Global Automotive Oems Market

Market Size in USD Billion

CAGR :

%

USD

36.98 Billion

USD

53.28 Billion

2024

2032

USD

36.98 Billion

USD

53.28 Billion

2024

2032

| 2025 –2032 | |

| USD 36.98 Billion | |

| USD 53.28 Billion | |

|

|

|

|

Automotive Original Equipment Manufacturer (OEMS) Market Size

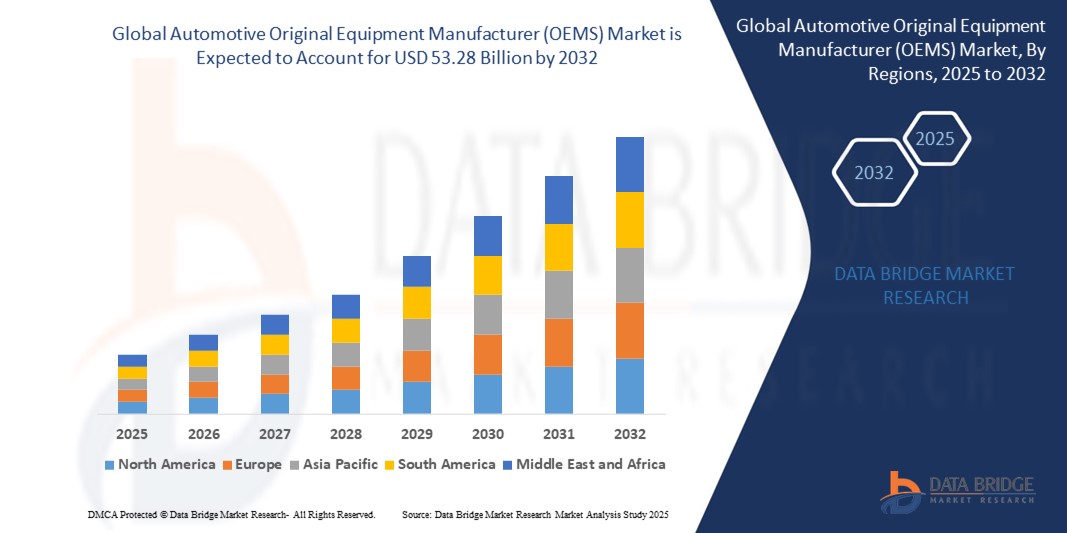

- The global automotive original equipment manufacturer (OEMS) market size was valued at USD 36.98 billion in 2024 and is expected to reach USD 53.28 billion by 2032, at a CAGR of 4.67% during the forecast period

- The market growth is largely fueled by the increasing demand for advanced features in vehicles, rising vehicle ownership across the globe, and the surge in electric vehicle (EV) innovation

- Growing consumer preference for individualized and high-performance automobiles, coupled with stringent environmental regulations and a global shift toward lower carbon emissions, further drives market expansion

Automotive Original Equipment Manufacturer (OEMS) Market Analysis

- The automotive OEM market is witnessing steady growth as manufacturers prioritize technological advancements and sustainable manufacturing methods to meet evolving customer demands and regulatory mandates

- OEMs are heavily investing in research and development to upgrade products with state-of-the-art electronics, lightweight materials, and networked automotive features to enhance product excellence and competitiveness

- Europe is dominating the revenue the automotive original equipment manufacturer (OEM) market with the largest revenue share of 42% in 2024, driven by rising automobile sales and robust demand for commercial and passenger vehicles equipped with advanced brake technologies

- Asia-Pacific is projected to be the fastest-growing region in the automotive original equipment manufacturer (OEM) market during the forecast period, fueled by rapid urbanization, increasing automotive sales, high demand for vehicles in the region, and the presence of significant players, particularly in countries such as China, India, Japan, and South Korea

- The power-train and chassis segment holds the largest market revenue share of 67.7% in 2024, driven by the essential role of powertrain systems in vehicle performance and significant OEM investments in developing internal powertrain technologies that reflect brand core intelligence

Report Scope and Automotive Original Equipment Manufacturer (OEMS) Market Segmentation

|

Attributes |

Automotive Original Equipment Manufacturer (OEMS) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Automotive Original Equipment Manufacturer (OEMS) Market Trends

