Global Automotive Bushing Market

Market Size in USD Billion

CAGR :

%

USD

6.21 Billion

USD

9.11 Billion

2024

2032

USD

6.21 Billion

USD

9.11 Billion

2024

2032

| 2025 –2032 | |

| USD 6.21 Billion | |

| USD 9.11 Billion | |

|

|

|

|

Automotive Bushing Market Size

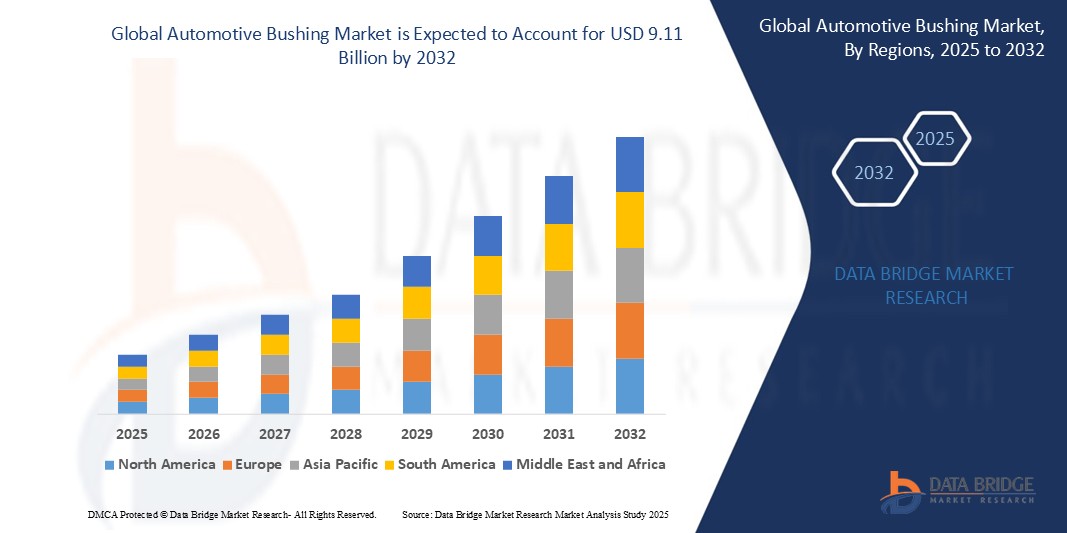

- The Global Automotive Bushing Market size was valued at USD 6.21 billion in 2024 and is expected to reach USD 9.11 billion by 2032, at a CAGR of 4.9% during the forecast period

- This growth is driven by factors such as the increasing vehicle production, demand for enhanced ride comfort, and advancements in electric vehicle (EV) technology.

Automotive Bushing Market Analysis

- Automotive bushing is a type of rubber based element which is used to segregate the vibrations of the parts it is used on, as well as isolating the part from any surrounding vibrations.

- It acts as a medium between two parts dropping the effect of interactions among two metal parts and causing a lessening in friction between the two.

- Asia-Pacific leads the automotive bushing because of the rapid rise in the demand for vehicles along with the strong presence of a large number of contract manufacturers as well as increasing adoption of automation processes in this particular region.

- North America is expected to expand at a significant growth rate over the forecast period of 2025 to 2032 owing to the increasing demand for vision-guided robotic systems and high adoption of application-specific machine vision systems in the region.

- Damper Top Mounts segment is expected to dominate the market with a market share of 55.12% due to their crucial role in enhancing vehicle stability, reducing vibrations, and improving overall ride comfort.

Report Scope and Automotive Bushing Market Segmentation

|

Attributes |

Automotive Bushing Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Automotive Bushing Market Trends

“Increasing Focus on Lightweight and Sustainable Materials”

- One of the prominent trends in the Global Automotive Bushing Market is the growing focus on using lightweight and sustainable materials. As automakers work to improve fuel efficiency and reduce the overall weight of vehicles, bushing manufacturers are responding by developing components made from lightweight materials such as high-performance composites and advanced polymers. These materials not only help reduce the weight of the vehicle, but they also contribute to the overall sustainability of the automotive industry.

- By lowering the weight, automakers can improve fuel efficiency, reduce carbon emissions, and enhance vehicle performance. In addition to lightweighting, there is also a significant shift toward environmentally friendly materials, such as bio-based plastics and recyclable elastomers, to meet stricter environmental regulations and consumer demand for greener vehicles.

- For instance, In January 2025, TE Connectivity, a global leader in connectivity and sensor solutions, announced the development of advanced automotive bushings made from lightweight and sustainable materials. These bushings are designed specifically to reduce the overall weight of vehicles while maintaining high performance and durability. TE Connectivity’s new range of bushings utilizes bio-based plastics and recyclable elastomers, aligning with the growing demand for eco-friendly automotive components.

