Global Automated Test Equipment Market

Market Size in USD Billion

CAGR :

%

USD

8.17 Billion

USD

12.42 Billion

2024

2032

USD

8.17 Billion

USD

12.42 Billion

2024

2032

| 2025 –2032 | |

| USD 8.17 Billion | |

| USD 12.42 Billion | |

|

|

|

|

Automated Test Equipment Market Size

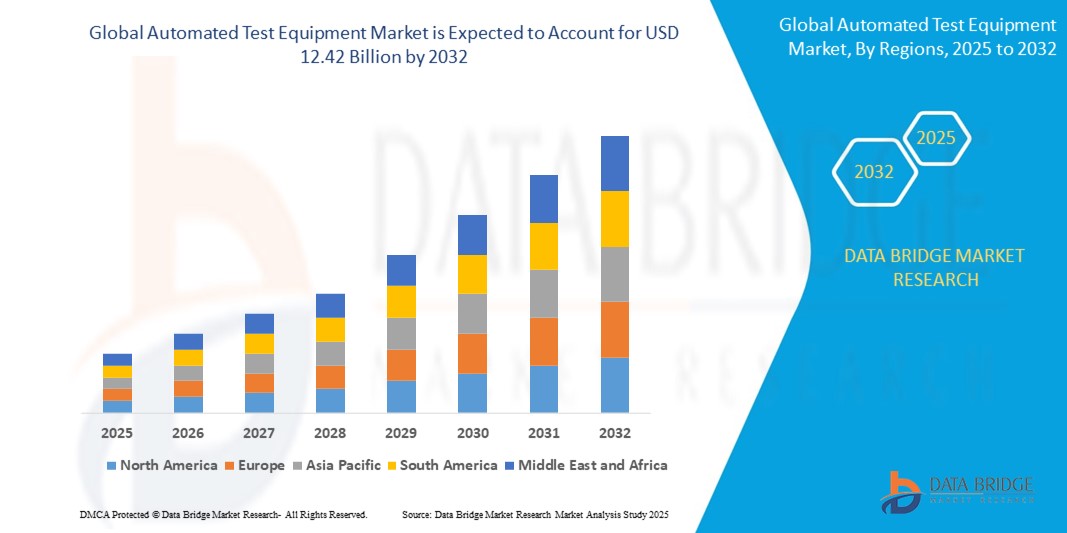

- The Global Automated Test Equipment Market size was valued at USD 8.17 billion in 2024 and is expected to reach USD 12.42 billion by 2032, at a CAGR of 5.38% during the forecast period

- The market growth is largely fueled by increasing complexity and volume of semiconductors used across various industries, including consumer electronics, automotive, telecommunications, and industrial automation

Automated Test Equipment Market Analysis

- Automated Test Equipment (ATE) plays a crucial role in streamlining the testing process for electronic components, semiconductors, and systems by improving speed, precision, and repeatability in quality assurance. These systems are integral to high-volume production environments such as consumer electronics, automotive, aerospace, and telecommunications, where consistent performance and reduced testing time are essential.

- Market growth is primarily driven by the increasing complexity of semiconductor devices, the growing adoption of electric vehicles (EVs), and the surge in demand for consumer electronics and 5G-enabled devices. As devices become smaller and more complex, the need for high-performance, multi-functional ATE systems continues to rise.

- Asia Pacific dominates the global Automated Test Equipment market with 51.87% in 2024, owing to the presence of major semiconductor manufacturing hubs in countries like China, Taiwan, South Korea, and Japan. Rapid industrialization, strong demand for electronic products, and significant investments in chip production facilities are further accelerating regional growth.

- North America is anticipated to witness the fastest growth, fueled by advanced R&D in semiconductor design, the presence of leading technology firms, and rising demand for automated testing in aerospace and defense sectors. The U.S. is particularly active in developing ATE systems for high-reliability applications.

- The Non-Memory ATE segment led the market with the largest revenue share of 66.07% in 2024, attributed to the high testing requirements for microcontrollers, logic chips, and analog components used across various end-use industries. This segment benefits from steady growth in consumer electronics and automotive

Report Scope and Automated Test Equipment Market Segmentation

|

Attributes |

Automated Test Equipment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Automated Test Equipment Market Trends

“AI Integration and Advanced Packaging Drive Test Equipment Evolution”

- A major trend shaping the ATE market is the growing integration of Artificial Intelligence (AI) and machine learning for predictive diagnostics, test optimization, and defect detection. This trend is improving test coverage, reducing cycle times, and enhancing product quality, particularly in high-complexity semiconductor designs.

- Additionally, the rise of advanced semiconductor packaging (e.g., 3D ICs, chiplets, and system-in-package) is pushing demand for next-gen ATE systems capable of handling heterogeneous integration and testing at multiple interconnect levels.

For instance,

- In February 2025, Advantest introduced an AI-enhanced diagnostics platform for its V93000 ATE system, enabling predictive maintenance and real-time fault detection. This innovation reduces unplanned downtime and increases test efficiency, especially for advanced node and 5G chipsets.

