Global Automotive Control Panel Market

Market Size in USD Billion

CAGR :

%

USD

126.60 Billion

USD

215.40 Billion

2024

2032

USD

126.60 Billion

USD

215.40 Billion

2024

2032

| 2025 –2032 | |

| USD 126.60 Billion | |

| USD 215.40 Billion | |

|

|

|

|

Automotive Control Panel Market Size

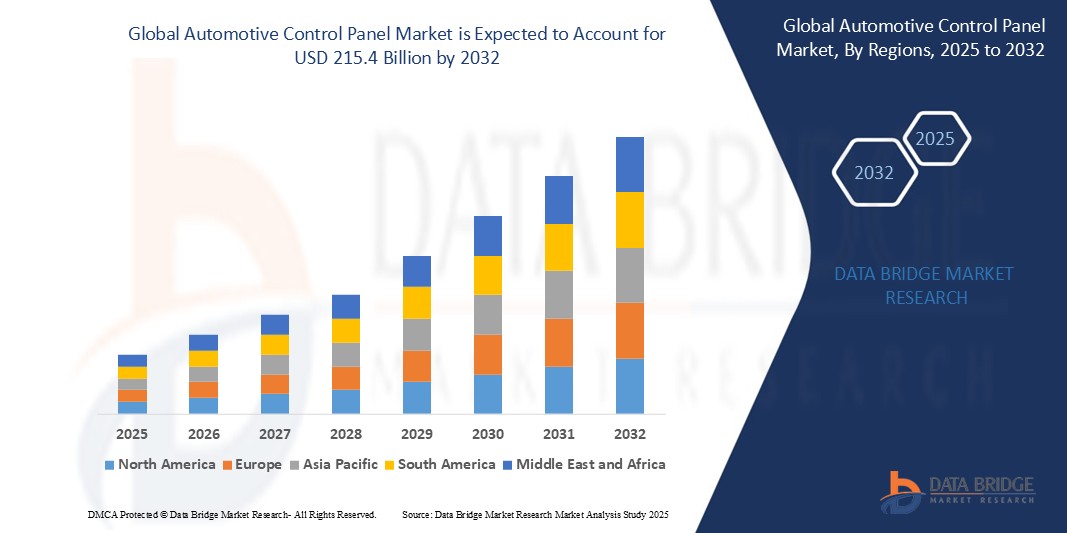

- The Global Automotive Logistics Market was valued at USD 126.6 billion in 2025 and is projected to reach USD 215.4 billion by 2032, growing at a CAGR of 7.9% during the forecast period.

- Market growth is driven by the rising demand for efficient vehicle transportation, growing production of electric and connected vehicles, and the increasing need for seamless global supply chains. Advanced logistics technologies such as real-time tracking, automated warehousing, and digital freight platforms are transforming traditional logistics into streamlined, tech-enabled operations. Additionally, expanding automotive exports, rising aftermarket activity, and infrastructure development in emerging economies continue to support robust growth across developed and developing regions.

Automotive Control Panel Market Analysis

- The automotive control panel market is being transformed by rapid advancements in human-machine interface (HMI) technologies, including capacitive touch sensors, haptic feedback systems, voice control modules, and gesture recognition. These innovations are enhancing user interaction, reducing driver distraction, and enabling seamless control of in-vehicle systems such as infotainment, climate, lighting, and ADAS.

- The adoption of digital cockpits, integrated displays, and software-defined vehicle platforms is driving demand for sophisticated control panels that combine hardware modularity with customizable software interfaces. This shift supports automaker goals of differentiated user experiences and streamlined manufacturing across vehicle platforms.

- Europe leads the automotive control panel market in 2025, driven by premium vehicle manufacturing, stringent safety regulations, and leadership in vehicle electronics R&D. German and French OEMs are at the forefront of integrating advanced control systems into luxury and EV segments.

- Asia-Pacific is expected to record the highest CAGR through 2032, fueled by large-scale automotive production, increasing consumer demand for tech-integrated interiors, and government support for electric mobility in countries such as China, India, South Korea, and Japan.

- Among control panel types, touchscreen and hybrid digital-physical panels dominate due to their intuitive design and multifunctionality. Components such as electronic control units (ECUs), smart switches, and high-resolution display modules are experiencing significant innovation and demand. OEM-installed systems account for the majority of the market, though the aftermarket segment is growing due to vehicle customization trends and infotainment upgrades.

Report Scope and Automotive Control Panel Market Segmentation

|

Attributes |

Automotive Control Panel Market Key Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

The increasing focus on connected and intelligent vehicle interiors is creating strong demand for advanced control panels that integrate infotainment, climate, navigation, and ADAS functionalities. OEMs are seeking customizable, software-defined interface platforms that allow for over-the-air updates and personalized user settings, offering suppliers new revenue streams and long-term value.

