Global Automotive Data Cables Market

Market Size in USD Billion

CAGR :

%

USD

8.41 Billion

USD

13.61 Billion

2025

2033

USD

8.41 Billion

USD

13.61 Billion

2025

2033

| 2026 –2033 | |

| USD 8.41 Billion | |

| USD 13.61 Billion | |

|

|

|

|

Automotive Data Cables Market Size

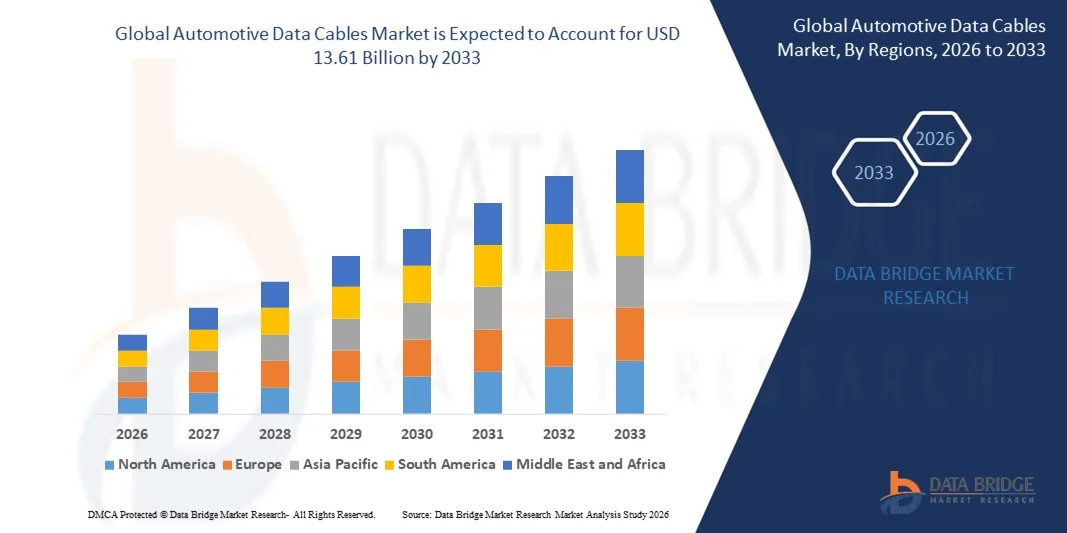

- The global automotive data cables market size was valued at USD 8.41 billion in 2025 and is expected to reach USD 13.61 billion by 2033, at a CAGR of 6.20% during the forecast period

- The market growth is largely fuelled by the rising integration of advanced electronic systems in vehicles, such as ADAS, infotainment systems, and digital instrument clusters

- Increasing adoption of electric and connected vehicles is driving higher demand for high-speed, lightweight, and reliable data transmission solutions within automotive architectures

Automotive Data Cables Market Analysis

- The market is witnessing steady growth due to the transition from conventional wiring to high-performance data cables capable of supporting high data rates, electromagnetic compatibility, and reduced signal loss

- Continuous advancements in automotive electronics, along with OEM focus on reducing vehicle weight and improving energy efficiency, are encouraging the adoption of next-generation data cable technologies across modern vehicles

- North America dominated the global automotive data cables market with the largest revenue share in 2025, driven by the strong presence of automotive OEMs, early adoption of advanced vehicle electronics, and rising deployment of ADAS and connected vehicle technologies

- Asia-Pacific region is expected to witness the highest growth rate in the global automotive data cables market, driven by expanding automotive production, rapid electrification, growing demand for connected vehicles, and supportive government initiatives across emerging economies

- The CAN cable segment held the largest market revenue share in 2025 driven by its widespread adoption in vehicle communication systems for reliable, cost-effective, and real-time data exchange between electronic control units. CAN cables are extensively used across multiple automotive functions due to their robustness, simplicity, and compatibility with existing vehicle architectures

Report Scope and Automotive Data Cables Market Segmentation

|

Attributes |

Automotive Data Cables Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Automotive Data Cables Market Trends

