Global Automotive Leaf Spring Market

Market Size in USD Billion

CAGR :

%

USD

5.09 Billion

USD

8.24 Billion

2025

2033

USD

5.09 Billion

USD

8.24 Billion

2025

2033

| 2026 –2033 | |

| USD 5.09 Billion | |

| USD 8.24 Billion | |

|

|

|

|

Automotive Leaf Spring Market Size

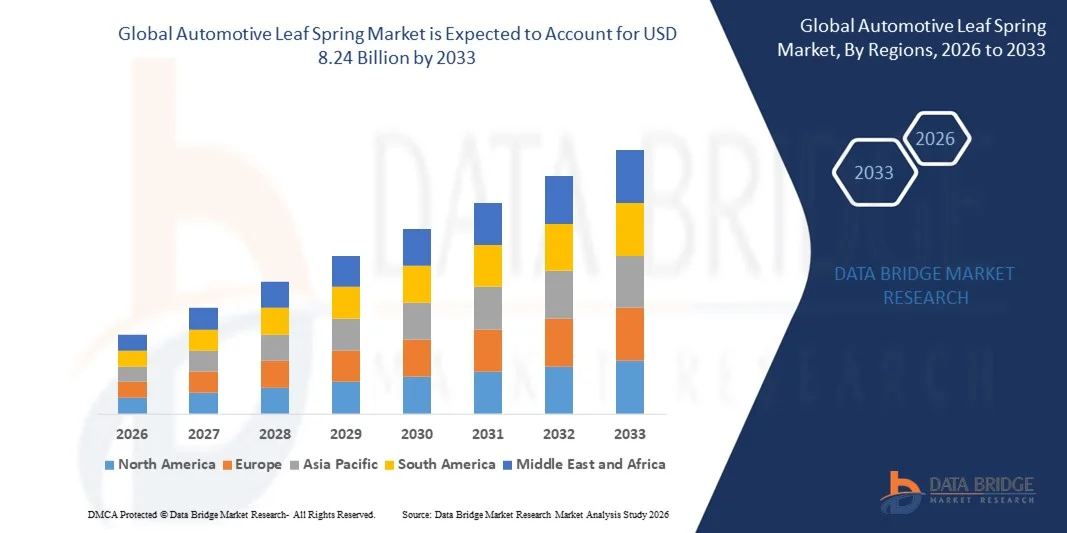

- The global automotive leaf spring market size was valued at USD 5.09 billion in 2025 and is expected to reach USD 8.24 billion by 2033, at a CAGR of 6.20% during the forecast period

- The market growth is largely fuelled by increasing demand for commercial vehicles, trucks, and SUVs, which require durable and reliable suspension systems

- Rising focus on vehicle safety, load-carrying capacity, and enhanced ride comfort is further driving the adoption of leaf spring suspensions

Automotive Leaf Spring Market Analysis

- The market is witnessing a shift toward high-strength, lightweight materials such as alloy steel and composite materials to improve fuel efficiency and performance

- Technological advancements in leaf spring design and manufacturing, including multi-leaf and parabolic configurations, are enhancing durability and ride quality

- North America dominated the automotive leaf spring market with the largest revenue share of 35.40% in 2025, driven by the high demand for commercial vehicles, trucks, and buses, as well as the presence of established vehicle manufacturers and suppliers

- Asia-Pacific region is expected to witness the highest growth rate in the global automotive leaf spring market, driven by rising vehicle production, expanding commercial and heavy-duty vehicle fleets, and growing local manufacturing capabilities

- The multi-leaf spring segment held the largest market revenue share in 2025, driven by its widespread use in heavy-duty trucks, buses, and commercial vehicles due to superior load-carrying capacity and durability

Report Scope and Automotive Leaf Spring Market Segmentation

|

Attributes |

Automotive Leaf Spring Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• Hendrickson USA, L.L.C. (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Automotive Leaf Spring Market Trends

Rising Demand for Durable and High-Performance Suspension Systems

- The growing focus on vehicle safety, load-carrying capacity, and ride comfort is significantly shaping the automotive leaf spring market, as manufacturers increasingly prefer durable, high-strength materials for commercial vehicles, trucks, and SUVs. Leaf springs are gaining traction due to their ability to support heavy loads, enhance stability, and reduce maintenance costs, strengthening their adoption across automotive and aftermarket sectors

