growing consumer and regulatory demand for enhanced vehicle safety and reduced emissions is a key driver for the Global Automotive Pressure Sensor Market

- Pressure sensors are critical in safety systems such as anti-lock braking systems (ABS), airbags, and direct tire pressure monitoring systems (TPMS), ensuring optimal performance and compliance with safety standards

- Government mandates, such as the U.S. TREAD Act for TPMS and similar regulations in Europe and Asia-Pacific, are accelerating the adoption of pressure sensors

- The rise of electric vehicles (BEVs, HEVs, PHEVs, and FCEVs) further boosts demand, as pressure sensors are essential for battery management and thermal regulation in these vehicles

- Automakers are increasingly incorporating factory-fitted pressure sensors to meet stringent emission norms and enhance vehicle safety, particularly in passenger cars and commercial vehicles

Restraint/Challenge

“High Development Costs and Data Integration Complexities”

- The high costs associated with developing and integrating advanced pressure sensors, particularly those using MEMS or piezoresistive technologies, pose a significant barrier to market growth

- Retrofitting pressure sensors into older vehicle models is technically complex and expensive, limiting adoption in cost-sensitive markets

- In addition, the integration of IoT-enabled sensors raises concerns about data management, interoperability, and cybersecurity, as these systems handle sensitive vehicle and driver information

- The lack of standardized protocols across regions for sensor data processing and communication complicates operations for global manufacturers

- These challenges may slow market expansion, especially in emerging economies where cost constraints and limited technological infrastructure are prevalent

Automotive Pressure Sensor market Scope

The market is segmented on the basis of application type, electric vehicle type, vehicle type, transduction type, and technology.

- By Application Type

On the basis of application type, the global automotive pressure sensor market is segmented into anti-lock braking system (ABS), Airbags, Direct Tire Pressure Monitoring System (TPMS), engine control system, heating ventilation and air conditioning (HVAC), power steering, and transmission. The engine control system segment dominated the largest market revenue share of 32.5% in 2024, driven by its critical role in optimizing engine performance, fuel efficiency, and emissions through real-time pressure monitoring in fuel injection, exhaust, and air intake systems.

The direct TPMS segment is expected to witness the fastest growth rate from 2025 to 2032, propelled by stringent global safety regulations mandating tire pressure monitoring in passenger vehicles and increasing consumer awareness of tire safety and fuel efficiency. Advancements in sensor accuracy and integration with connected vehicle systems further boost adoption.

- By Electric Vehicle Type

On the basis of electric vehicle type, the global automotive pressure sensor market is segmented into battery electric vehicle (BEV), hybrid electric vehicle (HEV), Plug-in Hybrid electric vehicle (PHEV), and fuel cell electric vehicle (FCEV). The BEV segment is expected to hold the largest market revenue share of 45.8% in 2024, driven by the rapid global adoption of electric vehicles and the critical need for pressure sensors in battery management, cooling systems, and tire pressure monitoring to ensure safety and efficiency.

The PHEV segment is anticipated to witness the fastest growth rate of 12.3% from 2025 to 2032, fueled by increasing consumer preference for plug-in hybrids due to their flexibility and government incentives promoting low-emission vehicles. Pressure sensors are essential for monitoring hybrid powertrains and enhancing system reliability.

- By Vehicle Type

On the basis of vehicle type, the global automotive pressure sensor market is segmented into passenger cars and commercial vehicles. The passenger car segment dominated the market revenue share of 70.2% in 2024, owing to the high production volume of passenger vehicles globally and growing consumer demand for advanced safety features such as ABS, airbags, and TPMS. OEMs are increasingly integrating pressure sensors as standard features to meet regulatory requirements.

The commercial vehicle segment is expected to witness rapid growth of 11.8% from 2025 to 2032, driven by the rising adoption of pressure sensors in heavy-duty trucks and buses for applications such as transmission monitoring, engine control, and TPMS. Enhanced sensor data analytics supports fleet management and operational efficiency.

- By Transduction Type

On the basis of transduction type, the global automotive pressure sensor market is segmented into piezoresistive, capacitive, optical, resonant, and others. The piezoresistive segment is expected to hold the largest market revenue share of 48.6% in 2024, due to its high accuracy, reliability, and widespread use in critical applications such as engine control and braking systems. Its compatibility with harsh automotive environments further drives adoption.

