Global Automatic And Smart Pet Feeder Market

Market Size in USD Billion

CAGR :

%

USD

2.31 Billion

USD

5.71 Billion

2023

2032

USD

2.31 Billion

USD

5.71 Billion

2023

2032

| 2024 –2032 | |

| USD 2.31 Billion | |

| USD 5.71 Billion | |

|

|

|

Automatic and Smart Pet Feeder Market Size

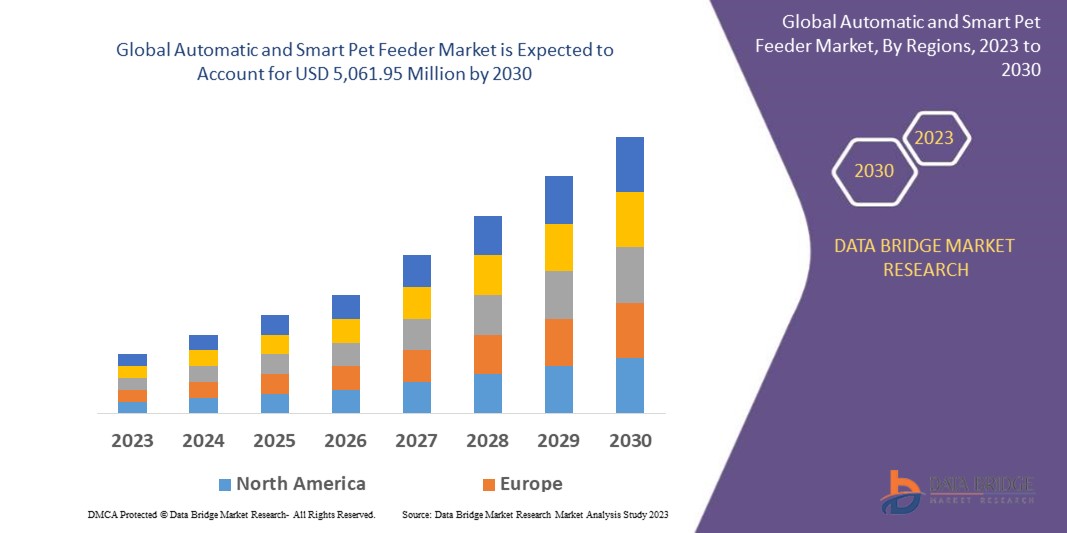

- The global automatic and smart pet feeder market was valued at USD 2.31 billion in 2024 and is expected to reach USD 5.71 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 12.00%, primarily driven by busy lifestyles and demand for convenience

- This growth is driven by factors such as dual-income households, flexible schedules and tech-savvy owners

Automatic and Smart Pet Feeder Market Analysis

- The automatic and smart pet feeder market consists of innovative pet care solutions that offer scheduled feeding, portion control, and remote monitoring through advanced technologies such as AI, IoT, and mobile app integration

- The market is expanding due to rising pet ownership, increasing disposable income, and growing awareness of pet health and wellness. As busy lifestyles drive demand for automated pet care solutions, manufacturers are investing in AI-driven smart feeders to enhance feeding precision and user experience

- The integration of AI, IoT, and smart sensors is transforming the industry by enabling personalized feeding schedules, real-time alerts, and data-driven insights into pet nutrition and habits

- For instance, Petlibro introduced an AI-powered smart feeder with mobile app connectivity, allowing pet owners to customize feeding times and receive real-time notifications

- The automatic and smart pet feeder market is poised for significant growth, fueled by technological advancements, increasing demand for connected pet care devices, and the expansion of e-commerce platforms. With pet owners prioritizing convenience and pet well-being, companies are focusing on innovation and product diversification to stay competitive in the evolving market landscape

Report Scope and Automatic and Smart Pet Feeder Market Segmentation

|

Attributes |

Automatic and Smart Pet Feeder Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Automatic and Smart Pet Feeder Market Trends

“AI and IoT Integration in Smart Pet Feeders”

- One prominent trend in the global automatic and smart pet feeder market is the AI and IoT integration in smart pet feeders

