Global Automotive Garage Equipment Market

Market Size in USD Billion

CAGR :

%

USD

8.85 Billion

USD

12.11 Billion

2025

2033

USD

8.85 Billion

USD

12.11 Billion

2025

2033

| 2026 –2033 | |

| USD 8.85 Billion | |

| USD 12.11 Billion | |

|

|

|

|

What is the Global Automotive Garage Equipment Market Size and Growth Rate?

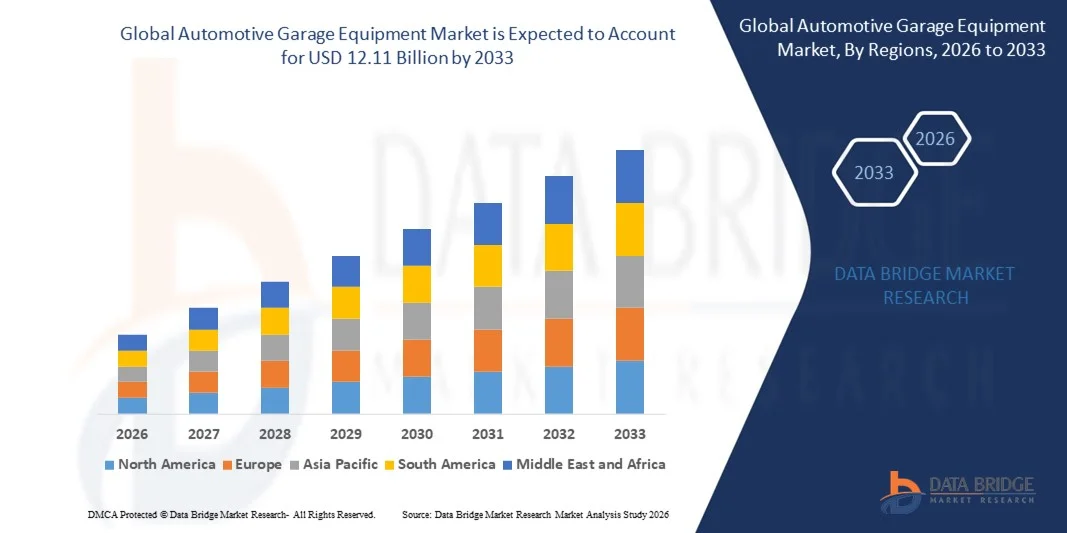

- The global automotive garage equipment market size was valued at USD 8.85 billion in 2025 and is expected to reach USD 12.11 billion by 2033, at a CAGR of4.00% during the forecast period

- Rising stringent rules and regulations regarding vehicle’s fuel efficiency is a crucial factor accelerating the market growth, also rising demand for garage equipment, rising urbanization, increasing disposable income, rising standard of living in emerging countries, increasing average age of vehicles, rising sales of used vehicles, and rising number of manufacturers authorized service centers and emergence of multi-brand service centers are the major factors among others boosting the automotive garage equipment market

What are the Major Takeaways of Automotive Garage Equipment Market?

- Rising demand for ECU and other electronic features and rising preference towards quality and authentic products, service centers are entering into partnerships with OEM’s which will further create new opportunities for automotive garage equipment market in the forecast period mentioned above

- However, rising international trade regulations is the major factors among others restraining the market growth, and will further challenge the automotive garage equipment market in the forecast period mentioned above

- Asia-Pacific dominated the automotive garage equipment market with a 41.6% revenue share in 2025, driven by rapid growth in vehicle production, expanding automotive aftermarket services, and rising penetration of organized repair workshops across China, India, Japan, South Korea, and Southeast Asia

- North America is expected to register the fastest CAGR of 11.36% from 2026 to 2033, driven by rising adoption of electric vehicles, increasing vehicle age, and growing demand for advanced diagnostics, ADAS calibration systems, and EV-compatible garage equipment across the U.S. and Canada

- The Wheel & Tire Service Equipment segment dominated the market with a 34.6% share in 2025, driven by high replacement frequency of tires, rising demand for wheel alignment and balancing, and mandatory safety inspections across passenger and commercial vehicles

Report Scope and Automotive Garage Equipment Market Segmentation

|

Attributes |

Automotive Garage Equipment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Automotive Garage Equipment Market?

