Global Automotive Camera Market

Market Size in USD Billion

CAGR :

%

USD

9.57 Billion

USD

19.85 Billion

2024

2032

USD

9.57 Billion

USD

19.85 Billion

2024

2032

| 2025 –2032 | |

| USD 9.57 Billion | |

| USD 19.85 Billion | |

|

|

|

|

Automotive Camera Market Size

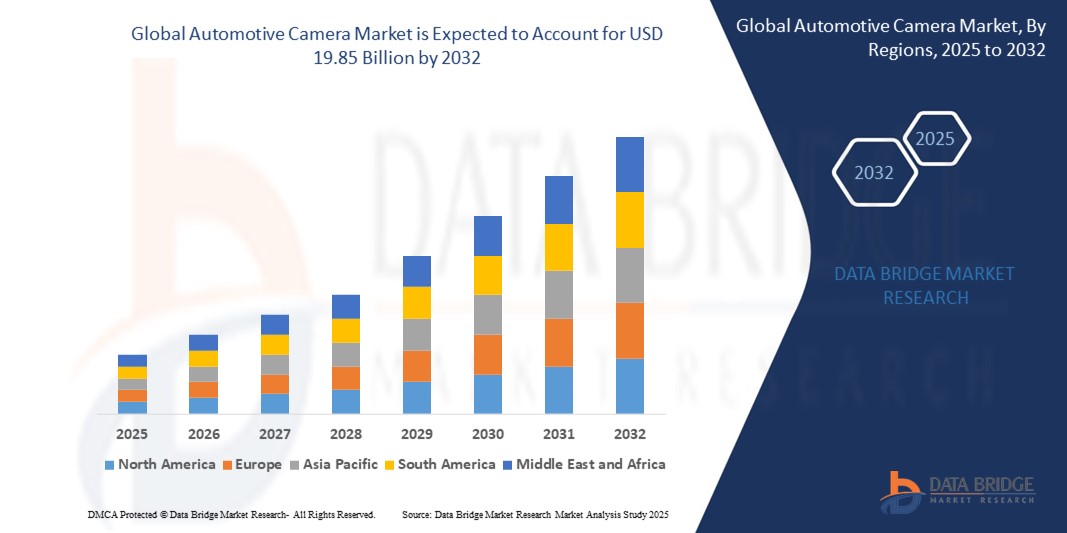

- The global automotive camera market size was valued at USD 9.57 billion in 2024 and is expected to reach USD 19.85 billion by 2032, at a CAGR of 9.54% during the forecast period

- The market growth is primarily driven by the increasing integration of advanced driver-assistance systems (ADAS) in vehicles and the rising demand for enhanced safety features

- Furthermore, the growing adoption of autonomous vehicles and the continuous technological advancements in camera systems are significantly contributing to the expansion of the automotive camera market

Automotive Camera Market Analysis

- Automotive cameras, integral to modern vehicle safety and autonomous driving systems, provide critical visual data for various applications such as parking assistance, blind spot detection, and driver monitoring, thereby enhancing overall driving experience and safety

- The escalating demand for automotive cameras is largely fueled by stringent government regulations regarding vehicle safety, the rapid development of ADAS functionalities, and increasing consumer awareness about vehicle safety features

- North America dominates the automotive camera market, characterized by early adoption of advanced automotive technologies, strong investments in autonomous driving R&D, and the presence of major automotive OEMs and Tier 1 suppliers. The U.S. is a key growth driver, with substantial demand for camera-enabled safety features in new vehicle models

- Asia-Pacific is expected to be the fastest-growing region in the automotive camera market during the forecast period, driven by rapid automotive production growth, increasing disposable incomes, and the rising adoption of advanced safety features in developing economies such as China and India

- The digital camera segment dominates the automotive camera market, owing to its high resolution, cost-effectiveness, and widespread application in various ADAS features, including rearview cameras and surround-view systems

Report Scope and Automotive Camera Market Segmentation

|

Attributes |

Automotive Camera Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Automotive Camera Market Trends