The capacitive segment is anticipated to experience significant growth from 2025 to 2032, driven by its increasing use in advanced applications such as HVAC and TPMS, where low power consumption and high sensitivity are essential. Innovations in capacitive sensor design enhance performance in electric and autonomous vehicles.

- By Technology

On the basis of technology, the global automotive pressure sensor market is segmented into micro-electro-mechanical systems (MEMS), strain gauge, and ceramic. The MEMS segment is expected to hold the largest market revenue share of 62.4% in 2024, owing to its compact size, high precision, and cost-effectiveness, making it ideal for integration into modern vehicle systems such as ABS, TPMS, and engine control.

The ceramic segment is expected to witness the fastest growth from 2025 to 2032, driven by its durability and resistance to extreme temperatures and corrosive environments, particularly in heavy-duty commercial vehicles and electric vehicle applications. Advancements in ceramic sensor manufacturing enhance reliability and adoption.

Automotive Pressure Sensor Market Regional Analysis

- Asia-Pacific dominated the automotive pressure sensor market with the largest revenue share of 42.5% in 2024, attributed to the region’s robust automotive manufacturing hub, high vehicle production rates, and increasing adoption of electric vehicles, particularly in China, Japan, and South Korea

- Consumers prioritize pressure sensors for enhancing vehicle safety, fuel efficiency, and performance, particularly in applications such as anti-lock braking systems (ABS), tire pressure monitoring systems (TPMS), and engine control systems

- Growth is supported by advancements in sensor technology, including microelectromechanical systems (MEMS) and piezoresistive sensors, alongside rising adoption in both OEM and aftermarket segments for electric and conventional vehicles

U.S. Automotive Pressure Sensor Market Insight

The U.S. automotive pressure sensor is expected to witness significant growth, fueled by stringent safety regulations and growing consumer awareness of vehicle safety and efficiency benefits. The trend towards advanced driver assistance systems (ADAS) and increasing adoption of electric vehicles (EVs) further boost market expansion. Automakers’ integration of pressure sensors in factory-installed systems such as ABS and TPMS complements strong aftermarket demand, creating a robust market ecosystem.

Europe Automotive Pressure Sensor Market Insight

The Europe automotive pressure sensor market is expected to witness significant growth, supported by regulatory emphasis on vehicle safety and emissions reduction. Consumers seek sensors that enhance driving safety and optimize performance in applications such as airbags and engine control systems. Growth is prominent in both new vehicle installations and aftermarket retrofits, with countries such as Germany and France showing significant uptake due to advanced automotive industries and environmental concerns.

U.K. Automotive Pressure Sensor Market Insight

The U.K. market for automotive pressure sensors is expected to witness rapid growth, driven by demand for enhanced vehicle safety and fuel efficiency in urban and suburban settings. Increased adoption of ADAS features, such as TPMS and ABS, and rising awareness of emission reduction benefits encourage market growth. Evolving safety regulations influence consumer choices, balancing sensor functionality with compliance.

Germany Automotive Pressure Sensor Market Insight

Germany is expected to witness rapid growth in the automotive pressure sensor market, attributed to its advanced automotive manufacturing sector and high consumer focus on vehicle safety and energy efficiency. German consumers prefer technologically advanced sensors, such as MEMS and piezoresistive types that optimize engine performance and reduce fuel consumption. The integration of these sensors in premium vehicles and aftermarket options supports sustained market growth.

Asia-Pacific Automotive Pressure Sensor Market Insight

The Asia-Pacific region dominates the global automotive pressure sensor market, driven by expanding automotive production and rising disposable incomes in countries such as China, India, and Japan. Increasing awareness of vehicle safety, fuel efficiency, and emission reduction boosts demand for pressure sensors in applications such as TPMS, ABS, and engine control systems. Government initiatives promoting vehicle safety and environmental sustainability further encourage the adoption of advanced sensor technologies.