The shift towards electric and self-driving vehicles is reshaping cockpit design, emphasizing minimalism, modularity, and digital interaction. This transformation opens opportunities for manufacturers of curved OLED touch displays, voice-command interfaces, and AI-enhanced haptic feedback systems. The unique UX requirements of EVs and autonomous cars are driving innovation in layout, material use, and multi-function control design. |

|

Value Added Data Infosets |

In addition to insights on market value, CAGR, segmentation, and regional trends, the Global Automotive Control Panel Market Report delivers detailed analysis of interface technology adoption, cross-platform design compatibility, and integration benchmarks for control modules across vehicle categories and OEM models. The report also offers use-case comparisons of digital versus hybrid control panels, ROI evaluations for cockpit digitization, and lifecycle performance analytics for control panel components under varying climate and usage conditions. Strategic frameworks including PESTLE Analysis, Porter’s Five Forces, and assessments of in-vehicle software regulations, cybersecurity mandates, and UI/UX standardization guidelines help stakeholders—automakers, Tier-1 suppliers, and investors—make data-driven development and procurement decisions. |

Automotive Control Panel Market Trends

“Digital Cockpit Innovation Driven by Connectivity, Minimalism, and UX Personalization”

- A leading trend reshaping the automotive control panel market is the integration of large-format touchscreens, voice-enabled assistants, and haptic feedback to provide seamless driver interaction and a more immersive user experience. This aligns with consumer demand for smart, smartphone-like interfaces inside vehicles.

- Automakers are adopting digital twin simulation and AI-enhanced UX testing to model in-cabin interaction, optimize control layouts, and reduce driver distraction—accelerating the development of intuitive, adaptive control platforms.

- The transition to electric and autonomous vehicles is fostering the need for simplified, modular dashboards, eliminating traditional buttons and dials in favor of centralized digital control panels with real-time performance displays.

- Biometric integration (such as fingerprint recognition and facial ID) and AI-driven user preference memory are gaining popularity, allowing drivers to personalize control panel settings based on usage patterns and profiles.

- The rise of software-defined vehicles is enabling over-the-air (OTA) updates to control panel software, unlocking new features post-sale and extending product life cycles, while also transforming the control panel into a revenue-generating interface.

Automotive Control Panel Market Dynamics

Driver

“Growing Demand for Smart, Integrated Vehicle Interiors and Enhanced Driver Experience”

- The shift toward connected mobility and advanced infotainment systems is accelerating the demand for smart control panels capable of integrating multiple systems—navigation, ADAS, climate, and entertainment—into a unified interface.

- OEMs are leveraging next-gen electronic control units (ECUs) and flexible display technologies to create sophisticated, ergonomic dashboard designs that enhance aesthetics and functionality while improving safety and usability.

- The rise of EVs is prompting new panel configurations to replace traditional gauges with energy consumption metrics, battery health displays, and interactive charging interfaces, expanding the scope of digital dashboards.

- Consumer preference for minimalist, tech-forward interiors is driving the replacement of physical knobs and switches with seamless capacitive surfaces and dynamic touch interfaces across mid-range and premium segments.

- Automakers are also investing in user-centric software platforms that allow drivers to control vehicle settings through smartphones or cloud-connected voice assistants—further embedding the control panel into a broader ecosystem of digital touchpoints.

Restraint/Challenge

“High Development Costs and Complexity in Multi-System Integration”

- The development of advanced control panel systems requires significant investment in hardware, embedded software, and compliance with vehicle safety standards like ISO 26262 and ASIL levels—posing cost barriers for new entrants and smaller suppliers.

- Integrating diverse subsystems—infotainment, telematics, HVAC, and ADAS—into a single interface presents engineering and UI challenges, especially when targeting global platforms with region-specific requirements.

- Fragmentation in in-car software platforms and lack of standardization in HMI protocols often leads to interoperability issues between components from different suppliers, delaying time-to-market and increasing validation costs.

- Rising concerns over cybersecurity and data privacy, particularly in cloud-connected control systems, are forcing manufacturers to invest in robust encryption, intrusion detection, and fail-safe architectures—adding complexity to system design.

- In emerging markets, cost sensitivity and limited digital infrastructure continue to hinder the adoption of high-end digital cockpit solutions, keeping traditional control systems in circulation despite global innovation trends.

Automotive Control Panel Market Scope

The automotive control panel market is segmented on the basis of type, vehicle type, component, distribution channel, and region.

• By Type

The market is segmented into manual, push button, touch screen, and rotary switch. In 2025, the manual and push button segments jointly dominate due to their cost-effectiveness, simplicity, and widespread use in mid-range vehicles across developing economies.

The touch screen segment is expected to register the highest CAGR from 2025 to 2032, driven by the surge in digital cockpit installations, demand for enhanced user interfaces, and the influence of consumer electronics on vehicle interiors. Touchscreen interfaces are becoming the standard in premium and electric vehicles for controlling HVAC, navigation, and infotainment systems.