“Evolution towards High-Resolution and AI-Powered Camera Systems”

- A significant and accelerating trend in the global automotive camera market is the continuous evolution towards higher resolution cameras and the deepening integration of artificial intelligence (AI) for enhanced perception and decision-making capabilities

- For instance, leading automotive camera manufacturers are developing cameras with resolutions exceeding current industry standards, enabling clearer images and more precise object detection, even in challenging lighting conditions. Companies such as Sony and Samsung are at the forefront of developing high-megapixel automotive image sensors that offer superior low-light performance and dynamic range

- AI integration in automotive cameras empowers features such as advanced object recognition (differentiating between pedestrians, cyclists, and animals), lane keeping assist with improved accuracy, and predictive analysis for collision avoidance

- Furthermore, AI-powered cameras are crucial for developing robust driver monitoring systems (DMS) that can detect driver fatigue or distraction, contributing to improved road safety

- The seamless integration of high-resolution cameras with AI processing allows for the creation of more sophisticated perception systems, which are vital for increasing the levels of autonomy in vehicles

- The demand for automotive cameras that offer superior image quality and intelligent analytics capabilities is growing rapidly across all vehicle segments, as consumers and regulations increasingly prioritize enhanced safety and the future of autonomous mobility

Automotive Camera Market Dynamics

Driver

“Increasing Integration of ADAS and Stringent Safety Regulations”

- The escalating integration of Advanced Driver-Assistance Systems (ADAS) into modern vehicles, coupled with increasingly stringent global safety regulations, is a primary driver for the heightened demand for automotive cameras

- For instance, many countries have mandated rearview cameras in new vehicles, and there's a growing push for features such as automatic emergency braking, which heavily relies on camera input. In April 2024, the National Highway Traffic Safety Administration (NHTSA) in the U.S. finalized a rule requiring automatic emergency braking and pedestrian detection systems on new passenger cars and light trucks, directly increasing the need for sophisticated camera solutions

- As consumers become more aware of potential road hazards and seek enhanced protection for themselves and their passengers, vehicles equipped with advanced camera-based safety features offer a compelling advantage

- Furthermore, the rapid advancements in autonomous driving technology, ranging from Level 2 semi-autonomous systems to future Level 5 fully autonomous vehicles, are making automotive cameras an indispensable sensor

- They offer critical visual data for navigation, obstacle avoidance, and understanding complex driving scenarios, thereby propelling their adoption across all vehicle segments

Restraint/Challenge

“High System Costs and Performance Limitations in Adverse Conditions”

- Concerns surrounding the relatively high initial cost of advanced automotive camera systems, particularly those required for higher levels of autonomy and multi-camera setups, pose a significant challenge to broader market penetration

- For instance, while basic rearview cameras have become standard, the cost of complex multi-camera systems for 360-degree views or advanced ADAS features can still be a barrier for price-sensitive segments of the automotive market. This can limit the adoption of these advanced systems in entry-level or mid-range vehicles.

- Addressing these cost concerns through economies of scale, technological advancements that reduce manufacturing expenses, and modular system designs is crucial for wider market acceptance

- In addition, the performance limitations of automotive cameras in adverse weather conditions (such as heavy rain, fog, snow, or extreme glare) and challenging lighting scenarios (such as tunnels or direct sunlight) can raise reliability concerns

- Overcoming these challenges through continuous innovation in sensor technology, advanced image processing algorithms, and sensor fusion will be vital for sustained market growth and building consumer trust in camera-dependent automotive safety and autonomous systems

Automotive Camera Market Scope

The market is segmented on the basis of technology, view type, level of autonomy, application, vehicle type, and electric vehicle type.

- By Technology

On the basis of technology, the automotive camera market is segmented into digital camera, infrared camera, and thermal camera. The digital camera segment dominates the largest market revenue share, driven by its high resolution, cost-effectiveness, and widespread application across various ADAS features. Digital cameras are the standard for rearview cameras, surround-view systems, and many front-facing ADAS applications due to their versatility and image quality.

