Global Automotive Battery Management System Market

Market Size in USD Billion

CAGR :

%

USD

7.50 Billion

USD

20.22 Billion

2024

2032

USD

7.50 Billion

USD

20.22 Billion

2024

2032

| 2025 –2032 | |

| USD 7.50 Billion | |

| USD 20.22 Billion | |

|

|

|

Automotive Battery Management System Market Analysis

The rising demand for hybrid electric and battery electric vehicles is expected to propel the global market for automotive battery management systems to considerable growth over the recent years. The introduction of strict government rules regarding environmental degradation and government incentives in the form of subsidies, grants, and tax rebates to promote the use of eco-friendly forms of transportation have led to an increase in demand for these cars. Consequently, such growth determinants give the market a positive outlook over the forecasted timeline.

Automotive Battery Management System Market Size

Global automotive battery management system market size was valued at USD 7.50 billion in 2024 and is projected to reach USD 20.22 billion by 2032, with a CAGR of 13.20% during the forecast period of 2025 to 2032.

Global Automotive Battery Management System Market Trends

"Advancements in Battery Technology and Growing EV Adoption"

One of the key trends in the global automotive battery management system (BMS) market is the increasing demand for advanced battery technologies, driven by the growing adoption of electric vehicles (EVs). As automakers focus on enhancing vehicle performance, range, and safety, the need for efficient and reliable BMS solutions has surged. These systems are crucial for optimizing battery life, managing energy consumption, and ensuring safety in EVs. The shift towards sustainable transportation, along with stricter environmental regulations, has further accelerated the demand for BMS technologies. Additionally, advancements in battery chemistries, such as lithium-ion and solid-state batteries, are expected to drive the development of more sophisticated BMS solutions. As more consumers embrace electric mobility and automakers invest in EV infrastructure, the automotive BMS market is poised for continued growth.

Report Scope and Market Segmentation

|

Attributes |

Automotive Battery Management System Key Market Insights |

|

Segmentation |

|

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, Israel, Egypt, South Africa, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Key Market Players |

Robert Bosch GmbH (Germany), Continental AG (Germany), Toshiba Corporation (Japan), Intel Corporation (U.S.), Texas Instruments Incorporated (U.S.), NXP Semiconductors (Netherlands), Analog Devices, Inc. (U.S.), Denso Corporation (Japan), Johnson Matthey (U.K.), LG Chem (South Korea), Midtronics, Inc. (U.S.), Sensata Technologies, Inc. (Denmark), Midtronics, Inc. (U.S.), Microchip Technology Inc. (U.S.), Nuvation (U.S.) |

|

Market Opportunities |

|

Automotive Battery Management System Market Definition

The automotive battery management system aids in keeping track of a battery's performance and consumption. By regulating the operating area, balancing the battery, and providing protection for the battery, this system further manages rechargeable batteries. It also manages how an electric car's battery is recharged. The market for automotive battery management systems is expanding due to factors including temperature control, data logging, and improving battery longevity.

Automotive Battery Management System Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints and challenges. All of this is discussed in detail as below:

Drivers

- Increasing Usage across Vehicles

The automotive battery management system connects with other drivetrain parts to keep track of the charge level. It aids in cell balance, battery heat protection, and current regulation during charging and is one of the essential components of an electric vehicle's powertrain. Along with protecting the operating of the car, it also seeks to protect the battery. To avoid situations where a battery management system can impair the motion or movement of the vehicles, it is also crucial to identify what control functions should be allocated to it. Therefore, during the coming years, the market is anticipated to witness the development of improved automotive battery management systems due to the increased usage of electric vehicles.

- Growth in Urbanization

The majority of the population has been migrating there in recent years, urbanisation is reaching its pinnacle due to the increasing employment opportunities and rapid industrialisation in urban regions. Additionally, metropolitan passengers are more inclined to support the environmentally friendly and technologically advanced movements. The electric automobile battery management system is one of the best high-tech options due to its compact form. Urbanization is a common phenomenon, and as a result, demand for better travel and transportation infrastructure has significantly increased. The demand for electric vehicles has increased as a result of growing urbanisation and a renewed focus on green mobility.

Furthermore, the factors such as high need for effective electric grid management will accelerate the overall market expansion during the forecast period. Additionally, the rising sales of automotive is anticipated to drive the growth rate of the automotive battery management system market. The adoption and implementation of technologies, such as the IoT, AI, machine learning, and others, will further positively impact the market's growth rate during the forecast period. The expansion of the market is projected to be aided by the rising demand for battery management systems revenue in order to reduce greenhouse gas emissions and the disputed government policy.