Rising Integration Of Advanced Vehicle Electronics And Connectivity

- The increasing integration of advanced electronic systems in modern vehicles is significantly shaping the automotive data cables market, as OEMs and Tier 1 suppliers focus on high-speed, reliable, and lightweight data transmission solutions. Automotive data cables are gaining prominence due to their ability to support ADAS, infotainment, telematics, and digital cockpit systems while ensuring signal integrity and electromagnetic compatibility. This trend is strengthening adoption across passenger and commercial vehicles, encouraging continuous innovation in cable design and materials

- Growing demand for connected, electric, and software-defined vehicles has accelerated the need for high-bandwidth data cables capable of handling large data volumes generated by sensors, cameras, and control units. Automakers are increasingly deploying advanced data cable architectures to enable seamless communication between vehicle subsystems, supporting real-time data processing and enhanced driving experiences. This shift is reinforcing investments in next-generation automotive networking technologies

- Technological advancements focused on reducing vehicle weight, improving durability, and enhancing data transmission efficiency are influencing purchasing decisions among manufacturers. Emphasis on lightweight materials, improved insulation, and compliance with automotive safety and performance standards is helping suppliers differentiate offerings in a competitive market. In addition, manufacturers are highlighting reliability and long-term performance to strengthen OEM partnerships

- For instance, in 2024, leading automotive suppliers such as Yazaki in Japan and LEONI in Germany expanded their portfolios of high-speed automotive data cables designed for ADAS and electric vehicle platforms. These solutions were introduced to meet rising demand for high-performance connectivity and were supplied to multiple global OEMs for integration into next-generation vehicle models

- While demand for automotive data cables is increasing, sustained market growth depends on continuous R&D, cost optimization, and maintaining performance under harsh automotive environments. Manufacturers are focusing on scalability, compliance with evolving standards, and innovation in materials to balance performance, durability, and cost for broader adoption

Automotive Data Cables Market Dynamics

Driver

Growing Demand For Connected, Electric, And Autonomous Vehicles

- The rapid growth of connected, electric, and autonomous vehicles is a major driver for the global automotive data cables market. Automakers are increasingly adopting high-speed data cables to support complex electronic architectures, enabling efficient data exchange between sensors, control units, and onboard systems. This shift is also driving research into advanced cable technologies that can support higher data rates and reduced latency

- Expanding applications of ADAS, infotainment, telematics, and vehicle-to-everything communication systems are contributing to market growth. Automotive data cables play a critical role in ensuring reliable connectivity and system performance, allowing manufacturers to meet consumer expectations for safety, comfort, and advanced digital features. The rising focus on vehicle automation further reinforces this trend

- OEMs and suppliers are actively investing in product innovation, strategic collaborations, and compliance with automotive standards to enhance data cable performance and reliability. These efforts are supported by increasing regulatory emphasis on vehicle safety and the growing consumer preference for technologically advanced vehicles, encouraging long-term supply agreements across the value chain

- For instance, in 2023, Bosch in Germany and Continental in Germany reported increased deployment of high-speed automotive data cables across ADAS and connected vehicle platforms. This expansion was driven by higher adoption of driver assistance systems and connected features, supporting improved vehicle safety and functionality while strengthening supplier relationships

- Although demand from connected and electric vehicles is driving growth, long-term market expansion relies on continuous innovation, cost efficiency, and alignment with evolving automotive architectures. Investments in advanced manufacturing, testing, and standardization will be essential to maintain competitiveness

Restraint/Challenge

High Cost And Complexity Of Advanced Automotive Data Cable Solutions

- The relatively high cost of advanced automotive data cables compared to conventional wiring systems remains a key challenge, particularly for cost-sensitive vehicle segments. Specialized materials, stringent quality requirements, and complex manufacturing processes contribute to higher pricing, limiting rapid adoption across all vehicle categories

- Design and integration complexity also pose challenges, as automotive data cables must meet strict performance, safety, and durability standards while operating in harsh environments. Ensuring compatibility with evolving vehicle architectures and electronic systems requires extensive testing and validation, increasing development time and costs for manufacturers

- Supply chain constraints and dependence on specialized raw materials can further impact market growth. Disruptions in material availability or fluctuations in prices affect production planning and cost stability. Manufacturers must also ensure compliance with global automotive standards, adding to operational complexity

- For instance, in 2024, several mid-sized automotive suppliers in China and Southeast Asia reported challenges in adopting high-speed automotive data cables due to higher costs and integration complexities compared to traditional wiring harnesses. Limited technical expertise and investment capacity slowed adoption in certain vehicle programs

- Addressing these challenges will require cost-effective manufacturing solutions, improved design standardization, and enhanced collaboration between OEMs and suppliers. Continued investment in R&D, automation, and supply chain optimization will be critical to unlocking the full growth potential of the global automotive data cables market

Automotive Data Cables Market Scope

The market is segmented on the basis of cable type, vehicle type, and application.