• By Vehicle Type

The market is bifurcated into passenger cars and commercial vehicles. Passenger cars lead the market in 2025, attributed to higher production volumes, increasing integration of advanced driver-assistance systems (ADAS), and rising consumer demand for feature-rich interiors.

Commercial vehicles are projected to grow steadily, with a focus on fleet modernization, the integration of telematics, and enhanced driver ergonomics in heavy-duty and delivery vehicles.

• By Component

Key components in the automotive control panel market include electronic control units (ECUs), display panels, switches, and control knobs. Switches account for the largest share in 2025, driven by their widespread application in traditional dashboards for controlling lights, windows, and HVAC systems.

The display panel and electronic control unit segments are anticipated to experience robust growth, propelled by advancements in OLED and LCD technologies, rising software-defined vehicle (SDV) trends, and the need for seamless integration of multiple functions into centralized control units.

• By Distribution Channel

The market is segmented into OEM and aftermarket. OEMs dominate the market in 2025, as automakers increasingly incorporate digital and customized control interfaces into vehicle design to enhance brand identity and user experience.

The aftermarket segment is expected to expand due to growing consumer interest in retrofitting older vehicles with advanced panels and the rising trend of vehicle personalization.

• By Region

The global market is divided into North America, Europe, Asia-Pacific, Middle East & Africa, and South America. Asia-Pacific holds the largest share in 2025, supported by the strong presence of major automotive manufacturers in China, Japan, South Korea, and India, alongside rapid EV adoption and rising disposable incomes.

Europe is expected to witness significant growth, driven by stringent regulations on vehicle safety and electronics, as well as high penetration of luxury vehicles.

North America remains a mature yet stable market, fueled by technological innovation and early adoption of connected vehicle platforms.

Emerging economies in South America and the Middle East & Africa are also poised to grow, supported by infrastructure development and increasing vehicle ownership.

Automotive Control Panel Market Regional Analysis

- North America is expected to hold a substantial share of the automotive control panel market in 2025, driven by high vehicle production volumes, early adoption of advanced infotainment systems, and consumer demand for premium in-car experiences. The United States leads the region due to its robust automotive manufacturing base and increasing integration of digital touchscreens, rotary switches, and customizable control modules in both passenger and commercial vehicles. OEMs in the U.S. are also prioritizing the development of smart HMI (human-machine interface) systems, enhancing driver safety and convenience.

- Europe remains a key market for automotive control panels, supported by the presence of major OEMs in Germany, France, and Italy. Stringent safety regulations, coupled with the push for connected and autonomous vehicles, are driving the adoption of touch-sensitive panels, rotary controllers, and multifunctional displays. Germany dominates the regional market with widespread integration of advanced ECUs (electronic control units) and growing investments in user-centric cockpit design. Rising demand for electric vehicles (EVs) is also fueling the need for EV-specific control modules.

- Asia-Pacific is projected to register the highest CAGR during the forecast period (2025–2032), led by rapid industrialization, growing automotive production, and increasing consumer preference for technologically enhanced vehicles. China, Japan, and India are the key contributors to regional growth.

China leads in both production and consumption of automotive control panels, driven by the expansion of the EV sector and increasing adoption of digital dashboards and touchscreens.

Japan maintains a strong presence with advanced vehicle electronics, integrating push-button systems and intuitive interfaces in compact cars and hybrids.

India is emerging as a growth hub due to its expanding vehicle market and demand for affordable, tech-enabled features in mid-range passenger cars.

- Middle East and Africa (MEA) region shows moderate growth, supported by rising vehicle assembly operations and increasing adoption of luxury vehicles in countries like UAE and Saudi Arabia. Growing focus on automotive digitalization and aftermarket customization is leading to the increased installation of upgraded control panels, especially in premium vehicle segments.

- South America, led by Brazil and Argentina, is witnessing gradual growth in the automotive control panel market. Improvements in vehicle production capabilities and rising consumer interest in infotainment and safety features are driving demand for manual and touch-based control systems. OEMs are focusing on cost-effective yet advanced panel designs to cater to local market preferences.

United States

The U.S. automotive control panel market is driven by high consumer demand for technologically advanced vehicles and luxury interiors. Automakers are integrating digital touchscreens, haptic controls, and customizable ambient lighting systems into dashboards. The strong presence of Tier 1 suppliers and early adoption of connected car technologies are fueling innovation. Increased production of electric vehicles (EVs) further accelerates the need for EV-specific control interfaces and digital clusters.

