Global Automation Testing Market Segmentation, By Component (Testing Types and Services), Endpoint Interface (Mobile, Web, Desktop, and Embedded Software), Organization Size (Small and Medium-Sized Enterprises and Large Enterprises), Vertical (Banking, Financial Services, Insurance, Automotive, Defense and Aerospace, Healthcare and Life Sciences, Retail, Telecom and IT, Manufacturing, Logistics and Transportation, Energy and Utilities, Media and Entertainment, Government and Public Sector, and Others) – Industry Trends and Forecast to 2031

Automation Testing Market Analysis

The automation testing market is experiencing rapid growth, driven by advancements in technologies and methodologies that enhance software quality and reduce time-to-market. Key developments include the integration of artificial intelligence (AI) and machine learning (ML) into testing frameworks, enabling smarter, self-healing tests that adapt to code changes without manual intervention. This evolution significantly improves efficiency, allowing teams to focus on higher-value tasks.

In addition, the rise of DevOps practices promotes continuous testing throughout the software development lifecycle, further fueling market growth. Automation tools such as Selenium, Appium, and TestComplete are increasingly popular for their ability to streamline processes and support various testing environments, including web, mobile, and API testing.

Moreover, cloud-based testing solutions are gaining traction, offering scalability and flexibility that cater to dynamic project requirements. These tools facilitate easier collaboration among distributed teams, essential in today’s global work environment. The combination of these advancements not only enhances the accuracy and speed of software testing but also ensures that organizations can meet the increasing demand for rapid deployment of high-quality applications. Consequently, the automation testing market is projected to expand significantly, driven by ongoing innovation and the need for efficient testing solutions.

Automation Testing Market Size

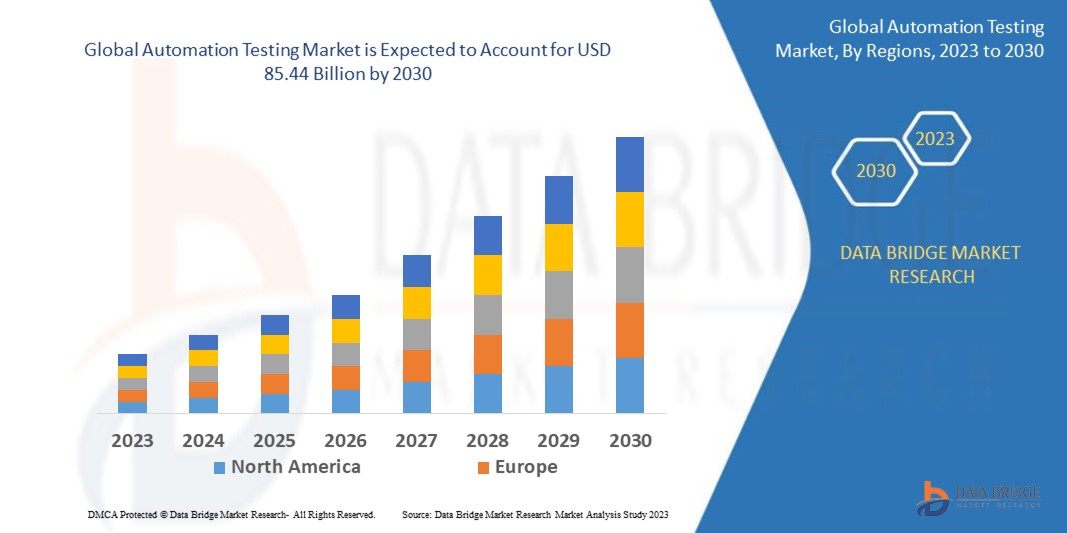

The global automation testing market size was valued at USD 28.49 billion in 2023 and is projected to reach USD 104.24 billion by 2031, with a CAGR of 17.6% during the forecast period of 2024 to 2031. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis.