“Rising Adoption of Advanced Electrical and Electronics Components”

- OEMs are increasingly integrating advanced electrical and electronic systems, such as advanced driver-assistance systems (ADAS), infotainment systems, and connectivity features, to meet consumer demand for smart and connected vehicles

- These components enhance vehicle safety, convenience, and user experience, making them a key differentiator in the competitive automotive market

- In regions with high tech adoption, such as Europe and North America, OEMs such as BMW and Volkswagen are incorporating cutting-edge electronics in their premium models

- Electric vehicles (EVs) are driving demand for specialized electrical components, including high-capacity batteries and efficient power management systems, to optimize range and performance

- For instance, Tesla integrates proprietary electrical systems in its vehicles, setting a benchmark for EV performance and innovation

- Dealerships and OEM retailers are offering upgraded electronics packages as value-added options, particularly for luxury and electric vehicle buyers

Automotive Original Equipment Manufacturer (OEMS) Market Dynamics

Driver

“Growing Demand for Electric Vehicles and Sustainable Mobility

- Rising consumer awareness of environmental concerns and stringent emissions regulations are driving demand for electric vehicles, prompting OEMs to invest heavily in EV production and innovation

- EVs require specialized components, such as high-efficiency power-trains and advanced battery systems, which are boosting the demand for OEMs specializing in these areas

- Governments in regions such as Europe and Asia-Pacific are offering incentives and subsidies for EV adoption, further encouraging OEMs to expand their electric vehicle portfolios

- For instance, Mercedes-Benz has committed to an all-electric lineup by 2030, with models such as the EQS featuring advanced power-train and interior technologies

- The focus on sustainable mobility is also increasing the demand for lightweight materials in vehicle bodies and chassis to improve fuel efficiency and EV range

Restraint/Challenge

“Supply Chain Disruptions and Semiconductor Shortages”

- Global supply chain disruptions, particularly semiconductor shortages, are limiting OEMs' ability to meet production demands, especially for vehicles with advanced electrical and electronic components

- The complexity of sourcing components across different regions, coupled with geopolitical tensions and trade restrictions, creates challenges for manufacturers operating internationally

- Semiconductor shortages have led to production delays for major OEMs such as Ford and General Motors, impacting delivery timelines and market growth

- High dependency on specific suppliers for critical components, such as batteries for EVs, poses risks to scalability and cost management

- In Asia-Pacific, where rapid market growth is expected, supply chain bottlenecks could slow the pace of expansion for OEMs aiming to capitalize on rising demand

Automotive Original Equipment Manufacturer (OEMS) Market Scope

The market is segmented on the basis of component, vehicle type, and distribution channel.

- By Component

On the basis of component, the automotive original equipment manufacturer (OEM) market is segmented into body, electrical and electronics, interior, powertrain and chassis, and others. The power-train and chassis segment holds the largest market revenue share of 67.7% in 2024, driven by the essential role of powertrain systems in vehicle performance and significant OEM investments in developing internal powertrain technologies that reflect brand core intelligence. This reflects the core intelligence and performance capabilities of vehicle brands.

The electrical and electronics segment is expected to witness substantial growth, driven by the increasing integration of advanced driver-assistance systems (ADAS), infotainment systems, connectivity features, and the growing electrification of vehicles. As vehicles become more technologically advanced, the demand for sophisticated electronic components from OEMs rises significantly.

- By Vehicle Type

On the basis of vehicle type, the automotive original equipment manufacturer (OEM) market is segmented into passenger cars, commercial vehicles, and electric vehicles. The passenger cars segment is expected to dominate the market, attributed to the high global production and sales volume of passenger vehicles and the continuous consumer demand for enhanced comfort, safety, and aesthetic features. OEMs are consistently innovating to meet these evolving demands in the passenger car segment.

The electric vehicles segment is projected to witness the fastest growth rate during the forecast period. This rapid growth is driven by increasing global adoption of EVs, supportive government regulations promoting electrification, and significant OEM investments in developing specialized components and platforms for electric mobility.