Germany

Germany leads the European control panel market, fueled by premium automotive brands like BMW, Audi, and Mercedes-Benz. These OEMs are at the forefront of developing cutting-edge, integrated control panels with voice, touch, and gesture recognition capabilities. The country’s focus on vehicle electrification and user-centric cockpit design is driving the use of advanced electronic control units (ECUs), capacitive touchscreens, and multifunctional rotary switches.

China

China is a major growth driver, supported by the world’s largest automotive production base and rapid EV adoption. Domestic OEMs are aggressively pushing for cost-effective yet feature-rich control panels, integrating AI assistants, large central displays, and touch-sensitive buttons. Government mandates on vehicle connectivity and digital cockpit advancements are spurring investment in smart control panel ecosystems and local supplier innovation.

Japan

Japan’s automotive control panel market is marked by precision engineering and a strong focus on user safety and ergonomics. OEMs like Toyota and Honda emphasize seamless integration of tactile buttons and touchscreen displays with advanced infotainment and navigation systems. Japan is also a key innovator in compact control systems for hybrid and EV interiors, often integrating environmental controls, drive modes, and driver-assist features into centralized panels.

India

India is an emerging market with significant growth potential, driven by the rise in mid-range passenger car production and consumer demand for semi-digital interfaces. OEMs are increasingly adopting touchscreen infotainment systems, physical control knobs, and digital instrument clusters to balance affordability with modern features. Government initiatives like “Make in India” are encouraging local manufacturing of electronic control units and display panels.

South Korea

Home to major players like Hyundai and Kia, South Korea is advancing digital and touch-based automotive control panels with a strong focus on user experience. High penetration of connected and electric vehicles is driving innovation in voice-controlled systems, AI-enabled assistants, and dual-screen interfaces. Integration with smartphone ecosystems is also a key trend in Korean vehicle interiors.

Brazil

Brazil’s automotive control panel market is gradually evolving, with increasing adoption of digital displays and manual switch interfaces in compact and commercial vehicles. OEMs and local assemblers are focusing on cost-effective manufacturing solutions while incorporating essential connectivity and infotainment features to appeal to tech-savvy consumers.

Global Automotive Control Panel Market Share

The competitive landscape of the global automotive control panel market is shaped by leading manufacturers who capitalize on technological innovation, strategic collaborations, and expansive OEM partnerships to capture significant market share. Prominent companies such as Continental AG, Bosch, LG Display, Denso Corporation, Panasonic Automotive Systems, and Valeo dominate the market owing to their comprehensive product portfolios, advanced control panel technologies, and global manufacturing footprint.

These market leaders emphasize the integration of cutting-edge technologies like AI-powered interfaces, flexible OLED displays, haptic feedback systems, and modular design architectures to enhance driver experience, safety, and vehicle connectivity. Their ability to deliver customizable solutions—from traditional manual switches to sophisticated touchscreen and voice-activated control panels—strengthens their position across passenger and commercial vehicle segments.

In addition, emerging players and regional manufacturers are gaining traction by focusing on niche segments such as electric vehicle-specific control panels, aftermarket upgrades, and specialized components like electronic control units (ECUs) and control knobs. The growing demand for smart, connected vehicles and EV adoption is accelerating investments in R&D and production capacity to innovate and capture new market opportunities.

The competitive dynamics are characterized by strategic mergers & acquisitions, technology licensing agreements, and joint ventures aimed at enhancing product capabilities and expanding geographic reach. Companies prioritize seamless integration with automotive digital ecosystems, enabling over-the-air updates, real-time diagnostics, and improved human-machine interface (HMI) experiences, which are critical for maintaining agility and scalability in a rapidly evolving market.

- Continental AG (Germany)

- Robert Bosch GmbH (Germany)

- Denso Corporation (Japan)

- Hyundai Mobis Co., Ltd. (South Korea)

- Faurecia SE (France)

- Magneti Marelli S.p.A (Italy)

- Preh GmbH (Germany)

- Valeo SA (France)

- Delphi Technologies (United Kingdom)

- Calsonic Kansei Corporation (Japan)

- Panasonic Automotive Systems Co., Ltd. (Japan)

- Visteon Corporation (United States)

Latest Developments in Global Automotive Control Panel Market

- April 2025: Continental AG unveiled its next-generation AI-enabled automotive control panel featuring adaptive touchscreens and voice command integration, enhancing driver safety and in-car experience.

- March 2025: Bosch introduced a modular control panel system that supports both manual and push-button interfaces, enabling easier customization for passenger and commercial vehicles.

- February 2025: LG Display launched flexible OLED display panels for automotive control systems, offering improved brightness, energy efficiency, and curved design compatibility.

- January 2025: Denso Corporation integrated advanced haptic feedback technology into their rotary and touch-screen control knobs, improving tactile response for safer driver interaction.

- December 2024: Panasonic Automotive Systems announced a collaboration with major OEMs to deploy cloud-connected control panels that enable over-the-air software updates and real-time diagnostics.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.