- This trend is driven by the growing demand for smart home connectivity and pet wellness tracking, allowing pet owners to remotely control feeding times, track consumption patterns, and receive alerts on irregular eating behavior through mobile applications

- For instance, PETKIT Fresh Element Infinity Feeder leverages AI-driven meal scheduling and IoT integration to adjust feeding based on a pet’s dietary needs and activity levels

- As pet owners seek more convenient and data-driven pet care solutions, smart pet feeders are evolving with advanced AI analytics, voice assistant compatibility, and automated food replenishment, enhancing both pet well-being and owner convenience

- This shift is expected to accelerate technological advancements in smart pet care, driving continuous innovation, market expansion, and greater adoption of AI-integrated pet feeding solutions worldwide

Automatic and Smart Pet Feeder Market Dynamics

Driver

“Increasing Awareness of Pet Health and Nutrition”

- Growing awareness of pet health and nutrition is a key driver of the automatic and smart pet feeder market. Pet owners are increasingly prioritizing balanced diets, portion control, and meal timing to enhance their pets' well-being and prevent health issues

- This shift is particularly prominent in regions such as North America, Europe, and Asia-Pacific, where pet humanization and premium pet care are on the rise

- With an increasing number of pet owners treating their pets as family members, there is a growing willingness to invest in advanced feeding technologies that provide better nutrition management. Veterinarians and pet nutritionists also emphasize the importance of controlled feeding, further driving the adoption of automated feeders

- As pet owners seek more personalized and data-driven care, smart pet feeders with AI-driven nutrition tracking, portion control, and mobile app integration are gaining popularity

- The increasing availability of veterinary-recommended smart feeders and companion apps has further fueled adoption. Many modern feeders now incorporate features such as calorie tracking, multiple meal programming, and alerts for low food levels, helping owners maintain healthy eating habits for their pets

For instance,

- WOPET’s automatic feeder features app-controlled scheduling, voice recording, and portion customization, ensuring pets eat on time and in the right quantities

- Sure Petcare’s Microchip Pet Feeder is designed for multi-pet households, using RFID technology to dispense food only to the assigned pet, preventing food theft and ensuring dietary consistency

- As awareness of pet health and nutrition continues to rise, the demand for automatic and smart pet feeders is expected to grow significantly. This emphasis on smarter and healthier feeding solutions is expected to drive further innovation and market expansion, making automated feeders an essential tool for modern pet care

Opportunity

“Health Monitoring and Integration”

- The integration of health monitoring features in smart pet feeders presents a significant opportunity for market expansion. By incorporating AI-driven analytics, weight tracking, and dietary insights, these devices can help pet owners proactively manage their pets' well-being and detect potential health issues early

- Leading pet tech brands are developing feeders that sync with smart collars, activity trackers, and veterinary platforms to provide a comprehensive health profile, offering insights into meal consumption, hydration levels, and calorie intake

- Smart pet feeders are also being integrated with remote veterinary consultation services, enabling real-time health monitoring and personalized diet recommendations based on medical history and activity levels

For instance,

- Whisker Feeder-Robot integrates with a mobile app to track portion sizes, meal frequency, and weight trends, ensuring pets maintain a balanced diet

- Wopet SmartFeeder features a built-in HD camera and two-way audio, allowing pet owners to monitor feeding habits and interact with their pets remotely

- As pet owners become increasingly focused on preventive healthcare and data-driven pet management, the demand for smart feeders with health monitoring capabilities is expected to grow. This trend presents a major opportunity for manufacturers to innovate and develop holistic pet wellness solutions, strengthening their position in the evolving pet tech market

Restraint/Challenge

“Limited Compatibility of Automatic and Smart Pet Feeders”

- The limited compatibility of automatic and smart pet feeders with different pet food types, smart home ecosystems, and companion pet devices poses a significant challenge to market growth

- Many feeders are designed for specific kibble sizes, making them incompatible with wet food, raw diets, or prescription-based pet nutrition plans, restricting their usability

