Global Automation Identification System Market, By Class (Class A AIS, Class B AIS and AIS Base Stations), Platform (Vessel-Based Platform and Onshore-Based Platform), Application (Fleet Management, Vessel Tracking, Maritime Security and Other Applications) – Industry Trends and Forecast to 2029.

Automation Identification System Market Analysis and Size

Automation identification system transmit radio signals in the maritime VHF band, which is naturally noisy. As competing signals interfere with each other, bandwidths often become congested in ports and crowded areas. Furthermore, satellites and ground-based receivers may only receive a limited amount of data at the same time. Due to the congestion, any individual vessel may appear and disappear from the map. More satellites receiving automation identification system signals will help to improve coverage.

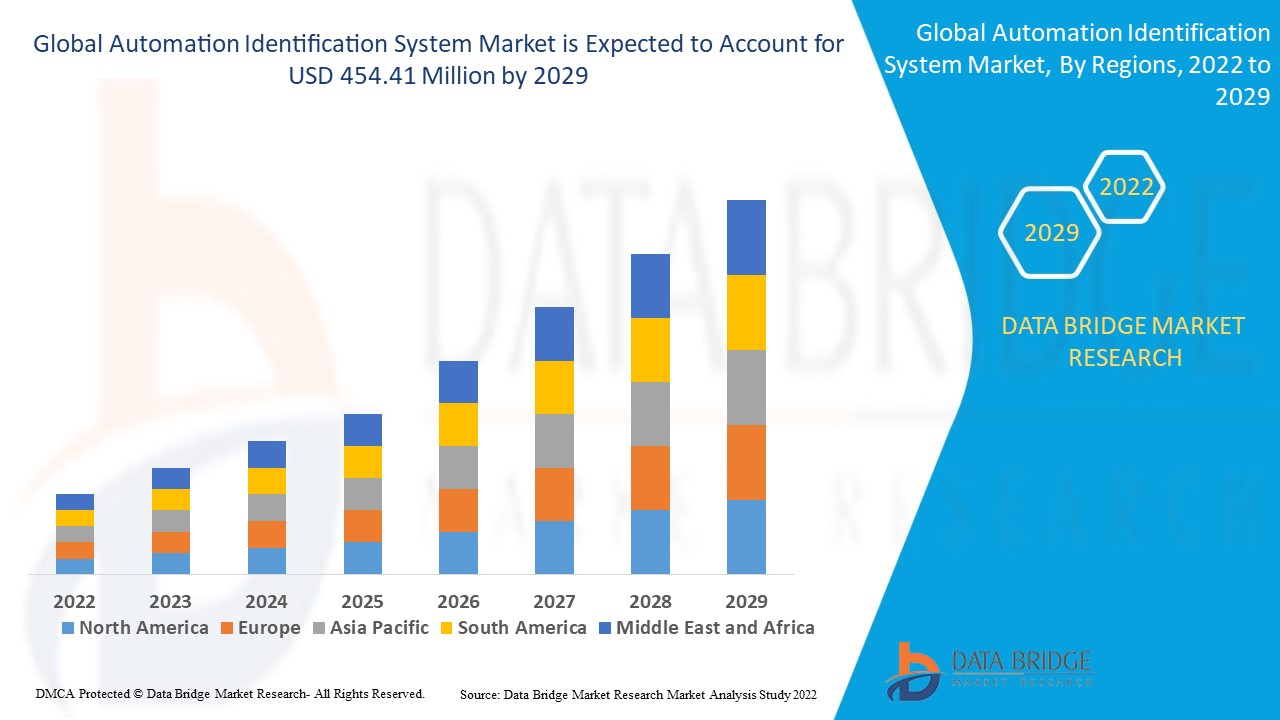

Data Bridge Market Research analyses that the automation identification system market was valued at USD 276.64 million in 2021 and is expected to reach the value of USD 454.41 million by 2029, at a CAGR of 6.40% during the forecast period. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand.

Automation Identification System Market Scope and Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2022 to 2029

|

|

Base Year

|

2021

|

|

Historic Years

|

2020 (Customizable to 2014 - 2019)

|

|

Quantitative Units

|

Revenue in USD Million, Volumes in Units, Pricing in USD

|

|

Segments Covered

|

Class (Class A AIS, Class B AIS and AIS Base Stations), Platform (Vessel-Based Platform and Onshore-Based Platform), Application (Fleet Management, Vessel Tracking, Maritime Security and Other Applications),

|

|

Countries Covered

|

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

|

|

Market Players Covered

|

Saab AB (Sweden), FURUNO ELECTRIC CO., LTD. (U.S), Exact Earth Ltd (Canada), ORBCOMM. (U.S), Garmin Ltd (U.S), KONGSBERG (Norway), True Heading (Sweden), Japan Radio Co (Japan), CNS Systems AB (Sweden), Wärtsilä (Finland), COMNAV (Canada), L3Harris Technologies, Inc. (U.S)

|

|

Market Opportunities

|

|

Market Definition

An automatic identification system (AIS) is a tracking system that uses transponders on ships to display other vessels in the vicinity and is used by vessel traffic services (VTS). An automatic identification system aids in traffic management and the avoidance of potential maritime collisions. It has been discovered that automated identification systems are primarily used to keep ships safe.

Drivers

- Growing need for tracking system due to growing maritime traffics

Increasing maritime traffic at sea has caused a slew of issues, both near ports and on the high seas. Many ship collisions and accidents have occurred in the past as a result of a lack of communication between nearby ships and misguided instructions from port authorities. These incidents prompted the development and widespread use of ship tracking devices such as AIS. Furthermore, many ship owners must keep track of the cargo they are transporting. Ship tracking devices also aid in meeting these requirements. The market for advanced AIS for real-time navigation to avoid collisions, improve security and safety, and manage sea traffic is expected to grow dramatically. Such factors contribute to market expansion.

