Global Automotive Drive Shaft Market

Market Size in USD Billion

CAGR :

%

USD

74.29 Billion

USD

122.95 Billion

2024

2032

USD

74.29 Billion

USD

122.95 Billion

2024

2032

| 2025 –2032 | |

| USD 74.29 Billion | |

| USD 122.95 Billion | |

|

|

|

Automotive Drive Shaft Market Analysis

The automotive drive shaft market is witnessing significant growth due to increasing demand for fuel-efficient vehicles, advancements in materials, and lightweight component designs. Drive shafts are a crucial component in vehicle power transmission, transferring torque from the engine to the wheels. The market is driven by rising vehicle production, growing adoption of electric vehicles (EVs), and stringent fuel economy regulations worldwide. Manufacturers are focusing on innovative materials such as carbon fiber and aluminum to reduce the weight of drive shafts while maintaining durability and performance. Advanced manufacturing techniques, such as precision forging and hybrid shaft designs, enhance strength and efficiency. The rise of EVs has also led to the development of specialized drive shafts optimized for electric powertrains, improving overall vehicle efficiency and reducing energy loss.

Automotive Drive Shaft Market Size

The global automotive drive shaft market size was valued at USD 74.29 billion in 2024 and is projected to reach USD 122.95 billion by 2032, with a CAGR of 6.50% during the forecast period of 2025 to 2032. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis.

Automotive Drive Shaft Market Trends

“Increasing Adoption of Lightweight Drive Shafts”

The automotive drive shaft market is evolving rapidly, with a key trend being the increasing adoption of lightweight drive shafts to enhance fuel efficiency and vehicle performance. Automakers are shifting toward carbon fiber drive shafts due to their superior strength-to-weight ratio, reduced rotational mass, and improved durability compared to traditional steel or aluminum shafts. This trend is particularly evident in high-performance and electric vehicles (EVs), where weight reduction directly impacts energy efficiency and range. For instance, Ford's Mustang Shelby GT500 features a carbon fiber drive shaft to enhance power delivery and reduce drivetrain losses. In addition, manufacturers are leveraging advanced manufacturing techniques, such as precision forging and composite material integration, to optimize drive shaft design for passenger vehicles, light commercial vehicles (LCVs), and heavy commercial vehicles (HCVs). As regulatory bodies enforce stricter fuel economy standards, the demand for lightweight, high-performance drive shafts is expected to accelerate further.

Report Scope and Automotive Drive Shaft Market Segmentation

|

Attributes |

Automotive Drive Shaft Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Key Market Players |

Melrose Industries PLC (U.K.), ACPT Inc. (U.S.), American Axle & Manufacturing, Inc. (U.S.), Bailey Morris (U.K.), D&F Propshafts (U.K.), Dana Limited (U.S.), HYUNDAI WIA CORP (South Korea), Cummins Inc. (U.S.), Neapco Holdings (U.S.), Nexteer Automotive (U.S.), MPP (U.S.), The Timken Company (U.S.), Wanxiang Qianchao Co., Ltd. (China), Xuchang Yuandong Drive Shaft Co., Ltd. (China), and YAMADA MANUFACTURING CO., LTD. (Japan) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Automotive Drive Shaft Market Definition

An automotive drive shaft is a critical component of a vehicle's drivetrain that transfers torque from the transmission to the differential, enabling the wheels to rotate. It ensures smooth power delivery and maintains balance while compensating for changes in distance and alignment between the transmission and wheels.

Automotive Drive Shaft Market Dynamics

Drivers

- Rising Vehicle Production Driving Market Growth

The steady increase in global vehicle production is a key driver for the automotive drive shaft market, as more vehicles require high-performance drivetrain components. Growing urbanization, rising disposable incomes, and expanding transportation networks have fueled the demand for passenger vehicles, light commercial vehicles (LCVs), and heavy commercial vehicles (HCVs). In addition, infrastructure development and logistics expansion are boosting commercial vehicle sales, further increasing drive shaft demand. For instance, in India and China, government initiatives promoting local manufacturing, such as "Make in India" and "Made in China 2025," have led to significant investments in automotive production. This surge in vehicle manufacturing directly drives the demand for durable and efficient drive shafts, supporting market growth.

- Growing Demand for Fuel Efficiency and Lightweight Components

With stricter fuel economy regulations and consumer preference for fuel-efficient vehicles, automakers are focusing on reducing vehicle weight without compromising performance. This has led to the widespread adoption of lightweight drive shafts made from carbon fiber and aluminum, replacing traditional steel shafts. Lightweight materials reduce rotational mass, improving fuel efficiency and enhancing overall vehicle performance. For instance, BMW integrates carbon fiber drive shafts in its M-series performance models to improve acceleration and drivetrain efficiency. Similarly, in the electric vehicle (EV) market, manufacturers prioritize lightweight drive shafts to extend battery range and optimize energy consumption. As governments worldwide enforce stringent emission standards, the demand for advanced drive shafts continues to grow, reinforcing their role as a market driver.

