Global Automotive Air Flow Meter Market

Market Size in USD Billion

CAGR :

%

USD

1.75 Billion

USD

4.34 Billion

2025

2033

USD

1.75 Billion

USD

4.34 Billion

2025

2033

| 2026 –2033 | |

| USD 1.75 Billion | |

| USD 4.34 Billion | |

|

|

|

|

What is the Global Automotive Air Flow Meter Market Size and Growth Rate?

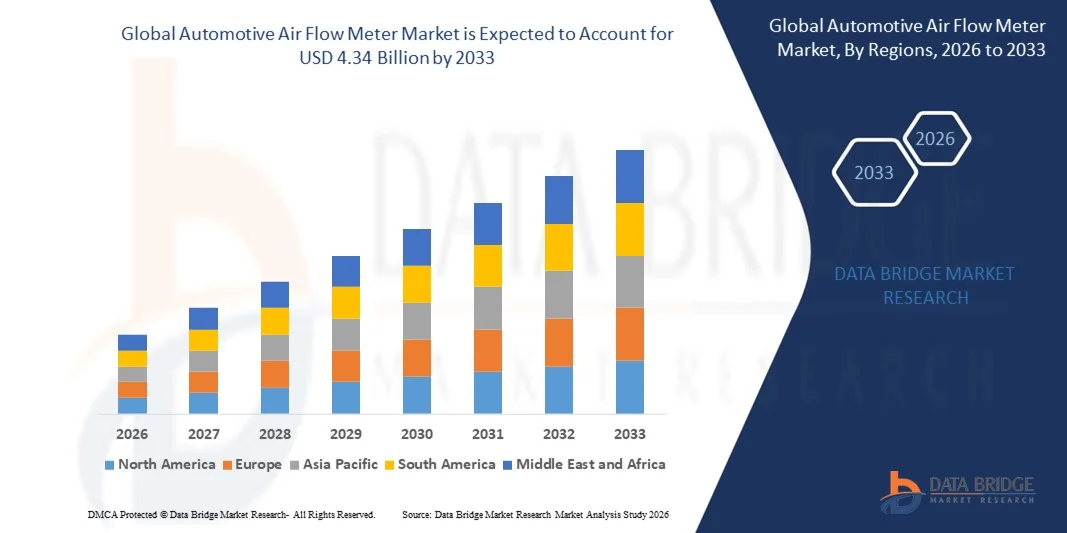

- The global automotive air flow meter market size was valued at USD 1.75 billion in 2025 and is expected to reach USD 4.34 billion by 2033, at a CAGR of12.0% during the forecast period

- Major factors that are expected to boost the growth of the automotive air flow meter market in the forecast period are the rising demand of integrated electronics systems in the automotive industry, the increasing of the automotive sector, and the growing issues regarding the efficacy of the vehicles

What are the Major Takeaways of Automotive Air Flow Meter Market?

- The rise in the need for the accuracy and sturdiness of the air flow, rising global problem for the exhaust emission and fuel economy and the upsurge in the need for durable and better efficient air flow meter are few of the factors further expected to propel the growth of the automotive air flow meter market

- On the other hand, the increase in the manufacturing cost of the air flow meter is one of the factors estimated to further impede the growth of the automotive air flow meter market in the near future

- North America dominated the automotive air flow meter market with a 41.18% revenue share in 2025, driven by high vehicle production volumes, early adoption of advanced engine management systems, and strict emission regulations across the U.S. and Canada

- Asia-Pacific is projected to register the fastest CAGR of 10.6% from 2026 to 2033, driven by expanding automotive manufacturing, rising vehicle ownership, and tightening emission norms across emerging and developed economies

- The Light Duty Vehicle segment dominated the market with a 64.7% share in 2025, driven by high global production of passenger cars, SUVs, and light commercial vehicles

Report Scope and Automotive Air Flow Meter Market Segmentation

|

Attributes |

Automotive Air Flow Meter Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Automotive Air Flow Meter Market?

Increasing Shift Toward Compact, High-Precision, and Digitally Integrated Automotive Air Flow Meters

- The automotive air flow meter market is witnessing a strong shift toward compact, lightweight, and high-accuracy sensors designed to support modern engine management systems, hybrid vehicles, and electric vehicles

- Manufacturers are increasingly introducing digital and MEMS-based air flow meters that offer faster response times, improved signal stability, and enhanced resistance to temperature fluctuations and vibration

- Growing demand for fuel efficiency optimization, emission reduction, and precise air–fuel ratio control is accelerating adoption across passenger cars and commercial vehicles

- For instance, leading suppliers such as Bosch, DENSO, Continental, and Hitachi are upgrading mass air flow (MAF) sensors with improved calibration accuracy and integrated diagnostics

- Rising integration of air flow meters with ECUs, onboard diagnostics (OBD), and predictive maintenance systems is strengthening real-time engine performance monitoring

- As automotive powertrains become more efficient and electronically controlled, Automotive Air Flow Meters remain critical for engine optimization, emission compliance, and performance enhancement

What are the Key Drivers of Automotive Air Flow Meter Market?