- These developments are positioning AI-enabled and packaging-ready ATE systems as essential tools for modern chip manufacturing environments.

Automated Test Equipment Market Dynamics

Driver

“Surge in Semiconductor Demand Across Consumer and Automotive Sectors”

- The ATE market is driven by the exponential rise in global semiconductor consumption, led by applications in smartphones, electric vehicles (EVs), 5G infrastructure, and high-performance computing.

- As chips become more compact, multifunctional, and mission-critical, precise and automated testing becomes indispensable for quality control and time-to-market acceleration.

For instance,

- In June 2024, major EV manufacturers in Europe ramped up demand for ATE systems to test silicon carbide (SiC) power modules and advanced driver-assistance systems (ADAS), citing the need for high-throughput, low-error testing under real-world conditions.

- This increasing reliance on electronics in critical applications is elevating the role of ATE in ensuring product safety, performance, and reliability.

Restraint/Challenge

“High Cost of Test System Development and Maintenance”

- One of the primary challenges in the ATE market is the significant capital investment required to develop and maintain high-performance, scalable test systems.

- As test demands evolve with each new semiconductor node, ATE systems must be frequently upgraded or redesigned, placing pressure on manufacturers’ budgets and product timelines.

- In October 2024, a U.S.-based fabless semiconductor firm reported delayed rollout of a new ATE platform due to rising costs of integrating 7nm chip support and AI-based test analytics. The company faced a 20% budget overrun and postponed product validation by two quarters.

- While innovation continues, the cost and complexity of staying technologically current remains a key barrier, especially for smaller fabless players and niche manufacturers.

Automated Test Equipment Market Scope

The market is segmented on the basis of Product, type, vertical

- By Product

On the basis of product, the Global Automated Test Equipment Market is segmented into Non-Memory ATE, Memory ATE, Discrete ATE, and Others.

The Non-Memory ATE segment led the market with the largest revenue share of 66.07% in 2024, attributed to the high testing requirements for microcontrollers, logic chips, and analog components used across various end-use industries. This segment benefits from steady growth in consumer electronics and automotive

The Memory ATE segment is projected to witness the fastest growth rate 19.87% CAGR from 2025 to 2032, fueled by growing demand for DRAM, flash, and advanced memory chips in smartphones, data centers, and AI-driven applications. The increase in memory density and the shift to high-speed memory protocols are pushing manufacturers to adopt specialized memory testing equipment to ensure speed, performance, and reliability.

- By type

On the basis of type, the market is segmented into Logic Testing, Printed Circuit Board (PCB) Testing, and Interconnection and Verification Testing. The Logic Testing segment accounted for the largest market share in 2024 due to rising demand for automated functional validation of digital components. It plays a critical role in high-volume testing environments, particularly for consumer electronics, automotive ECUs, and industrial automation devices, where logic accuracy and timing are crucial.

The Printed Circuit Board (PCB) Testing segment is expected to grow at the fastest rate over the forecast period. This growth is attributed to increasing PCB complexity in smartphones, EVs, medical devices, and aerospace systems. Manufacturers are investing in ATE platforms capable of quickly validating multilayered, densely packed boards with minimal defects, which enhances overall product quality and reduces time to market.

- By Vertical

On the basis of vertical, the market is segmented into Automotive, Consumer Electronics, Aerospace & Defense, IT & Telecommunications, and Others. The Consumer Electronics segment held the highest market revenue in 2024, driven by massive production volumes of smartphones, wearables, tablets, and smart appliances. Automated test systems are essential for high-throughput testing of SoCs, RF modules, and power components, ensuring compliance with increasingly stringent performance standards.

The Automotive segment is anticipated to witness the fastest CAGR from 2025 to 2032, owing to the rapid electrification of vehicles, rising adoption of ADAS systems, and increasing integration of chips in infotainment and control systems. Automakers are relying on advanced ATE to meet stringent quality and safety benchmarks while accelerating development cycles for electric and autonomous vehicles.

Automated Test Equipment Market Regional Analysis

- Asia Pacific dominates the Automated Test Equipment Market with the largest revenue share of 51.87% in 2024, driven by rapid semiconductor production expansion in countries like China, Taiwan, South Korea, and Japan.

- The region benefits from strong OEM presence, cost-effective manufacturing, and growing demand for smartphones, laptops, and high-performance computing devices. Government initiatives such as China’s “Made in China 2025” and India’s “Make in India” campaign are also stimulating domestic chip production, increasing the demand for reliable and scalable testing solutions.

China Automated Test Equipment Market Insight

The China Automated Test Equipment Market captured the largest revenue share of 79.88% in 2024 within Asia Pacific, driven by aggressive investments in semiconductor fabrication plants and government-backed efforts to build a self-reliant chip ecosystem. Domestic demand for smartphones, electric vehicles, and industrial automation continues to rise, necessitating fast, accurate ATE platforms. Chinese ATE vendors are also scaling up to compete globally, further intensifying market activity.