Increasing Shift Toward Smart, Compact, and Digitally Integrated Automotive Garage Equipments

- The automotive garage equipment market is witnessing growing adoption of compact, space-efficient, and digitally enabled equipment such as smart vehicle lifts, computerized wheel aligners, advanced tire changers, and diagnostic systems designed for modern workshops

- Manufacturers are increasingly introducing PC-based, IoT-enabled, and sensor-integrated garage equipment that supports real-time monitoring, predictive maintenance, and seamless software updates

- Rising demand for cost-efficient, portable, and multi-functional garage solutions is driving adoption across independent repair shops, authorized service centers, fleet operators, and training institutes

- For instance, companies such as Bosch, Snap-on, Continental, MAHA, and ISTOBAL have launched advanced garage systems featuring digital diagnostics, cloud connectivity, automated calibration, and enhanced safety controls

- Increasing complexity of EVs, ADAS-equipped vehicles, and connected cars is accelerating the shift toward smart, PC-integrated garage equipment capable of handling high-precision servicing

- As vehicles become more electronically complex, automotive garage equipments will remain critical for efficient servicing, accurate diagnostics, and future-ready workshop operations

What are the Key Drivers of Automotive Garage Equipment Market?

- Rising demand for efficient, accurate, and easy-to-operate garage equipment to support faster vehicle servicing, diagnostics, and maintenance across passenger and commercial vehicles

- For instance, in 2024–2025, leading manufacturers such as Bosch, Snap-on, Continental, and Vehicle Service Group upgraded their portfolios with smart lifts, advanced diagnostics, and automated calibration systems

- Growing adoption of electric vehicles, hybrid vehicles, connected cars, and ADAS technologies is boosting demand for specialized garage equipment across the U.S., Europe, and Asia-Pacific

- Advancements in automation, sensor technology, AI-based diagnostics, and cloud-connected service platforms have enhanced equipment efficiency, accuracy, and workshop productivity

- Rising focus on vehicle safety regulations, emission compliance, and preventive maintenance is increasing demand for advanced inspection and testing equipment

- Supported by continuous investments in automotive aftermarket expansion, workshop modernization, and digital service infrastructure, the Automotive Garage Equipment market is expected to witness sustained long-term growth

Which Factor is Challenging the Growth of the Automotive Garage Equipment Market?

- High costs associated with advanced, automated, and digitally integrated garage equipment limit adoption among small garages and independent service workshops

- For instance, during 2024–2025, fluctuations in steel prices, electronic component costs, and supply chain disruptions increased manufacturing and procurement costs for several global vendors

- Complexity in operating ADAS calibration tools, EV-specific service equipment, and software-driven systems increases the need for skilled technicians and training programs

- Limited awareness in emerging markets regarding advanced garage equipment capabilities, digital diagnostics, and automation benefits slows adoption

- Competition from low-cost local manufacturers and refurbished equipment providers creates pricing pressure and impacts product differentiation

- To address these challenges, companies are focusing on cost-optimized designs, technician training, modular equipment offerings, and software-driven service models to expand global adoption of automotive garage equipments

How is the Automotive Garage Equipment Market Segmented?

The market is segmented on the basis of equipment type, vehicle type, and garage type.

- By Equipment Type

On the basis of equipment type, the automotive garage equipment market is segmented into Wheel & Tire Service Equipment, Lifting Equipment, Vehicle Diagnostic & Testing Equipment, Body Shop Equipment, Washing Equipment, and Other Tools. The Wheel & Tire Service Equipment segment dominated the market with a 34.6% share in 2025, driven by high replacement frequency of tires, rising demand for wheel alignment and balancing, and mandatory safety inspections across passenger and commercial vehicles. Tire changers, wheel balancers, and alignment systems are essential tools in both authorized service centers and independent garages, ensuring steady demand.