- Rising demand for fuel-efficient vehicles and stringent emission regulations is driving widespread adoption of high-precision air flow meters

- For instance, during 2024–2025, major OEMs and Tier-1 suppliers enhanced air flow sensor designs to meet Euro 7, BS-VI, and EPA emission standards

- Increasing production of passenger vehicles, SUVs, and light commercial vehicles, particularly in Asia-Pacific and Europe, is boosting market demand

- Advancements in MEMS technology, sensor miniaturization, and digital signal processing have improved measurement accuracy and durability

- Growing adoption of hybrid vehicles, engine downsizing, and turbocharged engines requires precise air intake monitoring

- Supported by continuous investment in automotive electronics, powertrain optimization, and emission control technologies, the Automotive Air Flow Meter market is expected to witness steady long-term growth

Which Factor is Challenging the Growth of the Automotive Air Flow Meter Market?

- High costs of advanced digital and MEMS-based air flow meters limit adoption in low-cost vehicle segments and price-sensitive markets

- For instance, during 2024–2025, sensor material cost volatility and semiconductor supply constraints impacted production costs for global manufacturers

- Sensitivity of air flow meters to contamination, dust, and oil vapors can affect long-term accuracy and reliability

- Increasing complexity in calibration and integration with advanced ECUs raises development and maintenance challenges

- Competition from alternative sensing technologies and virtual air flow estimation methods creates pricing pressure

- To overcome these challenges, manufacturers are focusing on cost-efficient sensor designs, improved protective coatings, enhanced software calibration, and better integration with vehicle diagnostics systems

How is the Automotive Air Flow Meter Market Segmented?

The market is segmented on the basis of vehicle type, product type, sales channel, and application.

- By Vehicle Type

On the basis of vehicle type, the automotive air flow meter market is segmented into Light Duty Vehicles and Heavy Duty Vehicles. The Light Duty Vehicle segment dominated the market with a 64.7% share in 2025, driven by high global production of passenger cars, SUVs, and light commercial vehicles. Increasing demand for fuel-efficient vehicles, stricter emission norms, and widespread adoption of advanced engine management systems have led to extensive use of air flow meters in light-duty vehicles. OEMs focus heavily on precise air–fuel ratio control to meet BS-VI, Euro 6, and EPA standards, further supporting dominance.

The Heavy Duty Vehicle segment is expected to grow at the fastest CAGR from 2026 to 2033, supported by rising commercial transportation, construction activity, and logistics demand. Heavy trucks and buses increasingly require robust, high-accuracy air flow meters to improve fuel economy, reduce emissions, and comply with tightening environmental regulations, particularly across Asia-Pacific and Latin America.

- By Product Type

On the basis of product type, the automotive air flow meter market is segmented into Analog Flow Meters and Digital Flow Meters. The Digital Flow Meter segment dominated the market with a 58.9% share in 2025, owing to superior accuracy, faster response time, and seamless integration with modern ECUs and onboard diagnostics systems. Digital air flow meters support real-time data processing, self-diagnostics, and enhanced engine performance monitoring, making them the preferred choice for modern vehicles, hybrids, and EVs.

The Analog Flow Meter segment is projected to grow at a steady CAGR from 2026 to 2033, primarily driven by demand in cost-sensitive vehicle models and aftermarket applications. Their simple design, lower cost, and ease of replacement make analog meters suitable for older vehicles and emerging markets. However, gradual technological transition continues to shift preference toward digital solutions.

- By Sales Channel

On the basis of sales channel, the automotive air flow meter market is segmented into the Original Equipment Market (OEM) and the Aftersales Market. The OEM segment dominated the market with a 61.3% share in 2025, supported by rising vehicle production, factory-installed sensor requirements, and long-term supply contracts between automakers and Tier-1 suppliers. OEM-installed air flow meters are optimized for specific engine platforms and calibrated to meet regulatory and performance standards, ensuring reliability and compliance.

The Aftersales Market segment is expected to grow at the fastest CAGR from 2026 to 2033, driven by increasing vehicle parc, aging vehicles, and higher replacement rates due to sensor wear, contamination, and performance degradation. Growing awareness of engine efficiency, emission failures, and preventive maintenance is boosting demand for replacement air flow meters, particularly across North America, Europe, and emerging Asian markets.

- By Application

On the basis of application, the automotive air flow meter market is segmented into Residential, Commercial, and Industrial. The Commercial segment dominated the market with a 45.6% share in 2025, driven by extensive use in fleet vehicles, logistics vans, taxis, and service vehicles where fuel efficiency and emission compliance are critical. Regular vehicle usage and higher mileage increase reliance on accurate air intake measurement for optimal engine performance.

The Industrial segment is expected to grow at the fastest CAGR from 2026 to 2033, supported by rising demand from heavy machinery, industrial transport vehicles, and construction equipment. Stringent emission regulations and fuel cost optimization are accelerating adoption in industrial applications.