Opportunities

- Increasing Trend of Electric Vehicles (EVs)

The increasing trend of electric vehicles is estimated to generate lucrative opportunities for the market, which will further expand the automotive battery management system market's growth rate in the future. During the projection period, the number of electric vehicles is expected to increase dramatically. The International Energy Agency (IEA) projects that by 2030, there will be 145 million electric automobiles, heavy trucks, vans, and buses on the road worldwide based on existing trends and legislation. Thus, it is important to note that the industry players are confident that once the epidemic eases down, this market is poised to grow quickly because of the huge increase in electric car sales that occurred during the pandemic.

- Surging Technological Advancements

Additionally, the surging product launches and other innovations by market players further offer numerous growth opportunities within the market. The introduction and development of battery and charging technology for electric vehicles are in high demand. The market's top manufacturers are creating and introducing a variety of technologically sophisticated battery management systems for battery-operated and hybrid automobiles. For instance, Grinntech, a start-up that specializes in Lithium-ion batteries for electric cars and energy storage systems, introduced IoT-based battery monitoring & control systems for 2-wheelers, 3-wheelers, and tractors/light vehicles in August 2020. As a result, significant prospects for market expansion are being created by technological advancement in automotive battery monitoring & control systems with benefits like decreased complexity, greater battery efficiency, and improved reliability, among others.

Restraints/Challenges

- High Cost

The automotive battery management system sector is facing financial constraints in the developing nations due to problems with many of these nations' weak foundations. Import taxes have been consistently higher for parts other than those from emerging regions. The cost of import requirements for systems and components is another annoyance. Thus, during the forecast period, the market for automotive battery management systems is anticipated to be constrained by the high cost of producing battery management systems due to obstacles including port obligations, import levies, and taxes.

- Complications in Battery Structures

The battery packs, main and aux chargers, motor controllers, safety devices, cooling and heating elements, SOC displays, and BMS main control units are just a few examples of the various parts that make up an electric vehicle's battery management system. As a result, market expansion is hampered by battery management systems that are incapable of handling complicated battery structures. Additionally, according to our primary research, technologically deficient battery management systems cannot be combined with the intricate battery structure, severely limiting market expansion. This factor is therefore estimated to be significant challenge for the automotive battery management system market over the forecast period.

This automotive battery management system market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the automotive battery management system market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Automotive Battery Management System Market Scope

The automotive battery management system market is segmented on the basis of battery type, vehicle type, connection topology, component, propulsion type, battery capacity, technology and end use. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Battery Type

- Lithium-Ion Based

- Advanced Lead-Acid Based

- Nickel-Based

- Flow Batteries

Vehicle Type

- Passenger Vehicle

- Commercial Vehicle

- Golf Cart

- E-Bikes

Connection Topology

- Centralized

- Distributed

- Modular

Component

- Battery IC

- Battery Sensor

- Other Component

Propulsion Type

- IC Engine Vehicle

- Electric Vehicle

Battery Capacity

- <100 kWh

- 100-200 kWh

- 200-500 kWh

- >500 kWh

Technology

- Active

- Passive

End Use

- OEMs

- Aftermarket

Automotive Battery Management System Market Regional Analysis

The automotive battery management system market is analyzed and market size insights and trends are provided by country, battery type, vehicle type, connection topology, component, propulsion type, battery capacity, technology and end use as referenced above.

The countries covered in the automotive battery management system market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, Israel, Egypt, South Africa, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

