Global Automated Truck Loading System Market, By Loading Dock (Flush, Enclosed, Saw-tooth), System Type (Chain Conveyor, Slat Conveyor, Belt Conveyor, Skate Conveyor, Roller Track, Automated Guided Vehicle), Industry (Aviation, Cement, Paper, FMCG, Post and Parcel, Automotive, Textile, Pharmaceutical, Warehouse and Distribution), Truck Type (Modified Truck Type, Non-modified Truck Type) – Industry Trends and Forecast to 2029

Market Analysis and Size

Almost every situation requires a forklift or pallet truck to load and unload. With higher numbers, hand loading and unloading becomes more customized to their specific needs. As a result, many businesses are eager to streamline and optimize this particular area of the logistics supply chain. Aside from greater efficiency, a focus on a clean and safe working environment as well as damage minimization are equally vital. Minimizing cooling loss during the loading process can reduce energy costs and have favourable environmental consequences, especially in temperature-controlled transportation. Due to increased demand for automated shipping, Loading Automation, Inc. launched the world's first completely automated system, the automatic truck loading system (ATLS), which automates racks and slip-sheets' loading and unloading and pallets.

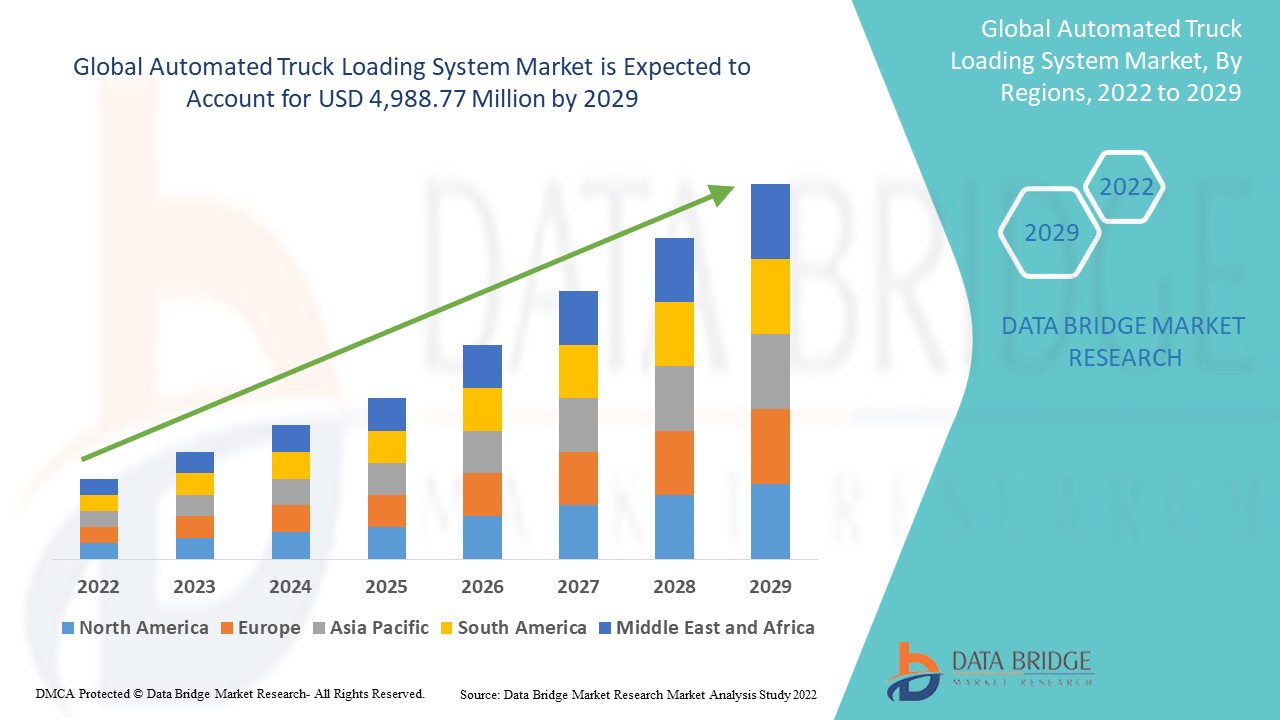

Data Bridge Market Research analyses that the automated truck loading system market was valued at USD 2,839.20 million in 2021 and is expected to reach USD 4,988.77 million by 2029, registering a CAGR of 7.30% during the forecast period of 2022 to 2029. The market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production and sales, and pestle analysis.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2022 - 2029