- Dwell time and port performance

Dwell time is the amount of time a vessel spends in port while loading and unloading. Every effort is made to keep this time as short as possible. Shorter dwell times are preferred because vessel operating costs typically rise as dwell time increases. The AIS identifies the dwell time for each vessel using the vast data gathered from the vessel and may thus improve port performance. As it reduces operational costs, this is a driving force in the AIS market. Many Indian airports demonstrated inefficiency in cargo handling when compared to global ports due to constraints such as long dwell time. As a result, in an effort to improve efficiency, many ports around the world are now deploying new technologies in which AIS may play a significant role.

Opportunities

- Advancements in technologies

AIS vessel tracking systems have made rapid advances in terms of both global reach and technology accessibility. Due to advancements in underlying technology and the shipping industry, the future of AIS promises that the rate of change will only accelerate in the coming years. The rise of autonomous vessels is expected to put AIS front and centre.

Restraints

- Signal tampering

AIS signals can also be intermittent, with long gaps in transmission not uncommon. Furthermore, tracks appear in unlikely places, such as over mountain ranges and through deserts. In such cases, either the AIS transponders have failed or they have been deliberately tampered with. Errors caused by incorrect equipment settings can result in an emergency incident, posing a significant challenge to the market. This presents difficulties for the market.

This automation identification system market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the automation identification system market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Impact and Current Market Scenario of Raw Material Shortage and Shipping Delays

Data Bridge Market Research offers a high-level analysis of the market and delivers information by keeping in account the impact and current market environment of raw material shortage and shipping delays. This translates into assessing strategic possibilities, creating effective action plans, and assisting businesses in making important decisions.

Apart from the standard report, we also offer in-depth analysis of the procurement level from forecasted shipping delays, distributor mapping by region, commodity analysis, production analysis, price mapping trends, sourcing, category performance analysis, supply chain risk management solutions, advanced benchmarking, and other services for procurement and strategic support.

COVID-19 Impact on Automation Identification System Market

The spread of COVID-19 had a significant impact on market growth. Because international borders were closed to contain the virus's spread, ports were closed with no trade deals, impeding market growth during the pandemic.

Expected Impact of Economic Slowdown on the Pricing and Availability of Products

When economic activity slows, industries begin to suffer. The forecasted effects of the economic downturn on the pricing and accessibility of the products are taken into account in the market insight reports and intelligence services provided by DBMR. With this, our clients can typically keep one step ahead of their competitors, project their sales and revenue, and estimate their profit and loss expenditures.

Recent Developments

- May 2022 - At the Tokyo summit, Quad leaders planned to launch a number of initiatives, including a marine security partnership to monitor illegal fishing, "black ships," and other tactical-level activities. This maritime initiative will track dark shipping and other tactical-level movements, such as rendezvous at sea, and improve partners' ability to respond to climate and humanitarian events, as well as protect their fisheries, both of which are critical to many Indo-Pacific economies."

- In June 2022 Accelleron, the rebranded ABB Turbocharging subsidiary, has announced two new data collection and analytic collaborations with Danelec Marine and Hoppe Marine. The new joint service with Danelec will collect data from vessel systems such as the automation system, voyage data recorder, GPS, ECDIS, gyro compass, engine, propeller, automatic identification system (AIS), and individual sensors and will provide real-time operational data by combining Accelleron's Tekomar XPERT marine performance analysis system and the DanelecConnect maritime IoT product.

Global Automation Identification System Market Scope

The automation identification system market is segmented on the basis of class, platform and application. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Class

- Class A AIS

- Class B AIS

- AIS Base Stations

Platform

- Vessel-Based Platform

- Onshore-Based Platform

Application

- Fleet Management

- Vessel Tracking

- Maritime Security

- Other Applications

Automation Identification System Market Regional Analysis/Insights

The automation identification system market is analysed and market size insights and trends are provided by country, class, platform and application as referenced above.

The countries covered in the automation identification system market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

North America had the largest market share. The location is well-known for having a large coastal area, which necessitates constant monitoring. Furthermore, the growing commercial activity and commerce in the region drive the demand for marine safety and monitoring. As a result, increased trading operations across the region are expected to boost market growth throughout the forecast period. The region is also distinguished by the presence of a significant number of AIS solution providers, which contributes to the region's high share and aids in its sector dominance.

The Asia-Pacific region is the highest growing region. The Asia-Pacific region is home to the majority of the world's busiest ports, including the Port of Shanghai, Singapore Port, Shenzhen Port, and Guangzhou Port, among others. Due to the high volume of traffic at these ports, they are vulnerable to a variety of illegal activities, necessitating strict security measures. Furthermore, the port authorities must manage a large amount of traffic in order for the ports to function properly.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Automation Identification System Market Share Analysis

The automation identification system market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to automation identification system market.

Some of the major players operating in the automation identification system market are:

- Saab AB (Sweden)

- FURUNO ELECTRIC CO., LTD. (U.S)

- Exact Earth Ltd (Canada)

- ORBCOMM. (U.S)

- Garmin Ltd (U.S)

- KONGSBERG (Norway)

- True Heading (Sweden)

- Japan Radio Co (Japan)

- CNS Systems AB (Sweden)

- Wärtsilä (Finland)

- COMNAV (Canada)

- L3Harris Technologies, Inc. (U.S)

SKU-