Automotive Bushing Market Dynamics

Driver

“Rising Demand for Automotive Comfort and Safety Features”

- One of the key drivers of the Global Automotive Bushing Market is the increasing demand for improved passenger comfort and vehicle safety. Consumers today are more conscious about their driving experience, seeking vehicles that offer a smoother, quieter, and more stable ride. As a result, automakers are focusing on enhancing the ride quality and safety of their vehicles, which directly impacts the demand for high-performance bushings.

- Bushings play a critical role in reducing vibrations, absorbing shocks, and minimizing noise, contributing to a more comfortable and stable driving experience. This growing emphasis on passenger comfort is particularly evident in luxury vehicles, where NVH (Noise, Vibration, and Harshness) levels are key factors in consumer satisfaction

For instance,

- In February 2025, Delphi Technologies introduced a new line of high-performance automotive bushings designed to improve passenger comfort and vehicle safety. These bushings are specifically engineered to reduce noise, vibration, and harshness (NVH), contributing to a quieter and smoother ride for consumers. Additionally, Delphi’s advanced bushings are made with materials that enhance vehicle stability and handling, directly addressing the growing demand for safety features in vehicles. By focusing on both performance and safety, Delphi Technologies is meeting the rising consumer expectations for a comfortable and secure driving experience

Opportunity

“Growing Demand for Electric Vehicles (EVs)”

- The surge in the electric vehicle (EV) market presents a significant opportunity for the Global Automotive Bushing Market. As the automotive industry shifts toward sustainability, EV manufacturers are focusing on innovations to improve performance and reduce environmental impact. Bushings, particularly in EVs, play a critical role in enhancing suspension systems, reducing vibrations, and ensuring the longevity of the vehicle.

- With an increasing number of EV models hitting the market, there is a growing need for specialized bushings that cater to the unique requirements of electric drivetrains and battery systems. As EVs typically have different structural and dynamic characteristics compared to traditional vehicles, there is an opportunity for manufacturers to create customized bushings to optimize performance. This includes bushings for electric motor mounts, battery enclosures, and suspension components.

For instance,

- In March 2025, NEXCOM International Co., Ltd. introduced a new line of specialized bushings designed specifically for electric vehicle (EV) applications. The new bushings cater to the unique requirements of electric drivetrains and battery systems, addressing key factors such as vibration reduction, noise suppression, and increased durability. These bushings are developed with high-performance elastomer materials to withstand the demands of EV powertrains, offering enhanced stability and longevity.

Restraint/Challenge

“High Manufacturing Costs of Advanced Materials”

- The high cost of Automotive Bushings poses a significant challenge for the market, particularly affecting the purchasing decisions of healthcare facilities, especially in developing regions

- These microscopes, which are essential for performing intricate eye surgeries, can often range from tens of thousands to several hundred thousand dollars

- This substantial financial barrier can deter smaller clinics and hospitals with limited budgets from upgrading their equipment or investing in new technologies, leading to a reliance on outdated tools

For instance,

- In April 2025, Bosch Group, a global leader in automotive technology, acknowledged the challenge of high manufacturing costs associated with advanced materials in their automotive bushing production. As the demand for lightweight and environmentally friendly bushings increased, Bosch had to invest in composite polymers and bio-based plastics, which come with a higher price tag compared to traditional materials. The company highlighted that while these materials offer superior performance, such as improved durability and reduced vehicle weight, they significantly raised production costs. Bosch also noted that advanced manufacturing processes like precision molding and 3D printing, required to create these high-performance bushings, further added to expenses.

Automotive Bushing Market Scope

The market is segmented on the basis product type, vehicle type, application and distribution channel.

|

Segmentation |

Sub-Segmentation |

|

Product type |

|

|

Vehicle type |

|

|

Application |

|

|

Distribution Channel |

|

In 2025, the Damper Top Mounts is projected to dominate the market with a largest share in segment

In 2025, the Damper Top Mounts segment is projected to dominate the automotive bushing market with the largest market share of 55.12%. This dominance can be attributed to the critical role that damper top mounts play in the suspension system of vehicles. These components are designed to provide stability and support to the damper and other suspension elements, contributing significantly to ride comfort and handling. As automakers continue to prioritize passenger comfort and vehicle safety, the demand for high-performance damper top mounts is expected to increase, particularly in luxury and electric vehicles (EVs) where suspension performance is vital.