Opportunities

- Expansion of Electric Vehicles (EVs)

The rapid growth of the electric vehicle (EV) market is a significant opportunity for the automotive drive shaft industry, as EVs require specialized, lightweight, and high-strength drive shafts to optimize power transmission and efficiency. Unlike conventional internal combustion engine (ICE) vehicles, EVs demand drive shafts that can handle higher torque loads while minimizing energy loss to extend battery range. As major automakers such as Tesla, Rivian, and BYD expand their EV production, the demand for advanced drive shafts continues to rise. For instance, Tesla’s Model S Plaid utilizes a high-performance carbon fiber drive shaft, reducing rotational mass and enhancing acceleration. In addition, governments worldwide are promoting EV adoption through incentives and strict CO₂ emission regulations, encouraging manufacturers to develop innovative, lightweight drive shaft solutions. This shift creates new growth opportunities for suppliers focusing on energy-efficient drivetrain components in the evolving automotive landscape.

- Increasing Advancements in Materials and Manufacturing

Innovations in materials and manufacturing techniques are revolutionizing the automotive drive shaft market, offering enhanced durability, strength, and performance. Traditional steel drive shafts are increasingly being replaced by composite materials such as carbon fiber and aluminum, which offer higher strength-to-weight ratios, improved fuel efficiency, and reduced vibration. In addition, precision forging techniques and hybrid drive shaft designs are optimizing structural integrity while reducing manufacturing costs. For instance, General Motors (GM) has adopted aluminum drive shafts in its Chevrolet Corvette to improve agility and acceleration while maintaining durability. Similarly, manufacturers such as Dana Incorporated are investing in next-generation composite drive shafts, catering to both internal combustion engine (ICE) and EV markets. As automakers strive for weight reduction and enhanced performance, advancements in materials and production processes create significant growth opportunities for drive shaft manufacturers worldwide.

Restraints/Challenges

- High Manufacturing Costs and Raw Material Prices

The production of advanced drive shafts using carbon fiber, aluminum, and composite materials involves high manufacturing costs due to expensive raw materials and complex fabrication processes. For instance, carbon fiber drive shafts, while lightweight and durable, are costly compared to traditional steel alternatives, limiting their adoption in budget and mid-range vehicles. In addition, fluctuations in raw material prices, especially for metals such as aluminum and steel, pose a challenge for manufacturers in maintaining cost-effective production.

- Stringent Regulatory Compliance and Emission Standards

Governments worldwide have imposed strict fuel economy and emission regulations, pushing automakers to develop lightweight and eco-friendly drivetrain components. However, compliance with varying global standards such as CAFE (Corporate Average Fuel Economy) regulations in the U.S. and Euro 7 standards in Europe requires continuous investment in R&D and material innovation, increasing operational costs for manufacturers.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Automotive Drive Shaft Market Scope

The market is segmented on the basis of drive shaft type, design type, position type, sales channel, and vehicle type. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Drive Shaft Type