- By Cable Type

On the basis of cable type, the global automotive data cables market is segmented into Controller Area Network (CAN), Controller Area Network Flexible Data-Rate (CAN-FD), FlexRay, Ethernet, Low Voltage Differential Signaling (LVDS)/High Speed Data (HSD), and Coaxial Cables. The CAN cable segment held the largest market revenue share in 2025 driven by its widespread adoption in vehicle communication systems for reliable, cost-effective, and real-time data exchange between electronic control units. CAN cables are extensively used across multiple automotive functions due to their robustness, simplicity, and compatibility with existing vehicle architectures.

The Ethernet cable segment is projected to register the fastest growth from 2026 to 2033, driven by the rising need for high-bandwidth data transmission to support ADAS, infotainment, and connected vehicle applications. Automotive Ethernet enables faster data speeds, reduced latency, and scalable network architectures, making it increasingly preferred for next-generation vehicles with advanced connectivity and autonomous features.

- By Vehicle Type

On the basis of vehicle type, the market is segmented into Passenger Vehicles and Commercial Vehicles. The passenger vehicles segment accounted for the largest market share in 2025 due to the high production volume of passenger cars and the growing integration of advanced electronic systems such as infotainment, digital dashboards, and driver assistance technologies. Increasing consumer demand for connected and feature-rich vehicles is further driving the adoption of automotive data cables in this segment.

The commercial vehicles segment is projected to register the fastest growth from 2026 to 2033, supported by rising deployment of telematics, fleet management systems, and safety technologies. The increasing focus on vehicle monitoring, diagnostics, and regulatory compliance is boosting the demand for reliable data communication solutions in trucks, buses, and logistics vehicles.

- By Aplication

Based on application, the automotive data cables market is segmented into Powertrain, Body Control & Comfort, Infotainment & Communication, and Safety & ADAS. The body control & comfort segment dominated the market in 2025, driven by extensive use of data cables in lighting systems, climate control, door modules, and seat control systems. These applications require stable and efficient data transmission to enhance vehicle comfort and functionality.

The safety & ADAS segment is projected to register the fastest growth from 2026 to 2033, owing to the increasing adoption of advanced driver assistance systems such as lane departure warning, adaptive cruise control, and collision avoidance systems. These applications rely heavily on high-speed data cables to transmit large volumes of data from sensors and cameras, supporting real-time decision-making and improved vehicle safety.

Automotive Data Cables Market Regional Analysis

- North America dominated the global automotive data cables market with the largest revenue share in 2025, driven by the strong presence of automotive OEMs, early adoption of advanced vehicle electronics, and rising deployment of ADAS and connected vehicle technologies

- Automakers in the region place high importance on high-speed, reliable data transmission to support infotainment, telematics, and safety systems, increasing the demand for advanced automotive data cable solutions

- This strong adoption is further supported by high R&D investments, rapid electrification of vehicles, and growing regulatory focus on vehicle safety and automation, positioning automotive data cables as a critical component across passenger and commercial vehicles

U.S. Automotive Data Cables Market Insight

The U.S. automotive data cables market captured the largest revenue share in 2025 within North America, supported by rapid adoption of connected, electric, and autonomous vehicle technologies. Automotive manufacturers are increasingly integrating high-speed data cables to enable advanced infotainment, over-the-air updates, and driver assistance systems. Strong demand for technologically advanced vehicles, along with increasing investments in software-defined vehicle architectures, continues to propel market growth in the country.

Europe Automotive Data Cables Market Insight

The Europe automotive data cables market is expected to witness the fastest growth rate from 2026 to 2033, driven by stringent vehicle safety regulations, aggressive electrification targets, and strong adoption of ADAS technologies. The region’s focus on emission reduction and smart mobility solutions is accelerating the integration of advanced electronic systems, thereby increasing demand for high-performance automotive data cables across both new vehicle production and platform upgrades.