The thermal camera segment is anticipated to witness the fastest growth rate during the forecast period, fueled by increasing demand for enhanced safety features in challenging conditions such as low visibility, fog, or complete darkness. Thermal cameras offer superior object detection capabilities in these environments, making them crucial for advanced night vision systems and future autonomous driving applications.

- By View Type

On the basis of view type, the automotive camera market is segmented into single view system and multi camera system. The multi camera system segment held the largest market revenue share, driven by the growing adoption of features such as 360-degree surround view, automated parking assist, and advanced ADAS functionalities that require comprehensive environmental perception. Multi-camera systems provide a holistic view around the vehicle, significantly enhancing safety and convenience.

The single view system segment is expected to witness significant growth as it remains a fundamental component for essential safety features such as rearview cameras and basic front-facing collision warning systems, which are becoming standard across all vehicle segments due to regulatory mandates and consumer demand.

- By Level of Autonomy

On the basis of level of autonomy, the automotive camera market is segmented into L1 camera unit, L2&3 camera units, L4 camera unit, and L5 camera unit. The L2&3 camera units segment held the largest market revenue share, reflecting the current widespread adoption of advanced ADAS features that enable partial automation, such as adaptive cruise control with lane centering, which rely heavily on sophisticated camera systems.

The L4 camera unit and L5 camera unit segments are expected to witness the fastest CAGR during the forecast period, driven by the intense research and development in fully autonomous driving technologies. As vehicles move towards higher levels of autonomy, the demand for highly advanced, redundant, and robust camera systems capable of perceiving complex environments in real-time will surge.

- By Application

On the basis of application, the automotive camera market is segmented into driver monitoring system, park assist system, ADAS, blind spot detection, night vision system, and others. The ADAS (Advanced Driver-Assistance Systems) segment accounted for the largest market revenue share, driven by increasing safety concerns, stringent government regulations, and consumer demand for features that enhance driving safety and convenience. Cameras are a core sensor for most ADAS functionalities.

The driver monitoring system segment is expected to witness the fastest CAGR during the forecast period, fueled by growing awareness about distracted driving and fatigue, coupled with regulatory pushes for systems that ensure driver attentiveness, especially as vehicles gain more autonomous capabilities.

- By Vehicle Type

On the basis of vehicle type, the automotive camera market is segmented into passenger cars, economic vehicles, mid-priced vehicles, luxury vehicles, light commercial vehicles, heavy commercial vehicles, and others. The passenger cars segment accounted for the largest market revenue share, driven by the sheer volume of passenger vehicle sales globally and the increasing integration of safety and convenience features across all price points.

The electric vehicles (EVs) sub-segment within passenger cars, and luxury vehicles, are expected to witness the fastest CAGR during the forecast period, as EVs are often equipped with advanced technologies, including comprehensive camera systems, to enhance their smart and futuristic appeal, while luxury vehicles consistently adopt the latest and most sophisticated camera-based safety and autonomous features.

- By Electric Vehicle Type

On the basis of electric vehicle type, the automotive camera market is segmented into Battery Electric Vehicle (BEV), Fuel Cell Electric Vehicle (FCEV), Hybrid Electric Vehicle (HEV), and Plug-In Hybrid Electric Vehicle (PHEV). The Battery Electric Vehicle (BEV) segment held the largest market revenue share, driven by the overall rapid growth and increasing market share of BEVs globally. BEVs are often designed with advanced digital cockpits and ADAS features, making comprehensive camera systems a standard offering.

The Plug-In Hybrid Electric Vehicle (PHEV) segment is expected to witness significant growth as these vehicles bridge the gap between traditional internal combustion engines and full electric vehicles, increasingly incorporating advanced safety and driver-assistance features that rely on camera technology to appeal to a broader consumer base.