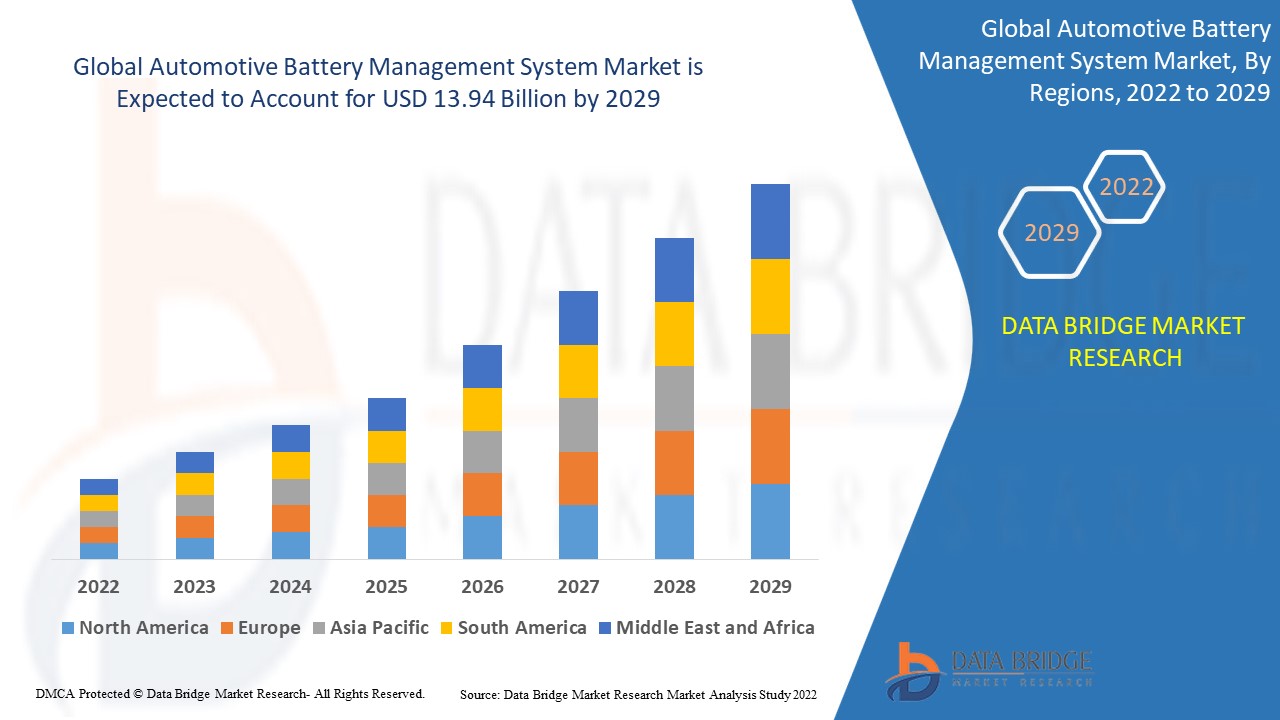

North America dominates the automotive battery management system market because of the increasing demand of the commercial and passenger vehicle within the region over the forecast period of 2025 to 2032. Moreover, the presence of manufacturing facilities of major automotive manufacturers is further estimated to accelerate the expansion over the forecast period.

Asia-Pacific is expected to witness significant growth during the forecast period of 2025 to 2032 due to improved infrastructure development in India and China within the region. The increase in battery-electric automotive is also a significant contributor to the regional market expansion.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Automotive Battery Management System Market Share

The automotive battery management system market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to automotive battery management system market.

Automotive Battery Management System Market Leaders Operating in the Market Are:

- Robert Bosch GmbH (Germany)

- Continental AG (Germany)

- Toshiba Corporation (Japan)

- Intel Corporation (U.S.)

- Texas Instruments Incorporated (U.S.)

- NXP Semiconductors (Netherlands)

- Analog Devices, Inc. (U.S.)

- Denso Corporation (Japan)

- Johnson Matthey (U.K.)

- LG Chem (South Korea)

- Midtronics, Inc. (U.S.)

- Sensata Technologies, Inc. (Denmark)

- Midtronics, Inc. (U.S.)

- Microchip Technology Inc. (U.S.)

- Nuvation (U.S.)

Latest Developments in Automotive Battery Management System Market

- In September 2020, In order to give automakers more flexibility in scaling up the manufacturing of their electric vehicle fleets across a variety of vehicle classes, Analog Devices, Inc. has developed a wireless battery management system (wBMS). The business's wBMS enhances design adaptability and manufactureability without compromising precision and range over the course of the battery. This can reduce the wiring by up to 90% and the battery pack space by up to 15%.

- In March 2022, Aston Martin and Britishvolt disclosed a partnership to create high-performance cars' next-generation battery technology. This collaboration will concentrate on the creation of new battery modules and automotive BMS as part of Aston Martin's efforts to introduce an electric vehicle.

- In May 2022, Marelli Holdings Co., Ltd. introduced the Wireless Distributed Battery Management System to expand its battery management technology for electric vehicles (wBMS). With this technology, connected physical connections are no longer necessary, resulting in better flexibility, enhanced efficiency, improved reliability, and lower costs than traditional battery management system architectures.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.