U.K. Automotive Data Cables Market Insight

The U.K. automotive data cables market is expected to witness notable growth from 2026 to 2033, supported by increasing adoption of electric vehicles and connected car technologies. Growing investments in intelligent mobility solutions and rising consumer preference for advanced safety and infotainment features are encouraging OEMs to deploy high-speed data cables. In addition, the expansion of EV charging infrastructure and digital vehicle platforms is contributing to sustained demand.

Germany Automotive Data Cables Market Insight

The Germany automotive data cables market is expected to witness the fastest growth rate from 2026 to 2033, fueled by the country’s strong automotive manufacturing base and leadership in vehicle engineering and innovation. German OEMs are actively adopting advanced data cable solutions to support ADAS, autonomous driving development, and in-vehicle networking. The emphasis on precision, reliability, and next-generation mobility solutions continues to drive market expansion.

Asia-Pacific Automotive Data Cables Market Insight

The Asia-Pacific automotive data cables market is expected to witness the fastest growth rate from 2026 to 2033, driven by rapid vehicle production, rising electrification, and increasing adoption of connected vehicle technologies in countries such as China, Japan, and India. Growing urbanization, improving disposable incomes, and government initiatives supporting electric mobility are significantly boosting demand for automotive data cables across the region.

Japan Automotive Data Cables Market Insight

The Japan automotive data cables market is expected to grow at a strong pace from 2026 to 2033 due to the country’s advanced automotive technology ecosystem and high adoption of intelligent vehicle systems. Japanese automakers emphasize safety, reliability, and efficiency, driving the integration of high-speed data cables for ADAS, infotainment, and vehicle control systems. The growing focus on autonomous driving and smart mobility further supports market growth.

China Automotive Data Cables Market Insight

The China automotive data cables market accounted for the largest revenue share in Asia Pacific in 2025, attributed to massive vehicle production volumes, rapid growth of electric vehicles, and strong government support for smart mobility and connected vehicle development. The presence of a large domestic automotive manufacturing base and increasing deployment of advanced electronic systems are key factors accelerating demand for automotive data cables across passenger and commercial vehicles.

Automotive Data Cables Market Share

The Automotive Data Cables industry is primarily led by well-established companies, including:

ACOME (France)

• Amphenol Corporation (U.S.)

• Belden Inc. (U.S.)

• Champlain Cable Corporation (U.S.)

• COFICAB (Tunisia)

• Condumex S.A. de C.V. (Mexico)

• Coroplast Fritz Müller GmbH & Co. KG (Germany)

• BorgWarner Inc. (U.S.)

• FURUKAWA ELECTRIC CO., LTD. (Japan)

• Gebauer & Griller (Austria)

• General Cable Technologies Corporation (U.S.)

• HUBER+SUHNER (Switzerland)

• ITC Thermo Cable GmbH (Germany)

• Lear Corporation (U.S.)

• LEONI (Germany)

• Prysmian Group (Italy)

• Salcavi Industrie (Italy)

• SAMPSISTEMI (Italy)

• Sumitomo Electric Industries, Ltd. (Japan)

• Waytek, Inc. (U.S.)

Latest Developments in Global Automotive Data Cables Market

- In July 2024, Leoni introduced its LIMEVERSE cable portfolio as a sustainability-focused product development aimed at reducing the environmental impact of automotive wiring. The new vehicle cables are fully recyclable and use insulation materials derived from renewable sources instead of petroleum-based inputs. Verified through ASTM D6866 testing, the biocarbon content and use of mass-balanced plastics enable nearly a 50% reduction in carbon dioxide emissions compared to conventional automotive cables. This development supports the automotive industry’s shift toward sustainable mobility and strengthens Leoni’s position in eco-friendly cable solutions

- In September 2023, Samtec Inc. expanded its manufacturing capabilities by opening a new 24,000 square foot production facility in Royersford, Pennsylvania, focused on advanced manufacturing expansion. The facility is dedicated to producing precision coaxial cables and RF connectors for multiple end-use industries, including automotive, aerospace, and data communications. By integrating advanced material science and signal integrity technologies, the expansion enhances production efficiency and product quality. This move supports growing demand for high-performance data transmission solutions and reinforces Samtec’s competitive presence in the global cable and connector market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.