The Vehicle Diagnostic & Testing Equipment segment is expected to grow at the fastest CAGR from 2026 to 2033, supported by increasing adoption of EVs, connected vehicles, and ADAS-equipped cars. Advanced diagnostics tools capable of ECU scanning, battery testing, and software-based fault detection are becoming critical as vehicle electronics grow more complex, driving rapid segment expansion.

- By Vehicle Type

On the basis of vehicle type, the automotive garage equipment market is segmented into Passenger Cars and Commercial Vehicles. The Passenger Cars segment dominated the market with a 62.3% share in 2025, supported by a large global passenger vehicle parc, higher service frequency, and growing demand for routine maintenance such as tire services, diagnostics, oil changes, and washing. Urbanization, rising vehicle ownership, and expansion of organized service networks continue to support strong equipment demand in this segment.

The Commercial Vehicles segment is projected to register the fastest CAGR from 2026 to 2033, driven by increasing logistics activity, fleet expansion, and rising adoption of electric buses and trucks. Commercial vehicle garages require heavy-duty lifting systems, advanced diagnostics, and specialized maintenance equipment, boosting investments in high-capacity and technologically advanced garage solutions.

- By Garage Type

On the basis of garage type, the automotive garage equipment market is segmented into Automotive OEM Dealerships, Franchised Garages, and Independent Garages. The Independent Garages segment dominated the market with a 41.8% share in 2025, owing to their large global presence, competitive pricing, and growing capability to service multi-brand vehicles. Independent workshops increasingly invest in modern garage equipment to remain competitive, particularly in diagnostics, lifting systems, and tire service tools.

The Automotive OEM Dealerships segment is expected to grow at the fastest CAGR from 2026 to 2033, supported by rising sales of EVs, software-defined vehicles, and warranty-linked servicing. OEM dealerships are adopting advanced, brand-specific diagnostic tools, ADAS calibration systems, and EV service equipment to meet manufacturer standards, driving accelerated investment in high-end garage technologies.

Which Region Holds the Largest Share of the Automotive Garage Equipment Market?

- Asia-Pacific dominated the automotive garage equipment market with a 41.6% revenue share in 2025, driven by rapid growth in vehicle production, expanding automotive aftermarket services, and rising penetration of organized repair workshops across China, India, Japan, South Korea, and Southeast Asia. Increasing ownership of passenger cars, commercial fleets, and two-wheelers has accelerated demand for lifting equipment, tire service tools, diagnostics systems, and washing equipment across urban and semi-urban regions.

- Strong presence of automotive manufacturing hubs, cost-effective labor, and rising investments in service infrastructure are encouraging garage modernization across the region

- Government initiatives supporting EV adoption, smart mobility, and local manufacturing further reinforce Asia-Pacific’s leadership in the global Automotive Garage Equipment market

China Automotive Garage Equipment Market Insight

China is the largest contributor to Asia-Pacific, supported by the world’s largest vehicle parc, rapid expansion of independent and franchised garages, and strong demand for diagnostic and EV servicing equipment. Government-backed electrification and rising aftermarket spending continue to drive large-scale equipment adoption.

Japan Automotive Garage Equipment Market Insight

Japan shows steady growth due to advanced automotive technology adoption, high service quality standards, and continuous upgrades in OEM dealerships and independent workshops. Strong focus on precision, safety, and automation supports demand for premium garage equipment.

India Automotive Garage Equipment Market Insight

India is emerging as a key growth market, driven by expanding vehicle ownership, rising organized service centers, and government initiatives such as Make in India and EV incentives. Increasing investments in modern diagnostic and lifting equipment accelerate market penetration.