Automation Testing Market Trends

“Growing Adoption of AI-Powered Automation Tools”

One specific trend driving growth in the automation testing market is the increasing adoption of AI-powered automation tools. These tools enhance the efficiency and accuracy of testing processes by leveraging machine learning algorithms to predict potential defects and optimize test cases. For instance, in 2021, SmartBear initiated a strategic alliance with QBS Software, focusing on enhancing the delivery of enterprise software solutions to over 240,000 organizations in the EMEA region. This partnership aims to improve the efficiency of software deployment and provide better access to SmartBear's suite of tools. By collaborating with QBS Software, SmartBear seeks to bolster its presence in the European market and drive innovation in software development.

Report Scope and Automation Testing Market Segmentation

|

Attributes

|

Automation Testing Key Market Insights

|

|

Segments Covered

|

|

|

Countries Covered

|

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America

|

|

Key Market Players

|

Verizon (U.S.), IBM (U.S.), Aemulus Corporation Sdn. Bhd. (Malaysia), Chroma ATE Inc. (Taiwan), AEROFLEX (U.S.), Astronics Corporation. (U.S.), ADVANTEST CORPORATION (Japan), Cohu, Inc (U.S.), Teradyne Inc. (U.S.), Star Infomatic Pvt. Ltd. (India), TESEC, Inc (Japan), ROOS INSTRUMENTS, INC. (U.S.), Marvin Test Solutions, Inc. (U.S.), Danaher (U.S.), Capgemini (France), Wipro (India), Accenture (Ireland), TATA Consultancy Services Limited (India), The Qt Company (Finalnd), Worksoft, Inc. (U.S.)

|

|

Market Opportunities

|

|

|

Value Added Data Infosets

|

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis.

|

Automation Testing Market Definition

Automation testing is a software testing technique that uses automated tools and scripts to execute test cases, compare actual outcomes with expected results, and report discrepancies. This approach improves testing efficiency and accuracy by reducing the need for manual intervention, allowing repetitive tasks to be performed quickly and consistently. Automation testing is especially beneficial for regression testing, performance testing, and load testing, where large volumes of data or multiple scenarios must be assessed. Popular tools include Selenium, JUnit, and TestNG. Ultimately, automation testing enhances software quality, accelerates the development process, and enables continuous integration and delivery practices.

Automation Testing Market Dynamics

Drivers

- Increased Adoption of Agile Methodologies

The increased adoption of agile methodologies significantly drives the automation testing market. Agile focuses on iterative development, where software is built in small increments, necessitating frequent testing. Automation seamlessly integrates with Agile IoT by enabling continuous testing and rapid feedback loops. For instance, in 2021, Performance testing company Neotys was acquired by Tricentis, a move designed to enrich Tricentis’ portfolio with enterprise-grade performance testing solutions. With the integration of Neoload, Tricentis aims to provide customers with comprehensive testing capabilities that ensure applications can withstand real-world performance demands. This acquisition strengthens Tricentis' offerings and enhances its position in the performance testing market, benefitting users with robust testing frameworks.

- Rise of Cloud-based Applications

The rise of cloud-based applications significantly drives the automation testing market as organizations increasingly rely on cloud solutions for scalability and flexibility. Automated testing is vital for ensuring these applications function correctly across different cloud environments, maintaining performance under varying loads, and securing sensitive data. For instance, in March 2023, At Embedded World 2023, Crank AMETEK introduced a ground-breaking embedded GUI testing framework integrated into their Application Storyboard software. This new tool is designed to modernize the GUI development testing process, offering a powerful yet user-friendly solution that enhances development efficiency. By simplifying the testing workflow, this framework enables developers to create high-quality embedded applications more effectively, thereby addressing the growing demand for robust GUI testing solutions.