- Increasing awareness around vehicle performance, reliability, and long-term operational efficiency has accelerated the demand for advanced leaf spring solutions in commercial trucks, buses, and off-road vehicles. Fleet operators and vehicle manufacturers are actively seeking leaf springs that deliver improved suspension performance, durability, and safety under varying load conditions

- Safety and performance trends are influencing purchasing decisions, with manufacturers emphasizing high-quality steel or composite materials, optimized design, and compliance with regulatory standards. These factors help brands differentiate vehicles in competitive markets and build customer trust, while also driving the adoption of lightweight and corrosion-resistant leaf springs

- For instance, in 2024, Tata Motors in India and Daimler Trucks in Germany expanded their commercial vehicle portfolios by incorporating high-strength and composite leaf springs in trucks and buses. These enhancements were introduced in response to rising demand for improved ride comfort, load management, and durability, with deployment across domestic and export markets

- While demand for automotive leaf springs is growing, sustained market expansion depends on continuous R&D, cost-effective production, and maintaining performance comparable to emerging alternatives such as coil springs or air suspensions. Manufacturers are also focusing on supply chain efficiency, material innovation, and scalable production processes for broader adoption

Automotive Leaf Spring Market Dynamics

Driver

Growing Demand for Commercial Vehicles and Heavy-Duty Applications

- Rising production and sales of trucks, buses, and SUVs are major drivers for the automotive leaf spring market. Manufacturers are increasingly deploying leaf springs to enhance load-bearing capacity, stability, and durability in heavy-duty vehicles, supporting performance and safety standards

- Expanding applications in commercial transport, logistics, and off-road sectors are influencing market growth. Leaf springs provide cost-effective suspension solutions that maintain ride quality and reduce maintenance requirements, enabling manufacturers to meet evolving vehicle performance demands

- Vehicle manufacturers and fleet operators are actively promoting leaf spring-based suspension systems through product innovation, marketing campaigns, and technical partnerships. These efforts are supported by growing consumer preference for safe, durable, and reliable vehicles, and they also encourage collaborations with material suppliers to enhance performance and reduce operational costs

- For instance, in 2023, Volvo Trucks in Sweden and Ashok Leyland in India reported increased incorporation of high-strength and multi-leaf spring systems in commercial trucks and buses. This expansion followed higher demand for durability, safety, and load-carrying efficiency, driving repeat purchases and fleet operator preference

- Although rising commercial vehicle production supports growth, wider adoption depends on cost optimization, raw material availability, and production scalability. Investment in lightweight materials, advanced manufacturing technology, and quality control will be critical to meet global demand and maintain competitive advantage

Restraint/Challenge

High Production Cost and Material Constraints

- The relatively higher cost of high-strength or composite leaf springs compared to conventional steel alternatives remains a key challenge, limiting adoption among cost-sensitive manufacturers. Complex manufacturing processes and material sourcing contribute to elevated pricing

- Fleet operators and vehicle manufacturers in emerging markets have limited awareness of advanced leaf spring benefits, slowing adoption. Lack of understanding of performance, durability, and safety advantages can restrict demand

- Supply chain and logistical challenges also impact market growth, as leaf springs require consistent quality, timely delivery, and adherence to automotive standards. Variations in steel quality, material shortages, and production bottlenecks can increase operational costs

- For instance, in 2024, distributors in Brazil and Southeast Asia supplying trucks and buses reported slower uptake of high-strength leaf springs due to higher costs and limited awareness of performance advantages compared to conventional suspension systems. These factors also prompted some fleet operators to delay upgrades or limit adoption

- Overcoming these challenges will require cost-efficient production, sustainable sourcing of materials, and educational initiatives for manufacturers and fleet operators. Collaboration with OEMs, suppliers, and regulatory bodies can help unlock the long-term growth potential of the global automotive leaf spring market. In addition, developing lightweight, high-performance, and cost-effective leaf springs will be essential for widespread adoption

Automotive Leaf Spring Market Scope

The market is segmented on the basis of spring type, location type, material type, manufacturing process, vehicle type, and distribution channel.

- By Spring Type

On the basis of spring type, the automotive leaf spring market is segmented into parabolic leaf spring and multi-leaf spring. The multi-leaf spring segment held the largest market revenue share in 2025, driven by its widespread use in heavy-duty trucks, buses, and commercial vehicles due to superior load-carrying capacity and durability.

The parabolic leaf spring segment is expected to witness the fastest growth rate from 2026 to 2033, driven by its lightweight design, improved ride comfort, and fuel efficiency benefits. Parabolic leaf springs are increasingly adopted in light-duty trucks and SUVs, making them popular for performance-focused and fuel-efficient vehicles.