- Connectivity issues, such as Wi-Fi and Bluetooth disruptions, further affect feeder performance, leading to missed feedings or inaccurate portion control, raising concerns over reliability and pet well-being

For instance,

- PetSafe Smart Feed struggles with certain kibble shapes, leading to food jams and inconsistent portioning

- As consumer expectations for fully integrated and flexible smart pet care solutions continue to rise, manufacturers must focus on enhancing feeder compatibility with various food types, smart home platforms, and pet health ecosystems to overcome this challenge and drive market adoption

Automatic and Smart Pet Feeder Market Scope

The market is segmented on the basis of product, application, and distribution channel.

|

Segmentation |

Sub-Segmentation |

|

By Product |

|

|

By Application |

|

|

By Distribution Channel |

|

Automatic and Smart Pet Feeder Market Regional Analysis

“Asia-Pacific is the Dominant Region in the Automatic and Smart Pet Feeder Market”

- Asia-Pacific dominates the automatic and smart pet feeder market, driven by the high demand and widespread adoption of smart pet care solutions in key countries such as China and Japan. The region's growing pet ownership rates and increasing awareness of automated feeding systems contribute significantly to market expansion

- China holds a significant share due to the rapid growth of the pet care industry, increasing disposable incomes, and strong e-commerce penetration that facilitates access to smart pet feeding products. Similarly, Japan’s tech-savvy consumer base and preference for premium pet care solutions fuel demand for automatic and smart pet feeders

- The presence of leading regional manufacturers and startups, such as PETKIT, Xiaomi, and Dogness, further strengthens market growth by introducing AI-powered feeders, remote monitoring capabilities, and health tracking integration

- With rising urbanization and busy lifestyles, pet owners in the Asia-Pacific region are increasingly adopting automated pet care solutions, reinforcing the region’s dominance in the global market

“North America is Projected to Register the Highest Growth Rate”

- The North America region is expected to witness the highest growth rate in the automatic and smart pet feeder market, driven by technological advancements and growing demand for pet monitoring solutions.

- The U.S. and Canada are experiencing a surge in smart pet product adoption, with pet owners seeking convenient, tech-driven feeding solutions. The integration of video cameras, mobile app connectivity, and AI-powered portion control in smart feeders is driving market expansion

- Advancements in IoT-enabled pet care, voice assistant integration (Alexa, Google Assistant), and health-tracking smart feeders are enhancing pet monitoring and feeding efficiency, further fueling growth in the region

- With an increasing focus on pet wellness and safety, North America is poised to become the fastest-growing market for automatic and smart pet feeders during the forecast period

Automatic and Smart Pet Feeder Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Samsung (South Korea)

- Robert Bosch GmbH (Germany)

- Schneider Electric (France)

- Siemens (Germany)

- Haier Group (China)

- Google (U.S.)

- Resideo Technologies Inc. (U.S.)

- ABB (Switzerland)

- Emerson Electric Co. (U.S.)

- Johnson Controls (Ireland)

- Legrand (France)

- ADT (U.S.)

- Vivint, LLC (U.S.)

- Acuity Brands, Inc. (U.S.)

- Chamberlain Group LLC (U.S.)

- Crestron Electronics, Inc. (U.S.)

- Lutron (U.S.)

Latest Developments in Global Automatic and Smart Pet Feeder Market

- In May 2023, Pet Marvel has introduced the Automatic 2-in-1 Pet Feeder and Water Dispenser on Kickstarter, catering to pet parents with a comprehensive solution. This innovative device combines feeding, watering, and real-time monitoring, featuring multi-cat facial recognition, voice announcements, and a smart food bowl to prevent jams. It includes an intelligent water purification system with a flushing function for easy maintenance

- In December 2023, Xiaomi launched its advanced Smart Automatic Feeder, designed to meet pets' dietary needs for up to a month. This innovative device ensures scheduled feeding, notifies owners when food levels are low, and guarantees reliable meal distribution even when pet owners are away. With this launch, Xiaomi expands its presence in the smart home pet care market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.