- By Distribution Channel

On the basis of distribution channel, the automotive original equipment manufacturer (OEM) market is segmented into OEM retailers, wholesalers, and distributors. The OEM retailers segment accounted for the largest revenue share of 48.8% in 2024, supported by direct sales through branded dealerships and the growing trend of OEMs offering customized vehicle packages.

The Distributors segment is expected to witness the fastest growth rate during the forecast period, driven by the increasing demand for aftermarket parts and the expansion of distribution networks in emerging markets to support OEM supply chains.

Automotive Original Equipment Manufacturer (OEMS) Market Regional Analysis

- Europe is dominating the revenue the automotive original equipment manufacturer (OEM) market with the largest revenue share of 42% in 2024, driven by rising automobile sales and robust demand for commercial and passenger vehicles equipped with advanced brake technologies

- Consumers prioritize advanced safety features, fuel efficiency, and connectivity, boosting the adoption of innovative OEM component

- Growth is supported by technological advancements in electric and hybrid powertrains, as well as strong OEM presence in countries such as Germany and France

U.S. Automotive Original Equipment Manufacturer (OEMS) Market Insight

The U.S. holds a significant share in the North American automotive OEMs market in 2024, fueled by robust demand for passenger cars and electric vehicles, coupled with strong domestic manufacturing capabilities. The trend toward vehicle electrification and the integration of advanced electronics, such as ADAS and infotainment systems, drives market expansion. OEMs such as General Motors and Ford are increasingly incorporating sustainable materials and smart technologies, complementing both domestic and export markets.

Europe Automotive Original Equipment Manufacturer (OEMS) Market Insight

Europe dominates the revenue growth of the automotive OEMs market, supported by stringent environmental regulations and a strong focus on vehicle safety and sustainability. Consumers demand high-quality components that enhance fuel efficiency and reduce emissions, driving innovation in power-train and electrical systems. Countries such as Germany and France lead due to their advanced automotive manufacturing ecosystems and significant investments in EV production.

U.K. Automotive Original Equipment Manufacturer (OEMS) Market Insight

The U.K. market is expected to witness rapid growth, driven by increasing demand for electric and hybrid vehicles and the integration of advanced connectivity features. Consumer preference for premium vehicles with enhanced interiors and safety systems boosts OEM component demand. Supportive government policies promoting low-emission vehicles and the presence of major OEMs such as Jaguar Land Rover further accelerate market growth.

Germany Automotive Original Equipment Manufacturer (OEMS) Market Insight

Germany is a key contributor to the European automotive OEMs market, driven by its leadership in automotive manufacturing and innovation. German OEMs, such as Volkswagen and BMW, prioritize advanced power-train and chassis components to meet stringent emission standards and consumer demand for high-performance vehicles. The integration of smart electronics and sustainable materials supports sustained market growth.

Asia-Pacific Automotive Original Equipment Manufacturer (OEMS) Market Insight

The Asia-Pacific region is projected to be the fastest-developing region, driven by rapid urbanization, rising vehicle ownership, and increasing demand for electric vehicles in countries such as China, Japan, and India. Government incentives for EV adoption and investments in smart manufacturing technologies boost OEM component demand. The region’s growing middle class and focus on vehicle safety and connectivity further enhance market growth.

Japan Automotive Original Equipment Manufacturer (OEMS) Market Insigh

Japan’s automotive OEMs market is expected to witness significant growth, driven by its leadership in automotive innovation and strong demand for high-quality components in passenger cars and EVs. Major OEMs such as Toyota and Honda are integrating advanced electrical and power-train systems to enhance vehicle efficiency and performance. The growing trend of vehicle electrification and aftermarket customization supports market expansion.

China Automotive Original Equipment Manufacturer (OEMS) Market Insight

The China holds the largest share of the Asia-Pacific automotive OEMs market, propelled by rapid industrialization, increasing vehicle production, and government policies promoting electric vehicles. The country’s expanding middle class and demand for advanced safety and connectivity features drive the adoption of OEM components. Strong domestic manufacturing capabilities and competitive pricing further enhance market accessibility.