Which Region Holds the Largest Share of the Automotive Air Flow Meter Market?

- North America dominated the automotive air flow meter market with a 41.18% revenue share in 2025, driven by high vehicle production volumes, early adoption of advanced engine management systems, and strict emission regulations across the U.S. and Canada. Strong demand for precise air–fuel ratio control in passenger vehicles, commercial fleets, and performance vehicles continues to support widespread deployment of air flow meters.

- Leading automotive OEMs and Tier-1 suppliers in North America are increasingly integrating digital and sensor-based air flow meters to improve fuel efficiency, reduce emissions, and enhance engine diagnostics, strengthening regional market leadership

- Advanced automotive R&D infrastructure, high penetration of electronic fuel injection systems, and strong aftermarket replacement demand further reinforce North America’s dominance

U.S. Automotive Air Flow Meter Market Insight

The U.S. is the largest contributor in North America, supported by a mature automotive ecosystem, high vehicle ownership rates, and continuous upgrades in engine technologies. Stringent EPA emission standards, growing adoption of turbocharged engines, and rising demand for fuel-efficient vehicles are driving sustained use of Automotive Air Flow Meters across OEM and aftermarket channels. Strong presence of global automakers, sensor manufacturers, and testing facilities further accelerates market growth.

Canada Automotive Air Flow Meter Market Insight

Canada contributes steadily to regional growth due to rising vehicle parc, increasing adoption of advanced automotive sensors, and strong aftermarket demand. Growth in light commercial vehicles, cold-climate performance requirements, and regulatory alignment with U.S. emission standards support consistent demand for high-accuracy Automotive Air Flow Meters across passenger and commercial vehicles.

Asia-Pacific Automotive Air Flow Meter Market

Asia-Pacific is projected to register the fastest CAGR of 10.6% from 2026 to 2033, driven by expanding automotive manufacturing, rising vehicle ownership, and tightening emission norms across emerging and developed economies. Rapid growth in passenger vehicles, SUVs, and commercial fleets increases demand for efficient engine air management solutions. Rising adoption of digital sensors, cost-effective manufacturing, and expanding aftermarket networks further fuel regional expansion.

China Automotive Air Flow Meter Market Insight

China is the largest contributor to Asia-Pacific, supported by massive automotive production, strong EV and hybrid vehicle growth, and government-led emission reduction initiatives. High demand for precise engine control systems and large-scale vehicle parc replacement cycles drive strong adoption of Automotive Air Flow Meters across OEM and aftermarket segments.

Japan Automotive Air Flow Meter Market Insight

Japan shows stable growth driven by advanced automotive engineering, strong focus on fuel efficiency, and continuous innovation in engine technologies. High-quality manufacturing standards and demand for reliable sensor performance support adoption of premium Automotive Air Flow Meters across passenger and commercial vehicles.

India Automotive Air Flow Meter Market Insight

India is emerging as a high-growth market due to rising vehicle production, stricter BS-VI emission norms, and rapid expansion of the aftermarket. Increasing demand for fuel-efficient vehicles, growing middle-class vehicle ownership, and localization of automotive components are accelerating market penetration.

South Korea Automotive Air Flow Meter Market Insight

South Korea contributes significantly through strong automotive exports, advanced powertrain technologies, and growing adoption of hybrid and electric vehicles. Continuous innovation in engine efficiency, sensor integration, and vehicle electronics supports sustained demand for Automotive Air Flow Meters.

Which are the Top Companies in Automotive Air Flow Meter Market?

The automotive air flow meter industry is primarily led by well-established companies, including:

- DENSO CORPORATION (Japan)

- Robert Bosch GmbH (Germany)

- Siemens (Germany)

- Continental AG (Germany)

- ABB (Switzerland)

- Festo (Germany)

- Hitachi, Ltd. (Japan)

- BorgWarner Inc. (U.S.)

- Mitsubishi Motors Corporation (Japan)

- K&N Engineering, Inc. (U.S.)

- Nissan (Japan)

- FLIR Systems, Inc. (U.S.)

- ACDelco (U.S.)

- Aptiv (Ireland)

- United Automotive Electronic Systems Co., Ltd. (China)

- HYUNDAI KEFICO Corporation (South Korea)

- TT Electronics (U.K.)

- erae Automotive Systems Co., Ltd. (South Korea)

- Emerson Electric Co. (U.S.)

- Schneider Electric (France)

- SAISON INFORMATION SYSTEMS CO., LTD (Japan)

What are the Recent Developments in Global Automotive Air Flow Meter Market?

- In September 2023, ENVEA, a leading provider of environmental monitoring solutions, expanded its AirFlow P sensor portfolio by launching a high-temperature variant capable of operating at temperatures up to 800 °C, significantly enhancing performance in extreme industrial environments, thereby strengthening its positioning in advanced and demanding airflow monitoring applications

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.