The Suspension Arm Bushings is expected to account for the largest share during the forecast period in market

The Suspension Arm Bushings segment is expected to account for the largest share of 51.76% during the forecast period in the automotive bushing market. This growth is driven by the critical role suspension arm bushings play in vehicle performance. These bushings are integral to the suspension system, providing essential support and helping to absorb shocks, reduce vibrations, and improve overall ride comfort. As a result, they directly contribute to better vehicle handling, stability, and safety, making them highly sought after by automakers.

Automotive Bushing Market Regional Analysis

“Asia-Pacific Holds the Largest Share in the Automotive Bushing Market”

- The Asia-Pacific region is expected to hold the largest share in the Automotive Bushing Market due to several key factors driving growth in this area. Asia-Pacific, particularly countries like China, Japan, South Korea, and India, is home to some of the world's largest automotive manufacturing hubs. These nations not only produce a substantial number of vehicles annually but also have a significant share in the global demand for automotive components, including bushings. The region's rapid industrialization, increasing urbanization, and expanding middle-class population contribute to the growing demand for vehicles, which in turn drives the need for automotive bushings.

- Moreover, the increasing adoption of electric vehicles (EVs) in Asia-Pacific is another factor propelling the market, as these vehicles require specialized bushings for their electric drivetrains, battery enclosures, and suspension systems. The region’s automotive industry is also becoming more focused on enhancing vehicle comfort and safety, which directly impacts the demand for high-quality bushings.

“North America is Projected to Register the Highest CAGR in the Automotive Bushing Market”

- North America is projected to register the highest CAGR (Compound Annual Growth Rate) in the Automotive Bushing Market during the forecast period. This growth is primarily driven by the increasing demand for advanced and high-performance automotive components, including bushings, as well as the rapid adoption of electric vehicles (EVs) in the region. North America, particularly the United States and Canada, is witnessing significant shifts in the automotive sector, with both established automakers and new EV manufacturers ramping up production to meet consumer demand for more sustainable and efficient vehicles.

- The rising focus on vehicle safety, comfort, and environmental sustainability is also fueling the demand for high-quality bushings, as these components play a critical role in reducing vibrations, enhancing ride quality, and improving overall vehicle stability. Furthermore, stricter emission standards and safety regulations in North America are pushing automakers to adopt better suspension systems, which rely heavily on automotive bushings for performance and durability.

Automotive Bushing Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Continental AG,

- ZF Friedrichshafen AG,

- Sumitomo Riko Company Limited,

- DuPont,

- MAHLE GmbH,

- Tenneco Inc.,

- OILES CORPORATION,

- Cooper Standard,

- Vibracoustic,

- BOGE Rubber & Plastics,

- HYUNDAI POLYTECH INDIA,

- Hallstar,

- Hutchinson Paulstra,

- MarkLines Co., Ltd.,

- The Benara Udyog Limited,

- Keats Manufacturing,

- DAYTON LAMINA CORPORATION,

- Jotex Rubber Industrial Co. Ltd.,

- JRB Engineering Works

- Xiamen Monake Import and Export Co. Ltd.,

Latest Developments in Global Automotive Bushing Market

- In January 2025, At CES, MAHLE showcased advancements in electrification and thermal management. Highlights included a new technology kit for electric motors combining high peak power with contactless, wear-free power transmission. Additionally, MAHLE introduced a bionic fan and cooling plate inspired by nature, aiming to enhance battery life and reduce noise in electric vehicles.

- In January 2025, Vibracoustic invested approximately 21.6 million Euros to expand its production facility in Chongqing, China. The plant specializes in manufacturing NVH solutions such as motor mounts, chassis mounts, and isolators. This expansion aims to meet the growing demand from China-based automotive manufacturers and includes sustainable production practices.

- In November 2024, MAHLE streamlined its group structure to accelerate its electrification strategy. This included merging business units and acquiring full ownership of MAHLE Behr GmbH & Co. KG. The restructuring aims to strengthen thermal management and powertrain technologies, positioning MAHLE as a leader in e-mobility solutions.

- In February 2025, Continental expanded its aftermarket product range to include wishbone bushings and ball joints. These components are designed to enhance vehicle safety and comfort by effectively absorbing vibrations. The addition aims to provide workshops with high-quality suspension parts, ensuring reliable and durable repairs.

- In March 2025, Vibracoustic announced the establishment of a new production facility in Chongqing, China. The plant will specialize in manufacturing a comprehensive range of NVH (Noise, Vibration, and Harshness) products, including motor mounts, chassis mounts, and isolators. This expansion aims to strengthen Vibracoustic's presence in the Chinese automotive market. The facility will also introduce sustainable production processes, such as a water-based bonding production line, to reduce emissions. This move reflects Vibracoustic's commitment to innovation and sustainability in the automotive industry.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.