Automotive Original Equipment Manufacturer (OEMS) Market Share

The automotive original equipment manufacturer (OEMS) industry is primarily led by well-established companies, including:

- TOYOTA MOTOR CORPORATION (Japan)

- Volkswagen (Germany)

- Nissan (Japan)

- Honda Motor Co., Ltd. (Japan)

- Magna International Inc. (Canada)

- Continental AG (Germany)

- Siemens (Germany)

- BMW AG (Germany)

- EXIDE INDUSTRIES LTD (India)

- Robert Bosch, GMbH (Germany)

- Valeo (France)

- Ford Motor Company (U.S.)

- MITSUBISHI MOTORS CORPORATION (Japan)

- ZF Friedrichshafen AG (Germany)

- BorgWarner Inc.(U.S.)

Latest Developments in Global Automotive Original Equipment Manufacturer (OEMS) Market

- In March 2025, American Axle & Manufacturing (AAM) acquired Dowlais Group’s GKN Automotive and GKN Powder Metallurgy divisions to expand its expertise in powertrain-agnostic solutions. This acquisition enhances AAM’s capabilities in EV and hybrid vehicle components, aligning with the industry’s shift toward electrification. The deal strengthens AAM’s global supply chain presence, particularly in North America and Europe, to meet rising OEM demand for advanced driveline systems

- In February 2025, Hyundai entered a strategic partnership with CATL, a leading battery manufacturer, to supply high-performance batteries for its future EV models. This collaboration focuses on developing next-generation batteries with enhanced energy density and faster charging capabilities. By ensuring a stable battery supply chain, the partnership strengthens Hyundai’s competitiveness in the global EV market, particularly in North America and Asia-Pacific

- In January 2025, Volkswagen expanded its Modular Electric Drive Matrix (MEB) platform, introducing the ID.7 electric sedan with advanced driver-assistance systems (ADAS) and an improved battery range. This upgrade supports multiple EV models, enhancing production flexibility and cost efficiency. The expansion strengthens Volkswagen’s position in the global EV market, particularly in Europe and Asia-Pacific, where demand for sustainable mobility continues to rise

- In January 2025, General Motors (GM) merged its Cruise robotaxi business with its in-house autonomous and driving assist technology division, responsible for Super Cruise software. This strategic consolidation follows a $9 billion investment in Cruise, aiming to streamline autonomous vehicle development and enhance efficiency in a competitive market. The merger strengthens GM’s capabilities in autonomous driving technology, with expectations of contributing USD 1 billion to 2025 revenues

- In October 2023, Stellantis acquired a 20% stake in Leapmotor, a Chinese EV manufacturer, and expanded the partnership in 2025 to co-develop affordable EV models for global markets. This collaboration leverages Leapmotor’s cost-effective battery technology to enhance Stellantis’ EV portfolio, aiming for 500,000 sales outside China by 2030. The alliance strengthens Stellantis’ presence in Asia-Pacific and supports its electrification goals

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL AUTOMOTIVE ORIGINAL EQUIPMENT MANUFACTURER (OEMS) MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL AUTOMOTIVE ORIGINAL EQUIPMENT MANUFACTURER (OEMS) MARKET

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 MARKET GUIDE

2.2.4 COMPANY MARKET SHARE ANALYSIS

2.2.5 MULTIVARIATE MODELLING

2.2.6 TOP TO BOTTOM ANALYSIS

2.2.7 STANDARDS OF MEASUREMENT

2.2.8 VENDOR SHARE ANALYSIS

2.2.9 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.10 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL AUTOMOTIVE ORIGINAL EQUIPMENT MANUFACTURER (OEMS) MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHT

5.1 PORTERS FIVE FORCES

5.2 REGULATORY STANDARDS

5.3 TECHNOLOGICAL TRENDS

5.4 PATENT ANALYSIS

5.5 CASE STUDY

5.6 VALUE CHAIN ANALYSIS

5.7 PRICING ANALYSIS

6 GLOBAL AUTOMOTIVE ORIGINAL EQUIPMENT MANUFACTURER (OEMS) MARKET, BY COMPONENT

6.1 OVERVIEW

6.2 EXTERIOR COMPONENTS

6.2.1 BUMPER

6.2.1.1. BY POSITION

6.2.1.1.1. FRONT END

6.2.1.1.2. REAR END

6.2.2 FENDERS

6.2.2.1. STEEL

6.2.2.2. FIBERGLASS

6.2.2.3. CARBON FIBER

6.2.3 DOORS

6.2.3.1. FRONT-HINGED DOOR

6.2.3.2. REAR-HINGED DOOR

6.2.3.3. SCISSOR DOOR

6.2.3.4. GULLWING DOOR

6.2.3.5. SLIDING DOOR

6.2.4 HOODS

6.2.5 TAILGATES

6.2.6 OTHERS

6.3 INTERIOR

6.3.1 CENTER STACK

6.3.2 HEAD-UP DISPLAY

6.3.3 INSTRUMENT CLUSTER

6.3.4 REAR SEAT ENTERTAINMENT

6.3.5 DOME MODULE

6.3.6 HEADLINER

6.3.7 SEAT

6.3.8 INTERIOR LIGHTING

6.3.9 DOOR PANEL

6.3.10 ADHESIVES & TAPES

6.3.11 OTHERS

6.4 ENGINE AND EXHAUST SYSTEMS

6.4.1 ENGINE BLOCKS

6.4.1.1. 3 CYLINDER

6.4.1.2. INLINE 4 CYLINDER

6.4.1.3. INLINE 6 CYLINDER

6.4.1.4. V6 CYLINDER

6.4.1.5. V8 CYLINDER

6.4.2 PISTONS

6.4.2.1. PISTON

6.4.2.2. PISTON RING

6.4.2.3. PISTON PIN

6.4.3 CYLINDER HEAD

6.4.3.1. STRAIGHT OR INLINE ENGINE

6.4.3.2. V-TYPE ENGINE

6.4.4 CRANKSHAFT

6.4.5 CAMSHAFT

6.4.6 VALVES

6.4.6.1. SOLENOID

6.4.6.2. EGR VALVE

6.4.6.3. BRAKE COMBINATION VALVE

6.4.6.4. AT CONTROL VALVE

6.4.6.5. ENGINE VALVE

6.4.7 OIL PANS

6.4.8 MANIFOLD

6.4.9 CONNECTING RODS

6.4.10 FLYWHEELS

6.4.11 GASKET

6.4.12 SPARK PLUGS

6.4.13 OTHERS

6.5 POWERTRAIN

6.5.1 BY DRIVE TYPE

6.5.1.1. FRONT WHEEL DRIVE

6.5.1.2. REAR WHEEL DRIVE

6.5.1.3. ALL-WHEEL DRIVE

6.6 ADVANCED TECHNOLOGIES

6.7 AUTOMOTIVE ELECTRONICS AND ELECTRICAL EQUIPMENT

6.7.1 POWER ELECTRONICS

6.7.1.1. BY DEVICE TYPE

6.7.1.1.1. POWER

6.7.1.1.2. IC

6.7.1.1.3. MODULE & DICRETE

6.7.2 DIAGNOSTIC SCAN TOOLS

6.7.3 POWER SENSOR

6.7.4 RELAY

6.7.4.1. BY TYPE

6.7.4.1.1. PCB

