Global Automatic Labeling Machine Market Segmentation, By Type (Front and Back Labeling Machines, Wrap-Around Labeling Machines, Sleeve Labeling Machines, Carton Labeling Machines, and Others), Technology (Pressure-Sensitive Labeling, Heat-Shrink Labeling, In-Mold Labeling, and Glue-Based Labeling), End-Use (Food and Beverage, Pharmaceuticals, Cosmetics and Personal Care, Chemicals, Logistics and Retail, and Others), Operation Mode (Automatic Labeling Machines and Semi-Automatic Labeling Machines)– Industry Trends and Forecast to 2031

Global Automatic Labeling Machine Market Analysis

The global automatic labeling machine market is witnessing substantial growth, fueled by the escalating demand for efficient and accurate labeling solutions across diverse industries, particularly food and beverage, pharmaceuticals, and cosmetics. As consumer preferences shift towards packaged and ready-to-use products, manufacturers are investing in advanced labeling technologies to ensure product visibility and compliance with stringent regulatory standards. In the pharmaceutical sector, precise labeling is critical for safety and traceability, driving the need for automated solutions. In addition, the rapid growth of e-commerce has amplified the requirement for effective labeling in logistics and distribution, ensuring products are accurately identified and packaged for delivery. Innovations in labeling technology, such as smart and IoT-integrated systems, further enhance operational efficiency, reduce labor costs, and support sustainability efforts. This confluence of factors positions the market for continued expansion, as businesses increasingly recognize the importance of efficient labeling in maintaining competitiveness and meeting consumer expectations.

Global Automatic Labeling Machine Market Size

Global automatic labeling machine market size was valued at USD 7.99 billion in 2023 and is projected to reach USD 13.12 billion by 2031, with a CAGR of 6.4% during the forecast period of 2024 to 2031. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework

Global Automatic Labeling Machine Market Trends

“Increased Demand for Automation”

The surge in demand for automation across various industries is largely driven by the need for improved efficiency and cost reduction. Automated labeling solutions, which streamline the packaging and labeling process, play a crucial role in this transformation. By minimizing human intervention, these systems enhance accuracy, reduce the likelihood of errors, and accelerate production timelines. Industries such as food and beverage, pharmaceuticals, and consumer goods are particularly benefitting, as regulatory compliance and branding require precise labeling. Moreover, automated labeling machines can easily adapt to different product sizes and label types, offering scalability for businesses experiencing growth. In addition to cost savings, automation allows companies to allocate labor resources to more strategic tasks, fostering innovation and productivity. As the technology continues to evolve, industries are increasingly recognizing the competitive advantage that automated labeling solutions can provide, leading to a rapid expansion of their adoption.

Report Scope and Market Segmentation

|

Attributes

|

Global Automatic Labeling Machine Key Market Insights

|

|

Segmentation

|

|

|

Countries Covered

|

U.S., Canada, Mexico, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa, Brazil, Argentina, Rest of South America

|

|

Key Market Players

|

ProMach Inc. (U.S.), Krones AG (Germany), CVC Technologies, Inc. (U.S.), SATO Holdings Corporation (Japan), LABELMATE (U.S.), Videojet Technologies Pvt. Ltd. (U.S.), Herma (Germany), Epson America, Inc. (U.S.), Avery Dennison Corporation (U.S.), Wihuri Group (Finland), Marchesini Group S.p.A. (Italy), AutomateIT (Germany), Sidel (France), UPM Global (U.S.), PAC Machinery (U.S.)

|

|

Market Opportunities

|

|

|

Value Added Data Infosets

|

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework.

|

Global Automatic Labeling Machine Market Definition

An automatic labeling machine is a device designed to apply labels to products or packaging with minimal human intervention. These machines are used in various industries, including food and beverage, pharmaceuticals, and consumer goods, to enhance efficiency and accuracy in labeling processes. They can handle a wide range of label sizes and formats, adjusting to different product shapes and types.