|

|

Base Year

|

2021

|

|

Historic Years

|

2020 (Customizable to 2019 - 2014)

|

|

Quantitative Units

|

Revenue in USD Million, Volumes in Units, Pricing in USD

|

|

Segments Covered

|

Loading Dock (Flush, Enclosed, Saw-tooth), System Type (Chain Conveyor, Slat Conveyor, Belt Conveyor, Skate Conveyor, Roller Track, Automated Guided Vehicle), Industry (Aviation, Cement, Paper, FMCG, Post and Parcel, Automotive, Textile, Pharmaceutical, Warehouse and Distribution), Truck Type (Modified Truck Type, Non-modified Truck Type)

|

|

Countries Covered

|

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, Israel, Egypt, South Africa, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

|

|

Market Players Covered

|

ACTIW LTD. (Finland), Ancra Systems B.V. (Netherlands), Asbreuk Service B.V. (Netherlands), BEUMER GROUP (Germany), Cargo Floor B.V. (Netherlands), GEBHARDT Fördertechnik GmbH (Germany), HAVER & BOECKER OHG (Germany), Joloda International Ltd (UK), Möllers Packaging Technology GmbH (Germany), Secon Components S.L. (Spain), VDL Systems bv (Netherlands), Secon Components S.L. (Spain), FLSmidth (Demanrk), Reno Forklift, Inc. (US), Loading Automation Inc. (US)

|

|

Market Opportunities

|

|

Market Definition

The term automated truck loading systems (ATLS) refers to the automation of loading and unloading trucks and trailers in the material handling sector. Automatic loading and unloading systems are designed to expedite a routine procedure that occurs in every manufacturing and storage facility. Depending on the type of products and their weight, the forklift procedure of loading a full trailer takes around 30 minutes, whereas manually unloading a truck takes about an hour. This operation could be automated to reduce the duration to around 10 minutes.

Automated Truck Loading System Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints and challenges. All of this is discussed in detail as below:

Drivers

- Increasing awareness about the benefits offered by automated truck loading system

The surging awareness about the benefits offered by automated truck loading system is anticipated to enhance the market’s growth rate during the forecast period of 2022-2029. Product safety will be improved, labour costs will be reduced, truck loading and unloading time will be reduced, personnel safety will be improved, working space will be better utilized, tonnage to be transported will be under control, inappropriate equipment maneuvers will be eliminated, and overall operational costs will be reduced owing to automated truck loading.

- Rising demand for automation systems

The automated truck loading system market is anticipated to increase because to rising demand for automation systems from manufacturers and distributors that handle large volumes of items and are fitted with microprocessors that provide information on the instrument's performance. Also, the introduction of automation in logistics has increased the efficiency of production, operations, and adaptability. Additionally, manufacturers are striving to save costs, thus truck loading automation provides a chance to save money in post-production processes while also significantly speeding up the entire cash cycle.

Furthermore, rapid industrialization and rising demand from key stakeholders in the food and beverage industry, such as manufacturers, breweries, beverage distributors, and processing plants, will be major factors influencing the growth of the automated truck loading system market. Also, swift growth of e-commerce market and developing infrastructure will drive market value growth.

Opportunities

- Growing adoption of sawtooth-designed loading docks

For more effective loading and unloading processes, sawtooth-designed loading docks are becoming more popular. Sawtooth docks are used in situations where dock space is limited. The vehicle takes less room in this dock arrangement because it is already aligned in the drive-way orientation. As a result, these docks are used in industries where loading and unloading operations are limited in space. This is expected to boost the new market opportunities during the forecast period of 2022-2029.