- One-Piece Drive Shaft

- Two-Piece Drive Shaft

- Slip-in-Tube Drive Shaft

Design Type

- Hollow Shaft

- Solid Shaft

Position Type

- Rear Axle

- Front Axle

Vehicle Type

- Passenger Vehicle

- Light Commercial Vehicle

- Heavy Commercial Vehicle

Sales Channel

- OEM

- Aftermarket

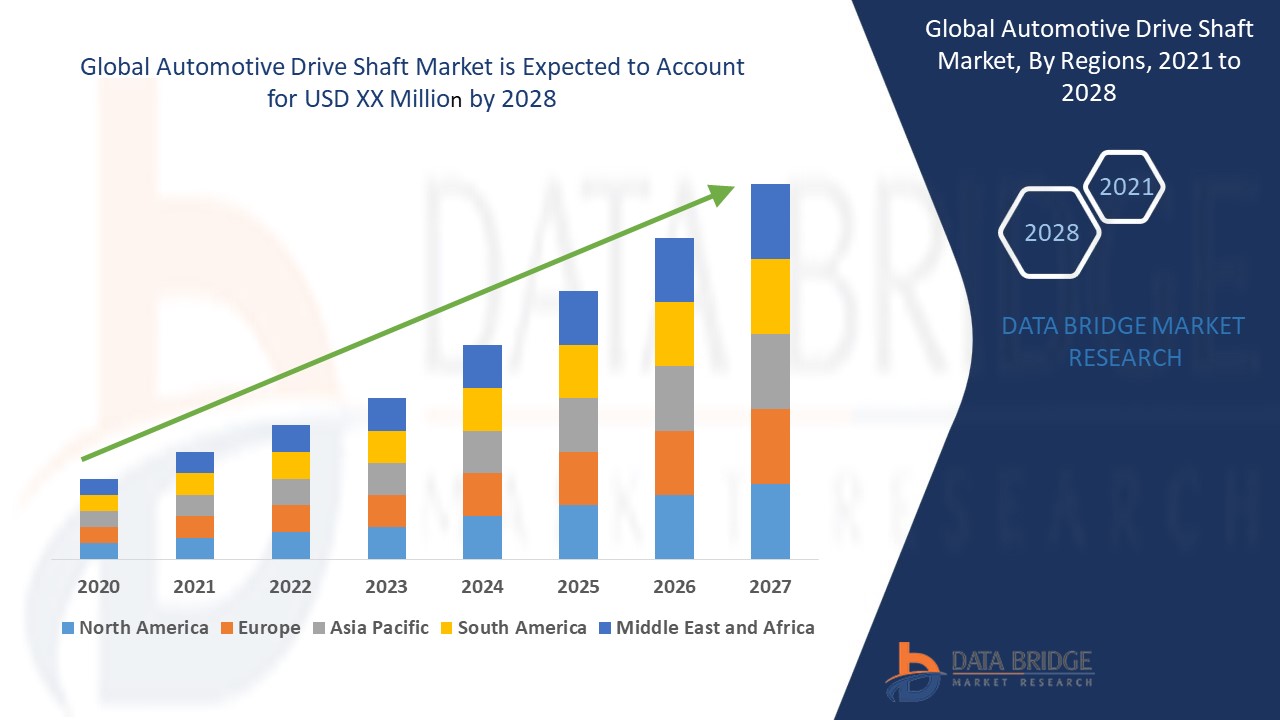

Automotive Drive Shaft Market Regional Analysis

The market is analysed and market size insights and trends are provided by drive shaft type, design type, position type, sales channel, and vehicle type as referenced above.

The countries covered in the market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

Asia-Pacific dominates the automotive drive shaft market due to strict environmental protection policies and fuel economy regulations. Manufacturers in the region are actively developing lightweight drive shafts to enhance vehicle fuel efficiency. The demand for fuel-efficient and eco-friendly vehicles has driven innovations in drive shaft materials and designs. In addition, the region's strong automotive production and growing consumer demand further contribute to its market dominance.

North America is projected to experience fastest growth in the automotive drive shaft market from 2025 to 2032, driven by rising investments in the automobile sector. Automakers in these regions are focusing on advanced vehicle technologies, including lightweight components and fuel-efficient designs. Government initiatives supporting sustainable mobility and stringent emission regulations further accelerate market expansion. In addition, growing consumer demand for high-performance and electric vehicles contributes to the increasing adoption of advanced drive shafts.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Automotive Drive Shaft Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Automotive Drive Shaft Market Leaders Operating in the Market Are:

- Melrose Industries PLC (U.K.)

- ACPT Inc. (U.S.)

- American Axle & Manufacturing, Inc. (U.S.)

- Bailey Morris (U.K.)

- D&F Propshafts (U.K.)

- Dana Limited (U.S.)

- HYUNDAI WIA CORP (South Korea)

- Cummins Inc. (U.S.)

- Neapco Holdings (U.S.)

- Nexteer Automotive (U.S.)

- MPP (U.S.)

- The Timken Company (U.S.)

- Wanxiang Qianchao Co., Ltd. (China)

- Xuchang Yuandong Drive Shaft Co., Ltd. (China)

- YAMADA MANUFACTURING CO., LTD. (Japan)

Latest Developments in Automotive Drive Shaft Market

- In February 2024, JTEKT introduced an ultra-compact product series designed for size and weight reduction in eAxles. This series includes the Differential (JUCD), Ball Bearing (JUCB), Conductive Ball Bearing (JUEB), and Oil Seal (JUCS)

- In January 2023, DANA Cardanes inaugurated a new USD 21 million facility in Querétaro, Mexico, to manufacture Toyota components. The first production line, staffed with 110 employees, was expected to expand to three lines by the end of 2023, reaching an annual production capacity of 545,000 units with 300 employees. The 917-square-meter facility focuses on producing Cardan shafts (drive shafts) for Toyota trucks

- In February 2022, Endurance Technologies announced the addition of drive shafts as a new product vertical. This high-tech proprietary component is essential for three-wheelers, four-wheelers, and light commercial vehicles. In addition, it plays a crucial role in electric vehicles (EVs)

- In August 2021, Wanxiang Qianchao, through its subsidiary Wanxiang Qianchao Transmission Shaft Co., commenced production of high-speed ball cage drive shafts. These are manufactured for a van model produced by the Russian company GAZ International LLC

- In February 2021, American Axle Manufacturing (AAM) secured a long-term contract for Ram’s heavy-duty pickup truck axle and driveshaft program, extending through 2030

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.