Global Automatic Labeling Machine Market Dynamics

Drivers

- Increased Production Capacity

Manufacturers are increasingly focused on expanding their production capacities to meet rising consumer demand and stay competitive in fast-paced markets. This growth drives the need for faster and more efficient labeling solutions, as traditional manual methods cannot keep up with the increased output. Automated labeling systems provide the speed and precision required to label products in high volumes, significantly reducing bottlenecks in production lines. These advanced labeling machines can operate at remarkable speeds while maintaining accuracy, ensuring that labels are applied consistently and correctly. In addition, they can adapt to different product sizes and types, allowing manufacturers to diversify their offerings without compromising efficiency. Investing in cutting-edge labeling technology not only enhances productivity but also improves compliance with regulatory requirements and brand consistency. For Instance, Kraft Heinz implemented Model Predictive Control (MPC) to optimize its packaging processes, allowing for real-time adjustments based on production data. This advanced control strategy enhanced efficiency by minimizing downtime and maximizing throughput, ensuring smoother operations and better resource utilization, ultimately contributing to cost savings and improved product quality. As manufacturers seek to optimize their operations and maximize throughput, the demand for innovative labeling solutions continues to grow, making automation a critical component of modern production strategies.

- Demand for Unique Labels Drives Investment

The growing emphasis on customization and branding is compelling companies to invest in versatile labeling machines capable of handling diverse label types and sizes. In today’s competitive market, businesses recognize that unique and appealing packaging can significantly enhance brand identity and consumer appeal. Customized labels allow for personalization, helping brands connect with consumers on a deeper level. Versatile labeling machines equipped with advanced features can efficiently manage multiple label formats, sizes, and materials, allowing manufacturers to quickly adapt to changing market demands and seasonal promotions. This flexibility enables companies to experiment with new designs or limited-edition labels without extensive downtime or additional costs. Moreover, such machines often integrate seamlessly into existing production lines, ensuring that customization efforts do not disrupt overall efficiency. By investing in these adaptable labeling solutions, companies can strengthen their branding efforts while maintaining high levels of productivity, ultimately driving customer engagement and loyalty.

Opportunities

- Technological Innovations

Technological innovations in artificial intelligence (AI), machine learning (ML), and the Internet of Things (IoT) are revolutionizing labeling systems, making them smarter and more efficient. AI and ML algorithms enable labeling machines to analyze production data in real time, optimizing processes based on patterns and predictive analytics. This leads to reduced downtime, as machines can anticipate maintenance needs and adjust operations to prevent bottlenecks. In addition, IoT integration allows labeling systems to connect with other machinery and software across the production line, facilitating seamless data sharing and real-time monitoring. This interconnectedness improves traceability and compliance, enabling manufacturers to respond swiftly to regulatory changes or market demands. With enhanced data integration, companies can also gain valuable insights into consumer behavior and preferences, informing their labeling strategies and customization efforts. For instance, Food manufacturers have been slower to adopt IoT compared to other sectors, but interest is growing. As they face cost inflation, companies are seeking more efficient manufacturing and distribution methods. IoT, though currently underutilized, has the potential to significantly transform the food manufacturing industry in the future. Overall, these technological advancements significantly enhance operational efficiency, reduce costs, and improve the overall quality of labeling processes in various industries.

- Expansion into New Industries

The expansion of automated labeling into new industries, such as cosmetics, electronics, and health supplements, presents significant growth opportunities for manufacturers. These sectors are increasingly recognizing the benefits of automation, including enhanced efficiency, accuracy, and compliance with regulatory standards. In cosmetics, for instance, the demand for eye-catching, customizable labels is rising, prompting brands to invest in automated systems that can quickly adapt to different packaging requirements and design changes. In the electronics industry, where precision and speed are crucial, automated labeling solutions help ensure that products are accurately labeled, meeting safety regulations and improving brand visibility. Similarly, the health supplement sector faces stringent labeling requirements, making automation essential for maintaining compliance while increasing production speed. As these industries continue to evolve, the adoption of automated labeling technologies will likely accelerate, enabling companies to streamline their operations and enhance product differentiation, ultimately driving growth and competitiveness in the marketplace.

Restraints/Challenges

- Competition from Manual Labeling

Despite the advantages of automated labeling systems, manual labeling continues to be a viable and cost-effective alternative in certain industries, particularly for smaller operations or low-volume production. Many small businesses or niche manufacturers may find manual labeling more practical, as it requires lower initial investment and can be easily scaled according to production needs. For companies producing limited quantities or specialized products, manual labeling allows for flexibility in design and customization without the commitment to automated systems. In addition, the simplicity of manual processes can be appealing for businesses that prioritize direct control over production and labeling tasks. However, relying on manual labeling can lead to challenges, such as inconsistent label application and longer production times. As companies grow or seek to enhance efficiency, they may eventually consider transitioning to automated solutions. Nevertheless, for low-volume producers, the continued relevance of manual labeling underscores the importance of tailoring labeling strategies to specific business needs and operational contexts.