Opportunities

- Continuous Integration and Continuous Delivery (CI/CD)

The growing adoption of Continuous Integration and Continuous Delivery (CI/CD) practices presents significant opportunities in the automation testing market. As organizations strive for faster and more reliable software deployment, automated testing becomes essential for quickly validating code changes. Tools such as Jenkins and GitLab CI enable seamless integration of automated tests within CI/CD pipelines, ensuring immediate feedback on code quality. For instance, in August 2023, Tricentis unveiled its innovative optical character recognition (OCR) technology, featuring a patented single-pass OCR methodology designed to enhance the efficiency of AI testing. This technology, integral to Vision AI, is part of Tricentis Tosca, their intelligent test automation solution. By automating the OCR process, Tricentis aims to significantly streamline testing workflows, enabling faster and more accurate results in software development and quality assurance.

- Integration with DevOps Practices

The integration of automation testing within DevOps practices presents significant market opportunities. This approach enhances collaboration between development and operations, ensuring rapid feedback loops and continuous delivery. Companies such as Atlassian and GitLab have developed tools that facilitate seamless integration of testing in CI/CD pipelines, allowing teams to deploy code updates multiple times a day without compromising quality. Moreover, organizations adopting DevOps practices report reduced deployment failures by up to 50%, leading to faster recovery times. As more companies embrace agile methodologies and seek to improve operational efficiency, the demand for automation testing tools designed for DevOps will continue to grow, creating a robust market landscape.

Restraints/Challenges

- High Initial Investment

The automation testing market is hindered by high initial investment requirements. Implementing automation solutions necessitates significant upfront costs for tools, infrastructure, and training. Smaller organizations, in particular, may struggle to allocate the necessary budget, which restricts their ability to adopt automation technologies. This financial barrier creates a disparity between larger enterprises, which can absorb these costs, and smaller firms that cannot. Consequently, the market experiences slower growth as many potential users are unable or unwilling to invest in automation testing. This limitation also results in a lack of diversity in automation adoption across different sectors, further stalling innovation and progress within the industry.

- Complexity in Test Automation

Automating tests for intricate applications poses significant challenges, particularly for those with dynamic user interfaces or rapidly changing requirements. The complexity involved can make it daunting for organizations to develop effective automated tests. Crafting these tests often necessitates specialized skills in programming, test design, and tool utilization, which are not widely available. This shortage of expertise can lead to delays in project timelines and increased costs, hindering the overall effectiveness of automation initiatives. Consequently, organizations may struggle to fully implement automated testing, limiting their ability to achieve the desired speed and efficiency in their software development processes.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Automation Testing Market Scope

The market is segmented on the basis of component, endpoint interface, organization size, and vertical. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Component

- Testing Types

- Static Testing

- Dynamic Testing

- Functional Testing

- Non-functional Testing

- System Testing

- Performance Testing

- Compatibility Testing

- Compliance Testing

- Usability Testing

- Others

- Services

- Advisory and Consulting

- Planning and Development

- Support and Maintenance

- Documentation and Training

- Implementation

- Managed Services

- Others

Endpoint Interface

- Mobile

- Web

- Desktop

- Embedded Software

Organization Size

- Small and Medium-Sized Enterprises

- Large Enterprises

Vertical

- Banking, Financial Services, Insurance

- Automotive

- Defense and Aerospace

- Healthcare and Life Sciences

- Retail

- Telecom and IT

- Manufacturing

- Logistics and Transportation

- Energy and Utilities

- Media and Entertainment

- Government and Public Sector

- Others

Automation Testing Market Regional Analysis

The market is analyzed and market size insights and trends are provided by component, endpoint interface, organization size, and vertical as referenced above.

The countries covered in the market report are U.S., Canada, Mexico in North America, Germany, Sweden, Poland, Denmark, Italy, U.K., France, Spain, Netherland, Belgium, Switzerland, Turkey, Russia, Rest of Europe in Europe, Japan, China, India, South Korea, New Zealand, Vietnam, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in Asia-Pacific (APAC), Brazil, Argentina, Rest of South America as a part of South America, U.A.E, Saudi Arabia, Oman, Qatar, Kuwait, South Africa, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA).