- By Location Type

On the basis of location type, the market is segmented into front suspension and rear suspension. The rear suspension segment held the largest market revenue share in 2025, attributed to its critical role in supporting heavy loads and ensuring stability in trucks, buses, and commercial vehicles.

The front suspension segment is expected to witness the fastest growth rate from 2026 to 2033, driven by increasing adoption in passenger cars and light-duty vehicles where enhanced ride comfort, stability, and handling are required.

- By Material Type

On the basis of material type, the market is segmented into metal leaf springs and composite leaf springs. The metal leaf spring segment held the largest market revenue share in 2025, owing to its robustness, cost-effectiveness, and widespread availability in commercial vehicle application.

The composite leaf spring segment is expected to witness the fastest growth rate from 2026 to 2033, driven by increasing demand for lightweight, high-strength, and corrosion-resistant solutions to improve fuel efficiency and reduce vehicle weight.

- By Manufacturing Process

On the basis of manufacturing process, the market is segmented into shot peening, HP-RTM, prepreg layup, and others. The shot peening segment held the largest market revenue share in 2025, attributed to its ability to enhance fatigue strength and durability of steel leaf springs.

The HP-RTM and prepreg layup segments are expected to witness the fastest growth rate from 2026 to 2033, driven by the increasing adoption of advanced composite materials and modern manufacturing techniques in light-duty and performance vehicles.

- By Vehicle Type

On the basis of vehicle type, the market is segmented into passenger cars, light-duty vehicles, medium and heavy-duty vehicles, and others. The medium and heavy-duty vehicle segment held the largest market revenue share in 2025, fueled by high demand for commercial trucks, buses, and transport vehicles that require durable suspension systems.

The passenger car and light-duty vehicle segments are expected to witness the fastest growth rate from 2026 to 2033, driven by rising adoption of parabolic leaf springs and composite materials to improve ride comfort, handling, and fuel efficiency.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into OEMs and aftermarket. The OEM segment held the largest market revenue share in 2025, owing to the inclusion of leaf springs in new vehicle manufacturing and preference for standardized suspension solutions.

The aftermarket segment is expected to witness the fastest growth rate from 2026 to 2033, driven by increasing replacement demand, upgrades for heavy-duty vehicles, and rising awareness among fleet operators and commercial vehicle owners.

Automotive Leaf Spring Market Regional Analysis

- North America dominated the automotive leaf spring market with the largest revenue share of 35.40% in 2025, driven by the high demand for commercial vehicles, trucks, and buses, as well as the presence of established vehicle manufacturers and suppliers

- Fleet operators and manufacturers in the region highly value durability, load-carrying capacity, and performance offered by high-strength leaf springs, supporting adoption across commercial and heavy-duty vehicles

- This widespread adoption is further supported by advanced manufacturing infrastructure, strong regulatory standards, and growing investment in vehicle safety and performance, establishing leaf springs as a preferred suspension solution in North America

U.S. Automotive Leaf Spring Market Insight

The U.S. automotive leaf spring market captured the largest revenue share in 2025 within North America, fueled by growing demand for trucks, buses, and commercial vehicles. Fleet operators are increasingly prioritizing suspension solutions that improve load capacity, stability, and durability. The rise of logistics, transportation, and construction sectors, combined with government safety regulations, is further driving market growth. Moreover, the adoption of high-strength steel and composite leaf springs is contributing significantly to the expansion of the market.

Europe Automotive Leaf Spring Market Insight

The Europe automotive leaf spring market is expected to witness the fastest growth rate from 2026 to 2033, primarily driven by stringent vehicle safety regulations and increasing demand for durable and high-performance suspension systems in commercial and heavy-duty vehicles. Urbanization, modernization of transport fleets, and growth in e-commerce logistics are fostering the adoption of advanced leaf spring solutions. European operators also prefer lightweight and corrosion-resistant options to improve vehicle efficiency.

U.K. Automotive Leaf Spring Market Insight

The U.K. automotive leaf spring market is expected to witness significant growth from 2026 to 2033, driven by the expanding commercial vehicle sector and rising focus on vehicle safety, reliability, and durability. Increasing replacement demand for fleet vehicles and the adoption of lightweight and parabolic leaf springs for enhanced ride quality are expected to propel market growth. The U.K.’s logistics and transportation infrastructure further supports market expansion.

