Global Automotive Block Chain Market

Market Size in USD Billion

CAGR :

%

USD

10.56 Billion

USD

121.15 Billion

2024

2032

USD

10.56 Billion

USD

121.15 Billion

2024

2032

| 2025 –2032 | |

| USD 10.56 Billion | |

| USD 121.15 Billion | |

|

|

|

Automotive Blockchain Market Analysis

Manufacturing, commerce, finance, healthcare, automotive, and supply chain management are just a few of the industries that have benefited from Blockchain (BC) technology. BC's unique approach, which is focused on trust and value, is one of the most appealing aspects of this revolution that provides new ways of doing business. Even though the automotive industry only recently became acquainted with complete digitization, it has and continues to hold enormous promise for the future of personal mobility. With the advancement of technology, the automotive industry has evolved from automobiles powered by internal combustion engines to hybrid and electric vehicles.

Global Automotive Blockchain Market Size

Global automotive blockchain market size was valued at USD 10.56 billion in 2024 and is projected to reach USD 121.15 billion by 2032, with a CAGR of 35.66% during the forecast period of 2025 to 2032.

Global Automotive Blockchain Market Trends

“Increased Adoption of Blockchain for Enhanced Security and Efficiency in Automotive Industry”

One of the key trends in the global automotive blockchain market is the increasing adoption of blockchain technology to improve security, efficiency, and transparency in the automotive industry. Blockchain is gaining popularity as a solution to address challenges such as vehicle data security, supply chain transparency, and fraud prevention. By enabling secure, tamper-proof data sharing across all parties involved in the automotive ecosystem—manufacturers, suppliers, dealerships, and consumers—blockchain enhances trust and operational efficiency. Additionally, the rise of connected and autonomous vehicles is driving the demand for blockchain to ensure secure communication and data m

Report Scope and Market Segmentation

|

Attributes |

Automotive Blockchain Key Market Insights |

|

Segmentation |

|

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America. |

|

Key Market Players |

IBM Corporation (U.S.), Microsoft (U.S.), BASF SE (Germany), DSM (Netherlands), Oracle (U.S.), Huawei Technologies Co., Ltd. (China), Bitfury Group Limited. (Netherlands), TIBCO Software Inc. (U.S.), Applied Blockchain Ltd (U.S.), Guardtime (Estonia), OARO (Canada), Peer Ledger Inc. (Canada), Venture Proxy Ltd. (U.K.), Datex Corporation (U.S.), Omnichain Solutions (U.S.), Amazon Web Services, Inc. (U.S.), Bitnation.co (U.S.), Blockverify (U.K.), BTL Group Ltd. (U.K.), and Cambridge Blockchain, LLC (U.S.), among others |

|

Market Opportunities |

|

Automotive Blockchain Market Definition

A decentralised ledger used to store, track, and monitor data related to automobiles is referred to as automotive blockchain. It is linked by cryptography, which focuses on transforming data into formats that are unrecognised by unauthorised users in order to provide immediate, shared, and transparent information. Automotive blockchain provides numerous advantages, including quick warranty claim processing, easy-to-track operations, improved smart contracts and car sales, tamper-proof transaction records, improved transparency, instant traceability, and lower payment exchange fees. Aside from that, it is widely used to streamline procedures, store unique data, verify and secure vehicle mileages, and prevent fraud.

Drivers

- Expansion of automobile industries

The increasing number of vehicle manufacturing processes around the world is creating a positive market outlook. Automotive blockchain is widely used to improve supply chain management and assist original equipment manufacturers (OEMs) in following up on automotive parts and components regarding their most recent modifications, thereby assisting in the detection of counterfeit products and ensuring high-quality products and services to consumers.

- Offerings of advanced technologies

Various technological advancements, such as the integration of the Internet of Things (IoT) and artificial intelligence (AI) with connected devices to track, process, authenticate, and exchange transaction systems, are driving market growth. Other factors, such as a growing emphasis on reducing data leaks and manipulations, a growing need for faster transactions, and extensive research and development (R&D) activities, are expected to propel the market even further forward.

Opportunities

- Growing investments will bolster the growth

The growing investment in self-driving vehicles and mobility services, such as vehicle leasing, rental, sharing, hailing, and pooling, has fuelled demand for automotive blockchain, which allows car rental companies to track the maintenance, cleaning, rent, and user data of registered vehicles. This, in turn, supports market growth.

Restraints

- Limited scalability will challenge the growth

In the forecasted period, market restraints for automotive block chain include limited scalability and regulatory uncertainty.