- Integration with Existing Systems

Integrating automatic labeling machines with existing production lines and systems poses significant technical challenges and can be resource-intensive. Businesses often operate with diverse machinery, software, and processes, making it crucial to ensure compatibility and smooth communication between new labeling systems and existing equipment. This integration requires careful planning, including assessing current workflows, understanding data protocols, and aligning operational goals. The complexity arises from the need to synchronize various components, such as conveyors, packaging machines, and inventory management systems. Any discrepancies can lead to production delays, increased downtime, and potential errors in labeling. In addition, customizing software interfaces to facilitate real-time data exchange and monitoring can further complicate the integration process. Investing in skilled personnel or external consultants may be necessary to manage the technical aspects effectively. Despite these challenges, successful integration can lead to enhanced efficiency, reduced errors, and improved overall production capabilities, ultimately providing a strong return on investment in the long term.

Impact and Current Market Scenario of Raw Material Shortage and Shipping Delays

Data Bridge Market Research offers a high-level analysis of the market and delivers information by keeping in account the impact and current market environment of raw material shortage and shipping delays. This translates into assessing strategic possibilities, creating effective action plans, and assisting businesses in making important decisions.

Apart from the standard report, we also offer in-depth analysis of the procurement level from forecasted shipping delays, distributor mapping by region, commodity analysis, production analysis, price mapping trends, sourcing, category performance analysis, supply chain risk management solutions, advanced benchmarking, and other services for procurement and strategic support.

Expected Impact of Economic Slowdown on the Pricing and Availability of Products

When economic activity slows, industries begin to suffer. The forecasted effects of the economic downturn on the pricing and accessibility of the products are taken into account in the market insight reports and intelligence services provided by DBMR. With this, our clients can typically keep one step ahead of their competitors, project their sales and revenue, and estimate their profit and loss expenditures.

Global Automatic Labeling Machine Market Scope

The market is segmented on the basis of type, technology, end-use, and operation mode. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Front and Back Labeling Machines