6.7.4.1.2. PLUG-IN

6.7.4.1.3. HIGH VOLTAGE

6.7.4.1.4. PROTECTIVE

6.7.4.1.5. SIGNAL

6.7.4.1.6. OTHERS

6.7.5 BODY CONTROL MODULES

6.7.5.1. BY FUNCTIONALITY

6.7.5.1.1. HIGH END

6.7.5.1.2. LOW END

6.7.6 AUTOMOTIVE COMMUNICATION

6.7.6.1. LIN

6.7.6.2. CAN

6.7.6.3. FLEX

6.7.6.4. MOST

6.7.6.5. EHTERNET

6.7.7 AUTOMOTIVE ECU

6.7.8 OTHERS

6.8 HEADLIGHTS CONTROL MODULES

6.9 OTHERS

7 GLOBAL AUTOMOTIVE ORIGINAL EQUIPMENT MANUFACTURER (OEMS) MARKET, BY PROPULSION TYPE

7.1 OVERVIEW

7.2 INTERNAL COMBUSTION ENGINE (ICE)

7.2.1 DIESEL

7.2.2 PETROL

7.2.3 CNG

7.3 ELECTRIC

7.3.1 BATTERY ELECTRIC VEHICLES (BEV)

7.3.2 HYBRID ELECTRIC VEHICLES (HEV)

7.3.3 PLUG-IN HYBRID ELECTRIC VEHICLES (PHEV)

7.3.4 FUEL CELL ELECTRIC VEHICLES (FCEV)

8 GLOBAL AUTOMOTIVE ORIGINAL EQUIPMENT MANUFACTURER (OEMS) MARKET, BY MATERIAL

8.1 OVERVIEW

8.2 STEEL

8.3 ALUMINIUM

8.4 PLASTICS

8.5 GLASS COMPOSITES

8.6 CARBON COMPOSITES

8.7 METAL

8.8 VINYL

8.9 FABRIC

8.1 OTHERS

9 GLOBAL AUTOMOTIVE ORIGINAL EQUIPMENT MANUFACTURER (OEMS) MARKET, BY ACCESSORIES

9.1 OVERVIEW

9.2 SEAT COVERS

9.3 DASH CAM

9.4 SUN BLINDS

9.5 FLOOR MATS

9.6 WINDOW TINTING

9.7 FOOT REST

9.8 BLUETOOTH TRANSMITTER

9.9 WIRELESS CHARGER

9.1 OTHERS

10 GLOBAL AUTOMOTIVE ORIGINAL EQUIPMENT MANUFACTURER (OEMS) MARKET, BY SEATING CAPACITY

10.1 OVERVIEW

10.2 4 SEATERS

10.3 5 SEATERS

10.4 6 SEATERS

10.5 7 SEATERS

10.6 MORE THAN 7 SEATORS

11 GLOBAL AUTOMOTIVE ORIGINAL EQUIPMENT MANUFACTURER (OEMS) MARKET, BY DRIVING TYPE

11.1 OVERVIEW

11.2 SEMI-AUTONOMOUS

11.3 AUTONOMOUS

11.4 MANUAL

12 GLOBAL AUTOMOTIVE ORIGINAL EQUIPMENT MANUFACTURER (OEMS) MARKET, BY VEHICLE TYPE

12.1 OVERVIEW

12.2 PASSENGER CARS

12.2.1 PASSENGER CARS, BY VEHICLE TYPE

12.2.1.1. HATCHBACK

12.2.1.2. SEDAN

12.2.1.3. MPV

12.2.1.4. SUV

12.2.1.5. CROSSOVER

12.2.1.6. COUPE

12.2.1.7. CONVERTIBLE

12.2.1.8. OTHERS

12.3 COMMERCIAL VEHICLES