This automotive blockchain market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the automotive blockchain market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Automotive Blockchain Market Scope

The automotive blockchain market is segmented on the basis of application, provider, mobility type, technology type, propulsion, vehicle type and type. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Application

- Smart Contracts

- Supply Chain

- Financing

- Mobility Solutions

- Others

Provider

- Middleware Provider

- Infrastructure and Protocols Provider

- Application

- Solution Provider

Mobility Type

- Personal Mobility

- Shared Mobility

- Commercial Mobility

Technology type

- Open Block Chain

- Closed Block Chain

- Consortium Block Chain

- Hybrid Block Chain

Vehicle type

- Passenger Car

- Commercial Vehicle

Type

- Public

- Private

- Hybrid

Propulsion

- ICE

- Electric Vehicle

Automotive Blockchain Market Regional Analysis

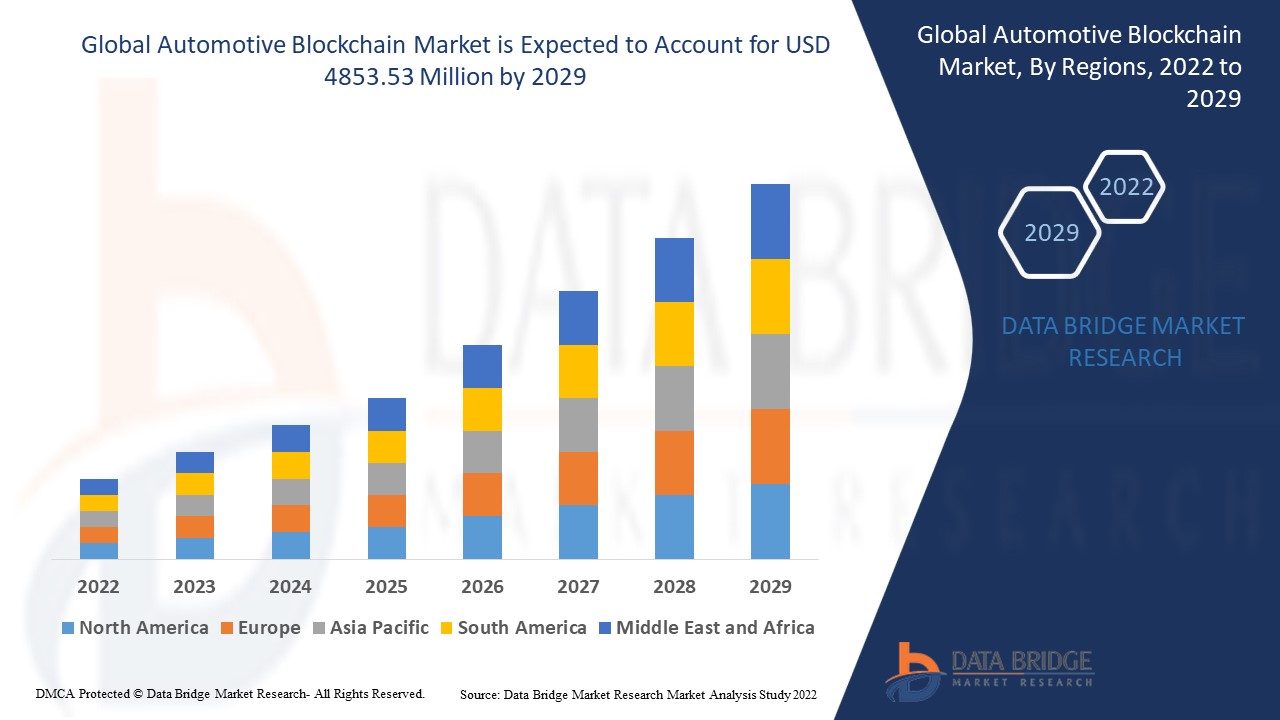

The automotive blockchain market is analyzed and market size insights and trends are provided by country of application, provider, mobility type, technology type, propulsion, vehicle type and type as referenced above.

The countries covered in the automotive blockchain market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

In terms of revenue share, the North American region dominated the global market. The presence of major players such as General Motors, Ford, and Tesla has contributed to regional growth. These firms were early adopters of emerging technologies and have strong presences in all major industry verticals.

Asia-Pacific region is expected to grow significantly during the forecast period as a result of increased government support for the adoption of innovative technologies across various industries, as well as rising investments from multinational corporations operating in this space.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Automotive Blockchain Market Share

The automotive blockchain market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to automotive blockchain market.

Automotive Blockchain Market Leaders Operating in the Market Are:

- IBM Corporation (US)

- Microsoft (US)

- BASF SE (Germany)

- DSM (Netherlands)

- Oracle (US)

- Huawei Technologies Co., Ltd. (China)

- Bitfury Group Limited. (Netherlands)

- TIBCO Software Inc. (US)

- Applied Blockchain Ltd (US)

- Guardtime (Estonia)

- OARO (Canada)

- Peer Ledger Inc. (Canada)

- Venture Proxy Ltd. (UK)

- Datex Corporation (US)

- Omnichain Solutions (US)

- Amazon Web Services, Inc. (US)

- Bitnation.co (US)

- Blockverify (UK)

- BTL Group Ltd. (UK)

- Cambridge Blockchain, LLC (US)

Latest Developments in Automotive Blockchain Market

- In April 2021 Tech Mahindra Ltd has agreed to launch 'Stablecoin-As-A-Service' blockchain solutions with the Netherlands-based Blockchain technology application incubator Quantoz.

- In October 2020 Skoda Auto DigiLab has partnered with innovation management firm Lumos Labs and Microsoft to identify blockchain solutions in manufacturing. The collaboration intends to use its development expertise and digitization knowledge to identify problem statements for the startups to work on innovative blockchain-based solutions.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.