- Wrap-Around Labeling Machines

- Sleeve Labeling Machines

- Carton Labeling Machines

- Others

Technology

- Pressure-Sensitive Labeling

- Heat-Shrink Labeling

- In-Mold Labeling

- Glue-Based Labeling

End-Use

- Food and Beverage

- Pharmaceuticals

- Cosmetics and Personal Care

- Chemicals

- Logistics and Retail

- Others

Operation Mode

- Automatic Labeling Machines

- Semi-Automatic Labeling Machines

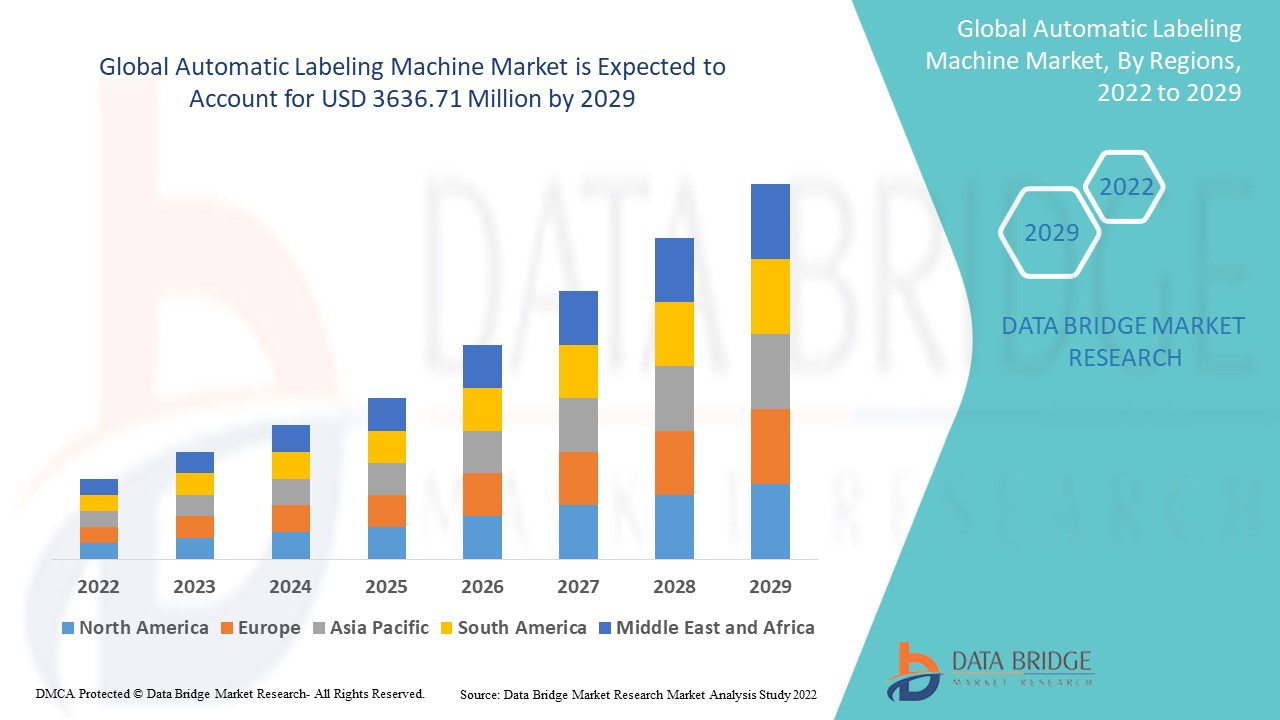

Global Automatic Labeling Machine Market Regional Analysis

The market is analyzed and market size insights and trends are provided by country, type, technology, end-use, and operation mode as referenced above.

The countries covered in the market are U.S., Canada, Mexico, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, rest of Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, rest of Asia-Pacific, Saudi Arabia, U.A.E., South Africa, Egypt, Israel, rest of Middle East and Africa, Brazil, Argentina, and rest of South America.

North America, especially the U. S., leads the global automatic labeling machine market thanks to its advanced manufacturing capabilities and widespread adoption of automation technologies. Key industries, including food and beverage, pharmaceuticals, and consumer goods, drive significant demand, fostering innovation and investment in efficient labeling solutions.

Europe, particularly Germany and Italy, excels in the automatic labeling machine market due to its engineering expertise and focus on innovation. The region's strong manufacturing base supports advanced packaging technologies, catering to diverse industries such as food, pharmaceuticals, and cosmetics, thereby driving growth and maintaining a competitive edge.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Global Automatic Labeling Machine Market Share

The market competitive landscape provides details by competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Global Automatic Labeling Machine Leaders Operating in the Market Are:

- ProMach Inc. (U.S.)

- Krones AG (Germany)

- CVC Technologies, Inc. (U.S.)

- SATO Holdings Corporation (Japan)

- LABELMATE (U.S.)

- Videojet Technologies Pvt. Ltd. (U.S.)

- Herma (Germany)

- Epson America, Inc. (U.S.)

- Avery Dennison Corporation (U.S.)

- Wihuri Group (Finland)

- Marchesini Group S.p.A. (Italy)

- AutomateIT (Germany)

- Sidel (France)

- UPM Global (U.S.)

- PAC Machinery (U.S.)

Latest Developments in Global Automatic Labeling Machine Market

- In January 2021, Sidel Manufacturing Company celebrated the delivery of its 5,000th labeling machine. The EvoDECO Roll-Fed model features an automatic vacuum cleaning system and automatic label removal. Designed for versatility, the EvoDECO platform can handle multiple labeling applications in one machine or focus on a single application, aiming to lower total ownership costs for users while enhancing operational efficiency

- In July 2020, KHS GmbH launched the Innoket Neo Flex, a modular labeling machine designed for filling and packaging. The Flex series can be configured with two to four modules based on machine size and requirements, allowing for easy tool-free adjustments. This machine efficiently labels plastic and glass containers at speeds of up to 74,000 containers per hour, enhancing production capabilities in various industries

- In March 2019, Herma launched a robot-assisted pallet labeling solution designed to enhance flexibility in pallet labeling and optimize the print-and-apply process. This innovative system allows for more efficient labeling operations, accommodating varying product types and sizes. By integrating robotic assistance, Herma aims to streamline workflows, reduce manual handling, and improve overall productivity in pallet labeling applications

- In October 2018, Krones AG acquired W. M. Sprinkman LLC to strengthen its ‘House of Krones’ product portfolio. This acquisition aims to enhance offerings in bottling and packaging equipment, particularly focusing on solutions for plastics recycling, thereby expanding their capabilities in the packaging industry

SKU-