Automotive Camera Market Regional Analysis

- North America dominates the automotive camera market with a significant revenue share, driven by early adoption of advanced automotive technologies, substantial investments in autonomous driving research and development, and a strong presence of key industry players

- Consumers in the region show a high willingness to adopt vehicles equipped with advanced safety features and ADAS, contributing to the widespread integration of camera systems

- This widespread adoption is further supported by high disposable incomes, a technologically advanced consumer base, and a robust regulatory environment pushing for enhanced vehicle safety, establishing automotive cameras as a favored solution for both conventional and next-generation vehicles

U.S. Automotive Camera Market Insight

The U.S. automotive camera market captured a significant revenue share within North America, fueled by the rapid integration of advanced driver-assistance systems (ADAS) and the accelerating development of autonomous vehicles. Consumers are increasingly prioritizing enhanced vehicle safety features, leading to higher demand for camera-based solutions such as rearview cameras, lane departure warnings, and automatic emergency braking. The widespread adoption of cutting-edge automotive technology, combined with a strong focus on innovation by leading OEMs and tech companies, further propels the automotive camera industry. Moreover, growing consumer awareness about road safety and the desire for improved driving convenience are significantly contributing to the market's expansion in the U.S.

Asia-Pacific Automotive Camera Market Insight

The Asia-Pacific automotive camera market is poised to grow at the fastest CAGR during the forecast period, driven by increasing automotive production, rising disposable incomes, and rapid technological advancements in countries such as China, Japan, and India. The region's growing inclination towards vehicle safety features, supported by government initiatives promoting advanced automotive technologies, is driving the adoption of automotive cameras. Furthermore, as APAC emerges as a manufacturing hub for automotive components and vehicles, the affordability and accessibility of camera-enabled safety systems are expanding to a wider consumer base.

Japan Automotive Camera Market Insight

The Japan automotive camera market is gaining momentum due to the country’s high-tech automotive industry, strong focus on safety, and demand for sophisticated ADAS and autonomous driving technologies. The Japanese market places a significant emphasis on reducing traffic accidents, and the adoption of automotive cameras is driven by the increasing integration of ADAS into new vehicles and the robust R&D efforts in self-driving cars. The collaboration between Japanese OEMs and technology providers to integrate advanced camera-based sensors for improved object recognition and night vision capabilities is fueling growth. Moreover, Japan's progressive stance on smart mobility and intelligent transportation systems is such as to spur demand for highly accurate and reliable camera solutions.

China Automotive Camera Market Insight

The China automotive camera market accounted for the largest market revenue share in Asia Pacific, attributed to the country's massive automotive production volume, expanding middle class, and high rates of technological adoption in vehicles. China stands as one of the largest markets for ADAS and new energy vehicles (NEVs), and automotive cameras are becoming increasingly crucial for enhancing safety and enabling autonomous functionalities across passenger and commercial vehicles. The strong government push towards smart cities and intelligent transportation systems, coupled with the rapid rise of domestic manufacturers and a competitive market, are key factors propelling the automotive camera market in China.

Europe Automotive Camera Market Insight

The Europe automotive camera market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by stringent safety regulations and the escalating need for enhanced vehicle safety across the region. The implementation of regulations such as the EU's General Safety Regulation (GSR), which mandates various ADAS features, is fostering the widespread adoption of automotive cameras. European consumers are also increasingly drawn to the advanced safety and comfort features offered by camera systems, particularly in premium and luxury vehicle segments. The region is experiencing significant growth across passenger cars and commercial vehicles, with camera systems being incorporated into both new vehicle designs and fleet upgrades.

U.K. Automotive Camera Market Insight

The U.K. automotive camera market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the escalating focus on vehicle safety and the increasing integration of ADAS technologies. In addition, the growing popularity of electric vehicles and autonomous driving trials are encouraging both automakers and consumers to adopt advanced camera solutions. The UK’s embrace of technological advancements in the automotive sector, alongside its robust R&D infrastructure, is expected to continue to stimulate market growth, particularly in areas such as high-resolution imaging and intelligent camera systems.