Asia-Pacific is expected to witness high growth in the automation testing market, driven by the widespread adoption of agile development environments for quality assurance and testing. The region's increasing consumption of mobile-based applications further fuels this demand. Companies are prioritizing automation to enhance testing efficiency, reduce time-to-market, and improve software quality, positioning Asia-Pacific as a key player in the global automation testing landscape.

Europe is expected to show significant growth in the automation testing market due to a rise in the adoption of agile development environments for quality assurance and testing, a rise in the consumption of mobile-based applications, an increase in the digitalization in developing economies and rise in the production of automobile vehicles in these regions.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Automation Testing Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Automation Testing Market Leaders Operating in the Market Are:

- Verizon (U.S.)

- IBM (U.S.)

- Aemulus Corporation Sdn. Bhd. (Malaysia)

- Chroma ATE Inc. (Taiwan)

- AEROFLEX (U.S.)

- Astronics Corporation. (U.S.)

- ADVANTEST CORPORATION (Japan)

- Cohu, Inc (U.S.)

- Teradyne Inc. (U.S.)

- Star Infomatic Pvt. Ltd. (India)

- TESEC, Inc.(Japan)

- ROOS INSTRUMENTS, INC. (U.S.)

- Marvin Test Solutions, Inc. (U.S.)

- Danaher (U.S.)

- Capgemini (France)

- Wipro (India)

- Accenture (Ireland)

- TATA Consultancy Services Limited (India)

- The Qt Company (Finalnd)

- Worksoft, Inc. (U.S.)

Latest Developments in Automation Testing Market

- In March 2024, Sauce Labs announced a strategic partnership with GitHub Actions, aimed at optimizing continuous testing workflows for developers. This collaboration enables developers to trigger tests directly within their GitHub repositories, utilizing Sauce Labs' robust cloud infrastructure. As a result, teams can efficiently automate testing for both web and mobile applications right from their CI/CD pipelines, enhancing development speed and software quality

- In February 2024, Micro Focus launched UFT One 17.5, the latest iteration of its automation testing platform. This version introduces advanced features such as scriptless automation, which simplifies the testing process, and AI-driven test maintenance that adapts to changes. In addition, enhanced test reporting capabilities allow organizations to gain deeper insights into testing workflows, ultimately leading to improved software quality in increasingly complex IT environments

- In January 2024, Eggplant unveiled Eggplant AI 2.0, an upgraded version of its intelligent automation testing platform. This release focuses on autonomous test creation, leveraging machine learning for adaptive learning that improves over time. Furthermore, it incorporates predictive analytics, enabling organizations to foresee potential testing outcomes. As a result, companies can achieve faster, more reliable testing processes, contributing to higher quality software releases

- In June 2023, ESCRIBA AG, a leader in scanning software solutions, entered into a strategic partnership with Software AG, aiming to revolutionize the digital landscape. This collaboration introduces advanced tools that facilitate end-to-end applications, promoting digital transformation across various business sectors. By leveraging Software AG’s innovative platform, ESCRIBA AG enhances its capabilities, enabling businesses of all sizes to optimize their processes and drive efficiency through comprehensive digital solutions

- In May 2023, UiPath established a partnership with Peraton to deliver its business automation platform as a managed service, tailored for high-security environments within the U.S. intelligence, civilian agencies, and defense sectors. This collaboration allows organizations to harness UiPath’s AI-powered automation solutions securely via cloud or on-premises deployments. The initiative aims to enhance operational efficiency and streamline processes while ensuring compliance with stringent security standards in sensitive environments

- In April 2023, Emerson announced its acquisition of NI for USD 60 per share in cash, valuing the deal at approximately USD 8.2 billion. This strategic move enhances Emerson's automation capabilities by integrating NI's advanced testing and measurement solutions. With this acquisition, Emerson aims to penetrate high-growth markets such as transportation, electric vehicles, semiconductors, and aerospace, ultimately positioning itself as a leader in industries poised for significant long-term growth

SKU-