Moreover, rise in strategic collaborations and emerging new markets will act as market drivers and further boost beneficial opportunities for the market’s growth rate. The constant developments in technologies and the rising adoption of autonomous vehicles will provide new market opportunities in coming years.

Restraints/ Challenges

- High cost of implementation

Automating truck loading procedures necessitates a significant financial investment. The installation of automation equipment, software, and solutions for large-scale automated warehousing operations is costly. Because of the high cost of new and innovative technology, several organizations cannot afford to update their present logistics procedures. Industry-specific automation systems require periodic maintenance and updates, which require significant capital reinvestment. As a result, companies with limited financial resources are unable to invest in automation systems, slowing the market's growth rate.

On the other hand, the dearth of skilled professionals and unorganized automated infrastructure will pose major challenges to the automated truck loading system market growth. Additionally, the availability of cheap labour will act as restrain and further impede the growth rate of market during the forecast period of 2022-2029.

This automated truck loading system market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the automated truck loading system market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

COVID-19 Impact on Automated Truck Loading System Market

The advent of the COVID-19 outbreak resulted in a labour shortage. In addition, production operations and supply chain management were disrupted in the industry. This has a huge impact on the market for automated truck loading system. The COVID-19 crisis is causing market uncertainty by slowing supply chains, stifling business growth, and instilling fear among customer segments. The focus of fleet operators is projected to be on working capital management, with little room for major investment in innovative technologies.

However, due to its practical feasibility in achieving safety measures as well as cost-effectiveness of operations, smart fleet management technology is most likely to gain sales momentum. Key players are getting into contracts and agreements in the COVID-19 health crisis scenario to secure long-term business prospects. Smart fleet management system vendors and end users or fleet operators benefit from these long-term contracts. Moreover, as the trend toward contactless and efficient logistics infrastructure grows, the industry is expected to rise at a rapid pace in the future.

Global Automated Truck Loading System Market Scope

The automated truck loading system market is segmented on the basis of loading dock, system type, truck type and industry. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Loading Dock

- Flush

- Enclosed

- Saw-tooth

System Type

- Chain Conveyor

- Slat Conveyor

- Belt Conveyor

- Skate Conveyor

- Roller Track

- Automated Guided Vehicle

Industry

- Aviation

- Cement

- Paper

- FMCG

- Post and Parcel

- Automotive

- Textile

- Pharmaceutical

- Warehouse and Distribution

Truck Type

- Modified Truck Type

- Non-modified Truck Type

Automated Truck Loading System Market Regional Analysis/Insights

The automated truck loading system market is analysed and market size insights and trends are provided by country, loading dock, system type, truck type and industry as referenced above.

The countries covered in the automated truck loading system market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, Israel, Egypt, South Africa, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

Europe dominates the automated truck loading system market in terms of market share and market revenue and will continue to flourish its dominance during the forecast period. This is due to the surging demand for automating the truck loading and unloading process by numerous companies in this region. Also, the presence of well-organized logistics supply chain will propel the market’s growth rate in this region.

Asia-Pacific on the other hand is projected to exhibit the highest growth rate during the forecast period of 2022 to 2029 due to the increasing demand for automation in this region. Additionally, cost effective operations provided by automated truck loading systems will enhance the market’s growth rate in this region.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Automated Truck Loading System Market Share Analysis

The automated truck loading system market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to automated truck loading system market.

Some of the major players operating in the automated truck loading system market are:

- ACTIW LTD. (Finland)

- Ancra Systems B.V. (Netherlands)

- Asbreuk Service B.V. (Netherlands)

- BEUMER GROUP (Germany)

- Cargo Floor B.V. (Netherlands)

- GEBHARDT Fördertechnik GmbH (Germany)

- HAVER & BOECKER OHG (Germany)

- Joloda International Ltd (UK)

- Möllers Packaging Technology GmbH (Germany)

- Secon Components S.L. (Spain)

- VDL Systems bv (Netherlands)

- Secon Components S.L. (Spain)

- FLSmidth (Demanrk)

- Reno Forklift, Inc. (US)

- Loading Automation Inc. (US)

SKU-