Germany Automotive Leaf Spring Market Insight

The Germany automotive leaf spring market is expected to witness considerable growth from 2026 to 2033, fueled by the country’s strong automotive manufacturing base, emphasis on engineering excellence, and focus on heavy-duty and commercial vehicle performance. High adoption of multi-leaf and parabolic leaf springs, coupled with advanced manufacturing processes, supports durability, load management, and operational efficiency in vehicles.

Asia-Pacific Automotive Leaf Spring Market Insight

The Asia-Pacific automotive leaf spring market is expected to witness the fastest growth rate from 2026 to 2033, driven by rapid industrialization, increasing commercial vehicle production, and rising demand for trucks and buses in countries such as China, India, and Japan. Government initiatives promoting transportation infrastructure, urbanization, and the emergence of local manufacturers are boosting adoption. In addition, the availability of cost-effective, high-strength, and lightweight leaf springs is expanding accessibility to a wider vehicle base.

Japan Automotive Leaf Spring Market Insight

The Japan automotive leaf spring market is expected to witness significant growth from 2026 to 2033 due to the country’s focus on advanced vehicle technology, high-performance commercial vehicles, and urban logistics needs. Fleet operators and manufacturers are adopting parabolic and composite leaf springs to enhance ride comfort, fuel efficiency, and vehicle safety. The aging population also encourages development of reliable, low-maintenance suspension systems for commercial and passenger vehicles.

China Automotive Leaf Spring Market Insight

The China automotive leaf spring market accounted for the largest revenue share in Asia-Pacific in 2025, attributed to rapid urbanization, expanding commercial vehicle fleets, and high adoption of heavy-duty trucks and buses. China is one of the largest markets for commercial vehicles, and the increasing focus on durability, load efficiency, and cost-effective suspension systems is driving market growth. Government policies supporting vehicle safety, infrastructure development, and local manufacturing of high-strength leaf springs are key factors propelling the market.

Automotive Leaf Spring Market Share

The Automotive Leaf Spring industry is primarily led by well-established companies, including:

Hendrickson USA, L.L.C. (U.S.)

• Sogefi SpA (Italy)

• Rassini (Mexico)

• Jamna Auto Industries Ltd. (India)

• Emco Industries (U.S.)

• NHK SPRING Co. Ltd. (Japan)

• Muhr und Bender KG (Germany)

• SGL Carbon (Germany)

• Frauenthal Holding AG (Austria)

• Eaton (U.S.)

• OlgunCelik San. Tic. A.S. (Turkey)

• Jonas Woodhead & Sons (I) Ltd. (U.K.)

• MackSprings (India)

• Vikrant Auto Suspensions (India)

• Auto Steels (India)

• Kumar Steels (India)

• Akar Tools Limited (India)

• Navbharat Industrial Corporation (India)

• Betts Spring Manufacturing (U.S.)

• Sonkem India Pvt. Ltd. (India)

Latest Developments in Global Automotive Leaf Spring Market

- In November 2024, MidOcean Partners, Acquisition, acquired Arnott Industries, adding 800 air-suspension SKUs covering 90% of factory-equipped vehicles. This acquisition expanded MidOcean’s product portfolio and market coverage, boosting its presence in the global air suspension sector

- In April 2024, Mitsubishi Steel Manufacturing Group, Capacity Expansion, enhanced its Springs business in India by doubling production capacity at its joint venture, Stumpp Schuele & Somappa Auto Suspension Systems Pvt. Ltd. This expansion improved supply capabilities and met growing demand in the Indian automotive leaf spring market

- In March 2024, DexKo Global Inc., Acquisition, acquired City Spring & Axle Ltd., a leading spring manufacturing and distribution company in Western Canada. The acquisition strengthened DexKo’s market presence in Canada and enhanced support for trailer and truck industries with high-quality spring and suspension components

- In July 2021, Rassini, Technology Development, selected Hexcel’s HexPly M901 prepreg system to accelerate prototype and new product development. This initiative aimed to reduce time-to-market, enable efficient early-stage design testing, and support cost-effective production, strengthening Rassini’s competitive position in the automotive suspension market

- In June 2021, Rassini, Product Specification, adopted an EPIKOTE epoxy resin system from Hexion Inc. for the rear suspension system of Ford Motor Co’s new pickup truck model. This development improved product performance and durability, enhancing Rassini’s reputation as a supplier of high-quality suspension components

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.