Europe Automated Test Equipment Market Insight

Europe’s Automated Test Equipment market is projected to expand at a solid CAGR through 2030, propelled by the region’s strong automotive electronics ecosystem, government support for semiconductor manufacturing, and increasing demand for industrial automation. Countries like Germany, France, and the Netherlands are driving growth through investments in advanced manufacturing and AI chip production. The adoption of ATE systems is particularly strong in EV production and safety-critical applications, aligning with EU policies on sustainability and digital transformation.

Germany Automated Test Equipment Market Insight

Germany is expected to lead the European ATE market in 2025, fueled by its position as a global automotive innovation hub. The surge in demand for automated driver assistance systems (ADAS), electric powertrains, and infotainment electronics is creating a strong pull for high-precision IC testing solutions. Additionally, Germany’s initiatives in Industry 4.0 and smart manufacturing are driving the adoption of ATE across industrial machinery and embedded systems testing.

North America Automated Test Equipment Market Insight

The North America Automated Test Equipment Market is poised to grow at the fastest CAGR of 20.04% during the forecast period of 2025 to 2032, driven by the strong presence of leading semiconductor manufacturers, growing adoption of advanced automotive electronics, and increasing demand for 5G-enabled devices. The region’s focus on deploying cutting-edge chips in AI, defense, and cloud computing sectors fuels the need for high-performance testing equipment. Technological maturity, robust R&D investments, and a thriving consumer electronics base further support the region’s market leadership.

U.S. Automated Test Equipment Market Insight

The U.S. Automated Test Equipment Market accounted for the largest market revenue share in 2024, owing to the extensive presence of fabless semiconductor companies and defense electronics developers. The rising deployment of electric vehicles and autonomous driving systems has accelerated the need for precise, high-speed IC testing. Moreover, U.S. chip manufacturers’ initiatives to onshore semiconductor fabrication and reduce dependence on Asian supply chains are resulting in new demand for localized, advanced test solutions.

Automated Test Equipment Market Share

The Automated Test Equipment is primarily led by well-established companies, including:

- Aemulus Corporation (Malaysia)

- Chroma ATE Inc. (Taiwan)

- VIAVI Solutions Inc. (US)

- Astronics Corporation (US)

- ADVANTEST CORPORATION (Japan)

- Cohu, Inc (US)

- Teradyne Inc. (US)

- STAr Technologies Inc. (Taiwan)

- TESEC Corporation (Japan)

- Roos Instruments (US)

- Marvin Test Solutions, Inc. (US)

- Danaher (US)

Latest Developments in Global Automated Test Equipment Market

- In April 2025, Teradyne introduced the UltraFlex 2.0, an advanced automated test equipment platform designed to meet the testing demands of next-generation system-on-chip (SoC) devices. This new platform offers enhanced parallel test capabilities, improved signal integrity, and faster test times, catering to the increasing complexity of semiconductor devices used in AI, 5G, and automotive applications. The UltraFlex 2.0 aims to provide semiconductor manufacturers with a scalable and efficient solution to maintain high throughput and quality in chip production.

- In May 2025, AMETEK announced its acquisition of FARO Technologies, a leader in 3D measurement and imaging solutions, in a deal valued at approximately $920 million. This strategic acquisition is set to enhance AMETEK's electronic instruments division by integrating FARO's advanced metrology technologies, which are crucial for precision testing and quality assurance in manufacturing processes. The merger is expected to strengthen AMETEK's position in the ATE market, particularly in sectors like aerospace, automotive, and industrial manufacturing.

- In July 2023, Teradyne entered into a strategic partnership with Israeli software company ProteanTecs to develop advanced testing and debugging solutions for complex systems-on-chips (SoCs). The collaboration focuses on integrating ProteanTecs' deep data analytics with Teradyne's testing platforms to enable predictive maintenance and real-time performance monitoring of semiconductor devices. This partnership aims to address the growing need for intelligent testing solutions in the face of increasing chip complexity.

- In January 2025, Vitrek launched a new test automation software compatible with its 95x, 98x, and V7x series of hipot testers, as well as the 964i high-voltage switches. This software aims to simplify test designs and enhance the efficiency of high-voltage testing processes. By integrating automation capabilities, Vitrek's solution addresses the growing demand for streamlined and reliable testing in industries requiring stringent safety and compliance standards.

- In March 2025, several ATE manufacturers unveiled innovations to support testing requirements for next-generation semiconductors used in AI, high-performance computing (HPC), and data center applications. These platforms feature ultra-high signal fidelity, multi-site parallel testing, and advanced thermal control to validate complex chip architectures. The innovations respond to surging demand for AI-enabled devices and growing semiconductor complexity, which necessitate precise, high-speed testing methodologies.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Automated Test Equipment Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Automated Test Equipment Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Automated Test Equipment Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.