Germany Automotive Camera Market Insight

The Germany automotive camera market is expected to expand at a considerable CAGR during the forecast period, fueled by its leading position in automotive innovation, strong emphasis on engineering excellence, and the demand for highly sophisticated safety and autonomous driving solutions. Germany’s well-developed automotive manufacturing sector, combined with its focus on cutting-edge research and development, promotes the adoption of advanced camera systems, particularly in luxury and performance vehicles. The integration of automotive cameras with complex sensor fusion platforms for next-generation ADAS and autonomous driving functionalities is also becoming increasingly prevalent, aligning with local industry expectations for superior performance and reliability.

Automotive Camera Market Share

The automotive camera industry is primarily led by well-established companies, including:

- Continental AG (Germany)

- Robert Bosch GmbH (Germany)

- Valeo (France)

- Aptiv (Ireland)

- Magna International Inc. (Canada)

- Denso Corporation (Japan)

- Ficosa Internacional SA (Spain)

- Autoliv Inc. (Sweden)

- Mobileye (Israel)

- Clarion (Japan)

- OMNIVISION (U.S.)

- Veoneer Inc. (Sweden)

- HYUNDAI MOBIS (South Korea)

- ZF Friedrichshafen AG (Germany)

- AEi Boston (U.S.)

Latest Developments in Global Automotive Camera Market

- In February 2024, VIA Optronics AG entered into a partnership with Immervision Inc. to design and develop its Next Generation Automotive Camera. This collaboration aims to create specialized lens technology for customizing and manufacturing exterior automotive cameras. The new technology is expected to enhance VIA’s camera portfolio and meet growing customer demand for various field-of-view applications, including e-mirror and surround view systems. The agreement allows VIA to leverage Immervision’s expertise in optical engineering to accelerate innovation while reducing non-recurring engineering costs

- In January 2024, Eyeris Technologies, Inc. partnered with Leopard Imaging, Inc. to develop a production reference design aimed at enhancing safety and comfort in automotive cabins. This collaboration integrates Eyeris’ advanced monocular 3D sensing AI software algorithm into Leopard Imaging’s 5-megapixel (MP) backside illuminated (BSI) global shutter (GS) camera. The technology enables depth-aware in-cabin sensing, improving driver and occupant monitoring systems. The reference design was showcased at CES 2024, demonstrating its potential for faster market adoption and reduced integration risks

- In October 2023, Denso Corporation and Koito Manufacturing Co., Ltd. announced a collaboration to enhance the object recognition capabilities of vehicle image sensors in nighttime conditions. This partnership integrates Koito’s advanced lighting technologies with Denso’s expertise in image sensor development to improve visibility and detection accuracy in low-light environments. The initiative aims to enhance safety for advanced driver assistance systems (ADAS) and autonomous driving technologies by reducing nighttime pedestrian fatalities. By combining their strengths, the companies seek to develop innovative solutions for next-generation mobility

- In April 2023, Ford introduced BlueCruise in the U.K., marking the debut of its Level 2 advanced driver assistance system (ADAS) for hands-free driving. BlueCruise builds on Ford’s Intelligent Adaptive Cruise Control, allowing vehicles to maintain traffic flow while adhering to legal speed limits. The system utilizes radar and automotive cameras to detect and track surrounding vehicles, ensuring safer and more efficient driving. Approved for use on pre-mapped motorways, BlueCruise enhances driver convenience while maintaining safety through continuous monitoring

- In April 2023, OmniVision and AVIVA Links Inc. announced their collaboration to develop automotive camera systems based on Automotive SerDes Alliance (ASA) standards. This partnership integrates AVIVA’s high-speed connectivity solutions with OmniVision’s advanced image sensor technology to support the next generation of intelligent, connected, and autonomous vehicles. The initiative aims to enhance vehicle safety, efficiency, and data transmission capabilities while ensuring seamless integration with modern automotive architectures. By leveraging ASA-compliant technology, the companies seek to accelerate innovation in automotive imaging and connectivity

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.