12.3.1 COMMERCIAL VEHICLES, BY VEHICLE TYPE

12.3.1.1. LIGHT COMMERCIAL VEHICLES (LCV)

12.3.1.1.1. VANS

12.3.1.1.1.1 PASSENGER VANS

12.3.1.1.1.2 CARGO VANS

12.3.1.1.2. PICK UP TRUCKS

12.3.1.1.3. MINI BUS

12.3.1.1.4. COACHES

12.3.1.1.5. OTHERS

12.3.1.2. HEAVY COMMERCIAL VEHICLES (HCV)

12.3.1.2.1. BUSES

12.3.1.2.2. TRUCKS

12.3.1.2.2.1 CEMENT TRUCKS

12.3.1.2.2.2 DUMP TRUCKS

12.3.1.2.2.3 SEMI-TRAILERS

12.3.1.2.2.4 OTHERS

13 GLOBAL AUTOMOTIVE ORIGINAL EQUIPMENT MANUFACTURER (OEMS) MARKET, BY GEOGRAPHY

13.1 GLOBAL AUTOMOTIVE ORIGINAL EQUIPMENT MANUFACTURER (OEMS) MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

13.1.1 NORTH AMERICA

13.1.1.1. U.S.

13.1.1.2. CANADA

13.1.1.3. MEXICO

13.1.2 EUROPE

13.1.2.1. GERMANY

13.1.2.2. FRANCE

13.1.2.3. U.K.

13.1.2.4. ITALY

13.1.2.5. SPAIN

13.1.2.6. RUSSIA

13.1.2.7. TURKEY

13.1.2.8. BELGIUM

13.1.2.9. NETHERLANDS

13.1.2.10. NORWAY

13.1.2.11. FINLAND

13.1.2.12. SWITZERLAND

13.1.2.13. DENMARK

13.1.2.14. SWEDEN

13.1.2.15. POLAND

13.1.2.16. REST OF EUROPE

13.1.3 ASIA PACIFIC

13.1.3.1. JAPAN

13.1.3.2. CHINA

13.1.3.3. SOUTH KOREA

13.1.3.4. INDIA

13.1.3.5. AUSTRALIA

13.1.3.6. NEW ZEALAND

13.1.3.7. SINGAPORE

13.1.3.8. THAILAND

13.1.3.9. MALAYSIA

13.1.3.10. INDONESIA

13.1.3.11. PHILIPPINES

13.1.3.12. TAIWAN

13.1.3.13. VIETNAM

13.1.3.14. REST OF ASIA PACIFIC

13.1.4 SOUTH AMERICA

13.1.4.1. BRAZIL

13.1.4.2. ARGENTINA

13.1.4.3. REST OF SOUTH AMERICA

13.1.5 MIDDLE EAST AND AFRICA

13.1.5.1. SOUTH AFRICA

13.1.5.2. EGYPT

13.1.5.3. SAUDI ARABIA

13.1.5.4. U.A.E

13.1.5.5. OMAN

13.1.5.6. BAHRAIN

13.1.5.7. ISRAEL

13.1.5.8. KUWAIT

13.1.5.9. QATAR

13.1.5.10. REST OF MIDDLE EAST AND AFRICA

13.1.6 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

14 GLOBAL AUTOMOTIVE ORIGINAL EQUIPMENT MANUFACTURER (OEMS) MARKET,COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: GLOBAL