North America Automotive Garage Equipment Market

North America is expected to register the fastest CAGR of 11.36% from 2026 to 2033, driven by rising adoption of electric vehicles, increasing vehicle age, and growing demand for advanced diagnostics, ADAS calibration systems, and EV-compatible garage equipment across the U.S. and Canada. Strong aftermarket spending, high labor costs encouraging automation, and rapid adoption of digital service solutions are accelerating equipment upgrades. Continuous investment in dealership modernization, fleet maintenance, and smart workshop solutions supports long-term regional growth

U.S. Automotive Garage Equipment Market Insight

The U.S. leads North America due to a large aging vehicle fleet, strong aftermarket culture, and rapid expansion of EV charging and servicing infrastructure. OEM dealerships and independent garages are increasingly investing in advanced diagnostics, lifting systems, and software-integrated service equipment.

Canada Automotive Garage Equipment Market Insight

Canada contributes steadily, supported by growing vehicle ownership, cold-climate maintenance needs, and increasing adoption of organized repair networks. Government focus on EVs and clean mobility further drives demand for next-generation garage equipment.

Which are the Top Companies in Automotive Garage Equipment Market?

The automotive garage equipment industry is primarily led by well-established companies, including:

- Arex Test Systems BV (Netherlands)

- Gray Manufacturing (U.S.)

- Snap-on Incorporated (U.S.)

- Vehicle Service Group SM (U.S.)

- Bosch Limited (Germany)

- Continental AG (Germany)

- MAHA Maschinenbau Haldenwang GmbH & Co. KG (Germany)

- Boston Garage Equipment Ltd (U.K.)

- M/s Samvit Garage Equipments (India)

- Sarveshwari Engineers (India)

- Guangzhou Jingjia Auto Equipment Co., Ltd. (China)

- Euro Car Parts Ltd T/A LKQ Coatings (U.K.)

- Aro Equipments Pvt. Ltd (India)

- ISTOBAL (Spain)

- Con Air Equipments Private Limited (India)

- Oil Lube Systems Pvt Ltd (India)

What are the Recent Developments in Global Automotive Garage Equipment Market?

- In May 2025, QuickJack, a division of BendPak Inc., introduced multiple upgrades to its portable car lift portfolio with the launch of new models. The QuickJack 6000TL and 6000TLX offer a lifting capacity of 6,000 lbs, while the 8000TL and 8000TLX models support up to 8,000 lbs, enhancing versatility for both light and heavy vehicles. This launch strengthens QuickJack’s position in high-capacity, portable lifting solutions for modern workshops

- In April 2025, Bosch Auto Service launched its franchise operations in the United States, committing to provide partners with branded garage equipment, structured training programs, and comprehensive marketing support. This expansion reinforces Bosch’s strategy to scale its service network and standardize workshop quality across the U.S. market

- In January 2025, ATS ELGI, an Indian garage equipment manufacturer and subsidiary of Elgi Equipment Limited, showcased a new generation of automotive service solutions at Bharat Mobility 2025, The Components Show. The company highlighted innovations focused on advanced vehicle diagnostics, EV servicing, and improved workshop productivity. This development underscores ATS ELGI’s focus on future-ready garage technologies and EV ecosystem readiness

- In June 2024, Boston Garage Equipment announced the launch of its EOBD-400 measurement and diagnostic device for vehicle emissions testing. The tester analyzes exhaust emissions to verify regulatory compliance and features Bluetooth 5 (LE), long-range connectivity, and a durable neoprene rubber casing. This product enhances accuracy, durability, and connectivity in emissions diagnostics

- In July 2023, Robert Bosch GmbH revealed plans to expand its independent aftermarket portfolio by introducing cabin blowers for vehicle air-conditioning systems. Designed for quiet operation and optimized airflow, the blowers were initially launched for select Ford and VW models in Europe, with broader rollout planned. This expansion supports Bosch’s commitment to high-quality replacement parts and aftermarket growth

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.