Japan Automotive Pressure Sensor Market Insight

Japan’s automotive pressure sensor market is expected to witness rapid growth due to strong consumer preference for high-quality, technologically advanced sensors that enhance vehicle safety and performance. The presence of major automotive manufacturers and the integration of pressure sensors in OEM vehicles, particularly for battery electric vehicles (BEVs) and hybrid electric vehicles (HEVs), accelerate market penetration. Rising interest in aftermarket applications also contributes to growth.

China Automotive Pressure Sensor Market Insight

China holds the largest share of the Asia-Pacific automotive pressure sensor market, propelled by rapid urbanization, rising vehicle ownership, and increasing demand for safety and efficiency solutions. The country’s growing middle class and focus on smart mobility support the adoption of advanced pressure sensors, such as MEMS and piezoresistive types, in applications such as engine control and TPMS. Strong domestic manufacturing capabilities and competitive pricing enhance market accessibility.

Automotive Pressure Sensor Market Share

The automotive pressure sensor industry is primarily led by well-established companies, including:

- TE Connectivity (Switzerland)

- STMicroelectronics (Switzerland)

- Littelfuse Inc. (U.S.)

- Robert Bosch GmbH (Germany)

- Continental AG (Germany)

- Delphi Technologies (U.K.)

- Analog Devices Inc. (U.S.)

- NXP Semiconductors (Netherlands)

- Sensata Technologies Inc. (U.S.)

- Infineon Technologies AG (Germany)

- DENSO CORPORATION (Japan)

- Autoliv Inc. (Sweden)

- Texas Instruments Incorporated (U.S.)

- Hitachi Automotive Systems Americas Inc. (U.S.)

What are the Recent Developments in Global Automotive Pressure Sensor Market?

- In October 2024, Melexis expanded its Triphibian™ MEMS pressure sensor lineup with the launch of the MLX90834, a robust sensor designed for demanding automotive applications such as engine management and pneumatic seat systems. This sensor stands out for its ability to accurately measure pressures from 2 to 70 bar in both gas and liquid media—even under extreme conditions. Its innovative cantilever-based MEMS design ensures durability, while features such as digital SENT output, temperature diagnostics, and factory calibration enhance system performance and reliability

- In June 2024, NXP Semiconductors introduced the MCX A14x and A15x microcontroller families, purpose-built to power advanced pressure sensor applications in automotive systems. These MCUs are based on the Arm® Cortex®-M33 core, operating at up to 96 MHz, and feature intelligent peripherals, high-speed analog interfaces, and low-power architecture. Their robust design supports real-time data analytics, enhanced connectivity, and precise sensor integration—key for improving vehicle performance, safety, and efficiency. With scalable memory options and support for automotive-grade reliability, the MCX A14x/15x series is ideal for next-gen smart mobility solutions

- In September 2023, Infineon Technologies introduced the XENSIV SP49 tire pressure monitoring sensor, a cutting-edge solution that merges MEMS and ASIC technologies to elevate vehicle safety and performance. Designed for modern Tire Pressure Monitoring Systems (TPMS), the SP49 features intelligent capabilities such as on-tire auto-position sensing, tire blowout detection, load identification, and inflation assistance. It incorporates a 32-bit Arm® M0+ core, low power monitoring, and multiple interface options, making it ideal for both sub-1GHz and BLE TPMS applications. Its compact, energy-efficient design supports battery-powered systems and aligns with ASIL-A safety standards

- In April 2021, Sensata Technologies completed the acquisition of Xirgo Technologies for $400 million, marking a pivotal move to expand its footprint in the automotive pressure sensor and telematics markets. The acquisition brought in Xirgo’s advanced wireless IoT communication solutions, enhancing Sensata’s Smart & Connected initiative aimed at delivering real-time data insights across transportation and logistics sectors. With this deal, Sensata gained approximately 160 employees, including over 75 engineers, and significantly bolstered its capabilities in fleet management, asset tracking, and connected vehicle technologies

- In 2021, Denso Corporation launched a next-generation MEMS pressure sensor specifically engineered for fuel injection systems. This compact sensor delivers enhanced accuracy and rapid response times, enabling more precise fuel metering and combustion control. As a result, it contributes to improved engine performance, reduced emissions, and greater fuel efficiency—key priorities in modern automotive engineering. The sensor’s MEMS-based design also supports durability and integration into increasingly compact engine compartments

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.