14.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

14.3 COMPANY SHARE ANALYSIS: EUROPE

14.4 COMPANY SHARE ANALYSIS: ASIA PACIFIC

14.5 MERGERS & ACQUISITIONS

14.6 NEW PRODUCT DEVELOPMENT AND APPROVALS

14.7 EXPANSIONS

14.8 REGULATORY CHANGES

14.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

15 GLOBAL AUTOMOTIVE ORIGINAL EQUIPMENT MANUFACTURER (OEMS) MARKET, SWOT & DBMR ANALYSIS

16 GLOBAL AUTOMOTIVE ORIGINAL EQUIPMENT MANUFACTURER (OEMS) MARKET, COMPANY PROFILE

16.1 CONTINENTAL AG

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 GEOGRAPHIC PRESENCE

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENT

16.2 ROBERT BOSCH GMBH

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 GEOGRAPHIC PRESENCE

16.2.4 PRODUCT PORTFOLIO

16.2.5 RECENT DEVELOPMENT

16.3 DENSO CORPORATION

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 GEOGRAPHIC PRESENCE

16.3.4 PRODUCT PORTFOLIO

16.3.5 RECENT DEVELOPMENT

16.4 VALEO S.A

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 GEOGRAPHIC PRESENCE

16.4.4 PRODUCT PORTFOLIO

16.4.5 RECENT DEVELOPMENT

16.5 HITACHI LTD.

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 GEOGRAPHIC PRESENCE

16.5.4 PRODUCT PORTFOLIO

16.5.5 RECENT DEVELOPMENT

16.6 DELPHI AUTOMOTIVE PLC (A PART OF PHINIA INC)

16.6.1 COMPANY SNAPSHOT

16.6.2 REVENUE ANALYSIS

16.6.3 GEOGRAPHIC PRESENCE

16.6.4 PRODUCT PORTFOLIO

16.6.5 RECENT DEVELOPMENT

16.7 ACE FORGE PVT LTD (AFPL)

16.7.1 COMPANY SNAPSHOT

16.7.2 REVENUE ANALYSIS

16.7.3 GEOGRAPHIC PRESENCE

16.7.4 PRODUCT PORTFOLIO

16.7.5 RECENT DEVELOPMENT

16.8 TOYOTA MOTOR CORP

16.8.1 COMPANY SNAPSHOT

16.8.2 REVENUE ANALYSIS

16.8.3 GEOGRAPHIC PRESENCE

16.8.4 PRODUCT PORTFOLIO

16.8.5 RECENT DEVELOPMENT

16.9 MERCEDES-BENZ DURHAM (A PART OF DAIMLER AG)

16.9.1 COMPANY SNAPSHOT

16.9.2 REVENUE ANALYSIS

16.9.3 GEOGRAPHIC PRESENCE

16.9.4 PRODUCT PORTFOLIO

16.9.5 RECENT DEVELOPMENT

16.1 BHARAT FORGE (IS THE FLAGSHIP COMPANY OF KALYANI GROUP)

16.10.1 COMPANY SNAPSHOT

16.10.2 REVENUE ANALYSIS

16.10.3 GEOGRAPHIC PRESENCE

16.10.4 PRODUCT PORTFOLIO

16.10.5 RECENT DEVELOPMENT

16.11 DANA LIMITED

16.11.1 COMPANY SNAPSHOT

16.11.2 REVENUE ANALYSIS

16.11.3 GEOGRAPHIC PRESENCE

16.11.4 PRODUCT PORTFOLIO

16.11.5 RECENT DEVELOPMENT

16.12 SMITHS MANUFACTURING (PTY) LTD.

16.12.1 COMPANY SNAPSHOT

16.12.2 REVENUE ANALYSIS

16.12.3 GEOGRAPHIC PRESENCE

16.12.4 PRODUCT PORTFOLIO

16.12.5 RECENT DEVELOPMENT

16.13 COOPER STANDARD.

16.13.1 COMPANY SNAPSHOT

16.13.2 REVENUE ANALYSIS

16.13.3 GEOGRAPHIC PRESENCE

16.13.4 PRODUCT PORTFOLIO

16.13.5 RECENT DEVELOPMENT

16.14 MAHLE GMBH (A PART OF MAHLE STIFTUNG GMBH)

16.14.1 COMPANY SNAPSHOT

16.14.2 REVENUE ANALYSIS

16.14.3 GEOGRAPHIC PRESENCE

16.14.4 PRODUCT PORTFOLIO

16.14.5 RECENT DEVELOPMENT

16.15 HYUNDAI MOTOR COMPANY

16.15.1 COMPANY SNAPSHOT

16.15.2 REVENUE ANALYSIS

16.15.3 GEOGRAPHIC PRESENCE

16.15.4 PRODUCT PORTFOLIO

16.15.5 RECENT DEVELOPMENT

16.16 FREUDENBERG FILTRATION TECHNOLOGIES GMBH & CO. KG

16.16.1 COMPANY SNAPSHOT

16.16.2 REVENUE ANALYSIS

16.16.3 GEOGRAPHIC PRESENCE

16.16.4 PRODUCT PORTFOLIO

16.16.5 RECENT DEVELOPMENT

16.17 CUMMINS INC

16.17.1 COMPANY SNAPSHOT

16.17.2 REVENUE ANALYSIS

16.17.3 GEOGRAPHIC PRESENCE

16.17.4 PRODUCT PORTFOLIO

16.17.5 RECENT DEVELOPMENT

16.18 JOHNSON ELECTRIC HOLDINGS LIMITED.

16.18.1 COMPANY SNAPSHOT

16.18.2 REVENUE ANALYSIS

16.18.3 GEOGRAPHIC PRESENCE

16.18.4 PRODUCT PORTFOLIO

16.18.5 RECENT DEVELOPMENT

16.19 AISIN CORPORATION

16.19.1 COMPANY SNAPSHOT

16.19.2 REVENUE ANALYSIS

16.19.3 GEOGRAPHIC PRESENCE

16.19.4 PRODUCT PORTFOLIO

16.19.5 RECENT DEVELOPMENT

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

17 CONCLUSION

18 QUESTIONNAIRE

19 RELATED REPORTS

20 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.